Noticias del mercado

-

20:21

American focus: The US dollar was down against the British Pound

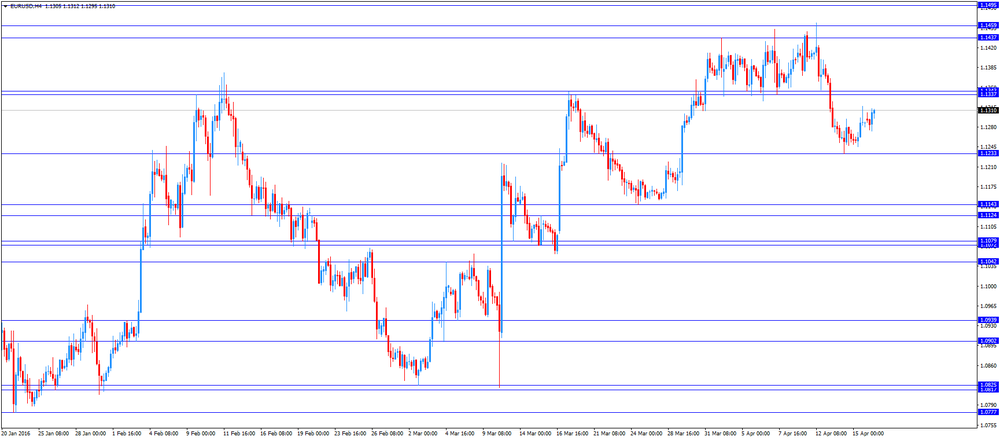

The US dollar fell moderately against the euro, by updating at least Friday. Currently, there is clearly no important fundamental factors and technical sales targets on the market, so the impact on the quotes provided changing risk appetite, as well as the revision of the forecasts regarding the timing of further enhancing the US Federal Reserve rates. Today the head of the New York Fed Dudley repeated that the Fed is in no hurry to raise interest rates. "Changes in monetary policy are likely to be carried out slowly and carefully, as we are still faced with considerable uncertainty, and the obstacles to economic growth caused by the financial crisis has not disappeared completely," - he said.

Recall Dudley has long been in favor of a gradual increase in interest rates. Now investors expect that the next time the Fed will raise rates in the June meeting. Futures on interest rates Fed point to 3% probability of a rate hike in April and 14% probability in June.

A slight pressure on the dollar have data on the housing market. As it became known from the report of the National Association of Home Builders / Wells Fargo, the confidence of the builders on the market of newly built single-family homes remained unchanged in April at 58. "Trust builders held at 58 for three consecutive months, showing that the housing sector single-family homes continued to recover slowly, but consistent pace, - said chairman of the NAHB Ed Brady -. while we enter into the spring home buying season, we have seen that the market is moving forward. " The component measuring sales expectations for the next six months, rose by one point to 62, while customer traffic index also increased by one point to 44. At the same time, the component of current sales conditions fell two points to 63.

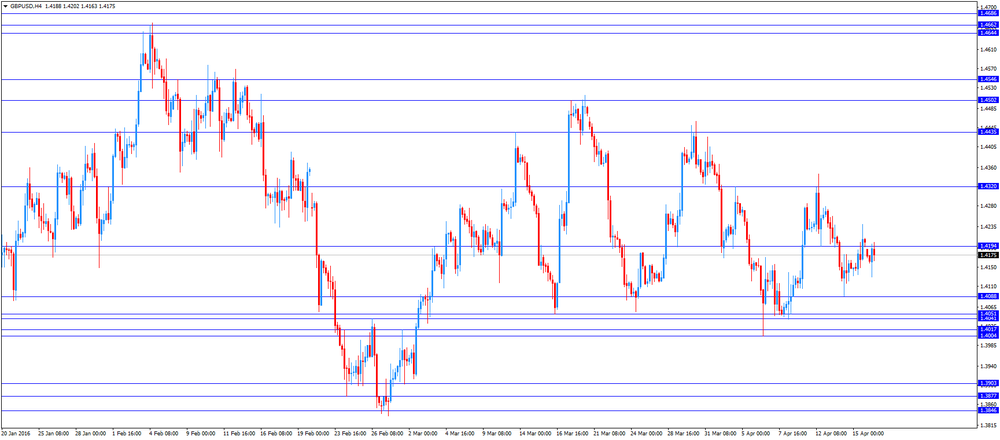

The British pound rose nearly 100 points against the dollar, updating the April 13, which was due to increased risk appetite on the background of the oil price recovery after the collapse in the early session. Support has also had a marked decrease in the pair EUR / GBP, which allowed it to reach its lowest level since April 1. Meanwhile, in the course of trade affected by the publication of data on standby in Britain. Later this week, investors will be focused on statistics on public sector borrowing. Economists believe that the data may be weak and the government will have to significantly reduce the volume of loans in order to meet the forecasts. It is also important will be data on the labor market. The February data was quite strong, but in March, is expected to slow growth in employment and accelerating wage growth. Meanwhile, the focus will be on retail sales report, which will have an important role against the backdrop of slowing activity in most sectors.

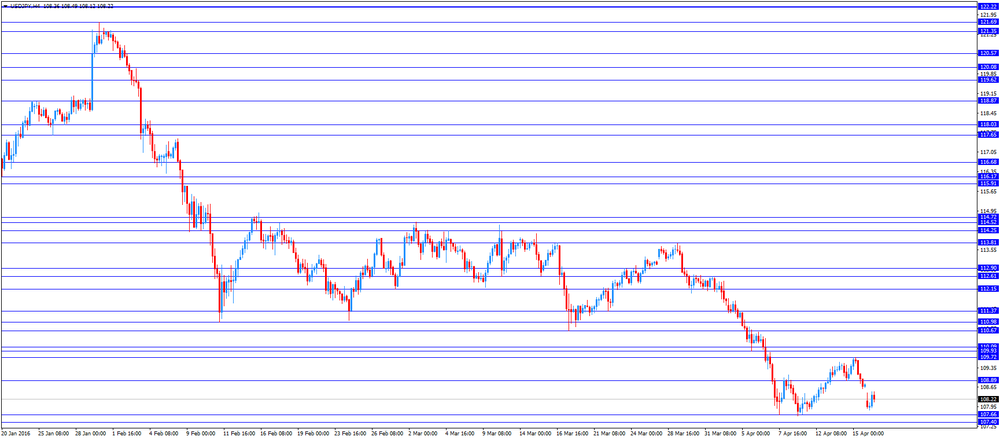

The yen has fallen significantly against the dollar, closing the gap formed at the opening of today's trading. Pressure on the yen has a general increase in risk appetite, as well as speculation that the government may take action to prevent further strengthening of the national currency. Today the head of the Bank of Japan Kuroda said that the yen's rise may undermine the Bank of Japan for higher inflation. He also stressed that the Bank of Japan will take measures without embarrassment again to boost inflation. Earlier today, the Japanese government spokesman said the government was closely monitoring the currency market and will take action if market participants are intentionally raising the yen too high. According to him, the Ministry of Finance and the Bank of Japan is often carried out consultations on the yen and in contact with the office of the Prime Minister.

Investors are also waiting for the Bank of Japan meeting, scheduled for April 27-28. In addition to the decision on the monetary policy of the Bank will publish its inflation forecasts and economic growth. The latest survey of 16 analysts conducted by Reuters showed that the Bank of Japan may again soften the policy by July. 8 of them are waiting for policy easing at the meeting of 27-28 April, 3 predict that softening occurs in June, 5- in July.

-

17:43

People’s Bank of China injected 162.5 billion yuan into market

The People's Bank of China (PBoC) injected 162.5 billion yuan ($25 billion) into market through via its medium-term lending facility (MLF) on Monday.

The reason for this injection could be the decision to boost liquidity.

-

17:22

New York Fed President William Dudley: the Fed will likely raise its interest gradually and cautiously

New York Fed President William Dudley said in a speech on Monday that the Fed would likely raise its interest gradually and cautiously.

"Monetary policy adjustments are likely to be gradual and cautious, as we continue to face significant uncertainties and the headwinds to growth from the financial crisis have not fully abated," he said.

Dudley noted that the U.S. labour market improved, the housing sector was recovering, the household sector was much less leveraged, and the banking system was much healthier, while the corporate sector was highly profitable.

New York Fed president expects inflation to rise toward 2% target over the next few years.

-

16:28

European Central Bank purchases €18.22 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €18.22 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €2.42 billion of covered bonds, and €45 million of asset-backed securities.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

-

16:12

New motor vehicle sales in Australia rise 2.2% in March

The Australian Bureau of Statistics released its new motor vehicle sales data on Monday. New motor vehicle sales in Australia rose 2.2% in March, after a 0.1% fall in February.

Sales of passenger vehicles declined 0.9% in March, sales of sports utility vehicles were up 0.2%, while sales of other vehicles increased 1.8%.

On a yearly basis, new motor vehicle sales climbed 4.2% in March, after a 2.3% increase in February.

-

15:55

Bundesbank’s monthly report: Germany's economy expands strongly in the first quarter

Germany's Bundesbank released its monthly report on Monday. The central bank said that Germany's economy expanded strongly in the first quarter, driven by domestic demand. Bundesbank added that the economy would likely slow down in the second quarter due to a fall in factory orders and weak business expectations.

-

15:47

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1200 (EUR 307m)

GBP/USD: 1.4000 (GBP 707m) 1.4200 (785m)

EUR/GBP 0.8000 ( EUR 282m) 0.8080-85 (248m)

AUD/USD: 0.7660 (AUD 422m) 0.7675 (590m) 0.7700 (611m)

USD/CAD 1.2800 (USD 480m) 1.2835 (340m) 1.3000 (541m)

-

15:40

NAHB housing market index remains unchanged at 58 in April

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Monday. The NAHB housing market index remained unchanged at 58 in April, missing expectations for an increase to 59.

A level above 50.0 is considered positive, below indicates a negative outlook.

The buyer traffic sub-index climbed to 44 in April from 43 in March, the current sales conditions sub-index dropped to 63 from 65, while the sub-index measuring sales expectations in the next six months increased to 62 from 61.

"As we enter the spring home buying season, we should see the market move forward," the NAHB Chairman Ed Brady.

"Builders remain cautiously optimistic about construction growth in 2016. Solid job creation and low mortgage interest rates will sustain continued gains in the single-family housing market in the months ahead," the NAHB Chief Economist Robert Dietz said.

-

14:41

Foreign investors purchase C$15.94 billion of Canadian securities in February

Statistics Canada released foreign investment figures on Monday. Foreign investors purchased C$15.94 billion of Canadian securities in February, after an investment of C$11.41 billion in January. January's figure was revised down from an investment of C$13.51 billion.

The investment was led by Canadian dollar denominated instruments.

Canadian investors added C$4.4 billion of foreign securities in February, mainly U.S. bonds.

-

14:31

Canada: Foreign Securities Purchases, February 15.94

-

14:23

Foreign exchange market. European session: the euro traded higher against the U.S. dollar in the absence of any major economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (YoY) March 2.3% 4.2%

01:30 Australia New Motor Vehicle Sales (MoM) March -0.1% 2.2%

10:00 Germany Bundesbank Monthly Report

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The NAHB housing market index is expected to rise 59 in April from 58 in March.

The euro traded higher against the U.S. dollar in the absence of any major economic data from the Eurozone.

The Bundesbank released its monthly report on Monday. The central bank said that Germany's economy expanded strongly in the first quarter, driven by domestic demand.

The British pound traded higher against the U.S. dollar in the absence of any major economic data from the U.K.

According to property tracking website Rightmove, U.K. house prices rose 1.3% in April, after a 1.3% increase in March.

"The onset of spring is traditionally when the housing market swings into full-on action, and while the early Easter this year could be credited with its very active current state, the housing market actually received a much earlier kick-start at the end of November," Rightmove director and housing market analyst, Miles Shipside, said.

"Chains need a buyer at the bottom to enable everyone to move, and that was boosted by investors looking to avoid the 3% levy introduced on April 1st," he added.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the economic data from Canada.

EUR/USD: the currency pair rose to $1.1313

GBP/USD: the currency pair increased to $1.4202

USD/JPY: the currency pair climbed to Y108.50

The most important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases February 13.51

12:30 U.S. FOMC Member Dudley Speak

14:00 U.S. NAHB Housing Market Index April 58 59

14:00 U.S. Leading Indicators March 0.1%

-

13:51

Orders

EUR/USD

Offers: 1.1320-25 1.1360 1.1385 1.1400 1.1420 1.1450 1.1465-70

Bids: 1.1270-75 1.1350 1.1235 1.1220 1.1200 1.1180 1.1160 1.1150 1.1125-30 1.1100

GBP/USD

Offers: 1.4165 1.4180 1.4200 1.4220 1.4235 1.4250 1.4280 1.4300 1.4330 1.4350

Bids: 1.4120-25 1.4100 1.4080-851.4050-60 1.4030 1.4000 1.3980 1.3965 1.3950

EUR/JPY

Offers: 122.50 122.80 123.00 123.30 123.50 123.80 124.00 124.30 124.50

Bids: 122.00 121.75-80 121.50 121.30 121.00 120.80 120.50 120.00

EUR/GBP

Offers: 0.8000 0.8020 0.8030 0.8050 0.8075-80 0.8100

Bids: 0.7970 0.7050-55 0.7925-30 0.7900 0.7880 0.7850 0.7830 0.7800

USD/JPY

Offers: 108.20-25 108.50 108.80 109.00 109.30 109.50 109.75-80 110.00 110.20 110.50

Bids: 107.80-85 107.60-65 107.50 107.30 107.00 106.85 1.0650

AUD/USD

Offers: 0.7680-85 0.7700 0.7720-25 0.7750 0.7780 0.7800

Bids: 0.7650 0.7620-25 0.7600 0.7580 0.7550 0.7520 0.7500

-

11:42

Home prices in China rise in March

According to Reuters calculations based on data from China's National Bureau of Statistics (NBS), average new home prices in 70 major cities climbed at an annual rate of 4.9% in March, after a 3.6% gain in February.

The main contributor was Shenzhen, where home prices jumped by 61.6% year-on-year in March.

On a monthly base, house prices increased in 62 of 70 cities, while prices slid in 8 cities, according to the NBS.

The monthly rise was mainly driven by higher prices in Xiamen, which climbed 5.4% in March.

-

11:31

Consumer prices in New Zealand increase 0.2% in the first quarter

Statistics New Zealand released its consumer price inflation data on late Sunday evening. Consumer prices in New Zealand increased 0.2% in the first quarter, exceeding expectations for a 0.1% rise, after a 0.5% drop in the fourth quarter.

The increase in consumer price inflation was driven by higher prices for cigarettes, food, and housing-related costs.

On a yearly basis, consumer price inflation increased 0.4% in the first quarter, in line with forecasts, after a 0.1% gain in the fourth quarter. It was the weakest rise since 1999.

The rise was mainly driven by higher housing-related prices, which climbed 3.0% year-on-year in the first quarter.

-

11:20

Rightmove: U.K. house prices rise 1.3% in April

According to property tracking website Rightmove, U.K. house prices rose 1.3% in April, after a 1.3% increase in March.

"The onset of spring is traditionally when the housing market swings into full-on action, and while the early Easter this year could be credited with its very active current state, the housing market actually received a much earlier kick-start at the end of November. Chains need a buyer at the bottom to enable everyone to move, and that was boosted by investors looking to avoid the 3% levy introduced on April 1st," Rightmove director and housing market analyst, Miles Shipside, said.

On a yearly basis, house prices in the U.K. climbed 7.3% in April, after a 7.6% increase in March.

-

11:05

Meeting between OPEC and non-OPEC countries ends without any deal

The meeting between OPEC and non-OPEC countries on Sunday ended without any deal on the freeze of the oil output. Oil producers said that they needed more time to decide on the freeze of the oil production.

Participants of the meeting discussed the freeze of the oil output at January levels, which should help to balance the oil market. Iran did not participate in that meeting.

Next meeting is scheduled to be in June.

-

10:44

Britain’s Chancellor George Osborne: Britain’s economy would shrink by 6% by 2030 in case of Britain’s exit from the European Union

Britain's Chancellor George Osborne said the country's economy would shrink by 6% by 2030 in case of Britain's exit from the European Union (EU), while every household would lose £4,300 ($6,100) a year. He named Britain's exit from the EU as "the most extraordinary self-inflicted wound".

-

10:24

Chicago Fed President Charles Evans: an interest rate hike in April is unlikely

Chicago Fed President Charles Evans said on Friday that an interest rate hike in April was unlikely, adding that two interest rate hikes this year were still possible.

He pointed out that inflation should pick up toward 2% target before raising interest rates further.

"Inflation is the responsibility of the central bank. If we are at one percent and it is supposed to be two percent, that is us. If it is three percent, that is us," Chicago Fed president said.

-

10:02

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1200 (EUR 307m)

GBP/USD: 1.4000 (GBP 707m) 1.4200 (785m)

EUR/GBP 0.8000 ( EUR 282m) 0.8080-85 (248m)

AUD/USD: 0.7660 (AUD 422m) 0.7675 (590m) 0.7700 (611m)

USD/CAD 1.2800 (USD 480m) 1.2835 (340m) 1.3000 (541m)

-

08:22

Asian session: Commodity currencies slumped

Commodity currencies slumped on Monday while the safe-haven yen soared after major oil producers failed to agree on an output freeze, sending oil prices tumbling anew. A plan for OPEC and non-OPEC producers deal to freeze oil production fell apart on Sunday after Saudi Arabia demanded that Iran join in, despite calls on Riyadh to save the agreement and help prop up crude prices.

Investors rushed to the safe-haven yen, sending it to three-year highs against the euro. The latest move means the euro has given back the bulk of the gains made against the yen since the Bank of Japan launched its massive asset buying program three years ago.

The United States offered a cool response to concerns voiced by Tokyo that the yen's gains are too sharp and may justify intervention, with Lew saying on Friday that he did not see any disorderly moves in the currency market.

EUR/USD: during the Asian session the pair traded in the range of $1.1375-05

GBP/USD: during the Asian session the pair fell to $1.4160

USD/JPY: during the Asian session the pair fell to Y107.80

Based on Reuters materials

-

07:09

Options levels on monday, April 18, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1424 (2086)

$1.1374 (953)

$1.1331 (452)

Price at time of writing this review: $1.1288

Support levels (open interest**, contracts):

$1.1230 (2852)

$1.1180 (3698)

$1.1149 (3326)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 33907 contracts, with the maximum number of contracts with strike price $1,1600 (3835);

- Overall open interest on the PUT options with the expiration date May, 6 is 48608 contracts, with the maximum number of contracts with strike price $1,0900 (4774);

- The ratio of PUT/CALL was 1.43 versus 1.46 from the previous trading day according to data from April, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.4406 (2152)

$1.4309 (1466)

$1.4214 (1168)

Price at time of writing this review: $1.4168

Support levels (open interest**, contracts):

$1.4091 (1645)

$1.3994 (2649)

$1.3896 (1300)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 25102 contracts, with the maximum number of contracts with strike price $1,4500 (2772);

- Overall open interest on the PUT options with the expiration date May, 6 is 30729 contracts, with the maximum number of contracts with strike price $1,3850 (4053);

- The ratio of PUT/CALL was 1.22 versus 1.23 from the previous trading day according to data from April, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:31

Australia: New Motor Vehicle Sales (YoY) , March 4.2%

-

03:30

Australia: New Motor Vehicle Sales (MoM) , March 2.2%

-

01:03

Currencies. Daily history for Apr 15’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1287 +0,24%

GBP/USD $1,4202 +0,39%

USD/CHF Chf0,9676 +0,11%

USD/JPY Y108,75 -0,61%

EUR/JPY Y122,70 -0,41%

GBP/JPY Y154,45 -0,21%

AUD/USD $0,7721 +0,41%

NZD/USD $0,6918 +1,08%

USD/CAD C$1,2819 -0,21%

-

00:45

New Zealand: CPI, y/y, Quarter I 0.4% (forecast 0.4%)

-

00:45

New Zealand: CPI, q/q , Quarter I 0.2% (forecast 0.1%)

-