Noticias del mercado

-

23:00

New Zealand: RBNZ Interest Rate Decision, 2.25% (forecast 2.25%)

-

20:00

U.S.: Fed Interest Rate Decision , 0.5% (forecast 0.5%)

-

17:54

The Bank of England Governor Mark Carney: Britain’s exit from the European Union (EU) could lead to a higher inflation and a lower economic growth

The Bank of England (BoE) Governor Mark Carney said in a letter to Andrew Tyrie, the Treasury Select Committee (TSC) chairman, on Wednesday that Britain's exit from the European Union (EU) could lead to a higher inflation and a lower economic growth.

"There are plausible scenarios where the combined effects of the exchange rate move and its drivers on aggregate demand, aggregate supply and exchange rate pass through lead to a lower path for growth and a higher path for inflation," he said.

"Firms can ultimately be expected to pass through higher costs to consumers, resulting in higher prices," Carney added.

The BoE governor noted that the depreciation of the pound could lead to higher consumer price inflation.

"A persistent 10% depreciation (or appreciation) of the sterling effective exchange rate (ERI) increases (or decreases) annual consumer price inflation by around 0.75% over the baseline path after two to three years, and the price level by around 2.75% over four years.

-

17:20

OECD: Britain’s exit from the European Union (‘Brexit’) would be like a tax for Britain

The Organisation for Economic Co-operation and Development (OECD) said on Wednesday that Britain's exit from the European Union ('Brexit') would be like a tax for Britain.

"Leaving Europe would impose a Brexit tax on generations to come. Instead of funding public services, this tax would be a pure deadweight loss, with no economic benefit," OECD Secretary-General Angel Gurría said.

The referendum on Britain's membership in the European Union (EU) will take place on June 23.

Brexit could cost households £3,200 per year by 2030, the OECD said.

According to the OECD, the U.K. GDP would be more than 3% by 2020 and more than 5% lower by 2030 if Britain leaves the EU.

-

16:30

U.S.: Crude Oil Inventories, April 1.999 (forecast 2.5)

-

16:17

U.S. pending home sales increases 1.4% in March

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Wednesday. Pending home sales in the U.S. increased 1.4% in March, exceeding expectations for a 0.5% gain, after a 3.4% rise in February. February's figure was revised down from a 3.5% gain.

The increase was mainly lead by rises in almost all regions. Only pending home sales in the West region declined in March.

"Despite supply deficiencies in plenty of areas, contract activity was fairly strong in a majority of markets in March," the NAR's chief economist Lawrence Yun said.

"This spring's surprisingly low mortgage rates are easing some of the affordability pressures potential buyers are experiencing and are taking away some of the sting from home prices that are still rising too fast and above wage growth," he added.

-

16:01

U.S.: Pending Home Sales (MoM) , March 1.4% (forecast 0.5%)

-

16:00

Spaniards have to elect new parliament

Spain's King Felipe VI said on Tuesday evening that he would give up the search for a new prime minister. That means new parliament elections on June 26.

The parties were unable to form a new government since December.

-

15:47

Option expiries for today's 10:00 ET NY cut

USDJPY 110.00 (USD 1.2bln) 110.50 (797m) 111.00 (743m) 111.50 (598m) 112.00 (741m) 112.50 (330m)

EURUSD: 1.1100 (EUR 331m) 1.1200 (1.0bln) 1.1215 (226m) 1.1250 (599m) 1.1300 (210m) 1.1345 (294m)

AUDUSD 0.7675 (AUD 247m) 0.7700 (785m) 0.7800 (237m) 0.7845-50 (1.04bln) 0.7900 (268m)

USDCAD 1.2615 (USD 200m) 1.2745-50 (505m)

NZDUSD 0.6920 (NZD 231m)

AUDNZD 1.1180 (AUD 268m) 1.1275 (292m)

-

15:42

Profits of industrial companies in China jump 11.1% in March from a year earlier

China's National Bureau of Statistics (NBS) said on Wednesday that profits of industrial companies in China jumped 11.1% in March from a year earlier.

For the first quarter of 2016, industrial profits climbed 7.4% from a year earlier.

NBS official He Ping said in a statement that the rise profits of industrial companies in March was partly driven by an improving economy. He added that it was not a balanced and stable recovery.

-

15:32

Japan’s all industry activity index slides 1.2% in February

Japan's Ministry of Economy, Trade and Industry (METI) released its all industry activity index on Wednesday. The index slid 1.2% in February, beating expectations for a 1.3% drop, after a 1.2% rise in January. January's figure was revised down from a 2.0% increase.

Construction industry activity index fell 0.2% in February, industrial production index dropped 5.2%, while tertiary industry activity decreased 0.1%.

-

14:52

New Zealand’s trade surplus narrows to NZ$117 million in March

Statistics New Zealand released its trade data on late Tuesday evening. New Zealand's trade surplus narrowed to NZ$117 million in March from NZ$367 million in February. February's figure was revised up from a surplus of NZ$339 million.

Analysts had expected the surplus to rise to NZ$405 million.

Exports dropped 14.0% year-on-year in March, mainly driven by milk powder, while imports decreased by 3.7%.

-

14:28

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Trimmed Mean CPI q/q March 0.6% 0.5% 0.2%

01:30 Australia Trimmed Mean CPI y/y March 2.1% 2% 1.7%

01:30 Australia CPI, q/q Quarter I 0.4% 0.3% -0.2%

01:30 Australia CPI, y/y Quarter I 1.7% 1.8% 1.3%

04:30 Japan All Industry Activity Index, m/m February 1.2% Revised From 2.0% -1.3% -1.2%

06:00 Germany Gfk Consumer Confidence Survey May 9.4 9.4 9.7

06:00 Switzerland UBS Consumption Indicator March 1.45 Revised From 1.53 1.51

06:45 France Consumer confidence April 94 95 94

08:00 Eurozone Private Loans, Y/Y March 1.6% 1.7% 1.6%

08:00 Eurozone M3 money supply, adjusted y/y March 4.9% Revised From 5.0% 5% 5%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter I 0.6% 0.4% 0.4%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter I 2.1% 2% 2.1%

10:00 United Kingdom CBI retail sales volume balance April 7 12 -13

11:00 U.S. MBA Mortgage Applications April 1.3% -4.1%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the Fed's interest rate decision later in the day. Analysts expect the Fed to keep it monetary policy unchanged.

Pending home sales in the U.S. expected to rise 0.5% in March, after a 3.5% gain in February.

The euro traded lower against the U.S. dollar after the release of the mixed economic data from the Eurozone. The European Central Bank (ECB) released its M3 money supply figures on Wednesday. M3 money supply rose 5.0% in March from last year, in line with expectations, after a 4.9 % increase in February. February's figure was revised down from a 5.0% rise.

Loans to the private sector in the Eurozone climbed 1.6% in March from the last year, missing expectations for a 1.7% rise, after a 1.6% gain in February.

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index climbed to 9.7 in May from 9.4 in April. Analysts had expected the index to remain unchanged at 9.4.

"Consumers are clearly assuming that the German economy will regain some momentum in the coming months," Gfk noted.

ECB Executive Board member Benoit Coeure said in an interview with the Italian newspaper Il Sole 24 Ore Wednesday that the central bank's stimulus measures were working. Coeure pointed out that the ECB did not discuss helicopter money and further stimulus measures. He also said that a sharp appreciation in the euro would be a problem for the central bank.

The British pound traded mixed against the U.S. dollar on the U.K. GDP data. The Office for National Statistics released its U.K. GDP data on Wednesday. The preliminary U.K. gross domestic product (GDP) climbed 0.4% in the first quarter, in line with expectations, after a 0.6% rise in the third quarter.

The growth was mainly driven by a strong output in the services sector, which climbed 0.6% in the first quarter.

Construction fell 0.9% in the first quarter, production declined 0.4%, while agriculture decreased 0.1%.

On a yearly basis, the preliminary U.K. GDP increased 2.1% in the first quarter, beating forecasts of a 2.0% rise, after a 2.1% gain in the fourth quarter.

The Confederation of British Industry (CBI) released its retail sales balance data on Wednesday. The CBI retail sales balance plunged to -13% in April from +7% in March, missing expectations for a rise to +12%. It was the fastest pace since January 2012.

The decline was driven by drops in department stores and the clothing sales.

Sales are expected to rebound next month, while orders are expected to fall.

The Swiss franc traded lower against the U.S. dollar. UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.51 in March from 1.45 in February. February's figure was revised down from 1.53.

The increase was driven by improved retailer sentiment and the tourism sector. Demand for automobiles fell slightly in March.

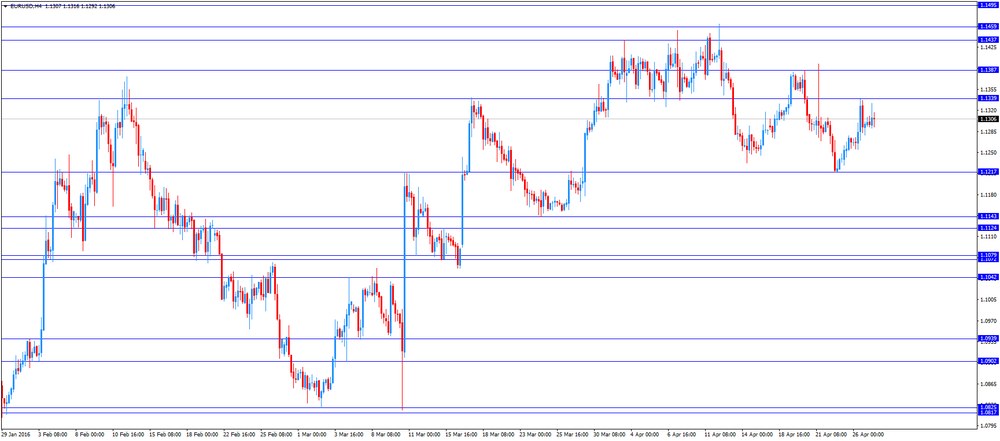

EUR/USD: the currency pair fell to $1.1292

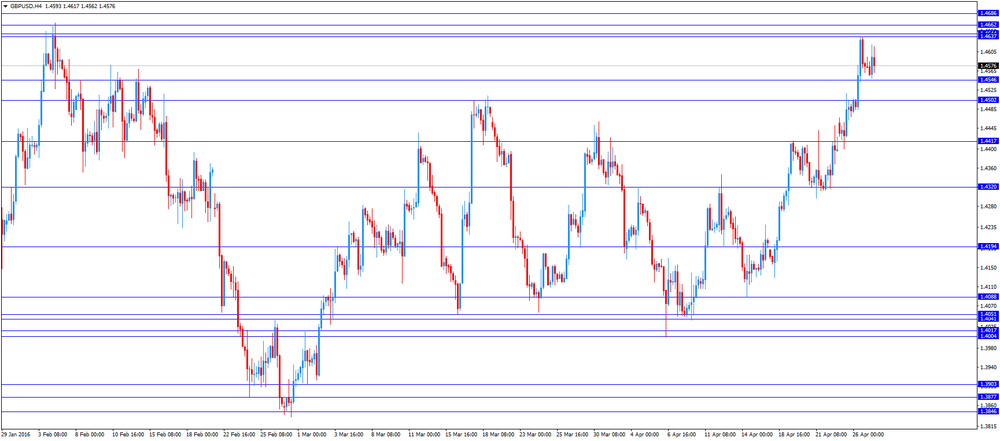

GBP/USD: the currency pair traded mixed

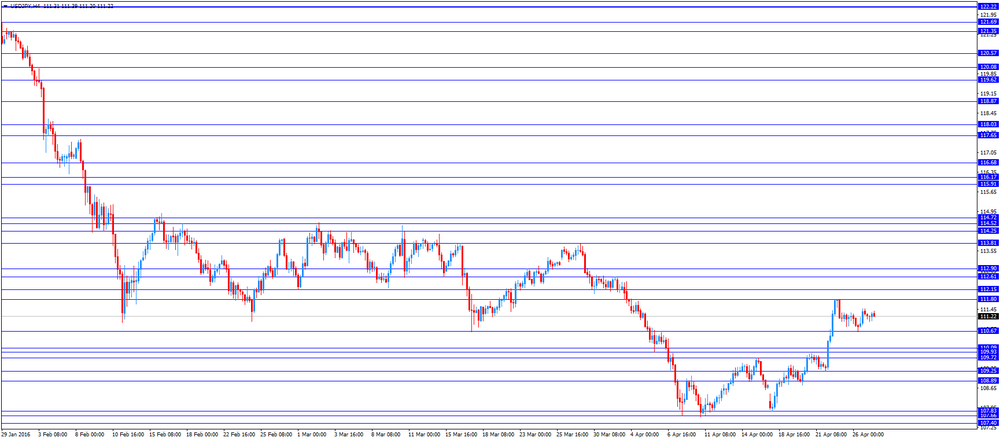

USD/JPY: the currency pair climbed to Y111.39

The most important news that are expected (GMT0):

14:00 U.S. Pending Home Sales (MoM) March 3.5% 0.5%

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Statement

21:00 New Zealand RBNZ Interest Rate Decision 2.25% 2.25%

21:00 New Zealand RBNZ Rate Statement

23:30 Japan Household spending Y/Y March 1.2% -4.2%

23:30 Japan Tokyo Consumer Price Index, y/y April -0.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y April -0.3% -0.3%

23:30 Japan National Consumer Price Index, y/y March 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y March 0% -0.2%

23:50 Japan Retail sales, y/y March 0.5% -1.5%

23:50 Japan Industrial Production (MoM) (Preliminary) March -5.2% 2.9%

23:50 Japan Industrial Production (YoY) (Preliminary) March -1.2%

-

14:16

CBI retail sales balance declines to -13% in April

The Confederation of British Industry (CBI) released its retail sales balance data on Wednesday. The CBI retail sales balance plunged to -13% in April from +7% in March, missing expectations for a rise to +12%. It was the fastest pace since January 2012.

The decline was driven by drops in department stores and the clothing sales.

Sales are expected to rebound next month, while orders are expected to fall.

"Cold weather put a chill in sales of spring and summer ranges with a reported dip in retail sales in the year to April, but with the near-term outlook for household spending holding up the sector expects a modest rise in sales next month," CBI Director of Economics, Rain Newton-Smith, said.

-

14:10

Orders

EUR/USD

Offers 1.1335 1.1350 1.13851.1400 1.1420 1.1450 1.1480 1.1500

Bids 1.1300 1.1280-85 1.1250 1.1220-25 1.1200 1.1180 1.1160 1.1150 1.1130 1.1100

GBP/USD

Offers 1.4625-30 1.4650 1.4680 1.4700 1.4725 1.4750 1.4775 1.4800

Bids 1.4580 1.4550-55 1.4520 1.4500 1.4485 1.4465 1.4450 1.4420 1.4400 1.4385 1.4350

EUR/JPY

Offers 126.00 126.50 126.85 127.00 127.50 127.80 128.00

Bids 125.50 125.00 124.80 124.50 124.30 124.00 123.50 123.20 123.00

EUR/GBP

Offers 0.7770 0.7785 0.7800 0.7825-30 07850 0.7880-85 0.7900

Bids 0.7730- 35 0.7720 0.7700 0.7685 0.7650 0.7630 0.7600

USD/JPY

Offers 111.30-35 111.50 111.75-80 112.00 112.30 112.50 112.80 113.00

Bids 111.00 110.85 110.65 110.50 110.20 110.00 109.80 109.50 109.30 109.00

AUD/USD

Offers 0.7630 0.7650 0.7680 0.7700 0.7730 0.7750 0.7780 0.7800 0.7825-30 0.7850

Bids 0.7600 0.7585 0.7550 0.7530 0.7500 0.7485 0.7465 0.7450 0.7430 0.7400

-

13:00

U.S.: MBA Mortgage Applications, April -4.1%

-

12:04

European Central Bank Executive Board member Benoit Coeure: the central bank’s stimulus measures are working, a sharp appreciation in the euro would be a problem

European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview with the Italian newspaper Il Sole 24 Ore Wednesday that the central bank's stimulus measures were working.

"Our monetary policy is working: credit is improving significantly, both in the volume and cost of loans, and economic activity is recovering. Not strongly enough, but it is steadily increasing," he said.

Coeure pointed out that the ECB did not discuss helicopter money and further stimulus measures.

He also said that a sharp appreciation in the euro would be a problem for the central bank.

"The euro has stabilised over the last month after a clear depreciation. It is not an obstacle to our monetary policy. Only if there was a sharp appreciation of the euro would that be a concern," Coeure noted.

-

12:00

United Kingdom: CBI retail sales volume balance, April -13 (forecast 12)

-

11:51

German import prices are up 0.2% in March

Destatis released its import prices data for Germany on Wednesday. German import prices declined by 5.9% in March from last year, after a 5.7% fall in February. It was the biggest drop since October 2009.

The decline was driven by a drop in energy prices, which plunged 29.8% year-on-year in March.

Import prices decline since January 2013.

On a monthly base, import prices increased 0.7% in March, after a 0.6% fall in February.

On a yearly base, import prices excluding crude oil and mineral oil products fell by 3.6% in March.

Export prices dropped 1.6% year-on-year in March, after a 1.2% decrease in February.

On a monthly base, export prices were up 0.2% in March, after a 0.5% fall in February.

-

11:46

German Gfk consumer confidence index climbs to 9.7 in May

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index climbed to 9.7 in May from 9.4 in April. Analysts had expected the index to remain unchanged at 9.4.

The economic expectations index increased by 5.8 points to 6.3 points in April, while the willingness to buy index rose by 5.4 points to 55.4.

The income expectations index were up by 7.0 points to 57.5 in April.

"Consumers are clearly assuming that the German economy will regain some momentum in the coming months," Gfk noted.

-

11:40

Retail sales in Spain rise at a seasonally adjusted rate of 0.5% in March

The Spanish statistical office INE released its retail sales data on Wednesday. Retail sales in Spain rose at a seasonally adjusted rate of 0.5% in March, after a flat reading in February. February's reading was revised down from a 0.2% rise.

Food sales were down 1.0% in March, while non-food sales increased by 0.9%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 4.4% in March, after a 4.1% rise in February. February's figure was revised up from a 3.9% gain.

Sales of non-food products jumped 5.1% in March from a year ago, while food sales rose 1.4%.

-

11:32

Italian consumer confidence index decreases to 114.2 in April

The Italian statistical office Istat released its consumer confidence index for Italy on Wednesday. The Italian consumer confidence index decreased to 114.2 in April from 114.9 in March. March's figure was revised down from 115.0.

The decrease was driven by declines in all components.

The business confidence index rose to 102.7 in April from 102.2 in March.

The rise was driven by an increase in production expectations.

-

11:26

UBS consumption index rises to 1.51 in March

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.51 in March from 1.45 in February. February's figure was revised down from 1.53.

The increase was driven by improved retailer sentiment and the tourism sector.

Demand for automobiles fell slightly in March.

-

11:21

French consumer confidence index remains unchanged at 94 in April

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index remained unchanged at 94 in April. Analysts had expected the index to rise to 95.

The index of the outlook on consumers' saving capacity rose to -9 in April from -10 in March.

The index of households' assessment of their financial situation in the past twelve months remained unchanged at -25 in April.

The index of the outlook on consumers' financial situation for next twelve months decreased to -14 in April from -13 in March.

The index of the outlook on unemployment rising in coming months climbed to 49 in April from 43 in March.

The index for future inflation expectations remained unchanged at -36 in April.

-

11:08

Option expiries for today's 10:00 ET NY cut

USDJ/PY 110.00 (USD 1.2bln) 110.50 (797m) 111.00 (743m) 111.50 (598m) 112.00 (741m) 112.50 (330m)

EUR/USD: 1.1100 (EUR 331m) 1.1200 (1.0bln) 1.1215 (226m) 1.1250 (599m) 1.1300 (210m) 1.1345 (294m)

AUD/USD 0.7675 (AUD 247m) 0.7700 (785m) 0.7800 (237m) 0.7845-50 (1.04bln) 0.7900 (268m)

USD/CAD 1.2615 (USD 200m) 1.2745-50 (505m)

NZD/USD 0.6920 (NZD 231m)

AUD/NZD 1.1180 (AUD 268m) 1.1275 (292m)

-

11:02

M3 money supply in the Eurozone rises 5.0% in March from last year

The European Central Bank (ECB) released its M3 money supply figures on Wednesday. M3 money supply rose 5.0% in March from last year, in line with expectations, after a 4.9 % increase in February. February's figure was revised down from a 5.0% rise.

Loans to the private sector in the Eurozone climbed 1.6% in March from the last year, missing expectations for a 1.7% rise, after a 1.6% gain in February.

Total credit to euro area residents decreased to 3.1% year-on-year in March from 3.2% in February.

Loans to non-financial corporations rose to 1.1% year-on-year in March from 1.0% in February.

-

10:55

U.K. gross domestic product (GDP) climbs 0.4% in the first quarter

The Office for National Statistics released its U.K. GDP data on Wednesday. The preliminary U.K. gross domestic product (GDP) climbed 0.4% in the first quarter, in line with expectations, after a 0.6% rise in the third quarter.

The growth was mainly driven by a strong output in the services sector, which climbed 0.6% in the first quarter.

Construction fell 0.9% in the first quarter, production declined 0.4%, while agriculture decreased 0.1%.

On a yearly basis, the preliminary U.K. GDP increased 2.1% in the first quarter, beating forecasts of a 2.0% rise, after a 2.1% gain in the fourth quarter.

-

10:30

United Kingdom: GDP, q/q, Quarter I 0.4% (forecast 0.4%)

-

10:30

United Kingdom: GDP, y/y, Quarter I 2.1% (forecast 2%)

-

10:23

Consumer prices in Australia fall 0.2% in the first quarter

The Australian Bureau of Statistics released its consumer inflation data on Wednesday. The consumer price inflation in Australia fell 0.2% in the first quarter, missing expectations for a 0.3% gain, after a 0.4% increase in the fourth quarter.

The quarterly inflation was mainly driven by lower prices for clothing and footwear and transport.

On a yearly basis, Australia's consumer price inflation slid to 1.3% in the first quarter from 1.7% in the fourth quarter, missing expectations for an increase to 1.8%.

The annual inflation was mainly driven by higher prices for alcohol and tobacco, education and health care.

The trimmed mean consumer price index (CPI) (the Reserve Bank of Australia's (RBA) main indicator of inflation) dropped to 1.7% year-on-year in the first quarter from 2.1% in the fourth quarter, missing expectations for a fall to 2.0%.

-

10:09

Number of unemployed people in France declines 1.7% in March

The French Labour Ministry released its labour market data on Tuesday. The number of unemployed people in France fell by 1.7% or by 60,000 in March compared with the previous month.

The total number of unemployed people was 3,531,000 in March, up 0.5% from a year ago.

The French government is struggling to bring down unemployment despite a rise in economic growth.

-

10:01

Eurozone: Private Loans, Y/Y, March 1.6% (forecast 1.7%)

-

10:00

Eurozone: M3 money supply, adjusted y/y, March 5% (forecast 5%)

-

08:45

France: Consumer confidence , April 94 (forecast 95)

-

08:30

Options levels on wednesday, April 27, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1401 (2413)

$1.1374 (2563)

$1.1335 (578)

Price at time of writing this review: $1.1299

Support levels (open interest**, contracts):

$1.1254 (2835)

$1.1232 (3047)

$1.1204 (4562)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 38122 contracts, with the maximum number of contracts with strike price $1,1400 (4834);

- Overall open interest on the PUT options with the expiration date May, 6 is 58986 contracts, with the maximum number of contracts with strike price $1,1000 (10085);

- The ratio of PUT/CALL was 1.55 versus 1.58 from the previous trading day according to data from April, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.4803 (979)

$1.4706 (1342)

$1.4610 (1537)

Price at time of writing this review: $1.4564

Support levels (open interest**, contracts):

$1.4493 (625)

$1.4396 (1454)

$1.4298 (815)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 25180 contracts, with the maximum number of contracts with strike price $1,4400 (2060);

- Overall open interest on the PUT options with the expiration date May, 6 is 32784 contracts, with the maximum number of contracts with strike price $1,3850 (4025);

- The ratio of PUT/CALL was 1.30 versus 1.29 from the previous trading day according to data from April, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

Asian session: The Australian dollar tumbled

The Australian dollar tumbled on Wednesday after surprisingly soft local inflation data, while the dollar and yen were on the defensive after a broad retreat overnight ahead of policy decisions by both the Federal Reserve and Bank of Japan. It was the first time since 2009 the inflation gauge fell to a negative level, raising speculation that the Reserve Bank of Australia may have to consider rate cuts. The Aussie had risen almost 15 percent earlier this month from its near seven-year low touched in January, thanks to recovery in commodity prices, but rising expectations of a rate cut could halt the rally.

Other major currencies were mostly stable in Asia with dollar bulls seeming to suspect the Fed will sound dovish again, even though a rise in U.S. Treasury yields to five-week highs suggested other investors were primed for a more hawkish tone. The BOJ, on the other hand, could ease further. The Fed is considered certain to keep rates steady later on Wednesday, so the focus rests squarely on the tone of its statement. Traders said policymakers may be wary of sending too strong a message of an imminent policy tightening, particularly after another batch of disappointing data.

EUR/USD: during the Asian session the pair traded in the range of $1.1295-10

GBP/USD: during the Asian session the pair traded in the range of $1.4510-90

USD/JPY: during the Asian session the pair dropped to Y111.00

Based on Reuters materials

-

08:01

Switzerland: UBS Consumption Indicator, March 1.51

-

08:00

Germany: Gfk Consumer Confidence Survey, May 9.7 (forecast 9.4)

-

06:31

Japan: All Industry Activity Index, m/m, February -1.2% (forecast -1.3%)

-

03:31

Australia: Trimmed Mean CPI y/y, March 1.7% (forecast 2%)

-

03:31

Australia: CPI, q/q, Quarter I -0.2% (forecast 0.3%)

-

03:30

Australia: Trimmed Mean CPI q/q, March 0.2% (forecast 0.5%)

-

03:30

Australia: CPI, y/y, Quarter I 1.7% (forecast 1.8%)

-

01:00

Currencies. Daily history for Apr 26’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1297 +0,27%

GBP/USD $1,4575 +0,64%

USD/CHF Chf0,9737 -0,14%

USD/JPY Y111,29 +0,06%

EUR/JPY Y125,72 +0,33%

GBP/JPY Y161,17 +0,07%

AUD/USD $0,7745 +0,43%

NZD/USD $0,6895 +0,57%

USD/CAD C$1,2603 -0,58%

-

00:45

New Zealand: Trade Balance, mln, March 117 (forecast 405)

-