Noticias del mercado

-

17:39

Bank of England’s quarterly Credit Conditions Survey: consumer credit continues to rise strongly

The Bank of England released its quarterly Credit Conditions Survey on Wednesday. Consumer credit continued to rise strongly in the three months to February, mainly driven by the increased provision of car finance.

According to the report, mortgage lending increased in the recent months.

Net lending to UK non-financial businesses was positive in the three months to February 2016, the central bank said.

-

17:30

Fed Chairwoman Janet Yellen: the Fed’s cautious approach in hiking interest rate should help to avoid “the big mistakes”

Fed Chairwoman Janet Yellen said in an interview with Time Magazine that the Fed's cautious approach in hiking interest rate should help to avoid "the big mistakes". She noted that it was the appropriate approach as there was uncertainty.

"In such an environment, it makes sense to use a risk-management approach to identify and avoid the big mistakes. That's one reason I favour a cautious approach," Yellen said.

-

17:18

U.K. leading economic index increases 0.2% in February

The Conference Board (CB) released its leading economic index for the U.K. on Wednesday. The leading economic index (LEI) increased 0.2% in February, after a 0.3% rise in January. January's figure was revised up from a 0.2% gain.

The coincident index was flat in February, after a 0.2% increase in January. January's figure was revised down from a 0.3% rise.

-

16:53

Bank of Canada keeps its interest rate unchanged at 0.50% in April

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy was appropriate. This decision was expected by analysts.

The BoC upgraded its growth forecast for to 1.7% from 1.4%. The economy is expected to expand 2.3% in 2017 and 2.0% in 2018.

The BoC noted that the Canadian economic growth in the first quarter was unexpectedly strong due to temporary factors, adding that it will reverse in the second quarter.

The central bank also said that the labour market continued to improve, household spending continued to expand moderately, while business investment was shrinking.

According to the central bank, inflation was evolving as anticipated by the BoC, and was expected to decline further.

Risks around the inflation are roughly balanced, the central bank said.

The BoC added that financial vulnerabilities continued to edge higher.

-

16:30

U.S.: Crude Oil Inventories, April 6.634 (forecast 2.85)

-

16:24

U.S. business inventories decrease 0.1% in February

The U.S. Commerce Department released the business inventories data on Wednesday. The U.S. business inventories decline 0.1% in February, in line with expectations, after a 0.1% decrease in January. January's figure was revised down from a 0.1% rise.

Retail inventories climbed 0.6% in February, wholesale inventories were down 0.5%, while manufacturing inventories decreased 0.4%.

Retail sales declined 0.2% in February, while business sales were down 0.4%.

The business inventories/sales ratio remained unchanged at 1.41 months in February. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:00

Canada: Bank of Canada Rate, 0.5% (forecast 0.50%)

-

16:00

U.S.: Business inventories , February -0.1% (forecast -0.1%)

-

15:50

Option expiries for today's 10:00 ET NY cut

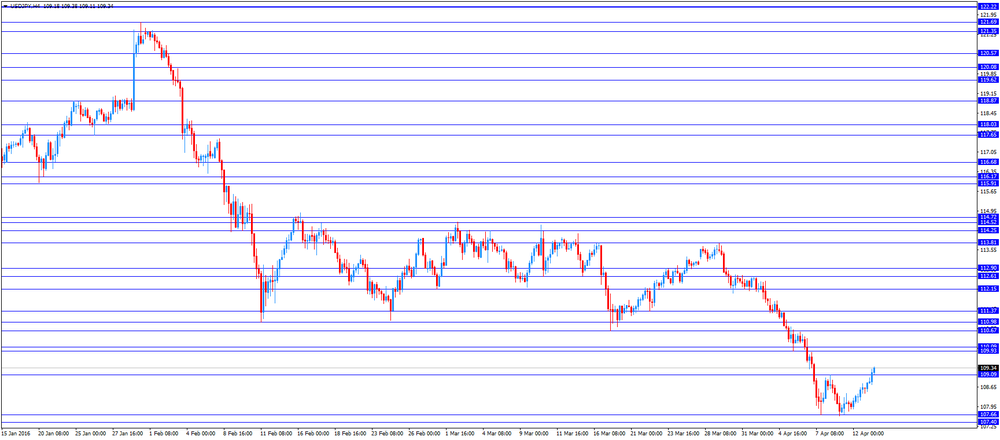

USDJPY: 109.00 (USD 660m) 110.00 (217m)

EURUSD: 1.1250 (USD 201m) 1.1335-40 (365m) 1.1400 (502m) 1.1430 (263m) 1.1450 (261m) 1.1500 (252m)

GBPUSD: 1.4050-55 (GBP 362m)

EURGBP 0.8000 ( EUR 385m)

AUDUSD: 0.7450 (AUD 320m) 0.7500 (468m) 0.7700 (617m) 0.7900 (253m)

USDCAD 1.2915-20 (USD 510m) 1.3250 (411m)

NZDUSD 0.6750 (NZD 231m) 0.6900 (201m)

-

15:09

Producer prices in Japan fall 0.1% in March

The Bank of Japan (BoJ) released its Corporate Goods Price Index (CGPI) data on late Tuesday evening. Producer prices in Japan declined 0.1% in March, after a 0.2% fall in February.

Export prices rose 0.3% in March, while import prices increased 0.3%.

On a yearly basis, producer prices slid 3.8% in March, after a 3.4% drop in February. It was the biggest drop since October 2015

Export prices dropped 4.8% year-on-year in March, while import prices plunged 15.6%.

-

15:00

U.S. retail sales decline 0.3% in March

The U.S. Commerce Department released the retail sales data on Wednesday. The U.S. retail sales declined 0.3% in March, missing expectations for a 0.1% rise, after a 0.1% fall in February.

The decrease was mainly driven by a fall in sales at auto dealerships.

Sales at clothing retailers were down 0.9% in March, sales at building material and garden equipment stores increased 1.4%, while sales at auto dealerships slid 2.1%.

Retail sales excluding automobiles rose 0.2% in March, missing expectations for a 0.5% increase, after a 0.1% decline in February.

Sales at service stations climbed 0.9% in March, while sales at furniture stores rose 0.3%.

These figures indicates that the U.S. economic growth was weak in the first quarter.

-

14:49

U.S. producer prices fall 0.1% in March

The U.S. Commerce Department released the producer price index figures on Wednesday. The U.S. producer price index fell 0.1% in March, missing expectations for a 0.2% rise, after a 0.2% drop in February.

The decrease was mainly driven by a fall in services prices.

Energy prices increased 1.8% in March, wholesale food prices decreased 0.9%.

Services prices were down 0.2% in March, the first fall since October 2015, while prices for goods rose 0.2%.

On a yearly basis, the producer price index decreased 0.1% in March, missing expectations for a 0.3% increase, after a flat reading in February.

The producer price index excluding food and energy decreased 0.1% in March, missing expectations for a 0.1% gain, after a flat reading in February.

On a yearly basis, the producer price index excluding food and energy climbed 1.0% in March, missing forecasts of a 1.3% increase, after a 1.2% rise in February.

These figures could mean that the Fed will raise its interest rate cautiously and gradually.

-

14:30

U.S.: PPI excluding food and energy, m/m, March -0.1% (forecast 0.1%)

-

14:30

U.S.: PPI, m/m, March -0.1% (forecast 0.2%)

-

14:30

U.S.: Retail sales, March -0.3% (forecast 0.1%)

-

14:30

U.S.: PPI, y/y, March -0.1% (forecast 0.3%)

-

14:30

U.S.: PPI excluding food and energy, Y/Y, March 1% (forecast 1.3%)

-

14:30

U.S.: Retail Sales YoY, March 1.7%

-

14:30

U.S.: Retail sales excluding auto, March 0.2% (forecast 0.5%)

-

14:21

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weaker-than-expected industrial production data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence April -2.2% -4.0%

02:00 China Trade Balance, bln March 32.59 30.85 29.86

09:00 Eurozone Industrial production, (MoM) February 1.9% Revised From 2.1% -0.7% -0.8%

09:00 Eurozone Industrial Production (YoY) February 2.9% Revised From 2.8% 1.2% 0.8%

11:00 U.S. MBA Mortgage Applications April 2.7% 10%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic data. The U.S. retail sales are expected to rise 0.1% in March, after a 0.1% decline in February.

The U.S. PPI is expected to increase 0.2% in March, after a 0.2% drop in February.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in March, after a flat reading in February.

The euro traded lower against the U.S. dollar after the release of the weaker-than-expected industrial production data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Wednesday. Industrial production in the Eurozone fell 0.8% in February, missing expectations for a 0.7% decrease, after a 1.9% rise in January. January's figure was revised down from a 2.1% increase.

Non-durable consumer goods output dropped 1.8% in February, capital goods output decreased 0.3%, while energy output fell 1.2%. Intermediate goods output were flat in February, while durable consumer goods declined 0.4%.

On a yearly basis, Eurozone's industrial production rise 0.8% in February, missing expectations for a 1.2% rise, after a 2.9% increase in January. January's figure was revised up from a 2.8% gain.

Durable consumer goods climbed by 0.8% in February from a year ago, capital goods rose by 3.0%, non-durable consumer goods gained by 0.7%, while intermediate goods output increased by 1.9%. Energy output declined by 5.2% in February from a year ago.

The British pound traded mixed against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Bank of Canada's interest rate decision. The central bank is expected to keep its interest rate unchanged.

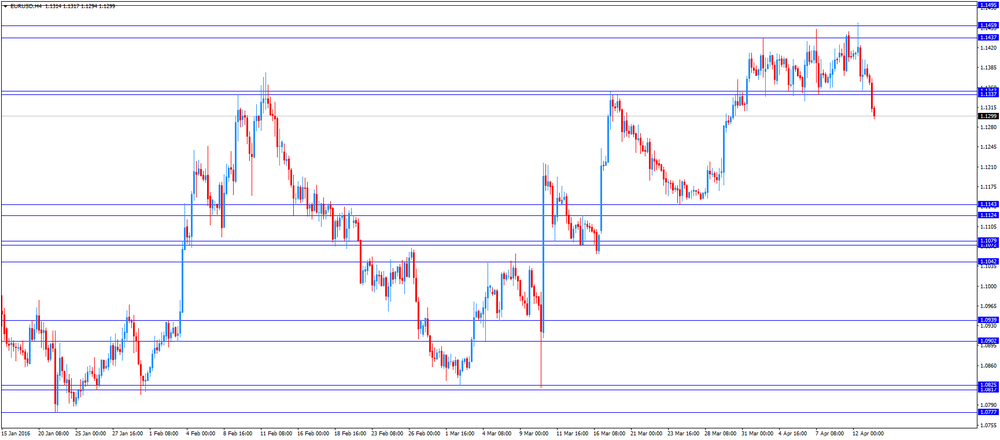

EUR/USD: the currency pair declined to $1.1294

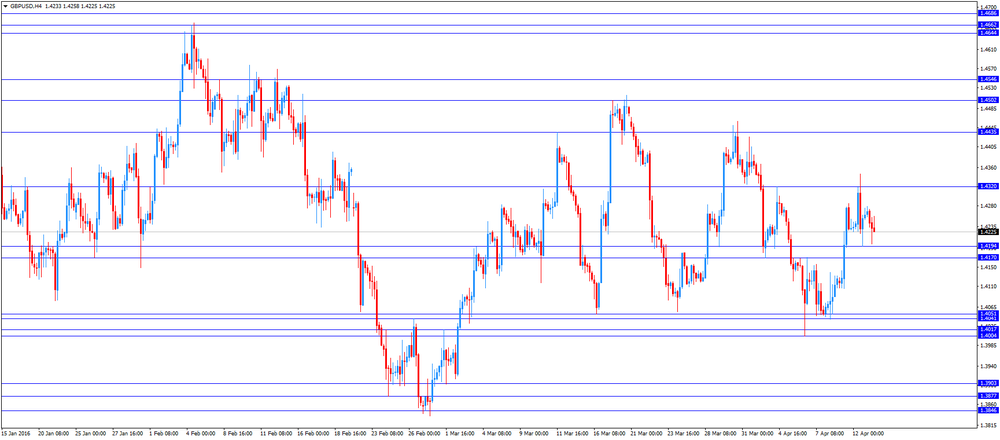

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y109.38

The most important news that are expected (GMT0):

12:30 U.S. PPI, m/m March -0.2% 0.2%

12:30 U.S. PPI, y/y March 0% 0.3%

12:30 U.S. PPI excluding food and energy, m/m March 0.0% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y March 1.2% 1.3%

12:30 U.S. Retail sales March -0.1% 0.1%

12:30 U.S. Retail Sales YoY March 3.1%

12:30 U.S. Retail sales excluding auto March -0.1% 0.5%

14:00 Canada Bank of Canada Rate 0.5% 0.50%

14:00 Canada Bank of Canada Monetary Policy Report

14:00 Canada BOC Rate Statement

14:00 U.S. Business inventories February 0.1% -0.1%

14:30 U.S. Crude Oil Inventories April -4.937 2.85

15:15 Canada BOC Press Conference

18:00 U.S. Fed's Beige Book

22:30 New Zealand Business NZ PMI March 56.0

-

13:45

Orders

EUR/USD

Offers 1.1360 1.1385 1.1400 1.1420 1.1450 1.1465-70 1.1480 1.1500-10 1.1530 1.1550

Bids 1.1335 1.1320 1.1300 1.1275-80 1.1250 1.1230 1.1200

GBP/USD

Offers 1.4250 1.4280 1.4300 1.4330 1.4350 1.4380 1.4400 1.4420 1.4450

Bids 1.4200 1.4185 1.4165 1.4150 1.4100 1.4080 1.4050-60 1.4030 1.4000

EUR/JPY

Offers 123.80 124.00 124.30 124.50 124.80 125.00

Bids 123.30 123.00 122.70 122.50 122.00

EUR/GBP

Offers 0.7980-85 0.8000 0.8020 0.8030 0.8050 0.8075-80 0.8100

Bids 0.7950 0.7925-30 0.7900 0.7880 0.7850 0.7830 0.7800

USD/JPY

Offers 109.00-10 109.30 109.50 109.80 110.00 110.20 110.50

Bids 108.70 105.50 108.30 108.00 107.85 107.60-65 107.50 107.30 107.00

AUD/USD

Offers 0.7680 0.7700 0.7720 0.7735-40 0.7750 0.7780 0.7800

Bids 0.7625-30 0.7600 0.7580 0.7550 0.7520 0.7500 0.7485 0.7465 0.7450

-

13:00

U.S.: MBA Mortgage Applications, April 10%

-

11:50

Westpac’s consumer confidence index for Australia falls 4.0% in April

Westpac Bank released its consumer confidence index for Australia on late Tuesday evening. The index fell 4.0% in April, after a 2.2% decline in March.

The index was driven by declines in four of the five sub-indexes.

"It appears that international and market developments continue to create unease for respondents although the signals are mixed," Westpac Chief Economist Bill Evans said.

"The Reserve Bank Board next meets on May 3. Despite this disappointing read on sentiment we expect the Board will keep rates on hold for another month. We retain our call that rates will remain on hold for the remainder of 2016," he added.

-

11:42

Final consumer price inflation in Spain rises 0.6% in March

The Spanish statistical office INE released its final consumer price inflation data on Wednesday. Consumer price inflation in Spain was up 0.6% in March, in line with the preliminary reading, after a 0.4% decrease in February.

The monthly rise was mainly driven by an increase in clothing and footwear, which climbed 4.3% in March.

On a yearly basis, consumer prices fell by 0.8% in March from a year ago, in line with preliminary reading, after a 0.8% decline in February.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

11:33

French final consumer price inflation rises 0.7% in March

The French statistical office Insee released its final consumer price inflation for France on Wednesday. The French consumer price inflation rose 0.7% in March, in line with the preliminary reading, after a 0.3% increase in February.

On a yearly basis, the consumer price index decreased 0.1% in March, up from the preliminary reading of -0.2%, after a 0.2% decline in February.

Fresh food prices rose 0.4% year-on-year in March, services prices climbed by 0.9%, while petroleum products prices dropped by 13.2%.

-

11:27

Eurozone’s industrial production falls 0.8% in February

Eurostat released its industrial production data for the Eurozone on Wednesday. Industrial production in the Eurozone fell 0.8% in February, missing expectations for a 0.7% decrease, after a 1.9% rise in January. January's figure was revised down from a 2.1% increase.

Non-durable consumer goods output dropped 1.8% in February, capital goods output decreased 0.3%, while energy output fell 1.2%.

Intermediate goods output were flat in February, while durable consumer goods declined 0.4%.

On a yearly basis, Eurozone's industrial production rise 0.8% in February, missing expectations for a 1.2% rise, after a 2.9% increase in January. January's figure was revised up from a 2.8% gain.

Durable consumer goods climbed by 0.8% in February from a year ago, capital goods rose by 3.0%, non-durable consumer goods gained by 0.7%, while intermediate goods output increased by 1.9%.

Energy output declined by 5.2% in February from a year ago.

-

11:08

San Francisco Fed President John Williams: two or three interest rate hikes this year would be appropriate

San Francisco Fed President John Williams said on Tuesday that two or three interest rate hikes this year would be appropriate. He pointed out that it did not matter when to raise the interest rate.

"We stay on this kind of basic path of raising interest rates gradually over the next couple of years, that's kind of what's important for financial conditions," Williams added.

He noted that the Fed's interest rate hikes would not lead to a lot of turmoil in financial markets.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

11:00

Eurozone: Industrial production, (MoM), February -0.8% (forecast -0.7%)

-

11:00

Eurozone: Industrial Production (YoY), February 0.8% (forecast 1.2%)

-

10:59

Richmond Fed President Jeffrey Lacker: the Fed should raise its interest rate as inflation in the U.S. picked up

Richmond Fed President Jeffrey Lacker said on Tuesday that the Fed should raise its interest rate as inflation in the U.S. picked up. He added that the Fed should hike its interest rate four times this year.

"My sense is that the less leisurely but still gradual pace of target rate increases that FOMC participants submitted at year-end is still more likely to be appropriate," Lacker said.

He noted that global risks to the U.S. subsided.

Lacker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:39

Fitch Ratings affirms the U.S.’s sovereign debt rating at 'AAA'

Rating agency Fitch Ratings affirmed the U.S.'s sovereign debt rating at 'AAA'. The outlook is 'stable'.

"The U.S.'s 'AAA' rating is underpinned by the sovereign's unparalleled financing flexibility as the issuer of the world's pre-eminent reserve currency and benchmark fixed-income asset and as home to the world's deepest and most liquid capital markets," the agency said.

Fitch expects general government debt to increase to over 107% of GDP over the next decade from 101% of GDP in 2016, while federal fiscal deficit is expected to rise 2.9% of GDP in 2016 from 2.5% of GDP in 2015 according to the Congressional Budget Office.

The agency downgraded its growth forecasts to 2.1% in 2016 and 2017.

Fitch expects two interest rate hikes in 2016 and three in 2017.

-

10:25

China's trade surplus drops to $29.86 billion in March

The Chinese Customs Office released its trade data on Wednesday. China's trade surplus dropped to $29.86 billion in March from $32.59 billion in February, missing expectations for a decline to a surplus of $30.85 billion.

Exports climbed at an annual rate of 11.5% in March, while imports slid at an annual rate of 13.8%, the sixteenth consecutive decline.

-

10:11

U.S. budget deficit is $108.0 billion in March

The U.S. Treasury Department released its federal budget data on Tuesday. The budget deficit was $108.0 billion in March, missing expectations for a deficit of $104.0 billion, after a deficit of $109.0 billion in February.

The budget deficit was driven by higher expenditure for military programs, Medicare and other categories.

In the six months of the fiscal year 2016, which ends at September this year, the budget deficit totalled $461.0 billion, up 5.0% from a year ago.

-

10:01

Option expiries for today's 10:00 ET NY cut

USD/JPY:109.00 (USD 660m) 110.00 (217m)

EUR/USD:1.1250 (USD 201m) 1.1335-40 (365m) 1.1400 (502m) 1.1430 (263m) 1.1450 (261m) 1.1500 (252m)

GBP/USD:1.4050-55 (GBP 362m)

EUR/GBP0.8000 ( EUR 385m)

AUD/USD:0.7450 (AUD 320m) 0.7500 (468m) 0.7700 (617m) 0.7900 (253m)

USD/CAD 1.2915-20 (USD 510m) 1.3250 (411m)

NZD/USD 0.6750 (NZD 231m) 0.6900 (201m)

-

08:34

Options levels on wednesday, April 13, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1517 (2734)

$1.1476 (1998)

$1.1435 (452)

Price at time of writing this review: $1.1362

Support levels (open interest**, contracts):

$1.1301 (2716)

$1.1241 (3476)

$1.1206 (2642)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 32112 contracts, with the maximum number of contracts with strike price $1,1600 (3400);

- Overall open interest on the PUT options with the expiration date May, 6 is 44663 contracts, with the maximum number of contracts with strike price $1,0900 (4816);

- The ratio of PUT/CALL was 1.39 versus 1.47 from the previous trading day according to data from April, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.4507 (2511)

$1.4410 (1714)

$1.4314 (1100)

Price at time of writing this review: $1.4235

Support levels (open interest**, contracts):

$1.4188 (748)

$1.4092 (1231)

$1.3994 (2067)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 23015 contracts, with the maximum number of contracts with strike price $1,4500 (2511);

- Overall open interest on the PUT options with the expiration date May, 6 is 28213 contracts, with the maximum number of contracts with strike price $1,3850 (3822);

- The ratio of PUT/CALL was 1.23 versus 1.21 from the previous trading day according to data from April, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:22

Asian session: The Aussie extended gains

The safe-haven Japanese yen slid from recent peaks against the greenback on Wednesday as solid gains in oil prices helped underpin risk appetite. The yen has mostly brushed off recent comments by Japanese officials warning that a rapid appreciation by the currency was unwelcome.

The Canadian dollar hovered just under a nine-month peak, having rallied along with other commodity currencies such as the Australian dollar on higher oil prices. Also helping the currency, the Bank of Canada is widely expected to hold interest rates at 0.5 percent following its meeting on Wednesday. After a run of better-than-expected economic data at the start of the year, the central bank is also likely to raise its growth forecasts.

The Aussie extended gains as upbeat China trade data favoured risk appetite. Chinese exports in March rose a much stronger-than-expected 11.5 percent, the first increase since June and largest gain since February 2015.

EUR/USD: during the Asian session the pair fell to $1.1365

GBP/USD: during the Asian session the pair traded in the range of $1.4255-80

USD/JPY: during the Asian session the pair rose to Y108.95

Based on Reuters materials

-

04:30

China: Trade Balance, bln, March 29.86 (forecast 30.85)

-

02:30

Australia: Westpac Consumer Confidence, April -4.0%

-

00:32

Currencies. Daily history for Apr 12’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1382 -0,19%

GBP/USD $1,4261 +0,20%

USD/CHF Chf0,9552 +0,07%

USD/JPY Y108,61 +0,60%

EUR/JPY Y123,63 +0,41%

GBP/JPY Y154,87 +0,79%

AUD/USD $0,7680 +1,13%

NZD/USD $0,6918 +0,97%

USD/CAD C$1,2769 -1,03%

-

00:02

Schedule for today, Wednesday, Apr 13’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence April -2.2%

02:00 China Trade Balance, bln March 32.59 30.85

09:00 Eurozone Industrial production, (MoM) February 2.1% -0.7%

09:00 Eurozone Industrial Production (YoY) February 2.8% 1.2%

11:00 U.S. MBA Mortgage Applications April 2.7%

12:30 U.S. PPI, m/m March -0.2% 0.2%

12:30 U.S. PPI, y/y March 0% 0.3%

12:30 U.S. PPI excluding food and energy, m/m March 0.0% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y March 1.2% 1.3%

12:30 U.S. Retail sales March -0.1% 0.1%

12:30 U.S. Retail Sales YoY March 3.1%

12:30 U.S. Retail sales excluding auto March -0.1% 0.5%

14:00 Canada Bank of Canada Rate 0.5% 0.50%

14:00 Canada Bank of Canada Monetary Policy Report

14:00 Canada BOC Rate Statement

14:00 U.S. Business inventories February 0.1% -0.1%

14:30 U.S. Crude Oil Inventories April -4.937

15:15 Canada BOC Press Conference

18:00 U.S. Fed's Beige Book

22:30 New Zealand Business NZ PMI March 56.0

-