Noticias del mercado

-

21:00

DJIA 17893.08 -33.35 -0.19%, NASDAQ 4937.12 -8.77 -0.18%, S&P 500 2079.63 -3.15 -0.15%

-

18:20

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes Wall Street was flat on Friday as investors digested U.S. corporate earnings as well as data that pointed to a slow global economic recovery, ahead of a crucial meeting of oil producers to help tackle a global surplus. Crude oil was down more than 3% ahead of Sunday's meeting in Doha, led by top exporters Saudi Arabia and Russia, to discuss a production freeze. The nervousness about the meeting overshadowed positive Chinese data, which showed the country's gross domestic product in the first quarter was in line with expectations - another sign that Asia's largest economy was on the mend.

Dow stocks mixed (17 in positive area, 13 in negative area). Top looser - Cisco Systems, Inc. (CSCO, -1,35%). Top gainer - The Travelers Companies, Inc. (TRV +0,99%).

Most of S&P sectors in positive area. Top looser - Basic Materials (-0,5%). Top gainer - Utilities (+0,5%).

At the moment:

Dow 17831.00 -11.00 -0.06%

S&P 500 2074.75 -1.75 -0.08%

Nasdaq 100 4545.25 -1.00 -0.02%

Oil 40.29 -1.21 -2.92%

Gold 1235.90 +9.40 +0.77%

U.S. 10yr 1.75 -0.03

-

18:00

European stocks close: stocks closed lower on the Chinese economic data

Stock indices closed lower on the Chinese economic data. China's National Bureau of Statistics released its gross domestic product (GDP) data on Friday. The country's economy expanded 6.7% in the first quarter, in line with expectations, after a 6.8% rise in the fourth quarter of 2015. It was the slowest rise since 2009.

European Central Bank (ECB) President Mario Draghi said in a speech on Friday that the Eurozone's economy continued to recover, adding that there was uncertainty about the outlook, mainly due to downside risks to growth prospects in emerging economies.

Draghi noted that inflation in the Eurozone would likely be negative in the coming months before rising later in 2016.

Market participants also eyed the economic data from the Eurozone. Eurostat released its trade data for the Eurozone on Friday. Eurozone's unadjusted trade surplus climbed to €19.0 billion in February from €6.2 billion in January.

Exports rose at an unadjusted annual rate of 1.0% in February, while imports climbed 2.0%.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.3% in February, after a 0.4% fall in January.

Repair and maintenance activity fell 0.5% in February, while new work declined 0.2%.

On a yearly basis, construction output increased 0.3% in February, after a 0.9% drop in January.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,343.75 -21.35 -0.34 %

DAX 10,051.57 -42.08 -0.42 %

CAC 40 4,495.17 -16.34 -0.36 %

-

18:00

European stocks closed: FTSE 6343.75 -21.35 -0.34%, DAX 10051.57 -42.08 -0.42%, CAC 40 4495.17 -16.34 -0.36%

-

17:41

European Central Bank President Mario Draghi: the Eurozone’s economy continued to recover

European Central Bank (ECB) President Mario Draghi said in a speech on Friday that the Eurozone's economy continued to recover, adding that there was uncertainty about the outlook, mainly due to downside risks to growth prospects in emerging economies.

Draghi noted that inflation in the Eurozone would likely be negative in the coming months before rising later in 2016.

Effective structural policies were needed to support the central bank's monetary policy, the ECB president said.

Draghi pointed out that there was no evidence for asset bubbles.

-

17:37

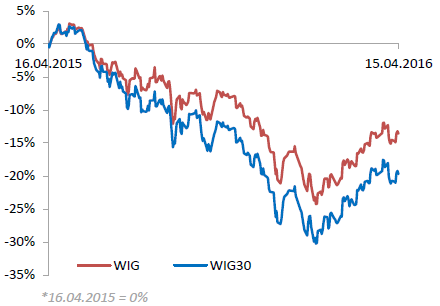

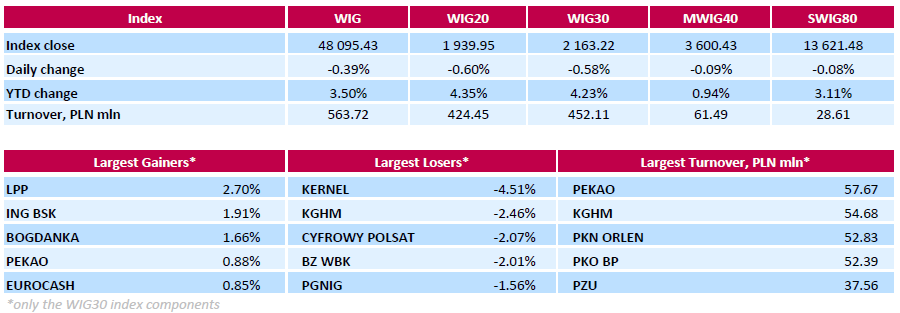

WSE: Session Results

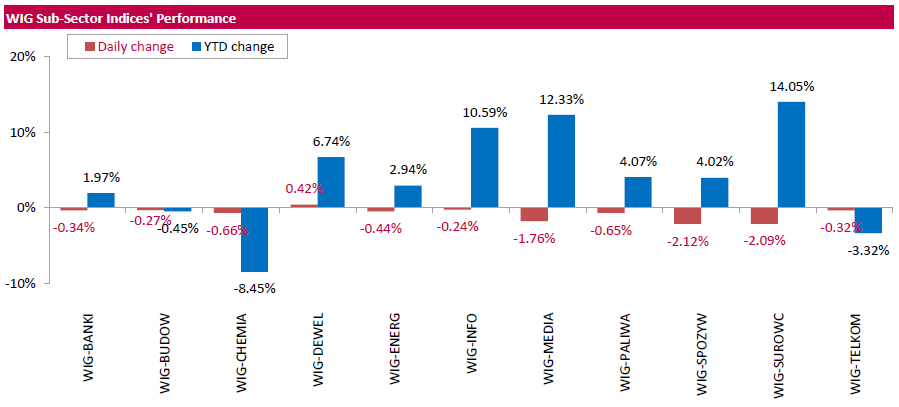

Polish equity market closed lower on Friday. The broad measure, the WIG index, lost 0.39%. Sector-wise, developing sector (+0.42%) was sole gainer within the WIG Index, while materials (-2.09%) and food sector (-2.12%) fared the worst.

The large-cap benchmark, the WIG30 Index, fell by 0.58%. Within the index components, agricultural holding KERNEL (WSE: KER) led the decliners, tumbling by 4.51%. The company reported it had divested two oilseed crushing plants located in southern Russia with a total crushing capacity of 200 ths tons of sunflower seed per year. Other biggest losers were copper producer KGHM (WSE: KGH), media group CYFROWY POLSAT (WSE: CPS) and bank BZ WBK (WSE: BZW), retreating by 2.46%, 2.07% and 2.01% respectively. On the other side of the ledger, clothing retailer LPP (WSE: LPP), bank ING BSK (WSE: ING) and thermal coal miner BOGDANKA (WSE: LWB) were the best-performing names, advancing by 2.7%, 1.91% and 1.66% respectively.

-

17:26

Bank of England appoints Michael Saunders as an external member on its Monetary Policy Committee

The Bank of England (BoE) appointed Michael Saunders as an external member on its Monetary Policy Committee (MPC), the central bank said in a statement on its website. Saunders will replace Martin Weale, whose term ends on August 8.

Saunders is a managing director and head of European economics at Citigroup.

"He brings first-rate knowledge of the UK economy and a wealth of economic and financial experience," the BoE Governor Mark Carney said about Saunders.

-

17:14

International Monetary Fund (IMF) Managing Director Christine Lagarde is sceptical the Greece will meet its budget target

International Monetary Fund (IMF) Managing Director Christine Lagarde said on Thursday that she was sceptical the Greece would meet its budget target.

"We are sceptical about it," she said.

"What we find highly unrealistic is the assumption that this primary surplus of 3.5% can be maintained over decades. That just will not happen," Lagarde added.

-

16:50

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy increase to 43.6 in in the week ended April 10

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 43.6 in in the week ended April 10 from 42.6 the prior week.

The increase was driven by rises in two of three sub-indexes. The measure of views of the economy climbed to 35.6 from 32.6, the buying climate index rose to 38.7 from 38.3, while the personal finances index fell to 56.6 from 56.9.

-

16:46

St. Louis Fed President James Bullard: the Fed should continue to raise its interest rate

St. Louis Fed President James Bullard wrote in a letter on Thursday that the Fed should continue to raise its interest rate.

"Even if the Fed continues to raise interest rates, U.S. monetary policy will remain exceptionally accommodative," he said.

"A key reason for normalizing policy is that the FOMC's goals regarding inflation and employment have essentially been met," St. Louis Fed president added.

Bullard pointed out that low interest rates for a longer period could lead to a bubble in asset prices.

-

16:23

Thomson Reuters/University of Michigan preliminary consumer sentiment index falls to 89.7 in April

The Thomson Reuters/University of Michigan preliminary consumer sentiment index fell to 89.7 in April from a final reading of 91.0 in March. Analysts had expected the index to rise at 92.0.

"Concerns have risen about the resilience of consumers in the months ahead. Consumers reported a slowdown in expected wage gains, weakening inflation-adjusted income expectations, and growing concerns that slowing economic growth would reduce the pace of job creation. These apprehensions should ease as the economy rebounds from its dismal start in the first quarter of 2016," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

"Overall, the data now indicate that inflation-adjusted personal consumption expenditures will grow by 2.5% in 2016," he added.

The index of current economic conditions declined to 105.4 in April from 105.6 in March, while the index of consumer expectations decreased to 79.6 from 81.5.

The one-year inflation expectations remained unchanged at 2.7% in March from 2.5% in February.

-

16:11

U.S. industrial production slides 0.6% in March

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production slid 0.6% in March, missing expectations for a 0.1% decrease, after a 0.6% drop in February. February's figure was revised down from a 0.5% decrease.

The decline was mainly driven by a drop in mining. Mining output fell 2.9% in March, while utilities production declined 1.2%.

Manufacturing output fell 0.3% in March, after a 0.1% decrease in February.

Capacity utilisation rate decreased to 74.8% in March from 75.3% in February, missing expectations for a rise to 75.4%. February's figure was revised down from 76.7%.

-

15:49

WSE: After start on Wall Street

Citigroup results were better than expected; EPS $1.10 vs. $1.51 last year (expected $1.03)

Revenues $17.6 billion vs $19.7 billion the year before (expected $17.4 billion)

The company should have a positive impact on market sentiment, but does not change the fact that the contracts for the S&P500 were listed on lightweight minuses.

The trading on Wall Street started on neutral level and does not contribute much to the overall situation in the markets. Cosmetic changes in major indexes only confirms the previously anticipated lack of volatility.

U.S. Stocks open: Dow +0.04%, Nasdaq -0.06%, S&P 0.00%

-

15:33

U.S. Stocks open: Dow +0.04%, Nasdaq -0.06%, S&P 0.00%

-

15:20

Before the bell: S&P futures -0.13%, NASDAQ futures -0.14%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 16,848.03 -63.02 -0.37%

Hang Seng 21,316.47 -21.34 -0.10%

Shanghai Composite 3,078.45 -3.91 -0.13 %

FTSE 6,333.09 -32.01 -0.50%

CAC 4,488.43 -23.08 -0.51%

DAX 10,042.94 -50.71 -0.50%

Crude oil $40.34 (-2.80%)

Gold $1231.40 (+0.40%)

-

15:02

NY Fed Empire State manufacturing index jumps to 9.56 in April

The New York Federal Reserve released its survey on Friday. The NY Fed Empire State manufacturing index jumped to 9.56 in April from 0.62 in March, exceeding expectations for an increase to 2.21.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The April 2016 Empire State Manufacturing Survey indicates that business activity expanded for New York manufacturers," the New York Federal Reserve said in its report.

The new orders index increased to 11.14 in April from 9.57 in March, while the shipments index fell to 10.17 from 13.88.

The general business conditions expectations index for the next six months jumped to 29.40 in April from 25.52 in March.

The price-paid index jumped to 19.23 in April from 2.97 in March.

The index for the number of employees rose to 1.92 in April from -1.98 in March.

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.91

-0.10(-0.999%)

13606

Amazon.com Inc., NASDAQ

AMZN

620.73

-0.02(-0.0032%)

5539

Apple Inc.

AAPL

112

-0.10(-0.0892%)

47765

AT&T Inc

T

38.48

0.06(0.1562%)

573

Barrick Gold Corporation, NYSE

ABX

15.61

0.19(1.2322%)

20649

Caterpillar Inc

CAT

78.85

-0.20(-0.253%)

17280

Chevron Corp

CVX

97.32

-0.66(-0.6736%)

4483

Cisco Systems Inc

CSCO

28.08

-0.17(-0.6018%)

10528

Citigroup Inc., NYSE

C

46.1

1.12(2.49%)

961642

Exxon Mobil Corp

XOM

84.78

-0.65(-0.7609%)

8332

Facebook, Inc.

FB

110.75

-0.09(-0.0812%)

27598

Ford Motor Co.

F

13.08

-0.01(-0.0764%)

3699

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.45

-0.28(-2.6095%)

131688

General Electric Co

GE

30.97

-0.05(-0.1612%)

5881

Goldman Sachs

GS

161.25

0.34(0.2113%)

3600

Intel Corp

INTC

31.7

-0.10(-0.3145%)

1713

JPMorgan Chase and Co

JPM

62.79

0.20(0.3195%)

30103

Merck & Co Inc

MRK

56.03

-0.42(-0.744%)

342

Microsoft Corp

MSFT

55.3

-0.06(-0.1084%)

3425

Nike

NKE

58.8

-0.69(-1.1599%)

10891

Pfizer Inc

PFE

32.5

-0.15(-0.4594%)

7430

Tesla Motors, Inc., NASDAQ

TSLA

252.29

0.43(0.1707%)

7483

The Coca-Cola Co

KO

45.76

-0.07(-0.1527%)

2200

Twitter, Inc., NYSE

TWTR

17.51

-0.02(-0.1141%)

32162

Verizon Communications Inc

VZ

51.3

-0.06(-0.1168%)

5130

Visa

V

80.33

0.00(0.00%)

506

Walt Disney Co

DIS

98.8

0.17(0.1724%)

3718

Yahoo! Inc., NASDAQ

YHOO

37.02

-0.15(-0.4036%)

11236

Yandex N.V., NASDAQ

YNDX

16.91

0.07(0.4157%)

301

-

14:44

Canadian manufacturing shipments drop 3.3% in February

Statistics Canada released manufacturing shipments on Friday. Canadian manufacturing shipments dropped 3.3% in February, missing expectations for a 1.5% decrease, after a 2.3% increase in January.

The decrease was mainly driven by lower motor vehicles, and petroleum and coal products sales. Motor vehicle sales plunged 10.5% in February, while sales of petroleum and coal products dropped 12.6%.

Inventories decreased 0.7% in February, driven by drops in petroleum and coal product, computer and electronic product, and aerospace product and parts sales.

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Hewlett Packard Enterprise (HPE) initiated with an Outperform at Oppenheimer; target $21

Intel (INTC) target lowered to $39 from $41 at Wedbush

Johnson & Johnson (JNJ) target raised to $122 from $114 at RBC Capital Mkts

-

14:21

-

13:20

WSE: Mid session comment

The first part of the session was the oscillation around the level of 1,950 points, from where is as far as to 2,000 points as to 1900 points levels. The second half does not appear better in terms of some serious recovery.

Total turnover for companies from the WIG20 portfolio was only PLN 147 mln. The result is weaker compared to the previous few sessions, but probably this atmosphere reflects a state of waiting, with which we are facing today, and not only the WSE, but also other European stock exchanges.

-

12:04

European stock markets mid session: stocks traded lower on the Chinese economic data

Stock indices traded lower on the Chinese economic data. China's National Bureau of Statistics released its gross domestic product (GDP) data on Friday. The country's economy expanded 6.7% in the first quarter, in line with expectations, after a 6.8% rise in the fourth quarter of 2015. It was the slowest rise since 2009.

The National Bureau of Statistics said on Friday that China's industrial production increased 6.8% year-on-year in March, exceeding expectations for a 5.9% rise, down from a 5.4% gain in January and February. It was the biggest rise since June 2015.

On a monthly base, the country's industrial production was up 0.64% in March.

Fixed-asset investment in China climbed 10.7% year-on-year in the January - March period, beating forecasts for a 10.3% growth, after a 10.2% rise in the January - February period.

Retail sales in China increased 10.5% year-on-year in March, exceeding expectations for a 10.4% gain, after a 10.2% rise in January and February.

Market participants also eyed the economic data from the Eurozone. Eurostat released its trade data for the Eurozone on Friday. Eurozone's unadjusted trade surplus climbed to €19.0 billion in February from €6.2 billion in January.

Exports rose at an unadjusted annual rate of 1.0% in February, while imports climbed 2.0%.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.3% in February, after a 0.4% fall in January.

Repair and maintenance activity fell 0.5% in February, while new work declined 0.2%.

On a yearly basis, construction output increased 0.3% in February, after a 0.9% drop in January.

Current figures:

Name Price Change Change %

FTSE 100 6,356.92 -8.18 -0.13 %

DAX 10,046.11 -47.54 -0.47 %

CAC 40 4,493.29 -18.22 -0.40 %

-

12:00

UK’s construction output declines 0.3% in February

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.3% in February, after a 0.4% fall in January.

Repair and maintenance activity fell 0.5% in February, while new work declined 0.2%.

On a yearly basis, construction output increased 0.3% in February, after a 0.9% drop in January.

-

11:39

Final industrial production in Japan slides 5.2% in February

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Friday. Final industrial production in Japan slid 5.2% in February, up from the preliminary estimate of a 6.2% rise, after a 3.7% increase in January.

Industrial shipments plunged 4.1% in February, while inventories jumped 5.7%.

On a yearly basis, Japan's industrial production was down 1.2% in February, up from the preliminary estimate of a 1.5% decline, after a 3.8% drop in January.

-

11:22

Eurozone's unadjusted trade surplus climbs €19.0 billion in February

Eurostat released its trade data for the Eurozone on Friday. Eurozone's unadjusted trade surplus climbed to €19.0 billion in February from €6.2 billion in January.

Exports rose at an unadjusted annual rate of 1.0% in February, while imports climbed 2.0%.

-

11:10

Italy’ trade surplus widens to €3.68 billion in February

The Italian statistical office Istat released its trade data for Italy on Friday. Italy' trade surplus widened to €3.68 billion in February from €0.03 billion in January. January's figure was revised down €0.04 billion.

Exports rose 3.3% year-on-year in February, while imports increased 2.4%.

On a monthly basis, exports climbed a seasonally-adjusted 2.5% in February, while imports were up 0.6%.

The seasonally-adjusted trade surplus with the EU was €1.22 billion in February, while the trade surplus with non-EU countries was €3.32 billion.

-

10:58

Germany's leading economic institutes cut their growth forecasts for Germany

Germany's leading economic institutes downgraded their growth forecasts for Germany on Thursday. Germany's economy is expected to expand 1.6% this year, down from the previous estimate of 1.8% growth, and by 1.5% in 2017. The institutes noted that the economy would continue to expand moderately.

Inflation is expected to be 0.5% this year and 1.5% in 2017, driven by domestic demand and higher wages.

The institutes also said that the European Central Bank's quantitative easing was appropriate.

The institutes noted that the government should boost investments in infrastructure and education.

-

10:44

China’s industrial production increases 6.8% year-on-year in March

The National Bureau of Statistics said on Friday that China's industrial production increased 6.8% year-on-year in March, exceeding expectations for a 5.9% rise, down from a 5.4% gain in January and February. It was the biggest rise since June 2015.

On a monthly base, the country's industrial production was up 0.64% in March.

Fixed-asset investment in China climbed 10.7% year-on-year in the January - March period, beating forecasts for a 10.3% growth, after a 10.2% rise in the January - February period.

Retail sales in China increased 10.5% year-on-year in March, exceeding expectations for a 10.4% gain, after a 10.2% rise in January and February.

These data shows that the Chinese economy seems to stabilise.

-

10:22

China’s economy grows 6.7% in the first quarter

China's National Bureau of Statistics released its gross domestic product (GDP) data on Friday. The country's economy expanded 6.7% in the first quarter, in line with expectations, after a 6.8% rise in the fourth quarter of 2015. It was the slowest rise since 2009.

-

10:10

Bank of Japan Governor Haruhiko Kuroda: the recent increase in the yen is “excessive”

Bank of Japan (BoJ) Governor Haruhiko Kuroda said in on Thursday that the recent increase in the yen was "excessive", but he added that there was some correction in the past few days.

Kuroda reiterated that the central bank will ease its monetary policy further if needed to reach 2% inflation target.

-

09:38

WSE: After opening

WIG20 index opened at 1952.47 points (+0.04%)*

WIG 48291.55 0.01%

WIG30 2175.48 -0.02%

mWIG40 3611.90 0.23%

*/ - change to previous close

Given that better data from China was not pulled up Asian markets nor contracts for the major European indices, generally opening in Europe fall below the line. In this rhythm also we start the session in Warsaw. The WIG20 after the first few bars on a good day gives what obtained yesterday after being outstretched up on the fixing. Generally, the atmosphere resembles the first phase of the session yesterday, which have brought bulls final success.

-

08:28

WSE: Before opening

Thursday's sessions on Wall Street ended with a modest changes in the major indexes. In case of the S&P500 boosters totaled 0.02 percent. Throughout the day there was a low volatility and investors were focused on company earnings. The results of the banks not particularly surprised in deviation from the forecasts.

As a result, Europe should come into Friday's trading at levels similar to yesterday's close, which also indicates a modest change in the contract for S&P500, which is traded now at level oscillates around zero changes. In this arrangement, after the quiet opening, investors should quickly move to the macro calendar, in which there is a dose of important reports from the US and the results of US companies with the most important - Citigroup. In practice, this means that an important highlight of the day will be the period before trading on Wall Street. Night brought a strengthening of yen, which just grabs shortness of breath after the speech of the head of the Japanese central bank.

Warsaw WIG20 index is at technically neutral levels so it is difficult to expect today an important shift. In the short term WIG20 seems to look again at level of 2,000 pts., but the growth with low turnover suggests a scenario in which the current movement looks like the defense of 1,900 points area.

-

07:10

Global Stocks

European shares inched higher on Thursday at the end of a choppy day, with food company Nestle gaining after an encouraging earnings update and Ferrovial leading the advance on a broker's upgrade. Nestle rose 2 percent as the food group confirmed its full-year outlook after first-quarter underlying sales growth beat expectations.

The S&P 500 and the Dow eked out a modest advance Thursday to notch new 2016 highs, overcoming disappointing bank earnings as a drop in unemployment claims pointed to strength in the jobs market.

Asian stocks were subdued on Friday as caution over a weekend meeting of oil producers tempered risk sentiment, while the region's markets took China's relatively upbeat GDP data in stride.

Based on MarketWatch materials

-

00:33

Stocks. Daily history for Sep Apr 14’2016:

(index / closing price / change items /% change)

Nikkei 225 16,911.05 +529.83 +3.23 %

Hang Seng 21,337.81 +179.10 +0.85 %

S&P/ASX 200 5,118.62 +63.97 +1.27 %

Shanghai Composite 3,082.54 +15.90 +0.52 %

FTSE 100 6,365.1 +2.21 +0.03 %

CAC 40 4,511.51 +21.20 +0.47 %

Xetra DAX 10,093.65 +67.55 +0.67 %

FTSE 100 6,365.1 +2.21 +0.03 %

CAC 40 4,511.51 +21.20 +0.47 %

Xetra DAX 10,093.65 +67.55 +0.67 %

-