Noticias del mercado

-

21:00

Dow +0.60% 18,161.60 +108.00 Nasdaq +0.52% 4,966.16 +25.83 S&P +0.45% 2,110.28 +9.48

-

18:51

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock-indexes slightly higher on Wednesday as a recovery in oil added to the boost from earnings reports that beat tempered expectations. Crude pared earlier losses after a report showed a less-than-expected build in U.S. stockpiles. A three-day strike by Kuwaiti oil workers had driven prices higher and helped the S&P 500 breach 2,100 on Tuesday, about 30 points shy of its record high.

Investors are focused on the earnings season as they seek catalysts to drive stocks higher. Big-bank earnings reports last week were better than expected and helped lift sentiment, even though expectations for profit growth are bleak.

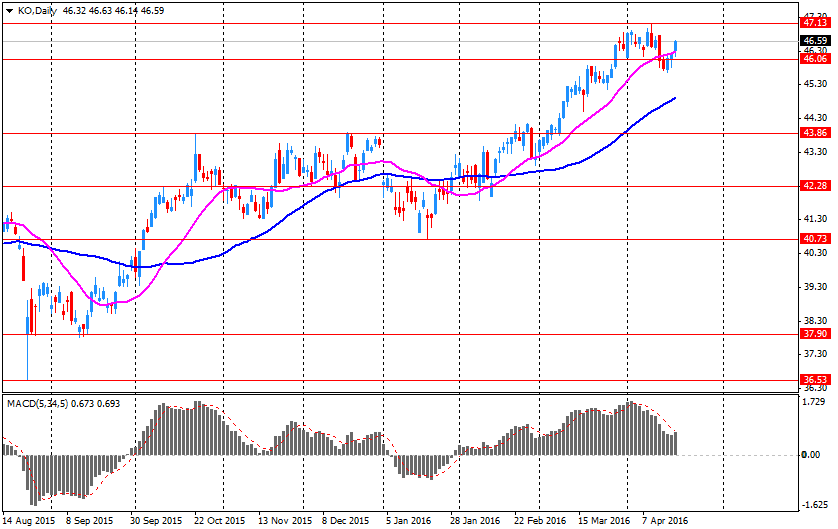

Most of Dow stocks in positive area (18 of 30). Top looser - The Coca-Cola Company (KO, -4,44%). Top gainer - UnitedHealth Group Incorporated (UNH +2,77%).

S&P sectors mixed. Top looser - Conglomerates (-0,7%). Top gainer - Basic Materials (+0,8%).

At the moment:

Dow 18031.00 +70.00 +0.39%

S&P 500 2099.25 +5.50 +0.26%

Nasdaq 100 4547.75 +21.00 +0.46%

Oil 43.51 +1.04 +2.45%

Gold 1255.70 +1.40 +0.11%

U.S. 10yr 1.81 +0.02

-

18:00

European stocks closed: FTSE 100 6,410.26 +4.91 +0.08% CAC 40 4,591.92 +25.44 +0.56% DAX 10,421.29 +71.70 +0.69%

-

18:00

European stocks close: stocks closed higher on rising oil prices

Stock indices closed higher as oil prices rebounded. Oil prices rose on the U.S. crude oil inventories data. According to the U.S. Energy Information Administration on Wednesday, U.S. crude inventories rose by 2.08 million barrels to 538.6 million in the week to April 15. Analysts had expected U.S. crude oil inventories to rise by 2.5 million barrels.

Market participants also eyed the economic data from the Germany. Destatis released its producer price index (PPI) for Germany on Wednesday. German PPI producer prices were flat in March, missing expectations for a 0.2% rise, after a 0.5% drop in February.

On a yearly basis, German PPI dropped 3.1% in March, missing expectations for a 2.9% decrease, after a 3.0% fall in February. It was the biggest drop since January 2010.

PPI excluding energy sector fell by 0.9% year-on-year in March. Energy prices were down 9.2% year-on-year in March.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the December to February quarter, in line with expectations.

The claimant count rose by 6,700 people in March, missing expectations for a fall by 11,300, after a decrease of 9,300 people in February. February's figure was revised down from a 18,000 decrease.

U.K. unemployment in the November to January period increased by 21,000 to 1.7 million from the previous quarter. It was the first rise since the May-July quarter of 2015.

The employment rate remained unchanged at 74.1% in the December to February quarter. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 2.2% in the December to February quarter, after a 2.2% gain in the November to January quarter.

Average weekly earnings, including bonuses, rose by 1.8% in the December to February quarter, in missing expectations for a 2.3% gain, after a 2.1% increase in the November to January quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,410.26 +4.91 +0.08 %

DAX 10,421.29 +71.70 +0.69 %

CAC 40 4,591.92 +25.44 +0.56 %

-

17:44

Germany's Economy Minister Sigmar Gabriel: the European Central Bank’s monetary policy reaches its limits

Germany's Economy Minister Sigmar Gabriel said on Wednesday that the European Central Bank's monetary policy reached its limits.

"Printing money is not a sustainable economic policy," he said.

-

17:40

WSE: Session Results

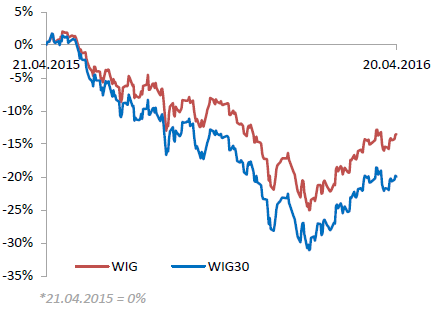

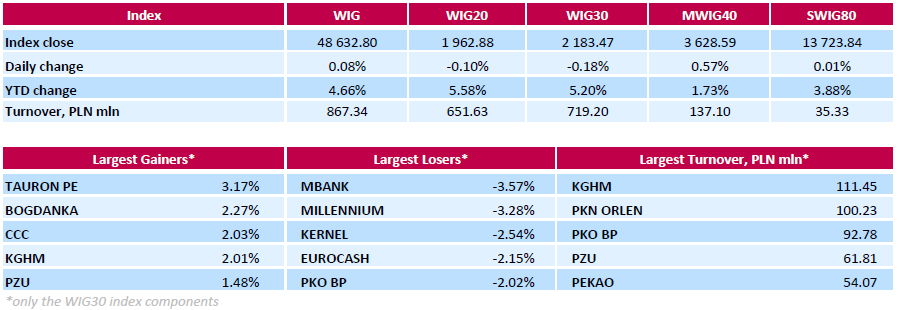

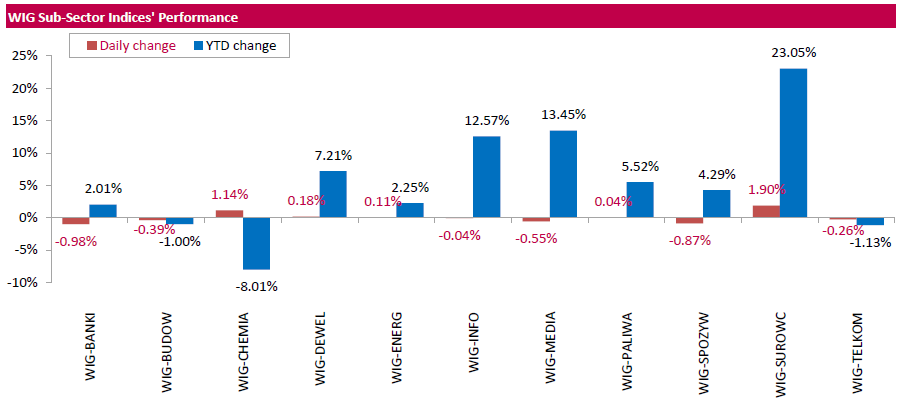

Polish equities closed flat on Wednesday. The broad market measure, the WIG Index, inched up 0.08%. Sector performance within the WIG Index was mixed. Banking sector (-0.98%) fared the worst, while materials (+1.90%) outperformed.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.18%. In the index basket, banks MBANK (WSE: MBK) and MILLENNIUM (WSE: MIL) were the poorest performers, slumping 3.57% and 3.28% respectively on analyst downgrade. They were followed by agricultural producer KERNEL (WSE: KER) and FMCG-wholesaler EUROCASH (WSE: EUR), tumbling 2.54% and 2.15% respectively. On the plus side, genco TAURON PE (WSE: TPE), thermal coal miner BOGDANKA (WSE: LWB), footwear retailer CCC (WSE: CCC) and copper producer KGHM (WSE: KGH) posted the best gains, returning 2.01%-3.17%.

-

17:39

Bank of England Monetary Policy Committee member Ian McCafferty: wage growth could pick up faster once inflation starts to rise

Bank of England (BoE) Monetary Policy Committee (MPC) member Ian McCafferty said in a speech on Wednesday that wage growth could pick up faster once inflation starts to rise.

"Although the pick-up in wages as the labour market has tightened appears to have been interrupted by current low inflation, once CPI (consumer price index) inflation starts to rise, behaviour is likely to revert, and wage inflation may rise surprisingly quickly in response," he said.

McCafferty noted that the uncertainty around the referendum on Britain's membership in the European Union weighed on business investment in Britain.

"Very recently there have been some signs that increased uncertainty linked to the outcome of the EU referendum to be held on 23 June may weigh on investment in coming months, such that we may see a slight softening in GDP growth through the summer," he said.

-

17:26

Bank of Japan Governor Haruhiko Kuroda signals further stimulus measures

Bank of Japan (BoJ) Governor Haruhiko Kuroda signals on Wednesday that the central bank could ease its monetary policy further, saying that the BoJ's presence in the exchange-traded fund (ETF) market was "not too big".

Kuroda pointed out that helicopter money was not an option for the central bank.

"It's unthinkable. The BOJ isn't thinking about this at all," the BoJ governor said.

-

16:14

U.S. existing homes sales climb 5.1% in March

The National Association of Realtors released existing homes sales figures in the U.S. on Wednesday. Sales of existing homes climbed 5.1% to a seasonally adjusted annual rate of 5.33 million in March from 5.07 in February. February's figure was revised down from 5.08 million units.

Analysts had expected an increase to 5.30 million units.

"Buyer demand remains sturdy in most areas this spring and the mid-priced market is doing quite well. However, sales are softer both at the very low and very high ends of the market because of supply limitations and affordability pressures," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers remained unchanged at 30% in March.

"With rents steadily rising and average fixed rates well below 4 percent, qualified first-time buyers should be more active participants than what they are right now," Yun said.

-

15:47

WSE: After start on Wall Street

U.S. Stocks open: Dow +0.04%, Nasdaq +0.08%, S&P +0.05%

Wall Street began the day with cosmetic pluses, which is not surprising taking into consideration the previous trading of future contracts. In fact, the beginning of the US can be considered as neutral and in the case of the S&P500 as an attempt to keep the area of the 2,100 points.

Recently it became a standard, that regardless of the mood of Americans, with the start of trading on Wall Street on the Warsaw market was either the same or neutral, even better situation. Will see if we can continue on this pattern.

-

15:47

German government expects the country's economy to expand 1.7% this year

The German government said on Wednesday that it expected the country's economy to expand 1.7% this year, unchanged from its previous forecast, and 1.5% in 2017, down from its previous forecast of a 1.8% growth.

Export growth is expected to be 2.9% this year and 3.7% in 2017.

The government expects German private consumption to rise by 2.0% this year and by 1.5% in 2017.

-

15:33

U.S. Stocks open: Dow +0.04%, Nasdaq +0.08%, S&P +0.05%

-

15:15

Before the bell: S&P futures +0.11%, NASDAQ futures +0.15%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 16,906.54 +32.10 +0.19%

Hang Seng 21,236.31 -199.90 -0.93%

Shanghai Composite 2,972.57 -70.25 -2.31%

FTSE 6,387.94 -17.41 -0.27%

CAC 4,570.5 +4.02 +0.09%

DAX 10,366.84 +17.25 +0.17%

Crude oil $41.61 (-2.02%)

Gold $1252.20 (-0.17%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.54

0.01(0.095%)

25633

Amazon.com Inc., NASDAQ

AMZN

629.28

1.38(0.2198%)

3477

American Express Co

AXP

63.99

0.42(0.6607%)

2458

Apple Inc.

AAPL

106.75

-0.16(-0.1497%)

85637

AT&T Inc

T

38.89

-0.03(-0.0771%)

574

Barrick Gold Corporation, NYSE

ABX

16.33

0.01(0.0613%)

28540

Boeing Co

BA

129.69

-2.99(-2.2535%)

38246

Caterpillar Inc

CAT

80.24

-0.15(-0.1866%)

3900

Chevron Corp

CVX

100

-0.50(-0.4975%)

4000

Citigroup Inc., NYSE

C

45.62

-0.01(-0.0219%)

28176

Deere & Company, NYSE

DE

82.35

-0.01(-0.0121%)

2000

Exxon Mobil Corp

XOM

85.95

-0.26(-0.3016%)

1684

Facebook, Inc.

FB

112.45

0.16(0.1425%)

82788

Ford Motor Co.

F

13.46

0.02(0.1488%)

15097

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.93

-0.08(-0.6661%)

412875

General Electric Co

GE

31.14

-0.01(-0.0321%)

5669

General Motors Company, NYSE

GM

31.79

-0.18(-0.563%)

1200

Goldman Sachs

GS

162.25

-0.40(-0.2459%)

2222

Google Inc.

GOOG

758

4.07(0.5398%)

2010

Hewlett-Packard Co.

HPQ

12.7

-0.08(-0.626%)

2600

Intel Corp

INTC

31.01

-0.59(-1.8671%)

1448727

International Business Machines Co...

IBM

143.85

-0.15(-0.1042%)

3059

Johnson & Johnson

JNJ

112.75

0.07(0.0621%)

2418

JPMorgan Chase and Co

JPM

63.24

-0.08(-0.1263%)

2836

Merck & Co Inc

MRK

57.14

0.28(0.4924%)

797

Microsoft Corp

MSFT

56.17

-0.22(-0.3901%)

96147

Nike

NKE

59.53

-0.03(-0.0504%)

1828

Starbucks Corporation, NASDAQ

SBUX

61

0.10(0.1642%)

112

Tesla Motors, Inc., NASDAQ

TSLA

247.3

-0.07(-0.0283%)

9660

The Coca-Cola Co

KO

45.77

-0.83(-1.7811%)

95319

Twitter, Inc., NYSE

TWTR

16.92

0.00(0.00%)

30926

Verizon Communications Inc

VZ

52.19

0.11(0.2112%)

253

Visa

V

80.85

0.10(0.1238%)

569

Wal-Mart Stores Inc

WMT

69.8

0.03(0.043%)

390

Walt Disney Co

DIS

103.03

0.39(0.38%)

2879

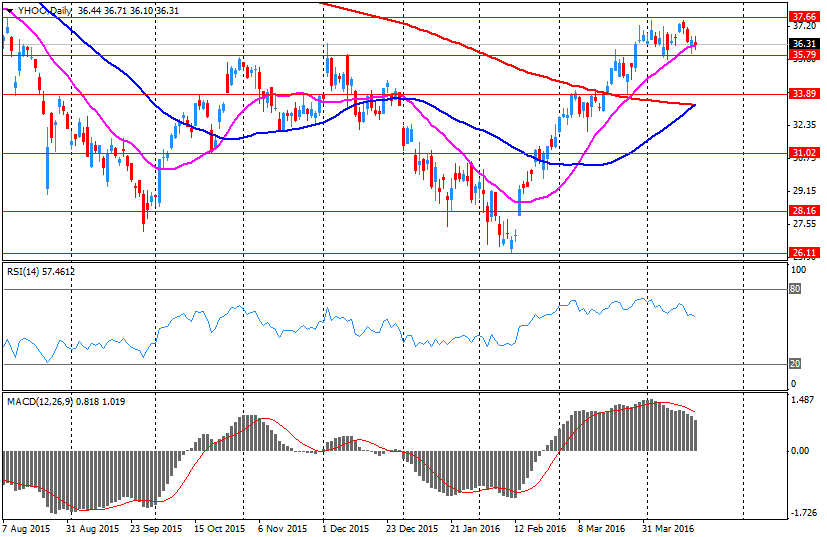

Yahoo! Inc., NASDAQ

YHOO

36.9

0.57(1.569%)

45195

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Boeing (BA) downgraded to Underperform from Neutral at BofA/Merrill

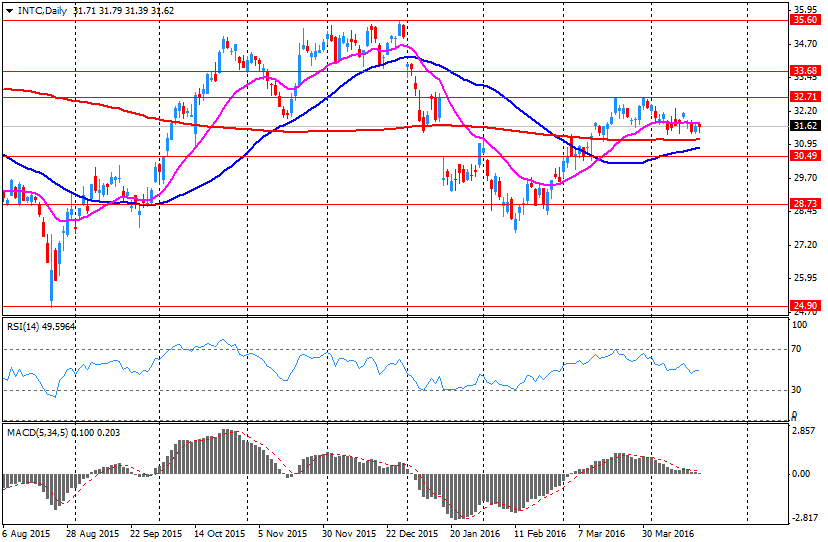

Intel (INTC) downgraded to Market Perform from Outerpform at Northland Capital

Other:

Yahoo! (YHOO) target raised to $40 from $31 at Piper Jaffray

Yahoo! (YHOO) target raised to $37 from $36 at Axiom Capital

Yahoo! (YHOO) maintained with a Neutral at Mizuho; target raised to $38 from $37

Yahoo! (YHOO) maintained with a Sector Perform at RBC Capital; target raised to $38 from $33

UnitedHealth (UNH) target raised to $156 from $150 at Mizuho

Facebook (FB) target raised to $137 from $125 at Raymond James

Intel (INTC) target lowered to $32 from $33 at Cowen; Market Perform

-

14:43

Canada’s wholesale sales drop 2.2% in February

Statistics Canada released wholesale sales figures on Wednesday. Wholesale sales dropped 2.2% in February, missing expectations for a 0.3% fall, after a flat reading rise in January.

The decline was mainly driven by a drop in the machinery, equipment and supplies.

Sales of motor vehicle and parts were down 3.5% in February, while sales in in the machinery, equipment and supplies subsector slid 4.8%.

Inventories increased by 0.2% in February.

-

14:15

European stock markets mid session: stocks traded lower on falling oil prices

Stock indices traded lower on a drop in oil prices. Oil prices fell as workers in Kuwait's oil sector ended a three-day strike.

Market participants also eyed the economic data from the Germany. Destatis released its producer price index (PPI) for Germany on Wednesday. German PPI producer prices were flat in March, missing expectations for a 0.2% rise, after a 0.5% drop in February.

On a yearly basis, German PPI dropped 3.1% in March, missing expectations for a 2.9% decrease, after a 3.0% fall in February. It was the biggest drop since January 2010.

PPI excluding energy sector fell by 0.9% year-on-year in March. Energy prices were down 9.2% year-on-year in March.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the December to February quarter, in line with expectations.

The claimant count rose by 6,700 people in March, missing expectations for a fall by 11,300, after a decrease of 9,300 people in February. February's figure was revised down from a 18,000 decrease.

U.K. unemployment in the November to January period increased by 21,000 to 1.7 million from the previous quarter. It was the first rise since the May-July quarter of 2015.

The employment rate remained unchanged at 74.1% in the December to February quarter. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 2.2% in the December to February quarter, after a 2.2% gain in the November to January quarter.

Average weekly earnings, including bonuses, rose by 1.8% in the December to February quarter, in missing expectations for a 2.3% gain, after a 2.1% increase in the November to January quarter.

Current figures:

Name Price Change Change %

FTSE 100 6,373.32 -32.03 -0.50 %

DAX 10,313.41 -36.18 -0.35 %

CAC 40 4,548.84 -17.64 -0.39 %

-

14:07

-

13:42

Company News: Intel (INTC) Q1 Earnings Beat Analysts’ Expectations

Intel reported Q1 FY 2016 earnings of $0.54 per share (versus $0.41 in Q1 FY 2015), beating analysts' consensus of $0.48.

The company's quarterly revenues amounted to $13.801 bln (+8% y/y), slightly below consensus estimate of $13.826 bln.

Intel lowered 2016 outlook and guided Q2 revenues below consensus ($13-14 bln versus. consensus of $14.18 bln).

The company also announced restructuring plan that would include the layoff of 12 ths workers globally, representing nearly 11% of its worldwide workforce.

INTC fell to $30.91 (-2.18%) in pre-market trading.

-

13:13

-

13:03

WSE: Mid session comment

Volatility is suppressed in the Warsaw market today, while the trading activity picked up against the backdrop of a correction, which, altogether, does not look promising for the bullish party. By the halfway point of the session, the turnover on the WIG20 index amounted to PLN 270 mln.

The overall technical context of the trading session remains the same, with neutral levels, which are played from the first minutes of trade today. The WIG20 remains frozen in the region of 1,955 points, losing 0.4 percent. Taking into account the fact that the German DAX and the French CAC have posted similar declines so far, and futures on the S&P500 are at zero level, it is difficult to expect a movement that will pull the market out of the current focal point. We expect that the new impulse will rather be associated owing to signals from the US markets later on today.

-

11:46

Greece’s current account narrows to €0.80 billion in February

The Bank of Greece released its current account data on Wednesday. Greece's current account deficit narrowed to €0.80 billion in February from €1.45 billion in February last year.

The Greek deficit on trade in goods declined to €1.45 billion in February from €1.59 billion in February last year, while the services surplus fell to €156 million from €382 million.

The primary income deficit turned into a surplus of €440 million in February from €140 million in February last year, while the deficit on secondary income turned into a surplus of €48 million from a deficit of €110 million last year.

The capital account surplus climbed to €244 million in February from €109 million last year.

-

11:35

German producer prices are flat in March

Destatis released its producer price index (PPI) for Germany on Wednesday. German PPI producer prices were flat in March, missing expectations for a 0.2% rise, after a 0.5% drop in February.

On a yearly basis, German PPI dropped 3.1% in March, missing expectations for a 2.9% decrease, after a 3.0% fall in February. It was the biggest drop since January 2010.

PPI excluding energy sector fell by 0.9% year-on-year in March.

Energy prices were down 9.2% year-on-year in March.

Consumer non-durable goods prices fell 0.3% year-on-year in March, intermediate goods sector prices decreased by 2.3%, while capital goods prices increased 0.6% and durable consumer goods sector prices gained 1.4%.

-

11:26

U.K. unemployment rate remains unchanged at 5.1% in the December to February quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the December to February quarter, in line with expectations.

The claimant count rose by 6,700 people in March, missing expectations for a fall by 11,300, after a decrease of 9,300 people in February. February's figure was revised down from a 18,000 decrease.

U.K. unemployment in the November to January period increased by 21,000 to 1.7 million from the previous quarter. It was the first rise since the May-July quarter of 2015.

The employment rate remained unchanged at 74.1% in the December to February quarter. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 2.2% in the December to February quarter, after a 2.2% gain in the November to January quarter.

Average weekly earnings, including bonuses, rose by 1.8% in the December to February quarter, in missing expectations for a 2.3% gain, after a 2.1% increase in the November to January quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

11:16

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index climbs to 11.5 in April

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index climbed to 11.5 in April from 2.5 in March. Analysts had expected the index to remain unchanged at 2.5.

"In regard to economic expectations as well as the current economic situation in Switzerland, the large majority of respondents do not expect to see any changes," the ZEW said.

The current conditions rose to -0.1 in April from -2.7 in March.

-

10:54

Employment rate in the OECD area rises by 0.2% in the fourth quarter

The Organization for Economic Co-operation and Development (OECD) released its employment rate for the fourth quarter on Tuesday. The employment rate in the OECD rose by 0.2% to 66.5% in the fourth quarter of 2015. It was slightly below pre-crisis peak of the first quarter of 2008.

The employment rate in the Eurozone was up 0.1% to 64.7% in the fourth quarter, the employment rate in the United Kingdom rose by 0.5% to 73.2%, while the rate in the United States climbed 0.2% to 68.9%.

Greece's employment rate climbed by 1.7% to 51.4% in the fourth quarter, while the employment rate in Germany increased by 0.1% to 74.1%.

-

10:38

European Central Bank Governing Council member Luis Maria Linde: Spain should continue to implement reforms to lower its budget deficit

The European Central Bank (ECB) Governing Council member and the Bank of Spain Governor Luis Maria Linde said on Tuesday that Spain should continue to implement reforms to lower its budget deficit.

"Our challenge is to reduce the amount of public debt," he said.

-

10:22

European Commission Vice President Valdis Dombrovskis: Portugal will breach the Stability and Growth Pact

European Commission Vice President Valdis Dombrovskis said on Tuesday that Portugal would breach the Stability and Growth Pact.

"The Commission considers that the government's plans are at risk of non-compliance with the provisions of the Stability and Growth Pact," he said.

The Portuguese government plans to reduce its budget deficit to 2.2% of GDP this year from 4.4% in 2015.

-

10:08

Japan's trade surplus widens to ¥755 billion in March

The Ministry of Finance released its trade data for Japan on the late Tuesday evening. Japan's trade surplus rose to ¥755 billion in March from ¥242.8 billion in February. Analysts had expected a surplus of ¥834.6 billion.

Exports fell 6.8% year-on-year in March, while imports dropped 14.9%.

Exports to Asia declined by 9.7% year-on-year in March, exports to the United States decreased by 5.1%, while exports to the European Union climbed by 12.1%.

Imports from Asia plunged by 5.3% year-on-year in March, imports from the United States slid by 20.0%, while imports from the European Union declined by 3.7%.

-

09:15

WSE: After opening

The mood before the session was defined by the declines on the Chinese market, and the downward move on commodity markets as well as declines in futures on European indices.

The WIG20 futures (June series) began the day sliding about 0.5% into the red.

WIG20 index opened at 1963.66 points (-0.06% to previous close)

WIG 48535.73 -0.12%

WIG30 2182.01 -0.25%

mWIG40 3619.45 0.31%

The sectoral blue chips started the day on a bearish note either, which is understandable given its correlation with the environment. The sector of small and medium-sized companies (the mWIG40 index), where mostly domestic capital is traded, retains a more optimistic attitude.

-

08:16

WSE: Before opening

During Tuesday's trading on Wall Street, investors were focused mainly on the results of companies. As a result, indices DJIA and S&P500 ended the day with increases of about 0.3 percent and the Nasdaq Composite slipped by 0.4 percent. The market was supported by rise in commodity prices, in technological sector investors reacted to the weak performance of IBM.

Night fall of contract for the S&P500 indicates that moods are worse now than at the time of closing of trading on European indices. It is therefore expected that yesterday's rise in the DAX (+2.3%) will take this morning some form of correction, which will most likely echo in the Polish market in the form of corrective stance on the WIG20.

Raw materials markets today are reassessing both oil and copper, both being direct drivers of the WIG20 performance. Yesterday's 1 percent increase, had healthy dynamics of raw materials as one of the major contributors. Therefore, correction in raw materials should reflect in a correction of WIG20 at opening.

-

07:13

Global Stocks: markets focus on European Central Bank remarks

European stock markets finished firmly higher on Tuesday as a round of upbeat earnings reports and a solid rebound in oil prices helped lift the region's benchmarks.

The Dow Jones Industrial Average finished firmly above the key 18,000 mark Tuesday, but U.S. stocks closed off of their intra-day highs as a slump in shares of large-cap tech firms, led by International Business Machines Corp., canceled out positive sentiment from stable oil prices and a string of better-than-expected earnings.

Asian stocks mixed as markets focus on European Central Bank remarks. The European Central Bank's governing council is meeting, and investors are closely watching for what President Mario Draghi might say at the news conference later this week.

Based on MarketWatch materials

-

04:01

Nikkei 225 16,959.99 +85.55 +0.51 %, Hang Seng 21,379.67 -56.54 -0.26 %, S&P/ASX 200 5,205.4 +16.59 +0.32%, Shanghai Composite 3,042.76 -0.06 0.00%

-

00:36

Stocks. Daily history for Sep Apr 19’2016:

(index / closing price / change items /% change)

HANG SENG 21,383.86 +222.36 +1.05%

S&P/ASX 200 5,188.8 +51.74 +1.01%

TOPIX 1,363.03 +42.88 +3.25%

SHANGHAI COMP 3,042.95 +9.29 +0.31%

FTSE 100 6,405.35 +51.83 +0.82 %

CAC 40 4,566.48 +59.64 +1.32 %

Xetra DAX 10,349.59 +229.28 +2.27 %

S&P 500 2,100.8 +6.46 +0.31 %

NASDAQ Composite 4,940.33 -19.69 -0.40 %

Dow Jones 18,053.6 +49.44 +0.27 %

-