Noticias del mercado

-

17:54

International Monetary Fund Managing Director Christine Lagarde: Britain’s exit from the European Union (EU) is "one of the serious downside risks” to the global growth outlook

The International Monetary Fund (IMF) Managing Director Christine Lagarde said on Thursday that Britain's exit from the European Union (EU) was "one of the serious downside risks" to the global growth outlook. She added that she hopped Britain would leave the EU.

-

16:25

Business NZ performance of manufacturing index for New Zealand declines to 54.7 in March

According to the Business NZ Survey published on late Thursday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand declined to 54.7 in March from 55.9 in February. It was the lowest level since October 2015.

February's figure was revised down from 56.0.

A reading above 50 indicates expansion in the manufacturing sector.

The decline was driven by drops in all sub-indexes.

"While a number of negative comments mentioned a slowdown in both domestic and offshore orders, it is still important to remember that two-thirds of comments from manufacturers remain positive, not to mention that the sector is still in expansion mode," Business NZ's executive director for manufacturing, Catherine Beard, said.

-

16:05

U.S. weekly earnings rise 0.2% in March

The U.S. Labor Department released its real earnings data on Thursday. Average weekly earnings rose 0.2% in March, after a 0.5% decrease in February.

Average hourly earnings increased 0.2% in March, after a 0.1% rise in February.

On a yearly basis, real average weekly earnings increased 1.1% in March, while hourly earnings rose 1.4%.

-

15:49

Atlanta Fed President Dennis Lockhart changes his mind and will not support an interest rate hike in April

Atlanta Fed President Dennis Lockhart said in an interview with Bloomberg News on Thursday that he changed his mind and would not support an interest rate hike in April. He noted that consumer spending seemed to slow down.

Atlanta Fed president downgraded his growth forecast for 2016, saying that the U.S. economy was likely to expand about 2.0% this year, down from his previous estimate of 2.5%.

He pointed out that the next interest rate hike would not depend on 2% inflation.

Lockhart is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

15:45

Option expiries for today's 10:00 ET NY cut

USDJPY 107.00 (USD 1.17bln) 108.00 (909m) 109.50 (477m) 110.00 (1.12bln) 110.50 (555m) 111.00 (335m)

EURUSD: 1.1105 (EUR 817m) 1.1115 (648m) 1.1235-50 (1.96bln) 1.1300 (415m) 1.1315 (334m) 1.1350-55 (462m) 1.1400 (459m) 1.1415 (264m) 1.1450 (496m) 1.1475 (271m) 1.1500 (340m)

GBPUSD: 1.4000 (GBP 345m) 1.4150 (312m) 1.4250 (247m) 1.4300 (211m)

EURGBP 0.7950 ( EUR 241m)

EURJPY 122.50 (EUR 200m) 125.00 (200m)

AUDUSD: 0.7500 (AUD 355m) 0.7540-45 (457m) 0.7615 (449m) 0.7670 (685m) 0.7700 (507m) 0.7800 (411m) 0.7875 (1.95bln)

USDCAD 1.28 (USD 1.3bln) 1.2900 (520m) 1.3000 (730m) 1.3100 (405m) 1.3200 (1.82bln)

AUDNZD 1.0900 (AUD 240m) 1.1050 (449m) 1.1300 (472m)

AUDJPY 82.50 (AUD 213m)

-

15:26

Bank of England's Monetary Policy Committee April minutes: uncertainty around the referendum on Britain’s membership in the European Union weighs on Britain’s economy

The Bank of England's Monetary Policy Committee (MPC) released its March meeting minutes on Thursday. All members voted to keep the central bank's monetary policy unchanged. Ian McCafferty, who voted to hike interest rate by 0.25% since August 2015, changed his mind in February.

The consumer price inflation in the U.K. was 0.5% in March, below the central bank's 2% target. The BoE noted that inflation was driven by declines in energy and food prices. The effect of falling in energy and food prices is expected to fade over the next year, according to the minutes.

The BoE noted that the pound depreciated in the recent month, adding that uncertainty around the referendum on Britain's membership in the European Union weighed on the currency.

The central bank said that uncertainty around the referendum on Britain's membership in the European Union also weighed on Britain's economy.

"There are some signs that uncertainty relating to the EU referendum has begun to weigh on certain areas of activity, as some decisions, including on capital expenditure and commercial property transactions, are being postponed pending the outcome of the vote. This might lead to some softening in growth during the first half of 2016," the minutes said.

The BoE noted that it was harder to interpret macroeconomic and financial market indicators in the coming months, saying that the central bank would likely act cautious.

All MPC members agreed to hike interest rate gradually once the BoE starts raising its interest rate and "to a lower level than in recent cycles", adding that further interest rate decision will depend on the incoming economic data.

-

15:07

Canada’s new housing price index climbs 0.2% in February

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.2% in February, exceeding expectations of a 0.1% gain, after a 0.1% rise in January.

The increase was mainly driven by higher prices in Toronto and Vancouver. New home prices in Toronto and Oshawa region rose 0.4% in February, while prices in Vancouver climbed 0.8%.

-

14:53

U.S. consumer price inflation rises 0.1% in March

The U.S. Labor Department released consumer price inflation data on Thursday. The U.S. consumer price inflation rose 0.1% in March, missing expectations for a 0.2% gain, after a 0.2% drop in February.

The index was mainly driven by higher energy prices, which climbed 0.9% in March.

Shelter costs climbed 0.2% in March, medical care costs were up 0.1%, while food prices decreased 0.2%.

On a yearly basis, the U.S. consumer price index decreased to 0.9% in March from 1.0% in February, missing expectations for a rise to 1.1%.

The U.S. consumer price inflation excluding food and energy gained 0.1% in March, missing expectations for a 0.2% rise, after a 0.3% increase in February.

The increase was driven by rents and medical costs.

On a yearly basis, the U.S. consumer price index excluding food and energy fall to 2.2% in March from 2.3% in February. Analysts had expected the index to remain unchanged at 2.3%.

The consumer price index is not preferred Fed's inflation measure.

-

14:40

Initial jobless claims decline to 253,000 in the week ending April 09

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending April 09 in the U.S. decreased by 13,000 to 253,000 from 266,000 in the previous week. The previous week's figure was revised down from 267,000.

Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 58th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 18,000 to 2,171,000 in the week ended April 02.

-

14:31

Canada: New Housing Price Index, MoM, February 0.2% (forecast 0.1%)

-

14:30

U.S.: CPI excluding food and energy, Y/Y, March 2.2% (forecast 2.3%)

-

14:30

U.S.: CPI, Y/Y, March 0.9% (forecast 1.1%)

-

14:30

U.S.: Initial Jobless Claims, April 253 (forecast 270)

-

14:30

U.S.: CPI, m/m , March 0.1% (forecast 0.2%)

-

14:30

U.S.: CPI excluding food and energy, m/m, March 0.1% (forecast 0.2%)

-

14:30

U.S.: Continuing Jobless Claims, April 2171 (forecast 2183)

-

14:24

Bank of England keeps its interest rate on hold at 0.5% in April

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

-

14:18

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the Bank of England's (BoE) interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Unemployment rate March 5.8% 5.9% 5.7%

01:30 Australia Changing the number of employed March -0.7 Revised From 0.3 20.0 26.1

07:15 Switzerland Producer & Import Prices, m/m March -0.6% -0.2% 0%

07:15 Switzerland Producer & Import Prices, y/y March -4.6% -4.7%

09:00 Eurozone Harmonized CPI March 0.2% 1.2% 1.2%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) March -0.2% -0.1% 0.0%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) March 0.8% 1% 1%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom Bank of England Minutes

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the U.S. economic data. The U.S. consumer price inflation is expected to rise to 1.1% year-on-year in March from 1.0% in January.

The U.S. consumer price index excluding food and energy is expected to remain unchanged at 2.3% year-on-year in March.

The number of initial jobless claims in the U.S. is expected to increase by 3,000 to 270,000 last week.

The euro traded mixed against the U.S. dollar after the release of the final consumer price inflation data from the Eurozone. Eurozone's harmonized consumer price index rose 1.2% in March, in line with expectations, after a 0.2% increase in February.

On a yearly basis, Eurozone's final consumer price inflation increased to 0.0% in March from -0.2% in February, up from the preliminary reading of -0.1%.

Restaurants and cafés prices were up 0.12% year-on-year in March, rents increased by 0.07%, package holidays rose by 0.09%, fuel prices for transport declined by 0.60%, heating oil prices decreased by 0.23%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco climbed to an annual rate of 1.0% in March from 0.8 in February, in line with the preliminary reading.

The British pound traded mixed against the U.S. dollar after the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected. All members voted to keep the central bank's monetary policy unchanged. The BoE was concerned over the weak global growth and uncertainty ahead of the referendum on Britain's membership in the European Union.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian economic data. Canada's new housing price index is expected to rise 0.1% in February, after a 0.1% gain in January.

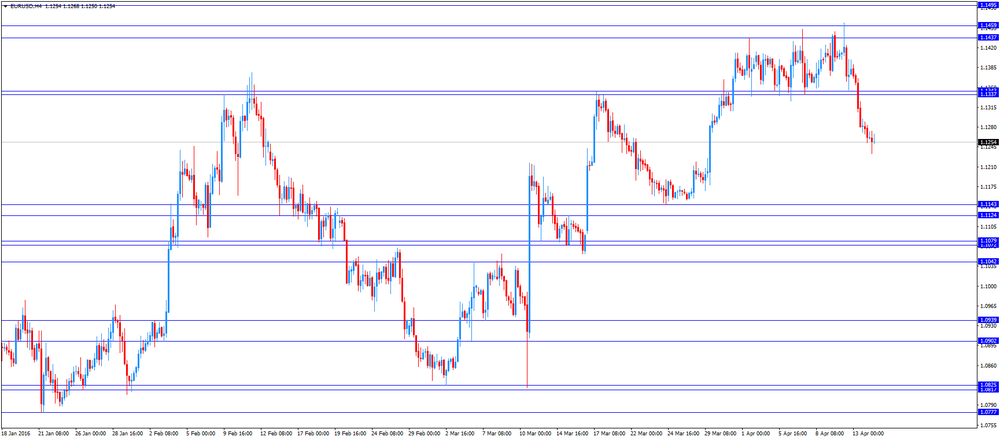

EUR/USD: the currency pair traded mixed

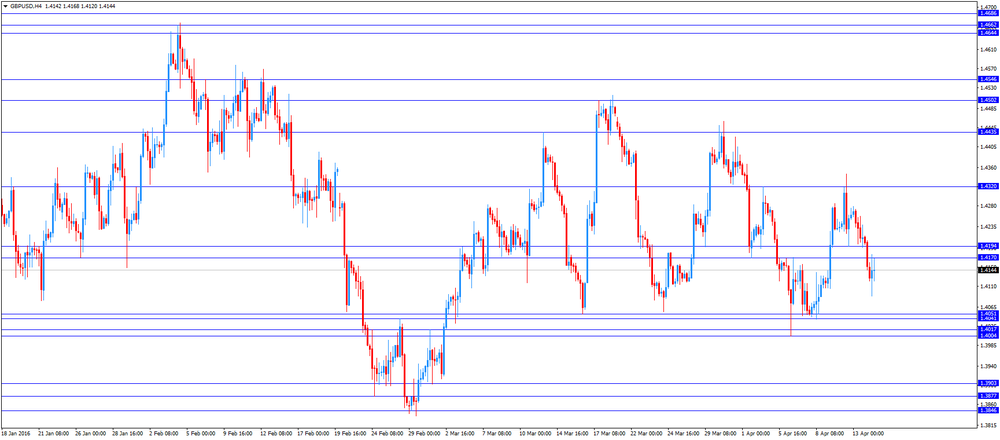

GBP/USD: the currency pair traded mixed

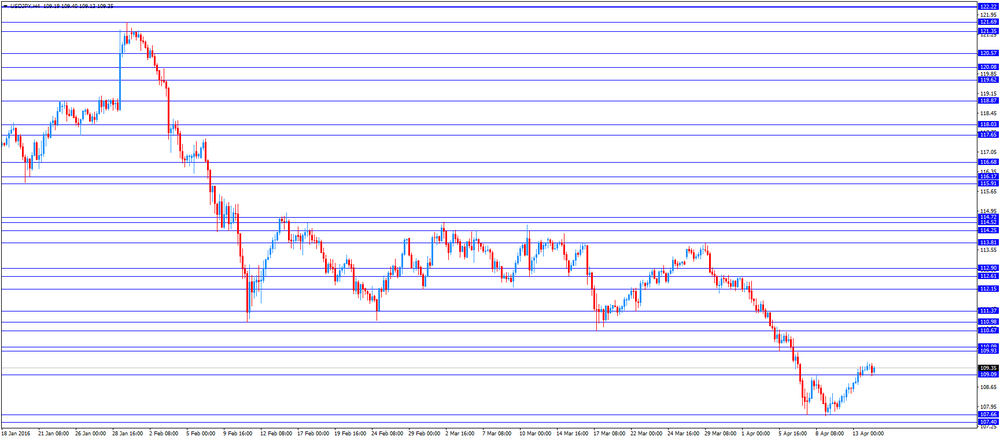

USD/JPY: the currency pair fell to Y109.05

The most important news that are expected (GMT0):

12:30 Canada New Housing Price Index, MoM February 0.1% 0.1%

12:30 U.S. Continuing Jobless Claims April 2191 2183

12:30 U.S. Initial Jobless Claims April 267 270

12:30 U.S. CPI, m/m March -0.2% 0.2%

12:30 U.S. CPI, Y/Y March 1.0% 1.1%

12:30 U.S. CPI excluding food and energy, m/m March 0.3% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y March 2.3% 2.3%

14:00 U.S. FOMC Member Jerome Powell Speaks

-

13:45

Orders

EUR/USD

Offers 1.1280-85 1.1300 1.1325 1.1360 1.1385 1.1400 1.1420 1.1450 1.1465-70

Bids 1.1250 1.1235 1.1220 1.1200 1.1180 1.1160 1.1150 1.1125-30 1.1100

GBP/USD

Offers 1.4150 1.4185 1.4200 1.4220 1.4235 1.4250 1.4280 1.4300 1.4330 1.4350

Bids 1.4100-10 1.4080 1.4050-60 1.4030 1.4000 1.3980 1.3965 1.3950

EUR/JPY

Offers 123.50 123.80 124.00 124.30 124.50 124.80 125.00

Bids 123.00 122.70 122.50 122.00 121.50

EUR/GBP

Offers 0.7980 0.8000 0.8020 0.8030 0.8050 0.8075-80 0.8100

Bids 0.7950 0.7925-30 0.7900 0.7880 0.7850 0.7830 0.7800

USD/JPY

Offers 109.60 109.80-85 110.00 110.20 110.50 110.80 111.00

Bids 109.20 109.00 108.80 108.50 108.30 108.00 107.85 107.60-65 107.50

AUD/USD

Offers 0.7670 0.7700 0.7720 0.7735-40 0.7750 0.7780 0.7800

Bids 0.7620-25 0.7600 0.7580 0.7550 0.7520 0.7500 0.7485 0.7465 0.7450

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.5%)

-

13:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

11:52

European Central Bank Vice President Vitor Constancio: there are limits of negative interest rates

European Central Bank (ECB) Vice President Vitor Constancio said in a speech on Wednesday that there were limits of negative interest rates.

"There are clear limits to the use of negative deposit facility rates as a policy instrument," he said.

"First, there is always the possibility of hitting the limit where the preference for cash withdrawals would set in. Second, the instruments should not push banks to pass on their additional direct costs by turning deposit rates negative or increasing lending rates to increase margins," Constancio added.

The ECB vice president defended the central bank's negative interest rates, saying that the result would be positive for the Eurozone as a whole. He added that time was needed for the recent ECB's stimulus measures "to fully materialize".

-

11:41

Final consumer prices in Italy increase 0.2% in March

The Italian statistical office Istat released its final consumer price inflation data for Italy on Thursday. Final consumer prices in Italy increased 0.2% in March, in line with preliminary reading, after a 0.2% decrease in February.

The monthly increase was driven by rises in prices of services related to transport. Prices for services related to transport rose 1.0% in March.

On a yearly basis, consumer prices declined 0.2% in March, in line with preliminary reading, after a 0.3% decline in February.

The declines was mainly driven by a faster decline of prices of non-regulated energy products. Prices of non-regulated energy products slid 11.2% year-on-year in March.

Final consumer price inflation excluding unprocessed food and energy prices rose to 0.6% year-on-year in March from 0.5% in February.

-

11:34

Switzerland's producer and import prices are flat in March

The Federal Statistical Office released its producer and import prices data on Thursday. Switzerland's producer and import prices were flat in March, beating expectations for a 0.2% fall, after a 0.6% decrease in February.

The Import Price Index was flat in March, while producer prices rose 0.1%.

On a yearly basis, producer and import prices plunged 4.7% in March, after a 4.6% drop in February.

The Import Price Index fell by 7.5% year-on year in March, while producer prices dropped 3.5%.

-

11:26

RICS house price balance for the U.K. drops to +42% in March

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on Thursday. The monthly house price balance dropped to +42% in March from +50% in February.

The RICS noted that uncertainty increased due to the impact of Stamp Duty changes, the EU referendum and devolved elections.

"As expected, the buy-to-let rush has now run its course and, as a natural result, the market is starting to slow," RICS Chief Economist, Simon Rubinsohn, said.

"The EU referendum, is likely to be an influencer in terms of the damper outlook for London in particular," he added.

-

11:20

Eurozone's harmonized consumer price index rises 1.2% in March

Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 1.2% in March, in line with expectations, after a 0.2% increase in February.

On a yearly basis, Eurozone's final consumer price inflation increased to 0.0% in March from -0.2% in February, up from the preliminary reading of -0.1%.

Restaurants and cafés prices were up 0.12% year-on-year in March, rents increased by 0.07%, package holidays rose by 0.09%, fuel prices for transport declined by 0.60%, heating oil prices decreased by 0.23%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco climbed to an annual rate of 1.0% in March from 0.8 in February, in line with the preliminary reading.

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, March 1% (forecast 1%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, March 0.0% (forecast -0.1%)

-

11:00

Eurozone: Harmonized CPI, March 1.2% (forecast 1.2%)

-

10:54

International Monetary Fund: public debt of the advanced economies reaches the highest level since World War II

The International Monetary Fund (IMF) said on Wednesday that public debt of the advanced economies hit the highest level since World War II.

"Public debt now exceeds the level observed during the Great Depression and is approaching the level immediately after World War II," the IMF said.

The lender noted that public debt of the advanced economies rose to over 107% of gross domestic product (GDP).

"Advanced economies are facing the triple threat of low growth, low inflation, and high public debt. This combination of factors could create self-reinforcing downward spirals," the IMF added.

-

10:39

Australia's unemployment rate declines to 5.7% in March

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate declined to 5.7% in March from 5.8% in February. Analysts had expected the unemployment rate to rise to 5.9%.

The number of employed people in Australia increased by 26,100 in March, beating forecast of a rise by 20,000, after a decline by 700 in February. February's figure was revised down from a rise by 300.

Full-time employment declined by 8,800 in March, while part-time employment fell by 34,900.

The participation rate remained unchanged at 64.9% in March.

-

10:11

Beige Book: the U.S. economic activity continues to expand across districts

The Fed released its Beige Book on Wednesday. The central bank said that the U.S. economic activity continued to expand in late February and March across districts.

The economy expanded modestly or moderately in most districts, the Fed said.

The Fed noted that consumer and business spending rose, the labour market continued to strengthen, while prices increased modestly across the majority of districts.

Manufacturing and construction activity rose in most districts in late February and March.

-

10:00

Option expiries for today's 10:00 ET NY cut

USD/JPY 107.00 (USD 1.17bln) 108.00 (909m) 109.50 (477m) 110.00 (1.12bln) 110.50 (555m) 111.00 (335m)

EUR/USD: 1.1105 (EUR 817m) 1.1115 (648m) 1.1235-50 (1.96bln) 1.1300 (415m) 1.1315 (334m) 1.1350-55 (462m) 1.1400 (459m) 1.1415 (264m) 1.1450 (496m) 1.1475 (271m) 1.1500 (340m)

GBP/USD: 1.4000 (GBP 345m) 1.4150 (312m) 1.4250 (247m) 1.4300 (211m)

EUR/GBP 0.7950 ( EUR 241m)

EUR/JPY 122.50 (EUR 200m) 125.00 (200m)

AUD/USD: 0.7500 (AUD 355m) 0.7540-45 (457m) 0.7615 (449m) 0.7670 (685m) 0.7700 (507m) 0.7800 (411m) 0.7875 (1.95bln)

USD/CAD 1.28 (USD 1.3bln) 1.2900 (520m) 1.3000 (730m) 1.3100 (405m) 1.3200 (1.82bln)

AUD/NZD 1.0900 (AUD 240m) 1.1050 (449m) 1.1300 (472m)

AUD/JPY 82.50 (AUD 213m)

-

09:15

Switzerland: Producer & Import Prices, m/m, March 0% (forecast -0.2%)

-

09:15

Switzerland: Producer & Import Prices, y/y, March -4.7%

-

08:32

Options levels on thursday, April 14, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1434 (1809)

$1.1383 (979)

$1.1336 (452)

Price at time of writing this review: $1.1262

Support levels (open interest**, contracts):

$1.1220 (2802)

$1.1170 (2547)

$1.1139 (3385)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 32160 contracts, with the maximum number of contracts with strike price $1,1600 (3407);

- Overall open interest on the PUT options with the expiration date May, 6 is 46529 contracts, with the maximum number of contracts with strike price $1,0900 (4782);

- The ratio of PUT/CALL was 1.45 versus 1.39 from the previous trading day according to data from April, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.4407 (2052)

$1.4311 (1100)

$1.4216 (1042)

Price at time of writing this review: $1.4128

Support levels (open interest**, contracts):

$1.4090 (1245)

$1.3993 (2364)

$1.3895 (1043)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 23675 contracts, with the maximum number of contracts with strike price $1,4500 (2539);

- Overall open interest on the PUT options with the expiration date May, 6 is 29116 contracts, with the maximum number of contracts with strike price $1,3850 (3822);

- The ratio of PUT/CALL was 1.23 versus 1.23 from the previous trading day according to data from April, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

Asian session: The dollar was broadly firmer

The dollar was broadly firmer on Thursday, having posted its biggest one-day gain in more than a month as an improvement in global sentiment led investors to trim bearish dollar positions. A surprise policy easing by Singapore's central bank, citing a tougher outlook for economic growth, also boosted regional equities and gave the dollar a lift against that country's currency.

The yen got no help from Bank of Japan Governor Haruhiko Kuroda, who said overnight in a speech in New York that the central bank was ready to expand monetary stimulus again if recent weaknesses in inflation expectations persist, stressing that there are "many ways" to do so to achieve his ambitious price target. Kuroda made the remarks ahead of a meeting of Group of 20 financial leaders in Washington this week, where currency policy is seen high on the agenda in the face of subdued global growth.

The Federal Reserve has highlighted global uncertainty as the major bar to another hike in interest rates. So, when upbeat trade data out of China and a pick-up in commodity prices seemed to lessen the risk of a deeper world downturn, dollar bulls figured there was now more chance of a move.

EUR/USD: during the Asian session the pair fell to $1.1365

GBP/USD: during the Asian session the pair traded in the range of $1.4255-80

USD/JPY: during the Asian session the pair rose to Y108.95

Based on Reuters materials

-

03:30

Australia: Unemployment rate, March 5.7% (forecast 5.9%)

-

03:30

Australia: Changing the number of employed, March 260.1 (forecast 20.0)

-

01:00

Currencies. Daily history for Apr 13’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1277 -0,93%

GBP/USD $1,4201 -0,42%

USD/CHF Chf0,9667 +1,19%

USD/JPY Y109,27 +0,60%

EUR/JPY Y123,23 -0,32%

GBP/JPY Y155,17 +0,19%

AUD/USD $0,7652 -0,37%

NZD/USD $0,6917 -0,01%

USD/CAD C$1,2817 +0,37%

-

00:30

New Zealand: Business NZ PMI, March 54.7

-

00:01

Schedule for today, Thursday, Apr 14’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Unemployment rate March 5.8% 5.9%

01:30 Australia Changing the number of employed March 0.3 20.0

07:15 Switzerland Producer & Import Prices, m/m March -0.6% -0.2%

07:15 Switzerland Producer & Import Prices, y/y March -4.6%

09:00 Eurozone Harmonized CPI March 0.2% 1.2%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) March -0.2% -0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) March 0.8% 1%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom Bank of England Minutes

12:30 Canada New Housing Price Index, MoM February 0.1% 0.1%

12:30 U.S. Continuing Jobless Claims April 2191 2183

12:30 U.S. Initial Jobless Claims April 267 270

12:30 U.S. CPI, m/m March -0.2% 0.2%

12:30 U.S. CPI, Y/Y March 1.0% 1.1%

12:30 U.S. CPI excluding food and energy, m/m March 0.3% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y March 2.3% 2.3%

14:00 U.S. FOMC Member Jerome Powell Speaks

-