Noticias del mercado

-

20:20

American focus: The US dollar fell against most major currencies

The US dollar rose significantly against the euro, updating yesterday's high. Experts point out that the cause of this trend was the resumption of purchases of the US currency against the background of positive statistics on the US housing market. Meanwhile, some investors opted to take profits on the part of the pair EUR / USD after a three-day increase. Today, the National Association of Realtors reported that home sales in the secondary market rose in March and were slightly higher compared with a year earlier. The total volume of home sales in the secondary market jumped 5.1 percent to a seasonally adjusted annual rate reached 5.33 million. Compared with a downwardly revised level of 5.07 million in February. Sales rose in all four major regions and were 1.5 percent higher than in March 2015. Lawrence Yun, the NAR economist, said that home sales showed a good recovery in March, after an uncharacteristically large decline in February. The average house price in the secondary market for all housing types was $ 222,700, which is 5.7 percent higher than in March 2015. The increase in prices in March was noted in the 49 th month in a row. Total housing inventory increased by 5.9 percent to 1.98 million homes, but still remained 1.5 percent lower than a year ago (2.01 million). At the current sales rate 4.5 months is required to sell stocks in the market, as compared with 4.4 months in February.

Market participants are also starting to switch attention to tomorrow's ECB meeting. Many experts believe that the ECB will not run additional measures to support the economy, and would prefer to wait for the effects of the recent large-scale measures. Recall that last month the ECB lowered all interest rates, increased the size of the quantitative easing program and announced the launch of a new series of four targeted long-term refinancing operations (TLTRO), each with a term of four years. Reuters survey showed that most analysts do not expect further reduction of the ECB. Analysts also believe that negative rates will not harm the euro-zone economy, and low GDP growth and inflation in the region is a result of weak demand. Most likely, during the April meeting of the Central Bank will focus on the details of his previous statements and try to shed more light on the details of the new program for the purchase of bonds.

The British pound traded mixed against the dollar, but generally remains in a narrow range. Market participants continue to analyze data on the labor market in Britain, as well as waiting for tomorrow's publication of statistics on retail sales, which will have an important role against the backdrop of slowing activity in most sectors of the economy. The Office for National Statistics reported that the unemployment rate was 5.1 percent in the three months to February. The indicator has not changed compared to the previous three months and matched economists' expectations. The employment rate was 74.1 percent, the highest level since records began in 1971 data. Average earnings including bonuses rose by 1.8 percent, and excluding bonuses rose by 2.2 per cent compared with a year earlier. In March, the level of applications for unemployment benefits remained unchanged at 2.1 percent, as expected by economists. The number of people claiming benefits rose by 6,700, confounding expectations for a decline of 11,300.

The impact on the pound also provided news related to "Brekzitom". the latest survey results, presented the agency Ipsos MORI, indicated that 49% of British people in favor of preserving the country within the EU, and only 39% - for withdrawal from the. Recall that in March this ratio was 49% and 41%, respectively. The main reason that most people want to stay in the EU, is the fear of the consequences for the economy.

The Canadian dollar rose modestly against the US dollar, updating yesterday's high and briefly breaking CAD1.2600 mark (for the first time from 6 July 2015). The main support provided currency rise in price of oil futures on the background on US petroleum inventories report, which pointed to a smaller-than-expected increase in crude oil stocks. US Department of Energy reported that in the week of April 9-15, oil stocks rose 2.1 million barrels to 538.6 million barrels (historic high for this time of year). Analysts had expected an increase of reserves by 2.5 million. Barrels. Oil reserves in Cushing terminal fell 248,000 barrels to 64.3 million barrels. Gasoline inventories fell by 110,000 barrels to 239.7 million barrels. Analysts had expected a drop of 1.5 million barrels. Meanwhile, refining capacity utilization rate increased by 0.2% to 89.4%. Analysts expected an increase of 0.1%. Also, the data showed that oil production in the US in the week April 9-15, fell to 8.953 million barrels per day versus 8.977 million barrels the previous week.

-

17:44

Germany's Economy Minister Sigmar Gabriel: the European Central Bank’s monetary policy reaches its limits

Germany's Economy Minister Sigmar Gabriel said on Wednesday that the European Central Bank's monetary policy reached its limits.

"Printing money is not a sustainable economic policy," he said.

-

17:39

Bank of England Monetary Policy Committee member Ian McCafferty: wage growth could pick up faster once inflation starts to rise

Bank of England (BoE) Monetary Policy Committee (MPC) member Ian McCafferty said in a speech on Wednesday that wage growth could pick up faster once inflation starts to rise.

"Although the pick-up in wages as the labour market has tightened appears to have been interrupted by current low inflation, once CPI (consumer price index) inflation starts to rise, behaviour is likely to revert, and wage inflation may rise surprisingly quickly in response," he said.

McCafferty noted that the uncertainty around the referendum on Britain's membership in the European Union weighed on business investment in Britain.

"Very recently there have been some signs that increased uncertainty linked to the outcome of the EU referendum to be held on 23 June may weigh on investment in coming months, such that we may see a slight softening in GDP growth through the summer," he said.

-

17:26

Bank of Japan Governor Haruhiko Kuroda signals further stimulus measures

Bank of Japan (BoJ) Governor Haruhiko Kuroda signals on Wednesday that the central bank could ease its monetary policy further, saying that the BoJ's presence in the exchange-traded fund (ETF) market was "not too big".

Kuroda pointed out that helicopter money was not an option for the central bank.

"It's unthinkable. The BOJ isn't thinking about this at all," the BoJ governor said.

-

16:30

U.S.: Crude Oil Inventories, April 2.08 (forecast 2.5)

-

16:14

U.S. existing homes sales climb 5.1% in March

The National Association of Realtors released existing homes sales figures in the U.S. on Wednesday. Sales of existing homes climbed 5.1% to a seasonally adjusted annual rate of 5.33 million in March from 5.07 in February. February's figure was revised down from 5.08 million units.

Analysts had expected an increase to 5.30 million units.

"Buyer demand remains sturdy in most areas this spring and the mid-priced market is doing quite well. However, sales are softer both at the very low and very high ends of the market because of supply limitations and affordability pressures," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers remained unchanged at 30% in March.

"With rents steadily rising and average fixed rates well below 4 percent, qualified first-time buyers should be more active participants than what they are right now," Yun said.

-

16:00

U.S.: Existing Home Sales , March 5.33 (forecast 5.3)

-

15:47

German government expects the country's economy to expand 1.7% this year

The German government said on Wednesday that it expected the country's economy to expand 1.7% this year, unchanged from its previous forecast, and 1.5% in 2017, down from its previous forecast of a 1.8% growth.

Export growth is expected to be 2.9% this year and 3.7% in 2017.

The government expects German private consumption to rise by 2.0% this year and by 1.5% in 2017.

-

14:43

Canada’s wholesale sales drop 2.2% in February

Statistics Canada released wholesale sales figures on Wednesday. Wholesale sales dropped 2.2% in February, missing expectations for a 0.3% fall, after a flat reading rise in January.

The decline was mainly driven by a drop in the machinery, equipment and supplies.

Sales of motor vehicle and parts were down 3.5% in February, while sales in in the machinery, equipment and supplies subsector slid 4.8%.

Inventories increased by 0.2% in February.

-

14:30

Canada: Wholesale Sales, m/m, February -2.2% (forecast -0.3%)

-

14:21

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar despite the weak labour market data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany Producer Price Index (MoM) March -0.5% 0.2% 0.0%

06:00 Germany Producer Price Index (YoY) March -3.0% -2.9% -3.1%

08:30 United Kingdom Average Earnings, 3m/y February 2.1% 2.3% 1.8%

08:30 United Kingdom Claimant count March -9.3 Revised From -18 -11.3 6.7

08:30 United Kingdom ILO Unemployment Rate February 5.1% 5.1% 5.1%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) April 2.5 2.5 11.5

10:00 Eurozone ECB President Mario Draghi Speaks

11:00 U.S. MBA Mortgage Applications April 10% 1.3%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The existing home sales in the U.S. are expected to rise to 5.30 million units in March from 5.08 million units in January.

The euro traded higher against the U.S. dollar despite the negative economic data from Germany. Destatis released its producer price index (PPI) for Germany on Wednesday. German PPI producer prices were flat in March, missing expectations for a 0.2% rise, after a 0.5% drop in February.

On a yearly basis, German PPI dropped 3.1% in March, missing expectations for a 2.9% decrease, after a 3.0% fall in February. It was the biggest drop since January 2010.

PPI excluding energy sector fell by 0.9% year-on-year in March. Energy prices were down 9.2% year-on-year in March.

The British pound traded higher against the U.S. dollar despite the weak labour market data from the U.K. The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the December to February quarter, in line with expectations.

The claimant count rose by 6,700 people in March, missing expectations for a fall by 11,300, after a decrease of 9,300 people in February. February's figure was revised down from a 18,000 decrease.

U.K. unemployment in the November to January period increased by 21,000 to 1.7 million from the previous quarter. It was the first rise since the May-July quarter of 2015.

The employment rate remained unchanged at 74.1% in the December to February quarter. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 2.2% in the December to February quarter, after a 2.2% gain in the November to January quarter.

Average weekly earnings, including bonuses, rose by 1.8% in the December to February quarter, in missing expectations for a 2.3% gain, after a 2.1% increase in the November to January quarter.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian economic data. Wholesales sales in Canada are expected to decrease 0.3% in February, after a flat reading in January.

The Swiss franc traded higher against the U.S. dollar. A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index climbed to 11.5 in April from 2.5 in March. Analysts had expected the index to remain unchanged at 2.5.

"In regard to economic expectations as well as the current economic situation in Switzerland, the large majority of respondents do not expect to see any changes," the ZEW said.

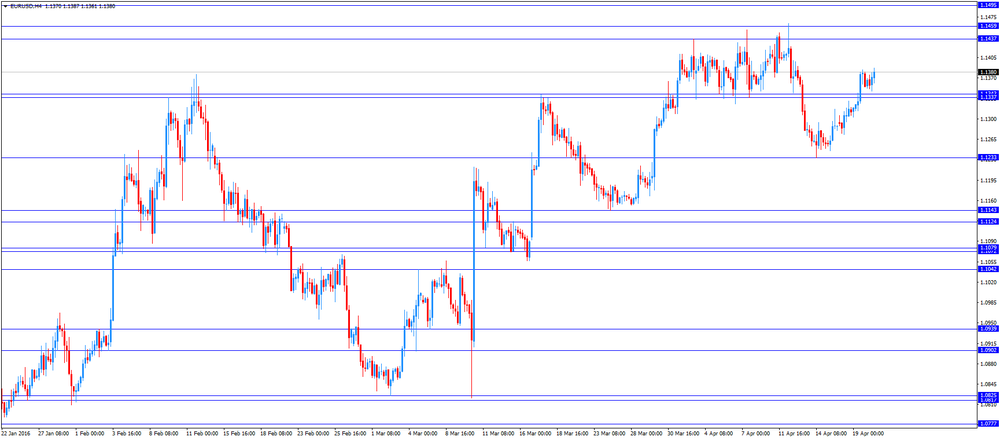

EUR/USD: the currency pair rose to $1.1387

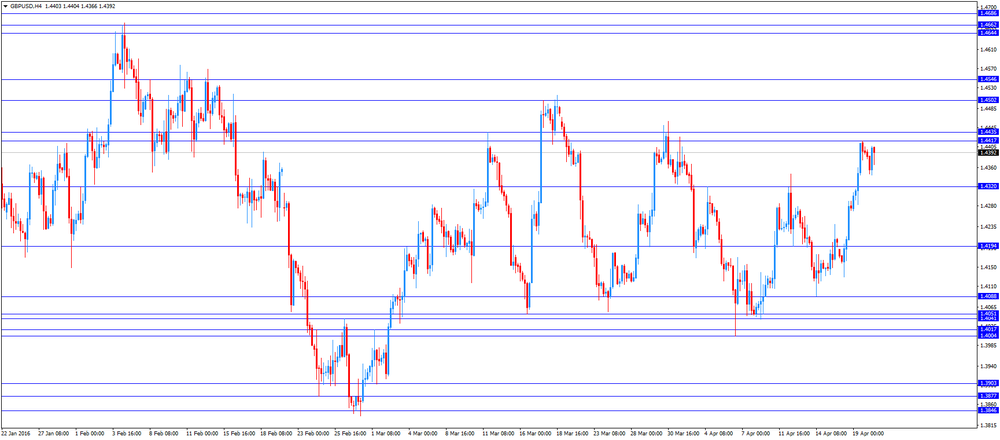

GBP/USD: the currency pair increased to $1.4406

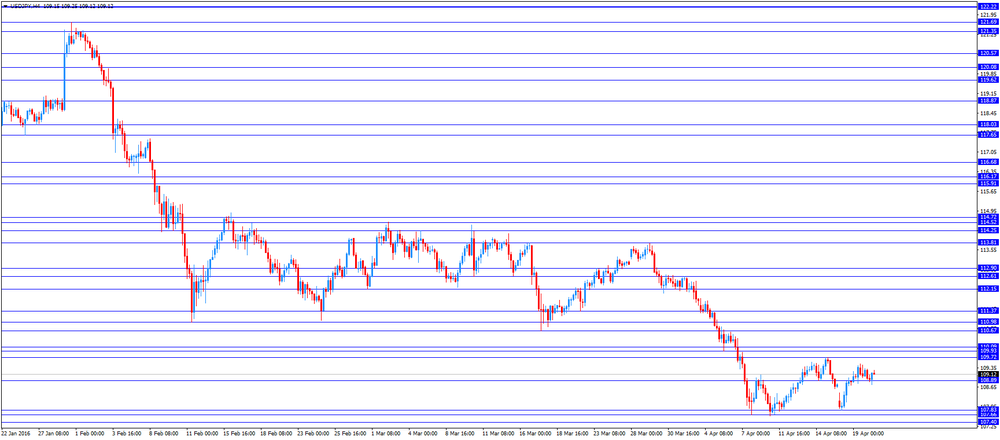

USD/JPY: the currency pair climbed to Y109.25

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m February 0.0% -0.3%

12:30 U.S. Chicago Federal National Activity Index March -0.29

13:00 United Kingdom MPC Member McCafferty Speaks

14:00 U.S. Existing Home Sales March 5.08 5.3

14:30 U.S. Crude Oil Inventories April 6.634 2.5

20:15 Canada BOC Gov Stephen Poloz Speaks

-

13:51

Orders

EUR/USD

Offers: 1.1385 1.1400 1.1420 1.1450 1.1465-70 1.1500

Bids: 1.1345-50 1.1320 1.1300 1.1275-80 1.1250 1.1235 1.1220 1.1200 1.1180 1.1160 1.1150

GBP/USD

Offers: 1.4385 1.4400 1.4420 1.4450 1.4480 1.4500

Bids: 1.4350 1.4325-30 1.4300 1.4280 1.4250 1.4230 1.4200 1.4180-85 1.4165 1.4150

EUR/JPY

Offers: 124.00 124.30 124.50 124.75 125.00 125.30 125.50 125.75 126.00

Bids: 123.50 123.20 123.00 122.80 122.50 122.00 121.75-80 121.50 121.30 121.00

EUR/GBP

Offers: 0.7920-25 0.7950 0.7980 0.8000 0.8020 0.8030 0.8050

Bids: 0.7880 0.7850 0.7830 0.7800 0.7780 0.7750

USD/JPY

Offers: 109.00 109.20 109.35 109.50 109.75-80 110.00 110.20 110.50

Bids: 108.75 108.50 108.20 108.00 107.80-85 107.60-65 107.50

AUD/USD

Offers: 0.7800 0.7820 0.7850 0.7880 0.7900 0.7930 0.7950

Bids: 0.7760 0.7740 0.7700 0.7680 0.7650 0.7620-25 0.7600 0.7580 0.7550

-

13:00

U.S.: MBA Mortgage Applications, April 1.3%

-

11:46

Greece’s current account narrows to €0.80 billion in February

The Bank of Greece released its current account data on Wednesday. Greece's current account deficit narrowed to €0.80 billion in February from €1.45 billion in February last year.

The Greek deficit on trade in goods declined to €1.45 billion in February from €1.59 billion in February last year, while the services surplus fell to €156 million from €382 million.

The primary income deficit turned into a surplus of €440 million in February from €140 million in February last year, while the deficit on secondary income turned into a surplus of €48 million from a deficit of €110 million last year.

The capital account surplus climbed to €244 million in February from €109 million last year.

-

11:35

German producer prices are flat in March

Destatis released its producer price index (PPI) for Germany on Wednesday. German PPI producer prices were flat in March, missing expectations for a 0.2% rise, after a 0.5% drop in February.

On a yearly basis, German PPI dropped 3.1% in March, missing expectations for a 2.9% decrease, after a 3.0% fall in February. It was the biggest drop since January 2010.

PPI excluding energy sector fell by 0.9% year-on-year in March.

Energy prices were down 9.2% year-on-year in March.

Consumer non-durable goods prices fell 0.3% year-on-year in March, intermediate goods sector prices decreased by 2.3%, while capital goods prices increased 0.6% and durable consumer goods sector prices gained 1.4%.

-

11:26

U.K. unemployment rate remains unchanged at 5.1% in the December to February quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the December to February quarter, in line with expectations.

The claimant count rose by 6,700 people in March, missing expectations for a fall by 11,300, after a decrease of 9,300 people in February. February's figure was revised down from a 18,000 decrease.

U.K. unemployment in the November to January period increased by 21,000 to 1.7 million from the previous quarter. It was the first rise since the May-July quarter of 2015.

The employment rate remained unchanged at 74.1% in the December to February quarter. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 2.2% in the December to February quarter, after a 2.2% gain in the November to January quarter.

Average weekly earnings, including bonuses, rose by 1.8% in the December to February quarter, in missing expectations for a 2.3% gain, after a 2.1% increase in the November to January quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

11:16

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index climbs to 11.5 in April

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index climbed to 11.5 in April from 2.5 in March. Analysts had expected the index to remain unchanged at 2.5.

"In regard to economic expectations as well as the current economic situation in Switzerland, the large majority of respondents do not expect to see any changes," the ZEW said.

The current conditions rose to -0.1 in April from -2.7 in March.

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), April 11.5 (forecast 2.5)

-

10:54

Employment rate in the OECD area rises by 0.2% in the fourth quarter

The Organization for Economic Co-operation and Development (OECD) released its employment rate for the fourth quarter on Tuesday. The employment rate in the OECD rose by 0.2% to 66.5% in the fourth quarter of 2015. It was slightly below pre-crisis peak of the first quarter of 2008.

The employment rate in the Eurozone was up 0.1% to 64.7% in the fourth quarter, the employment rate in the United Kingdom rose by 0.5% to 73.2%, while the rate in the United States climbed 0.2% to 68.9%.

Greece's employment rate climbed by 1.7% to 51.4% in the fourth quarter, while the employment rate in Germany increased by 0.1% to 74.1%.

-

10:38

European Central Bank Governing Council member Luis Maria Linde: Spain should continue to implement reforms to lower its budget deficit

The European Central Bank (ECB) Governing Council member and the Bank of Spain Governor Luis Maria Linde said on Tuesday that Spain should continue to implement reforms to lower its budget deficit.

"Our challenge is to reduce the amount of public debt," he said.

-

10:30

United Kingdom: ILO Unemployment Rate, February 5.1% (forecast 5.1%)

-

10:30

United Kingdom: Average Earnings, 3m/y , February 1.8% (forecast 2.3%)

-

10:30

United Kingdom: Claimant count , March 6.7 (forecast -11.3)

-

10:22

European Commission Vice President Valdis Dombrovskis: Portugal will breach the Stability and Growth Pact

European Commission Vice President Valdis Dombrovskis said on Tuesday that Portugal would breach the Stability and Growth Pact.

"The Commission considers that the government's plans are at risk of non-compliance with the provisions of the Stability and Growth Pact," he said.

The Portuguese government plans to reduce its budget deficit to 2.2% of GDP this year from 4.4% in 2015.

-

10:08

Japan's trade surplus widens to ¥755 billion in March

The Ministry of Finance released its trade data for Japan on the late Tuesday evening. Japan's trade surplus rose to ¥755 billion in March from ¥242.8 billion in February. Analysts had expected a surplus of ¥834.6 billion.

Exports fell 6.8% year-on-year in March, while imports dropped 14.9%.

Exports to Asia declined by 9.7% year-on-year in March, exports to the United States decreased by 5.1%, while exports to the European Union climbed by 12.1%.

Imports from Asia plunged by 5.3% year-on-year in March, imports from the United States slid by 20.0%, while imports from the European Union declined by 3.7%.

-

09:20

Option expiries for today's 10:00 ET NY cut

USD/JPY 108.00 (USD 200m) 108.75 (415m) 109.00 (390m) 110.00 (1.85bln)

EUR/USD: 1.1200 (EUR 247m) 1.1220 (358m) 1.1300 (EUR 522m) 1.1330 (212m) 1.1400-10 (557m)

AUD/USD: 0.7800 (AUD 661m)

USD/CAD 1.2600 (USD 653m) 1.2650-55 (207m) 1.2700 (445m) 1.2940 (673m) 1.2955 (250m) 1.3000 (285m)

EUR/JPY 122.00 (EUR 300m) 122.60 (210m) 125.80-85 (300m)

AUD/NZD 1.1200 (AUD 762m)

-

08:32

Options levels on wednesday, April 20, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1481 (4340)

$1.1457 (2057)

$1.1424 (918)

Price at time of writing this review: $1.1365

Support levels (open interest**, contracts):

$1.1312 (2618)

$1.1286 (2850)

$1.1255 (3586)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 36538 contracts, with the maximum number of contracts with strike price $1,1400 (4340);

- Overall open interest on the PUT options with the expiration date May, 6 is 49236 contracts, with the maximum number of contracts with strike price $1,0900 (4726);

- The ratio of PUT/CALL was 1.35 versus 1.40 from the previous trading day according to data from April, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.4605 (1468)

$1.4508 (3093)

$1.4412 (2151)

Price at time of writing this review: $1.4367

Support levels (open interest**, contracts):

$1.4292 (275)

$1.4195 (1072)

$1.4097 (1640)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 25784 contracts, with the maximum number of contracts with strike price $1,4500 (3093);

- Overall open interest on the PUT options with the expiration date May, 6 is 31063 contracts, with the maximum number of contracts with strike price $1,3850 (4042);

- The ratio of PUT/CALL was 1.20 versus 1.23 from the previous trading day according to data from April, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:20

Asian session: Commodity-linked currencies pulled back from recent peaks

Commodity-linked currencies like the Australian and Canadian dollars pulled back from recent peaks on Wednesday as a rally in crude oil prices stalled after a oil workers' strike in Kuwait ended.

The U.S. Federal Reserve's caution over raising interest rates, coupled with ultra-loose monetary policies in Japan and Europe, has boosted the appeal of the higher-yielding Aussie this year.

The Aussie's recent surge -it has gained seven percent this year after plumbing a seven-year low in January- had analysts wondering whether the currency had climbed too far too fast.

In March, ECB chief Mario Draghi unleashed a bold easing package but the euro rallied after he suggested there would be no further cuts.

EUR/USD: during the Asian session the pair traded in the range of $1.1355-75

GBP/USD: during the Asian session the pair fell to $1.4365

USD/JPY: during the Asian session the pair fell to Y108.85

Based on Reuters materials

-

08:00

Germany: Producer Price Index (MoM), March 0.0% (forecast 0.2%)

-

08:00

Germany: Producer Price Index (YoY), March -3.1% (forecast -2.9%)

-

01:50

Japan: Trade Balance Total, bln, March 755 (forecast 834.6)

-

00:33

Currencies. Daily history for Apr 19’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1355 +0,38%

GBP/USD $1,4392 +0,81%

USD/CHF Chf0,9618 -0,26%

USD/JPY Y109,26 +0,38%

EUR/JPY Y124,06 +0,75%

GBP/JPY Y157,25 +1,20%

AUD/USD $0,7811 +0,79%

NZD/USD $0,7045 +1,26%

USD/CAD C$1,2669 -0,16%

-

00:01

Schedule for today, Wednesday, Apr 20’2016:

(time / country / index / period / previous value / forecast)

06:00 Germany Producer Price Index (MoM) March -0.5% 0.2%

06:00 Germany Producer Price Index (YoY) March -3.0% -2.9%

08:30 United Kingdom Average Earnings, 3m/y February 2.1% 2.3%

08:30 United Kingdom Claimant count March -18 -10

08:30 United Kingdom ILO Unemployment Rate February 5.1% 5.1%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) April 2.5

10:00 Eurozone ECB President Mario Draghi Speaks

11:00 U.S. MBA Mortgage Applications April 10%

12:30 Canada Wholesale Sales, m/m February 0.0% -0.3%

12:30 U.S. Chicago Federal National Activity Index March -0.29

13:00 United Kingdom MPC Member McCafferty Speaks

14:00 U.S. Existing Home Sales March 5.08 5.3

14:30 U.S. Crude Oil Inventories April 6.634

20:15 Canada BOC Gov Stephen Poloz Speaks

-