Noticias del mercado

-

22:12

U.S. stocks closed

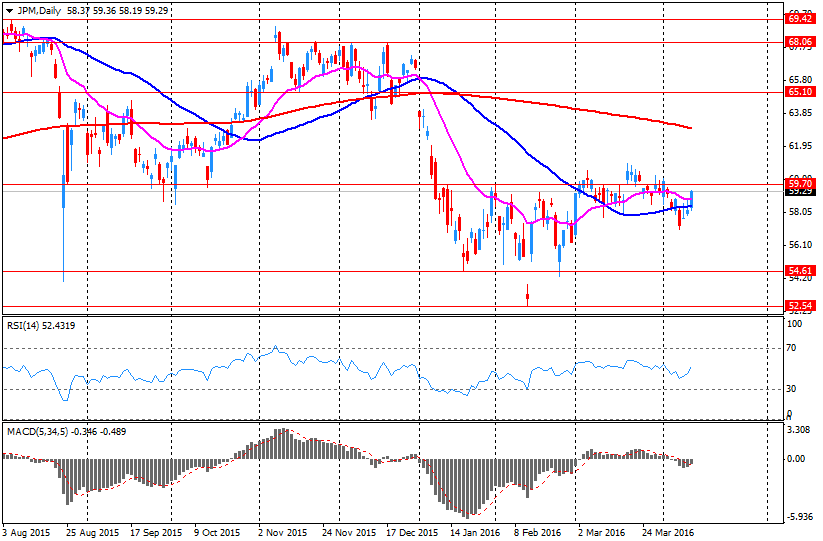

U.S. stocks extended gains a second day to reach the highest in four months, buoyed by improving Chinese trade data and better-than-expected results from JPMorgan Chase & Co., the biggest U.S. lender by assets.

JPMorgan advanced 4.2 percent after reporting first-quarter profit was boosted by pay cuts and trading revenue that declined less than most analysts predicted. Bank of America Corp., Wells Fargo & Co. and Citigroup Inc., scheduled to release results later this week, climbed at least 2.6 percent. Companies that are popular targets by short sellers rallied today, with a Goldman Sachs Group Inc. gauge of the 50 most shorted stocks posting the biggest increase since March 2.

The Standard & Poor's 500 Index rose 1 percent to 2,082.42 at 4 p.m. in New York, the highest since Dec. 4. Volume on U.S. exchanges was 8.1 percent higher than the 30-day average. All but five stocks in the 30-member Dow Jones Industrial Average increased, as the measure climbed 1.1 percent to 17,908.28 today. Futures contracts in pre-market trading held onto gains after releases showed U.S. retail sales and wholesale prices unexpectedly slumped last month, stoking speculation the Federal Reserve may slow the pace of further rate increases.

S&P 500 analysts have been projecting first-quarter profits by companies in the benchmark shrank 10 percent in the first quarter, with bank earnings contracting by 20 percent. That's fueled concern on the outlook for stocks, with valuations far above their five-year average and the seven-year bull market weeks away from becoming the second-longest in history.

A report showed China's exports jumped by the most in a year in March and declines in imports narrowed, helping ease worries about a slowdown in the world's second-largest economy. U.S. stocks are rebounding a second day, as crude pushed past $42 a barrel yesterday, lifting energy producers to their best one-day gain in almost two months.

Banks, the worst-performing group so far in 2016, led gains with all 17 stocks in the S&P 500 index rallying. Among lenders that advanced today were People's United Financial Inc. and Zions Bancorporation, which have short interest out of shares outstanding at 16 percent and 6 percent, respectively, data compiled by Markit Ltd. show.

Carmakers also advanced. Harley-Davidson Inc. added 4.3 percent after UBS AG said the company's retail sales in March likely jumped 10 percent because of warm weather. Bearish bets on the motorcycle maker is at 15 percent. Delphi Automotive Plc increased 5.6 percent after announcing a new buyback program and winning a long-running dispute with the U.S. Internal Revenue Service over whether the parts maker should be allowed to call itself British for tax purposes.

-

21:00

DJIA 17885.92 164.67 0.93%, NASDAQ 4934.27 62.18 1.28%, S&P 500 2078.19 16.47 0.80%

-

18:12

WSE: Session Results

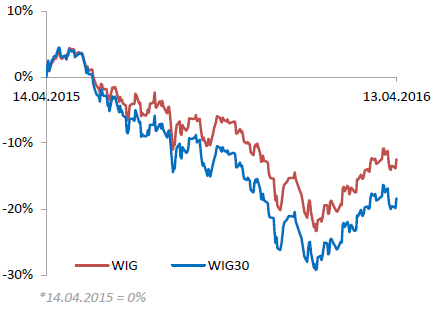

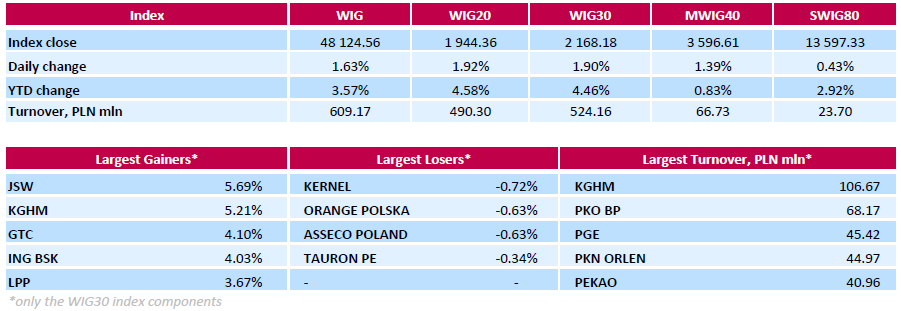

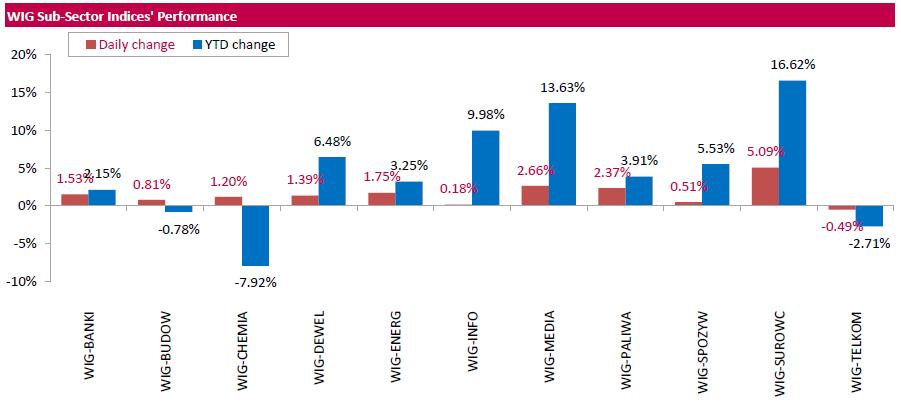

Polish equity market advanced on Wednesday. The broad market measure, the WIG Index, surged by 1.63%. Except for telecoms (-0.49%), every sector in the WIG Index gained, with materials (+5.09%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 1.90%. A majority of the index components returned gains, with the way up led by coking coal miner JSW (WSE: JSW) and copper producer KGHM (WSE: KGH), climbing by 5.69% and 5.21% respectively. They were followed by property developer GTC (WSE: GTC) and banking sector name ING BSK (WSE: ING), gaining 4.1% and 4.03% respectively. At the same time, the handful losers included agricultural producer KERNEL (WSE: KER), telecommunication services provider ORANGE POLSKA (WSE: OPL), IT-company ASSECO POLAND (WSE: ACP) and genco TAURON PE (WSE; TPE), declining by 0.34%-0.72%.

-

18:11

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes gained on Wednesday as JPMorgan's results kicked off bank earnings on an upbeat note and strong Chinese trade data raised hopes that the country's economy was on the mend. Shares of JPMorgan (JPM) were up 4,3% after the bank reported higher-than-expected quarterly earnings and revenue. Adding to the positive sentiment, data showed China's March exports handily beat expectations, rising for the first time in nine months. Global markets rallied following the data. However, U.S. retail sales and producer prices unexpectedly fell in March, more evidence that economic growth stumbled in the first quarter.

Most of Dow stocks in positive area (24 of 30). Top looser - Verizon Communications Inc. (VZ, -1,54%). Top gainer - JPMorgan Chase & Co. (JPM +4,54%).

Almost all of S&P sectors in positive area. Top looser - Utilities (-0,3%). Top gainer - Financial (+2,0%).

At the moment:

Dow 17786.00 +149.00 +0.84%

S&P 500 2071.50 +15.75 +0.77%

Nasdaq 100 4534.50 +44.50 +0.99%

Oil 42.21 +0.04 +0.09%

Gold 1247.30 -13.60 -1.08%

U.S. 10yr 1.78 +0.00

-

18:00

European stocks close: stocks closed higher on the Chinese trade data

Stock indices closed higher on the Chinese trade data. The Chinese Customs Office released its trade data on Wednesday. China's trade surplus dropped to $29.86 billion in March from $32.59 billion in February, missing expectations for a decline to a surplus of $30.85 billion. Exports climbed at an annual rate of 11.5% in March, while imports slid at an annual rate of 13.8%, the sixteenth consecutive decline.

Market participants also eyed the economic data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Wednesday. Industrial production in the Eurozone fell 0.8% in February, missing expectations for a 0.7% decrease, after a 1.9% rise in January. January's figure was revised down from a 2.1% increase.

Non-durable consumer goods output dropped 1.8% in February, capital goods output decreased 0.3%, while energy output fell 1.2%. Intermediate goods output were flat in February, while durable consumer goods declined 0.4%.

On a yearly basis, Eurozone's industrial production rise 0.8% in February, missing expectations for a 1.2% rise, after a 2.9% increase in January. January's figure was revised up from a 2.8% gain.

Durable consumer goods climbed by 0.8% in February from a year ago, capital goods rose by 3.0%, non-durable consumer goods gained by 0.7%, while intermediate goods output increased by 1.9%. Energy output declined by 5.2% in February from a year ago.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,362.89 +120.50 +1.93 %

DAX 10,026.1 +264.63 +2.71 %

CAC 40 4,490.31 +144.40 +3.32 %

-

18:00

European stocks closed: FTSE 6353.52 111.13 1.78%, DAX 10003.86 242.39 2.48%, CAC 40 4475.14 129.23 2.97%

-

17:39

Bank of England’s quarterly Credit Conditions Survey: consumer credit continues to rise strongly

The Bank of England released its quarterly Credit Conditions Survey on Wednesday. Consumer credit continued to rise strongly in the three months to February, mainly driven by the increased provision of car finance.

According to the report, mortgage lending increased in the recent months.

Net lending to UK non-financial businesses was positive in the three months to February 2016, the central bank said.

-

17:30

Fed Chairwoman Janet Yellen: the Fed’s cautious approach in hiking interest rate should help to avoid “the big mistakes”

Fed Chairwoman Janet Yellen said in an interview with Time Magazine that the Fed's cautious approach in hiking interest rate should help to avoid "the big mistakes". She noted that it was the appropriate approach as there was uncertainty.

"In such an environment, it makes sense to use a risk-management approach to identify and avoid the big mistakes. That's one reason I favour a cautious approach," Yellen said.

-

17:18

U.K. leading economic index increases 0.2% in February

The Conference Board (CB) released its leading economic index for the U.K. on Wednesday. The leading economic index (LEI) increased 0.2% in February, after a 0.3% rise in January. January's figure was revised up from a 0.2% gain.

The coincident index was flat in February, after a 0.2% increase in January. January's figure was revised down from a 0.3% rise.

-

16:53

Bank of Canada keeps its interest rate unchanged at 0.50% in April

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy was appropriate. This decision was expected by analysts.

The BoC upgraded its growth forecast for to 1.7% from 1.4%. The economy is expected to expand 2.3% in 2017 and 2.0% in 2018.

The BoC noted that the Canadian economic growth in the first quarter was unexpectedly strong due to temporary factors, adding that it will reverse in the second quarter.

The central bank also said that the labour market continued to improve, household spending continued to expand moderately, while business investment was shrinking.

According to the central bank, inflation was evolving as anticipated by the BoC, and was expected to decline further.

Risks around the inflation are roughly balanced, the central bank said.

The BoC added that financial vulnerabilities continued to edge higher.

-

16:24

U.S. business inventories decrease 0.1% in February

The U.S. Commerce Department released the business inventories data on Wednesday. The U.S. business inventories decline 0.1% in February, in line with expectations, after a 0.1% decrease in January. January's figure was revised down from a 0.1% rise.

Retail inventories climbed 0.6% in February, wholesale inventories were down 0.5%, while manufacturing inventories decreased 0.4%.

Retail sales declined 0.2% in February, while business sales were down 0.4%.

The business inventories/sales ratio remained unchanged at 1.41 months in February. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

15:35

WSE: After start on Wall Street

U.S. Stocks opened into green: Dow +0.48%, Nasdaq +0.73%, S&P +0.52%

The second half of today's session will be influenced by readings of macroeconomic data from the US. Data on both retail sales and PPI suggest that the US economy is growing and is not heading towards a recession, but growth is quite modest. This leaves little room for expectation of interest rate increases, with implications for USD exchange rate.

This afternoon the Warsaw market is quite calm, although the + 1.7% increase in the main index should generate significant interest, but in practice, a large part of this deviation was absorbed by the high opening. For the past few hours the market is drifting horizontally with approximately 15-points of volatility. All of this is happening under the local resistance level of 1,940 points. Closing the session at this point would indicate resumption of growth at tomorrow's opening.

-

15:32

U.S. Stocks open: Dow +0.48%, Nasdaq +0.73%, S&P +0.52%

-

15:20

Before the bell: S&P futures +0.46%, NASDAQ futures +0.70%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,381.22 +452.43 +2.84%

Hang Seng 21,158.71 +654.27 +3.19%

Shanghai Composite 3,067.2 +43.55 +1.44%

FTSE 6,332.8 +90.41 +1.45%

CAC 4,453.04 +107.13 +2.47%

DAX 9,955.51 +194.04 +1.99%

Crude oil $41.55 (-1.47%)

Gold $1248.40 (-0.99%)

-

15:09

Producer prices in Japan fall 0.1% in March

The Bank of Japan (BoJ) released its Corporate Goods Price Index (CGPI) data on late Tuesday evening. Producer prices in Japan declined 0.1% in March, after a 0.2% fall in February.

Export prices rose 0.3% in March, while import prices increased 0.3%.

On a yearly basis, producer prices slid 3.8% in March, after a 3.4% drop in February. It was the biggest drop since October 2015

Export prices dropped 4.8% year-on-year in March, while import prices plunged 15.6%.

-

15:00

U.S. retail sales decline 0.3% in March

The U.S. Commerce Department released the retail sales data on Wednesday. The U.S. retail sales declined 0.3% in March, missing expectations for a 0.1% rise, after a 0.1% fall in February.

The decrease was mainly driven by a fall in sales at auto dealerships.

Sales at clothing retailers were down 0.9% in March, sales at building material and garden equipment stores increased 1.4%, while sales at auto dealerships slid 2.1%.

Retail sales excluding automobiles rose 0.2% in March, missing expectations for a 0.5% increase, after a 0.1% decline in February.

Sales at service stations climbed 0.9% in March, while sales at furniture stores rose 0.3%.

These figures indicates that the U.S. economic growth was weak in the first quarter.

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.57

0.09(0.9494%)

126723

ALTRIA GROUP INC.

MO

63.99

0.17(0.2664%)

600

Amazon.com Inc., NASDAQ

AMZN

606.68

3.51(0.5819%)

25576

AMERICAN INTERNATIONAL GROUP

AIG

54.07

0.28(0.5205%)

2602

Apple Inc.

AAPL

110.96

0.52(0.4708%)

123919

AT&T Inc

T

38.8

0.13(0.3362%)

3975

Barrick Gold Corporation, NYSE

ABX

15.87

-0.48(-2.9358%)

117513

Boeing Co

BA

130.25

0.78(0.6025%)

1649

Caterpillar Inc

CAT

76.45

0.35(0.4599%)

2069

Chevron Corp

CVX

97.4

-0.11(-0.1128%)

7646

Cisco Systems Inc

CSCO

27.78

0.14(0.5065%)

6020

Citigroup Inc., NYSE

C

42.63

0.73(1.7422%)

179828

Exxon Mobil Corp

XOM

84.17

-0.18(-0.2134%)

3298

Facebook, Inc.

FB

112.02

1.41(1.2747%)

297734

Ford Motor Co.

F

12.89

0.08(0.6245%)

17837

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.74

0.31(2.9722%)

272765

General Electric Co

GE

30.94

0.13(0.4219%)

40346

General Motors Company, NYSE

GM

29.98

0.27(0.9088%)

22300

Goldman Sachs

GS

156.3

1.99(1.2896%)

21421

Google Inc.

GOOG

747

3.91(0.5262%)

4506

Hewlett-Packard Co.

HPQ

12.3

0.08(0.6547%)

400

Home Depot Inc

HD

135.25

0.87(0.6474%)

504

Intel Corp

INTC

32.05

0.19(0.5964%)

8011

JPMorgan Chase and Co

JPM

60.6

1.32(2.2267%)

664729

McDonald's Corp

MCD

127.69

0.08(0.0627%)

100

Microsoft Corp

MSFT

54.97

0.32(0.5855%)

10179

Nike

NKE

58.89

0.34(0.5807%)

4511

Pfizer Inc

PFE

31.89

-0.07(-0.219%)

1001447

Procter & Gamble Co

PG

83.2

0.37(0.4467%)

1320

Starbucks Corporation, NASDAQ

SBUX

59.82

0.32(0.5378%)

5179

Tesla Motors, Inc., NASDAQ

TSLA

249.25

1.43(0.577%)

22061

The Coca-Cola Co

KO

46.82

0.17(0.3644%)

543

Twitter, Inc., NYSE

TWTR

16.69

0.12(0.7242%)

55534

Verizon Communications Inc

VZ

52.09

0.14(0.2695%)

5269

Visa

V

79.04

0.52(0.6623%)

4829

Wal-Mart Stores Inc

WMT

69.1

0.30(0.436%)

3788

Walt Disney Co

DIS

97.71

0.36(0.3698%)

2840

Yahoo! Inc., NASDAQ

YHOO

37

0.34(0.9274%)

29213

Yandex N.V., NASDAQ

YNDX

16.81

0.05(0.2983%)

290

-

14:52

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

McDonald's (MCD) resumed with a Underperform at Credit Agricole

Starbucks (SBUX) resumed with a Buy at Credit Agricole

Yahoo! (YHOO) target raised to $44 from $40 at Sun Trust Rbsn Humphrey

-

14:49

U.S. producer prices fall 0.1% in March

The U.S. Commerce Department released the producer price index figures on Wednesday. The U.S. producer price index fell 0.1% in March, missing expectations for a 0.2% rise, after a 0.2% drop in February.

The decrease was mainly driven by a fall in services prices.

Energy prices increased 1.8% in March, wholesale food prices decreased 0.9%.

Services prices were down 0.2% in March, the first fall since October 2015, while prices for goods rose 0.2%.

On a yearly basis, the producer price index decreased 0.1% in March, missing expectations for a 0.3% increase, after a flat reading in February.

The producer price index excluding food and energy decreased 0.1% in March, missing expectations for a 0.1% gain, after a flat reading in February.

On a yearly basis, the producer price index excluding food and energy climbed 1.0% in March, missing forecasts of a 1.3% increase, after a 1.2% rise in February.

These figures could mean that the Fed will raise its interest rate cautiously and gradually.

-

13:47

-

13:13

WSE: Lotos SA Group

Listed fuel Group Lotos's SA (WSE: LTS) supervisory board dismissed the firm's long-standing CEO Pawel Olechnowicz and named Robert Pietryszyn as acting CEO.

Paweł Olechnowicz led Lotos since 2002. At that time company operated under the name of Gdansk Refinery. This makes the manager longest-serving president in the history of a listed company.

Olechnowicz's potential dismissal has been subject of media speculation in the recent months.

Lotos SA Group is the oil company, which is engaged in the exploration and production of crude oil, its processing, wholesale and retail sale of high-quality petroleum products. In 2015 Lotos Group SA recorded a PLN 22.7 Billion consolidated revenue.

-

12:25

WSE: Mid session comment

The morning session phase ended with a respectable increase of the WIG20 (+1.4%), which appears to reflect the atmosphere of the environment, where the DAX is rising by more than 2%. The issue to watch out for in Warsaw is the turnover volume, which is only somewhat higher than PLN 190 mln on the WIG20. With such a low volume gives a legitimate reason to suspect that the index increase does not have a lot of strength. While smaller participants benefit from the occasion, bigger participants withdraw from bidding on this movement.

We also have to consider that this growth of the market is being built on credit confidence to Wall Street, the entrance to the game of the US markets can weaken the upward pressure of the core markets.

-

12:00

European stock markets mid session: stocks traded higher on the Chinese trade data

Stock indices traded higher on the Chinese trade data. The Chinese Customs Office released its trade data on Wednesday. China's trade surplus dropped to $29.86 billion in March from $32.59 billion in February, missing expectations for a decline to a surplus of $30.85 billion. Exports climbed at an annual rate of 11.5% in March, while imports slid at an annual rate of 13.8%, the sixteenth consecutive decline.

Market participants also eyed the economic data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Wednesday. Industrial production in the Eurozone fell 0.8% in February, missing expectations for a 0.7% decrease, after a 1.9% rise in January. January's figure was revised down from a 2.1% increase.

Non-durable consumer goods output dropped 1.8% in February, capital goods output decreased 0.3%, while energy output fell 1.2%. Intermediate goods output were flat in February, while durable consumer goods declined 0.4%.

On a yearly basis, Eurozone's industrial production rise 0.8% in February, missing expectations for a 1.2% rise, after a 2.9% increase in January. January's figure was revised up from a 2.8% gain.

Durable consumer goods climbed by 0.8% in February from a year ago, capital goods rose by 3.0%, non-durable consumer goods gained by 0.7%, while intermediate goods output increased by 1.9%. Energy output declined by 5.2% in February from a year ago.

Current figures:

Name Price Change Change %

FTSE 100 6,334.24 +91.85 +1.47 %

DAX 9,979.35 +217.88 +2.23 %

CAC 40 4,452.56 +106.65 +2.45 %

-

11:50

Westpac’s consumer confidence index for Australia falls 4.0% in April

Westpac Bank released its consumer confidence index for Australia on late Tuesday evening. The index fell 4.0% in April, after a 2.2% decline in March.

The index was driven by declines in four of the five sub-indexes.

"It appears that international and market developments continue to create unease for respondents although the signals are mixed," Westpac Chief Economist Bill Evans said.

"The Reserve Bank Board next meets on May 3. Despite this disappointing read on sentiment we expect the Board will keep rates on hold for another month. We retain our call that rates will remain on hold for the remainder of 2016," he added.

-

11:42

Final consumer price inflation in Spain rises 0.6% in March

The Spanish statistical office INE released its final consumer price inflation data on Wednesday. Consumer price inflation in Spain was up 0.6% in March, in line with the preliminary reading, after a 0.4% decrease in February.

The monthly rise was mainly driven by an increase in clothing and footwear, which climbed 4.3% in March.

On a yearly basis, consumer prices fell by 0.8% in March from a year ago, in line with preliminary reading, after a 0.8% decline in February.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

11:33

French final consumer price inflation rises 0.7% in March

The French statistical office Insee released its final consumer price inflation for France on Wednesday. The French consumer price inflation rose 0.7% in March, in line with the preliminary reading, after a 0.3% increase in February.

On a yearly basis, the consumer price index decreased 0.1% in March, up from the preliminary reading of -0.2%, after a 0.2% decline in February.

Fresh food prices rose 0.4% year-on-year in March, services prices climbed by 0.9%, while petroleum products prices dropped by 13.2%.

-

11:27

Eurozone’s industrial production falls 0.8% in February

Eurostat released its industrial production data for the Eurozone on Wednesday. Industrial production in the Eurozone fell 0.8% in February, missing expectations for a 0.7% decrease, after a 1.9% rise in January. January's figure was revised down from a 2.1% increase.

Non-durable consumer goods output dropped 1.8% in February, capital goods output decreased 0.3%, while energy output fell 1.2%.

Intermediate goods output were flat in February, while durable consumer goods declined 0.4%.

On a yearly basis, Eurozone's industrial production rise 0.8% in February, missing expectations for a 1.2% rise, after a 2.9% increase in January. January's figure was revised up from a 2.8% gain.

Durable consumer goods climbed by 0.8% in February from a year ago, capital goods rose by 3.0%, non-durable consumer goods gained by 0.7%, while intermediate goods output increased by 1.9%.

Energy output declined by 5.2% in February from a year ago.

-

11:08

San Francisco Fed President John Williams: two or three interest rate hikes this year would be appropriate

San Francisco Fed President John Williams said on Tuesday that two or three interest rate hikes this year would be appropriate. He pointed out that it did not matter when to raise the interest rate.

"We stay on this kind of basic path of raising interest rates gradually over the next couple of years, that's kind of what's important for financial conditions," Williams added.

He noted that the Fed's interest rate hikes would not lead to a lot of turmoil in financial markets.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:59

Richmond Fed President Jeffrey Lacker: the Fed should raise its interest rate as inflation in the U.S. picked up

Richmond Fed President Jeffrey Lacker said on Tuesday that the Fed should raise its interest rate as inflation in the U.S. picked up. He added that the Fed should hike its interest rate four times this year.

"My sense is that the less leisurely but still gradual pace of target rate increases that FOMC participants submitted at year-end is still more likely to be appropriate," Lacker said.

He noted that global risks to the U.S. subsided.

Lacker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:39

Fitch Ratings affirms the U.S.’s sovereign debt rating at 'AAA'

Rating agency Fitch Ratings affirmed the U.S.'s sovereign debt rating at 'AAA'. The outlook is 'stable'.

"The U.S.'s 'AAA' rating is underpinned by the sovereign's unparalleled financing flexibility as the issuer of the world's pre-eminent reserve currency and benchmark fixed-income asset and as home to the world's deepest and most liquid capital markets," the agency said.

Fitch expects general government debt to increase to over 107% of GDP over the next decade from 101% of GDP in 2016, while federal fiscal deficit is expected to rise 2.9% of GDP in 2016 from 2.5% of GDP in 2015 according to the Congressional Budget Office.

The agency downgraded its growth forecasts to 2.1% in 2016 and 2017.

Fitch expects two interest rate hikes in 2016 and three in 2017.

-

10:25

China's trade surplus drops to $29.86 billion in March

The Chinese Customs Office released its trade data on Wednesday. China's trade surplus dropped to $29.86 billion in March from $32.59 billion in February, missing expectations for a decline to a surplus of $30.85 billion.

Exports climbed at an annual rate of 11.5% in March, while imports slid at an annual rate of 13.8%, the sixteenth consecutive decline.

-

10:11

U.S. budget deficit is $108.0 billion in March

The U.S. Treasury Department released its federal budget data on Tuesday. The budget deficit was $108.0 billion in March, missing expectations for a deficit of $104.0 billion, after a deficit of $109.0 billion in February.

The budget deficit was driven by higher expenditure for military programs, Medicare and other categories.

In the six months of the fiscal year 2016, which ends at September this year, the budget deficit totalled $461.0 billion, up 5.0% from a year ago.

-

09:19

WSE: After opening

WIG20 index opened at 1918.51 points (+0.57% to previous close)

WIG 47698.46 +0.73%

WIG30 2146.69 +0.89%

mWIG40 3559.37 +0.34%

After the first few bars the growth of index reached 1% and this shift of the market requires certain decisions among the participants of the trade, what we can see in the turnover, which in comparison with the two previous sessions presents at last decent. The WIG20 starts virtually with complete of greens. The copper company KGHM (WSE: KGH) is a leader in the WIG20 index at the opening. Shares KGH becoming more expensive by nearly 3 percent with PLN 3 mln of turnover

Europe also begins sessions of strong increases. CAC grow by 1.5 percent, and the DAX by 1.4 percent.

-

08:26

WSE: Before opening

Tuesday's trading on Wall Street was the first day on which the investors would move their attention from the macro data and the currency market on the condition of the companies. Border point was the quarterly report of the company Alcoa, whose results traditionally considered to be the beginning of the publication reports season. Aluminum producer posted figures that were better on the level of profit, but showed a drop in revenues. The company's shares have lost more than 2 percent yesterday.

On the other hand, the behavior of the market of raw materials, where the rise in oil prices and metal parts supported bulls, led to the situation that all US indices ended the day with increases.

Futures for US indices are traded now about 0.6 percent higher than during yesterday's finish in Europe and a similar rise can be expected at the openings of session eg. in Frankfurt. Additionally the Nikkei index rose by almost 3% due to the weakening of Yen.

In the following hours the attention of investors should be focus on Wall Street, where the results of JP Morgan will be announced today.

It must therefore be assumed that morning in Europe will adjust the valuation to yesterday's session on Wall Street and consolidate in anticipation of what will appear in the United States.

-

04:04

Nikkei 225 16,259.24 +330.45 +2.07 %, Hang Seng 20,779.08+274.64 +1.34 %, Shanghai Composite 3,049.32 +25.67 +0.85 %

-

00:33

Stocks. Daily history for Sep Apr 12’2016:

(index / closing price / change items /% change)

HANG SENG 20,496.43 +55.62 +0.27%

S&P/ASX 200 4,975.6 +44.07 +0.89%

TOPIX 1,299.35 +19.56 +1.53%

SHANGHAI COMP 3,024.53 -9.43 -0.31%

FTSE 100 6,242.39 +42.27 +0.68 %

CAC 40 4,345.91 +33.28 +0.77 %

Xetra DAX 9,761.47 +78.48 +0.81 %

S&P 500 2,061.72 +19.73 +0.97 %

NASDAQ Composite 4,872.09 +38.69 +0.80 %

Dow Jones 17,721.25 +164.84 +0.94 %

-