Noticias del mercado

-

22:17

U.S. stocks closed

U.S. stocks ended little changed on Thursday, with the Standard & Poor's 500 Index near a four-month high, as investors assessed earnings releases and data showing the labor market is improving with little pickup in inflation.

Banks rallied, with Bank of America Corp. advancing a fifth day after saying it sees more room for cost cuts. Airline operators jumped along with Delta Air Lines Inc., which posted quarterly earnings that beat projections. Technology shares retreated as Seagate Technology Plc plummeted 20 percent after reporting preliminary revenue that trailed estimates.

The S&P 500 added less than 0.1 percent to 2,082.78 at 4 p.m. in New York, after reaching the highest level since Dec. 4 yesterday. Financial shares and commodity producers have led the benchmark gauge to a 1.7 percent advance so far this week, after the measure faltered last week amid skepticism central banks' efforts to shore up growth will fail to be effective. The Dow Jones Industrial Average increased by 18 points to 17,926.43 on Thursday.

While the rally that lifted the S&P 500 since February is regaining momentum, skepticism still prevails, with valuations far above their five-year average and the seven-year bull market weeks away from becoming the second-longest in history. Some investors also attribute the rebound to short squeezes, with a Goldman Sachs Group Inc. gauge of the 50 most-shorted stocks posting its biggest two-day jump in almost two months.

Analysts have slashed profit estimates for S&P 500 members this year, now projecting net income fell 10 percent in the first quarter. Investors are also tracking economic releases. Stock futures climbed in pre-market trading after data showed initial jobless claims fell to match the lowest level since 1973 and the cost of living excluding food and fuel rose less than forecast in March.

-

21:00

DJIA 17926.50 18.22 0.10%, NASDAQ 4948.88 1.46 0.03%, S&P 500 2083.64 1.22 0.06%

-

18:01

European stocks close: stocks closed higher on a rise in oil prices

Stock indices closed higher on a rise in oil prices. Oil prices rise ahead of the meeting between OPEC and non-OPEC countries in Doha on April 17. The International Energy Agency (IEA) said on Thursday that a deal on the freeze of the oil production would not balance the oil market. The agency noted that the oil market would balance in the second half of the year.

Market participants also eyed the economic data from the Eurozone. Eurozone's harmonized consumer price index rose 1.2% in March, in line with expectations, after a 0.2% increase in February.

On a yearly basis, Eurozone's final consumer price inflation increased to 0.0% in March from -0.2% in February, up from the preliminary reading of -0.1%.

Restaurants and cafés prices were up 0.12% year-on-year in March, rents increased by 0.07%, package holidays rose by 0.09%, fuel prices for transport declined by 0.60%, heating oil prices decreased by 0.23%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco climbed to an annual rate of 1.0% in March from 0.8 in February, in line with the preliminary reading.

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Bank of England's Monetary Policy Committee (MPC) released its March meeting minutes on Thursday. All members voted to keep the central bank's monetary policy unchanged. The BoE noted that the pound depreciated in the recent month, adding that uncertainty around the referendum on Britain's membership in the European Union weighed on the currency.

The central bank said that uncertainty around the referendum on Britain's membership in the European Union also weighed on Britain's economy.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,365.1 +2.21 +0.03 %

DAX 10,093.65 +67.55 +0.67 %

CAC 40 4,511.51 +21.20 +0.47 %

-

18:00

European stocks closed: FTSE 6365.10 2.21 0.03%, DAX 10093.65 67.55 0.67%, CAC 40 4511.51 21.20 0.47%

-

17:54

International Monetary Fund Managing Director Christine Lagarde: Britain’s exit from the European Union (EU) is "one of the serious downside risks” to the global growth outlook

The International Monetary Fund (IMF) Managing Director Christine Lagarde said on Thursday that Britain's exit from the European Union (EU) was "one of the serious downside risks" to the global growth outlook. She added that she hopped Britain would leave the EU.

-

17:42

WSE: Session Results

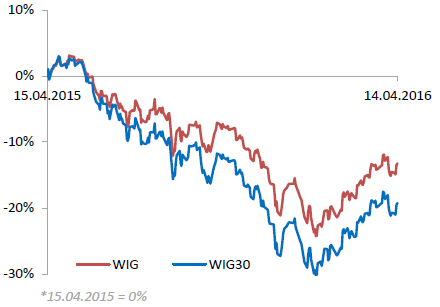

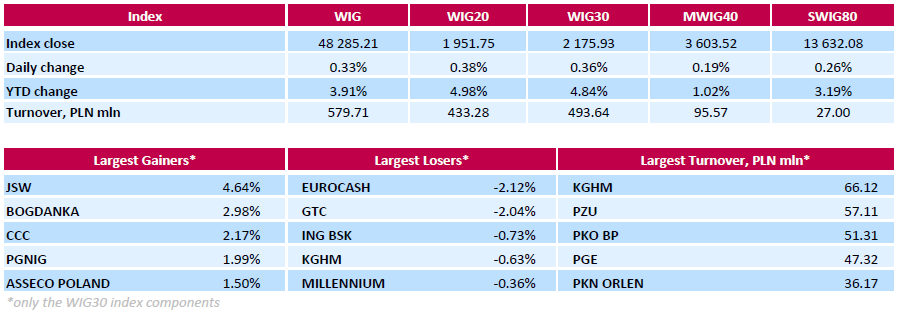

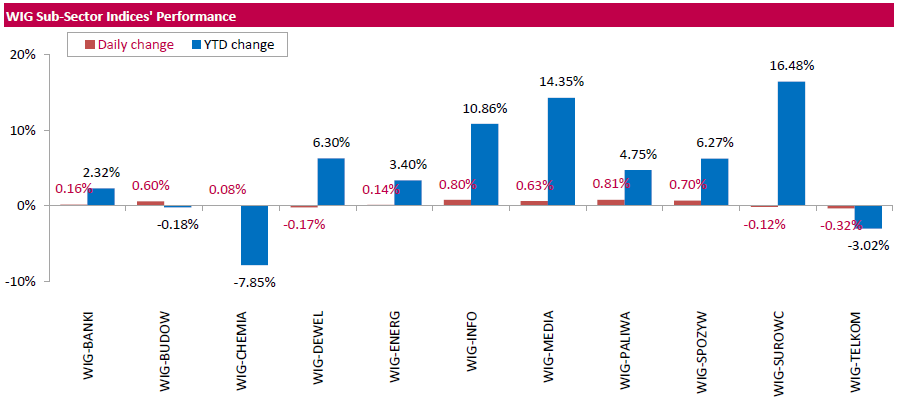

Polish equity market closed higher on Thursday. The broad market benchmark, the WIG Index, added 0.33%. Sector-wise, oil and gas sector (+0.81%) was the best-performing group, while telecoms (-0.32%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, grew by 0.36%. Within the index components, two coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB), and footwear retailer CCC (WSE: CCC) topped the list of the session's best performers, gaining 4.64%, 2.98% and 2.17% respectively. Oil and gas company PGNIG (WSE: PGN) advanced 1.99% after the company announced appointment of its new CEO. On the other side of the ledger, FMCG-wholesaler EUROCASH (WSE: EUR) recorded the biggest drop of 2.12%, following the news Poland plans to impose a new retail tax at between 0.4% and 1.4% of companies' monthly revenue. Other major decliners were property developer GTC (WSE: GTC), banking sector name ING BSK (WSE: ING) and copper producer KGHM (WSE: KGH), plunging by 2.04%, 0.73% and 0.63% respectively.

-

17:33

Wall Street. Major U.S. stock-indexes mixed

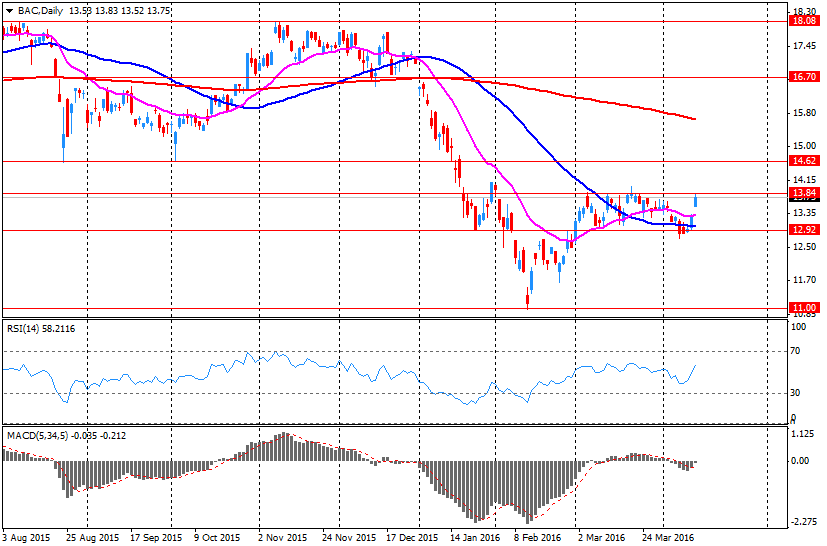

Major U.S. stock-indexes flat on Thursday as investors parsed earnings of big banks, while data pointed to strength in the labor market, despite sluggish economic growth. Bank of America (BAC) and Wells Fargo (WFC) posted lower quarterly profits and increased reserves to cover bad loans from their energy portfolios. Data on Thursday showed U.S. consumer prices barely rose in March, while jobless claims fell more than expected and sank to levels last seen in 1973.

Dow stocks mixed (17 in positive area, 13 in negative area). Top looser - Intel Corporation (INTC, -1,15%). Top gainer - JPMorgan Chase & Co. (JPM +1,20%).

Most of S&P sectors in positive area. Top looser - Utilities (-0,3%). Top gainer - Financial (+0,3%).

At the moment:

Dow 17848.00 +20.00 +0.11%

S&P 500 2076.75 +0.75 +0.04%

Nasdaq 100 4545.75 -2.00 -0.04%

Oil 41.93 +0.17 +0.41%

Gold 1233.60 -14.70 -1.18%

U.S. 10yr 1.79 +0.02

-

16:25

Business NZ performance of manufacturing index for New Zealand declines to 54.7 in March

According to the Business NZ Survey published on late Thursday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand declined to 54.7 in March from 55.9 in February. It was the lowest level since October 2015.

February's figure was revised down from 56.0.

A reading above 50 indicates expansion in the manufacturing sector.

The decline was driven by drops in all sub-indexes.

"While a number of negative comments mentioned a slowdown in both domestic and offshore orders, it is still important to remember that two-thirds of comments from manufacturers remain positive, not to mention that the sector is still in expansion mode," Business NZ's executive director for manufacturing, Catherine Beard, said.

-

16:05

U.S. weekly earnings rise 0.2% in March

The U.S. Labor Department released its real earnings data on Thursday. Average weekly earnings rose 0.2% in March, after a 0.5% decrease in February.

Average hourly earnings increased 0.2% in March, after a 0.1% rise in February.

On a yearly basis, real average weekly earnings increased 1.1% in March, while hourly earnings rose 1.4%.

-

15:49

Atlanta Fed President Dennis Lockhart changes his mind and will not support an interest rate hike in April

Atlanta Fed President Dennis Lockhart said in an interview with Bloomberg News on Thursday that he changed his mind and would not support an interest rate hike in April. He noted that consumer spending seemed to slow down.

Atlanta Fed president downgraded his growth forecast for 2016, saying that the U.S. economy was likely to expand about 2.0% this year, down from his previous estimate of 2.5%.

He pointed out that the next interest rate hike would not depend on 2% inflation.

Lockhart is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

15:44

WSE: After start on Wall Street

A series of data from the US, which we met this afternoon, was slightly positive for the demand side. The number of new applications for unemployment benefits were lower than expected and inflation has not proved to be as high as predicted. This means that the FOMC may be cautious in raising the cost of money, which leads to the weakening of the US currency. Inflationary pressure is not large, so there is no need to rush interest rate hikes, which would be beneficial from the point of view of the emerging markets.

After the publication of the data the growth of European stock exchanges was clearly accelerated.

U.S. Stocks open: Dow +0.08%, Nasdaq -0.03%, S&P +0.03%

The market in the United States opens in neutral. Two days of strong increases naturally dampen appetites, though demand may feel strong today after a set of data and yesterday's violation of the nearest resistance.

-

15:33

U.S. Stocks open: Dow +0.08%, Nasdaq -0.03%, S&P +0.03%

-

15:26

Bank of England's Monetary Policy Committee April minutes: uncertainty around the referendum on Britain’s membership in the European Union weighs on Britain’s economy

The Bank of England's Monetary Policy Committee (MPC) released its March meeting minutes on Thursday. All members voted to keep the central bank's monetary policy unchanged. Ian McCafferty, who voted to hike interest rate by 0.25% since August 2015, changed his mind in February.

The consumer price inflation in the U.K. was 0.5% in March, below the central bank's 2% target. The BoE noted that inflation was driven by declines in energy and food prices. The effect of falling in energy and food prices is expected to fade over the next year, according to the minutes.

The BoE noted that the pound depreciated in the recent month, adding that uncertainty around the referendum on Britain's membership in the European Union weighed on the currency.

The central bank said that uncertainty around the referendum on Britain's membership in the European Union also weighed on Britain's economy.

"There are some signs that uncertainty relating to the EU referendum has begun to weigh on certain areas of activity, as some decisions, including on capital expenditure and commercial property transactions, are being postponed pending the outcome of the vote. This might lead to some softening in growth during the first half of 2016," the minutes said.

The BoE noted that it was harder to interpret macroeconomic and financial market indicators in the coming months, saying that the central bank would likely act cautious.

All MPC members agreed to hike interest rate gradually once the BoE starts raising its interest rate and "to a lower level than in recent cycles", adding that further interest rate decision will depend on the incoming economic data.

-

15:24

Before the bell: S&P futures +0.11%, NASDAQ futures +0.02%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,911.05 +529.83 +3.23%

Hang Seng 21,337.81 +179.10 +0.85%

Shanghai Composite 3,082.54 +15.90 +0.52%

FTSE 6,370.69 +7.80 +0.12%

CAC 4,504.65 +14.34 +0.32%

DAX 10,075.5 +49.40 +0.49%

DAX 9,955.51 +194.04 +1.99%

Crude oil $42.09 (+0.79%)

Gold $1237.00 (-0.91%)

-

15:07

Canada’s new housing price index climbs 0.2% in February

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.2% in February, exceeding expectations of a 0.1% gain, after a 0.1% rise in January.

The increase was mainly driven by higher prices in Toronto and Vancouver. New home prices in Toronto and Oshawa region rose 0.4% in February, while prices in Vancouver climbed 0.8%.

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

168.78

0.19(0.1127%)

653

ALCOA INC.

AA

9.9

0.11(1.1236%)

14314

ALTRIA GROUP INC.

MO

62.1

0.03(0.0483%)

6390

Amazon.com Inc., NASDAQ

AMZN

616.26

1.44(0.2342%)

7058

American Express Co

AXP

62.06

-0.10(-0.1609%)

2242

Apple Inc.

AAPL

111.5

-0.54(-0.482%)

214435

AT&T Inc

T

38.25

0.00(0.00%)

3896

Barrick Gold Corporation, NYSE

ABX

16

-0.05(-0.3115%)

55951

Caterpillar Inc

CAT

79.24

0.11(0.139%)

1972

Chevron Corp

CVX

97.5

-0.10(-0.1025%)

538

Cisco Systems Inc

CSCO

28.29

0.06(0.2125%)

6269

Citigroup Inc., NYSE

C

44.2

-0.05(-0.113%)

173015

Deere & Company, NYSE

DE

78.75

0.29(0.3696%)

10022

Exxon Mobil Corp

XOM

84.82

-0.01(-0.0118%)

14038

Facebook, Inc.

FB

110.87

0.36(0.3258%)

151509

Ford Motor Co.

F

13.1

0.04(0.3063%)

12481

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.03

0.21(1.9408%)

124795

General Electric Co

GE

31

0.02(0.0646%)

3733

General Motors Company, NYSE

GM

30.72

-0.06(-0.1949%)

1564

Goldman Sachs

GS

159.75

-0.10(-0.0626%)

1394

Google Inc.

GOOG

753

1.28(0.1703%)

1283

HONEYWELL INTERNATIONAL INC.

HON

114.34

-0.40(-0.3486%)

100

Intel Corp

INTC

31.79

-0.34(-1.0582%)

87765

International Business Machines Co...

IBM

151.25

0.02(0.0132%)

1092

Johnson & Johnson

JNJ

110.06

0.19(0.1729%)

900

JPMorgan Chase and Co

JPM

61.57

-0.22(-0.356%)

34467

McDonald's Corp

MCD

127.11

0.22(0.1734%)

930

Merck & Co Inc

MRK

55.98

0.02(0.0357%)

1650

Microsoft Corp

MSFT

55.45

0.10(0.1807%)

8896

Nike

NKE

59.87

0.29(0.4867%)

4773

Pfizer Inc

PFE

32.53

-0.01(-0.0307%)

1794

Procter & Gamble Co

PG

81.92

0.1295(0.1583%)

1512

Tesla Motors, Inc., NASDAQ

TSLA

254.44

-0.09(-0.0354%)

7482

The Coca-Cola Co

KO

46.04

0.00(0.00%)

1124

Twitter, Inc., NYSE

TWTR

17.46

0.09(0.5181%)

27227

Verizon Communications Inc

VZ

51.15

-0.14(-0.273%)

1520

Visa

V

79.7

-0.01(-0.0125%)

2827

Wal-Mart Stores Inc

WMT

69.27

0.12(0.1735%)

2472

Walt Disney Co

DIS

99.16

-0.32(-0.3217%)

1276

Yahoo! Inc., NASDAQ

YHOO

37.51

0.20(0.536%)

20509

Yandex N.V., NASDAQ

YNDX

16.87

0.12(0.7164%)

1540

-

14:53

U.S. consumer price inflation rises 0.1% in March

The U.S. Labor Department released consumer price inflation data on Thursday. The U.S. consumer price inflation rose 0.1% in March, missing expectations for a 0.2% gain, after a 0.2% drop in February.

The index was mainly driven by higher energy prices, which climbed 0.9% in March.

Shelter costs climbed 0.2% in March, medical care costs were up 0.1%, while food prices decreased 0.2%.

On a yearly basis, the U.S. consumer price index decreased to 0.9% in March from 1.0% in February, missing expectations for a rise to 1.1%.

The U.S. consumer price inflation excluding food and energy gained 0.1% in March, missing expectations for a 0.2% rise, after a 0.3% increase in February.

The increase was driven by rents and medical costs.

On a yearly basis, the U.S. consumer price index excluding food and energy fall to 2.2% in March from 2.3% in February. Analysts had expected the index to remain unchanged at 2.3%.

The consumer price index is not preferred Fed's inflation measure.

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

JPMorgan Chase (JPM) reiterated with an Outperform at FBR Capital; target $75

UnitedHealth (UNH) reiterated with an Outperform at FBR Capital; target $130

-

14:40

Initial jobless claims decline to 253,000 in the week ending April 09

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending April 09 in the U.S. decreased by 13,000 to 253,000 from 266,000 in the previous week. The previous week's figure was revised down from 267,000.

Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 58th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 18,000 to 2,171,000 in the week ended April 02.

-

14:24

Bank of England keeps its interest rate on hold at 0.5% in April

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

-

13:33

-

13:16

WSE: Mid session comment

The middle phase of the session brought a slight stagnation. The scale of the current approach of future contracts in Frankfurt and Paris to the area of March peaks dampens appetite for further purchases and indexes are in slight fluctuations. The market obviously is going sideways, suggesting rest after yesterday's very strong approach up. Despite moderate fluctuations we have a slightly more interesting piece of trading on the stock exchanges in the region. The WIG20 return to the session highs accompanied by stronger attitude of parquet in Budapest, where the local BUX index with an increase of 0.8 percent returns to the maximum level of last Monday session.

-

12:00

European stock markets mid session: stocks traded mixed on lower oil prices

Stock indices traded mixed on lower oil prices. Oil prices fell on concerns that a deal on the freeze of the oil output would not reached at the meeting between OPEC and non-OPEC countries in Doha on April 17. The International Energy Agency (IEA) said on Thursday that a deal on the freeze of the oil production would not balance the oil market.

Market participants also eyed the economic data from the Eurozone. Eurozone's harmonized consumer price index rose 1.2% in March, in line with expectations, after a 0.2% increase in February.

On a yearly basis, Eurozone's final consumer price inflation increased to 0.0% in March from -0.2% in February, up from the preliminary reading of -0.1%.

Restaurants and cafés prices were up 0.12% year-on-year in March, rents increased by 0.07%, package holidays rose by 0.09%, fuel prices for transport declined by 0.60%, heating oil prices decreased by 0.23%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco climbed to an annual rate of 1.0% in March from 0.8 in February, in line with the preliminary reading.

The Bank of England (BoE) will release its interest rate decision later in the day. Analysts expect the central bank to keep its monetary policy unchanged.

Current figures:

Name Price Change Change %

FTSE 100 6,359.5 -3.39 -0.05 %

DAX 10,054.46 +28.36 +0.28 %

CAC 40 4,488.59 -1.72 -0.04 %

-

11:52

European Central Bank Vice President Vitor Constancio: there are limits of negative interest rates

European Central Bank (ECB) Vice President Vitor Constancio said in a speech on Wednesday that there were limits of negative interest rates.

"There are clear limits to the use of negative deposit facility rates as a policy instrument," he said.

"First, there is always the possibility of hitting the limit where the preference for cash withdrawals would set in. Second, the instruments should not push banks to pass on their additional direct costs by turning deposit rates negative or increasing lending rates to increase margins," Constancio added.

The ECB vice president defended the central bank's negative interest rates, saying that the result would be positive for the Eurozone as a whole. He added that time was needed for the recent ECB's stimulus measures "to fully materialize".

-

11:41

Final consumer prices in Italy increase 0.2% in March

The Italian statistical office Istat released its final consumer price inflation data for Italy on Thursday. Final consumer prices in Italy increased 0.2% in March, in line with preliminary reading, after a 0.2% decrease in February.

The monthly increase was driven by rises in prices of services related to transport. Prices for services related to transport rose 1.0% in March.

On a yearly basis, consumer prices declined 0.2% in March, in line with preliminary reading, after a 0.3% decline in February.

The declines was mainly driven by a faster decline of prices of non-regulated energy products. Prices of non-regulated energy products slid 11.2% year-on-year in March.

Final consumer price inflation excluding unprocessed food and energy prices rose to 0.6% year-on-year in March from 0.5% in February.

-

11:34

Switzerland's producer and import prices are flat in March

The Federal Statistical Office released its producer and import prices data on Thursday. Switzerland's producer and import prices were flat in March, beating expectations for a 0.2% fall, after a 0.6% decrease in February.

The Import Price Index was flat in March, while producer prices rose 0.1%.

On a yearly basis, producer and import prices plunged 4.7% in March, after a 4.6% drop in February.

The Import Price Index fell by 7.5% year-on year in March, while producer prices dropped 3.5%.

-

11:26

RICS house price balance for the U.K. drops to +42% in March

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on Thursday. The monthly house price balance dropped to +42% in March from +50% in February.

The RICS noted that uncertainty increased due to the impact of Stamp Duty changes, the EU referendum and devolved elections.

"As expected, the buy-to-let rush has now run its course and, as a natural result, the market is starting to slow," RICS Chief Economist, Simon Rubinsohn, said.

"The EU referendum, is likely to be an influencer in terms of the damper outlook for London in particular," he added.

-

11:20

Eurozone's harmonized consumer price index rises 1.2% in March

Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 1.2% in March, in line with expectations, after a 0.2% increase in February.

On a yearly basis, Eurozone's final consumer price inflation increased to 0.0% in March from -0.2% in February, up from the preliminary reading of -0.1%.

Restaurants and cafés prices were up 0.12% year-on-year in March, rents increased by 0.07%, package holidays rose by 0.09%, fuel prices for transport declined by 0.60%, heating oil prices decreased by 0.23%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco climbed to an annual rate of 1.0% in March from 0.8 in February, in line with the preliminary reading.

-

10:54

International Monetary Fund: public debt of the advanced economies reaches the highest level since World War II

The International Monetary Fund (IMF) said on Wednesday that public debt of the advanced economies hit the highest level since World War II.

"Public debt now exceeds the level observed during the Great Depression and is approaching the level immediately after World War II," the IMF said.

The lender noted that public debt of the advanced economies rose to over 107% of gross domestic product (GDP).

"Advanced economies are facing the triple threat of low growth, low inflation, and high public debt. This combination of factors could create self-reinforcing downward spirals," the IMF added.

-

10:39

Australia's unemployment rate declines to 5.7% in March

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate declined to 5.7% in March from 5.8% in February. Analysts had expected the unemployment rate to rise to 5.9%.

The number of employed people in Australia increased by 26,100 in March, beating forecast of a rise by 20,000, after a decline by 700 in February. February's figure was revised down from a rise by 300.

Full-time employment declined by 8,800 in March, while part-time employment fell by 34,900.

The participation rate remained unchanged at 64.9% in March.

-

10:11

Beige Book: the U.S. economic activity continues to expand across districts

The Fed released its Beige Book on Wednesday. The central bank said that the U.S. economic activity continued to expand in late February and March across districts.

The economy expanded modestly or moderately in most districts, the Fed said.

The Fed noted that consumer and business spending rose, the labour market continued to strengthen, while prices increased modestly across the majority of districts.

Manufacturing and construction activity rose in most districts in late February and March.

-

09:09

WSE: After opening

Futures market (WSE: FW20M16) began the day with increase by 0.26% (1,942 points). The contract on the DAX-and also cosmetically gained at the opening. The opening went slightly upward, near yesterday's close. This means maintaining of the output, but in parallel the lack of unambiguous impulses that already in the morning would be able to move parquet in any direction.

WIG20 index opened at 1941.15 points (-0.17%)*

WIG 48092.35 -0.07%

WIG30 2165.67 -0.12%

mWIG40 3599.48 0.08%

*/ - change to previous close

In Frankfurt, the opening went more successfully because of growth by almost 0.3%, although it was quickly captured. Both parquets took off so relatively neutral after yesterday's larger increases, which is a natural attitude.

The atmosphere on the markets in early trading is quite good, it's affects both yesterday's behavior of markets in the US as well as the results of today's trading in Asia and pluses in Euroland. However it's necessary to pay attention to the drop of oil prices, which promotes the strengthening of the dollar. This factor which should take into consideration and not to let carried away by emotions.

-

08:27

WSE: Before opening

Yesterday's session was very successful for most parquet. The better than expected results of JP Morgan supported the US market. Today we will see more of this type of information, because before the session on Wall Street the results of Bank of America and Wells Fargo will be given

Well data were adopted from China which resulted in increases of indexes in Asia. The Nikkei index soared by more than 3%. On other floors is definitely calmer, also contracts for US indices in the morning is no longer gain. Before the session in Europe, it is worth to keep in mind that contracts for the major indexes of Euroland have already reached the area of the previous local maxima, so continuation of approach can be difficult.

Yesterday WIG20 gained nearly 2%, but the small turnover and the general behavior of the last days rather shows relative weakness than strength.

Weaker market behavior can be partly explained by recurrent of the lower rhetoric around the Poland, which was also a part of the resolution adopted yesterday in the European Parliament.

Nevertheless the WIG20 managed to defend the level of 1,900 points and consolidation between key levels of 1,900 and 2000 points is upheld.

-

04:04

Nikkei 225 16,782.02 +400.80 +2.45 %, Hang Seng 21,300.42 +141.71 +0.67 %, Shanghai Composite 3,077.34 +10.70 +0.35 %

-

01:02

Stocks. Daily history for Sep Apr 13’2016:

(index / closing price / change items /% change)

Nikkei 225 16,381.22 +452.43 +2.84 %

Hang Seng 21,158.71 +654.27 +3.19 %

S&P/ASX 200 5,054.66 +79.01 +1.59 %

Shanghai Composite 3,066.64 +42.99 +1.42 %

FTSE 100 6,362.89 +120.50 +1.93 %

CAC 40 4,490.31 +144.40 +3.32 %

Xetra DAX 10,026.1 +264.63 +2.71 %

S&P 500 2,082.42 +20.70 +1.00 %

NASDAQ Composite 4,947.42 +75.33 +1.55 %

Dow Jones 17,908.28 +187.03 +1.06 %

-