Noticias del mercado

-

21:00

Dow +0.56% 17,998.34 +100.88 Nasdaq +0.37% 4,956.72 +18.50 S&P +0.60% 2,093.13 +12.40

-

18:01

European stocks closed: FTSE 100 6,353.52 +9.77 +0.15% CAC 40 4,506.84 +11.67 +0.26% DAX 10,120.31 +68.74 +0.68%

-

18:00

European stocks close: stocks closed higher despite a slightly drop in oil prices

Stock indices closed higher despite a slightly drop in oil prices. Oil prices fell as the meeting between OPEC and non-OPEC countries on Sunday ended without any deal on the freeze of the oil output. Oil producers said that they needed more time to decide on the freeze of the oil production.

Participants of the meeting discussed the freeze of the oil output at January levels, which should help to balance the oil market. Iran did not participate in that meeting.

Next meeting is scheduled to be in June.

Germany's Bundesbank released its monthly report on Monday. The central bank said that Germany's economy expanded strongly in the first quarter, driven by domestic demand. Bundesbank added that the economy would likely slow down in the second quarter due to a fall in factory orders and weak business expectations.

According to property tracking website Rightmove, U.K. house prices rose 1.3% in April, after a 1.3% increase in March.

"The onset of spring is traditionally when the housing market swings into full-on action, and while the early Easter this year could be credited with its very active current state, the housing market actually received a much earlier kick-start at the end of November," Rightmove director and housing market analyst, Miles Shipside, said.

"Chains need a buyer at the bottom to enable everyone to move, and that was boosted by investors looking to avoid the 3% levy introduced on April 1st," he added.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,353.52 +9.77 +0.15 %

DAX 10,120.31 +68.74 +0.68 %

CAC 40 4,506.84 +11.67 +0.26 %

-

17:59

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock-indexes reversed course to positive on Monday, lifted by Hasbro, Walt Disney and a recovery in oil prices. Crude was down about 2%, recovering from a near 7% fall spurred by the collapsed talks in Doha among major producers to tackle a stubborn global surplus.

Most if Dow stocks in positive are (25 of 30). Top looser - Apple Inc. (AAPL, -1,56%). Top gainer - The Walt Disney Company (DIS +2,34%).

Most of S&P sectors also in positive area. Top looser - Utilities (-0,2%). Top gainer - Conglomerates (+1,2%).

At the moment:

Dow 17885.00 +71.00 +0.40%

S&P 500 2083.50 +8.50 +0.41%

Nasdaq 100 4545.75 +7.25 +0.16%

Oil 41.46 -0.25 -0.60%

Gold 1237.50 +2.90 +0.23%

U.S. 10yr 1.79 +0.04

-

17:43

People’s Bank of China injected 162.5 billion yuan into market

The People's Bank of China (PBoC) injected 162.5 billion yuan ($25 billion) into market through via its medium-term lending facility (MLF) on Monday.

The reason for this injection could be the decision to boost liquidity.

-

17:38

WSE: Session Results

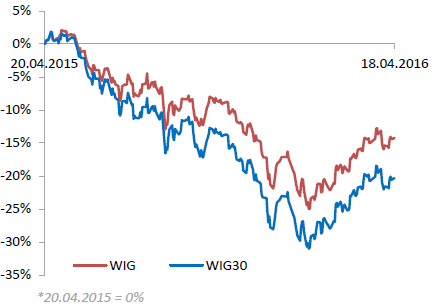

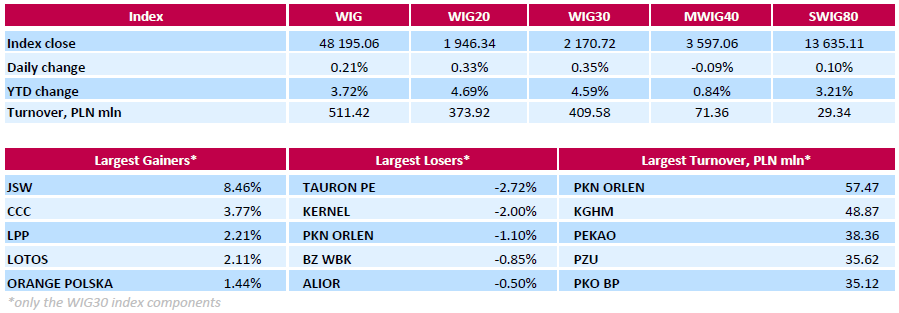

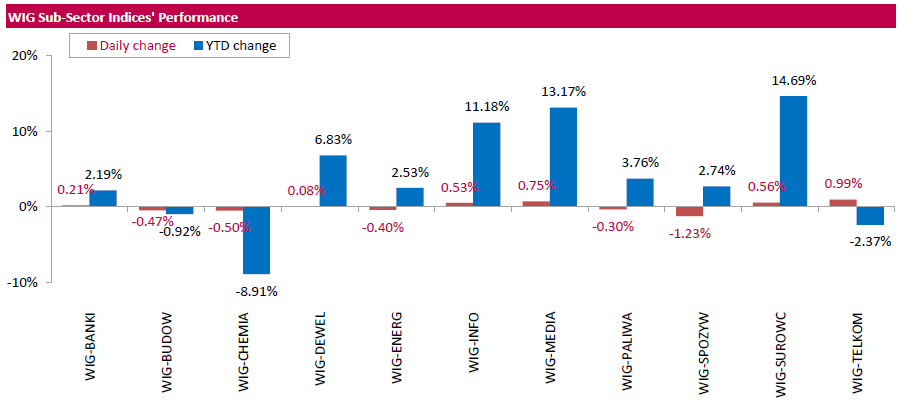

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, rose by 0.21%. Sector-wise, telecoms (+0.99%) fared the best, while food sector (-1.23%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, grew by 0.35%. Within the WIG30 Index components, coking coal miner JSW (WSE: JSW) led the gainers pack with a 8.21% advance. It was followed by footwear retailer CCC (WSE: CCC), clothing retailer LPP (WSE: LPP) and oil refiner LOTOS (WSE: LTS), adding 3.77%, 2.21% and 2.11% respectively. On the other side of the ledger, genco TAURON PE (WSE: TPE) tumbled the most, down 2.72%. Other biggest losers were agricultural producer KERNEL (WSE: KER), oil refiner PKN ORLEN (WSE: PKN) and bank BZ WBK (WSE: BZW), declining by 2%, 1.1% and 0.85% respectively.

-

17:22

New York Fed President William Dudley: the Fed will likely raise its interest gradually and cautiously

New York Fed President William Dudley said in a speech on Monday that the Fed would likely raise its interest gradually and cautiously.

"Monetary policy adjustments are likely to be gradual and cautious, as we continue to face significant uncertainties and the headwinds to growth from the financial crisis have not fully abated," he said.

Dudley noted that the U.S. labour market improved, the housing sector was recovering, the household sector was much less leveraged, and the banking system was much healthier, while the corporate sector was highly profitable.

New York Fed president expects inflation to rise toward 2% target over the next few years.

-

16:28

European Central Bank purchases €18.22 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €18.22 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €2.42 billion of covered bonds, and €45 million of asset-backed securities.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

-

16:12

New motor vehicle sales in Australia rise 2.2% in March

The Australian Bureau of Statistics released its new motor vehicle sales data on Monday. New motor vehicle sales in Australia rose 2.2% in March, after a 0.1% fall in February.

Sales of passenger vehicles declined 0.9% in March, sales of sports utility vehicles were up 0.2%, while sales of other vehicles increased 1.8%.

On a yearly basis, new motor vehicle sales climbed 4.2% in March, after a 2.3% increase in February.

-

15:55

Bundesbank’s monthly report: Germany's economy expands strongly in the first quarter

Germany's Bundesbank released its monthly report on Monday. The central bank said that Germany's economy expanded strongly in the first quarter, driven by domestic demand. Bundesbank added that the economy would likely slow down in the second quarter due to a fall in factory orders and weak business expectations.

-

15:51

WSE: After start on Wall Street

U.S. Stocks open: Dow -0.23%, Nasdaq -0.45%, S&P -0.32%

Opening of the market in the US took place under the sign of contraction, insignificant yet consistent across all major indices. Overall, it appears as if the US market participants are reacting in a less pronounced fashion to the failure of oil talks in Qatar. The global market recognized that this information should be approached in a balanced way and this reaction can be seen on Wall Street.

The S&P500 index returned to the level of the previous local maximum.

-

15:40

NAHB housing market index remains unchanged at 58 in April

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Monday. The NAHB housing market index remained unchanged at 58 in April, missing expectations for an increase to 59.

A level above 50.0 is considered positive, below indicates a negative outlook.

The buyer traffic sub-index climbed to 44 in April from 43 in March, the current sales conditions sub-index dropped to 63 from 65, while the sub-index measuring sales expectations in the next six months increased to 62 from 61.

"As we enter the spring home buying season, we should see the market move forward," the NAHB Chairman Ed Brady.

"Builders remain cautiously optimistic about construction growth in 2016. Solid job creation and low mortgage interest rates will sustain continued gains in the single-family housing market in the months ahead," the NAHB Chief Economist Robert Dietz said.

-

15:32

U.S. Stocks open: Dow -0.23%, Nasdaq -0.45%, S&P -0.32%

-

15:19

Before the bell: S&P futures -0.33%, NASDAQ futures -0.28%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 16,275.95 -572.08 -3.40%

Hang Seng 21,161.5 -154.97 -0.73%

Shanghai Composite 3,034.07 -44.05 -1.43%

FTSE 6,326.61 -17.14 -0.27%

CAC 4,482.2 -12.97 -0.29%

DAX 10,036.94 -14.63 -0.15%

Crude oil $38.54 (-4.51%)

Gold $1241.90 (+0.59%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

166.89

-1.89(-1.1198%)

2549

ALCOA INC.

AA

9.89

-0.12(-1.1988%)

83451

Amazon.com Inc., NASDAQ

AMZN

625.7

-0.19(-0.0304%)

7360

American Express Co

AXP

61.92

-0.22(-0.354%)

1952

Apple Inc.

AAPL

109.02

-0.83(-0.7556%)

254397

AT&T Inc

T

38.47

-0.01(-0.026%)

4129

Barrick Gold Corporation, NYSE

ABX

15.82

0.18(1.1509%)

61004

Boeing Co

BA

131

-0.13(-0.0991%)

4474

Caterpillar Inc

CAT

78.25

-0.92(-1.1621%)

8339

Chevron Corp

CVX

95.58

-1.65(-1.697%)

26807

Cisco Systems Inc

CSCO

27.84

-0.06(-0.2151%)

3542

Citigroup Inc., NYSE

C

44.47

-0.45(-1.0018%)

32019

E. I. du Pont de Nemours and Co

DD

65.2

-0.07(-0.1073%)

1241

Exxon Mobil Corp

XOM

83.75

-1.22(-1.4358%)

36383

Facebook, Inc.

FB

109.5

-0.14(-0.1277%)

56987

Ford Motor Co.

F

13.01

0.07(0.541%)

89294

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.42

-0.44(-4.0516%)

321977

General Electric Co

GE

30.91

-0.12(-0.3867%)

4989

General Motors Company, NYSE

GM

30.79

0.23(0.7526%)

19172

Goldman Sachs

GS

158.39

-0.13(-0.082%)

3197

Google Inc.

GOOG

758.36

-0.64(-0.0843%)

3217

Hewlett-Packard Co.

HPQ

12.5

-0.02(-0.1597%)

2877

Home Depot Inc

HD

134.81

-0.20(-0.1481%)

949

Intel Corp

INTC

31.5

0.04(0.1271%)

8758

International Business Machines Co...

IBM

151.25

-0.47(-0.3098%)

1322

Johnson & Johnson

JNJ

109.99

-0.19(-0.1724%)

913

JPMorgan Chase and Co

JPM

61.67

-0.20(-0.3233%)

2612

McDonald's Corp

MCD

127.5

-0.28(-0.2191%)

306

Merck & Co Inc

MRK

56.03

-0.11(-0.1959%)

1251

Microsoft Corp

MSFT

55.4

-0.25(-0.4492%)

27564

Nike

NKE

59.3

-0.20(-0.3361%)

3835

Procter & Gamble Co

PG

82.21

-0.09(-0.1094%)

1164

Starbucks Corporation, NASDAQ

SBUX

60.4

-0.11(-0.1818%)

20050

Tesla Motors, Inc., NASDAQ

TSLA

252

-2.51(-0.9862%)

14703

The Coca-Cola Co

KO

46.07

-0.03(-0.0651%)

3713

Twitter, Inc., NYSE

TWTR

17.7

0.12(0.6826%)

61765

United Technologies Corp

UTX

104.69

0.12(0.1148%)

770

Verizon Communications Inc

VZ

51.31

-0.04(-0.0779%)

3115

Visa

V

79.85

-0.23(-0.2872%)

887

Wal-Mart Stores Inc

WMT

69.14

0.08(0.1158%)

1684

Walt Disney Co

DIS

98.94

0.35(0.355%)

16539

Yahoo! Inc., NASDAQ

YHOO

36.35

-0.16(-0.4382%)

46803

Yandex N.V., NASDAQ

YNDX

16.19

-0.40(-2.4111%)

6510

-

14:53

Upgrades and downgrades before the market open

Upgrades:

Walt Disney (DIS) upgraded to Buy from Hold at Pivotal Research Group; target raised to $121 from $104

Downgrades:

Citigroup (C) downgraded to Mkt Perform from Outperform at Keefe Bruyette

Other:

Intel (INTC) maintained with a Market Perform at Cowen, target $33

Yahoo! (YHOO) maintained with a Neutral at Mizuho, target $37

Pfizer (PFE) resumed with a Neutral at Goldman; target $35

-

14:41

Foreign investors purchase C$15.94 billion of Canadian securities in February

Statistics Canada released foreign investment figures on Monday. Foreign investors purchased C$15.94 billion of Canadian securities in February, after an investment of C$11.41 billion in January. January's figure was revised down from an investment of C$13.51 billion.

The investment was led by Canadian dollar denominated instruments.

Canadian investors added C$4.4 billion of foreign securities in February, mainly U.S. bonds.

-

13:21

WSE: Mid session comment

At the noon phase, the markets are driven by reduction of oil prices, although major stock exchanges in Europe declined only marginally. Most important European indices chart white candles after low openings. Thus, the growth achievements from the past week have been defended. The WIG 20 is at the level similar to the opening, with a relatively low impressive turnover of PLN 148 mln.

-

12:21

Earnings Season in U.S.: Major Reports of the Week

April 18

After the Close:

IBM (IBM). Consensus EPS $2.09, Consensus Revenue $18285.90 mln

April 19

Before the Open:

UnitedHealth (UNH). Consensus EPS $1.72, Consensus Revenue $44278.96 mln

Goldman Sachs (GS). Consensus EPS $2.50, Consensus Revenue $6523.46 mln

Johnson & Johnson (JNJ). Consensus EPS $1.66, Consensus Revenue $17487.55 mln

After the Close:

Intel (INTC). Consensus EPS $0.48, Consensus Revenue $13854.44 mln

Yahoo! (YHOO). Consensus EPS $0.07, Consensus Revenue $846.83 mln

April 20

Before the Open:

Coca-Cola (KO). Consensus EPS $0.44, Consensus Revenue $10245.93 mln

After the Close:

American Express (AXP). Consensus EPS $1.34, Consensus Revenue $8085.90 mln

April 21

Before the Open:

Travelers (TRV). Consensus EPS $2.55, Consensus Revenue $6037.53 mln

Verizon (VZ). Consensus EPS $1.06, Consensus Revenue $32577.63 mln

General Motors (GM). Consensus EPS $1.00, Consensus Revenue $34583.23 mln

After the Close:

Starbucks (SBUX). Consensus EPS $0.39, Consensus Revenue $5027.30 mln

Microsoft (MSFT). Consensus EPS $0.64, Consensus Revenue $22133.48 mln

Visa (V). Consensus EPS $0.66, Consensus Revenue $3599.82 mln

Alphabet (GOOG). Consensus EPS $7.96, Consensus Revenue $20323.77 mln

April 22

Before the Open:

General Electric (GE). Consensus EPS $0.19, Consensus Revenue $27966.34 mln

McDonald's (MCD). Consensus EPS $1.16, Consensus Revenue $5795.79 mln

Caterpillar (CAT). Consensus EPS $0.68, Consensus Revenue $9461.28 mln

Honeywell (HON). Consensus EPS $1.50, Consensus Revenue $9365.30 mln

-

12:00

European stock markets mid session: stocks traded lower on falling oil prices

Stock indices traded lower on a drop in oil prices. Oil prices fell as the meeting between OPEC and non-OPEC countries on Sunday ended without any deal on the freeze of the oil output. Oil producers said that they needed more time to decide on the freeze of the oil production.

Participants of the meeting discussed the freeze of the oil output at January levels, which should help to balance the oil market. Iran did not participate in that meeting.

Next meeting is scheduled to be in June.

According to property tracking website Rightmove, U.K. house prices rose 1.3% in April, after a 1.3% increase in March.

"The onset of spring is traditionally when the housing market swings into full-on action, and while the early Easter this year could be credited with its very active current state, the housing market actually received a much earlier kick-start at the end of November," Rightmove director and housing market analyst, Miles Shipside, said.

"Chains need a buyer at the bottom to enable everyone to move, and that was boosted by investors looking to avoid the 3% levy introduced on April 1st," he added.

Current figures:

Name Price Change Change %

FTSE 100 6,331.7 -12.05 -0.19 %

DAX 10,028.41 -23.16 -0.23 %

CAC 40 4,478.3 -16.87 -0.38 %

-

11:42

Home prices in China rise in March

According to Reuters calculations based on data from China's National Bureau of Statistics (NBS), average new home prices in 70 major cities climbed at an annual rate of 4.9% in March, after a 3.6% gain in February.

The main contributor was Shenzhen, where home prices jumped by 61.6% year-on-year in March.

On a monthly base, house prices increased in 62 of 70 cities, while prices slid in 8 cities, according to the NBS.

The monthly rise was mainly driven by higher prices in Xiamen, which climbed 5.4% in March.

-

11:31

Consumer prices in New Zealand increase 0.2% in the first quarter

Statistics New Zealand released its consumer price inflation data on late Sunday evening. Consumer prices in New Zealand increased 0.2% in the first quarter, exceeding expectations for a 0.1% rise, after a 0.5% drop in the fourth quarter.

The increase in consumer price inflation was driven by higher prices for cigarettes, food, and housing-related costs.

On a yearly basis, consumer price inflation increased 0.4% in the first quarter, in line with forecasts, after a 0.1% gain in the fourth quarter. It was the weakest rise since 1999.

The rise was mainly driven by higher housing-related prices, which climbed 3.0% year-on-year in the first quarter.

-

11:20

Rightmove: U.K. house prices rise 1.3% in April

According to property tracking website Rightmove, U.K. house prices rose 1.3% in April, after a 1.3% increase in March.

"The onset of spring is traditionally when the housing market swings into full-on action, and while the early Easter this year could be credited with its very active current state, the housing market actually received a much earlier kick-start at the end of November. Chains need a buyer at the bottom to enable everyone to move, and that was boosted by investors looking to avoid the 3% levy introduced on April 1st," Rightmove director and housing market analyst, Miles Shipside, said.

On a yearly basis, house prices in the U.K. climbed 7.3% in April, after a 7.6% increase in March.

-

11:05

Meeting between OPEC and non-OPEC countries ends without any deal

The meeting between OPEC and non-OPEC countries on Sunday ended without any deal on the freeze of the oil output. Oil producers said that they needed more time to decide on the freeze of the oil production.

Participants of the meeting discussed the freeze of the oil output at January levels, which should help to balance the oil market. Iran did not participate in that meeting.

Next meeting is scheduled to be in June.

-

10:44

Britain’s Chancellor George Osborne: Britain’s economy would shrink by 6% by 2030 in case of Britain’s exit from the European Union

Britain's Chancellor George Osborne said the country's economy would shrink by 6% by 2030 in case of Britain's exit from the European Union (EU), while every household would lose £4,300 ($6,100) a year. He named Britain's exit from the EU as "the most extraordinary self-inflicted wound".

-

10:24

Chicago Fed President Charles Evans: an interest rate hike in April is unlikely

Chicago Fed President Charles Evans said on Friday that an interest rate hike in April was unlikely, adding that two interest rate hikes this year were still possible.

He pointed out that inflation should pick up toward 2% target before raising interest rates further.

"Inflation is the responsibility of the central bank. If we are at one percent and it is supposed to be two percent, that is us. If it is three percent, that is us," Chicago Fed president said.

-

09:18

WSE: After opening

Futures contracts on the WIG20 index started the week with a decline of almost 0.8% (FW20M16; 1916 pts.).

This was hardly surprising, considering the existing sentiment after yesterday's meeting of OPEC + Russia.

WIG20 index opened at 1932.52 points (-0.38% to previous close)

WIG 47793.92 -0.63%

WIG30 2144.95 -0.84%

mWIG40 3595.43 -0.14%

Cash market opened with the WIG20 index 0.38% lower, down to 1,932 points at a moderate turnover. The German DAX lost 1.25% and the main question is if such low today's openings is all of the downside potential or an invitation to expand it.

-

08:22

WSE: Before opening

The new week we enter with an empty macro calendar, but there is no reasons to complain about lack of pulses to trade outside the published data. The most important issue today is the lack of agreement in Doha regarding the freezing of oil production. Hence, in the morning there is a mood of disappointment indicated by a downward gap on a chart of oil, which has consequences in a similar gap in the case of contracts for the US indices and weak sentiment in Asia. The price of oil went down about 4%. The downward in the US contracts exceed 0.6%. Additionally we have an unfavorable reaction in Japan after the earthquake on Saturday.

Therefore it seems that the Warsaw Stock Exchange today would be the under pressure, at least at the beginning of the session. The headline negative news of the day is the lack of agreement in Doha.

-

07:04

Global Stocks

A five-day rally for European stock markets lost steam on Friday, as caution lingered ahead of a key meeting of major oil producers on Sunday.

U.S. stocks ended modestly lower Friday as a retreat in oil prices weighed on energy shares ahead of a meeting of major oil producers slated for Sunday. But despite the daily drop, the three main indexes posted weekly gains, with the Dow Jones Industrial Average up 1.8% for its strongest weekly gain in a month. The S&P 500 and Nasdaq Composite also logged weekly gains. Stocks found broad support this week from better-than-feared corporate earnings, which helped limit declines.

Stocks in Asia fell early Monday after major oil producers failed to reach an agreement to curtail production in Doha over the weekend. Broad losses in the region came as oil prices opened sharply lower in Asian trading hours. Over the weekend, talks between oil producers collapsed when Saudi Arabia reasserted a demand that Iran also agree to cap its oil production.

Based on MarketWatch materials

-

04:04

Nikkei 225 16,380.08 -467.95 -2.78 %, Hang Seng 21,097.7 -218.77 -1.03 %, Shanghai Composite 3,048.17 -29.94 -0.97 %

-

01:04

Stocks. Daily history for Sep Apr 15’2016:

(index / closing price / change items /% change)

Nikkei 225 16,848.03 -63.02 -0.37 %

Hang Seng 21,316.47 -21.34 -0.10 %

S&P/ASX 200 5,157.49 +38.86 +0.76 %

Shanghai Composite 3,078.45 -3.91 -0.13 %

FTSE 100 6,343.75 -21.35 -0.34 %

CAC 40 4,495.17 -16.34 -0.36 %

Xetra DAX 10,051.57 -42.08 -0.42 %

S&P 500 2,080.73 -2.05 -0.10 %

NASDAQ Composite 4,938.22 -7.67 -0.16 %

Dow Jones 17,897.46 -28.97 -0.16 %

-