Noticias del mercado

-

21:00

DJIA 17698.28 -132.48 -0.74%, NASDAQ 4752.67 -52.62 -1.10%, S&P 500 2054.56 -21.25 -1.02%

-

18:46

Dallas Federal Reserve President Robert Kaplan could vote for an interest rate hike in June or July if the U.S. economy continues to improve

Dallas Federal Reserve President Robert Kaplan said on Friday that he could vote for an interest rate hike in June or July if the U.S. economy continued to improve, adding that the Fed should rise its interest rate gradually.

"As we continue to make progress in achieving our dual mandate, I will advocate that we take actions to remove some amount of accommodation. However, I will also advocate that we take these steps in a gradual and patient manner," he said.

"We will see what meeting, whether that means June or July or what else," Kaplan noted.

Kaplan is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

18:26

European stocks close: stocks traded lower on the mixed economic data from the Eurozone

Stock indices traded lower on the mixed economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone declined to -0.2% year-on-year in April from 0.0 % in March, missing expectations for a fall to -0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.8% in April from 1.0% in March. Analysts had expected the index to decrease to 0.9%.

Food, alcohol and tobacco prices were up 0.8% in April, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.0%, while energy prices dropped 8.6%.

Eurozone's preliminary flash gross domestic product (GDP) increased by 0.6% in the first quarter, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.6% in the first quarter, after a 1.6% gain in the fourth quarter

Eurozone's unemployment rate declined to 10.2% in March from 10.4% in February, beating expectations for a fall to 10.3%. It was the lowest reading since August 2011. February's figure was revised up from 10.3%. The lowest unemployment rate in the Eurozone in March was recorded in Germany (4.2%) and the highest in Greece (24.4% in January 2016) and Spain (20.4%).

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Friday. The number of mortgages approvals in the U.K. was down to 71,357 in March from 73,195 in February, missing expectations for a decrease to 74,500. February's figure was revised down from 73,871.

Consumer credit in the U.K. rose by £1.883 billion in March, exceeding expectations for an £1.300 billion increase, after a £1.392 billion gain in February. February's figure was revised up from £1.287 billion.

Net lending to individuals in the U.K. increased by £9.3 billion in March, after a £5.0 billion gain in February. February's figure was revised up from a £4.9 rise.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,241.89 -80.51 -1.27 %

DAX 10,038.97 -282.18 -2.73 %

CAC 40 4,428.96 -128.40 -2.82 %

-

18:21

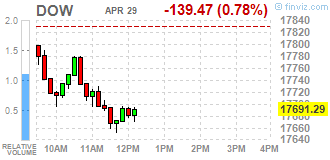

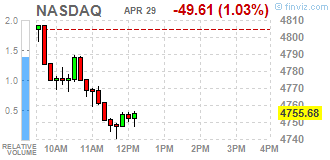

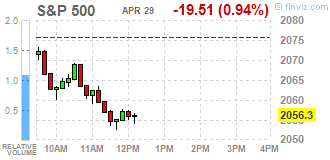

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower for a second day on Friday as investors assessed corporate earnings and data showed that U.S. inflation barely rose in March as consumer spending remains tepid. Adding to the day's selling pressure, inflation data clouded the path of future rate hikes by the Federal Reserve. The Commerce Department said the personal consumption expenditures price index, excluding the volatile food and energy components, edged up 0,1% last month after an upwardly revised 0,2% increase in February.

Most of Dow stocks in negative area (23 of 30). Top looser - Wal-Mart Stores Inc. (WMT, -3,18%). Top gainer - Caterpillar Inc. (CAT, +0,58%).

All S&P sectors in negative area. Top looser - Healthcare (-1,8%).

At the moment:

Dow 17607.00 -154.00 -0.87%

S&P 500 2050.25 -22.25 -1.07%

Nasdaq 100 4314.00 -68.00 -1.55%

Oil 45.83 -0.20 -0.43%

Gold 1292.00 +25.60 +2.02%

U.S. 10yr 1.84 +0.00

-

18:00

European stocks closed: FTSE 6241.89 -80.51 -1.27%, DAX 10038.97 -282.18 -2.73%, CAC 40 4428.96 -128.40 -2.82%

-

17:45

WSE: Session Results

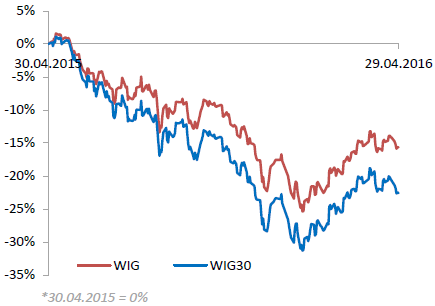

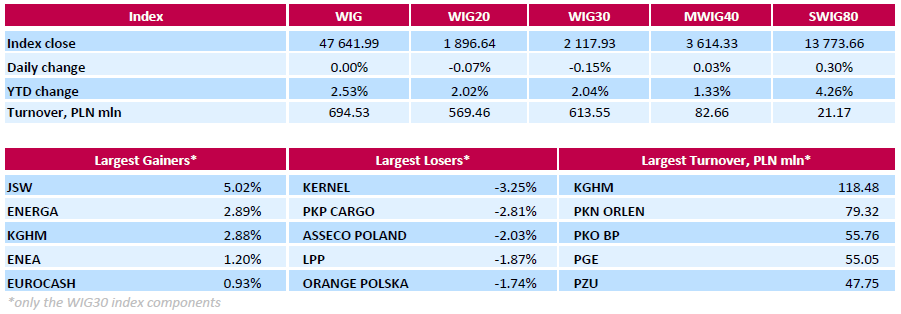

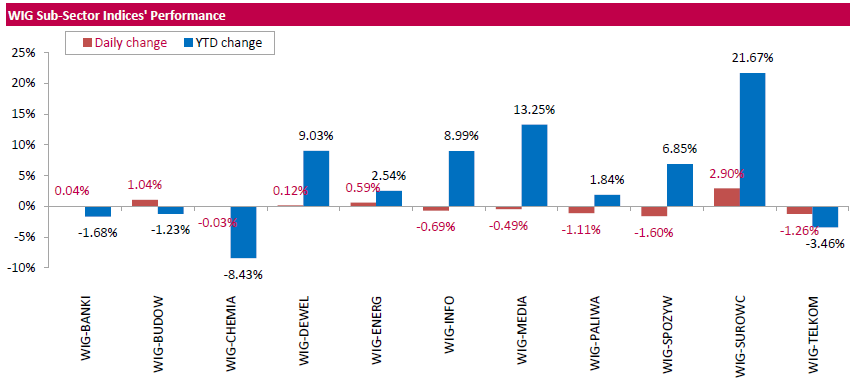

Polish equity market closed unchanged on Friday. Sector-wise, materials (+2.90%) held up best, while food sector (-1.60%) dropped the most.

The large-cap stocks' gauge, the WIG30 Index, fell by 0.15%. In the index basket, agricultural producer KERNEL (WSE: KER) emerged as the worst-performing stock, retreating by 3.25%. It was followed by railway freight transport operator PKP CARGO (WSE: PKP) and IT-company ASSECO POLAND (WSE: ACP), dropping by 2.81%and 2.03% respectively. On the other side of the ledger, coking coal producer JSW (WSE: JSW) continued its run-up, adding 5.02%. Other biggest advancers were genco ENERGA (WSE: ENG) and copper producer KGHM (WSE: KGH), gaining 2.89% and 2.88% respectively.

-

17:16

European Central Bank Executive Board member Peter Praet: there is a limit in lowering interest rates

The European Central Bank (ECB) Executive Board member Peter Praet said in an interview with the Spanish newspaper Expansión on Friday that there was a limit in lowering interest rates.

"It's clear that negative rates cannot be reduced indefinitely to ever lower levels," he said.

He added that the central bank would only cut its interest rate further if the inflation outlook worsened significantly.

"I don't think we're going to see these conditions materialising in the near future," Praet noted.

He also said that the banking union was needed, and the recent central bank's measures needed more time to show the effect.

Praet pointed out that the ECB did not discuss helicopter money.

-

16:45

U.S. employment cost index rises 0.6% in first quarter

The U.S. Bureau of Labour Statistics released its employment cost index on Friday. The U.S. employment cost index rose 0.6% in first quarter, after a 0.5% gain in fourth quarter.

Wages and salaries increased 0.7% in the first quarter, after a 0.6% rise in the fourth quarter, while benefits payments climbed 0.5% in the first quarter, after a 0.7% increase in the fourth quarter.

-

16:35

Spanish current account deficit widens to €1.46 billion in February

The Bank of Spain released its current account data on Friday. Spain's current account deficit widened to €1.46 billion in February from €0.66 billion in January.

The surplus on trade in goods and services totalled €1.0 billion in February, while the deficit on primary and second income totalled €2.4 billion.

-

16:31

Thomson Reuters/University of Michigan final consumer sentiment index declines to 89.0 in April

The Thomson Reuters/University of Michigan final consumer sentiment index decreased to 89.0 in April from 91.0 in March, down from the preliminary estimate of 89.7 and missing expectations a rise to 90.0.

"All of the April decline was in the Expectations component, which fell by 4.8% from one month ago and by 12.6% from a year ago and by 14.7% from its January 2015 peak. The retreat from the 2015 peaks was evident across a wide range of expectations about prospects for the national economy," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

"The size of the decline, while troublesome, is still far short of indicating an impending recession," he added.

The current economic conditions index increased to 106.7 in April from 105.6 in March, up from the preliminary reading of 105.4.

The index of consumer expectations declined to 77.6 in April from 81.5 in March, down from a preliminary reading of 79.6.

The one-year inflation expectations rose to 2.8% in April from 2.7% in March, up from the preliminary reading of 2.7%.

-

16:19

Chicago purchasing managers' index slides to 50.4 in April

The Institute for Supply Management released its Chicago purchasing managers' index on Friday. The Chicago purchasing managers' index slid to 50.4 in April from 53.6 in March, missing expectations for a decrease to 53.0.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decrease was mainly driven by drops in new orders and drop in order backlogs. New orders were down to 51.0 in April from 55.6 in March, order backlogs plunged to 38.7 from 49.7.

The production index rose to 54.0 in April from 53.7 in March, while the employment index fell to 47.5 from 52.8.

"This was a disappointing start to the second quarter, with the Barometer barely above the neutral 50 mark in April. Against a backdrop of softer domestic demand and the slowdown abroad, panellists are now more worried about the impact a rate hike might have on business than they were at the same time last year," Chief Economist of MNI Indicators Philip Uglow said.

-

16:00

Producer prices in Italy increase 0.2% in March

The Italian statistical office Istat released its producer price inflation data for Italy on Friday. Italian producer prices increased 0.2% in March, after a 0.5% decline in February. February's figure was revised down from a 0.4% fall.

Producer price rose by 0.2% on domestic market and by 0.1% on non-domestic market in March.

On a yearly basis, Italian PPI fell 3.4% in March, after a 3.6% drop in February. February's figure was revised down from a 3.5% decline.

Producer price slid 3.9% on domestic market and by 1.8% on non-domestic market in March.

-

15:54

Preliminary consumer prices in Italy are flat in April

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Friday. Preliminary consumer prices in Italy were flat in April, after a 0.2% rise in March.

The monthly rises of prices of non-regulated energy products, services related to recreation, including repair and personal care and of services related to transport offset declines of prices of regulated energy products.

On a yearly basis, consumer prices fell 0.4% in April, after a 0.2% decrease in March.

The decline was driven by lower prices for regulated energy products, which slid 4.7% year-on-year in April.

Prices for goods declined 1.0% year-on-year in April, while services prices rose 0.4%.

Consumer price inflation excluding unprocessed food and energy prices fell to 0.5% year-on-year in April from 0.6% in March.

-

15:46

Italy’s unemployment rate falls to 11.4% in March

The Italian statistical office Istat released its unemployment data on Friday. The seasonally adjusted unemployment rate decreased to 11.4% in March from 11.6% in February. It was the lowest rate since November 2012.

February's figure was revised down from 11.7%.

The number of unemployed people was 2.895 million in March, down 2.1% from the month before.

The youth unemployment rate decreased to 36.7 in March from 38.2% in February.

The employment rate rose to 56.7% in March from 56.5% in February.

-

15:40

WSE: After start on Wall Street

The afternoon data from the US economy have not been accepted by investors or were a pretext to cool markets. But the fact is that after their publication, we have a clear weakening of the dollar, and with it, the weakness in the equity markets. Contracts on the S&P500 went to the daily lows same like the DAX index. Our market tried to measure up with yesterday's maximum of the WIG20, but the data came at the worst time.

U.S. Stocks open: Dow -0.34%, Nasdaq -0.10%, S&P -0.25%

-

15:39

Spain’s economy expands 0.8% the first quarter

The Spanish statistical office INE released its preliminary gross domestic product (GDP) for Spain on Friday. Spain's economy expanded 0.8% the first quarter, after a 0.8% growth in the fourth quarter. It was the eleventh consecutive increase.

On a yearly, GDP grew 3.4% in the first quarter, after a 3.5% in the fourth quarter.

-

15:33

The ANZ business confidence index for New Zealand climbs to 6.2% in March

ANZ Bank released its latest business sentiment survey for New Zealand on Friday. The ANZ business confidence index for New Zealand climbed to 6.2% in March from 3.2% in February. The index means that 6.2% of respondents expected the country's economy to improve over the coming year.

"Winter may be coming but it's business as usual across the broader survey; firms continue to get on with it despite low headline confidence," the ANZ Chief Economist Cameron Bagrie said.

-

15:33

U.S. Stocks open: Dow -0.34%, Nasdaq -0.10%, S&P -0.25%

-

15:29

Building permits in New Zealand plunge 9.8% in March

Statistics New Zealand released its building permits data on late Thursday evening. Building permits in New Zealand plunged 9.8% in March, after a 10.0% gain in February. February's figure was revised down from a 10.8% rise.

Residential work rose 10% year-on-year in March, while non-residential work climbed 7.8%.

"The trend for the number of new dwellings consented shows signs of easing, but is still near the highest level since mid-2004," Statistics New Zealand said in its statement.

-

15:21

French final GDP rises 0.5% in the first quarter

The French statistical office Insee released its preliminary gross domestic product data for France on Friday. The French preliminary GDP rose 0.5% in the first quarter, after a 0.3% increase in the fourth quarter of 2015.

Household spending climbed 1.2% in the first quarter, after a 0.1% fall in the fourth quarter of 2015, while government spending rose 0.4%, after a 0.5% gain in the fourth quarter.

Business investment rose 0.9% in the first quarter, after a 0.7% increase in the fourth quarter

Total production in goods and services was up 0.6% in the first quarter, after a 0.6% rise in the fourth quarter.

Export decreased 0.2% in the first quarter, while imports rose 0.5%.

-

15:16

Before the bell: S&P futures -0.42%, NASDAQ futures -0.55%

U.S. stock-index futures slipped.

Global Stocks:

Nikkei Closed

Hang Seng 21,067.05 -320.98 -1.50%

Shanghai Composite 2,938.45 -7.14 -0.24%

FTSE 6,277.4 -45.00 -0.71%

CAC 4,471.4 -85.96 -1.89%

DAX 10,151.7 -169.45 -1.64%

Crude $46.53 (+1.09%)

Gold $1279.10 (+1.00%)

-

15:12

French preliminary consumer price inflation increases 0.1% in April

The French statistical office Insee released its preliminary consumer price inflation for France on Friday. The French consumer price inflation increased 0.1% in April, after a 0.7% rise in March.

The monthly increase was mainly driven by higher prices for services and petroleum products.

On a yearly basis, the consumer price declined to -0.2% in April from -0.1% in March.

The annual drop was driven by a fall in energy prices.

Food prices rose 0.4% year-on-year in April, services prices climbed 0.9%, while energy prices dropped by 6.8%.

-

15:07

German adjusted retail sales fall 1.1% in March

Destatis released its retail sales for Germany on Friday. German adjusted retail sales slid 1.1% in March, missing forecasts of a 0.3% gain, after a 0.4% decrease in February.

On a yearly basis, German unadjusted retail sales increased 0.7% in March, missing expectations for a 2.2% gain, after a 5.5% rise in February. February's figure was revised up from a 5.4% increase.

Sales of non-food products decreased at an annual rate of 1.1% in March, while sales of food, beverages and tobacco products rose by 2.7%.

-

14:59

U.S. personal spending rises 0.1% in March

The U.S. Commerce Department released personal spending and income figures on Friday. Personal spending rose 0.1% in March, missing expectations for a 0.2% gain, after a 0.2% increase in February. February's figure was revised up from a 0.1% rise.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 1.9% in the first quarter, the slowest pace since the first quarter of 2015, after a 2.4% increase in the fourth quarter.

This data suggests that American consumers remained cautious.

The saving rate climbed 5.4% in March from 5.1% in February.

Personal income increased 0.4% in March, exceeding expectations for 0.3% rise, after a 0.1% gain in February. February's figure was revised down from a 0.2% increase.

Wages and salaries were up 0.7% in March.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in March, in line with forecasts, after a 0.2% gain in February. February's figure was revised up from a 0.1% gain.

On a yearly basis, the PCE price index excluding food and index fell to 1.6% in March from 1.7% in February.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)/ изменение ($/%) / проторгованый объем)

ALCOA INC.

AA

11.26

0.11(0.9865%)

78161

ALTRIA GROUP INC.

MO

62.1

-0.09(-0.1447%)

1000

Amazon.com Inc., NASDAQ

AMZN

673.5

71.50(11.8771%)

219115

Apple Inc.

AAPL

94.7

-0.13(-0.1371%)

394182

Barrick Gold Corporation, NYSE

ABX

17.87

0.32(1.8234%)

103274

Caterpillar Inc

CAT

77.74

-0.01(-0.0129%)

2093

Chevron Corp

CVX

101.3

-1.10(-1.0742%)

49281

Cisco Systems Inc

CSCO

27.79

-0.17(-0.608%)

7901

Citigroup Inc., NYSE

C

46.51

-0.22(-0.4708%)

22993

E. I. du Pont de Nemours and Co

DD

66.41

0.00(0.00%)

200

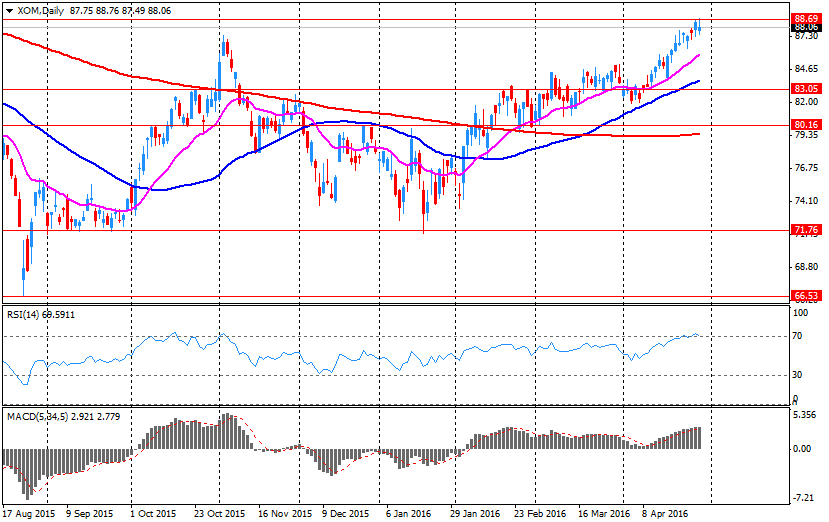

Exxon Mobil Corp

XOM

88.45

0.42(0.4771%)

126672

Facebook, Inc.

FB

117.3

0.57(0.4883%)

196908

FedEx Corporation, NYSE

FDX

165.67

0.01(0.006%)

1050

Ford Motor Co.

F

13.95

-0.14(-0.9936%)

202241

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.06

0.40(3.1596%)

359370

General Electric Co

GE

30.82

-0.08(-0.2589%)

4301

General Motors Company, NYSE

GM

32.4

-0.04(-0.1233%)

5452

Goldman Sachs

GS

164.33

0.04(0.0243%)

1514

Google Inc.

GOOG

693.85

2.83(0.4095%)

4825

Hewlett-Packard Co.

HPQ

12.48

-0.09(-0.716%)

4600

Home Depot Inc

HD

132.53

-0.20(-0.1507%)

1007

Intel Corp

INTC

30.9

-0.21(-0.675%)

19782

International Business Machines Co...

IBM

147.1

0.03(0.0204%)

1270

Johnson & Johnson

JNJ

112.75

0.27(0.24%)

297

Microsoft Corp

MSFT

49.6

-0.30(-0.6012%)

72836

Nike

NKE

58.54

0.00(0.00%)

500

Pfizer Inc

PFE

33.08

0.17(0.5166%)

123

Procter & Gamble Co

PG

80.02

0.26(0.326%)

706

Starbucks Corporation, NASDAQ

SBUX

56.21

-0.21(-0.3722%)

15734

Tesla Motors, Inc., NASDAQ

TSLA

248.5

0.79(0.3189%)

16392

The Coca-Cola Co

KO

44.61

-0.02(-0.0448%)

1557

Twitter, Inc., NYSE

TWTR

14.7

0.06(0.4098%)

105710

United Technologies Corp

UTX

104.18

-0.05(-0.048%)

383

Verizon Communications Inc

VZ

51

-0.02(-0.0392%)

610

Visa

V

77.65

-0.03(-0.0386%)

1185

Walt Disney Co

DIS

103.9

-0.13(-0.125%)

1780

Yahoo! Inc., NASDAQ

YHOO

36.58

-0.01(-0.0273%)

7640

Yandex N.V., NASDAQ

YNDX

19.89

0.02(0.1007%)

7281

-

14:53

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Ford Motor (F) downgraded to Neutral from Buy at BofA/Merrill

Other:

Amazon (AMZN) target raised to $811 from $797 at Axiom Capital

Amazon (AMZN) target raised to $810 from $685 at Mizuho

-

14:53

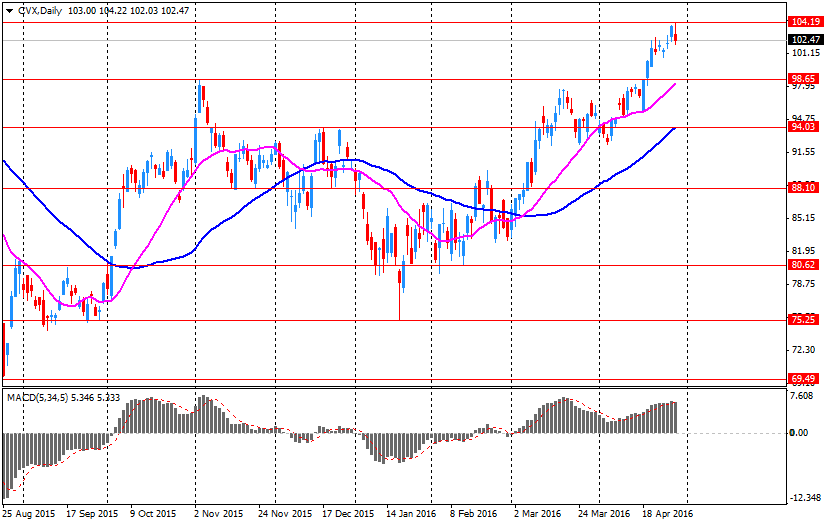

Company News: Chevron (CVX) posts Q1 losses above analysts’ expectations

Chevron reported Q1 FY 2016 net losses of $0.39 per share (versus net profit $1.37 in Q1 FY 2015), worse than analysts' consensus of -$0.16.

The company's quarterly revenues amounted to $23.533 bln (-31.9% y/y), beating consensus estimate of $22.735 bln.

CVX fell to $100.92 (-1.45%) in pre-market trading.

-

14:45

Canada's GDP falls 0.1% in February

Statistics Canada released GDP (gross domestic product) growth data on Friday. Canada's GDP growth fell 0.1% in February, in line with expectations, after a 0.6% increase in January.

The decrease was mainly driven by a drop in the output of goods-producing industries, which slid 0.6% in February.

The output of service-producing industries was flat in February.

The mining, quarrying, and oil and gas extraction sector fell 0.8% in February, manufacturing output decreased 0.8%, while the retail trade sector climbed 1.4%.

-

14:39

Canadian industrial product prices drop 0.6% in March

Statistics Canada released its industrial product and raw materials price indexes on Friday. The Industrial Product Price Index (IPPI) dropped 0.6% in March, missing expectations for a 0.1% rise, after a 1.0% decline in February. February's figure was revised up from a 1.1% fall.

The decrease was mainly driven by lower prices for motorized and recreational vehicles, which plunged 2.9% in March.

18 of the 21 commodity groups decreased, while 3 rose.

The Raw Materials Price Index (RMPI) climbed 4.5% in March, after a 0.7% increase in February. February's figure was revised up from a 2.6% drop.

The rise was driven by higher prices for crude energy products. Crude energy products jumped by 14.3% in March.

3 of the 6 commodity groups rose and 3 decreased.

-

14:25

-

13:59

Swiss National Bank Chairman Thomas Jordan: inflation in Switzerland remains negative

The Swiss National Bank (SNB) Chairman Thomas Jordan said in a speech on Friday that inflation in Switzerland remained negative, driven by a stronger Swiss franc and a decline in oil prices. He added that inflation was expected to be positive in 2017.

-

13:53

KOF leading indicator for Switzerland falls to 102.7 in April

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Friday. The KOF leading indicator fell to 102.7 in April from 102.8 in March. March's figure was revised up from 102.5.

Analysts had expected the index to remain unchanged at 102.8.

The decline was mainly driven by negative signals from the financial sector, the exporting industries and construction.

"The largely unchanged Barometer reading of just below 103 signals a continuation of the positive development of the Swiss economy in the coming months," the KOF said.

-

13:10

WSE: Mid session comment

The morning phase of the session showed matching of stock markets to yesterday's sell-off on Wall Street. As a result, in the halfway of the trading on the WSE the WIG20 loss exceeds 0.5 percent, while the DAX lost more than 1.3 percent. Emotions, however, are limited by sleepy turnover.

Now we have time for the southern calm, and then the results of oil companies in the US and US macro data.

Noteworthy today are quotations of mining companies. We see a noticeable rise in share prices of Bogdanka S.A (WSE: LWB + 1.59%) and JSW S.A. (WSE: JSW + 1.92%). Moreover, the technical situation of these values suggests a possible continuation of this, positive for bulls side, trend.

-

12:33

European stock markets mid session: stocks traded lower on the mixed economic data from the Eurozone

Stock indices traded lower on the mixed economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone declined to -0.2% year-on-year in April from 0.0 % in March, missing expectations for a fall to -0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.8% in April from 1.0% in March. Analysts had expected the index to decrease to 0.9%.

Food, alcohol and tobacco prices were up 0.8% in April, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.0%, while energy prices dropped 8.6%.

Eurozone's preliminary flash gross domestic product (GDP) increased by 0.6% in the first quarter, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.6% in the first quarter, after a 1.6% gain in the fourth quarter

Eurozone's unemployment rate declined to 10.2% in March from 10.4% in February, beating expectations for a fall to 10.3%. It was the lowest reading since August 2011. February's figure was revised up from 10.3%. The lowest unemployment rate in the Eurozone in March was recorded in Germany (4.2%) and the highest in Greece (24.4% in January 2016) and Spain (20.4%).

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Friday. The number of mortgages approvals in the U.K. was down to 71,357 in March from 73,195 in February, missing expectations for a decrease to 74,500. February's figure was revised down from 73,871.

Consumer credit in the U.K. rose by £1.883 billion in March, exceeding expectations for an £1.300 billion increase, after a £1.392 billion gain in February. February's figure was revised up from £1.287 billion.

Net lending to individuals in the U.K. increased by £9.3 billion in March, after a £5.0 billion gain in February. February's figure was revised up from a £4.9 rise.

Current figures:

Name Price Change Change %

FTSE 100 6,284.13 -38.27 -0.61 %

DAX 10,210.3 -110.85 -1.07 %

CAC 40 4,488.6 -68.76 -1.51 %

-

12:28

Number of mortgages approvals in the U.K. declines to 71,357 in March

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Friday. The number of mortgages approvals in the U.K. was down to 71,357 in March from 73,195 in February, missing expectations for a decrease to 74,500. February's figure was revised down from 73,871.

Consumer credit in the U.K. rose by £1.883 billion in March, exceeding expectations for an £1.300 billion increase, after a £1.392 billion gain in February. February's figure was revised up from £1.287 billion.

Net lending to individuals in the U.K. increased by £9.3 billion in March, after a £5.0 billion gain in February. February's figure was revised up from a £4.9 rise.

-

12:23

Eurozone’s economy expands at 0.6% in the first quarter

Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary flash gross domestic product (GDP) increased by 0.6% in the first quarter, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.6% in the first quarter, after a 1.6% gain in the fourth quarter.

Eurostat released no details of the component breakdown of GDP.

The U.S. economy grew 0.5% in the first quarter, after a 1.4% growth in fourth quarter.

-

12:16

Eurozone's unemployment rate drops to 10.2% in March, the lowest reading since August 2011

Eurostat released its unemployment data for the Eurozone on Friday. Eurozone's unemployment rate declined to 10.2% in March from 10.4% in February, beating expectations for a fall to 10.3%. It was the lowest reading since August 2011.

February's figure was revised up from 10.3%.

There were 16.437 million unemployed in the Eurozone in March, down by 226.000 from January.

The lowest unemployment rate in the Eurozone in March was recorded in Germany (4.2%) and the highest in Greece (24.4% in January 2016) and Spain (20.4%).

The youth unemployment rate was 21.2% in the Eurozone in March, compared to 22.7% in March a year ago.

-

12:10

Preliminary consumer price inflation in the Eurozone declines to -0.2% year-on-year in April

Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone declined to -0.2% year-on-year in April from 0.0 % in March, missing expectations for a fall to -0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.8% in April from 1.0% in March. Analysts had expected the index to decrease to 0.9%.

Food, alcohol and tobacco prices were up 0.8% in April, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.0%, while energy prices dropped 8.6%.

-

10:25

French producer prices increase 0.3% in March

French statistical office INSEE released its producer price index (PPI) data on Friday. French producer prices increased 0.3% in March, after a 0.5% drop in February.

The increase was mainly driven a rise in prices for coke and refined petroleum products, which climbed 15.5% in March.

On a yearly basis, French PPI fell 4.0% in March.

The annual drop was driven by a decline in prices for coke and refined petroleum products, which slid 33.3 year-on-year in March.

Import prices rose 1.1% in March, after a 0.6% fall in February.

-

10:18

French consumer spending rises 0.2% in March

French statistical office INSEE released its consumer spending data on Friday. French consumer spending rose 0.2% in March, after a 0.5% gain in February. February's figure was revised down from a 0.6% increase.

The increase was mainly driven by a rise in expenditure on energy. Spending on energy climbed by 3.5% in March, while spending on food fell 0.6%.

On a yearly basis, consumer spending climbed 1.9% in March.

-

10:03

Producer prices in Australia decrease 0.2% in the first quarter

The Australian Bureau of Statistics released its producer prices data on Friday. Producer prices in Australia decreased 0.2% in the first quarter, missing expectations for a 0.2% rise, after a 0.3% gain in the fourth quarter.

The decrease was mainly driven by falls in prices for petroleum refining and petroleum fuel manufacturing, other agriculture and pharmaceutical and medicinal product manufacturing.

On a yearly basis, producer prices climbed 1.2% in the first quarter, after a 1.9% increase in the fourth quarter.

-

09:54

Private sector credit in Australia rises 0.4% in March

The Reserve Bank of Australia (RBA) released its private sector credit data on Friday. The total value of private sector credit in Australia rose 0.4% in March, missing expectations for a 0.6% gain, after a 0.6% increase in February.

Housing credit increased 0.5% in March, personal credit declined 0.3%, while business credit rose 0.3%.

On a yearly basis, the private sector credit in Australia jumped 6.4% in March, after a 6.6% rise in February.

-

09:32

GfK’s U.K. consumer confidence index drops to -3 in April

Gfk released its consumer confidence index for the U.K. on late Thursday evening. GfK's U.K. consumer confidence index fell to -3 in April from 0 in March, missing expectations for a decline to -1. It was the lowest level since December 2014.

All 5 measures fell in April.

"Mixed-messages about a post-Brexit world and the on-going Eurozone crisis are casting a cloud over our economy," Joe Staton, Head of Market Dynamics at GfK, said.

"Trends in confidence show our degree of optimism about the state of the economy and this indicator will make for interesting reading between now and the EU referendum on June 23rd," he added.

-

09:16

WSE: After opening

The WIG20 futures (WSE: FW20M16) took off 6 points below yesterday's closing or 0.3 percent in the red.

WIG20 index opened at 1899.32 points (+0.07%)*

WIG 47613.78 -0.06%

WIG30 2118.38 -0.13%

mWIG40 3615.05 0.05%

*/ - change to previous close

As might be expected, after the opening of the cash market outweigh the color red, but the drop in the WIG20 index in the first minutes of trading by 0.2 percent must be considered aa a slight. After a strong devaluation in the US we may take into account more negative reaction of the markets, especially as when we were finishing, the Americans were on the rise and tried to attack the level of 2,100 points for the S&P500.

-

09:13

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 43.5 in in the week ended April 24

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy rose to 43.5 in in the week ended April 24 from 42.9 the prior week.

The increase was driven by rises in all sub-indexes. The measure of views of the economy was up to 33.5 from 33.4, the buying climate index rose to 40.0 from 39.6, while the personal finances index increased to 56.8 from 55.6.

-

08:30

WSE: Before opening

Thursday's session on Wall Street ended in solidarity declines of major indices, from 0.9 to nearly 1.2 percent. Sell was supported by mixture of macro factors, news from companies and the market reaction to the lack of changes in the liquidity program in Japan. Declines did not miss the Asian markets too, but this trade is quite subdued due to the holiday in Japan.

On the positives side is worth to noting the weakening of the euro against the dollar, which favors the prices of shares of European exporters, as well as the increase in oil prices.

It should also be noted that after the session, in Poland begins the period known as "May's weekend", in which the market is expected to enter a phase of reduced activity. Tuesday's celebration causes that many investors will take a rest from the market on Monday. For the whole week will be closed the stock market in Japan, and on Monday there is no sessions in China and in the UK. Through London goes a lot of orders for the Warsaw market from foreign investors, so there is an extra element favoring the activity of the full four days. Therefore we may not rule out a scenario in which normal trading on the Polish market will return only on the next Wednesday's session.

-

06:55

Global Stocks

European stocks pulled out a modest win Thursday, as oil shares benefited from a swing higher in energy prices, somewhat alleviating pressure on markets after the Bank of Japan's decision not to launch fresh stimulus measures. Commodity and consumer goods turned higher Thursday, but losses for all sectors intraday had pushed the pan-European index down by as much as 1.5%.

The Dow Jones Industrial Average had its worst day in over two months Thursday as Apple Inc. extended its losing streak while the broader market crumbled under the combined weight of disappointing data and weak corporate earnings. The market had started off on a sour note after the Bank of Japan decided to keep its interest rates unchanged and offer no additional stimulus. Sentiment further weakened on news that U.S. gross domestic product grew only 0.5% in the first quarter, its slowest pace in two years. Economists had projected 0.7% expansion.

Shares in most Asian stock markets edged lower Friday, with gains capped by disappointment over the Bank of Japan holding back on additional stimulus and worries about global economic growth. Broad losses in U.S. stocks overnight weighed on some stock markets in Asia.

Based on MarketWatch materials

-

04:04

Hang Seng 21,129.47 -258.56 -1.21 %, Shanghai Composite 2,937.55 -8.04 -0.27 %

-

00:34

Stocks. Daily history for Sep Apr 28’2016:

(index / closing price / change items /% change)

Nikkei 225 16,666.05 -624.44 -3.61 %

Hang Seng 21,388.03 +26.43 +0.12 %

S&P/ASX 200 5,225.43 +37.72 +0.73 %

Shanghai Composite 2,946.2 -7.47 -0.25 %

FTSE 100 6,322.4 +2.49 +0.04 %

CAC 40 4,557.36 -2.04 -0.04 %

Xetra DAX 10,321.15 +21.32 +0.21 %

S&P 500 2,075.81 -19.34 -0.92 %

NASDAQ Composite 4,805.29 -57.85 -1.19 %

Dow Jones 17,830.76 -210.79 -1.17 %

-