Noticias del mercado

-

20:19

American focus: The US dollar rose against most major currencies

The euro has appreciated sharply against the US dollar, updating yesterday's high, but almost immediately lost all positions. The reason for such dynamics were the statements of the ECB Draghi and profit taking on the euro. As expected, the Central Bank left unchanged the monetary policy settings change, and Draghi statements tone in the press conference as a whole was the "pigeon". Trichet said that interest rates will remain unchanged or will be reduced for a longer time. He also noted that the Central Bank will continue to closely monitor the situation with inflation and, if necessary, will use all available instruments in the framework of the mandate to reach the target level. "Under the available tools meant a change of key interest rates, but the rates on deposits, which are already negative, can not be reduced indefinitely." - Said Draghi. In addition, the head of the Central Bank made it clear that we should not wait for the new measures unless the conditions in the financial sector and the inflation outlook is not significantly deteriorate in the near future. Draghi even called markets for patience, noting that the action taken is enough, we just have to wait.

The dollar also helped the US market statistics. US Department of Labor said the number of initial applications for unemployment benefits dropped fell on 6000 and reached a seasonally adjusted 247,000 in the week ended April 16. It was the low level of applications for unemployment benefits, since the week ending November 24, 1973. Data last week also noted the 59th week in a row, when the primary applications for unemployment benefits remained below 300 000. Economists had expected 263,000 initial claims last week. Data last week have not been revised (253,000). The moving average of four weeks, which smooths out volatility, fell by 4,500 last week to 260 500. Fed policy is likely to take into account the relative health of the labor market at a meeting next week. Nevertheless, central banks have shown that they are concerned about the weakness in the global economy and a close look at inflation and wages. Most economists expect that during the April meeting the Fed will leave its key interest rate unchanged.

The pound depreciated significantly against the dollar, returning to the level of opening of the session, which was due to the resumption of purchases of US currency on background of labor and the outcome of the ECB meeting market data. Additional pressure on the pound has previously published statistics on Britain. The Office for National Statistics said that on a monthly basis, retail sales fell by 1.3 percent, which is higher than the 0.5 percent drop in February and the expected decline of 0.1 percent. It was the second consecutive drop in sales. Excluding automotive fuel, retail sales fell by 1.6 percent, after falling 0.3 percent in February. Economists had forecast a decline of 0.3 percent. In annual terms, total retail sales unexpectedly fell to 2.7 percent in March, compared with 3.6 percent a month earlier. Sales are expected to grow by 4.4 per cent. In addition, another report showed that net borrowing of the public sector with the exception of the public sector banks decreased by 2.6 billion pounds to 4.8 billion pounds sterling last year in March. This was less than the expected 5.5 billion pounds sterling deficit. In the fiscal year that ended in March 2016, the budget deficit fell to 17.7 billion pounds to 74 billion pounds. However, the finance minister was targeted deficit of 72.2 billion pounds.

The Canadian dollar fell against the US dollar, updating the minimum of yesterday's session, which was due to the correction in the oil market. Oil futures fell moderately, departing from five-month high, driven by the strengthening of the US dollar in response to labor market data and statements of the ECB Draghi. According to experts, lower prices - a sign that the market has reached unsustainable high after recent gains, and that traders are going to take profits.

The pressure on the Canadian dollar also had a report from Statistics Canada, which showed that the number of Canadians receiving unemployment benefits rose by the end of February, which was mainly due to an increase in resource provinces. Last change indicates that the fall in commodity prices continues to put pressure on the economy. In Alberta, where the number of unemployment applications for benefits increased from the end of 2014, there were 65.140 people receiving regular payments, which is 2.4 percent more compared to the previous month. In annual terms, the number of applications increased by 78.9 per cent. In Saskatchewan, the number of applications for benefits increased for the fourth consecutive month, by 3.5 percent, to 16740. increase of 38.6 percent was recorded on an annual basis. The Statistical Office stated that the increase in these two provinces is far ahead of figures for the country as a whole. According to the data, the number of appeals in February increased by 0.8 percent per year and 6.7 percent in monthly terms.

-

17:54

Greece beats primary budget target

According to the European Commission on Thursday, Greece beat primary budget target. Greece reached a primary surplus of 0.7% of GDP in 2015, higher than a target of a primary deficit of 0.25% of GDP set by the European Commission.

-

17:18

Demand for loans from companies drops in April, while demand for loans from households rises

The Bank of Japan (BoJ) released its Senior Loan Officer Opinion Survey on Thursday. The balance of demand for loans from companies decreased to 5 in April from 8 in January.

Demand for loans from large companies fell to 5 in April from 8 in January, demand for loans from medium-sized companies dropped to -1 from 3, while demand for loans from small companies was down to 4 from 5.

Demand for loans from households climbed to 9 in April from -1 in January.

-

17:09

European Central Bank President Mario Draghi: Eurozone’s economy is expected to continue to recover

The European Central Bank (ECB) President Mario Draghi said at a press conference on Thursday:

- The first operation of new targeted longer-term refinancing operations (TLTRO II) will be conducted in June;

- Financing conditions in the Eurozone improved;

- The ECB would act if needed to reach 2% inflation target;

- The economic growth in the first quarter was driven by domestic demand;

- Exports were weak in the first quarter;

- Eurozone's economy was expected to continue to recover;

- There were still downside risks to the outlook;

- Recent stimulus measures should support consumption and investment;

- Inflation in the Eurozone could be negative in the coming months before rising in the second half of 2016;

- Inflation was expected to recover in 2017 and 2018;

- Structural and fiscal policies were needed;

- The ECB did not discuss helicopter money;

- The ECB was independent, as stated by the law.

- The first operation of new targeted longer-term refinancing operations (TLTRO II) will be conducted in June;

-

16:16

U.S. leading economic index rises 0.2% in March

The Conference Board released its leading economic index (LEI) for the U.S. on Thursday. The leading economic index rose 0.2% in March, missing expectations for a 0.4% increase, after a 0.1% decline in February. February's figure was revised down from a 0.1%.

The coincident economic index was flat in March, after a 0.1% gain in February.

"With the March gain, the U.S. LEI's six-month growth rate improved slightly but still points to slow, although not slowing, growth in the coming quarters. Rebounding stock prices were offset by a decline in housing permits, but nonetheless there were widespread gains among the leading indicators," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

"Financial conditions, as well as expected improvements in manufacturing, should support a modest growth environment in 2016," he added.

-

16:07

Eurozone’s preliminary consumer confidence index rises to -9.3 in April

The European Commission released its preliminary consumer confidence figures for the Eurozone on Thursday. Eurozone's preliminary consumer confidence index rose to -9.3 in April from -9.7 in March. Analysts had expected the index to increase to -9.5.

European Union's consumer confidence index increased by 0.5 points to 6.8 in April.

-

16:00

Eurozone: Consumer Confidence, April -9.3 (forecast -9.5)

-

16:00

U.S.: Leading Indicators , March 0.2% (forecast 0.4%)

-

15:49

Eurozone’s government deficit to GDP ratio is 2.1% in 2015

Eurostat released its government deficit data for 2015 on Thursday. Eurozone's government deficit to GDP ratio fell to 2.1% in 2015 from 2.6% in 2014. Total government revenue in the Eurozone was 46.6% of GDP in 2015, while total government expenditure was 48.6% of GDP.

-

15:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 108.00 (USD 430m) 108.75 (250m) 108.90 (310m) 109.50 (795m) 110.00 (491m) 113.00 (1.27bln)

EUR/USD: 1.1240-45 (EUR 937m) 1.1280 (232m) 1.1300 (EUR 227m) 1.1320 (373m) 1.1400 (754m) 1.1415 (603m)

GBP/USD: 1.4000 (GBP 653m) 1.4300 (287m)

AUD/USD: 0.7585 (AUD 400m) 0.7600 (344m) 0.7650 (302m) 0.7690-95 (454m) 0.7725 (260m) 0.7735 (325m) 0.7750 (376m) 0.7800 (805m) 0.7900 (202m)

AUD/JPY 84.50 (AUD 438m)

-

15:00

Philadelphia Federal Reserve Bank’s manufacturing index drops to -1.6 in April

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index dropped to -1.6 in April from 12.4 in March, missing expectations for a decrease to 8.9.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"This month's Manufacturing Business Outlook Survey suggests a relapse in growth of the region's manufacturing sector. The survey's indicators for general activity, new orders, shipments, and employment all fell notably from their readings in March," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index slid to -10.8 in April from 22.1 in March.

The new orders index decreased to 0.0 in April from 15.7 in March.

The prices paid index rose to 13.2 in April from -0.9% in March, while the prices received index increased to 7.4 from 3.5.

The number of employees index was down to -18.5 in April from -1.1 in March.

According to the report, the future general activity index jumped to 42.2 in April from 28.8 in March.

-

14:44

Initial jobless claims decline to 247,000 in the week ending April 16

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending April 16 in the U.S. decreased by 6,000 to 247,000 from 253,000 in the previous week. It was the lowest level since the week of November 24, 1973.

Analysts had expected jobless claims to rise to 263,000.

Jobless claims remained below 300,000 the 59th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 39,000 to 2,137,000 in the week ended April 09. It was the lowest level since November 2000.

-

14:30

U.S.: Initial Jobless Claims, April 247 (forecast 263)

-

14:30

U.S.: Continuing Jobless Claims, April 2137 (forecast 2171)

-

14:30

U.S.: Philadelphia Fed Manufacturing Survey, April -1.6 (forecast 8.9)

-

14:26

European Central Bank keeps its interest rate unchanged at 0.00% in April

The European Central Bank (ECB) kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.00%. This decision was widely expected by analysts.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its meeting in March. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. The central bank decided to launch further four targeted longer-term refinancing operations (LTRO).

-

14:20

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the European Central Bank’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Japan Coincident Index (Finally) February 113.5 110.3

06:00 Japan Leading Economic Index (Finally) February 101.8 99.8

06:00 Switzerland Trade Balance March 4.02 Revised From 4.07 2.16

08:30 United Kingdom PSNB, bln March -6.33 Revised From -6.49 -5.5 -4.16

08:30 United Kingdom Retail Sales (MoM) March -0.5% Revised From -0.4% -0.1% -1.3%

08:30 United Kingdom Retail Sales (YoY) March 3.6% Revised From 3.8% 4.4% 2.7%

11:45 Eurozone ECB Interest Rate Decision 0.0% 0.0% 0.0%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to rise by 10,000 to 263,000 last week.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to decrease to 8.9 in April from 12.4 in March.

The euro traded higher against the U.S. dollar after the release of the European Central Bank's (ECB) interest rate decision. The central bank kept its interest rate unchanged as widely expected by analysts.

A press conference is scheduled to be at 12:30 GMT.

The British pound traded higher against the U.S. dollar despite the weaker-than-expected economic data from the U.K. The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 1.3% in March, missing expectations for a 0.1% drop, after a 0.5% decline in February. February's figure was revised down from a 0.4% decrease.

The decline was driven by a weak demand in all categories. Food sales were down 1.9% in March, while non-food store sales decreased 1.5%.

On a yearly basis, retail sales in the U.K. climbed 2.7% in March, missing forecasts of a 4.4% increase, after a 3.6% rise in February. February's figure was revised down from a 3.8% gain.

The ONS also released public sector net borrowing for the U.K. Public sector net borrowing excluding public sector banks declined to £74.0 billion in the fiscal year 2015/16 ending March 2016 from £91.7 billion in the previous fiscal year. It is equivalent to 3.9% of GDP.

The government forecasted £72.0 billion for the fiscal year 2015/16.

The debt-to-gross domestic product ratio rose to 83.5% in the fiscal year 2015/16 from 83.3% in the previous fiscal year.

Public sector net borrowing excluding public sector banks declined to £4.6 billion in March from £7.4 billion in March a year ago.

The Swiss franc traded higher against the U.S. dollar. The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus narrowed to CHF2.16 billion in March from CHF4.02 billion in the previous month. February's figure was revised down from a surplus of CHF4.07 billion. On a monthly basis, exports rose 1.1% in March, while imports jumped 9.9%.

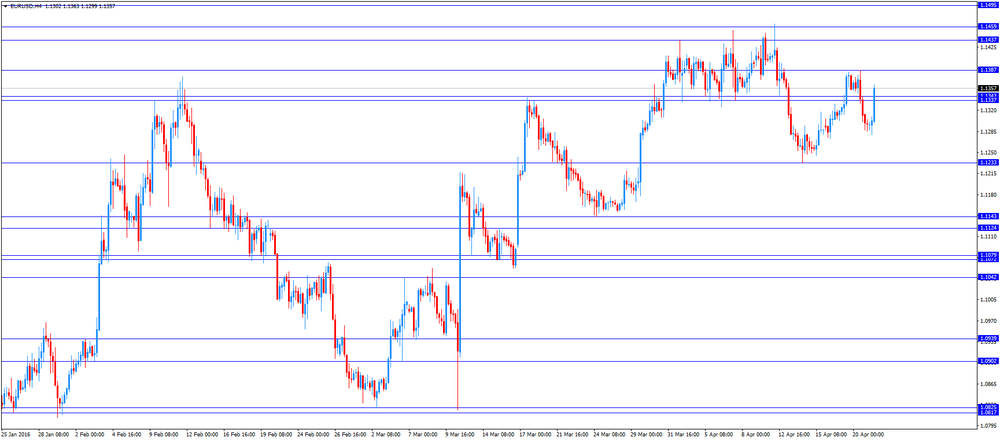

EUR/USD: the currency pair rose to $1.1363

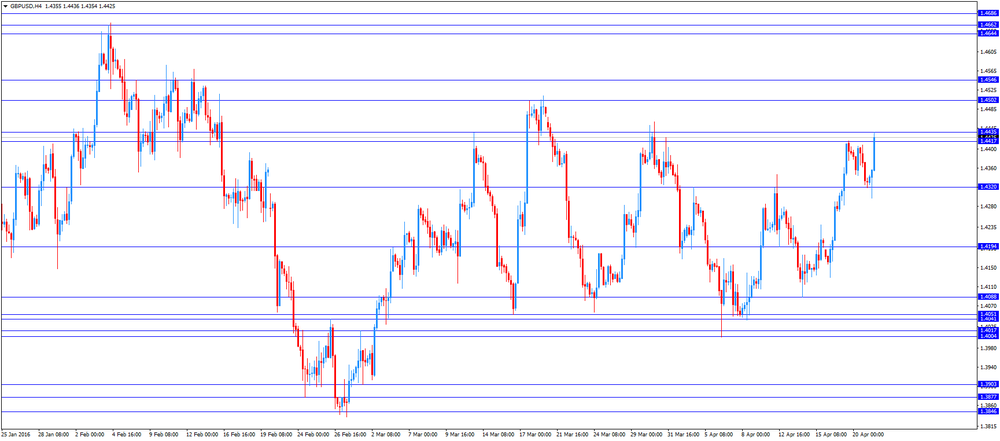

GBP/USD: the currency pair increased to $1.4436

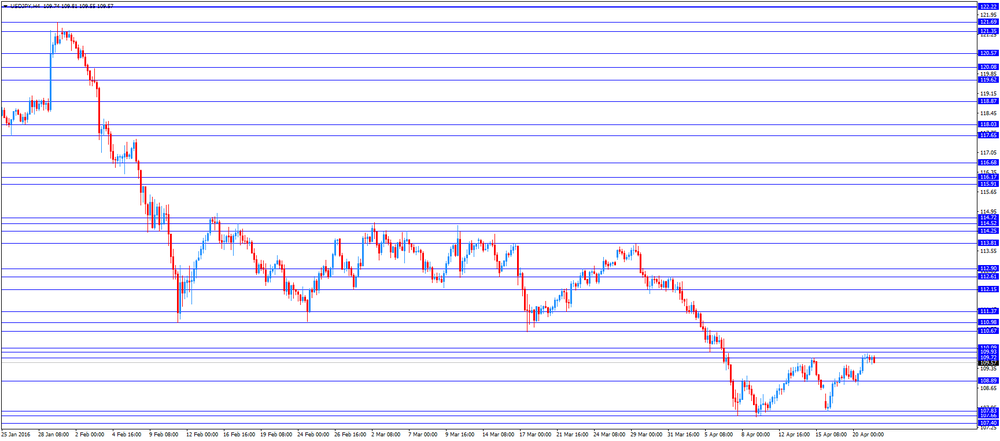

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Eurozone ECB Press Conference

12:30 U.S. Philadelphia Fed Manufacturing Survey April 12.4 8.9

12:30 U.S. Initial Jobless Claims April 253 263

14:00 Eurozone Consumer Confidence (Preliminary) April -9.7 -9.5

14:00 United Kingdom BOE Gov Mark Carney Speaks

14:00 U.S. Leading Indicators March 0.1% 0.4%

-

14:00

Orders

EUR/USD

Offers: 1.1320-25 1.1350 1.1385 1.1400 1.1420 1.1450 1.1465-70 1.1500

Bids: 1.1275-80 1.1250 1.1235 1.1220 1.1200 1.1180 1.1160 1.1150 1.1130 1.1100

GBP/USD

Offers: 1.4385 1.4400 1.4420 1.4450 1.4480 1.4500

Bids: 1.4350 1.4325-30 1.4300 1.4280 1.4250 1.4230 1.4200 1.4180-85 1.4165 1.4150

EUR/JPY

Offers: 124.00-10 124.30 124.50 124.75 125.00 125.30 125.50 125.75 126.00

Bids: 123.50 123.20 123.00 122.80 122.50 122.00 121.75-80 121.50 121.30 121.00

EUR/GBP

Offers: 0.7900 0.7920-25 0.7950 0.7980 0.8000 0.8020 0.8030 0.8050

Bids: 0.7850-55 0.7830 0.7800 0.7780 0.7750

USD/JPY

Offers: 109.80-85 110.00 110.20 110.50 110.65 110.80 111.00

Bids: 109.50 109.30 109.00 108.75 108.50 108.20 108.00 107.80-85 107.60-65 107.50

AUD/USD

Offers: 0.7825-30 0.7850 0.7880 0.7900 0.7930 0.7950

Bids: 0.7800 0.7785 0.7760 0.7740 0.7700 0.7680 0.7650 0.7620-25 0.7600

-

13:45

Eurozone: ECB Interest Rate Decision, 0.0% (forecast 0.0%)

-

11:43

Spain’s trade deficit narrowed €1.76 billion in February

Spain's Economy Ministry released its trade data on Thursday. The trade deficit narrowed to €1.76 billion in February from €2.39 billion in January.

The decrease in deficit was driven by a higher rise in exports.

Exports rose at an annual rate of 2.7% year-on-year in February, while imports climbed 1.2%.

-

11:30

NAB business confidence index for Australia falls to 4 in the first quarter

The National Australia Bank (NAB) released its Quarterly Business Confidence Survey on Thursday. The NAB business confidence index fell to 4 in the first quarter from 5 in the fourth quarter. The fourth quarter's figure was revised up from 4.

Business conditions outlook remained positive, while a resilient non-mining recovery and an outlook continued to improve.

"We find it encouraging to see that firms are continuing to look past all the 'noise' in financial markets to focus on what is going on at home, and in their own business. Market volatility could eventually start to have an impact on the economy via sentiment channels, but at this stage firms actually appear more optimistic about the outlook ", NAB Group Chief Economist Alan Oster said.

-

11:19

Public sector net borrowing in the U.K. declines to £74.0 billion in the fiscal year 2015/16

The Office for National Statistics released public sector net borrowing for the U.K. on Thursday. Public sector net borrowing excluding public sector banks declined to £74.0 billion in the fiscal year 2015/16 ending March 2016 from £91.7 billion in the previous fiscal year. It is equivalent to 3.9% of GDP.

The government forecasted £72.0 billion for the fiscal year 2015/16.

The debt-to-gross domestic product ratio rose to 83.5% in the fiscal year 2015/16 from 83.3% in the previous fiscal year.

Public sector net borrowing excluding public sector banks declined to £4.6 billion in March from £7.4 billion in March a year ago.

-

11:05

UK retail sales fall 1.3% in March

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 1.3% in March, missing expectations for a 0.1% drop, after a 0.5% decline in February. February's figure was revised down from a 0.4% decrease.

The decline was driven by a weak demand in all categories. Food sales were down 1.9% in March, while non-food store sales decreased 1.5%.

On a yearly basis, retail sales in the U.K. climbed 2.7% in March, missing forecasts of a 4.4% increase, after a 3.6% rise in February. February's figure was revised down from a 3.8% gain.

-

11:02

Option expiries for today's 10:00 ET NY cut

USD/JPY 108.00 (USD 430m) 108.75 (250m) 108.90 (310m) 109.50 (795m) 110.00 (491m) 113.00 (1.27bln)

EUR/USD: 1.1240-45 (EUR 937m) 1.1280 (232m) 1.1300 (EUR 227m) 1.1320 (373m) 1.1400 (754m) 1.1415 (603m)

GBP/USD: 1.4000 (GBP 653m) 1.4300 (287m)

AUD/USD: 0.7585 (AUD 400m) 0.7600 (344m) 0.7650 (302m) 0.7690-95 (454m) 0.7725 (260m) 0.7735 (325m) 0.7750 (376m) 0.7800 (805m) 0.7900 (202m)

AUD/JPY 84.50 (AUD 438m)

-

10:52

French manufacturing confidence index climbs to 104 in April

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index rose to 104 in April from 102 in March. It was the highest level since September.

March's figure was revised up from 101.

Past change in production index was up to 8 in April from -6 in March.

Personal production expectations index fell to 9 in April from 15 in March, while general production outlook index rose to -1 from -2.

-

10:37

Swiss trade surplus narrows to CHF2.16 billion in March

The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus narrowed to CHF2.16 billion in March from CHF4.02 billion in the previous month. February's figure was revised down from a surplus of CHF4.07 billion.

On a monthly basis, exports rose 1.1% in March, while imports jumped 9.9%.

Exports declined 1.2% year-on-year in March, while imports were up 5.4%.

-

10:30

United Kingdom: Retail Sales (MoM), March -1.3% (forecast -0.1%)

-

10:30

United Kingdom: Retail Sales (YoY) , March 2.7% (forecast 4.4%)

-

10:30

United Kingdom: PSNB, bln, March -4.16 (forecast -5.5)

-

10:23

U.K. household finance index rises to 45.3 in April

Markit Economics and financial information provider Ipsos Mori released its household finance index (HFI) for the U.K. on Wednesday. The household finance index increased to 45.3 in April from 44.8 in March.

The index measuring the outlook for financial well-being over the coming twelve months decreased to 49.6 in April from 51.4 in March.

The current inflation perceptions index climbed to 66.8 in April.

The index measuring expected living costs over the twelve months was up to 81.6 in April.

One-quarter of respondents expects the Bank of England's monetary policy to tighten within the next six months.

"Latest HFI data from Markit paints a mixed picture for UK households. On the one hand, the squeeze on finances softened in April… In contrast, the financial outlook worsened for the first time in three months," economist at Markit, Philip Leake, said.

-

10:10

China plans to boost its foreign trade

The Chinese government plans to boost the foreign trade.

"Foreign trade is an important part of the national economy," a State Council said in a statement after the meeting with China's Premier Li Keqiang.

Banks should encourage to lend to profitable foreign trade companies, a State Council noted.

-

08:32

Options levels on thursday, April 21, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1419 (2057)

$1.1371 (926)

$1.1335 (452)

Price at time of writing this review: $1.1293

Support levels (open interest**, contracts):

$1.1250 (2825)

$1.1198 (3858)

$1.1164 (3469)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 36922 contracts, with the maximum number of contracts with strike price $1,1400 (4271);

- Overall open interest on the PUT options with the expiration date May, 6 is 49398 contracts, with the maximum number of contracts with strike price $1,0900 (4711);

- The ratio of PUT/CALL was 1.34 versus 1.35 from the previous trading day according to data from April, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.4603 (1483)

$1.4506 (2535)

$1.4410 (2075)

Price at time of writing this review: $1.4345

Support levels (open interest**, contracts):

$1.4291 (443)

$1.4195 (959)

$1.4097 (1728)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 24967 contracts, with the maximum number of contracts with strike price $1,4500 (2535);

- Overall open interest on the PUT options with the expiration date May, 6 is 30833 contracts, with the maximum number of contracts with strike price $1,3850 (4031);

- The ratio of PUT/CALL was 1.23 versus 1.20 from the previous trading day according to data from April, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:20

Asian session: The euro wavered

The euro wavered on Thursday, well off its overnight peak as investors adjusted position ahead of a policy meeting by the European Central Bank later this session. The ECB is widely expected to hold interest rates unchanged at record lows, but President Mario Draghi is likely to drive home the case for ultra-loose monetary policy.

Last month, while the ECB delivered aggressive easing measures, the euro perversely rallied after Draghi said there was probably no need for more rate cuts if the latest stimulus worked. With three major central bank meetings looming, market participants cited a lack of market conviction on direction bets. The Federal Reserve is scheduled to hold its policy review on April 26-27, while the Bank of Japan will meet on April 28.

BOJ officials are growing more receptive to stepping up monetary easing measures by buying more ETFs invested in shares, as weak global growth threaten the country's fragile economic recovery, sources have told Reuters. On Wednesday, BOJ Governor Haruhiko Kuroda said the central bank's presence in the exchange-traded fund (ETF) market is "not too big," signaling that topping up purchases of ETFs could be a real, near-term option.

EUR/USD: during the Asian session the pair traded in the range of $1.1285-05

GBP/USD: during the Asian session the pair traded in the range of $1.4320-40

USD/JPY: during the Asian session the pair traded in the range of Y109.55-90

Based on Reuters materials

-

08:00

Switzerland: Trade Balance, March 2.16

-

01:18

Currencies. Daily history for Apr 20’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1299 -0,50%

GBP/USD $1,4333 -0,41%

USD/CHF Chf0,9716 +1,01%

USD/JPY Y109,74 +0,44%

EUR/JPY Y123,99 -0,06%

GBP/JPY Y157,27 +0,01%

AUD/USD $0,7791 -0,26%

NZD/USD $0,6975 -1,00%

USD/CAD C$1,2654 -0,12%

-

00:01

Schedule for today, Thursday, Apr 21’2016:

(time / country / index / period / previous value / forecast)

06:00 Japan Coincident Index (Finally) February 113.5 110.3

06:00 Japan Leading Economic Index (Finally) February 101.8 99.8

06:00 Switzerland Trade Balance March 4.07

08:30 United Kingdom PSNB, bln March -6.49 -5.5

08:30 United Kingdom Retail Sales (MoM) March -0.4% -0.1%

08:30 United Kingdom Retail Sales (YoY) March 3.8% 4.4%

11:45 Eurozone ECB Interest Rate Decision 0.0% 0.0%

12:30 Eurozone ECB Press Conference

12:30 U.S. Continuing Jobless Claims April 2171 2171

12:30 U.S. Philadelphia Fed Manufacturing Survey April 12.4 8.9

12:30 U.S. Initial Jobless Claims April 253 263

14:00 Eurozone Consumer Confidence (Preliminary) April -9.7 -9.5

14:00 United Kingdom BOE Gov Mark Carney Speaks

14:00 U.S. Leading Indicators March 0.1% 0.4%

-