Noticias del mercado

-

17:44

Australian import price index drops 3.0% in the first quarter

The Australian Bureau of Statistics released its import and export price indexes for Australia on Thursday. The Australian import price index dropped 3.0% in the first quarter, after a 0.3% fall in the fourth quarter.

The drop was mainly driven by a fall in import prices for mineral fuels, lubricants and related materials, which plunged 22.7% in the first quarter.

On a yearly basis, the import price index decreased 0.5% in the first quarter, after a 2.5% increase in the fourth quarter.

The export price index slides 4.7% in the first quarter, after a 5.4% decline in the fourth quarter.

On a yearly basis, the import price index plunged 13.8% in the first quarter.

-

17:34

European Central Bank Governing Council member Ewald Nowotny: an interest rate hike by the ECB will only make sense if the economic growth and inflation strengthen

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Thursday that an interest rate hike by the ECB would only make sense if the economic growth and inflation strengthen.

He noted that the central bank's stimulus measures would show effect in the second half of the year.

-

16:58

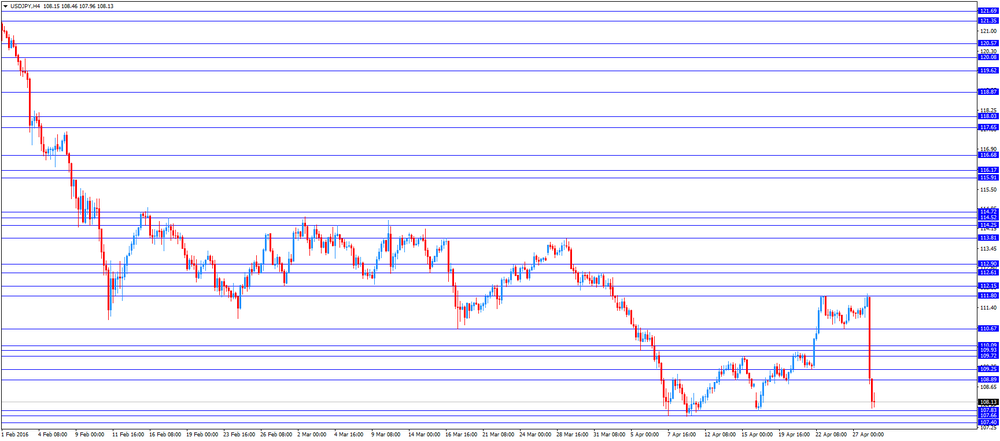

Bank of Japan Governor Haruhiko Kuroda: time is needed to monitor the effects of negative rates

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a press conference on Thursday that the current monetary policy was appropriate as time was needed to monitor the effects of negative rates.

He reiterated that the central bank was ready to add further stimulus measures to boost inflation toward 2% target if needed, adding that helicopter money was illegal.

The BoJ governor pointed out that there was no limit to the BoJ's monetary policy measures, noting that interest rates could be lowered further into negative territory.

-

16:41

Greek retail sales fall 4.3% in February

The Greek statistical office Hellenic Statistical Authority released its retail sales data on Thursday. Greek retail sales fell 4.3% in February.

On a yearly basis, Greek retail sales slid by 6.6% in February, after a 1.7% fall in January. January's figure was revised up from a 2.2% decrease.

Sales of food products decreased by 5.0% year-on-year in February, sales of non-food products declined by 6.4%, while sales of automotive fuel dropped by 7.9%.

-

16:19

Greek producer prices increase 2.1% in March

The Hellenic Statistical Authority released its producer price index (PPI) data on Thursday. Greek producer prices increased 2.1% in March, after a 0.4% drop in February.

Domestic market prices climbed by 1.8% in March, while foreign market prices rose 3.2%.

On a yearly basis, Greek PPI plunged 10.2% in March, after a 11.4% drop in February.

Domestic market prices slid 9.0% year-on-year in March, while foreign market prices dropped 14.3%.

Energy prices plunged 21.6% year-on-year in March, while non-durable consumer goods industrial prices were up 0.3%.

-

16:09

Unemployment rate in Spain rises to 21.0% in the first quarter

The Spanish statistical office INE released its labour market figures on Thursday. The unemployment rate was 21.0% in the first quarter, up from 20.9% in the fourth quarter.

The number of registered unemployed people rose by 11,900 in the first quarter to 4.79 million.

The number of employed people dropped by 64,600 in the first quarter to 18.03 million.

Spain's unemployment rate is the second-highest unemployment rate in the Eurozone after Greece.

-

15:49

Preliminary consumer price inflation in Spain is up 0.7% in April

The Spanish statistical office INE released its preliminary consumer price inflation data on Thursday. Consumer price inflation in Spain was up 0.7% in April, after a 0.6% rise in March.

On a yearly basis, consumer prices fell by 1.1% in April, after a 0.8% decrease in March.

The annual decline was mainly driven by the drop in in the prices of package holidays and electricity.

-

15:48

Option expiries for today's 10:00 ET NY cut

USDJPY 107.50 (USD 625m) 109.00 (626m) 110.00 (1.15bln) 111.00 (745m) 112.00 (700m) 113.00 (1.09bln)

EURUSD: 1.1275-80 (EUR 417m) 1.1300 (235m) 1.1315 (290m) 1.1325 (230m) 1.1330 (213m) 1.1340 (417m) 1.1365 (346m) 1.1500 (303m)

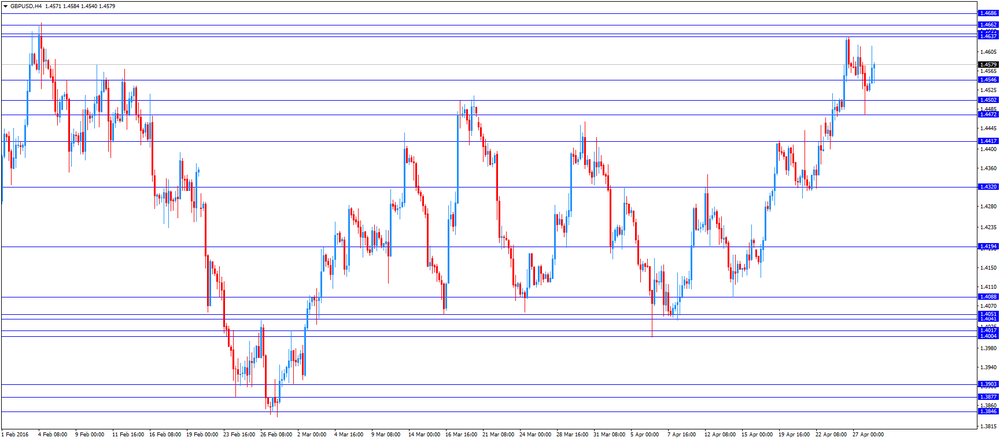

GBPUSD 1.4550 (GBP 220m)

AUDUSD 0.7700 (AUD 490m)

USDCAD 1.2490-2500 (USD 332m) 1.2700 (300m) 1.2920 (295m0

NZDUSD 0.6920 (NZD 231m)

AUDNZD 1.1000 (AUD 200m)

-

15:02

U.S. economy expands at 0.5% in the first quarter

The U.S. Commerce Department released gross domestic product data on Thursday. The U.S. preliminary gross domestic product increased by 0.5% in the first quarter, missing expectations for a 0.6% gain, after a 1.4% rise in the fourth quarter. It was the slowest growth since the first quarter of 2014.

The slower rise was mainly driven by a drop in business investment. Business investment plunged by 5.9% year-on-year in the first quarter, the biggest decline since the second quarter of 2009, driven by a decline in oil and gas exploration.

Consumer spending grew 1.9% in the first quarter, the slowest pace since the first quarter of 2015, after a 2.4% increase in the fourth quarter.

The personal saving rate rose to 5.2% in the first quarter from 5.0% in the fourth quarter.

Exports declined 2.6% in first quarter as a strong U.S. dollar weighed on exports, while imports increased 0.2%.

The personal consumption expenditures (PCE) price index rose 0.3% in the first quarter, exceeding expectations for a 0.2% gain, after a 0.3% increase in the fourth quarter.

The personal consumption expenditures (PCE) price index excluding food and energy increased 2.1% in the first quarter, beating forecasts of a 1.9% rise, after a 1.3% gain in the fourth quarter.

The personal consumption expenditures (PCE) price index is the Fed's preferred measure for inflation. The Fed's inflation target is 2%.

-

14:42

Initial jobless claims increase to 257,000 in the week ending April 23

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending April 23 in the U.S. increased by 9,000 to 257,000 from 248,000 in the previous week. The previous week's figure was revised up from 247,000.

Analysts had expected jobless claims to rise to 260,000.

Jobless claims remained below 300,000 the 60th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 5,000 to 2,130,000 in the week ended April 16. It was the lowest level since November 2000.

-

14:34

German consumer price inflation decreases 0.2% in April

Destatis released its consumer price data for Germany on Wednesday. German preliminary consumer price index decreased 0.2% in April, in line with expectations, after a 0.8% gain in March.

On a yearly basis, German preliminary consumer price index fell to 0.1% in April from 0.3% in March, in line with expectations.

Energy prices slid 8.5% year-on-year in April.

Goods prices dropped 1.0% year-on-year in April, while services prices increased 1.1%.

-

14:30

U.S.: GDP, q/q, Quarter I 0.5% (forecast 0.6%)

-

14:30

U.S.: Initial Jobless Claims, April 257 (forecast 260)

-

14:30

U.S.: PCE price index, q/q, Quarter I 0.3% (forecast 0.2%)

-

14:30

U.S.: Continuing Jobless Claims, April 2130 (forecast 2137)

-

14:30

U.S.: PCE price index ex food, energy, q/q, Quarter I 2.1% (forecast 1.9%)

-

14:16

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Export Price Index, q/q Quarter I -5.4% -4.7%

01:30 Australia Import Price Index, q/q Quarter I -0.3% -3.0%

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan Bank of Japan Monetary Base Target 275 275

05:00 Japan Construction Orders, y/y March -12.4% 19.8%

05:00 Japan Housing Starts, y/y March 7.8% -1.3% 8.4%

06:00 United Kingdom Nationwide house price index April 0.8% 0.4% 0.2%

06:00 United Kingdom Nationwide house price index, y/y April 5.7% 5% 4.9%

06:30 Japan BOJ Press Conference

07:55 Germany Unemployment Rate s.a. April 6.2% 6.2% 6.2%

07:55 Germany Unemployment Change April -3 0 -16

09:00 Eurozone Economic sentiment index April 103 103.4 103.9

09:00 Eurozone Consumer Confidence (Finally) April -9.7 -9.3 -9.3

09:00 Eurozone Business climate indicator April 0.12 Revised From 0.11 0.14 0.13

09:00 Eurozone Industrial confidence April -4.2 -4 -3.7

12:00 Germany CPI, m/m (Preliminary) April 0.8% -0.2% -0.2%

12:00 Germany CPI, y/y (Preliminary) April 0.3% 0.1% 0.1%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic later in the day. The U.S. preliminary GDP is expected to rise 0.6% in first quarter, after a 1.4% growth in the fourth quarter.

The number of initial jobless claims in the U.S. is expected to rise by 13,000 to 260,000 last week.

The euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone. Destatis released its consumer price data for Germany on Thursday. German preliminary consumer price index decreased 0.2% in April, in line with expectations, after a 0.8% gain in March.

On a yearly basis, German preliminary consumer price index fell to 0.1% in April from 0.3% in March, in line with expectations.

The European Commission released its economic sentiment index for the Eurozone on Thursday. The index rose to 103.9 in April from 103.0 in March. Analysts had expected the index to increase to 103.4.

The drop was driven by improvements in confidence among consumers and in all business sectors except retail trade.

The industrial confidence index increased to -3.7 in April from -4.2 in March, beating expectations for a rise to -4.0.

The final consumer confidence index was up to -9.3 in April from -9.7 in March, in line with expectations.

The business climate index increased to 0.13 in April from 0.12 in March. March's figure was revised up from 0.12. Analysts had expected the index to climb to 0.14.

The rise in business climate index was driven by a more favourable managers' assessment of production expectations, and of the stocks of finished products and export order books.

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany slid by 16,000 in April, beating expectations for a flat reading, after a 3,000 decrease in March.

The unemployment rate remained unchanged at 6.2% in April, in line with expectations.

The number of unemployed people was 1.80 million in March, down from 1.82 million in February, according to Destatis.

Destatis said that Germany's adjusted unemployment rate declined to 4.2% in March from 4.3% in February.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.2% in April, missing expectations for a 0.4% rise, after a 0.8% increase in March.

On a yearly basis, house prices fell to 4.9% in April from 5.7% in March. Analysts had expected house prices to decline by 5.0%.

"This slowdown returns the annual pace of house price growth to the fairly narrow range between 3% and 5% that had been prevailing since the summer of 2015," Nationwide's Chief Economist, Robert Gardner, said.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Continuing Jobless Claims April 2137 2137

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter I 1.3% 1.9%

12:30 U.S. PCE price index, q/q (Preliminary) Quarter I 0.3% 0.2%

12:30 U.S. Initial Jobless Claims April 247 260

12:30 U.S. GDP, q/q (Preliminary) Quarter I 1.4% 0.6%

-

14:00

Germany: CPI, y/y , April 0.1% (forecast 0.1%)

-

14:00

Germany: CPI, m/m, April -0.3% (forecast -0.2%)

-

13:46

Orders

EUR/USD

Offers 1.1370 1.1385 1.1400 1.1420 1.1450 1.1480 1.1500

Bids 1.1335 1.1320 1.1300 1.1280-85 1.1250 1.1220-25 1.1200 1.1180 1.1160 1.1150

GBP/USD

Offers 1.4625-30 1.4650 1.4680 1.4700 1.4725 1.4750 1.4775 1.4800

Bids 1.4580 1.4550-55 1.4520 1.4500 1.4485 1.4465 1.4450 1.4420 1.4400

EUR/JPY

Offers 123.30 123.50 123.80-85 124.00 124.50 125.00 125.60 126.00

Bids 122.65-70 122.50 122.00-05 121.70-75 121.50 121.30 121.00

EUR/GBP

Offers 0.7800 0.7825-30 07850 0.7880-85 0.7900

Bids 0.7760 0.7730- 35 0.7720 0.7700 0.7685 0.7650

USD/JPY

Offers 108.50 108.75 109.00 109.30 109.50 10975-80 110.00 110.30 110.50 110.80 111.00 111.30-35 111.50

Bids 108.00 107.80 107.50 107.30 107.00 106.80 106.50 106.00

AUD/USD

Offers 0.7675-80 0.7700 0.7730 0.7750 0.7780 0.7800

Bids 0.7620 0.7600 0.7580 0.7550 0.7530 0.7500 0.7485 0.7465 0.7450

-

13:25

Housing starts in Japan jump 8.4% year-on-year in March

Japan's Ministry of Land, Infrastructure, Transport and Tourism released its housing starts data on Thursday. Housing starts in Japan rose 8.4% year-on-year in March, beating expectations for a 1.3% drop, after a 7.8% increase in February. It was the biggest rise since August 2015.

On a yearly basis, housing starts were up to 993,000 in March from 974,000 in February.

Construction orders jumped 19.8% year-on-year in March, after a 12.4% drop in February.

-

13:20

Japan’s unemployment rate declines to 3.2% in March

Japan's Ministry of Internal Affairs and Communications released its unemployment rate on late Wednesday evening. Unemployment rate in Japan fell to 3.2% in March from 3.3% in February. Analysts had expected the unemployment rate to remain unchanged.

The number of unemployed persons fell by 120,000 in March from a year ago to 2.16 million.

The number of employed persons rose by 200,000 in March from a year ago to 63.39 million.

-

13:09

Preliminary industrial production in Japan climbs 3.6% in March

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Wednesday evening. Preliminary industrial production in Japan climbed 3.6% in March, exceeding expectations for a 2.9% rise, after a 5.2% drop in February.

The increase was mainly driven by rises in production, shipments, inventories and inventory ratio.

According to a survey by the ministry, industrial production is expected to increase 2.6% in April, and to decline 2.3% in May.

On a yearly basis, Japan's industrial production was up 0.1% in March, after a 1.2% decrease in February.

-

13:03

Retail sales in Japan are down at an annual rate of 1.1% in March

According to Japan's Ministry of Economy, Trade and Industry (METI), retail sales in Japan were down at an annual rate of 1.1% in March, beating expectations for a 1.5% drop, after a 0.4% increase in February. February's figure was revised down from a 0.5% rise.

Sales at large-scale retailers decreased 1.2% year-on-year in March, after a 2.2% rise in February.

On a monthly basis, retail sales were up 1.4% in March, after a 2.3% decrease in February.

-

12:55

Household spending in Japan plunges 5.3% year-on-year in March

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Wednesday evening. Household spending in Japan plunged 5.3% year-on-year in March, missing expectations of a 4.2% decline, after a 1.2% rise in February.

The drop was mainly driven by decreases in spending on clothing and footwear, and transport and communication.

Spending on clothing and footwear plunged 12.2% in real terms year-on-year in March, while spending on transport and communication slid 12.1%.

-

12:38

Nationwide: UK house prices rise 0.2% in April

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.2% in April, missing expectations for a 0.4% rise, after a 0.8% increase in March.

On a yearly basis, house prices fell to 4.9% in April from 5.7% in March. Analysts had expected house prices to decline by 5.0%.

"This slowdown returns the annual pace of house price growth to the fairly narrow range between 3% and 5% that had been prevailing since the summer of 2015," Nationwide's Chief Economist, Robert Gardner, said.

"It may be that the surge in house purchase activity resulting from the increase in stamp duty on second homes from 1 April provided a temporary boost to prices in March," he added.

-

12:33

Number of unemployed people in Germany slides by 16,000 in April

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany slid by 16,000 in April, beating expectations for a flat reading, after a 3,000 decrease in March.

The unemployment rate remained unchanged at 6.2% in April, in line with expectations.

The number of unemployed people was 1.80 million in March, down from 1.82 million in February, according to Destatis.

Destatis said that Germany's adjusted unemployment rate declined to 4.2% in March from 4.3% in February.

The employment rate remained unchanged at an adjusted rate of 65.8% in March, according to Destatis.

-

12:28

Eurozone’s economic sentiment index rises to 103.9 in April

The European Commission released its economic sentiment index for the Eurozone on Thursday. The index rose to 103.9 in April from 103.0 in March. Analysts had expected the index to increase to 103.4.

The drop was driven by improvements in confidence among consumers and in all business sectors except retail trade.

The industrial confidence index increased to -3.7 in April from -4.2 in March, beating expectations for a rise to -4.0.

The final consumer confidence index was up to -9.3 in April from -9.7 in March, in line with expectations.

The business climate index increased to 0.13 in April from 0.12 in March. March's figure was revised up from 0.12. Analysts had expected the index to climb to 0.14.

The rise in business climate index was driven by a more favourable managers' assessment of production expectations, and of the stocks of finished products and export order books.

-

12:11

Japan's national CPI declines to an annual rate of -0.1% in March

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Wednesday evening. Japan's national consumer price index (CPI) declined to an annual rate of -0.1% in March from 0.3% in February.

Inflation was mainly driven by declines in fuel, light and water charges, and transportation and communication prices. Fuel, light and water charges slid 8.5% year-on-year in March, while transportation and communication prices declined 3.0%.

Japan's national CPI excluding fresh food fell to an annual rate of -0.3% in March from 0.0%, missing expectations for a drop to -0.2%.

The Bank of Japan's inflation target is 2%.

-

12:05

Bank of Japan keeps its interest rate unchanged at -0.1% in April

The Bank of Japan (BoJ) released its interest rate decision on Thursday. The central bank kept its interest rate unchanged at -0.1% as widely expected by analysts. The monetary base target remained unchanged at 275 trillion yen, while the central bank said that it will expand its monetary base at an annual pace of 80 trillion yen as expected by analysts.

The BoJ lowered its inflation forecasts. Inflation is expected to reach 2% target in the fiscal year 2017, while inflation is expected to be 1.9% the fiscal year 2018.

The central bank downgraded its growth forecast for the fiscal year 2016 to 1.2% from 1.5%, and for the fiscal year 2017 to 0.1% from 0.3%.

-

11:33

European Central Bank President Mario Draghi: the ECB’s monetary policy is working

The European Central Bank (ECB) President Mario Draghi said in an interview with the German newspaper Bild on Wednesday that the central bank's monetary policy was working, but more time was needed.

He noted that the ECB was aware of the situation for savers, who are affected by low interest rates.

Draghi also said that Britain would lose benefits of the single market if it leaves the European Union.

-

11:21

Reserve Bank of New Zealand keeps its interest rate unchanged at 2.25% in April

The Reserve Bank of New Zealand (RBNZ) on Wednesday kept its interest rate unchanged at 2.25% as widely expected by analysts.

The RBNZ Graeme Wheeler said that New Zealand's economy was supported by strong inward migration, construction activity, tourism, and the central bank's accommodative monetary policy.

He pointed out on Wednesday that further monetary policy easing was possible.

"Further policy easing may be required to ensure that future average inflation settles near the middle of the target range," he said.

Wheeler noted that the New Zealand dollar remained high, adding that a weaker currency was desirable.

The RBNZ governor also said that inflation was low, driven by lower prices for fuel and other imports.

Wheeler pointed out that there were risks to the outlook from to weakness in the dairy sector, the fall in inflation expectations, the possible high net immigration, and pressures in the housing market.

The RBNZ lowered its interest rate to 2.25% from 2.50% in March. This decision was not expected by market participants.

-

11:07

The Fed keeps its monetary unchanged in April

The Fed's released its interest rate decision on Wednesday. The Fed kept its interest rate unchanged at 0.25% - 0.50% as widely expected by analysts.

The Fed said in its statement that the U.S. economic activity slowed, while the labour market continued to improve.

According to the Fed household spending rose moderately, despite higher real income.

Inflation remained low due to lower energy prices and falling prices of non-energy imports, the Fed noted.

The Fed expects inflation to rise to 2% over the medium term.

The Fed also said that it continued to closely monitor inflation indicators and global economic and financial developments, adding that an interest rate hike will depend on the incoming economic data.

Only Kansas City President Esther George voted for an interest rate hike by 0.25%.

-

11:00

Eurozone: Economic sentiment index , April 103.9 (forecast 103.4)

-

11:00

Eurozone: Business climate indicator , April 0.13 (forecast 0.14)

-

11:00

Eurozone: Industrial confidence, April -3.7 (forecast -4)

-

11:00

Eurozone: Consumer Confidence, April -9.3 (forecast -9.3)

-

09:55

Germany: Unemployment Change, April -16

-

09:55

Germany: Unemployment Rate s.a. , April 6.2% (forecast 6.2%)

-

09:22

Option expiries for today's 10:00 ET NY cut

USD/JPY 107.50 (USD 625m) 109.00 (626m) 110.00 (1.15bln) 111.00 (745m) 112.00 (700m) 113.00 (1.09bln)

EUR/USD: 1.1275-80 (EUR 417m) 1.1300 (235m) 1.1315 (290m) 1.1325 (230m) 1.1330 (213m) 1.1340 (417m) 1.1365 (346m) 1.1500 (303m)

GBP/USD 1.4550 (GBP 220m)

AUD/USD 0.7700 (AUD 490m)

USD/CAD 1.2490-2500 (USD 332m) 1.2700 (300m) 1.2920 (295m0

NZD/USD 0.6920 (NZD 231m)

AUD/NZD 1.1000 (AUD 200m)

-

08:31

Options levels on thursday, April 28, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1472 (2257)

$1.1436 (4753)

$1.1383 (2537)

Price at time of writing this review: $1.1349

Support levels (open interest**, contracts):

$1.1305 (2745)

$1.1258 (2940)

$1.1224 (4579)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 37878 contracts, with the maximum number of contracts with strike price $1,1400 (4753);

- Overall open interest on the PUT options with the expiration date May, 6 is 58452 contracts, with the maximum number of contracts with strike price $1,1000 (10060);

- The ratio of PUT/CALL was 1.54 versus 1.55 from the previous trading day according to data from April, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.4802 (975)

$1.4704 (1116)

$1.4607 (1444)

Price at time of writing this review: $1.4568

Support levels (open interest**, contracts):

$1.4492 (595)

$1.4396 (1362)

$1.4298 (826)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 25076 contracts, with the maximum number of contracts with strike price $1,4400 (2194);

- Overall open interest on the PUT options with the expiration date May, 6 is 32826 contracts, with the maximum number of contracts with strike price $1,3850 (4025);

- The ratio of PUT/CALL was 1.31 versus 1.30 from the previous trading day according to data from April, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:31

United Kingdom: Nationwide house price index, y/y, April 4.9% (forecast 5%)

-

08:31

United Kingdom: Nationwide house price index , April 0.2% (forecast 0.4%)

-

08:15

Asian session: The yen jumped

Elsewhere, New Zealand's central bank skipped a chance to cut its interest rates on Thursday, triggering a short squeeze that saw the kiwi dollar gain a full U.S. cent. The kiwi soared towards $0.6950 NZD=D4, from around $0.6850, after the RBNZ kept the cash rate steady at 2.25 percent. It was on track for a 1 percent rise this week. RBNZ retained an easing bias and tried to talk down the currency, but to no avail.

The yen jumped against the dollar and euro on Thursday after the Bank of Japan held monetary policy steady, quashing speculation that it would ramp up its already extensive easing program. The BOJ stood pat even as global headwinds, a strong yen and soft consumption threatened to derail a fragile economic recovery.

Concerns over China's economy have eased somewhat while crude oil prices have rebounded sharply from 13-year lows, in theory lessening demand for the safe-haven yen.

After a two-day policy meeting that ended Wednesday, the Federal Reserve said global economic headwinds remained on its radar. But unlike last month, it stopped short of mentioning the risks these posed.

EUR/USD: during the Asian session the pair traded in the range of $1.1300-40

GBP/USD: during the Asian session the pair traded in the range of $1.4520-50

USD/JPY: during the Asian session the pair fell to Y108.75

Based on Reuters materials

-

07:16

Japan: Construction Orders, y/y, March 19.8%

-

07:02

Japan: Housing Starts, y/y, March 8.4% (forecast -1.3%)

-

05:05

Japan: Bank of Japan Monetary Base Target, 275

-

05:04

Japan: BoJ Interest Rate Decision, -0.1%

-

03:46

Australia: Export Price Index, q/q, Quarter I -4.7%

-

03:46

Australia: Import Price Index, q/q, Quarter I -3.0%

-

01:51

Japan: Retail sales, y/y, March -1.1% (forecast -1.5%)

-

01:51

Japan: Industrial Production (YoY), March 0.1%

-

01:50

Japan: Industrial Production (MoM) , March 3.6% (forecast 2.9%)

-

01:39

Japan: National CPI Ex-Fresh Food, y/y, March -0.3% (forecast -0.2%)

-

01:32

Japan: Tokyo Consumer Price Index, y/y, April -0.4%

-

01:31

Japan: Tokyo CPI ex Fresh Food, y/y, April -0.3% (forecast -0.3%)

-

01:31

Japan: National Consumer Price Index, y/y, March -0.1%

-

01:30

Japan: Household spending Y/Y, March -5.3% (forecast -4.2%)

-

01:10

Currencies. Daily history for Apr 27’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1324 +0,24%

GBP/USD $1,4533 -0,29%

USD/CHF Chf0,9712 -0,26%

USD/JPY Y111,45 +0,14%

EUR/JPY Y126,21 +0,39%

GBP/JPY Y161,96 +0,49%

AUD/USD $0,7594 -1,99%

NZD/USD $0,6912 +0,25%

USD/CAD C$1,2592 -0,09%

-

00:01

Schedule for today, Thursday, Apr 28’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Export Price Index, q/q Quarter I -5.4%

01:30 Australia Import Price Index, q/q Quarter I -0.3%

03:00 Japan BoJ Interest Rate Decision -0.1%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan Bank of Japan Monetary Base Target 275

05:00 Japan Construction Orders, y/y March -12.4%

05:00 Japan Housing Starts, y/y March 7.8% -1.3%

06:00 United Kingdom Nationwide house price index April 0.8% 0.4%

06:00 United Kingdom Nationwide house price index, y/y April 5.7% 5%

06:30 Japan BOJ Press Conference

07:55 Germany Unemployment Rate s.a. April 6.2% 6.2%

07:55 Germany Unemployment Change April 0 0

09:00 Eurozone Economic sentiment index April 103 103.5

09:00 Eurozone Consumer Confidence (Finally) April -9.7 -9.3

09:00 Eurozone Business climate indicator April 0.11 0.14

09:00 Eurozone Industrial confidence April -4.2 -4

12:00 Germany CPI, m/m (Preliminary) April 0.8% -0.2%

12:00 Germany CPI, y/y (Preliminary) April 0.3% 0.1%

12:30 U.S. Continuing Jobless Claims April 2137 2134

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter I 1.3% 1.9%

12:30 U.S. PCE price index, q/q (Preliminary) Quarter I 0.3% 0.2%

12:30 U.S. Initial Jobless Claims April 247 260

12:30 U.S. GDP, q/q (Preliminary) Quarter I 1.4% 0.6%

22:45 New Zealand Building Permits, m/m March 10.8%

23:05 United Kingdom Gfk Consumer Confidence April 0 -1

-