Noticias del mercado

-

21:00

Dow +0.12% 18,004.40 +21.88 Nasdaq -0.77% 4,907.70 -38.19 S&P +0.01% 2,091.77 +0.29

-

18:05

European stocks close: stocks closed lower on a drop in shares in the auto sector and on the PMI data from the Eurozone

Stock indices closed lower on a drop in shares in the auto sector and on mostly weaker than expected manufacturing and services purchasing managers' indexes (PMI) from the Eurozone. Markit Economics released its preliminary manufacturing and services PMIs for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI declined to 51.5 in April from 51.6 in March. Analysts had expected the index to increase to 51.8.

Output in the manufacturing sector was moderate, new orders improved slightly, while input prices fell.

Eurozone's preliminary services PMI increased to 53.2 in April from 53.1 in March. Analysts had expected the index to climb to 53.3.

Output in the services sector was moderate, new orders improved slightly, while input prices rose.

"The Eurozone economy remains stuck in a slow growth rut in April, with the PMI once again signalling GDP growth of just 0.3% at the start of the second quarter, broadly in line with the meagre pace of expansion seen now for a full year," Markit's Chief Economist Chris Williamson said.

"A failure of business expectations to revive following the ECB's announcement of more aggressive stimulus in March is a major disappointment and suggests that the modest pace of growth is unlikely to accelerate in coming months," he added.

Germany's preliminary manufacturing PMI climbed to 51.9 in April from 50.7 in March, beating forecasts of a rise to 51.0.

The rise in the manufacturing PMI was driven by a stronger demand from foreign markets.

Germany's preliminary services PMI was down to 54.6 in April from 55.1 in March. Analysts had expected index to increase to 55.2.

France's preliminary manufacturing PMI dropped to 48.3 in April from 49.6 in March. Analysts had expected the index to rise to 49.8. The manufacturing index was driven by declines in output, new orders, employment and input prices.

France's preliminary services PMI climbed to 50.8 in April from 49.9 in March. Analysts had expected the index to increase to 50.2. The services index was driven by rises in output, new orders, employment and input prices.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,310.44 -71.00 -1.11 %

DAX 10,373.49 -62.24 -0.60 %

CAC 40 4,569.66 -13.17 -0.29 %

-

18:05

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Friday after a slew of disappointing earnings reports from Microsoft and other major companies eclipsed a surge in oil prices which boosted energy shares. Microsoft was the biggest drag on all three major indexes. Crude rose about 2,5% on signs of strong U.S. gasoline consumption, declining production around the world and oilfield outages.

Dow stocks mixed (14 in positive area, 16 in negative area). Top looser - Microsoft Corporation (MSFT, -6,71%). Top gainer - The Travelers Companies, Inc. (TRV +1,91%).

Most of S&P sectors mixed. Top looser - Technology (-1,3%). Top gainer - Basic Materials (+0,8%).

At the moment:

Dow 17878.00 -21.00 -0.12%

S&P 500 2079.50 -3.25 -0.16%

Nasdaq 100 4447.75 -50.00 -1.11%

Oil 44.17 +0.99 +2.29%

Gold 1239.10 -11.20 -0.90%

U.S. 10yr 1.88 +0.01

-

18:00

European stocks closed: FTSE 100 6,310.44 -71.00 -1.11% CAC 40 4,569.66 -13.17 -0.29% DAX 10,373.49 -62.24 -0.60%

-

17:58

Bank of England Monetary Policy Committee member Gertjan Vlieghe: the BOE’s interest rate could be theoretically negative

Bank of England (BoE) Monetary Policy Committee (MPC) member Gertjan Vlieghe said in an interview with the Evening Standard on Friday that the BOE's interest rate could be theoretically negative.

"Theoretically, I think interest rates could go a little bit negative," he said.

He added that the central bank had to think carefully about benefits and costs of negative rates.

-

17:40

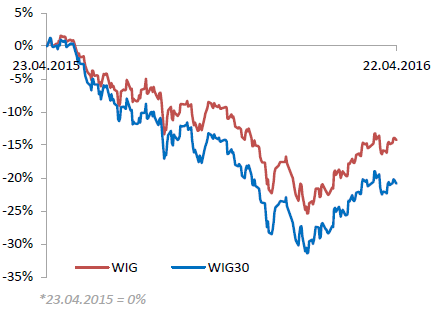

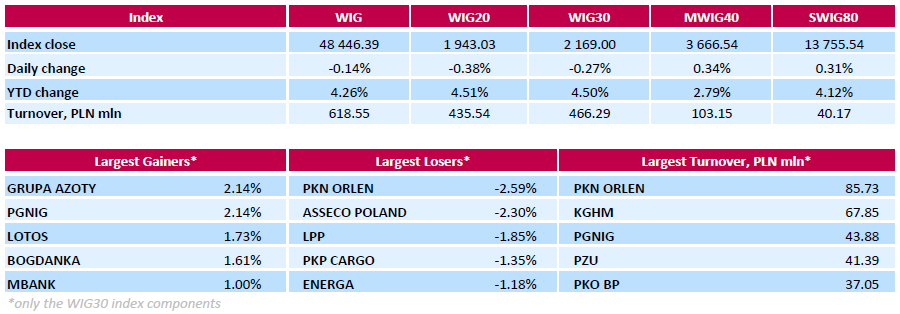

WSE: Session Results

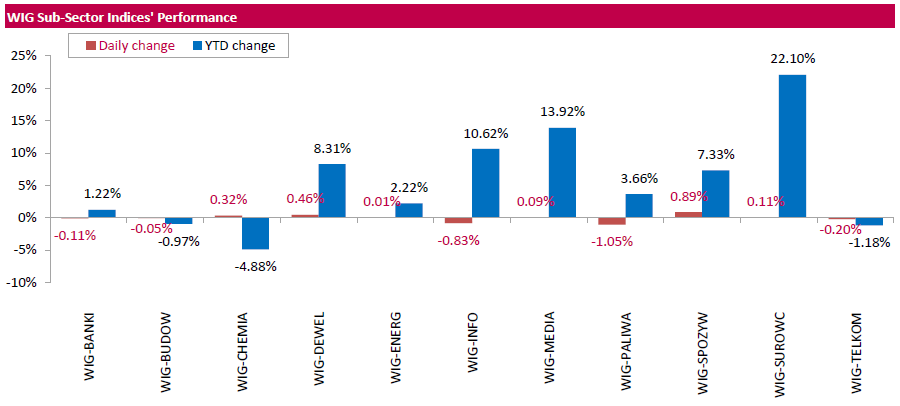

Polish equity market closed lower on Friday. The broad market measure, the WIG index, fell by 14%. Sector performance within the WIG Index was mixed. Oil and gas sector stocks (-1.05%) tumbled the most, while food sector names (+0.89%) fared the best.

The large-cap stocks' benchmark, the WIG30 Index, lost 0.27%. In the index basket, oil refiner PKN ORLEN (WSE: PKN) continued to retreat, losing 2.59%. Other major laggards were IT-company ASSECO POLAND (WSE: ACP), clothing retailer LPP (WSE: LPP) and railway freight transport operator PKP CARGO (WSE: PKP), plunging by 2.3%, 1.85% and 1.35% respectively. On the other side of the ledger, oil and gas producer PGNIG (WSE: PGN) and chemical producer GRUPA AZOTY (WSE: ATT) were the growth leaders, with each gaining 2.14%.

-

16:22

Japan's tertiary industry activity index decreases 0.1% in February

Japan's Ministry of Economy, Trade and Industry released its tertiary industry activity index on Friday. The index decreased 0.1% in February, after a 0.7% rise in January. January's figure was revised down from 1.5% increase.

The fall was driven by declines in business-related services, retail trade, electricity, gas, heat supply and water, and medical, health care and welfare.

On a yearly basis, the tertiary industry activity index climbed 2.3% in February, after a 0.2% rise in January.

-

16:05

European Central Bank’s Survey of Professional Forecasters: forecasters lower their inflation forecasts

The European Central Bank (ECB) released its Survey of Professional Forecasters for Q2 2016 on Friday. Forecasters cut their inflation forecasts. Eurozone's inflation is expected to be 0.3% in 2016, down from January estimate of 0.7%, 1.3% in 2017, down from January estimate of 1.4%, and 1.6% in 2018, unchanged from January estimate.

Long-term inflation forecasts (for 2020) remained unchanged at 1.8%.

The economic growth in the Eurozone is expected to expand 1.5% this year, down from January estimate of 1.7%, 1.6% next year, down from January estimate of 1.8%, and 1.7% in 2018, unchanged from January estimate.

Long-term growth forecasts (for 2020) remained unchanged at 1.7%.

-

15:54

WSE: After start on Wall Street

U.S. Stocks open: Dow +0.11%, Nasdaq -0.80%, S&P -0.09%

Wall Street started the session at levels with the small differ from the indications of future contracts. This flat opening of the S&P500 may not become a serious impetus to the game in Warsaw.

At the moment WIG20 looking for a way out of the consolidation in the region of 1,930 pts., which dominates trading from the morning.

Without a doubt, the most important picture of the session remains low activity, which slightly more than an hour before the end of the session is at the level of PLN 300 mln. Probably until the final will exceed Monday's PLN 373 million, but today's session will be the most peaceful in the current month.

-

15:51

U.S. preliminary manufacturing purchasing managers' index declines to 50.8 in April from 51.5 in March, the lowest level since September 2009

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 50.8 in April from 51.5 in March, missing expectations for an increase to 52.0. It was the lowest level since September 2009.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a softer pace of expansion in output, new business and employment.

"US factories reported their worst month for just over six-and-a-half years in April, dashing hopes that first quarter weakness will prove temporary. Survey measures of output and order book backlogs are down to their lowest since the height of the global financial crisis, prompting employers to cut back on their hiring," Markit Chief Economist Chris Williamson said.

"With prior months' survey data pointing to annualized GDP growth of just 0.7% in the first quarter, the deteriorating performance of manufacturing suggests that growth could weaken closer towards stagnation in the second quarter," he added.

-

15:33

U.S. Stocks open: Dow +0.11%, Nasdaq -0.80%, S&P -0.09%

-

15:15

Before the bell: S&P futures +0.05%, NASDAQ futures -0.16%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 17,572.49 +208.87 +1.20%

Hang Seng 21,467.04 -155.21 -0.72%

Shanghai Composite 2,959.68 +6.79 +0.23%

FTSE 6,308.18 -73.26 -1.15%

CAC 4,567.16 -15.67 -0.34%

DAX 10,389.33 -46.40 -0.44%

Crude oil $43.49 (+0.72%)

Gold $1248.50 (-0.14%)

-

15:05

Canadian consumer price inflation rises 0.6% in March

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.6% in March, in line with expectations, after a 0.2% gain in February.

The monthly rise was mainly driven by an increase in prices for gasoline, and clothing and footwear. Prices for gasoline were up 5.7% in March, while prices clothing and footwear increased 4.2%.

On a yearly basis, the consumer price index fell to 1.3% in March from 1.4% in February, beating expectations for a decline to 1.2%.

The consumer price index was mainly driven by higher food and shelter prices. Food prices climbed 3.6% year-on-year in March, while shelter prices increased 1.1%.

The index for recreation, education and reading climbed by 2.0% in March from the same month a year earlier, the gasoline prices dropped 13.6%, while clothing and footwear prices declined 0.4%.

The Canadian core consumer price index, which excludes some volatile goods, increased 0.7% in March, after a 0.5% increase in February.

On a yearly basis, core consumer price index in Canada climbed to 2.1% in March from 1.9% in February. Analysts had expected the index to drop to 1.7%.

The Bank of Canada's inflation target is 2.0%.

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

169.01

0.35(0.2075%)

3470

ALCOA INC.

AA

10.41

-0.01(-0.096%)

14850

ALTRIA GROUP INC.

MO

60.18

0.00(0.00%)

585

Amazon.com Inc., NASDAQ

AMZN

626

-5.00(-0.7924%)

13394

American Express Co

AXP

65.1

-0.51(-0.7773%)

8382

Apple Inc.

AAPL

105.4

-0.57(-0.5379%)

98870

AT&T Inc

T

37.86

0.00(0.00%)

6895

Barrick Gold Corporation, NYSE

ABX

16.37

0.03(0.1836%)

49503

Boeing Co

BA

130.86

0.12(0.0918%)

725

Caterpillar Inc

CAT

76.87

-1.79(-2.2756%)

204390

Chevron Corp

CVX

101.75

0.35(0.3452%)

2645

Cisco Systems Inc

CSCO

28.38

0.14(0.4957%)

33927

Citigroup Inc., NYSE

C

46.51

-0.09(-0.1931%)

22765

Deere & Company, NYSE

DE

82.1

-0.70(-0.8454%)

845

E. I. du Pont de Nemours and Co

DD

65.24

0.15(0.2304%)

2155

Exxon Mobil Corp

XOM

87

0.21(0.242%)

5064

Facebook, Inc.

FB

111.63

-1.81(-1.5956%)

252283

Ford Motor Co.

F

13.6

-0.05(-0.3663%)

16037

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.79

0.27(2.3437%)

147029

General Electric Co

GE

30.6

-0.38(-1.2266%)

208625

General Motors Company, NYSE

GM

32.64

-0.02(-0.0612%)

5292

Goldman Sachs

GS

165.04

-0.28(-0.1694%)

1445

Google Inc.

GOOG

723.5

-35.64(-4.6948%)

94043

Home Depot Inc

HD

134.47

-0.13(-0.0966%)

1701

HONEYWELL INTERNATIONAL INC.

HON

114.5

-0.42(-0.3655%)

9289

Intel Corp

INTC

31.7

-0.27(-0.8445%)

25463

International Business Machines Co...

IBM

149.1

-0.20(-0.134%)

2057

Johnson & Johnson

JNJ

113.31

-0.26(-0.2289%)

2455

JPMorgan Chase and Co

JPM

63.45

-0.15(-0.2358%)

15067

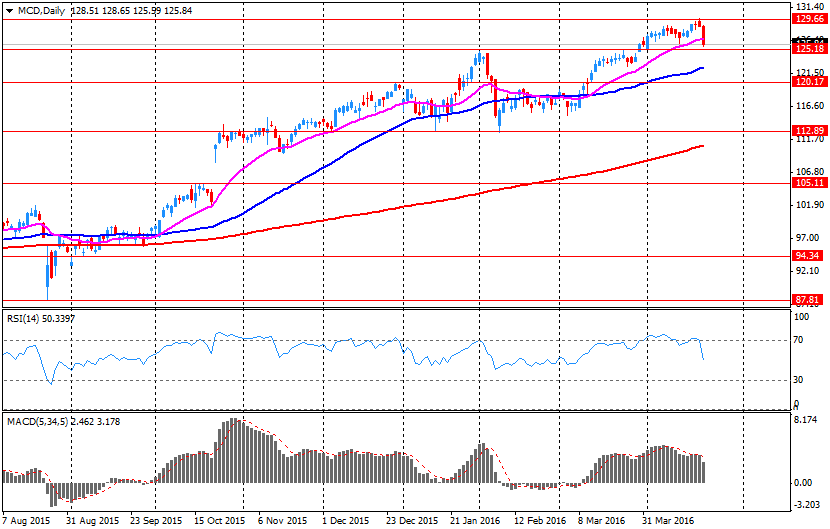

McDonald's Corp

MCD

128.01

2.22(1.7648%)

186700

Merck & Co Inc

MRK

56.61

0.01(0.0177%)

885

Microsoft Corp

MSFT

52.75

-3.03(-5.4321%)

1241398

Nike

NKE

60.25

0.17(0.283%)

2296

Pfizer Inc

PFE

33.21

-0.03(-0.0903%)

2125

Procter & Gamble Co

PG

80.36

-0.44(-0.5446%)

19661

Starbucks Corporation, NASDAQ

SBUX

58.7

-1.94(-3.1992%)

220630

Tesla Motors, Inc., NASDAQ

TSLA

247.8

-0.49(-0.1973%)

7568

The Coca-Cola Co

KO

43.7

0.04(0.0916%)

6908

Travelers Companies Inc

TRV

109.14

0.35(0.3217%)

2365

Twitter, Inc., NYSE

TWTR

17.41

-0.10(-0.5711%)

10230

United Technologies Corp

UTX

105.75

0.32(0.3035%)

1370

UnitedHealth Group Inc

UNH

133.28

0.32(0.2407%)

685

Verizon Communications Inc

VZ

50.11

0.08(0.1599%)

9019

Visa

V

78.09

-2.70(-3.342%)

38076

Wal-Mart Stores Inc

WMT

68.57

0.10(0.146%)

2055

Walt Disney Co

DIS

103.28

0.37(0.3595%)

2863

Yahoo! Inc., NASDAQ

YHOO

37.54

-0.13(-0.3451%)

1605

Yandex N.V., NASDAQ

YNDX

18.24

0.11(0.6067%)

9000

-

14:48

Canadian retail sales climb 0.4% in February

Statistics Canada released retail sales data on Friday. Canadian retail sales climbed by 0.4% in February, beating expectations for a 0.8% drop, after a 2.0% increase in January. January's figure was revised down from a 2.1% rise.

The increase was driven by rises in 9 of 11 subsectors.

Sales at motor vehicle and parts dealers rose by 1.0% in February, while sales at general merchandise stores increased by 1.9%.

Sales at gasoline stations declined 4.9% in February, while sales at food and beverage stores were up 0.2%.

Sales at building material and garden equipment and supplies dealers increased 1.3% in February, while sales at furniture and home furnishings stores rose 1.9%.

Canadian retail sales excluding automobiles rose 0.2% in February, beating expectations for a 0.5% fall, after a 1.3% increase in January. January's figure was revised up from a 1.2% gain.

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

American Express (AXP) downgraded to Hold from Buy at Deutsche Bank

Other:

General Motors (GM) target raised to $34 from $30 at RBC Capital Mkts

Microsoft (MSFT) target lowered to $61 from $63 at RBC Capital Mkts

Microsoft (MSFT) target lowered to $57 from $58 at BMO Capital Markets

Alphabet (GOOG) reiterated with a Buy at Mizuho

Alphabet (GOOG) reiterated with a Buy at Stifel Research; target $888

-

14:12

European stock markets mid session: stocks traded lower on the PMI data from the Eurozone

Stock indices traded lower on mostly weaker than expected manufacturing and services purchasing managers' indexes (PMI) from the Eurozone. Markit Economics released its preliminary manufacturing and services PMIs for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI declined to 51.5 in April from 51.6 in March. Analysts had expected the index to increase to 51.8.

Output in the manufacturing sector was moderate, new orders improved slightly, while input prices fell.

Eurozone's preliminary services PMI increased to 53.2 in April from 53.1 in March. Analysts had expected the index to climb to 53.3.

Output in the services sector was moderate, new orders improved slightly, while input prices rose.

"The Eurozone economy remains stuck in a slow growth rut in April, with the PMI once again signalling GDP growth of just 0.3% at the start of the second quarter, broadly in line with the meagre pace of expansion seen now for a full year," Markit's Chief Economist Chris Williamson said.

"A failure of business expectations to revive following the ECB's announcement of more aggressive stimulus in March is a major disappointment and suggests that the modest pace of growth is unlikely to accelerate in coming months," he added.

Germany's preliminary manufacturing PMI climbed to 51.9 in April from 50.7 in March, beating forecasts of a rise to 51.0.

The rise in the manufacturing PMI was driven by a stronger demand from foreign markets.

Germany's preliminary services PMI was down to 54.6 in April from 55.1 in March. Analysts had expected index to increase to 55.2.

France's preliminary manufacturing PMI dropped to 48.3 in April from 49.6 in March. Analysts had expected the index to rise to 49.8. The manufacturing index was driven by declines in output, new orders, employment and input prices.

France's preliminary services PMI climbed to 50.8 in April from 49.9 in March. Analysts had expected the index to increase to 50.2. The services index was driven by rises in output, new orders, employment and input prices.

Current figures:

Name Price Change Change %

FTSE 100 6,329.49 -51.95 -0.81 %

DAX 10,354.86 -80.87 -0.77 %

CAC 40 4,564.54 -18.29 -0.40 %

-

14:12

-

13:54

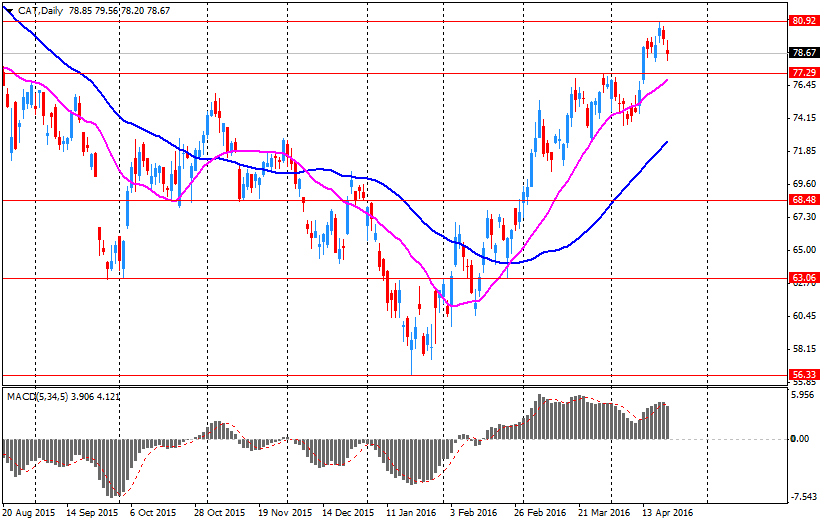

Company News: Caterpillar (CAT) Q1 Earnings Miss Analysts’ Forecasts

Caterpillar reported Q1 FY 2016 earnings of $0.67 per share (versus $1.72 in Q1 FY 2015), missing analysts' consensus of $0.68.

The company's quarterly revenues amounted to $9.461 bln (-25.5% y/y), generally in-line with consensus estimate of $9.455 bln.

Caterpillar lowered FY 2016 EPS guidance to $3.70 from $4.00 (versus analysts' consensus estimate of $3.60) and FY 2016 revenues guidance to $40-42 bln from $40-44 bln (versus analysts' consensus estimate of $41.08 bln).

CAT fell to $77.50 (-1.47%) in pre-market trading.

-

13:08

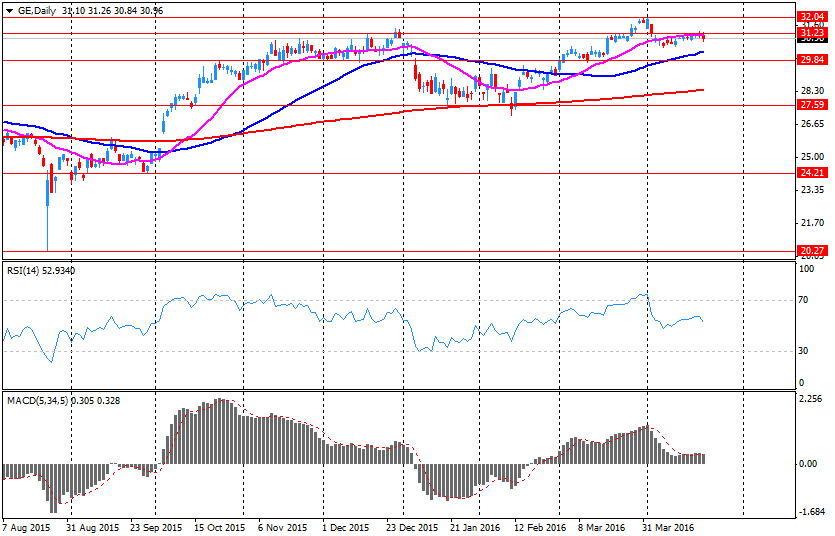

Company News: General Electric (GE) Q1 Earnings Beat Analysts’ Expectations

General Electric reported Q1 FY 2016 earnings of $0.21 per share (versus $0.31 in Q1 FY 2015), beating analysts' consensus of $0.19.

The company's quarterly revenues amounted to $27.597 bln (+6.4% y/y), missing consensus estimate of $27.966 bln.

General Electric reaffirmed guidance for FY 2016, projecting EPS of $1.45-1.55 (versus analysts' consensus estimate of $1.50).

GE fell to $30.60 (-1.23%) in pre-market trading.

-

13:00

WSE: Mid session comment

In the first part of trading on the Warsaw Stock Exchange the weak core markets resulted in weakness of the WIG20 index. Basket of blue chips lost 1.13 percent now, which greatly differs from the decline in the German DAX. Transfer of the atmosphere is obvious when we consider the fact that the WSE has not an argument on which to build a counterweight to the core markets. The weakness of the zloty and increase of the profitability of Polish debt have to discouraged investors. Technique forces waiting for the solstice, and the turnover - barely PLN 170 mln - does not indicate a serious operating capital. In the event of a revaluation has a positive side, because indicates a rather sleepy subsidence prices than serious attack of sellers.

-

12:53

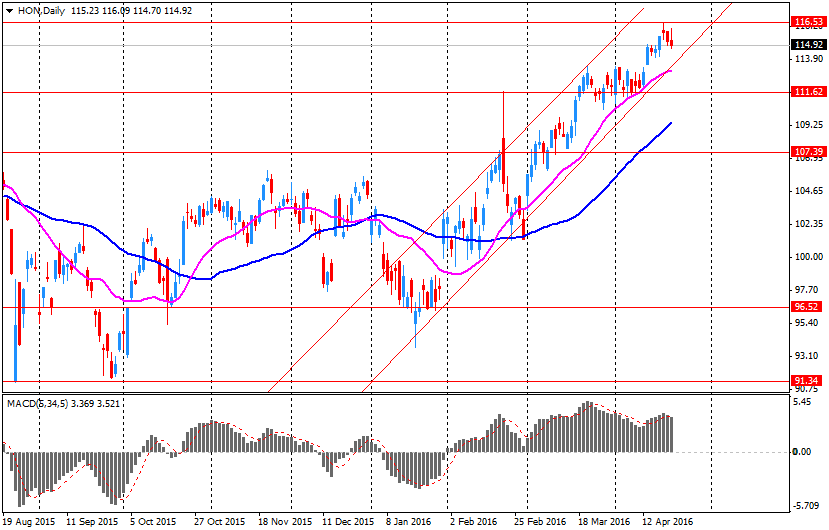

Company News: Honeywell (HON) Q1 Results Beat Analysts’ Estimates

Honeywell reported Q1 FY 2016 earnings of $1.53 per share (versus $1.41 in Q1 FY 2015), beating analysts' consensus of $1.50.

The company's quarterly revenues amounted to $9.522 bln (+3.4% y/y), beating consensus estimate of $9.365 bln.

Honeywell issued guidance for FY 2016, raising EPS to $6.55-6.70 from $6.45-6.70 (versus analysts' consensus estimate of $6.60) and revenues to $40.3-40.9 bln from $39.9-40.9 bln (versus analysts' consensus estimate of $40.61 bln).

HON rose to $116 00(+0.94%) in pre-market trading.

-

11:47

Italian retail sales climb 0.3% in February

The Italian statistical office Istat released its retail sales data for Italy on Friday. Italian retail sales climbed 0.3% in February, after a flat reading in January.

Sales of food products were up 0.7% in February, while sales of non-food products increased by 0.1%.

On a yearly basis, retail sales in Italy jumped 2.7% in February, after a 0.8% fall in January.

-

11:40

Industrial orders in Italy rise at a seasonally adjusted rate of 0.7% in February

The Italian statistical office Istat released its industrial orders data for Italy on Friday. Industrial orders in Italy rose at a seasonally adjusted rate of 0.7% in February, after a 0.6% increase in January. January's figure was revised down from a 0.7% gain.

Domestic orders were up 1.6% in February, while non-domestic orders declined 0.3%.

On a yearly basis, the unadjusted industrial orders in Italy increased 3.8% in February, after a 0.1% rise in January.

The seasonally adjusted industrial turnover in Italy climbed 0.1% in February, after a 0.9% increase in January. January's figure was revised down from a 1.0% rise.

Domestic turnover increased 0.2% in February, while non-domestic turnover fell 0.1%.

On a yearly basis, the adjusted industrial turnover in Italy declined 0.2% in February, after a 0.3% decrease in January.

-

11:33

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 48.0 in April

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 48.0 in April from 49.1 in March. It was the lowest level since January 2013.

A reading below 50 indicates contraction of activity, a reading above 50 indicates expansion.

The index was mainly driven by drop in output, new orders and input prices.

"Manufacturing conditions in Japan worsened at a sharper rate in April. Both production and new orders declined markedly, with total new work contracting at the fastest rate in over three years," economist at Markit, Amy Brownbill, said.

-

11:28

France's preliminary manufacturing PMI declines in April, while services PMI increases

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Friday. France's preliminary manufacturing PMI dropped to 48.3 in April from 49.6 in March. Analysts had expected the index to rise to 49.8.

The manufacturing index was driven by declines in output, new orders, employment and input prices.

France's preliminary services PMI climbed to 50.8 in April from 49.9 in March. Analysts had expected the index to increase to 50.2.

The services index was driven by rises in output, new orders, employment and input prices.

"The French private sector economy eked out marginal growth at the start of the second quarter after broadly stagnating on average during the opening three months of the year. Expansion was centred on the dominant service sector, as manufacturing was weighed down by a sharp drop in incoming new orders," the Senior Economist at Markit Jack Kennedy said.

-

11:21

Germany's preliminary manufacturing PMI rises in April, while services PMI declines

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Friday. Germany's preliminary manufacturing PMI climbed to 51.9 in April from 50.7 in March, beating forecasts of a rise to 51.0.

The rise in the manufacturing PMI was driven by a stronger demand from foreign markets.

Germany's preliminary services PMI was down to 54.6 in April from 55.1 in March. Analysts had expected index to increase to 55.2.

"The German private sector economy is continuing its unspectacular expansionary trend at the beginning of the second quarter. Although growth remained uninspiring and the headline PMI dropped to a 9-month low, the index was down only fractionally since March and is still indicative of modest growth," Markit's economist Oliver Kolodseike noted.

-

11:08

Eurozone's preliminary manufacturing PMI falls in April, while services PMIs rises slightly

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI declined to 51.5 in April from 51.6 in March. Analysts had expected the index to increase to 51.8.

Output in the manufacturing sector was moderate, new orders improved slightly, while input prices fell.

Eurozone's preliminary services PMI increased to 53.2 in April from 53.1 in March. Analysts had expected the index to climb to 53.3.

Output in the services sector was moderate, new orders improved slightly, while input prices rose.

"The Eurozone economy remains stuck in a slow growth rut in April, with the PMI once again signalling GDP growth of just 0.3% at the start of the second quarter, broadly in line with the meagre pace of expansion seen now for a full year," Markit's Chief Economist Chris Williamson said.

"A failure of business expectations to revive following the ECB's announcement of more aggressive stimulus in March is a major disappointment and suggests that the modest pace of growth is unlikely to accelerate in coming months," he added.

-

10:39

Bloomberg: the Bank of Japan is considering to offer a negative rate on some loans

Bloomberg reported on Friday that the Bank of Japan (BoJ) was considering to offer a negative rate on some loans, according to people familiar with the matter.

The BoJ lowered its interest rate to -0.1% at its monetary policy meeting in February.

-

10:28

Number of Canadian receiving unemployment benefits rises 0.8% in February

Statistics Canada released its unemployment benefits data on Thursday. More Canadians received unemployment benefits in the provinces of Alberta and Saskatchewan unemployment benefits in February. Both provinces depend on resources. The number of Canadian receiving unemployment benefits in Alberta rose 2.4% in February compared to the previous month, while the number of Canadian receiving unemployment benefits in Saskatchewan climbed 3.5%.

Overall, the number of Canadian receiving unemployment benefits rose 0.8% in February compared to the previous month.

-

10:09

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy fall to 42.9 in in the week ended April 17

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 42.9 in in the week ended April 17 from 43.6 the prior week.

The decrease was driven by declines in two of three sub-indexes. The measure of views of the economy dropped to 33.4 from 35.6, the buying climate index rose to 39.6 from 38.7, while the personal finances index fell to 55.6 from 56.6.

-

09:27

WSE: After opening

WIG20 index opened at 1949.60 points (-0.04%)*

WIG 48494.11 -0.04%

WIG30 2173.13 -0.08%

mWIG40 3655.08 0.03%

*/ - change to previous close

In the case of the WIG20 index, opening was simply flat and in the early exchanges index oscillates around yesterday's close, with a slight tendency for a revaluation. Opening properly conclusively shows, that the market will end a week of consolidation between 2,000-1,900 points. The session would have to have a custom course and require a surge in volatility to the limits of consolidation have been tested. Turnover in the first 10 minutes did not indicate that such a scenario was possible today. Market lacks not only of the variation but also activity.

-

08:29

WSE: Before opening

Thursday's session on Wall Street ended in solidarity declines in major indices. Clearly better than the rest coped Nasdaq Composite, which gave only 0.05 percent, while the DJIA and S&P500 lost - respectively - 0.63 and 0.52 percent. The impetus for the sell-off was the decline in oil prices. Without significance was not also the strengthening of the yen to the dollar.

In this arrangement of forces, start of the day on European markets should bring rather weaker than a stronger declines. After the opening of markets in the European region on the stock exchanges will flow readings of PMI indexes. Today will also be published the results of the company General Electric, which rarely surprises serious passing with market expectations.

Looking at the Warsaw market, the WIG 20 index from Wednesday is nearby the level of 1,950 pts., which from the point of view of technical analysis is they neutral levels. It can therefore be assumed that Friday will not bring a breakthrough, and the market will enter a new week in the range of consolidation.

-

07:26

Global Stocks

European stock markets ended a up-and-down session modestly lower on Thursday, after the European Central Bank reaffirmed its commitment to tackle low inflation and flagging growth, but stopped short of hinting at any further stimulus measures.

Major U.S. stock indexes turned in their largest declines in two weeks Thursday, pulling back after days of edging closer to record highs. Telecommunications and utilities shares led the broad losses, which pulled the Dow Jones Industrial Average back below 18000 after the index this week closed above the milestone for the first time since July. The two sectors, considered relatively steady and safe, are up the most in the S&P 500 over the past 12 months.

Asian stocks fell Friday after Wall Street broke a three-day winning streak and declined. Investors sold traditional safe-play stocks such as phone companies and utilities as they pored over earnings for clues about the trajectory of the U.S. economy. Analysts say companies are struggling to meet profit expectations.

Based on MarketWatch materials

-

04:33

Nikkei 225 17,293.42 -70.20 -0.40 %, Hang Seng 21,445.57 -176.68 -0.82 %, Shanghai Composite 2,936.1 -16.79 -0.57 %

-

01:04

Stocks. Daily history for Sep Apr 21’2016:

(index / closing price / change items /% change)

Nikkei 225 17,363.62 +457.08 +2.70%

Hang Seng 21,622.25 +385.94 +1.82%

S&P/ASX 200 5,272.71 +56.76 +1.09%

Shanghai Composite 2,952.6 -19.98 -0.67%

FTSE 100 6,381.44 -28.82 -0.45%

CAC 40 4,582.83 -9.09 -0.20%

Xetra DAX 10,435.73 +14.44 +0.14%

S&P 500 2,091.48 -10.92 -0.52%

NASDAQ Composite 4,945.89 -2.24 -0.05%

Dow Jones 17,982.52 -113.75 -0.63%

-