Noticias del mercado

-

21:00

DJIA 17945.23 -58.52 -0.33%, NASDAQ 4892.29 -13.94 -0.28%, S&P 500 2084.67 -6.91 -0.33%

-

18:41

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Monday as a drop in oil prices, lackluster quarterly earnings and an impending Federal Reserve meeting weighed on investor sentiment. The central bank's policymakers are expected to hold interest rates steady when they meet on Tuesday and Wednesday, but may tweak their description of the economic outlook to reflect more benign conditions. Oil prices fell about 1,5% after traders cited reports of a supply buildup, interrupting the stock market's long bull run.

Most of Dow stocks in negative area (23 of 30). Top looser - Caterpillar Inc. (CAT, -2,27%). Top gainer - McDonald's Corp. (MCD +0,90%).

All S&P sectors in negative area. Top looser - Basic Materials (-1,6%).

At the moment:

Dow 17815.00 -102.00 -0.57%

S&P 500 2074.50 -11.50 -0.55%

Nasdaq 100 4452.50 -13.25 -0.30%

Oil 43.12 -0.61 -1.39%

Gold 1242.40 +12.40 +1.01%

U.S. 10yr 1.90 +0.01

-

18:00

European stocks closed: FTSE 6260.92 -49.52 -0.78%, DAX 10294.35 -79.14 -0.76%, CAC 40 4546.12 -23.54 -0.52%

-

18:00

European stocks close: stocks traded lower on falling oil prices

Stock indices traded lower on falling oil prices. Oil prices declined on profit taking and on concerns over the global oil oversupply.

The weaker-than-expected German Ifo data also weighed on stocks. German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index fell to 106.6 in April from 106.7 in March, missing expectations for an increase to 107.0.

"Although companies were somewhat less satisfied with their current situation, their business expectations brightened once again. The moderate upturn in the German economy continues," Ifo President Clemens Fuest said.

The Ifo current conditions index decreased to 113.2 from 113.8. Analysts had expected the index to remain unchanged at 113.8.

The Ifo expectations index climbed to 100.4 from 100.0, missing expectations for a rise to 100.8.

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance rose to -11 in April from -14 in March, beating expectations for a decline to -15.

"Manufacturing has yet to pick-up after a flat start to the year, with falling orders providing little impetus for production. While expectations for the upcoming quarter are encouraging, manufacturers are still facing sizeable external headwinds," the CBI director of economics Rain Newton-Smith said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,260.92 -49.52 -0.78 %

DAX 10,294.35 -79.14 -0.76 %

CAC 40 4,546.12 -23.54 -0.52 %

-

17:39

WSE: Session Results

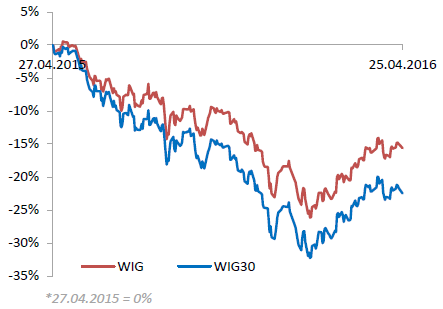

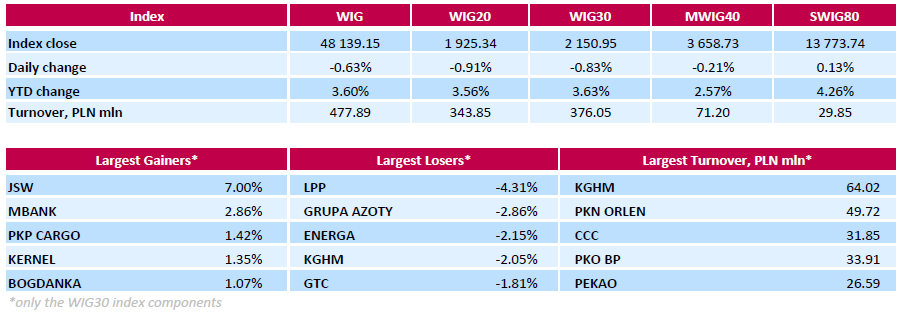

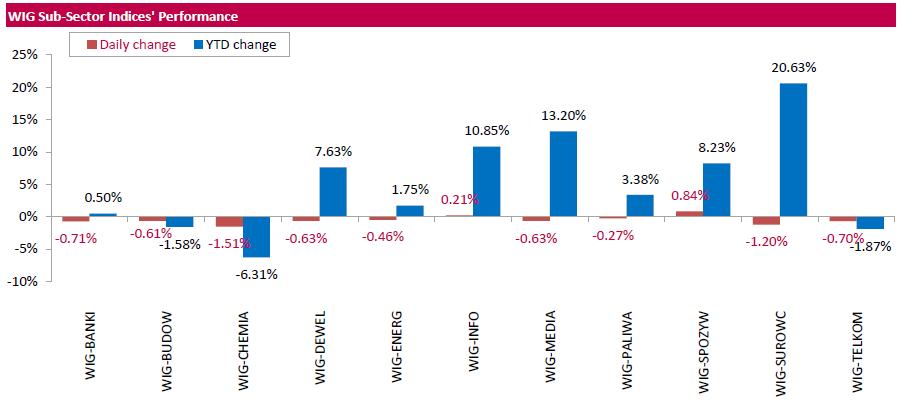

Polish equity market closed lower on Monday. The broad market measure, the WIG index, lost 0.63%. Except for informational technology sector (+0.21%) and food sector (+0.84%), every sector in the WIG Index fell, with chemicals (-1.51%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, declined by 0.83%. In the index basket, clothing retailer LPP (WSE: LPP) continued to retreat, correcting downwards by 4.31% after a significant surge, which was recorded earlier this month. It was followed by chemical producer GRUPA AZOTY (WSE: ATT), genco ENERGA (WSE: ENG) and copper producer KGHM (WSE: KGH), plunging by 2.86%, 2.15% and 2.05% respectively. On the other side of the ledger, coking coal miner JSW (WSE: JSW) recorded the strongest daily performance, soaring by 7% on improved outlooks for the company. Among the other biggest gainers were bank MBANK (WSE: MBK), railway freight transport operator PKP CARGO (WSE: PKP) and agricultural producer KERNEL (WSE: KER), advancing 2.86%, 1.42% and 1.35% respectively.

-

17:36

European Central Bank Executive Board member Peter Praet: the economic recovery in the Eurozone is driven by domestic demand

European Central Bank (ECB) Executive Board member Peter Praet said on Monday that the economic recovery in the Eurozone was driven by domestic demand. He added that there were large imbalances in the Eurozone.

Praet pointed out that disposable income in the Eurozone was supported by recovery in labour market and lower oil prices, adding that there was gradual rise in residential investment.

-

17:27

German IW economic institute: the slowdown in emerging economies and higher energy prices are risks to the German economic growth

The German think tank IW economic institute said on Monday that the slowdown in emerging economies and higher energy prices were risks to the country's economic growth. The uncertainty in emerging economies weighs on the German export sector.

IW expects the German economy to expand 1.5% in 2016 and 1.25% in 2017.

-

17:18

People’s Bank of China injected 267 billion yuan into market

The People's Bank of China (PBoC) injected 267 billion yuan ($41 billion) into 18 financial institutions via medium-term lending facility (MLF) on Monday.

The reason for this injection could be the decision to boost liquidity.

-

17:15

Services prices in Japan rise 0.6% in March

The Bank of Japan (BoJ) released its Corporate Services Price Index (CSPI) data on late Sunday evening. Producer prices in Japan rose 0.6% in March, after a flat reading in February.

On a yearly basis, producer prices increased 0.2% in March, after a 0.2% rise in February.

The increase was driven by rises in software development, television advertising, temporary employment agency services, security services and employment services.

-

16:37

European Central Bank purchases €19.91 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €19.91 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.76 billion of covered bonds, and the value of asset-backed securities fell by €45 million.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

-

16:17

New home sales in the U.S. decrease 1.5% in March

The U.S. Commerce Department released new home sales data on Monday. New home sales decreased 1.5% to a seasonally adjusted annual rate of 511,000 units in March from 519,000 units in February. February's figure was revised up from 512,000 units.

Analysts had expected new home sales to reach 519,000 units.

The decrease was mainly driven lower sales in the West region. New home sales in the West region plunged 23.6% in March.

-

15:48

WSE: After start on Wall Street

After 12 o'clock the situation on the markets of oil, silver, copper and gold was slightly improved. Such a gain in the raw materials sector may also affect other asset classes. For now we are talking about a relatively small approach, but which fits in quite a positive picture of raw materials in recent times (many of them are still consolidating near the recent highs).

Trading on Wall Street began with a small decline of 0.3%. It can be assumed that the decisions of Americans in the coming quarters may affect the level of global investment sentiment and thus consequently on our parquet. It should be also noted that the WIG20 recently shows a much higher correlation with the Polish currency. Till now the wave of the weakening of the domestic currency continues and it may be hard to find a factor for the rebound.

U.S. Stocks open: Dow -0.34%, Nasdaq -0.32%, S&P -0.32%

-

15:45

NBB business climate for Belgium rises to -2.4 in April

The National Bank of Belgium (NBB) released its business survey on Monday. The business climate rose to -2.4 in April from-4.2 in March. Analysts had expected the index to increase to -4.0.

2 of 4 indicators climbed in April.

The business climate index for the manufacturing sector was up to -4.9 in April from -7.9 in March due to a more favourable assessments of total order books.

The business climate index for the services sector fell to 10.8 in April from 11.2 in March due to a less favourable assessment of the current activity and a downward revision of forecasts for general market demand.

The business climate index for the building sector increased to -3.2 in April from -3.9 in March due to a more favourable assessment of current order books.

The business climate index for the trade sector dropped to -7.2 in April from -4.1 in March due to pessimism, which weighed on all components of the indicator.

-

15:33

U.S. Stocks open: Dow -0.34%, Nasdaq -0.32%, S&P -0.32%

-

15:07

Before the bell: S&P futures -0.22%, NASDAQ futures -0.23%

U.S. stock-index futures slipped.

Global Stocks:

Nikkei 17,439.3 -133.19 -0.76%

Hang Seng 21,304.44 -162.60 -0.76%

Shanghai Composite 2,946.96 -12.28 -0.41%

FTSE 6,272.54 -37.90 -0.60%

CAC 4,538.52 -31.14 -0.68%

DAX 10,285.55 -87.94 -0.85%

Crude $43.35 (-0.87%)

Gold $1236.40 (+0.52%)

-

15:04

Fitch affirms Cyprus’ sovereign debt rating at 'B+'

Rating agency Fitch Ratings Friday affirmed Cyprus' sovereign debt rating at 'B+'. The outlook is 'positive'.

"Cyprus is undergoing a major financial sector, fiscal, and economic adjustment following the 2013 banking sector crisis and the ensuing EU/IMF bail-out programme. The country's early exit from the macroeconomic adjustment programme in March 2016 reflects a track record of fiscal consolidation, progress in financial sector restructuring and economic recovery," Fitch said.

The agency also said that the country's economic recovery was underway.

The economy is expected to expand around 2.0% in 2016-17, driven by household consumption, according to Fitch's forecasts.

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.33

-0.07(-0.6731%)

55385

ALTRIA GROUP INC.

MO

60.2

-0.32(-0.5287%)

2471

Amazon.com Inc., NASDAQ

AMZN

618.79

-1.71(-0.2756%)

4903

Apple Inc.

AAPL

105.11

-0.57(-0.5394%)

112601

AT&T Inc

T

38.11

0.04(0.1051%)

3555

Barrick Gold Corporation, NYSE

ABX

16.26

0.14(0.8685%)

20338

Boeing Co

BA

130.7

-0.35(-0.2671%)

324

Caterpillar Inc

CAT

78.86

0.54(0.6895%)

5230

Chevron Corp

CVX

101.85

-0.16(-0.1568%)

7150

Cisco Systems Inc

CSCO

28.09

-0.06(-0.2131%)

565

Citigroup Inc., NYSE

C

46.75

-0.22(-0.4684%)

15180

E. I. du Pont de Nemours and Co

DD

66

0.03(0.0455%)

1300

Exxon Mobil Corp

XOM

87.34

-0.19(-0.2171%)

7469

Facebook, Inc.

FB

110.13

-0.43(-0.3889%)

67009

Ford Motor Co.

F

13.58

-0.03(-0.2204%)

20551

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.62

-0.05(-0.4284%)

146155

General Electric Co

GE

30.54

-0.22(-0.7152%)

25992

General Motors Company, NYSE

GM

32.15

-0.03(-0.0932%)

3660

Goldman Sachs

GS

166.25

-0.50(-0.2999%)

840

Google Inc.

GOOG

717.49

-1.28(-0.1781%)

2203

Intel Corp

INTC

31.54

-0.10(-0.3161%)

19952

International Business Machines Co...

IBM

148.26

-0.24(-0.1616%)

596

International Paper Company

IP

42.94

-0.42(-0.9686%)

2000

JPMorgan Chase and Co

JPM

63.85

-0.12(-0.1876%)

301

McDonald's Corp

MCD

125.3

-0.20(-0.1594%)

1560

Microsoft Corp

MSFT

51.6

-0.18(-0.3476%)

95186

Nike

NKE

59.48

0.05(0.0841%)

1345

Pfizer Inc

PFE

33.24

-0.03(-0.0902%)

2412

Procter & Gamble Co

PG

80.96

0.01(0.0124%)

2474

Starbucks Corporation, NASDAQ

SBUX

57.4

-0.28(-0.4854%)

6578

Tesla Motors, Inc., NASDAQ

TSLA

253.7

-0.05(-0.0197%)

13743

The Coca-Cola Co

KO

44.5

-0.04(-0.0898%)

7546

Twitter, Inc., NYSE

TWTR

17.24

0.01(0.058%)

32140

Verizon Communications Inc

VZ

50.5

-0.05(-0.0989%)

904

Visa

V

79

-0.11(-0.139%)

756

Wal-Mart Stores Inc

WMT

69.17

0.45(0.6548%)

200

Walt Disney Co

DIS

103.66

-0.11(-0.106%)

1294

Yahoo! Inc., NASDAQ

YHOO

37.5

0.02(0.0534%)

5759

Yandex N.V., NASDAQ

YNDX

18.05

-0.03(-0.1659%)

3020

-

14:51

Fitch affirms Italia’s sovereign debt rating at 'BBB+'

Rating agency Fitch Ratings Friday affirmed Italia's sovereign debt rating at 'BBB+'. The outlook is 'stable'.

The agency noted that Australia's rating was supported by "a large, high value-added and diversified economy, with moderate levels of private sector indebtedness and a sustainable pension system".

"The ratings balance these structural strengths against high public debt and weak growth performance and outlook," Fitch added.

The agency also said that Italia's economic recovery was supported by the European Central Bank's (ECB) quantitative easing and low oil prices.

The economy is expected to expand 1.0% this year and 1.3% next year, according to Fitch's forecasts.

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Caterpillar (CAT) upgraded to Neutral from Sell at Goldman; target $78

Downgrades:

Intl Paper (IP) downgraded to Sector Perform from Outperform at RBC Capital Mkts; target $46

Other:

McDonald's (MCD) target raised to $140 from $135 at RBC Capital Mkts

General Electric (GE) target raised to $35 from $33 at RBC Capital Mkts

Freeport-McMoRan (FCX) target raised to $12 from $6.50 at RBC Capital Mkts

Honeywell (HON) target raised to $122 from $121 at RBC Capital Mkts

Honeywell (HON) target raised to $129 from $127 at Stifel

Tesla Motors (TSLA) target raised to $245 from $202 at Goldman; Neutral

-

14:14

CBI industrial order books balance rises to -11 in April

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance rose to -11 in April from -14 in March, beating expectations for a decline to -15.

"Manufacturing has yet to pick-up after a flat start to the year, with falling orders providing little impetus for production. While expectations for the upcoming quarter are encouraging, manufacturers are still facing sizeable external headwinds," the CBI director of economics Rain Newton-Smith said.

"The falling exchange rate should give some support to manufacturers, and investment intentions are strong," she added.

-

13:59

Earnings Season in U.S.: Major Reports of the Week

April 26

Before the Open:

3M (MMM). Consensus EPS $1.92, Consensus Revenue $7326.17 mln

Barrick Gold (ABX). Consensus EPS $0.10, Consensus Revenue $1992.95 mln

DuPont (DD). Consensus EPS $1.04, Consensus Revenue $7096.82 mln

Freeport-McMoRan (FCX). Consensus EPS -$0.16, Consensus Revenue $3523.13 mln

Procter & Gamble (PG). Consensus EPS $0.82, Consensus Revenue $15809.32 mln

After the Close:

Apple (AAPL). Consensus EPS $2.00, Consensus Revenue $51983.45 mln

AT&T (T). Consensus EPS $0.69, Consensus Revenue $41365.70 mln

Twitter (TWTR). Consensus EPS $0.10, Consensus Revenue $607.55 mln

April 27

Before the Open:

Boeing (BA). Consensus EPS $1.84, Consensus Revenue $21497.36 mln

Intl Paper (IP). Consensus EPS $0.69, Consensus Revenue $5201.31 mln

United Tech (UTX). Consensus EPS $1.40, Consensus Revenue $13186.01 mln

After the Close:

Facebook (FB). Consensus EPS $0.62, Consensus Revenue $5255.31 mln

April 28

Before the Open:

Altria (MO). Consensus EPS $0.68, Consensus Revenue $4423.15 mln

Ford Motor (F). Consensus EPS $0.46, Consensus Revenue $35824.85 mln

Yandex N.V. (YNDX). Consensus EPS $6.31, Consensus Revenue $15379.49 mln

After the Close:

Amazon (AMZN). Consensus EPS $0.59, Consensus Revenue $28013.61 mln

April 29

Before the Open:

Chevron (CVX). Consensus EPS -$0.16, Consensus Revenue $22735.35 mln

Exxon Mobil (XOM). Consensus EPS $0.32, Consensus Revenue $49910.59 mln

After the Close:

Berkshire Hathaway (BRK.B). Consensus EPS $2744.48, Consensus Revenue $52336.15 mln

-

13:04

WSE: Mid session comment

After considerable downward impulse from the first hours of the session the light reflection and calm came onto the Warsaw market. However, the WIG 20 index recorded losses of about 1% compared to the level of the opening. European stock exchanges behave a little bit better. The German DAX lost 0.5% and the French CAC40 0.3%

In the mid-session WIG20 index was recorded at the level of 1,935 points (-0.93) with the turnover less than PLN 175 million.

-

12:01

European stock markets mid session: stocks traded lower on a decline in oil prices

Stock indices traded lower on falling oil prices. Oil prices declined on concerns over the global oil oversupply.

The weaker-than-expected German Ifo data also weighed on stocks. German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index fell to 106.6 in April from 106.7 in March, missing expectations for an increase to 107.0.

"Although companies were somewhat less satisfied with their current situation, their business expectations brightened once again. The moderate upturn in the German economy continues," Ifo President Clemens Fuest said.

The Ifo current conditions index decreased to 113.2 from 113.8. Analysts had expected the index to remain unchanged at 113.8.

The Ifo expectations index climbed to 100.4 from 100.0, missing expectations for a rise to 100.8.

Current figures:

Name Price Change Change %

FTSE 100 6,282.37 -28.07 -0.44 %

DAX 10,289.21 -84.28 -0.81 %

CAC 40 4,543.33 -26.33 -0.58 %

-

11:44

European Central Bank Vice President Vitor Constancio: financial integration in the Eurozone slowed recently

European Central Bank (ECB) Vice President Vitor Constancio said on Monday that financial integration in the Eurozone slowed recently. He pointed out that he banking union should be completed.

-

11:34

Japan's final leading index declines to 96.8 in February, the lowest level since February 2010

Japan's Cabinet Office released its final leading index data on Monday. The leading index decreased to 96.8 in February from 101.2 in January, down from the preliminary estimate of 99.8. It was the lowest level since February 2010.

January's figure was revised down from 101.8.

Japan's coincident index was down to 110.7 in February from 112.3 in January, up from the preliminary reading of 110.3.

-

11:28

Spanish producer prices increase 0.7% in March

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Monday. The Spanish producer prices increased 0.7% in March, after a 1.3% fall in February.

On a yearly basis, producer price inflation in Spain fell 5.4% in March, after a 5.7% decline in February. Producer prices have been declining since July 2014.

Energy prices slid 17.7% year-on-year in March, capital goods prices rose 0.7%, and consumer goods prices were flat, while intermediate goods prices declined 2.7%.

-

10:55

German Ifo business confidence index falls to 106.6 in April

German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index fell to 106.6 in April from 106.7 in March, missing expectations for an increase to 107.0.

"Although companies were somewhat less satisfied with their current situation, their business expectations brightened once again. The moderate upturn in the German economy continues," Ifo President Clemens Fuest said.

The Ifo current conditions index decreased to 113.2 from 113.8. Analysts had expected the index to remain unchanged at 113.8.

The Ifo expectations index climbed to 100.4 from 100.0, missing expectations for a rise to 100.8.

-

10:33

Head of the Eurogroup Jeroen Dijsselbloem: Greece should prepare additional measures to guarantee to be able to reach fiscal targets

Head of the Eurogroup Jeroen Dijsselbloem said on Friday that Greece should prepare additional measures to guarantee to be able to reach fiscal targets.

"We came to the conclusion that the policy package should include a contingent package of additional measures that would be implemented only if necessary to reach the primary surplus target for 2018," he said.

-

10:20

U.S. President Barack Obama: it could take 10 years to reach a trade deal with the U.S. if Britain would leave the European Union

U.S. President Barack Obama said in an interview with BBC that it could take 10 years to reach a trade deal with the U.S. if Britain would leave the European Union (EU).

"It could be five years from now, 10 years from now before we're actually able to get something done," he said.

Obama noted that Britain would not reach a trade deal with the U.S. faster that the EU. He added that the EU was the largest trading partner of the U.S.

-

09:15

WSE: After opening

Futures market (WSE: FW20M16) started the new week with an increase of 0.16% to 1,938 points.

WIG20 index opened at 1940.55 points (-0.13%)*

WIG 48,365.58 -0.17%

WIG30 2,162.52 -0.30%

mWIG40 3,667.91 0.04%

*/ - change to previous close

In the beginning of trading, the turnover on the WIG20 was very low. So far, it looks that at least in terms of activity this will be a slow Monday. The German DAX looked up slightly, so the start of the week is colored neutrally so far, relative to the Friday's closing.

-

08:26

WSE: Before opening

The last week of April will start off with a series of events that may have a significant impact on the market sentiment. A number of S&P companies will announce their results this week, and most attention will be focused on such giants as Apple (today after the session) or Facebook (Wednesday after the session). The most important event in the macro calendar of this week will be FOMC Statement on Wednesday's evening.

The morning moods are bearish, Asia is dominated by sellers, and contracts in the US have also slightly adjusted after a higher opening. The end of Friday's session in the US was neutral for the S&P500, but there was the decline on the Nasdaq where we saw negative echo of somewhat disappointing results by Google and Microsoft.

The WSE remains in consolidation with better performance displayed by smaller companies. The period when we could expect the blue chips to drive the WIG20 above the level of 2,000 points is likely over, and we assume continuation of the correction of the previous growth.

-

04:11

Nikkei 225 17,451.2 -121.29 -0.69 %, Hang Seng 21,398.71 -68.33 -0.32 %, Shanghai Composite 2,928.33 -30.91 -1.04 %

-

01:03

Stocks. Daily history for Sep Apr 22’2016:

(index / closing price / change items /% change)

Nikkei 225 17,572.49 +208.87 +1.20 %

Hang Seng 21,467.04 -155.21 -0.72 %

S&P/ASX 200 5,236.37 -36.35 -0.69 %

Shanghai Composite 2,959.68 +6.79 +0.23 %

FTSE 100 6,310.44 -71.00 -1.11 %

CAC 40 4,569.66 -13.17 -0.29 %

Xetra DAX 10,373.49 -62.24 -0.60 %

FTSE 100 6,310.44 -71.00 -1.11 %

CAC 40 4,569.66 -13.17 -0.29 %

Xetra DAX 10,373.49 -62.24 -0.60 %

-