Noticias del mercado

-

21:00

Dow -0.63% 17,983.10 -113.17 Nasdaq -0.17% 4,939.75 -8.38 S&P -0.57% 2,090.49 -11.91

-

18:09

European stocks close: stocks closed mixed on comments by the ECB President Mario Draghi

Stock indices closed mixed after the release of the European Central Bank's (ECB) interest rate decision. The interest rate remained unchanged at 0.00%. This decision was widely expected by analysts.

The ECB European Central Bank (ECB) President Mario Draghi said at a press conference on Thursday that Eurozone's economy was expected to continue to recover. He noted that inflation in the Eurozone could be negative in the coming months before rising in the second half of 2016. Draghi pointed out that the ECB did not discuss helicopter money.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 1.3% in March, missing expectations for a 0.1% drop, after a 0.5% decline in February. February's figure was revised down from a 0.4% decrease.

The decline was driven by a weak demand in all categories. Food sales were down 1.9% in March, while non-food store sales decreased 1.5%.

On a yearly basis, retail sales in the U.K. climbed 2.7% in March, missing forecasts of a 4.4% increase, after a 3.6% rise in February. February's figure was revised down from a 3.8% gain.

The ONS also released public sector net borrowing for the U.K. Public sector net borrowing excluding public sector banks declined to £74.0 billion in the fiscal year 2015/16 ending March 2016 from £91.7 billion in the previous fiscal year. It is equivalent to 3.9% of GDP.

The government forecasted £72.0 billion for the fiscal year 2015/16.

The debt-to-gross domestic product ratio rose to 83.5% in the fiscal year 2015/16 from 83.3% in the previous fiscal year.

Public sector net borrowing excluding public sector banks declined to £4.6 billion in March from £7.4 billion in March a year ago.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,381.44 -28.82 -0.45 %

DAX 10,435.73 +14.44 +0.14 %

CAC 40 4,582.83 -9.09 -0.20 %

-

18:00

European stocks closed: FTSE 100 6,381.44 -28.82 -0.45% CAC 40 4,582.83 -9.09 -0.20% DAX 10,435.73 +14.44 +0.14%

-

17:54

Greece beats primary budget target

According to the European Commission on Thursday, Greece beat primary budget target. Greece reached a primary surplus of 0.7% of GDP in 2015, higher than a target of a primary deficit of 0.25% of GDP set by the European Commission.

-

17:52

WSE: Session Results

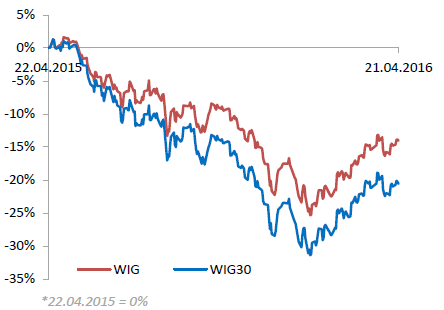

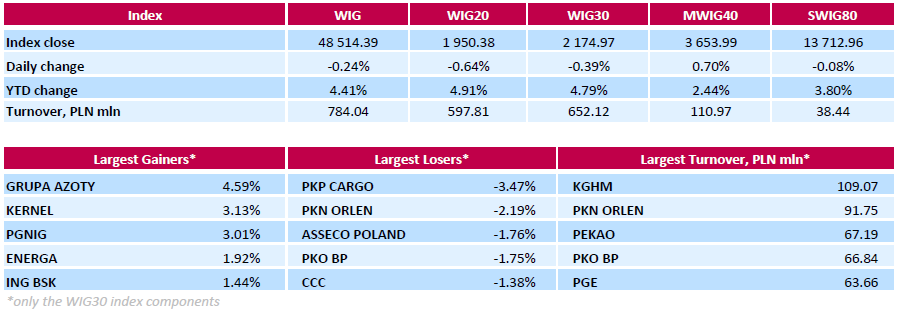

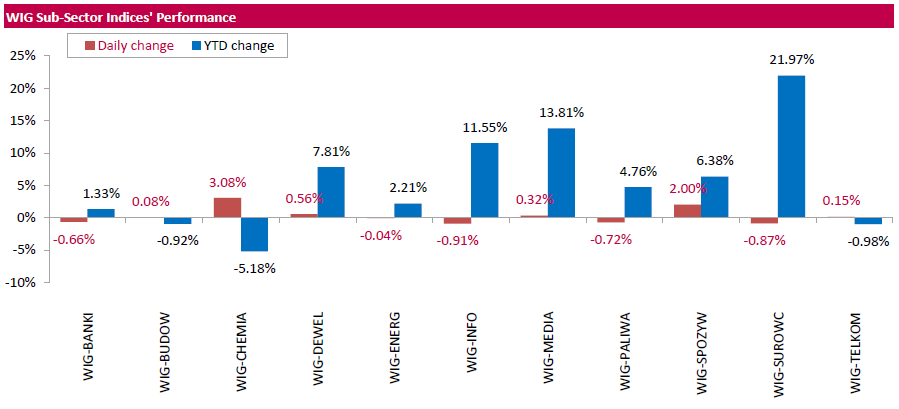

Polish equity market closed lower on Thursday. The broad market measure, the WIG Index, fell by 0.24%. Sector performance within the WIG Index was mixed. Chemicals (+3.08%) fared the best, while informational technology sector (-0.91%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.39%. Within the WIG30 Index components, railway freight transport operator PKP CARGO (WSE: PKP) recorded the biggest decline, down 3.47%. It was followed by oil refiner PKN ORLEN (WSE: PKN), which dropped by 2.19% after the company announced worse-than-expected bottom line result for Q1 FY2016 (the company reported net profit of PLN 337 mln (-55% y/y), whereas the analysts forecasted PLN 791 mln). Other major laggards were IT-company ASSECO POLAND (WSE: ACP), bank PKO BP (WSE: PKO), footwear retailer CCC (WSE: CCC) and genco TAURON PE (WSE; TPE), slumping by 1.37%-1.76%. On the other side of the ledger, chemical producer GRUPA AZOTY (WSE: ATT) topped the gainers with a 4.59% advance on the back of the announcement the company proposed to pay out a dividend of PLN 0.84 per share for FY 2015, which implied a dividend yield of 1% based on the yesterday's closing price. Agricultural holding KERNEL (WSE: KER) and oil and gas company PGNIG (WSE: PGN) also delivered solid advances, growing by 3.13% and 3.01% respectively.

-

17:18

Demand for loans from companies drops in April, while demand for loans from households rises

The Bank of Japan (BoJ) released its Senior Loan Officer Opinion Survey on Thursday. The balance of demand for loans from companies decreased to 5 in April from 8 in January.

Demand for loans from large companies fell to 5 in April from 8 in January, demand for loans from medium-sized companies dropped to -1 from 3, while demand for loans from small companies was down to 4 from 5.

Demand for loans from households climbed to 9 in April from -1 in January.

-

17:14

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes slightly lower on Thursday as oil prices fell and Travelers (TRV) and Verizon (VZ) reported weak results. Crude prices fell nearly 2% but were hovering near five-month highs after the International Energy Agency said 2016 would see the biggest fall in non-OPEC production in more than two decades.

Dow stocks mixed (14 in positive area, 16 in negative area). Top looser - The Travelers Companies, Inc. (TRV, -3,36%). Top gainer - International Business Machines Corporation (IBM +1,55%).

Most of S&P sectors mixed. Top gainer - Utilities (-1,3%). Top looser - Healthcare (+0,5%).

At the moment:

Dow 18013.00 -24.00 -0.13%

S&P 500 2097.25 -0.75 -0.04%

Nasdaq 100 4550.50 +14.75 +0.33%

Oil 43.42 -0.76 -1.72%

Gold 1252.10 -2.30 -0.18%

U.S. 10yr 1.88 +0.02

-

17:09

European Central Bank President Mario Draghi: Eurozone’s economy is expected to continue to recover

The European Central Bank (ECB) President Mario Draghi said at a press conference on Thursday:

- The first operation of new targeted longer-term refinancing operations (TLTRO II) will be conducted in June;

- Financing conditions in the Eurozone improved;

- The ECB would act if needed to reach 2% inflation target;

- The economic growth in the first quarter was driven by domestic demand;

- Exports were weak in the first quarter;

- Eurozone's economy was expected to continue to recover;

- There were still downside risks to the outlook;

- Recent stimulus measures should support consumption and investment;

- Inflation in the Eurozone could be negative in the coming months before rising in the second half of 2016;

- Inflation was expected to recover in 2017 and 2018;

- Structural and fiscal policies were needed;

- The ECB did not discuss helicopter money;

- The ECB was independent, as stated by the law.

- The first operation of new targeted longer-term refinancing operations (TLTRO II) will be conducted in June;

-

16:16

U.S. leading economic index rises 0.2% in March

The Conference Board released its leading economic index (LEI) for the U.S. on Thursday. The leading economic index rose 0.2% in March, missing expectations for a 0.4% increase, after a 0.1% decline in February. February's figure was revised down from a 0.1%.

The coincident economic index was flat in March, after a 0.1% gain in February.

"With the March gain, the U.S. LEI's six-month growth rate improved slightly but still points to slow, although not slowing, growth in the coming quarters. Rebounding stock prices were offset by a decline in housing permits, but nonetheless there were widespread gains among the leading indicators," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

"Financial conditions, as well as expected improvements in manufacturing, should support a modest growth environment in 2016," he added.

-

16:07

Eurozone’s preliminary consumer confidence index rises to -9.3 in April

The European Commission released its preliminary consumer confidence figures for the Eurozone on Thursday. Eurozone's preliminary consumer confidence index rose to -9.3 in April from -9.7 in March. Analysts had expected the index to increase to -9.5.

European Union's consumer confidence index increased by 0.5 points to 6.8 in April.

-

15:53

WSE: After start on Wall Street

The press conference of the head of the ECB does not bring anything new. The Governing Council will monitor closely the prospects for price stability and, if necessary, may take further action. We have also received a mixed data from the US economy. Still very good at the job market, but a negative surprise from the Philadelphia Fed index, whose components confirm the weak image.

As a result, the indexes in the US start trading from neutral levels, but contracts have a session lows. The S&P500 stopped at the line connecting previous peaks and is not able to break through.U.S. Stocks open: Dow -0.04%, Nasdaq +0.01%, S&P -0.03%

-

15:49

Eurozone’s government deficit to GDP ratio is 2.1% in 2015

Eurostat released its government deficit data for 2015 on Thursday. Eurozone's government deficit to GDP ratio fell to 2.1% in 2015 from 2.6% in 2014. Total government revenue in the Eurozone was 46.6% of GDP in 2015, while total government expenditure was 48.6% of GDP.

-

15:34

U.S. Stocks open: Dow -0.04%, Nasdaq +0.01%, S&P -0.03%

-

15:25

Before the bell: S&P futures +0.01%, NASDAQ futures -0.01%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 17,363.62 +457.08 +2.70%

Hang Seng 21,622.25 +385.94 +1.82%

Shanghai Composite 2,952.6 -19.98 -0.67%

FTSE 6,353.21 -57.05 -0.89%

CAC 4,553.02 -38.90 -0.85%

DAX 10,341.97 -79.32 -0.76%

Crude oil $43.95 (-0.52%)

Gold $1269.10 (+1.17%)

-

15:00

Philadelphia Federal Reserve Bank’s manufacturing index drops to -1.6 in April

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index dropped to -1.6 in April from 12.4 in March, missing expectations for a decrease to 8.9.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"This month's Manufacturing Business Outlook Survey suggests a relapse in growth of the region's manufacturing sector. The survey's indicators for general activity, new orders, shipments, and employment all fell notably from their readings in March," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index slid to -10.8 in April from 22.1 in March.

The new orders index decreased to 0.0 in April from 15.7 in March.

The prices paid index rose to 13.2 in April from -0.9% in March, while the prices received index increased to 7.4 from 3.5.

The number of employees index was down to -18.5 in April from -1.1 in March.

According to the report, the future general activity index jumped to 42.2 in April from 28.8 in March.

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.76

0.17(1.6053%)

81261

Apple Inc.

AAPL

107.32

0.19(0.1774%)

78086

Barrick Gold Corporation, NYSE

ABX

16.53

0.64(4.0277%)

268121

AMERICAN INTERNATIONAL GROUP

AIG

56.15

0.03(0.0535%)

3300

Amazon.com Inc., NASDAQ

AMZN

633.5

0.51(0.0806%)

5260

American Express Co

AXP

67

1.98(3.0452%)

74565

Boeing Co

BA

130.5

-0.07(-0.0536%)

770

Citigroup Inc., NYSE

C

46.91

0.17(0.3637%)

22913

Caterpillar Inc

CAT

79.1

0.13(0.1646%)

3506

Cisco Systems Inc

CSCO

28.5

0.06(0.211%)

2025

Chevron Corp

CVX

101.98

0.29(0.2852%)

2488

E. I. du Pont de Nemours and Co

DD

65

0.27(0.4171%)

775

Walt Disney Co

DIS

103.31

0.04(0.0387%)

2856

Ford Motor Co.

F

13.88

0.24(1.7595%)

196259

Facebook, Inc.

FB

112.99

0.57(0.507%)

173262

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.78

0.42(3.3981%)

373614

General Electric Co

GE

31.2

0.05(0.1605%)

11662

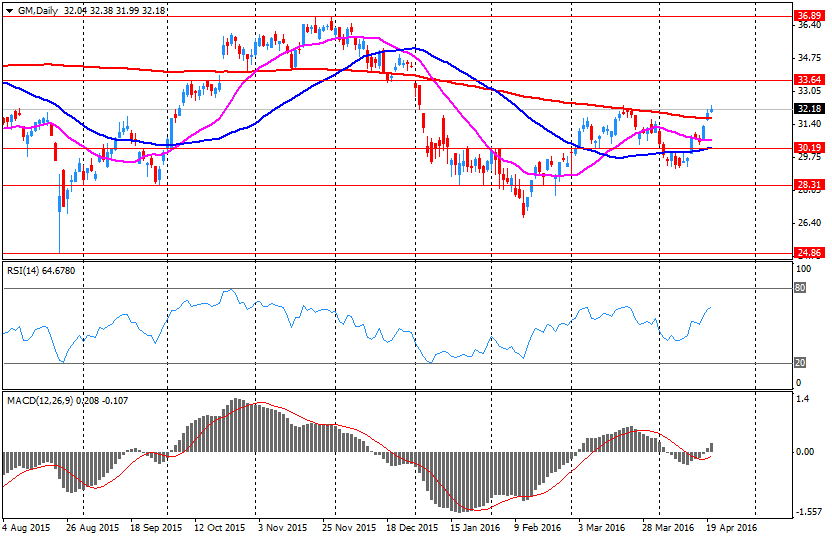

General Motors Company, NYSE

GM

33.3

1.11(3.4483%)

427537

Google Inc.

GOOG

756.11

3.44(0.457%)

7042

Goldman Sachs

GS

167.49

0.51(0.3054%)

1408

International Business Machines Co...

IBM

146.44

0.33(0.2259%)

724

Intel Corp

INTC

32.14

0.14(0.4375%)

150402

Johnson & Johnson

JNJ

113.6

0.02(0.0176%)

4141

JPMorgan Chase and Co

JPM

64.49

0.25(0.3892%)

6909

The Coca-Cola Co

KO

44.4

0.03(0.0676%)

37617

ALTRIA GROUP INC.

MO

61.72

0.24(0.3904%)

4943

Microsoft Corp

MSFT

55.84

0.25(0.4497%)

60538

Nike

NKE

60.52

0.90(1.5096%)

11320

Pfizer Inc

PFE

33.15

-0.08(-0.2407%)

750

Procter & Gamble Co

PG

81.62

0.07(0.0858%)

2787

Starbucks Corporation, NASDAQ

SBUX

61.2

0.30(0.4926%)

3759

AT&T Inc

T

38.47

-0.25(-0.6457%)

38370

Travelers Companies Inc

TRV

112

-3.80(-3.2815%)

4968

Tesla Motors, Inc., NASDAQ

TSLA

250

0.03(0.012%)

17533

Twitter, Inc., NYSE

TWTR

17.49

0.09(0.5172%)

33125

UnitedHealth Group Inc

UNH

133.95

0.02(0.0149%)

406

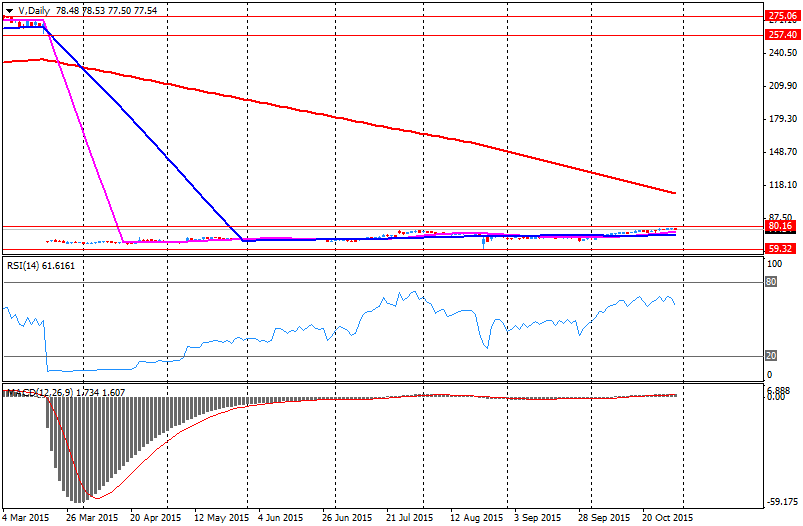

Visa

V

81.7

0.55(0.6778%)

9000

Verizon Communications Inc

VZ

50.6

-1.15(-2.2222%)

406941

Exxon Mobil Corp

XOM

87.03

0.23(0.265%)

997

Yahoo! Inc., NASDAQ

YHOO

37.85

0.01(0.0264%)

10336

Yandex N.V., NASDAQ

YNDX

18.21

-0.00(-0.00%)

100

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Tesla Motors (TSLA) removed from Focus List at Credit Suisse

American Express (AXP) reiterated with a Neutral at DA Davidson; target raised to $67 from $66

-

14:44

Initial jobless claims decline to 247,000 in the week ending April 16

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending April 16 in the U.S. decreased by 6,000 to 247,000 from 253,000 in the previous week. It was the lowest level since the week of November 24, 1973.

Analysts had expected jobless claims to rise to 263,000.

Jobless claims remained below 300,000 the 59th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 39,000 to 2,137,000 in the week ended April 09. It was the lowest level since November 2000.

-

14:39

Company News: Verizon (VZ) Posts Q1 Financials in Line With Analysts' Estimates

Verizon reported Q1 FY 2016 earnings of $1.06 per share (versus $1.02 in Q1 FY 2015), in-line with analysts' consensus of $1.06.

The company's quarterly revenues amounted to $32.171 bln (+0.6% y/y), generally in-line with consensus estimate of $32.481 bln.

Verizon reaffirmed guidance for FY 2016, projecting EPS of comparable to $3.99 in 2015 (versus analysts' consensus estimate of $3.97).

VZ fell to $50.45 (-2.51%) in pre-market trading.

-

14:26

European Central Bank keeps its interest rate unchanged at 0.00% in April

The European Central Bank (ECB) kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.00%. This decision was widely expected by analysts.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its meeting in March. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. The central bank decided to launch further four targeted longer-term refinancing operations (LTRO).

-

14:05

-

13:36

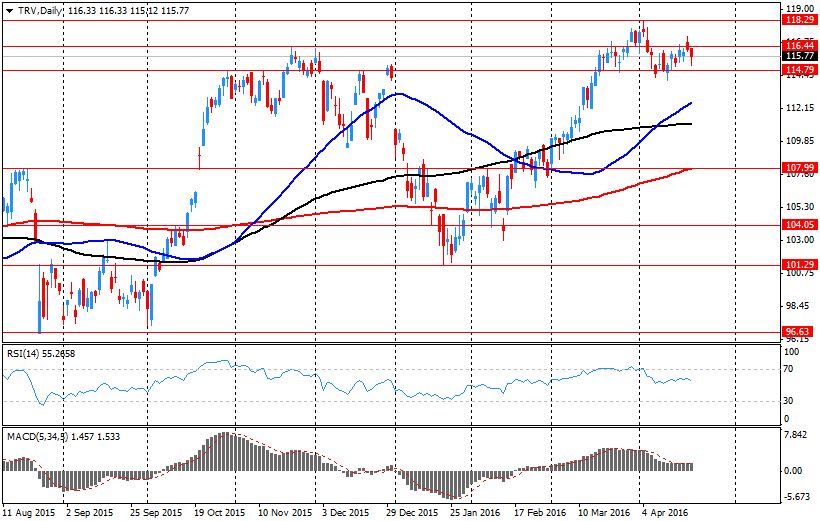

Company News: Travelers (TRV) Q1 Results Miss Analysts’ Estimates

Travelers reported Q1 FY 2016 earnings of $2.33 per share (versus $2.53 in Q1 FY 2015), missing analysts' consensus of $2.55.

The company's quarterly revenues amounted to $5.981 bln (+1.6% y/y), slightly below consensus estimate of $6.017 bln.

Travelers' board of directors announced a 10% increase in the company's regular quarterly cash dividend to $0.67 per share.

TRV fell to $115.80 (-0.40%) in yesterday's trading session.

-

13:04

WSE: Mid session comment

The first hour of trade on the Warsaw Stock Exchange brought good level of turnover, concentrated on the shares of KGHM and PKN Orlen, where the latter one still stand negatively out against other large companies.

The Tuesday's maximum was proved to be too difficult to obtain, and the main index gave out the higher today's opening and yesterday's slightly higher fixing. Thus it returned to the levels around 1,950 points, within which held most of yesterday's session. This is not a disaster, but rather a lack of visibility of own plan to trade, which still follows the rhythm of the environment, where the German DAX was slightly flushed.

In the markets in the last 2-3 quarters the situation has cooled, which applies to all classes of assets.

In the mid-session, the WIG index stood at 1,954 points at the turnover of about PLN 278 mln.

-

11:59

European stock markets mid session: stocks traded lower ahead the ECB’s interest rate decision

Stock indices traded lower ahead of the release of the European Central Bank's (ECB) interest rate decision. Analysts expect the central bank to keep its interest rate unchanged.

The ECB cut its interest rate to 0.00% from 0.05% (this decision was not expected by market participants) and deposit rate to -0.4% from -0.3% at its meeting in March. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. The central bank decided to launch further four targeted longer-term refinancing operations (LTRO).

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 1.3% in March, missing expectations for a 0.1% drop, after a 0.5% decline in February. February's figure was revised down from a 0.4% decrease.

The decline was driven by a weak demand in all categories. Food sales were down 1.9% in March, while non-food store sales decreased 1.5%.

On a yearly basis, retail sales in the U.K. climbed 2.7% in March, missing forecasts of a 4.4% increase, after a 3.6% rise in February. February's figure was revised down from a 3.8% gain.

The ONS also released public sector net borrowing for the U.K. Public sector net borrowing excluding public sector banks declined to £74.0 billion in the fiscal year 2015/16 ending March 2016 from £91.7 billion in the previous fiscal year. It is equivalent to 3.9% of GDP.

The government forecasted £72.0 billion for the fiscal year 2015/16.

The debt-to-gross domestic product ratio rose to 83.5% in the fiscal year 2015/16 from 83.3% in the previous fiscal year.

Public sector net borrowing excluding public sector banks declined to £4.6 billion in March from £7.4 billion in March a year ago.

Current figures:

Name Price Change Change %

FTSE 100 6,377.55 -32.71 -0.51 %

DAX 10,412.6 -8.69 -0.08 %

CAC 40 4,578.35 -13.57 -0.30 %

-

11:43

Spain’s trade deficit narrowed €1.76 billion in February

Spain's Economy Ministry released its trade data on Thursday. The trade deficit narrowed to €1.76 billion in February from €2.39 billion in January.

The decrease in deficit was driven by a higher rise in exports.

Exports rose at an annual rate of 2.7% year-on-year in February, while imports climbed 1.2%.

-

11:30

NAB business confidence index for Australia falls to 4 in the first quarter

The National Australia Bank (NAB) released its Quarterly Business Confidence Survey on Thursday. The NAB business confidence index fell to 4 in the first quarter from 5 in the fourth quarter. The fourth quarter's figure was revised up from 4.

Business conditions outlook remained positive, while a resilient non-mining recovery and an outlook continued to improve.

"We find it encouraging to see that firms are continuing to look past all the 'noise' in financial markets to focus on what is going on at home, and in their own business. Market volatility could eventually start to have an impact on the economy via sentiment channels, but at this stage firms actually appear more optimistic about the outlook ", NAB Group Chief Economist Alan Oster said.

-

11:19

Public sector net borrowing in the U.K. declines to £74.0 billion in the fiscal year 2015/16

The Office for National Statistics released public sector net borrowing for the U.K. on Thursday. Public sector net borrowing excluding public sector banks declined to £74.0 billion in the fiscal year 2015/16 ending March 2016 from £91.7 billion in the previous fiscal year. It is equivalent to 3.9% of GDP.

The government forecasted £72.0 billion for the fiscal year 2015/16.

The debt-to-gross domestic product ratio rose to 83.5% in the fiscal year 2015/16 from 83.3% in the previous fiscal year.

Public sector net borrowing excluding public sector banks declined to £4.6 billion in March from £7.4 billion in March a year ago.

-

11:05

UK retail sales fall 1.3% in March

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 1.3% in March, missing expectations for a 0.1% drop, after a 0.5% decline in February. February's figure was revised down from a 0.4% decrease.

The decline was driven by a weak demand in all categories. Food sales were down 1.9% in March, while non-food store sales decreased 1.5%.

On a yearly basis, retail sales in the U.K. climbed 2.7% in March, missing forecasts of a 4.4% increase, after a 3.6% rise in February. February's figure was revised down from a 3.8% gain.

-

10:52

French manufacturing confidence index climbs to 104 in April

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index rose to 104 in April from 102 in March. It was the highest level since September.

March's figure was revised up from 101.

Past change in production index was up to 8 in April from -6 in March.

Personal production expectations index fell to 9 in April from 15 in March, while general production outlook index rose to -1 from -2.

-

10:37

Swiss trade surplus narrows to CHF2.16 billion in March

The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus narrowed to CHF2.16 billion in March from CHF4.02 billion in the previous month. February's figure was revised down from a surplus of CHF4.07 billion.

On a monthly basis, exports rose 1.1% in March, while imports jumped 9.9%.

Exports declined 1.2% year-on-year in March, while imports were up 5.4%.

-

10:23

U.K. household finance index rises to 45.3 in April

Markit Economics and financial information provider Ipsos Mori released its household finance index (HFI) for the U.K. on Wednesday. The household finance index increased to 45.3 in April from 44.8 in March.

The index measuring the outlook for financial well-being over the coming twelve months decreased to 49.6 in April from 51.4 in March.

The current inflation perceptions index climbed to 66.8 in April.

The index measuring expected living costs over the twelve months was up to 81.6 in April.

One-quarter of respondents expects the Bank of England's monetary policy to tighten within the next six months.

"Latest HFI data from Markit paints a mixed picture for UK households. On the one hand, the squeeze on finances softened in April… In contrast, the financial outlook worsened for the first time in three months," economist at Markit, Philip Leake, said.

-

10:10

China plans to boost its foreign trade

The Chinese government plans to boost the foreign trade.

"Foreign trade is an important part of the national economy," a State Council said in a statement after the meeting with China's Premier Li Keqiang.

Banks should encourage to lend to profitable foreign trade companies, a State Council noted.

-

09:18

WSE: After opening

WIG20 index opened at 1966.84 points (+0.20% to previous close)

WIG 48830.14 0.41%

WIG30 2193.48 0.46%

mWIG40 3639.34 0.30%

Before the session we had the results of PKN Orlen (WSE: PKN) for the first quarter. The bottom line as per the disclosed financials turned out below consensus concerning net profit, operating profit, EBITDA, and EBIT. Only revenues turned out in line with the consensus expectation.

The result of the above is that PKN Orlen is the only WIG20 component that is not in the green area today. Overall, the market bursting with optimism entering the environment, against which we recently already had way behind.

-

08:26

WSE: Before opening

Thursday's session will proceed in the spirit of anticipation of a decision on interest rates in the Euro zone, as well as a press conference after the ECB meeting. Moreover, the impact on investors' decisions can result today from the publication of weekly data from the US labor market (number of people receiving unemployment benefits and newly registered unemployed) and readings from the Philadelphia Fed index (April) as well as leading indicators - Conference Board (March).

The price of copper is slightly falling on the London Metal Exchange. Analysts warn that demand for copper is weak and in 2016 and 2017 there is expected additional supply of the commodity.

-

07:30

Global Stocks

European stock benchmarks closed higher for a third straight session on Wednesday, helped by a reversal in oil prices.

U.S. stocks closed higher Wednesday, but off session highs, as a turnaround by oil futures and upbeat housing data provided support. Crude-oil futures turned higher after the data from the U.S. Energy Information Administration showed a fall in weekly domestic output for a sixth straight week.

China shares were choppy Thursday in a tug-of-war between rising spirits over fresh liquidity and disappointment over a signal that authorities could pull back from monetary stimulus. The People's Bank of China injected a net 220 billion yuan into the financial system Thursday by buying seven-day short-term loans known as reverse repurchase agreements.

Based on MarketWatch materials

-

04:05

Nikkei 225 17,216.72 +310.18 +1.83 %, Hang Seng 21,403.39 +167.08 +0.79 %, Shanghai Composite 2,952.15 -20.43 -0.69 %

-

01:22

Stocks. Daily history for Sep Apr 20’2016:

(index / closing price / change items /% change)

Nikkei 225 16,906.54 +32.10 +0.19 %

Hang Seng 21,236.31 -199.90 -0.93 %

S&P/ASX 200 5,215.95 +27.14 +0.52 %

Shanghai Composite 2,972.57 -70.25 -2.31 %

FTSE 100 6,410.26 +4.91 +0.08 %

CAC 40 4,591.92 +25.44 +0.56 %

Xetra DAX 10,421.29 +71.70 +0.69 %

S&P 500 2,102.4 +1.60 +0.08 %

NASDAQ Composite 4,948.13 +7.80 +0.16 %

Dow Jones Industrial Average 18,096.27 +42.67 +0.24 %

-