Noticias del mercado

-

20:20

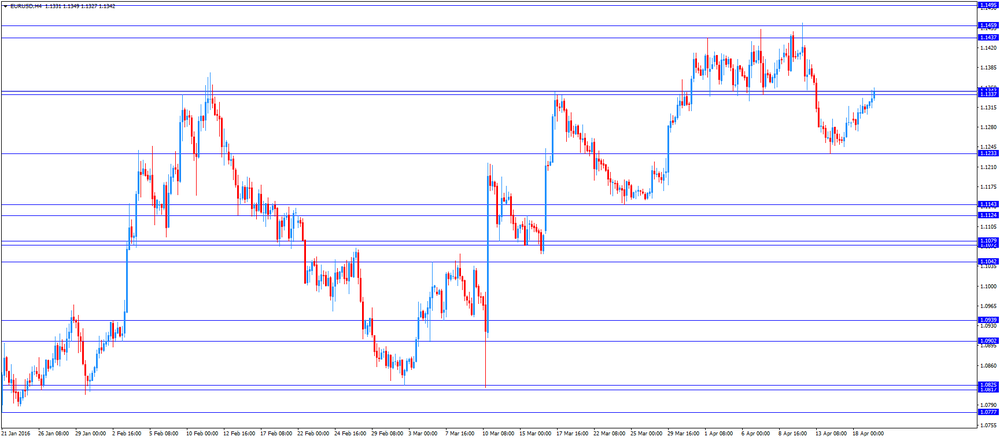

American focus: The US dollar fell against most major currencies

The dollar depreciated significantly against the euro, reaching a minimum of 13 April. The main pressure on the currency was weak data on the US housing market, which is likely to make the Fed more cautious approach to the issue of rising interest rates in the next few months.

The Commerce Department said that the establishment of new homes in the US fell more than expected in March, while the number of building permits reached a one-year low, suggesting a cooling of the housing market. Bookmarks new homes fell by 8.8 percent to a seasonally adjusted annual rate reached 1.09 million units, the lowest level since October. February data were revised to a level of 1.19 million units, compared with earlier estimates of 1.18 million units. Economists had forecast that the bookmarks of new homes will fall to 1170 thousand. Units last month. The fall in the last month pointed to a slowdown in the property market. Nevertheless, the fundamental indicators of the housing market remain strong amid growing labor market. Last month, bookmarks single-family homes, the largest segment of the market, fell by 9.2 percent to 764,000 units, the lowest since October. Building permits fell 7.7 percent to 1.09 million units last month, the lowest level since March last year.

The focus of the comments were also officials of the Federal Reserve System. Fed President Dudley of New York said that the economic conditions in the US "mostly favorable", but the Fed should be cautious when raising interest rates. Boston Fed President Rosengren, however, said the Fed could raise rates faster than currently expected by investors. Futures on interest rates Fed point to 1% probability of a rate hike in April and 20% probability in June.

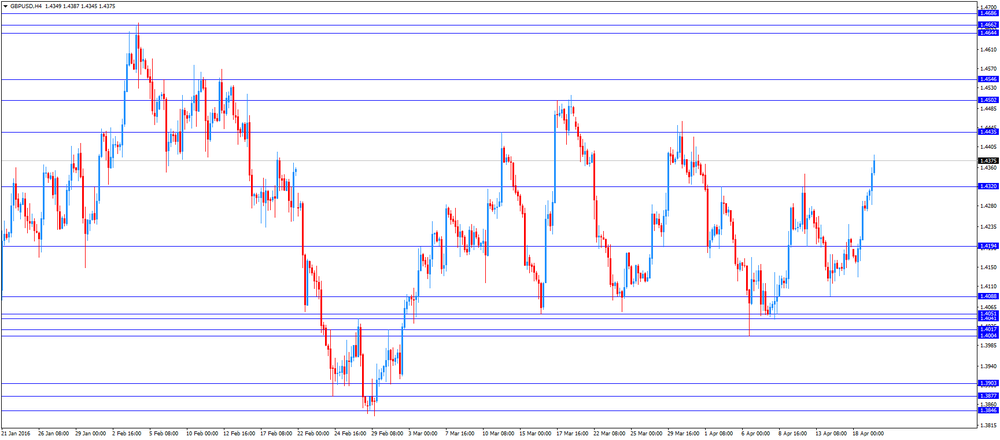

The pound has appreciated almost 150 pips against the dollar, updating the maximum of the current month. The growth of currency contributed to a general increase in risk appetite and the results of a public opinion poll reporting the excess number of supporters of the preservation of Britain in the European Union. A further increase in couples restrain statements of the Bank of England's Carney. He said that in the event of a serious threat to the Central Bank may lower interest rates. Carney also paid attention to the exit of Britain from the EU, and once again warned about the risks facing the economy in the run-up to the forthcoming referendum. "Voting in favor of leaving the EU could lead to a long period of uncertainty about the economic outlook This, in turn, could put pressure on demand and exports, and to sow doubts about the ability of the economy to continue to grow in the future.", - The head of the Central Bank said. "Also Brekzit may lead to an increase in mortgage interest rates, accelerating inflation and higher bank interest rates in the role of the London financial sector also significantly reduced after the release of the country out of the EU." - Added Carney. Meanwhile, Carney noted that the deterioration of the situation in China could harm Britain than withdrawal from the European Union.

The Canadian dollar rose substantially against the US dollar, reaching a maximum of 10 July 2015, which was due to rising oil prices and widespread weakening of the US currency. Oil futures rise in price, as the oil strike in Kuwait almost halved the volume of production in the country, and overshadowed the bearish sentiment. At the same time, analysts expect that production will fall short again, and soon, investors will focus on an excess of supply. "In the coming days, production in Kuwait may partially recover due to the reallocation of workers to strike is not published, and the use of reserves, which will help to avoid force majeure with loading" - believe Eurasia Group analysts. Investors are also awaiting the publication of the American Petroleum Institute (API) oil reserves. If the API reported a significant fall of stocks, oil prices could rise even more.

A slight effect on the Canadian dollar had the statements of the Bank of Canada's runners. He said that the strong GDP data for Q1 to some extent explained by temporary factors. As for the situation on the currency market, Poloz said that the restoration of the Canadian dollar is related to a change in expectations for monetary policy of the USA and Canada "Despite the fact that recent economic data were generally encouraging, they differ in the variable nature. We have not seen concrete evidence of increasing the volume of investment and accelerating growth in the number of new companies probability that the inflation target will be reached earlier expectations, very low, "-. said the head of the Bank of Canada.

-

18:02

European Central Bank’s negative deposit rate has a positive impact on lending volumes

The European Central Bank (ECB) said in a survey on Tuesday that the negative deposit rate had a positive impact on lending volumes.

"Regarding the impact of the ECB's negative deposit facility rate, banks reported a positive impact on lending volumes, specifically for loans to households, but a negative impact on their net interest income and loan margins for the last quarter of 2015 and the first quarter of 2016," the ECB said.

-

17:53

Spain will miss its budget deficit target this year

Spain's Finance Minister Luis de Guindos said on Tuesday that the country would miss its budget deficit target this year. He noted that the deficit was expected to be 3.6% of GDP in 2016, higher than the European Commission's target of below 3%.

de Guindos also said that the deficit was expected to be 2.9% of GDP in 2017.

-

17:46

Bank of Canada Governor Stephen Poloz: the recent economic data was encouraging but also quite variable

The Bank of Canada (BoC) Governor Stephen Poloz said before the House of Commons Standing Committee on Finance on Tuesday that the recent economic data was encouraging but also quite variable.

He noted that there was no evidence of higher investment.

"We have not yet seen concrete evidence of higher investment and strong firm creation. These are some of the ingredients needed for a return to natural, self-sustaining growth with inflation sustainably on target," Poloz said.

The BoC governor also said that the Canadian economy was hit by a drop in oil prices.

-

17:37

Bank of England Governor Mark Carney: the uncertainty about the results of the referendum on Britain’s membership in the European Union seems already to weigh on Britain’s economy

The Bank of England (BoE) Governor Mark Carney said before the House of Lords economic affairs committee on Tuesday that the uncertainty about the results of the referendum on Britain's membership in the European Union (EU) seemed to weigh on Britain's economy.

He noted that Britain's exit from the EU could have a negative impact on Britain's financial stability, property markets, market liquidity, and on the rest of the EU.

"Some elements of these risks may be beginning to manifest," Carney said.

-

17:21

Reserve Bank of Australia Governor Glenn Stevens: central banks’ inability to boost the global growth is the biggest risk to the global financial system

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said in a speech on Tuesday that central banks' inability to boost the global growth was the biggest risk to the global financial system.

"Our inability, so far, durably to lift growth prospects is arguably the biggest vulnerability the global financial system faces today. This needs to be our focus," he said.

Stevens also said that ultra-low interest rates for a longer period was a big problem for savers.

Referring to helicopter money, the RBA governor noted that it was easier to start doing helicopter money than to stop.

"Desperate times call for desperate measures, perhaps. Are we that desperate?" he added.

-

16:25

Business NZ’s performance of services index for New Zealand falls to 54.8 in March

Business NZ released its performance of services index for New Zealand on late Monday evening. The index fell to 54.8 in March from 56.7 in February. It was the lowest level since November 2014It was

February's figure was revised down from 56.9.

A reading above 50.0 indicates the expansion of activity.

The fall was driven by declines in all sub-indexes.

-

15:50

Option expiries for today's 10:00 ET NY cut

USD/JPY 108.50 (USD 366m) 110.00 (1.07bln) 110.50 (599m)

EUR/USD: 1.1300 (EUR 361m) 1.1310-25 (603m) 1.1400 (534m) 1.1460 (245m)

AUD/USD: 0.7590 (AUD 210m) 0.7750 (388m)

USD/CAD 1.2250 (USD 400m) 1.2900 (598m) 1.3100 (235m)

AUD/JPY 84.65 (AUD 236m)

-

15:43

Industrial production in Italy climbs 0.3% in February

The Italian statistical office Istat released its industrial production data on Tuesday. Industrial production in Italy climbed at a seasonally-adjusted rate of 0.3% in February, after a 1.6% decline in January. January's figure was revised down from a 1.9% rise.

On a yearly basis, industrial production in Italy jumped at a seasonally-adjusted rate of 0.3% in February, after a 1.7% decrease in January.

The construction cost index for residential buildings remained unchanged in February compared with the previous month, the cost index for road construction with tunnel section fell by 0.3%, while the cost index for road construction without tunnel section declined by 0.3%.

-

15:35

Italy’s current account deficit is €1.38 billion in February

The Bank of Italy released its current account on Tuesday. Italy's current account surplus rose €1.38 billion in February from €1.09 billion in February last year.

The goods trade surplus rose to €4.36 billion in February from €4.25 billion in February last year.

The deficit on services increased to €1.13 billion in February from €972 million in February last year.

The primary income surplus was €282 million in February, while the secondary income deficit was €2.13 billion.

-

14:49

Housing starts in the U.S. drop 8.8% in March

The U.S. Commerce Department released the housing market data on Tuesday. Housing starts in the U.S. dropped 8.8% to 1.089 million annualized rate in March from a 1.194 million pace in February, missing expectations for a decrease to 1.170 million. It was the lowest level since October 2015.

February's figure was revised up from 1.178 million units.

The drop was driven by declines in starts of single-family and multi-family homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. fell 7.7% to 1.086 million annualized rate in March from a 1.177 million pace in February, missing expectations for a 1,200 million pace. It was the lowest level since March 2015.

Starts of single-family homes slid 9.2% in March. Building permits for single-family homes were down 1.2%.

Starts of multi-family buildings fell 7.9% in March. Permits for multi-family housing slid 18.6%.

-

14:30

U.S.: Housing Starts, March 1089 (forecast 1170)

-

14:30

U.S.: Building Permits, March 1086 (forecast 1200)

-

14:14

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Meeting's Minutes

08:00 Eurozone Current account, unadjusted, bln February 8.3 Revised From 6.3 11.1

09:00 Eurozone Construction Output, y/y February 4.9% Revised From 6% 2.5%

09:00 Eurozone ZEW Economic Sentiment April 10.6 8.8 21.5

09:00 Germany ZEW Survey - Economic Sentiment April 4.3 8 11.2

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. housing market data. Housing starts in the U.S. are expected to decline to 1.170 million units in March from 1.178 million units in February.

The number of building permits is expected to increase to 1.200 million units in March from 1.177 million units in February.

The euro traded higher against the U.S. dollar after the release of the positive economic data from the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index increased to 11.2 in April from 4.3 in March, exceeding expectations for a rise to 8.0.

"Surprisingly positive economic news from China seem to have improved the sentiment amongst financial market experts. On balance, however, the continued poor growth in China and other important emerging markets continues to be a burden for the German export industry. Furthermore, concern about Great Britain's possible exit from the EU seems to be having a negative impact," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index climbed to 21.5 in April from 10.6 in March, beating expectations for a decline to 8.8.

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus declined to a seasonally adjusted €19.0 billion in February from €27.5 billion in January. January's figure was revised up from a surplus of €25.4 billion.

The trade surplus fell to €24.6 billion in February from €30.4 billion in January. The surplus on services increased to €6.8 billion in February from €3.8 billion in January.

The British pound traded higher against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead of a speech by the Bank of Canada Governor Stephen Poloz.

EUR/USD: the currency pair rose to $1.1349

GBP/USD: the currency pair increased to $1.4387

USD/JPY: the currency pair climbed to Y109.48

The most important news that are expected (GMT0):

12:30 U.S. Housing Starts March 1178 1170

12:30 U.S. Building Permits March 1177 1200

13:30 Australia RBA's Governor Glenn Stevens Speech

14:30 United Kingdom BOE Gov Mark Carney Speaks

15:00 Canada BOC Gov Stephen Poloz Speaks

23:50 Japan Tertiary Industry Index February 1.5%

23:50 Japan Trade Balance Total, bln March 242.8 834.6

-

13:58

Orders

EUR/USD

Offers: 1.1350 1.1365 1.1385 1.1400 1.1420 1.1450 1.1465-70 1.1500

Bids: 1.1320 1.1300 1.1275-80 1.1250 1.1235 1.1220 1.1200 1.1180 1.1160 1.1150

GBP/USD

Offers: 1.4350 1.4370 1.4390-1.4400 1.4420 1.4450 1.4480 1.4500

Bids: 1.4300 1.4280 1.4250 1.4230 1.4200 1.4180-85 1.4165 1.4150 1.4120-25 1.4100

EUR/JPY

Offers: 123.85 124.00 124.30 124.50 124.75 125.00 125.30 125.50

Bids: 123.50 123.20 123.00 122.80 122.50 122.00 121.75-80 121.50 121.30 121.00

EUR/GBP

Offers: 0.7925-30 0.7950 0.7980 0.8000 0.8020 0.8030 0.8050

Bids: 0.7900 0.7880 0.7850 0.7830 0.7800 0.7780 0.7750

USD/JPY

Offers: 109.10 109.30 109.50 109.75-80 110.00 110.20 110.50

Bids: 108.75-80 108.50 108.20 108.00 107.80-85 107.60-65 107.50

AUD/USD

Offers: 0.7820 0.7850 0.7880 0.7900 0.7930 0.7950

Bids: 0.7760 0.7740 0.7700 0.7680 0.7650 0.7620-25 0.7600 0.7580 0.7550

-

11:53

Eurozone’s current account surplus falls to a seasonally adjusted €19.0 billion in February

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus declined to a seasonally adjusted €19.0 billion in February from €27.5 billion in January. January's figure was revised up from a surplus of €25.4 billion.

The trade surplus fell to €24.6 billion in February from €30.4 billion in January.

The surplus on services increased to €6.8 billion in February from €3.8 billion in January.

The primary income surplus fell to €1.4 billion in February from €3.2 billion in January, while the secondary income deficit increased to €13.8 billion from €9.9 billion.

Eurozone's unadjusted current account surplus climbed to €11.1 billion in February from €8.3 billion in January. January's figure was revised up from a surplus of €6.3 billion.

-

11:45

Construction production in the Eurozone declines 1.1% in February

The Eurostat released its construction production data for the Eurozone on Tuesday. Construction production in the Eurozone declined 1.1% in February, after a 2.4% rise in January. January's figure was revised down from a 3.6% rise.

Civil engineering output rose 0.9% in February, while production in the building sector was down 1.5%.

On a yearly basis, construction output rose 2.5% in February, after a 4.9% gain in January. January's figure was revised down from a 6.0% increase.

Civil engineering output increased 1.3% year-on-year in February, while production in the building sector climbed 2.8%.

-

11:35

Germany's ZEW economic sentiment index increases to 11.2 in April

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index increased to 11.2 in April from 4.3 in March, exceeding expectations for a rise to 8.0.

The assessment of the current situation in Germany declined by 3.0 points to 47.7 points.

"Surprisingly positive economic news from China seem to have improved the sentiment amongst financial market experts. On balance, however, the continued poor growth in China and other important emerging markets continues to be a burden for the German export industry. Furthermore, concern about Great Britain's possible exit from the EU seems to be having a negative impact," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index climbed to 21.5 in April from 10.6 in March, beating expectations for a decline to 8.8.

The assessment of the current situation in the Eurozone fell by 0.3 points to -12.1 points.

-

11:11

April’s Reserve Bank of Australia monetary policy meeting: a stronger Australian dollar could have a negative impact on rebalancing towards the non-mining sectors of the economy

The Reserve Bank of Australia (RBA) released its minutes from April monetary policy meeting on Tuesday. The RBA said that the Australian economy expanded moderately in the December quarter.

The Australian inflation was likely to remain at low levels over the next year or two, the RBA said.

According to the central bank, the monetary policy should be accommodative, while low interest rates should help to support the consumer demand and the activity in the housing market.

Members said that a stronger Australian dollar could have a negative impact on rebalancing towards the non-mining sectors of the economy.

The central bank noted that it could ease monetary policy further if needed, the minutes said.

The RBA kept unchanged its interest rate at 2.00% in April.

-

11:01

Eurozone: Construction Output, y/y, February 2.5%

-

11:00

Germany: ZEW Survey - Economic Sentiment, April 11.2 (forecast 8)

-

11:00

Eurozone: ZEW Economic Sentiment, April 21.5 (forecast 8.8)

-

10:59

Australia’s leading economic index falls 0.3% in February

The Conference Board (CB) released its leading economic index for Australia on Monday. The leading economic index (LEI) fell 0.3% in February, after a 0.5% decline in January.

The coincident index increased 0.1% in February, after a flat reading in January.

-

10:41

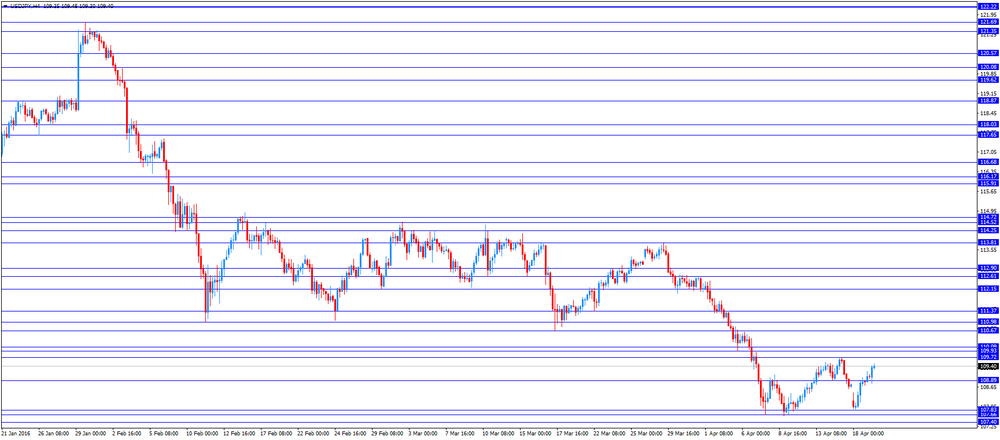

Bank of Japan Governor Haruhiko Kuroda: a stronger yen could weigh on inflation

Bank of Japan (BoJ) Governor Haruhiko Kuroda said in an interview with the Wall Street Journal over weekend that a stronger yen could weigh on inflation and could lead to further stimulus measures by the central bank.

"If excessive appreciation continues, that could affect not just actual inflation, but even the trend in inflation through its impact on business confidence, business activity, and even through inflation expectations," he said.

Kuroda pointed out that the exchange rate of the yen was the target of the BoJ's monetary policy, adding that the BoJ continued to closely monitor exchange-rate movements.

BoJ governor reiterated that the central bank would add further stimulus measures if needed to reach 2% inflation target.

Kuroda noted that there was room for further cut in interest rates, technically and theoretically speaking.

-

10:21

Boston Fed President Eric Rosengren: the U.S. economy is strong enough for further interest rates

Boston Fed President Eric Rosengren said in a speech on Monday that the U.S. economy was strong enough for further interest rates.

"The outlook is strong enough to engender further decline in the unemployment rate, even with some gradual normalization of interest rates," he said.

Rosengren noted that markets were too pessimistic regarding the Fed's monetary policy.

"While I believe that gradual federal funds rate increases are absolutely appropriate, I do not see that the risks are so elevated, nor the outlook so pessimistic, as to justify the exceptionally shallow interest rate path currently reflected in financial futures markets," Boston Fed president said.

Rosengren is a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:11

Minneapolis Fed President Neel Kashkari: the U.S. economy is in “uncharted waters”

Minneapolis Fed President Neel Kashkari said in an interview on Monday that the U.S. economy was in "uncharted waters".

"Even now, with the current economic environment, we're still in somewhat uncharted waters, and Chair Yellen has been bringing real creativity and real open-mindedness to how we approach monetary policy. That's the right thing for the country," he said.

Kashkari noted that developments abroad had an impact on the U.S. economy.

"Clearly what happens in global financial markets, as an example, will affect the U.S. economy. We can't be blind to the fact that actions we take could affect global economic developments, which in turn will have an effect on our economy. We need to think about those feedback loops, and I believe that we do," Minneapolis Fed president said.

Kashkari is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:00

Eurozone: Current account, unadjusted, bln , February 11.1

-

09:20

Option expiries for today's 10:00 ET NY cut

USD/JPY 108.50 (USD 366m) 110.00 (1.07bln) 110.50 (599m)

EUR/USD: 1.1300 (EUR 361m) 1.1310-25 (603m) 1.1400 (534m) 1.1460 (245m)

AUD/USD: 0.7590 (AUD 210m) 0.7750 (388m)

USD/CAD 1.2250 (USD 400m) 1.2900 (598m) 1.3100 (235m)

AUD/JPY 84.65 (AUD 236m)

-

08:38

Asian session: Commodity currencies rose

Commodity currencies rose on Tuesday with the Australian dollar hitting a 10-month high while the yen edged lower after oil prices appeared to stabilize from a sharp slide, underpinning risk sentiment.

The Aussie and other commodity currencies benefited from oil's bounce off lows touched on Monday, when they came under pressure after major oil producing countries failed to agree on an output freeze on Sunday. As risk appetite in broader financial markets also recovered, the U.S. dollar held the upper hand against the low-yielding yen.

The yen showed little reaction to news that Japan's government nominated Takako Masai, an executive at Shinsei Bank Ltd and an advocate of aggressive monetary easing, to join the Bank of Japan's policy board. New York Fed President William Dudley, seen as close to the Fed's mainstream thinking, said on Monday U.S. economic conditions are "mostly favorable" yet the Federal Reserve remains cautious in raising interest rates because threats loom. Bank of Japan Governor Haruhiko Kuroda said in an interview with the Wall Street Journal that the trend in inflation could be affected if the yen continued to appreciate excessively.

EUR/USD: during the Asian session the pair traded in the range of $1.1375-05

GBP/USD: during the Asian session the pair fell to $1.4160

USD/JPY: during the Asian session the pair fell to Y107.80

Based on Reuters materials -

08:33

Options levels on tuesday, April 19, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1459 (3712)

$1.1429 (2063)

$1.1384 (927)

Price at time of writing this review: $1.1335

Support levels (open interest**, contracts):

$1.1273 (2718)

$1.1228 (3534)

$1.1198 (3707)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 34836 contracts, with the maximum number of contracts with strike price $1,1600 (4013);

- Overall open interest on the PUT options with the expiration date May, 6 is 48826 contracts, with the maximum number of contracts with strike price $1,0900 (4793);

- The ratio of PUT/CALL was 1.40 versus 1.43 from the previous trading day according to data from April, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.4603 (1462)

$1.4505 (2772)

$1.4408 (2151)

Price at time of writing this review: $1.4325

Support levels (open interest**, contracts):

$1.4286 (266)

$1.4191 (1067)

$1.4094 (1640)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 25109 contracts, with the maximum number of contracts with strike price $1,4500 (2772);

- Overall open interest on the PUT options with the expiration date May, 6 is 30811 contracts, with the maximum number of contracts with strike price $1,3850 (4053);

- The ratio of PUT/CALL was 1.23 versus 1.22 from the previous trading day according to data from April, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:41

Currencies. Daily history for Apr 18’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1312 +0,22%

GBP/USD $1,4275 +0,51%

USD/CHF Chf0,9643 -0,34%

USD/JPY Y108,85 +0,09%

EUR/JPY Y123,13 +0,35%

GBP/JPY Y155,36 +0,59%

AUD/USD 0,7749 +0,36%

NZD/USD $0,6956 +0,55%

USD/CAD C$1,2689 -1,02%

-

00:01

Schedule for today, Tuesday, Apr 19’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia RBA Meeting's Minutes

08:00 Eurozone Current account, unadjusted, bln February 6.3

09:00 Eurozone Construction Output, y/y February 6%

09:00 Eurozone ZEW Economic Sentiment April 10.6

09:00 Germany ZEW Survey - Economic Sentiment April 4.3 8

12:30 U.S. Housing Starts March 1178 1170

12:30 U.S. Building Permits March 1177 1200

13:30 Australia RBA's Governor Glenn Stevens Speech

14:30 United Kingdom BOE Gov Mark Carney Speaks

15:00 Canada BOC Gov Stephen Poloz Speaks

23:50 Japan Tertiary Industry Index February 1.5%

23:50 Japan Trade Balance Total, bln March 242.8 834.6

-