Noticias del mercado

-

20:22

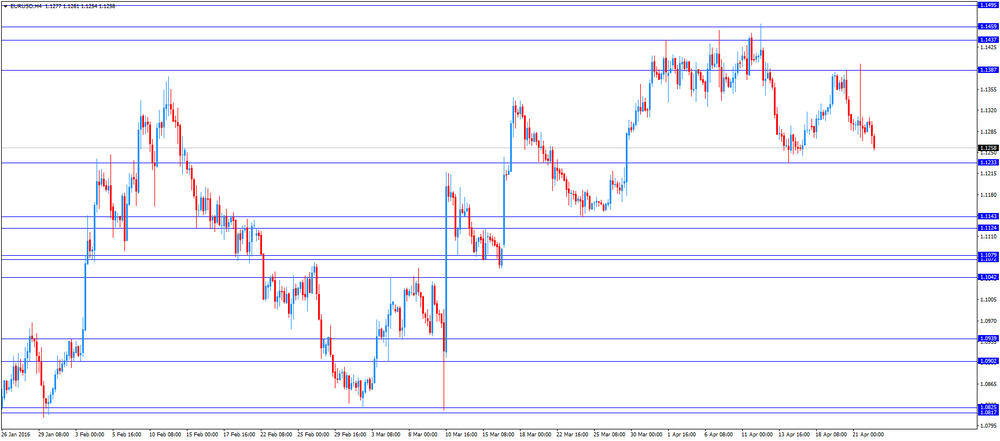

American focus: the US dollar significantly higher against the euro

The US dollar strengthened significantly against the euro, updating the maximum of April. Experts point out that the European currency came under pressure after the publication of weak data on business activity. The research organization Markit Economics said the composite Purchasing Managers' Index, which combines manufacturing and services, fell to two-month low of 53.1 from 53 in March. Economists had forecast a 53.3 estimate. Production Preliminary PMI fell to two-month low of 51.5 from 51.6 in March. Economists had expected a rise to 51.8. PMI in the service sector rose to 53.2 from 53.1 in March, but did not meet analysts' expectations at 53.3. "PMI data suggest that the pace of economic growth at the beginning of the second quarter was slightly weaker than the average in the first quarter, and a little slower than average in the past year", - Markit said.

A stronger dollar has continued despite the weak data on US PMI. Preliminary manufacturing PMI from Markit was 50.8 in April from 51.5 in March, signaling the weakest rise since September 2009. Weaker industrial production and the growth of new orders, along with weaker growth in the number of staff were major factors in the PMI pressure in April. Last rise the level of production has been uneven and the slowest since the moment when the recovery began in October 2009.

Meanwhile, the results of a survey of 80 economists conducted by Reuters showed that none of them did not believe in the possibility of increasing the Fed rate in April. 50 out of 80 respondents said that they expect a rate hike in June. However, according to the forecast of the majority, to the end of 2016 the rate will increase to a level of 0.75-1.0%, which actually means a further 2 increase.

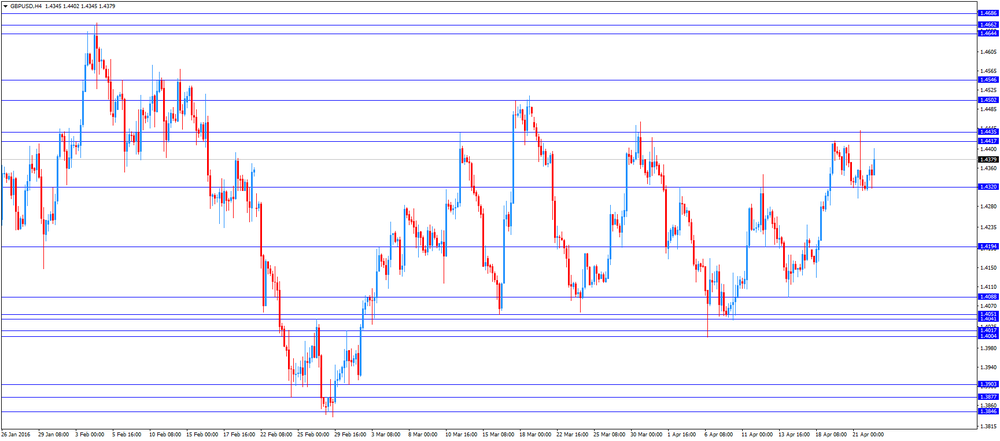

The pound rose substantially against the US dollar, setting a new April high. The main support to the pound provided the results of public opinion polls, which are somewhat eased concerns about the risk of the UK release of the EU. Also, raising the pair GBP / USD has contributed a noticeable drop in EUR / GBP and the growth of GBP / JPY on the weakening yen. Little influenced by the results of a survey by Markit Economics and Knight Frank. Sentiment against housing prices, or HPSI, by Knight Frank / Markit fell slightly to 60.1 in April from 60.5 in the previous month. However, the value above 50 indicates an increase in housing prices. This was the thirty-seventh month in a row, when the index is above 50. Housing prices in London are perceived with the strongest growth rate in April, followed by the south-east of prices. The future HPSI, the measure of house price expectations fell to 68.8 from 71.6 in March. "The study underscores another decline in the number of households who intend to buy property in the next two years, taking into account the fact that the index is significantly below its peak in February 2015," said Tim Moore, senior economist at Markit.

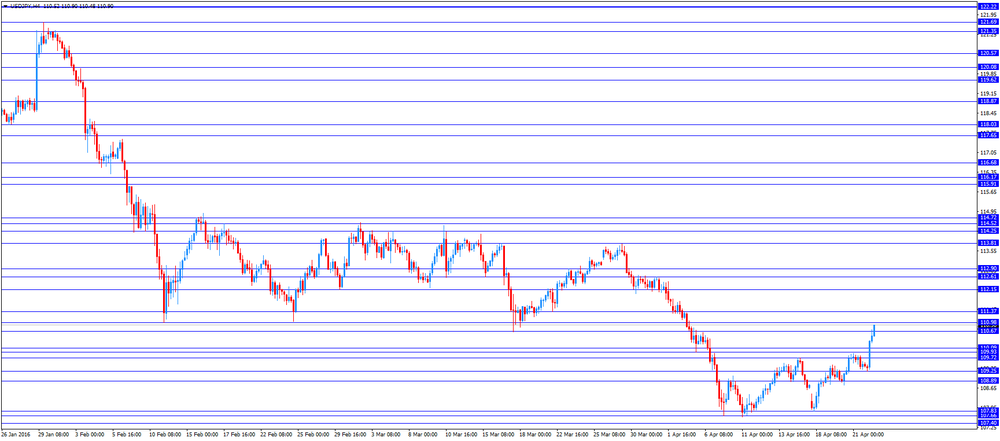

The Japanese yen fell more than 200 points against the US dollar, reaching a low of April 4 and fixing the maximum daily decline with the introduction of the Bank of Japan's era of negative interest rates on excess reserves with the Central Bank. Pressure on the yen strengthened to the information that the Bank of Japan is considering measures to support financial institutions. The Central Bank reported that they began to discuss the likelihood of the introduction of negative interest rates. Recall, the Central Bank is now offering loans at 0% APR. As of April 10, the Bank of Japan gave in 2013 about 24.4 trillion yen. Basically, the money went to buy government bonds.

Investors are also waiting for the Bank of Japan meeting, scheduled for 27-28 April. In addition to the decision on the monetary policy of the Bank will publish its inflation forecasts and economic growth. The latest survey of 16 analysts conducted by Reuters showed that the Bank of Japan may again soften the policy by July. 8 of them are waiting for policy easing at the meeting of 27-28 April, 3 predict that softening occurs in June, 5-Ro - in July.

The Canadian dollar has appreciated sharply against the US dollar after strong data on retail sales and consumer prices, but soon lost nearly all positions, despite the rise in oil prices. Statistics Canada reported that retail sales rose for the second month in a row, by 0.4% to $ 44.2 billion in February. Growth was recorded in 9 of 11 subsectors, representing 89% of total retail trade. The increase in February was kept lower sales at gasoline stations. Excluding sales in this subsector, retail sales advanced by 1.0%. After removing the effects of price changes, in particular, lower prices for gasoline, retail sales rose by 1.5% in real terms.

Another report showed that the consumer price index in Canada rose 1.3% in the 12 months to March, after increasing 1.4% in February. Excluding gasoline, the CPI rose by 1.9% year on year in March, matching the increase in February. Despite the monthly increase of 5.7% in gasoline prices in March, the gasoline index fell by 13.6% year on year in March, after falling 13.1% in the 12 months to February. Prices rose in six of the eight major components on an annual basis in March, with the price indices for food and accommodation contributed to the largest contribution to the increase in the consumer price index. The base consumer price index of the Bank of Canada increased by 2.1% per year, after rising 1.9% in February. The seasonally adjusted core index rose 0.3% MoM in March, after rising in February by 0.2%.

-

17:58

Bank of England Monetary Policy Committee member Gertjan Vlieghe: the BOE’s interest rate could be theoretically negative

Bank of England (BoE) Monetary Policy Committee (MPC) member Gertjan Vlieghe said in an interview with the Evening Standard on Friday that the BOE's interest rate could be theoretically negative.

"Theoretically, I think interest rates could go a little bit negative," he said.

He added that the central bank had to think carefully about benefits and costs of negative rates.

-

16:22

Japan's tertiary industry activity index decreases 0.1% in February

Japan's Ministry of Economy, Trade and Industry released its tertiary industry activity index on Friday. The index decreased 0.1% in February, after a 0.7% rise in January. January's figure was revised down from 1.5% increase.

The fall was driven by declines in business-related services, retail trade, electricity, gas, heat supply and water, and medical, health care and welfare.

On a yearly basis, the tertiary industry activity index climbed 2.3% in February, after a 0.2% rise in January.

-

16:05

European Central Bank’s Survey of Professional Forecasters: forecasters lower their inflation forecasts

The European Central Bank (ECB) released its Survey of Professional Forecasters for Q2 2016 on Friday. Forecasters cut their inflation forecasts. Eurozone's inflation is expected to be 0.3% in 2016, down from January estimate of 0.7%, 1.3% in 2017, down from January estimate of 1.4%, and 1.6% in 2018, unchanged from January estimate.

Long-term inflation forecasts (for 2020) remained unchanged at 1.8%.

The economic growth in the Eurozone is expected to expand 1.5% this year, down from January estimate of 1.7%, 1.6% next year, down from January estimate of 1.8%, and 1.7% in 2018, unchanged from January estimate.

Long-term growth forecasts (for 2020) remained unchanged at 1.7%.

-

15:51

U.S. preliminary manufacturing purchasing managers' index declines to 50.8 in April from 51.5 in March, the lowest level since September 2009

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 50.8 in April from 51.5 in March, missing expectations for an increase to 52.0. It was the lowest level since September 2009.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a softer pace of expansion in output, new business and employment.

"US factories reported their worst month for just over six-and-a-half years in April, dashing hopes that first quarter weakness will prove temporary. Survey measures of output and order book backlogs are down to their lowest since the height of the global financial crisis, prompting employers to cut back on their hiring," Markit Chief Economist Chris Williamson said.

"With prior months' survey data pointing to annualized GDP growth of just 0.7% in the first quarter, the deteriorating performance of manufacturing suggests that growth could weaken closer towards stagnation in the second quarter," he added.

-

15:45

U.S.: Manufacturing PMI, April 50.8 (forecast 52)

-

15:30

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.50 (USD 394m) 112.70 (2.2bln) 112.85 (1.95bln) 113.00 (1.27bln)

EUR/USD:1.1295-1.1300 (EUR 1.0bln) 1.1400 (1.26bln)

GBP/USD: 1.4130 (GBP 297m) 1.4300 (401m)

USD/CHF 0.9525 (USD 200m) 0.9675 (315m) 0.9785 (335m)

EUR/GBP 0.7865-67 (EUR 1.05bln)

AUD/USD: 0.7575 (AUD245m) 0.7650 (737m) 0.7715-20 (216m) 0

USD/CAD 1.2700 (USD 335m) 1.3100 ( 420m) 1.3125 (592m)

AUD/NZD 1.0900 (AUD 1.4bln) 1.1100 (1.31bln) 1.1200 (4.61bln) 1.1400 (1.85bln

-

15:05

Canadian consumer price inflation rises 0.6% in March

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.6% in March, in line with expectations, after a 0.2% gain in February.

The monthly rise was mainly driven by an increase in prices for gasoline, and clothing and footwear. Prices for gasoline were up 5.7% in March, while prices clothing and footwear increased 4.2%.

On a yearly basis, the consumer price index fell to 1.3% in March from 1.4% in February, beating expectations for a decline to 1.2%.

The consumer price index was mainly driven by higher food and shelter prices. Food prices climbed 3.6% year-on-year in March, while shelter prices increased 1.1%.

The index for recreation, education and reading climbed by 2.0% in March from the same month a year earlier, the gasoline prices dropped 13.6%, while clothing and footwear prices declined 0.4%.

The Canadian core consumer price index, which excludes some volatile goods, increased 0.7% in March, after a 0.5% increase in February.

On a yearly basis, core consumer price index in Canada climbed to 2.1% in March from 1.9% in February. Analysts had expected the index to drop to 1.7%.

The Bank of Canada's inflation target is 2.0%.

-

14:48

Canadian retail sales climb 0.4% in February

Statistics Canada released retail sales data on Friday. Canadian retail sales climbed by 0.4% in February, beating expectations for a 0.8% drop, after a 2.0% increase in January. January's figure was revised down from a 2.1% rise.

The increase was driven by rises in 9 of 11 subsectors.

Sales at motor vehicle and parts dealers rose by 1.0% in February, while sales at general merchandise stores increased by 1.9%.

Sales at gasoline stations declined 4.9% in February, while sales at food and beverage stores were up 0.2%.

Sales at building material and garden equipment and supplies dealers increased 1.3% in February, while sales at furniture and home furnishings stores rose 1.9%.

Canadian retail sales excluding automobiles rose 0.2% in February, beating expectations for a 0.5% fall, after a 1.3% increase in January. January's figure was revised up from a 1.2% gain.

-

14:31

Canada: Retail Sales YoY, February 5.6%

-

14:30

Canada: Consumer price index, y/y, March 1.3% (forecast 1.2%)

-

14:30

Canada: Consumer Price Index m / m, March 0.6% (forecast 0.6%)

-

14:30

Canada: Bank of Canada Consumer Price Index Core, y/y, March 2.1% (forecast 1.7%)

-

14:30

Canada: Retail Sales, m/m, February 0.4% (forecast -0.8%)

-

14:30

Canada: Retail Sales ex Autos, m/m, February 0.2% (forecast -0.5%)

-

14:21

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the mostly weaker than expected manufacturing and services purchasing managers' indexes from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 Japan Manufacturing PMI (Preliminary) April 49.1 48.0

04:30 Japan Tertiary Industry Index February 1.5% -0.1%

07:00 France Manufacturing PMI (Preliminary) April 49.6 49.8 48.3

07:00 France Services PMI (Preliminary) April 49.9 50.2 50.8

07:30 Germany Services PMI (Preliminary) April 55.1 55.2 54.6

07:30 Germany Manufacturing PMI (Preliminary) April 50.7 51 51.9

08:00 Eurozone Manufacturing PMI (Preliminary) April 51.6 51.8 51.5

08:00 Eurozone Services PMI (Preliminary) April 53.1 53.3 53.2

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. preliminary manufacturing PMI data. The U.S. preliminary manufacturing PMI is expected to rise to 52.0 in April from 51.5 in March.

The euro traded lower against the U.S. dollar after the release of the mostly weaker than expected manufacturing and services purchasing managers' indexes (PMI) from the Eurozone. Markit Economics released its preliminary manufacturing and services PMIs for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI declined to 51.5 in April from 51.6 in March. Analysts had expected the index to increase to 51.8.

Output in the manufacturing sector was moderate, new orders improved slightly, while input prices fell.

Eurozone's preliminary services PMI increased to 53.2 in April from 53.1 in March. Analysts had expected the index to climb to 53.3.

Output in the services sector was moderate, new orders improved slightly, while input prices rose.

"The Eurozone economy remains stuck in a slow growth rut in April, with the PMI once again signalling GDP growth of just 0.3% at the start of the second quarter, broadly in line with the meagre pace of expansion seen now for a full year," Markit's Chief Economist Chris Williamson said.

"A failure of business expectations to revive following the ECB's announcement of more aggressive stimulus in March is a major disappointment and suggests that the modest pace of growth is unlikely to accelerate in coming months," he added.

Germany's preliminary manufacturing PMI climbed to 51.9 in April from 50.7 in March, beating forecasts of a rise to 51.0.

The rise in the manufacturing PMI was driven by a stronger demand from foreign markets.

Germany's preliminary services PMI was down to 54.6 in April from 55.1 in March. Analysts had expected index to increase to 55.2.

France's preliminary manufacturing PMI dropped to 48.3 in April from 49.6 in March. Analysts had expected the index to rise to 49.8. The manufacturing index was driven by declines in output, new orders, employment and input prices.

France's preliminary services PMI climbed to 50.8 in April from 49.9 in March. Analysts had expected the index to increase to 50.2. The services index was driven by rises in output, new orders, employment and input prices.

The British pound traded higher against the U.S. dollar in the absence of any major U.K. economic reports.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian economic data. The consumer price index in Canada is expected to decline 1.2% year-on-year in March from 1.4% in February.

The core consumer price index in Canada is expected to fall 1.7% year-on-year in March from 1.9% in February.

Canadian retail sales are expected to decrease 0.8% in February, after a 2.1% rise in January.

EUR/USD: the currency pair declined to $1.1254

GBP/USD: the currency pair increased to $1.4402

USD/JPY: the currency pair rose to Y110.90

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m February 2.1% -0.8%

12:30 Canada Retail Sales YoY February 6.4%

12:30 Canada Retail Sales ex Autos, m/m February 1.2% -0.5%

12:30 Canada Consumer Price Index m / m March 0.2% 0.6%

12:30 Canada Consumer price index, y/y March 1.4% 1.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y March 1.9% 1.7%

13:45 U.S. Manufacturing PMI (Preliminary) April 51.5 52

-

14:01

Orders

EUR/USD

Offers: 1.1320 1.1335 1.1350 1.1385 1.1400 1.1420 1.1450 1.1465-70 1.1500

Bids: 1.1280 1.1250 1.1235 1.1220 1.1200 1.1180 1.1160 1.1150 1.1130 1.1100

GBP/USD

Offers: 1.4380-85 1.4400 1.4420 1.4450 1.4480 1.4500

Bids: 1.4320-25 1.4300 1.4280 1.4250 1.4230 1.4200 1.4180-85 1.4165 1.4150

EUR/JPY

Offers: 125.00 125.30 125.50 125.75 126.00 126.50

Bids: 124.50 124.30 124.00 123.50 123.20 123.00 122.80 122.50 122.00

EUR/GBP

Offers: 0.7880-85 0.7900 0.7920-25 0.7950 0.7980 0.8000 0.8020 0.8030 0.8050

Bids: 0.7850-55 0.7830 0.7800 0.7780 0.7750 0.7730 0.7700

USD/JPY

Offers: 110.80 111.00 111.30 111.50 111.75-80 112.00

Bids: 110.20 110.00 109.80 109.50 109.30 109.00 108.75 108.50 108.20 108.00

AUD/USD

Offers: 0.7780 0.7800 0.7825-30 0.7850 0.7880 0.7900

Bids: 0.7735 0.7720 0.7700 0.7680 0.7650 0.7620-25 0.7600

-

11:47

Italian retail sales climb 0.3% in February

The Italian statistical office Istat released its retail sales data for Italy on Friday. Italian retail sales climbed 0.3% in February, after a flat reading in January.

Sales of food products were up 0.7% in February, while sales of non-food products increased by 0.1%.

On a yearly basis, retail sales in Italy jumped 2.7% in February, after a 0.8% fall in January.

-

11:40

Industrial orders in Italy rise at a seasonally adjusted rate of 0.7% in February

The Italian statistical office Istat released its industrial orders data for Italy on Friday. Industrial orders in Italy rose at a seasonally adjusted rate of 0.7% in February, after a 0.6% increase in January. January's figure was revised down from a 0.7% gain.

Domestic orders were up 1.6% in February, while non-domestic orders declined 0.3%.

On a yearly basis, the unadjusted industrial orders in Italy increased 3.8% in February, after a 0.1% rise in January.

The seasonally adjusted industrial turnover in Italy climbed 0.1% in February, after a 0.9% increase in January. January's figure was revised down from a 1.0% rise.

Domestic turnover increased 0.2% in February, while non-domestic turnover fell 0.1%.

On a yearly basis, the adjusted industrial turnover in Italy declined 0.2% in February, after a 0.3% decrease in January.

-

11:33

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 48.0 in April

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 48.0 in April from 49.1 in March. It was the lowest level since January 2013.

A reading below 50 indicates contraction of activity, a reading above 50 indicates expansion.

The index was mainly driven by drop in output, new orders and input prices.

"Manufacturing conditions in Japan worsened at a sharper rate in April. Both production and new orders declined markedly, with total new work contracting at the fastest rate in over three years," economist at Markit, Amy Brownbill, said.

-

11:28

France's preliminary manufacturing PMI declines in April, while services PMI increases

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Friday. France's preliminary manufacturing PMI dropped to 48.3 in April from 49.6 in March. Analysts had expected the index to rise to 49.8.

The manufacturing index was driven by declines in output, new orders, employment and input prices.

France's preliminary services PMI climbed to 50.8 in April from 49.9 in March. Analysts had expected the index to increase to 50.2.

The services index was driven by rises in output, new orders, employment and input prices.

"The French private sector economy eked out marginal growth at the start of the second quarter after broadly stagnating on average during the opening three months of the year. Expansion was centred on the dominant service sector, as manufacturing was weighed down by a sharp drop in incoming new orders," the Senior Economist at Markit Jack Kennedy said.

-

11:21

Germany's preliminary manufacturing PMI rises in April, while services PMI declines

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Friday. Germany's preliminary manufacturing PMI climbed to 51.9 in April from 50.7 in March, beating forecasts of a rise to 51.0.

The rise in the manufacturing PMI was driven by a stronger demand from foreign markets.

Germany's preliminary services PMI was down to 54.6 in April from 55.1 in March. Analysts had expected index to increase to 55.2.

"The German private sector economy is continuing its unspectacular expansionary trend at the beginning of the second quarter. Although growth remained uninspiring and the headline PMI dropped to a 9-month low, the index was down only fractionally since March and is still indicative of modest growth," Markit's economist Oliver Kolodseike noted.

-

11:08

Eurozone's preliminary manufacturing PMI falls in April, while services PMIs rises slightly

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI declined to 51.5 in April from 51.6 in March. Analysts had expected the index to increase to 51.8.

Output in the manufacturing sector was moderate, new orders improved slightly, while input prices fell.

Eurozone's preliminary services PMI increased to 53.2 in April from 53.1 in March. Analysts had expected the index to climb to 53.3.

Output in the services sector was moderate, new orders improved slightly, while input prices rose.

"The Eurozone economy remains stuck in a slow growth rut in April, with the PMI once again signalling GDP growth of just 0.3% at the start of the second quarter, broadly in line with the meagre pace of expansion seen now for a full year," Markit's Chief Economist Chris Williamson said.

"A failure of business expectations to revive following the ECB's announcement of more aggressive stimulus in March is a major disappointment and suggests that the modest pace of growth is unlikely to accelerate in coming months," he added.

-

11:00

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.50 (USD 394m) 112.70 (2.2bln) 112.85 (1.95bln) 113.00 (1.27bln)

EUR/USD:1.1295-1.1300 (EUR 1.0bln) 1.1400 (1.26bln)

GBP/USD: 1.4130 (GBP 297m) 1.4300 (401m)

USD/CHF 0.9525 (USD 200m) 0.9675 (315m) 0.9785 (335m)

EUR/GBP 0.7865-67 (EUR 1.05bln)

AUD/USD: 0.7575 (AUD245m) 0.7650 (737m) 0.7715-20 (216m) 0

USD/CAD 1.2700 (USD 335m) 1.3100 ( 420m) 1.3125 (592m)

AUD/NZD 1.0900 (AUD 1.4bln) 1.1100 (1.31bln) 1.1200 (4.61bln) 1.1400 (1.85bln

-

10:39

Bloomberg: the Bank of Japan is considering to offer a negative rate on some loans

Bloomberg reported on Friday that the Bank of Japan (BoJ) was considering to offer a negative rate on some loans, according to people familiar with the matter.

The BoJ lowered its interest rate to -0.1% at its monetary policy meeting in February.

-

10:28

Number of Canadian receiving unemployment benefits rises 0.8% in February

Statistics Canada released its unemployment benefits data on Thursday. More Canadians received unemployment benefits in the provinces of Alberta and Saskatchewan unemployment benefits in February. Both provinces depend on resources. The number of Canadian receiving unemployment benefits in Alberta rose 2.4% in February compared to the previous month, while the number of Canadian receiving unemployment benefits in Saskatchewan climbed 3.5%.

Overall, the number of Canadian receiving unemployment benefits rose 0.8% in February compared to the previous month.

-

10:09

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy fall to 42.9 in in the week ended April 17

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 42.9 in in the week ended April 17 from 43.6 the prior week.

The decrease was driven by declines in two of three sub-indexes. The measure of views of the economy dropped to 33.4 from 35.6, the buying climate index rose to 39.6 from 38.7, while the personal finances index fell to 55.6 from 56.6.

-

10:00

Eurozone: Manufacturing PMI, April 51.5 (forecast 51.8)

-

10:00

Eurozone: Services PMI, April 53.2 (forecast 53.3)

-

09:30

Germany: Manufacturing PMI, April 51.9 (forecast 51)

-

09:30

Germany: Services PMI, April 54.6 (forecast 55.2)

-

09:00

France: Manufacturing PMI, April 48.3 (forecast 49.8)

-

09:00

France: Services PMI, April 50.8 (forecast 50.2)

-

08:36

Options levels on friday, April 22, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1409 (2284)

$1.1360 (1021)

$1.1324 (452)

Price at time of writing this review: $1.1293

Support levels (open interest**, contracts):

$1.1252 (2808)

$1.1229 (3484)

$1.1201 (3756)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 37784 contracts, with the maximum number of contracts with strike price $1,1400 (4334);

- Overall open interest on the PUT options with the expiration date May, 6 is 49445 contracts, with the maximum number of contracts with strike price $1,0900 (4725);

- The ratio of PUT/CALL was 1.31 versus 1.34 from the previous trading day according to data from April, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.4603 (1489)

$1.4505 (2425)

$1.4408 (2075)

Price at time of writing this review: $1.4352

Support levels (open interest**, contracts):

$1.4290 (408)

$1.4194 (960)

$1.4097 (1990)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 24848 contracts, with the maximum number of contracts with strike price $1,4500 (2425);

- Overall open interest on the PUT options with the expiration date May, 6 is 30808 contracts, with the maximum number of contracts with strike price $1,3850 (4025);

- The ratio of PUT/CALL was 1.24 versus 1.23 from the previous trading day according to data from April, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:22

Asian session: The euro wavered

The euro wavered on Thursday, well off its overnight peak as investors adjusted position ahead of a policy meeting by the European Central Bank later this session. The ECB is widely expected to hold interest rates unchanged at record lows, but President Mario Draghi is likely to drive home the case for ultra-loose monetary policy.

Last month, while the ECB delivered aggressive easing measures, the euro perversely rallied after Draghi said there was probably no need for more rate cuts if the latest stimulus worked. With three major central bank meetings looming, market participants cited a lack of market conviction on direction bets. The Federal Reserve is scheduled to hold its policy review on April 26-27, while the Bank of Japan will meet on April 28.

BOJ officials are growing more receptive to stepping up monetary easing measures by buying more ETFs invested in shares, as weak global growth threaten the country's fragile economic recovery, sources have told Reuters. On Wednesday, BOJ Governor Haruhiko Kuroda said the central bank's presence in the exchange-traded fund (ETF) market is "not too big," signaling that topping up purchases of ETFs could be a real, near-term option.

EUR/USD: during the Asian session the pair traded in the range of $1.1285-05

GBP/USD: during the Asian session the pair traded in the range of $1.4320-40

USD/JPY: during the Asian session the pair traded in the range of Y109.55-90

Based on Reuters materials

-

06:30

Japan: Tertiary Industry Index , February 1.5%

-

04:00

Japan: Manufacturing PMI, April 48.0

-

01:03

Currencies. Daily history for Apr 21’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1284 -0,13%

GBP/USD $1,4317 -0,11%

USD/CHF Chf0,9746 +0,31%

USD/JPY Y109,42 -0,29%

EUR/JPY Y123,47 -0,42%

GBP/JPY Y156,64 -0,40%

AUD/USD $0,7737 -0,70%

NZD/USD $0,6912 -0,91%

USD/CAD C$1,2727 +0,57%

-

00:00

Schedule for today, Friday, Apr 22’2016:

(time / country / index / period / previous value / forecast)

02:00 Japan Manufacturing PMI April 49.1

04:30 Japan Tertiary Industry Index February 1.5%

07:00 France Manufacturing PMI (Preliminary) April 49.6 49.8

07:00 France Services PMI (Preliminary) April 49.9 50.2

07:30 Germany Services PMI (Preliminary) April 55.1 55.2

07:30 Germany Manufacturing PMI (Preliminary) April 50.7 51

08:00 Eurozone Manufacturing PMI (Preliminary) April 51.6 51.8

08:00 Eurozone Services PMI (Preliminary) April 53.1 53.3

12:30 Canada Retail Sales, m/m February 2.1% -0.8%

12:30 Canada Retail Sales YoY February 6.4%

12:30 Canada Retail Sales ex Autos, m/m February 1.2% -0.5%

12:30 Canada Consumer Price Index m / m March 0.2% 0.6%

12:30 Canada Consumer price index, y/y March 1.4% 1.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y March 1.9% 1.7%

13:45 U.S. Manufacturing PMI (Preliminary) April 51.5 52

-