Noticias del mercado

-

22:01

U.S.: Total Net TIC Flows, February 33.5

-

22:01

U.S.: Net Long-term TIC Flows , February 72 (forecast -32.2)

-

17:41

European Central Bank President Mario Draghi: the Eurozone’s economy continued to recover

European Central Bank (ECB) President Mario Draghi said in a speech on Friday that the Eurozone's economy continued to recover, adding that there was uncertainty about the outlook, mainly due to downside risks to growth prospects in emerging economies.

Draghi noted that inflation in the Eurozone would likely be negative in the coming months before rising later in 2016.

Effective structural policies were needed to support the central bank's monetary policy, the ECB president said.

Draghi pointed out that there was no evidence for asset bubbles.

-

17:26

Bank of England appoints Michael Saunders as an external member on its Monetary Policy Committee

The Bank of England (BoE) appointed Michael Saunders as an external member on its Monetary Policy Committee (MPC), the central bank said in a statement on its website. Saunders will replace Martin Weale, whose term ends on August 8.

Saunders is a managing director and head of European economics at Citigroup.

"He brings first-rate knowledge of the UK economy and a wealth of economic and financial experience," the BoE Governor Mark Carney said about Saunders.

-

17:14

International Monetary Fund (IMF) Managing Director Christine Lagarde is sceptical the Greece will meet its budget target

International Monetary Fund (IMF) Managing Director Christine Lagarde said on Thursday that she was sceptical the Greece would meet its budget target.

"We are sceptical about it," she said.

"What we find highly unrealistic is the assumption that this primary surplus of 3.5% can be maintained over decades. That just will not happen," Lagarde added.

-

16:50

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy increase to 43.6 in in the week ended April 10

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 43.6 in in the week ended April 10 from 42.6 the prior week.

The increase was driven by rises in two of three sub-indexes. The measure of views of the economy climbed to 35.6 from 32.6, the buying climate index rose to 38.7 from 38.3, while the personal finances index fell to 56.6 from 56.9.

-

16:46

St. Louis Fed President James Bullard: the Fed should continue to raise its interest rate

St. Louis Fed President James Bullard wrote in a letter on Thursday that the Fed should continue to raise its interest rate.

"Even if the Fed continues to raise interest rates, U.S. monetary policy will remain exceptionally accommodative," he said.

"A key reason for normalizing policy is that the FOMC's goals regarding inflation and employment have essentially been met," St. Louis Fed president added.

Bullard pointed out that low interest rates for a longer period could lead to a bubble in asset prices.

-

16:23

Thomson Reuters/University of Michigan preliminary consumer sentiment index falls to 89.7 in April

The Thomson Reuters/University of Michigan preliminary consumer sentiment index fell to 89.7 in April from a final reading of 91.0 in March. Analysts had expected the index to rise at 92.0.

"Concerns have risen about the resilience of consumers in the months ahead. Consumers reported a slowdown in expected wage gains, weakening inflation-adjusted income expectations, and growing concerns that slowing economic growth would reduce the pace of job creation. These apprehensions should ease as the economy rebounds from its dismal start in the first quarter of 2016," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

"Overall, the data now indicate that inflation-adjusted personal consumption expenditures will grow by 2.5% in 2016," he added.

The index of current economic conditions declined to 105.4 in April from 105.6 in March, while the index of consumer expectations decreased to 79.6 from 81.5.

The one-year inflation expectations remained unchanged at 2.7% in March from 2.5% in February.

-

16:11

U.S. industrial production slides 0.6% in March

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production slid 0.6% in March, missing expectations for a 0.1% decrease, after a 0.6% drop in February. February's figure was revised down from a 0.5% decrease.

The decline was mainly driven by a drop in mining. Mining output fell 2.9% in March, while utilities production declined 1.2%.

Manufacturing output fell 0.3% in March, after a 0.1% decrease in February.

Capacity utilisation rate decreased to 74.8% in March from 75.3% in February, missing expectations for a rise to 75.4%. February's figure was revised down from 76.7%.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, April 89.7 (forecast 92.0)

-

15:45

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1200 (EUR 307m)

GBPUSD: 1.4000 (GBP 707m) 1.4200 (785m)

EURGBP 0.8000 ( EUR 282m) 0.8080-85 (248m)

AUDUSD: 0.7660 (AUD 422m) 0.7675 (590m) 0.7700 (611m)

USDCAD 1.2800 (USD 480m) 1.2835 (340m) 1.3000 (541m)

-

15:15

U.S.: Industrial Production (MoM), March -0.6% (forecast -0.1%)

-

15:15

U.S.: Capacity Utilization, March 74.8% (forecast 75.4%)

-

15:15

U.S.: Industrial Production YoY , March -2%

-

15:02

NY Fed Empire State manufacturing index jumps to 9.56 in April

The New York Federal Reserve released its survey on Friday. The NY Fed Empire State manufacturing index jumped to 9.56 in April from 0.62 in March, exceeding expectations for an increase to 2.21.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The April 2016 Empire State Manufacturing Survey indicates that business activity expanded for New York manufacturers," the New York Federal Reserve said in its report.

The new orders index increased to 11.14 in April from 9.57 in March, while the shipments index fell to 10.17 from 13.88.

The general business conditions expectations index for the next six months jumped to 29.40 in April from 25.52 in March.

The price-paid index jumped to 19.23 in April from 2.97 in March.

The index for the number of employees rose to 1.92 in April from -1.98 in March.

-

14:44

Canadian manufacturing shipments drop 3.3% in February

Statistics Canada released manufacturing shipments on Friday. Canadian manufacturing shipments dropped 3.3% in February, missing expectations for a 1.5% decrease, after a 2.3% increase in January.

The decrease was mainly driven by lower motor vehicles, and petroleum and coal products sales. Motor vehicle sales plunged 10.5% in February, while sales of petroleum and coal products dropped 12.6%.

Inventories decreased 0.7% in February, driven by drops in petroleum and coal product, computer and electronic product, and aerospace product and parts sales.

-

14:30

Canada: Manufacturing Shipments (MoM), February -3.3% (forecast -1.5%)

-

14:30

U.S.: NY Fed Empire State manufacturing index , April 9.56 (forecast 2.21)

-

14:00

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the positive trade data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Retail Sales y/y March 10.2% 10.4% 10.5%

02:00 China Fixed Asset Investment March 10.2% 10.3% 10.7%

02:00 China Industrial Production y/y March 5.4% 5.9% 6.8%

02:00 China GDP y/y Quarter I 6.8% 6.7% 6.7%

04:30 Japan Industrial Production (YoY) (Finally) February -3.8% -1.2%

04:30 Japan Industrial Production (MoM) (Finally) February 3.7% -6.2% -5.2%

09:00 Eurozone Trade balance unadjusted February 6.2 19

The U.S. dollar traded lower against the most major currencies ahead of the release of the U.S. economic data. The NY Fed Empire State manufacturing index is expected to rise to 2.21 in April from 0.62 in March.

The U.S. industrial production is expected to decrease 0.1% in March, after a 0.5% fall in February.

The preliminary Thomson Reuters/University of Michigan consumer sentiment index is expected to increase to 92.0 in April from 91.0 in March.

The euro traded higher against the U.S. dollar after the release of the positive trade data from the Eurozone. Eurostat released its trade data for the Eurozone on Friday. Eurozone's unadjusted trade surplus climbed to €19.0 billion in February from €6.2 billion in January.

Exports rose at an unadjusted annual rate of 1.0% in February, while imports climbed 2.0%.

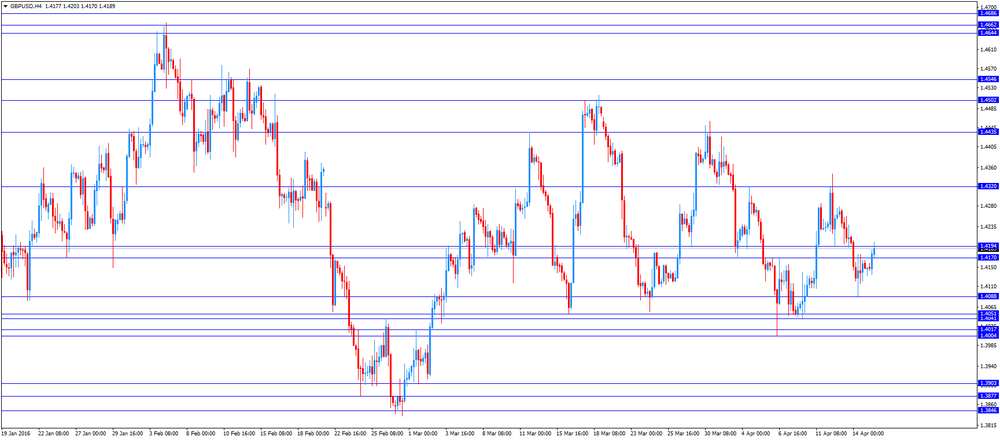

The British pound traded higher against the U.S. dollar after the release of the mixed U.K. construction output data. The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.3% in February, after a 0.4% fall in January.

Repair and maintenance activity fell 0.5% in February, while new work declined 0.2%.

On a yearly basis, construction output increased 0.3% in February, after a 0.9% drop in January.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the manufacturing shipments data from Canada. Canadian manufacturing shipments are expected to drop 1.5% in February, after a 2.3% gain in January.

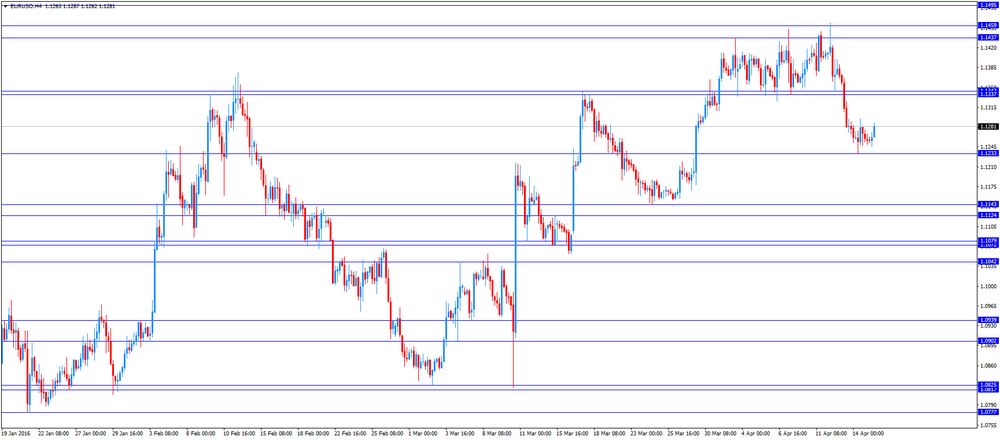

EUR/USD: the currency pair rose to $1.1287

GBP/USD: the currency pair increased to $1.4203

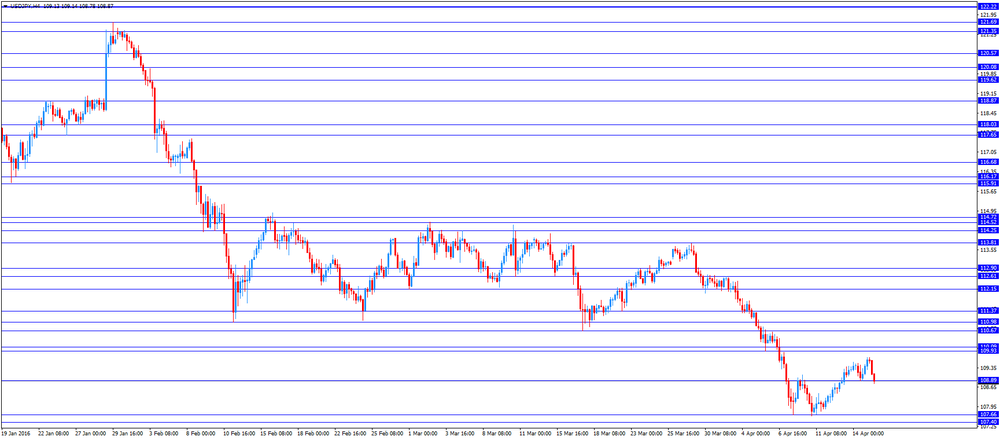

USD/JPY: the currency pair fell to Y108.78

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) February 2.3% -1.5%

12:30 U.S. NY Fed Empire State manufacturing index April 0.62 2.21

13:15 U.S. Capacity Utilization March 76.7% 75.4%

13:15 U.S. Industrial Production (MoM) March -0.5% -0.1%

13:15 U.S. Industrial Production YoY March -1.6%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) April 91 92.0

20:00 U.S. Net Long-term TIC Flows February -12.0 -32.2

20:00 U.S. Total Net TIC Flows February 118.4

-

13:45

Orders

EUR/USD

Offers 1.1275-80 1.1300 1.1325 1.1360 1.1385 1.1400 1.1420 1.1450 1.1465-70

Bids 1.1235 1.1220 1.1200 1.1180 1.1160 1.1150 1.1125-30 1.1100

GBP/USD

Offers 1.4175-80 1.4200 1.4220 1.4235 1.4250 1.4280 1.4300 1.4330 1.4350

Bids 1.4120 1.4100 1.4080-851.4050-60 1.4030 1.4000 1.3980 1.3965 1.3950

EUR/JPY

Offers 123.50 123.80 124.00 124.30 124.50 124.80 125.00

Bids 123.00 122.70 122.50 122.00 121.50

EUR/GBP

Offers 0.7975-80 0.8000 0.8020 0.8030 0.8050 0.8075-80 0.8100

Bids 0.7925-30 0.7900 0.7880 0.7850 0.7830 0.7800

USD/JPY

Offers 109.75-80 110.00 110.20 110.50 110.80 111.00

Bids 109.25-30 109.00 108.80 108.50 108.30 108.00 107.85 107.60-65 107.50

AUD/USD

Offers 0.7730-35 0.7750 0.7780 0.7800 0.7850 0.7900

Bids 0.7700 0.7680 0.7660 0.7650 0.7620-25 0.7600 0.7580 0.7550 0.7520 0.7500

-

12:00

UK’s construction output declines 0.3% in February

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.3% in February, after a 0.4% fall in January.

Repair and maintenance activity fell 0.5% in February, while new work declined 0.2%.

On a yearly basis, construction output increased 0.3% in February, after a 0.9% drop in January.

-

11:39

Final industrial production in Japan slides 5.2% in February

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Friday. Final industrial production in Japan slid 5.2% in February, up from the preliminary estimate of a 6.2% rise, after a 3.7% increase in January.

Industrial shipments plunged 4.1% in February, while inventories jumped 5.7%.

On a yearly basis, Japan's industrial production was down 1.2% in February, up from the preliminary estimate of a 1.5% decline, after a 3.8% drop in January.

-

11:22

Eurozone's unadjusted trade surplus climbs €19.0 billion in February

Eurostat released its trade data for the Eurozone on Friday. Eurozone's unadjusted trade surplus climbed to €19.0 billion in February from €6.2 billion in January.

Exports rose at an unadjusted annual rate of 1.0% in February, while imports climbed 2.0%.

-

11:10

Italy’ trade surplus widens to €3.68 billion in February

The Italian statistical office Istat released its trade data for Italy on Friday. Italy' trade surplus widened to €3.68 billion in February from €0.03 billion in January. January's figure was revised down €0.04 billion.

Exports rose 3.3% year-on-year in February, while imports increased 2.4%.

On a monthly basis, exports climbed a seasonally-adjusted 2.5% in February, while imports were up 0.6%.

The seasonally-adjusted trade surplus with the EU was €1.22 billion in February, while the trade surplus with non-EU countries was €3.32 billion.

-

11:00

Eurozone: Trade balance unadjusted, February 19

-

10:58

Germany's leading economic institutes cut their growth forecasts for Germany

Germany's leading economic institutes downgraded their growth forecasts for Germany on Thursday. Germany's economy is expected to expand 1.6% this year, down from the previous estimate of 1.8% growth, and by 1.5% in 2017. The institutes noted that the economy would continue to expand moderately.

Inflation is expected to be 0.5% this year and 1.5% in 2017, driven by domestic demand and higher wages.

The institutes also said that the European Central Bank's quantitative easing was appropriate.

The institutes noted that the government should boost investments in infrastructure and education.

-

10:44

China’s industrial production increases 6.8% year-on-year in March

The National Bureau of Statistics said on Friday that China's industrial production increased 6.8% year-on-year in March, exceeding expectations for a 5.9% rise, down from a 5.4% gain in January and February. It was the biggest rise since June 2015.

On a monthly base, the country's industrial production was up 0.64% in March.

Fixed-asset investment in China climbed 10.7% year-on-year in the January - March period, beating forecasts for a 10.3% growth, after a 10.2% rise in the January - February period.

Retail sales in China increased 10.5% year-on-year in March, exceeding expectations for a 10.4% gain, after a 10.2% rise in January and February.

These data shows that the Chinese economy seems to stabilise.

-

10:22

China’s economy grows 6.7% in the first quarter

China's National Bureau of Statistics released its gross domestic product (GDP) data on Friday. The country's economy expanded 6.7% in the first quarter, in line with expectations, after a 6.8% rise in the fourth quarter of 2015. It was the slowest rise since 2009.

-

10:10

Bank of Japan Governor Haruhiko Kuroda: the recent increase in the yen is “excessive”

Bank of Japan (BoJ) Governor Haruhiko Kuroda said in on Thursday that the recent increase in the yen was "excessive", but he added that there was some correction in the past few days.

Kuroda reiterated that the central bank will ease its monetary policy further if needed to reach 2% inflation target.

-

10:00

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1200 (EUR 307m)

GBP/USD: 1.4000 (GBP 707m) 1.4200 (785m)

EUR/GBP 0.8000 ( EUR 282m) 0.8080-85 (248m)

AUD/USD: 0.7660 (AUD 422m) 0.7675 (590m) 0.7700 (611m)

USD/CAD 1.2800 (USD 480m) 1.2835 (340m) 1.3000 (541m)

-

08:31

Options levels on friday, April 15, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1423 (2049)

$1.1370 (954)

$1.1321 (452)

Price at time of writing this review: $1.1267

Support levels (open interest**, contracts):

$1.1212 (2845)

$1.1165 (3732)

$1.1135 (3394)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 32937 contracts, with the maximum number of contracts with strike price $1,1600 (3460);

- Overall open interest on the PUT options with the expiration date May, 6 is 48214 contracts, with the maximum number of contracts with strike price $1,0900 (4774);

- The ratio of PUT/CALL was 1.46 versus 1.45 from the previous trading day according to data from April, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.4405 (2090)

$1.4308 (1459)

$1.4212 (1155)

Price at time of writing this review: $1.4164

Support levels (open interest**, contracts):

$1.4088 (1646)

$1.3992 (2542)

$1.3895 (1220)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 24570 contracts, with the maximum number of contracts with strike price $1,4500 (2623);

- Overall open interest on the PUT options with the expiration date May, 6 is 30320 contracts, with the maximum number of contracts with strike price $1,3850 (4015);

- The ratio of PUT/CALL was 1.23 versus 1.23 from the previous trading day according to data from April, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

Asian session: China's economy grew

Japan's Finance Minister Taro Aso said on Thursday he had expressed deep concerns to U.S. Treasury Secretary Jack Lew over one-sided currency moves that earlier this week saw the yen hit its strongest levels in more than 17 months against the dollar. Aso met with Lew on the sidelines of a Group of 20 finance ministers' meeting in Washington that is expected to put currency policies high on the agenda.

China's economy grew at its slowest pace in seven years in the first quarter, however, indicators from the country's consumer, investment and factory sectors point to nascent signs the slowdown in the world's second largest economy may be bottoming out. Official data on Friday showed gross domestic product (GDP) grew 6.7 percent in the first quarter from the previous year, in line with analyst forecasts and easing slightly from 6.8 percent in the fourth quarter.

EUR/USD: during the Asian session the pair traded in the range of $1.1250-65

GBP/USD: during the Asian session the pair traded in the range of $1.4130-50

USD/JPY: during the Asian session the pair rose to Y109.70

Based on Reuters materials

-

06:46

Japan: Industrial Production (MoM) , February -5.2% (forecast -6.2%)

-

06:46

Japan: Industrial Production (YoY), February -1.2%

-

04:01

China: Retail Sales y/y, March 10.5% (forecast 10.4%)

-

04:01

China: Fixed Asset Investment, March 10.7% (forecast 10.3%)

-

04:00

China: GDP y/y, Quarter I 6.7% (forecast 6.7%)

-

04:00

China: Industrial Production y/y, March 6.8% (forecast 5.9%)

-

00:32

Currencies. Daily history for Apr 14’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1260 -0,15%

GBP/USD $1,4147 -0,38%

USD/CHF Chf0,9665 -0,02%

USD/JPY Y109,41 +0,13%

EUR/JPY Y123,20 -0,02%

GBP/JPY Y154,77 -0,26%

AUD/USD $0,7689 +0,48%

NZD/USD $0,6843 -1,08%

USD/CAD C$1,2846 +0,23%

-

00:00

Schedule for today, Friday, Apr 15’2016:

(time / country / index / period / previous value / forecast)

02:00 China Retail Sales y/y March 10.2% 10.4%

02:00 China Fixed Asset Investment March 10.2% 10.3%

02:00 China Industrial Production y/y March 5.4% 5.9%

02:00 China GDP y/y Quarter I 6.8% 6.7%

04:30 Japan Industrial Production (YoY) (Finally) February -3.8%

04:30 Japan Industrial Production (MoM) (Finally) February 3.7% -6.2%

09:00 Eurozone Trade balance unadjusted February 6.2

12:30 Canada Manufacturing Shipments (MoM) February 2.3% -1.5%

12:30 U.S. NY Fed Empire State manufacturing index April 0.62 2.21

13:15 U.S. Capacity Utilization March 75.4% 75.4%

13:15 U.S. Industrial Production (MoM) March -0.5% -0.1%

13:15 U.S. Industrial Production YoY March -1.6%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) April 91 92.0

20:00 U.S. Net Long-term TIC Flows February -12.0 -32.2

20:00 U.S. Total Net TIC Flows February 118.4

-