Noticias del mercado

-

21:01

DJIA 17919.68 -121.87 -0.68%, NASDAQ 4842.58 -20.56 -0.42%, S&P 500 2087.69 -7.46 -0.36%

-

19:10

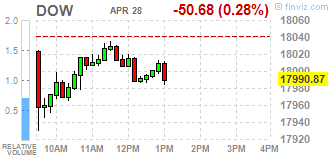

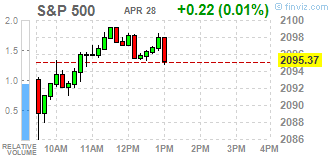

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed. Strong results from Facebook and a flurry of dealmaking helped U.S. stocks pare early losses caused by a surprising decision by the Bank of Japan to hold off from expanding monetary stimulus. Facebook (FB) jumped as much as 8% after the company reported a 50% rise in revenue. The stock provided the biggest boost to the S&P 500 and the Nasdaq. The Bank Of Japan decision to hold steady in the face of soft global demand and a rise in the yen was particularly jarring for markets after media reports that the central bank wanted to go deeper into negative interest rates.

Dow stocks mixed (15 in positive area, 15 on negative area). Top looser - Cisco Systems, Inc. (CSCO, -1,40%). Top gainer - General Electric Company (GE, +0,71%).

S&P sectors mixed. Top looser - Financial (-0,3%). Top gainer - Basic Materials (+0,6%).

At the moment:

Dow 17931.00 -32.00 -0.18%

S&P 500 2092.00 +1.25 +0.06%

Nasdaq 100 4423.00 -0.75 -0.02%

Oil 45.79 +0.46 +1.01%

Gold 1266.00 +15.60 +1.25%

U.S. 10yr 1.86 +0.00

-

18:00

European stocks closed: FTSE 6322.40 2.49 0.04%, DAX 10321.15 21.32 0.21%, CAC 40 4557.36 -2.04 -0.04%

-

18:00

European stocks close: stocks traded mixed on corporate earnings and as market participants eyed the Fed's and the BoJ’s interest rate decisions

Stock indices traded mixed on corporate earnings and on the Fed's and the Bank of Japan's (BoJ) interest rate decisions. The BoJ kept its monetary policy unchanged on Thursday. Market participants speculated that the central bank would add further stimulus measures.

The Fed kept its interest rate unchanged at 0.25% - 0.50% on Wednesday as widely expected by analysts. The Fed said in its statement that the U.S. economic activity slowed, while the labour market continued to improve.

Market participants also eyed the economic data from the Eurozone. The European Commission released its economic sentiment index for the Eurozone on Thursday. The index rose to 103.9 in April from 103.0 in March. Analysts had expected the index to increase to 103.4.

The drop was driven by improvements in confidence among consumers and in all business sectors except retail trade.

The industrial confidence index increased to -3.7 in April from -4.2 in March, beating expectations for a rise to -4.0.

The final consumer confidence index was up to -9.3 in April from -9.7 in March, in line with expectations.

The business climate index increased to 0.13 in April from 0.12 in March. March's figure was revised up from 0.12. Analysts had expected the index to climb to 0.14.

The rise in business climate index was driven by a more favourable managers' assessment of production expectations, and of the stocks of finished products and export order books.

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany slid by 16,000 in April, beating expectations for a flat reading, after a 3,000 decrease in March.

The unemployment rate remained unchanged at 6.2% in April, in line with expectations.

The number of unemployed people was 1.80 million in March, down from 1.82 million in February, according to Destatis.

Destatis said that Germany's adjusted unemployment rate declined to 4.2% in March from 4.3% in February.

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.2% in April, missing expectations for a 0.4% rise, after a 0.8% increase in March.

On a yearly basis, house prices fell to 4.9% in April from 5.7% in March. Analysts had expected house prices to decline by 5.0%.

"This slowdown returns the annual pace of house price growth to the fairly narrow range between 3% and 5% that had been prevailing since the summer of 2015," Nationwide's Chief Economist, Robert Gardner, said.

Sales are expected to rebound next month, while orders are expected to fall.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,322.4 +2.49 +0.04 %

DAX 10,321.15 +21.32 +0.21 %

CAC 40 4,557.36 -2.04 -0.04 %

-

17:57

WSE: Session Results

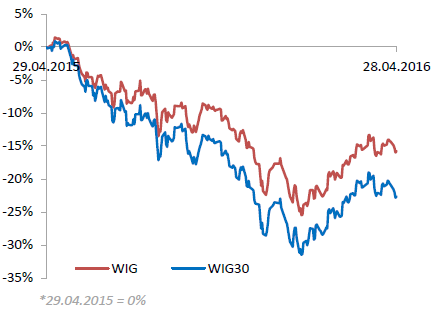

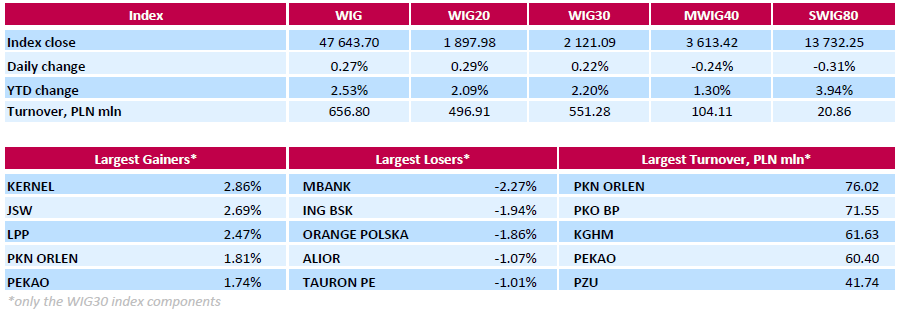

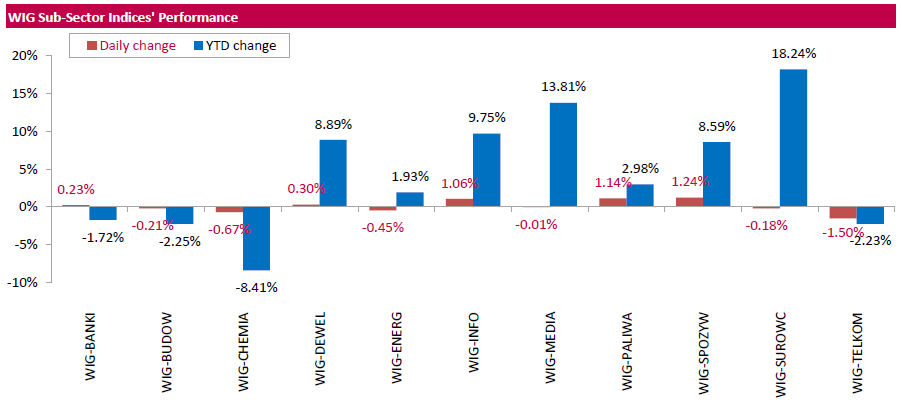

Polish equity market closed higher on Thursday. The broad market benchmark, the WIG Index, grew by 0.27%. Sector performance in the WIG Index was mixed. Food sector (+1.24%) recorded the biggest gains, while telecoms (-1.50%) lagged behind.

The large-cap stocks measure, the WIG30 Index, rose by 0.22%. In the index basket, agricultural producer KERNEL (WSE: KER), coking coal producer JSW (WSE: JSW) and clothing retailer LPP (WSE: LPP) were the best-performing names, advancing by 2.86%, 2.69% and 2.47% respectively. On the other side of the ledger, MBANK (WSE: MBK) led the decliners, losing 2.27% on report the bank's net profit fell by 32% y/y in Q1, to PLN 308 mln ($79.5 mln), but was above analysts' expectations of PLN 284 mln. It was followed by telecommunication services provider ORANGE POLSKA (WSE: OPL) and two banking names ING BSK (WSE: ING) and ALIOR (WSE: ALR), dropping by 1.07%-1.94%.

-

17:44

Australian import price index drops 3.0% in the first quarter

The Australian Bureau of Statistics released its import and export price indexes for Australia on Thursday. The Australian import price index dropped 3.0% in the first quarter, after a 0.3% fall in the fourth quarter.

The drop was mainly driven by a fall in import prices for mineral fuels, lubricants and related materials, which plunged 22.7% in the first quarter.

On a yearly basis, the import price index decreased 0.5% in the first quarter, after a 2.5% increase in the fourth quarter.

The export price index slides 4.7% in the first quarter, after a 5.4% decline in the fourth quarter.

On a yearly basis, the import price index plunged 13.8% in the first quarter.

-

17:34

European Central Bank Governing Council member Ewald Nowotny: an interest rate hike by the ECB will only make sense if the economic growth and inflation strengthen

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Thursday that an interest rate hike by the ECB would only make sense if the economic growth and inflation strengthen.

He noted that the central bank's stimulus measures would show effect in the second half of the year.

-

16:58

Bank of Japan Governor Haruhiko Kuroda: time is needed to monitor the effects of negative rates

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a press conference on Thursday that the current monetary policy was appropriate as time was needed to monitor the effects of negative rates.

He reiterated that the central bank was ready to add further stimulus measures to boost inflation toward 2% target if needed, adding that helicopter money was illegal.

The BoJ governor pointed out that there was no limit to the BoJ's monetary policy measures, noting that interest rates could be lowered further into negative territory.

-

16:41

Greek retail sales fall 4.3% in February

The Greek statistical office Hellenic Statistical Authority released its retail sales data on Thursday. Greek retail sales fell 4.3% in February.

On a yearly basis, Greek retail sales slid by 6.6% in February, after a 1.7% fall in January. January's figure was revised up from a 2.2% decrease.

Sales of food products decreased by 5.0% year-on-year in February, sales of non-food products declined by 6.4%, while sales of automotive fuel dropped by 7.9%.

-

16:19

Greek producer prices increase 2.1% in March

The Hellenic Statistical Authority released its producer price index (PPI) data on Thursday. Greek producer prices increased 2.1% in March, after a 0.4% drop in February.

Domestic market prices climbed by 1.8% in March, while foreign market prices rose 3.2%.

On a yearly basis, Greek PPI plunged 10.2% in March, after a 11.4% drop in February.

Domestic market prices slid 9.0% year-on-year in March, while foreign market prices dropped 14.3%.

Energy prices plunged 21.6% year-on-year in March, while non-durable consumer goods industrial prices were up 0.3%.

-

16:09

Unemployment rate in Spain rises to 21.0% in the first quarter

The Spanish statistical office INE released its labour market figures on Thursday. The unemployment rate was 21.0% in the first quarter, up from 20.9% in the fourth quarter.

The number of registered unemployed people rose by 11,900 in the first quarter to 4.79 million.

The number of employed people dropped by 64,600 in the first quarter to 18.03 million.

Spain's unemployment rate is the second-highest unemployment rate in the Eurozone after Greece.

-

15:52

WSE: After start on Wall Street

U.S. Stocks open: Dow -0.50%, Nasdaq -0.13%, S&P -0.38%

The market in the US opens from the decline that does not change much. Quotation of the index does not deviate from the narrow framework of consolidation of the last days and only it's leave would introduce a change.

Yesterday's gains make, however, that the same index is higher than at the start of yesterday's session. This result, which should foster more or less neutral the end of the session in Warsaw.

On the Warsaw parquet the four companies which participation in the WIG20 index exceeds 10 per cent are already on the plus side. Another locomotive of the main index is now PZU which share in the index is at the level of 11.6 percent. For these reasons the market went to the session highs.

-

15:49

Preliminary consumer price inflation in Spain is up 0.7% in April

The Spanish statistical office INE released its preliminary consumer price inflation data on Thursday. Consumer price inflation in Spain was up 0.7% in April, after a 0.6% rise in March.

On a yearly basis, consumer prices fell by 1.1% in April, after a 0.8% decrease in March.

The annual decline was mainly driven by the drop in in the prices of package holidays and electricity.

-

15:33

U.S. Stocks open: Dow -0.50%, Nasdaq -0.13%, S&P -0.38%

-

15:22

Before the bell: S&P futures -0.62%, NASDAQ futures -0.28%

U.S. stock-index futures declined.

Global Stocks:

Nikkei 16,666.05 -624.44 -3.61%

Hang Seng 21,388.03 +26.43 +0.12%

Shanghai Composite 2,946.2 -7.47 -0.25%

FTSE 6,261.39 -58.52 -0.93%

CAC 4,499.59 -59.81 -1.31%

DAX 10,196.26 -103.57 -1.01%

Crude $45.51 (+0.40%)

Gold $1257.70 (+0.58%)

-

15:02

U.S. economy expands at 0.5% in the first quarter

The U.S. Commerce Department released gross domestic product data on Thursday. The U.S. preliminary gross domestic product increased by 0.5% in the first quarter, missing expectations for a 0.6% gain, after a 1.4% rise in the fourth quarter. It was the slowest growth since the first quarter of 2014.

The slower rise was mainly driven by a drop in business investment. Business investment plunged by 5.9% year-on-year in the first quarter, the biggest decline since the second quarter of 2009, driven by a decline in oil and gas exploration.

Consumer spending grew 1.9% in the first quarter, the slowest pace since the first quarter of 2015, after a 2.4% increase in the fourth quarter.

The personal saving rate rose to 5.2% in the first quarter from 5.0% in the fourth quarter.

Exports declined 2.6% in first quarter as a strong U.S. dollar weighed on exports, while imports increased 0.2%.

The personal consumption expenditures (PCE) price index rose 0.3% in the first quarter, exceeding expectations for a 0.2% gain, after a 0.3% increase in the fourth quarter.

The personal consumption expenditures (PCE) price index excluding food and energy increased 2.1% in the first quarter, beating forecasts of a 1.9% rise, after a 1.3% gain in the fourth quarter.

The personal consumption expenditures (PCE) price index is the Fed's preferred measure for inflation. The Fed's inflation target is 2%.

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

166.8

-0.96(-0.5722%)

663

ALCOA INC.

AA

11.21

-0.10(-0.8842%)

111178

ALTRIA GROUP INC.

MO

62

0.45(0.7311%)

5839

Amazon.com Inc., NASDAQ

AMZN

615

8.43(1.3898%)

23060

Apple Inc.

AAPL

97.47

-0.35(-0.3578%)

142281

AT&T Inc

T

38.55

-0.17(-0.4391%)

2128

Barrick Gold Corporation, NYSE

ABX

16.76

0.15(0.9031%)

124687

Boeing Co

BA

135.72

-1.36(-0.9921%)

1393

Cisco Systems Inc

CSCO

28.38

-0.26(-0.9078%)

8041

Citigroup Inc., NYSE

C

46.75

-0.53(-1.121%)

53410

Exxon Mobil Corp

XOM

88.12

-0.34(-0.3844%)

300

Facebook, Inc.

FB

121.4

12.51(11.4887%)

3345741

Ford Motor Co.

F

13.89

0.23(1.6838%)

3809811

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.58

-0.07(-0.5534%)

108135

General Electric Co

GE

30.75

-0.18(-0.582%)

17563

General Motors Company, NYSE

GM

32.1

-0.06(-0.1866%)

6841

Goldman Sachs

GS

165.4

-1.52(-0.9106%)

5032

Google Inc.

GOOG

707.75

1.91(0.2706%)

4775

Home Depot Inc

HD

135.4

-0.35(-0.2578%)

217

Intel Corp

INTC

31.5

-0.25(-0.7874%)

7508

International Business Machines Co...

IBM

149.49

-0.98(-0.6513%)

2257

International Paper Company

IP

43.75

-0.43(-0.9733%)

4130

Johnson & Johnson

JNJ

112.29

-0.48(-0.4256%)

1843

JPMorgan Chase and Co

JPM

63.6

-0.51(-0.7955%)

5344

Microsoft Corp

MSFT

50.71

-0.23(-0.4515%)

42900

Procter & Gamble Co

PG

79.88

-0.01(-0.0125%)

1553

Starbucks Corporation, NASDAQ

SBUX

56.65

-0.25(-0.4394%)

12265

Tesla Motors, Inc., NASDAQ

TSLA

249.9

-1.57(-0.6243%)

10574

The Coca-Cola Co

KO

44.46

-0.22(-0.4924%)

152

Twitter, Inc., NYSE

TWTR

14.84

-0.02(-0.1346%)

301747

Visa

V

78.3

-0.46(-0.584%)

1856

Wal-Mart Stores Inc

WMT

69.42

-0.00(-0.00%)

350

Walt Disney Co

DIS

105

-0.28(-0.266%)

3967

Yahoo! Inc., NASDAQ

YHOO

36.72

-0.23(-0.6225%)

1183

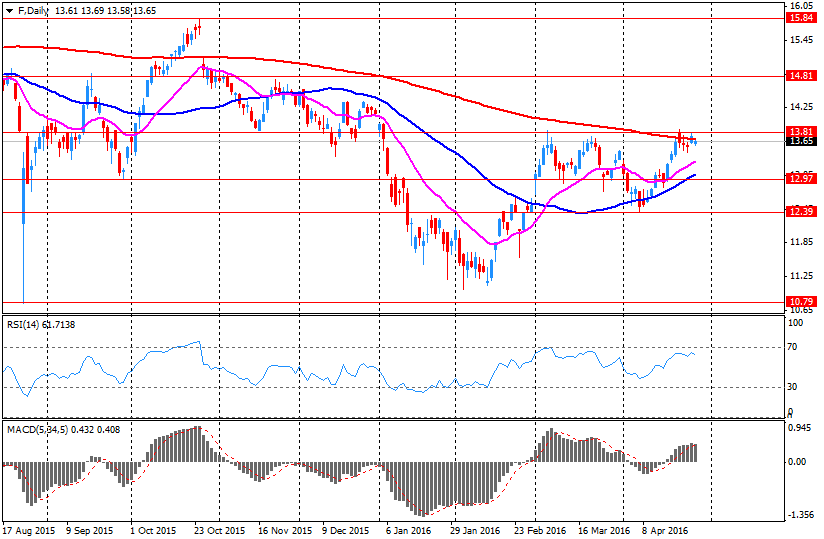

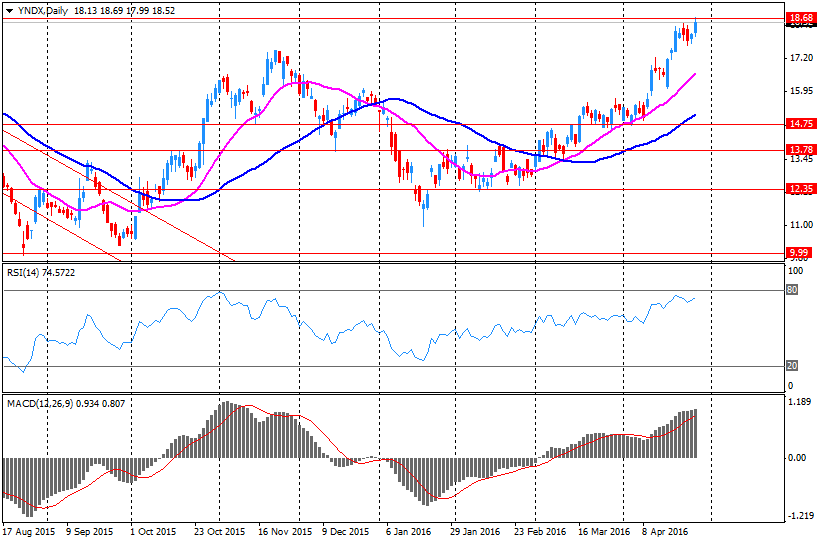

Yandex N.V., NASDAQ

YNDX

19.56

1.03(5.5586%)

134996

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Twitter (TWTR) downgraded to Hold from Buy at Argus

Intl Paper (IP) downgraded to Neutral from Outperform at Credit Suisse

Other:

Facebook (FB) target raised to $157 from $154 at Pivotal Research Group

Facebook (FB) target raised to $155 from $150 at Axiom Capital

Facebook (FB) target raised to $140 from $130 at Mizuho

Facebook (FB) target raised to $140 from $130 at Oppenheimer

Facebook (FB) target raised to $141 from $133 at Citigroup

Facebook (FB) target raised to $145 from $142 at Credit Suisse

Facebook (FB) target raised to $160 from $145 at Jefferies

Facebook (FB) target raised to $135 from $120 at Robert W. Baird

Facebook (FB) target raised to $161 from $136 at JP Morgan

Facebook (FB) target raised to $145 from $140 at Cowen

Facebook (FB) target raised to $145 from $140 at Susquehanna

Facebook (FB) target raised to $155 form $150 at Evercore ISI

-

14:42

Initial jobless claims increase to 257,000 in the week ending April 23

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending April 23 in the U.S. increased by 9,000 to 257,000 from 248,000 in the previous week. The previous week's figure was revised up from 247,000.

Analysts had expected jobless claims to rise to 260,000.

Jobless claims remained below 300,000 the 60th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 5,000 to 2,130,000 in the week ended April 16. It was the lowest level since November 2000.

-

14:34

German consumer price inflation decreases 0.2% in April

Destatis released its consumer price data for Germany on Wednesday. German preliminary consumer price index decreased 0.2% in April, in line with expectations, after a 0.8% gain in March.

On a yearly basis, German preliminary consumer price index fell to 0.1% in April from 0.3% in March, in line with expectations.

Energy prices slid 8.5% year-on-year in April.

Goods prices dropped 1.0% year-on-year in April, while services prices increased 1.1%.

-

14:28

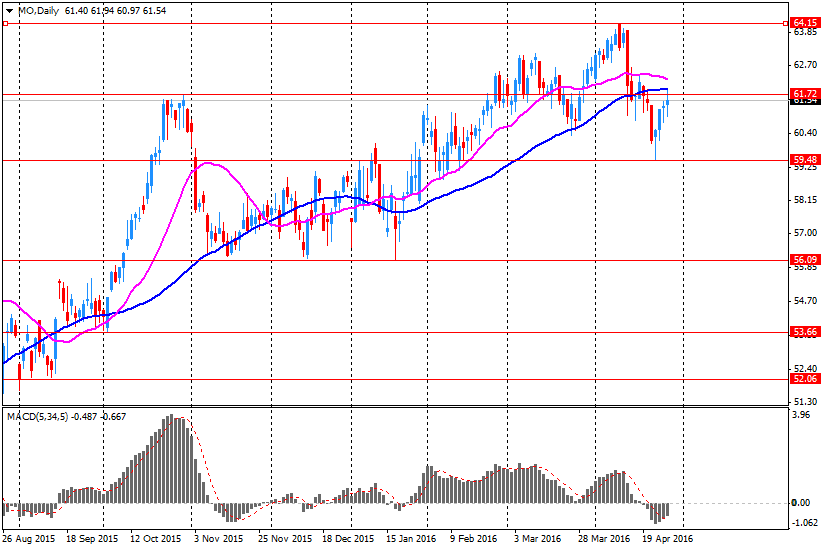

Company News: Altria (MO) Q1 earnings beat analysts’ forecasts

Altria reported Q1 FY 2016 earnings of $0.72 per share (versus $0.63 in Q1 FY 2015), beating analysts' consensus of $0.68.

The company's quarterly revenues amounted to $3.923 bln (+5.3% y/y), missing consensus estimate of $4.423 bln.

Altria reaffirmed guidance for FY 2016, projecting EPS of $3.00-3.05 (versus analysts' consensus estimate of. $3.05).

MO rose to $62.25 (+1.14%) in pre-market trading.

-

14:18

-

13:25

Housing starts in Japan jump 8.4% year-on-year in March

Japan's Ministry of Land, Infrastructure, Transport and Tourism released its housing starts data on Thursday. Housing starts in Japan rose 8.4% year-on-year in March, beating expectations for a 1.3% drop, after a 7.8% increase in February. It was the biggest rise since August 2015.

On a yearly basis, housing starts were up to 993,000 in March from 974,000 in February.

Construction orders jumped 19.8% year-on-year in March, after a 12.4% drop in February.

-

13:20

Japan’s unemployment rate declines to 3.2% in March

Japan's Ministry of Internal Affairs and Communications released its unemployment rate on late Wednesday evening. Unemployment rate in Japan fell to 3.2% in March from 3.3% in February. Analysts had expected the unemployment rate to remain unchanged.

The number of unemployed persons fell by 120,000 in March from a year ago to 2.16 million.

The number of employed persons rose by 200,000 in March from a year ago to 63.39 million.

-

13:09

Preliminary industrial production in Japan climbs 3.6% in March

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Wednesday evening. Preliminary industrial production in Japan climbed 3.6% in March, exceeding expectations for a 2.9% rise, after a 5.2% drop in February.

The increase was mainly driven by rises in production, shipments, inventories and inventory ratio.

According to a survey by the ministry, industrial production is expected to increase 2.6% in April, and to decline 2.3% in May.

On a yearly basis, Japan's industrial production was up 0.1% in March, after a 1.2% decrease in February.

-

13:08

WSE: Mid session comment

Since the beginning of trading worse and worse looks the situation of KGHM. Shares of the company losing today nearly 2 percent. This is influenced of the negative recommendation of Goldman Sachs, which lowered the recommendation for KGHM from "neutral" to "sell" with a target price also down from PLN 70 to PLN 63. An additional element is the decline of the valuation of contracts for copper, dissatisfied with the decision of the Bank of Japan.

Half of the session the WIG20 index welcome with drop by 0,68%;

Lose also the mWIG40 (-54%) and the sWIG80 slipped by 0,45%.

The turnover on the entire market exceeds a bit PLN 270 mln. The activity is still not so nice, but as we may see the demand still remains on the defensive side.

-

13:03

Retail sales in Japan are down at an annual rate of 1.1% in March

According to Japan's Ministry of Economy, Trade and Industry (METI), retail sales in Japan were down at an annual rate of 1.1% in March, beating expectations for a 1.5% drop, after a 0.4% increase in February. February's figure was revised down from a 0.5% rise.

Sales at large-scale retailers decreased 1.2% year-on-year in March, after a 2.2% rise in February.

On a monthly basis, retail sales were up 1.4% in March, after a 2.3% decrease in February.

-

12:55

Household spending in Japan plunges 5.3% year-on-year in March

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Wednesday evening. Household spending in Japan plunged 5.3% year-on-year in March, missing expectations of a 4.2% decline, after a 1.2% rise in February.

The drop was mainly driven by decreases in spending on clothing and footwear, and transport and communication.

Spending on clothing and footwear plunged 12.2% in real terms year-on-year in March, while spending on transport and communication slid 12.1%.

-

12:44

European stock markets mid session: stocks traded lower as market participants eyed the Fed's and the BoJ’s interest rate decisions

Stock indices traded lower on the Fed's and the Bank of Japan's (BoJ) interest rate decisions. The BoJ kept its monetary policy unchanged on Thursday. Market participants speculated that the central bank would add further stimulus measures.

The Fed kept its interest rate unchanged at 0.25% - 0.50% on Wednesday as widely expected by analysts. The Fed said in its statement that the U.S. economic activity slowed, while the labour market continued to improve.

Market participants also eyed the economic data from the Eurozone. The European Commission released its economic sentiment index for the Eurozone on Thursday. The index rose to 103.9 in April from 103.0 in March. Analysts had expected the index to increase to 103.4.

The drop was driven by improvements in confidence among consumers and in all business sectors except retail trade.

The industrial confidence index increased to -3.7 in April from -4.2 in March, beating expectations for a rise to -4.0.

The final consumer confidence index was up to -9.3 in April from -9.7 in March, in line with expectations.

The business climate index increased to 0.13 in April from 0.12 in March. March's figure was revised up from 0.12. Analysts had expected the index to climb to 0.14.

The rise in business climate index was driven by a more favourable managers' assessment of production expectations, and of the stocks of finished products and export order books.

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany slid by 16,000 in April, beating expectations for a flat reading, after a 3,000 decrease in March.

The unemployment rate remained unchanged at 6.2% in April, in line with expectations.

The number of unemployed people was 1.80 million in March, down from 1.82 million in February, according to Destatis.

Destatis said that Germany's adjusted unemployment rate declined to 4.2% in March from 4.3% in February.

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.2% in April, missing expectations for a 0.4% rise, after a 0.8% increase in March.

On a yearly basis, house prices fell to 4.9% in April from 5.7% in March. Analysts had expected house prices to decline by 5.0%.

"This slowdown returns the annual pace of house price growth to the fairly narrow range between 3% and 5% that had been prevailing since the summer of 2015," Nationwide's Chief Economist, Robert Gardner, said.

Current figures:

Name Price Change Change %

FTSE 100 6,265.89 -54.02 -0.85 %

DAX 10,178.5 -121.33 -1.18 %

CAC 40 4,500.75 -58.65 -1.29 %

-

12:41

Company News: Yandex N.V. (YNDX) Q1 financials beat analysts’ expectations

Yandex reported Q1 FY 2016 earnings of RUB 9.81 per share (versus RUB 6.99 in Q1 FY 2015), beating analysts' consensus of RUB 6.31.

The company's quarterly revenues amounted to RUB 16.473 bln (+33.5% y/y), beating consensus estimate of RUB 15.272 bln.

Yandex also announced the company expects its ruble-based revenue will grow in the range of 15% to 19% in 2016 compared with 2015.

YNDX rose to $19.40 (+4.70%) in pre-market trading.

-

12:38

Nationwide: UK house prices rise 0.2% in April

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.2% in April, missing expectations for a 0.4% rise, after a 0.8% increase in March.

On a yearly basis, house prices fell to 4.9% in April from 5.7% in March. Analysts had expected house prices to decline by 5.0%.

"This slowdown returns the annual pace of house price growth to the fairly narrow range between 3% and 5% that had been prevailing since the summer of 2015," Nationwide's Chief Economist, Robert Gardner, said.

"It may be that the surge in house purchase activity resulting from the increase in stamp duty on second homes from 1 April provided a temporary boost to prices in March," he added.

-

12:33

Number of unemployed people in Germany slides by 16,000 in April

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany slid by 16,000 in April, beating expectations for a flat reading, after a 3,000 decrease in March.

The unemployment rate remained unchanged at 6.2% in April, in line with expectations.

The number of unemployed people was 1.80 million in March, down from 1.82 million in February, according to Destatis.

Destatis said that Germany's adjusted unemployment rate declined to 4.2% in March from 4.3% in February.

The employment rate remained unchanged at an adjusted rate of 65.8% in March, according to Destatis.

-

12:28

Eurozone’s economic sentiment index rises to 103.9 in April

The European Commission released its economic sentiment index for the Eurozone on Thursday. The index rose to 103.9 in April from 103.0 in March. Analysts had expected the index to increase to 103.4.

The drop was driven by improvements in confidence among consumers and in all business sectors except retail trade.

The industrial confidence index increased to -3.7 in April from -4.2 in March, beating expectations for a rise to -4.0.

The final consumer confidence index was up to -9.3 in April from -9.7 in March, in line with expectations.

The business climate index increased to 0.13 in April from 0.12 in March. March's figure was revised up from 0.12. Analysts had expected the index to climb to 0.14.

The rise in business climate index was driven by a more favourable managers' assessment of production expectations, and of the stocks of finished products and export order books.

-

12:11

Japan's national CPI declines to an annual rate of -0.1% in March

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Wednesday evening. Japan's national consumer price index (CPI) declined to an annual rate of -0.1% in March from 0.3% in February.

Inflation was mainly driven by declines in fuel, light and water charges, and transportation and communication prices. Fuel, light and water charges slid 8.5% year-on-year in March, while transportation and communication prices declined 3.0%.

Japan's national CPI excluding fresh food fell to an annual rate of -0.3% in March from 0.0%, missing expectations for a drop to -0.2%.

The Bank of Japan's inflation target is 2%.

-

12:05

Bank of Japan keeps its interest rate unchanged at -0.1% in April

The Bank of Japan (BoJ) released its interest rate decision on Thursday. The central bank kept its interest rate unchanged at -0.1% as widely expected by analysts. The monetary base target remained unchanged at 275 trillion yen, while the central bank said that it will expand its monetary base at an annual pace of 80 trillion yen as expected by analysts.

The BoJ lowered its inflation forecasts. Inflation is expected to reach 2% target in the fiscal year 2017, while inflation is expected to be 1.9% the fiscal year 2018.

The central bank downgraded its growth forecast for the fiscal year 2016 to 1.2% from 1.5%, and for the fiscal year 2017 to 0.1% from 0.3%.

-

11:33

European Central Bank President Mario Draghi: the ECB’s monetary policy is working

The European Central Bank (ECB) President Mario Draghi said in an interview with the German newspaper Bild on Wednesday that the central bank's monetary policy was working, but more time was needed.

He noted that the ECB was aware of the situation for savers, who are affected by low interest rates.

Draghi also said that Britain would lose benefits of the single market if it leaves the European Union.

-

11:21

Reserve Bank of New Zealand keeps its interest rate unchanged at 2.25% in April

The Reserve Bank of New Zealand (RBNZ) on Wednesday kept its interest rate unchanged at 2.25% as widely expected by analysts.

The RBNZ Graeme Wheeler said that New Zealand's economy was supported by strong inward migration, construction activity, tourism, and the central bank's accommodative monetary policy.

He pointed out on Wednesday that further monetary policy easing was possible.

"Further policy easing may be required to ensure that future average inflation settles near the middle of the target range," he said.

Wheeler noted that the New Zealand dollar remained high, adding that a weaker currency was desirable.

The RBNZ governor also said that inflation was low, driven by lower prices for fuel and other imports.

Wheeler pointed out that there were risks to the outlook from to weakness in the dairy sector, the fall in inflation expectations, the possible high net immigration, and pressures in the housing market.

The RBNZ lowered its interest rate to 2.25% from 2.50% in March. This decision was not expected by market participants.

-

11:07

The Fed keeps its monetary unchanged in April

The Fed's released its interest rate decision on Wednesday. The Fed kept its interest rate unchanged at 0.25% - 0.50% as widely expected by analysts.

The Fed said in its statement that the U.S. economic activity slowed, while the labour market continued to improve.

According to the Fed household spending rose moderately, despite higher real income.

Inflation remained low due to lower energy prices and falling prices of non-energy imports, the Fed noted.

The Fed expects inflation to rise to 2% over the medium term.

The Fed also said that it continued to closely monitor inflation indicators and global economic and financial developments, adding that an interest rate hike will depend on the incoming economic data.

Only Kansas City President Esther George voted for an interest rate hike by 0.25%.

-

09:16

WSE: After opening

The futures market (WSE: FW20M16) began with discount of about 0.16% (1,886 points). The contract on the DAX fell by 0.75%, which is identical with the return of yesterday's gains. The Warsaw Stock Exchange did not have any increases yesterday, so drop a little less and the beginning of the Warsaw can be considered neutral, but still below the level of 1900 points.

WIG20 index opened at 1885.19 points (-0.39%)*

WIG 47466.14 -0.10%

WIG30 2108.99 -0.35%

mWIG40 3620.67 -0.04%

*/ - change to previous close

At the start of the day the market went down below yesterday's minimum of the WIG20 despite slightly outstretched on yesterday's final fixing. In this way, we participate in the movement, which today morning was tickled to markets by the Bank of Japan. At the moment the consequences of this descent is that it is a confirmation of yesterday's sale signals.

However, we should bear in mind that today's beginning is a bit emotional, because it stems from the surprising decision of the BoJ. Emotions are not the good counselor, therefore, a continuation of departure in the next stages of the session is not so sure.

-

08:24

WSE: Before opening

After yesterday's meeting of the Federal Open Market Committee in the United States, as expected, rates have not changed and the confidence in the prospects of the US economy was signaled , which leaves the open possibility of increasing the cost of credit in June.

The market's expectations especially not changed, which in turn meant little change in the currency market and the S&P500 index gained a modest 0.16%.

Today morning the BoJ decided not to continue loosening its policy, and this event is associated with a greater response. As a result, the yen strengthened, the Nikkei index went down by over 3%, while contracts in the US have given the whole of yesterday's approach and on the morning lose up to 0.7%.

On the Warsaw market today the dividend from the shares of BZ WBK (WSE: BZW) will be deducted, which will have a slightly negative effect on the WIG20 index. Yesterday, the index failed to defend the level of 1,900 points. Desire to take profits also appeared on the wide market and we have to keep in mind that the approach to shares may begin to change to the more defensive one.

-

07:07

Global Stocks

European stock markets rose for the first time in four sessions on Tuesday, aided by a round of well-received earnings reports, including results from oil giant BP PLC and telecom company Orange SA.

U.S. stocks rose on Wednesday as the Federal Reserve left interest rates unchanged even as it reiterated that it is monitoring global economic developments. However, its statement also focused on improvements in the U.S. labor market and in household income.

The Bank of Japan left its main policy unchanged Thursday, brushing aside calls for more stimulus from the markets, but it introduced a measure offering aid to areas devastated by recent earthquakes. The central bank kept its asset purchase target at 80 trillion yen ($718 billion) a year, a measure aimed at putting more money into circulation to stimulate growth and inflation. The BOJ's policy board voted 8-1 in favor of maintaining the target.

Based on MarketWatch materials

-

04:03

Nikkei 225 17,553.55 +263.06 +1.52 %, Hang Seng 21,631.75 +270.15 +1.26 %, Shanghai Composite 2,944.31 -9.36 -0.32 %

-

01:14

Stocks. Daily history for Sep Apr 27’2016:

(index / closing price / change items /% change)

Nikkei 225 17,290.49 -62.79 -0.36 %

Hang Seng 21,361.6 -45.67 -0.21 %

Shanghai Composite 2,954.01 -10.69 -0.36 %

FTSE 100 6,319.91 +35.39 +0.56 %

CAC 40 4,559.4 +26.22 +0.58 %

Xetra DAX 10,299.83 +40.24 +0.39 %

S&P 500 2,095.15 +3.45 +0.16 %

NASDAQ Composite 4,863.14 -25.14 -0.51 %

Dow Jones 18,041.55 +51.23 +0.28 %

-