Noticias del mercado

-

21:00

Dow +0.60% 17,880.27 +106.63 Nasdaq +0.72% 4,809.66 +34.30 S&P +0.67% 2,079.11 +13.81

-

18:16

European Central Bank Executive Board member Benoit Coeure: the ECB’s stimulus measures are working

European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview with on radio station France Inter on Monday that the central bank's stimulus measures were working, but more time was needed.

"That's working and creating growth, but where we're still waiting for results is on inflation, because it takes time and because energy prices are still low," he said.

-

18:13

European Central Bank Executive Board member Benoit Coeure: the central bank is acting to fulfil its price stability mandate

European Central Bank (ECB) Executive Board member Benoit Coeure said in opinion piece in the German newspaper Frankfurter Allgemeine Sonntagszeitung on Sunday that the central bank was acting to fulfil its price stability mandate.

He noted that inflation would rise only gradually.

Coeure defended the ECB's quantitative easing.

"People are not just savers - they are also employees, taxpayers and borrowers, as such benefiting from the low level of interest rates," he said.

-

18:00

European stocks closed: CAC 40 4,442.75 +13.79 +0.31% DAX 10,123.27 +84.30 +0.84%

-

18:00

European stocks close: stocks traded higher on the manufacturing PMI data from the Eurozone

Stock indices traded higher after the release of the mostly positive final manufacturing purchasing managers' index (PMI) data for the Eurozone. Markit Economics released its final manufacturing PMI for the Eurozone on Monday. Eurozone's final manufacturing PMI climbed to 51.7 in April from 51.6 in March, up from the preliminary reading of 51.5.

The rise was driven by a faster growth in employment and as deflationary pressures moderated.

"The survey is signalling an anaemic annual rate of growth of manufacturing production of just less than 1%, which is half the pace seen in the months leading up to the recent slowdown," Chris Williamson, Chief Economist at Markit said.

"The survey data therefore so far show no signs of ECB stimulus or the weaker euro helping to revive the manufacturing sector, at least for the euro area as a whole," he added.

Germany's final Markit/BME manufacturing PMI rose to 51.8 in April from 50.7 in March, down from the preliminary reading of 51.9. The index was mainly driven by rises in new business and employment.

France's final manufacturing PMI decreased to 48.0 in April from 49.6 in March, down the preliminary reading of 48.3. The index was driven by drops in new business, output and output prices. Output prices slid a fastest pace since July 2009.

European Central Bank (ECB) President Mario Draghi said on Monday that there was no alternative to the central bank's quantitative easing.

"There is simply no alternative to this today," he said.

Draghi noted that savers would benefit from the central bank's monetary policy in the medium term.

"It might seem at first glance that this policy is tantamount to penalising savers in favour of borrowers. But in the medium-term, expansionary policy is actually very much to the benefit of savers," the ECB president said.

Markets in the U.K. are closed for a public holiday.

Indexes on the close:

Name Price Change Change %

FTSE 100 closed

DAX 10,123.27 +84.30 +0.84 %

CAC 40 4,442.75 +13.79 +0.31 %

-

17:42

European Central Bank President Mario Draghi: there is no alternative to the central bank’s quantitative easing

European Central Bank (ECB) President Mario Draghi said on Monday that there was no alternative to the central bank's quantitative easing.

"There is simply no alternative to this today," he said.

Draghi noted that savers would benefit from the central bank's monetary policy in the medium term.

"It might seem at first glance that this policy is tantamount to penalising savers in favour of borrowers. But in the medium-term, expansionary policy is actually very much to the benefit of savers," the ECB president said.

-

17:40

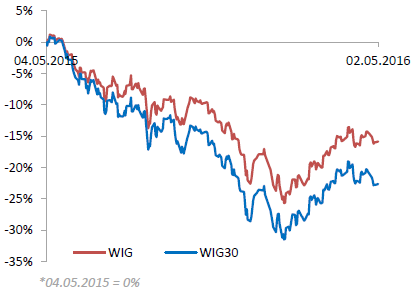

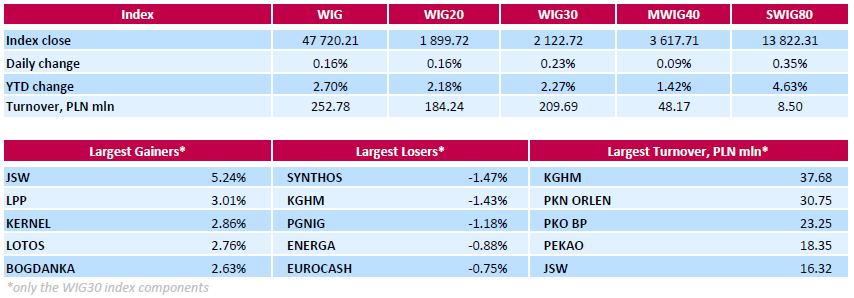

WSE: Session Results

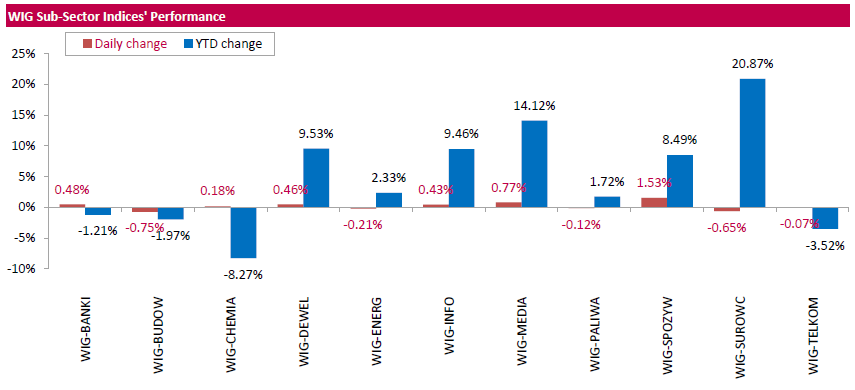

Polish equity market closed higher on Monday. The broad market measure, the WIG index, added 016%. Sector performance in the WIG Index was mixed. Construction sector (-0.75%) suffered the biggest loss, while food sector (+1.53%) fared the best.

The large-cap stocks' measure, the WIG30 Index, advanced 0.23%. Coking coal producer JSW (WSE: JSW) kept its position as a growth leader among the large-cap stocks, gaining 5.24%. It was announced that the company would receive about PLN 300-400 mln ($79-105 mln) in state funding to restructure its coal mines. Clothing retailer LPP (WSE: LPP) emerged as the second best-performing stock, adding 3.01% on the back of strong sales report for April. Other major advancers were agricultural producer KERNEL (WSE: KER), oil refiner LOTOS (WSE: LTS) and thermal coal miner BOGDANKA (WSE: LWB), surging by 2.86%, 2.76% and 2.63% respectively. On the other side of the ledger, chemical producer SYNTHOS (WSE: SNS) and copper producer KGHM (WSE: KGH) tumbled the most, down 1.47% and 1.43% respectively.

The Warsaw Stock Exchange will be closed on Tuesday, May 3, due to celebration of Polish Constitution Day (Święto Konstytucji 3 Maja or Święto Narodowe Trzeciego Maja).

-

17:28

European Central Bank Governing Council member Jens Weidmann: quantitative easing is appropriate as inflation is low

European Central Bank (ECB) Governing Council member Jens Weidmann said on Monday that quantitative easing was appropriate as inflation was low, adding that quantitative easing for a longer period could entail risks and side effects.

He pointed out that global economy needed supply side demand reforms not stimulus measures.

-

17:21

Standard & Poor's affirms the U.K.’s AA+ credit rating with a negative outlook

Standard & Poor's (S&P) affirmed the U.K.'s AAA credit rating on Friday. The outlook is negative.

According to S&P analysts, Britons will vote to remain in the European Union (EU).

"Our affirmation of the rating reflects our assumption that, by a small majority, the referendum will deliver a vote to remain in the EU", the agency said.

But S&P added that a possible leave weighed on Britain's creditworthiness.

-

17:10

MI Inflation gauge for Australia rises 0.1% in April

The Melbourne Institute (MI) released its monthly inflation data for Australia on Monday. MI Inflation gauge for Australia rose 0.1% in April, after a flat reading in March.

On a yearly basis, inflation gauge climbed 1.5% in April, after a 1.7% increase in March.

Prices for fruit and vegetables climbed 3.4% in April, medical and hospital services prices rose 3.5% and automotive fuel prices jumped 3.7%, while prices for holiday travel and accommodation slid 4.3%, prices for insurance and financial services fell 0.4% and household furniture & equipment prices were down 0.2%.

-

16:58

National Australia Bank’s business confidence index falls to 5 points in April

The National Australia Bank (NAB) released its business confidence index for Australia on Monday. The index fell to 5 points in April from 6 points in March.

"Even though business conditions eased this month, they have remained well above average levels for the past year. With consistently good results like these from our survey it is difficult not to have a degree of confidence in the near-term outlook," NAB Group Chief Economist Alan Oster said.

The main business conditions index decreased to 9 points in April from 12 points in March, while employment remained uncaged at 4 points.

-

16:52

Australian Industry Group’s manufacturing purchasing managers’ index for Australia drops to 53.4 in April

The Australian Industry Group (AiG) released its manufacturing purchasing managers' index (PMI) for Australia on the late Sunday evening. The index dropped to 53.4 in April from 58.1 in March. It was the highest level since April 2004.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

A stronger Australian dollar weighed on the activity in the manufacturing sector.

-

16:45

European Central Bank purchases €17.55 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €17.55 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.24 billion of covered bonds, and the value of asset-backed securities fell by €132 million.

In April as whole, the central bank purchased €78.5 billion of government and agency bonds, €6.6 billion of covered bonds, and €50 million of asset-backed securities

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion.

-

16:32

WSE: After start on Wall Street

U.S. Stocks open: Dow +0.17%, Nasdaq +0.07%, S&P +0.16%

Wall Street started the session at levels that in the small extent differ from the indications of derivatives. Europe extends the correction of Friday's weakness, but the CAC and the DAX indexes are still far to make up the losses from Friday. In fact, the German bulls managed to barely make up half of the decline from the last session. The WSE tries to nourish this impulse and no weakening of the zloty to the dollar, but at 130 million turnover every move is easy to generate.

It is worth to remember that tomorrow's macro calendar contains PMI reading for the Chinese industry, which in the absence of other data may raise some emotions in the markets, especially of raw materials.

-

16:28

Construction spending in the U.S. is up 0.3% in March

The U.S. Commerce Department released construction spending data on Monday. Construction spending in the U.S. increased 0.3% in March, in line with expectations, after a 1.0% rise in February. February's figure was revised up from a 0.5% decline.

The increase was mainly driven by a rise in total private spending. Total public construction spending slid 1.9% in March, while total spending on private construction projects increased 1.1%.

-

16:09

ISM manufacturing purchasing managers’ index slides to 50.8 in April

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index slid to 50.8 in April from 51.8 in March. Analysts had expected the index to decrease to 51.5.

A reading above 50 indicates expansion, below indicates contraction.

The decrease was mainly driven by falls in production and new orders. The production index dropped to 54.2 in April from 55.3 in March, while the new orders index plunged to 55.8 from 58.3.

The employment index was up to 49.2 in April from 48.1 in March.

The price index jumped to 59.0 in April from 51.5 in March.

-

15:55

U.S. final manufacturing purchasing managers' index (PMI) decreases to 50.8 in April

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. final manufacturing purchasing managers' index (PMI) decreased to 50.8 in April from 51.5 in March, in line with the preliminary estimate.

A reading above 50 indicates expansion in economic activity.

The index was driven by a slower pace of growth in output and new business.

"The April PMI data suggest there's no end in sight to the current downturn in manufacturing activity," Markit's Chief Economist Chris Williamson said.

"Rather than reviving after a disappointingly weak first quarter, the data flow therefore appears to be worsening in the second quarter, raising question marks over whether GDP growth will improve on the near-stalling seen in the first three months of the year," he added.

-

15:43

Canadian manufacturing PMI rises to 52.2 in April

Royal Bank of Canada (RBC), the Supply Chain Management Association (SCMA) and Markit Economics released their RBC Canadian manufacturing PMI on Monday. The index rose to 52.2 in April from 51.5 in March. It was the highest level since December 2014.

The rise was mainly driven by increases in output, new orders and employment.

"The recent trend in Canadian manufacturing is encouraging with an improvement in output, new orders and employment. This pickup in activity has come alongside solid U.S. domestic demand and a more competitive currency which supports export activity," RBC senior vice-president and chief economist, Craig Wright, said.

-

15:33

U.S. Stocks open: Dow +0.17%, Nasdaq +0.07%, S&P +0.16%

-

15:12

Final Markit/Nikkei manufacturing purchasing managers' index for Japan rises to 48.2 in April

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan rose to 48.2 in April from 48.0 in March, up from the preliminary reading of 48.0. It was the lowest level since January 2013.

March's figure was revised down from 49.1.

A reading above 50 indicates expansion, a reading below 50 indicates contraction of activity.

Output, new orders and input prices declined at a faster pace in April.

"Latest survey data signalled a marked deterioration in operating conditions at Japanese manufacturers, partly a consequence of the two earthquakes which struck one of Japan's key manufacturing regions," economist at Markit, Amy Brownbill, said.

-

15:11

Before the bell: S&P futures +0.23%, NASDAQ futures +0.17%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,147.38 -518.67 -3.11%

Hang Seng Closed

Shanghai Composite Closed

FTSE Closed

CAC 4,451.61 +22.65 +0.51%

DAX 10,131.53 +92.56 +0.92%

Crude $45.82 (-0.22%)

Gold $1301.50 (+0.85%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

11.25

0.08(0.7162%)

37460

ALTRIA GROUP INC.

MO

62.84

0.13(0.2073%)

600

Amazon.com Inc., NASDAQ

AMZN

661.7

2.11(0.3199%)

28887

American Express Co

AXP

65.55

0.12(0.1834%)

156

AMERICAN INTERNATIONAL GROUP

AIG

55.84

0.02(0.0358%)

50530

Apple Inc.

AAPL

94.04

0.30(0.32%)

153511

AT&T Inc

T

38.89

0.07(0.1803%)

11672

Barrick Gold Corporation, NYSE

ABX

19.58

0.21(1.0842%)

296424

Boeing Co

BA

134.7

-0.10(-0.0742%)

815

Caterpillar Inc

CAT

77.7

-0.02(-0.0257%)

3688

Chevron Corp

CVX

102.25

0.07(0.0685%)

506

Cisco Systems Inc

CSCO

27.36

-0.13(-0.4729%)

6700

Deere & Company, NYSE

DE

84.11

0.00(0.00%)

1671

Exxon Mobil Corp

XOM

88.31

-0.09(-0.1018%)

6169

Facebook, Inc.

FB

117.89

0.31(0.2636%)

131327

Ford Motor Co.

F

13.6

0.04(0.295%)

51384

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.21

0.21(1.50%)

319401

General Electric Co

GE

30.71

-0.04(-0.1301%)

27687

General Motors Company, NYSE

GM

32.1

0.30(0.9434%)

1362

Google Inc.

GOOG

695.83

2.82(0.4069%)

1078

Home Depot Inc

HD

134.15

0.26(0.1942%)

1325

HONEYWELL INTERNATIONAL INC.

HON

114.27

-0.00(-0.00%)

2576

Intel Corp

INTC

30.38

0.10(0.3302%)

13152

International Business Machines Co...

IBM

146.38

0.44(0.3015%)

656

Johnson & Johnson

JNJ

112.08

0.00(0.00%)

7435

JPMorgan Chase and Co

JPM

63.34

0.14(0.2215%)

300

McDonald's Corp

MCD

126.52

0.03(0.0237%)

6342

Microsoft Corp

MSFT

49.94

0.07(0.1404%)

10445

Nike

NKE

58.94

-0.00(-0.00%)

1665

Pfizer Inc

PFE

32.83

0.12(0.3669%)

4002

Procter & Gamble Co

PG

80.32

0.20(0.2496%)

4393

Starbucks Corporation, NASDAQ

SBUX

56.28

0.05(0.0889%)

4091

Tesla Motors, Inc., NASDAQ

TSLA

241.49

0.73(0.3032%)

6205

The Coca-Cola Co

KO

44.83

0.03(0.067%)

9815

Twitter, Inc., NYSE

TWTR

14.73

0.11(0.7524%)

80716

United Technologies Corp

UTX

104

-0.37(-0.3545%)

261

Verizon Communications Inc

VZ

50.98

0.04(0.0785%)

1991

Wal-Mart Stores Inc

WMT

66.85

-0.02(-0.0299%)

1982

Walt Disney Co

DIS

103.5

0.24(0.2324%)

15337

Yahoo! Inc., NASDAQ

YHOO

36.68

0.08(0.2186%)

21557

Yandex N.V., NASDAQ

YNDX

20.52

0.05(0.2443%)

765

-

14:51

Spain’s manufacturing PMI is up to 53.5 in April

Markit Economics released its manufacturing purchasing managers' index (PMI) for Spain on Monday. Spain's manufacturing purchasing managers' index (PMI) was up to 53.5 in April from 53.4 in March.

The increase was mainly driven by a faster growth in output, while input costs declined at a slower pace.

"There were mixed signals from the latest Spanish manufacturing PMI, with output growth accelerating but other key variables such as new orders and employment increasing at slower rates. There was also a noticeable weakening in the pace of cost deflation in April in a sign that inflationary pressures may be returning," a senior economist at Markit Andrew Harker said.

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

United Tech (UTX) downgraded to Neutral from Buy at Goldman

Other:

Chevron (CVX) target raised to $114 from $110 at Jefferies

-

14:37

Italy’s manufacturing PMI increases to 53.9 in April

Markit Economics released its manufacturing purchasing managers' index (PMI) for Italy on Monday. Italy's Markit/ADACI manufacturing PMI increased to 53.9 in April from 53.5 in March.

The increase was driven by a faster growth in output, new orders, exports and job creation, while output and input prices fell at a slower pace.

"The manufacturing economy showed signs of improved health in April. The PMI moved to its highest level in 2016 so far, as accelerating inflows of new orders led to a robust increase in production as well as the creation of more jobs at factories," Markit economist Phil Smith said.

-

14:10

Earnings Season in U.S.: Major Reports of the Week

May 2

After the Close:

American International Group (AIG). Consensus EPS $1.00, Consensus Revenue $13749.00 mln

May 3

Before the Open:

Pfizer (PFE). Consensus EPS $0.55, Consensus Revenue $11991.71 mln

May 4

After the Close:

Tesla Motors (TSLA). Consensus EPS -$0.65, Consensus Revenue $1602.78 mln

May 5

Before the Open:

Merck (MRK). Consensus EPS $0.85, Consensus Revenue $9453.44 mln

-

13:02

WSE: Mid session comment

The final of the forenoon phase of the session brings greater departure of the WIG20 from defended last week resistance. The WIG20 index in the middle of the session was in the area of 1,906 pts., which is largely a response to the rise in core markets. The DAX has been growing about 0,8 percent - far away to catch Friday's losses and a decrease of more than 3 percent in the previous week - and clearly creates upward pressure in Warsaw. It also helps to gold, which loses to the euro, but not to the dollar. Unfortunately, the turnover on the level of PLN 83 mln reinforces expectations that the session will not have serious, especially reliable consequences.

-

12:00

European stock markets mid session: stocks traded higher on the manufacturing PMI data from the Eurozone

Stock indices traded higher after the release of the mostly positive final manufacturing purchasing managers' index (PMI) data for the Eurozone. Markit Economics released its final manufacturing PMI for the Eurozone on Monday. Eurozone's final manufacturing PMI climbed to 51.7 in April from 51.6 in March, up from the preliminary reading of 51.5.

The rise was driven by a faster growth in employment and as deflationary pressures moderated.

"The survey is signalling an anaemic annual rate of growth of manufacturing production of just less than 1%, which is half the pace seen in the months leading up to the recent slowdown," Chris Williamson, Chief Economist at Markit said.

"The survey data therefore so far show no signs of ECB stimulus or the weaker euro helping to revive the manufacturing sector, at least for the euro area as a whole," he added.

Germany's final Markit/BME manufacturing PMI rose to 51.8 in April from 50.7 in March, down from the preliminary reading of 51.9. The index was mainly driven by rises in new business and employment.

France's final manufacturing PMI decreased to 48.0 in April from 49.6 in March, down the preliminary reading of 48.3. The index was driven by drops in new business, output and output prices. Output prices slid a fastest pace since July 2009.

Markets in the U.K. are closed for a public holiday.

Current figures:

Name Price Change Change %

FTSE 100 closed

DAX 10,119.77 +80.80 +0.80 %

CAC 40 4,443.16 +14.20 +0.32 %

-

11:49

Swiss manufacturing PMI climbs to 54.7 in April

Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The manufacturing purchasing managers' index in Switzerland climbed to 54.7 in April from 53.2 in March, hitting the 2-year high.

A reading above 50 indicates expansion.

The increase was mainly driven by rises in output and backlog of orders sub-indexes. The production increased to 59.4 in April from 58.0 in March, while the backlog of orders sub-index jumped to 57.6 from 54.9.

Purchase prices were up to 47.3 in April from 47.0 in March.

Employment rose to 49.1 in April from 46.1 in March.

-

11:41

Swiss retail sales decline 1.3% year-on-year in March

The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland were down at an annual rate of 1.3% in March, after a 0.4% decrease in February. February's figure was revised down from a 0.2% fall.

Sales of food, beverages and tobacco climbed at an annual rate of 1.5% in March, while non-food sales dropped 5.7%.

On a monthly basis, retail sales fell by 0.3% in March, after a 0.6% drop in February. February's figure was revised down from a 0.4% fall.

Sales of food, beverages and tobacco declined 0.3% in March, while non-food sales dropped 1.6%.

-

11:34

France’s final manufacturing PMI decreases to 48.0 in April

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) decreased to 48.0 in April from 49.6 in March, down the preliminary reading of 48.3.

The index was driven by drops in new business, output and output prices. Output prices slid a fastest pace since July 2009.

"The French manufacturing sector slipped further into contraction during April, precipitated by a steeper reduction in new order intakes. This was despite output prices being cut at the steepest rate since mid-2009, highlighting the sector's struggles in the face of persistently weak demand," Markit Senior Economist Jack Kennedy said.

-

11:30

Germany’s final manufacturing PMI rises to 51.8 in April

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's final Markit/BME manufacturing purchasing managers' index (PMI) rose to 51.8 in April from 50.7 in March, down from the preliminary reading of 51.9.

The index was mainly driven by rises in new business and employment.

"Although some relief was offered by today's survey results, the German manufacturing sector remains stuck in a low gear at the start of the second quarter," Markit economist Oliver Kolodseike said.

-

11:26

Eurozone’s final manufacturing PMI climbs to 51.7 in April

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) climbed to 51.7 in April from 51.6 in March, up from the preliminary reading of 51.5.

The rise was driven by a faster growth in employment and as deflationary pressures moderated.

"The survey is signalling an anaemic annual rate of growth of manufacturing production of just less than 1%, which is half the pace seen in the months leading up to the recent slowdown," Chris Williamson, Chief Economist at Markit said.

"The survey data therefore so far show no signs of ECB stimulus or the weaker euro helping to revive the manufacturing sector, at least for the euro area as a whole," he added.

-

10:24

Canada’s budget surplus narrows in February

Canada's government said on Friday that budget surplus narrowed to C$3.2 billion ($2.56 billion) in February. For 11 months of the fiscal year 2015-16, revenue climbed by 6.2%, program expenses increased by 7.0%, while public debt charges dropped 5.0%.

The government said in March that it expected budget deficits in the coming years.

-

10:13

Official data: Chinese manufacturing PMI declines to 50.1 in April

The Chinese manufacturing PMI fell to 50.1 in April from 50.2 in March, according to the Chinese government. Analysts had expected the index to increase to 50.4.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decrease was driven by falls in output, new orders and employment. The production sub-index declined to 52.2 in April from 52.3 in March, the new orders sub-index was down to 51 from 51.4, and the new exports sub-index fell to 50.1 from 50.2, while the employment sub-index decreased to 47.8 from 48.1.

The services PMI decreased to 53.5 in April from 53.8 in March.

-

09:17

WSE: After opening

WIG20 futures took off 6 points above Friday's closing. This increase is part of a morning uplift of contracts on major European stock exchanges, but how this will translate into trade in the next stages of today's specific session is a different matter. Theoretically we have a chance to bounce in the context of the return movement to the broken last week support. Such opportunities are flowing at least from a technical analysis of the Friday session.

WIG20 index opened at 1898.93 points (+0.12%)*

WIG 47681.11 0.08%

WIG30 2118.74 0.04%

mWIG40 3622.23 0.22%

*/ - change to previous close

Europe begins sessions with the expected increases - the DAX and the CAC are growing by more than 0.5 per cent, while London is celebrating. For valuation of shares in the euro zone helps the weaker common currency, but the echo of this weakness is the strengthening of the dollar. Stronger dollar weakens zloty (PLN), which strength was helping the bulls in Warsaw at the end of Friday's session. As a result, the WIG20 begins the day without big change, but clearly outpacing the increases in the environment. The shallowness of the market causes, however, that a single bound slight decrease changes in uplift of 0.2 per cent. The topics for the sessions seem to be partly revealed: sensitivity to the condition of the zloty and a hole in the order book.

-

08:16

WSE: Before opening

Friday's trading on Wall Street ended in solidarity declines in major indices, which lost 0.3 to 0.6 percent. On Friday, Europe responded not only to the weakness of Wall Street.

The main element of lowering the share prices of CAC and DAX indexes was the strength of the euro against the dollar, and in this area there is no change. The dollar remains weak against the yen and euro. It does not help also in Asia, where the Nikkei in response to the strength of the yen lost 3,3 percent today. In short, at the threshold of a new week the atmosphere is not better than at the end of the previous one.

Investors' attention should shift to always published at the beginning of the month readings of PMI indices in the euro zone. In the next hours will be valid until the reading of the US ISM also for the industry. The London market is closed today, Chinese stock exchanges are also off. Therefore on the Warsaw Stock Exchange a low liquidity and low turnover are expected today.

Starting today May on core markets is considered to be a weak period for stocks. This favors the extension of the April correction, which may result in a decline in WIG20 in area of ,1800 points. The market had also recently sensitivity to the condition of the zloty (PLN), which will be an important element in the balance of power in the course of the month starting today.

-

07:15

Global Stocks

European stocks suffered their worst session in two months Friday, as investors tackled a raft of economic data and a fresh batch of corporate results as the week and month drew to a close. But, separately, inflation in the currency bloc fell to negative 0.2% in April, missing expectations for a flat reading. The data highlight the challenge of stubbornly low inflation the European Central Bank has been battling against.

Stocks fell on Friday as blue-chip tech shares dragged on the market, but the S&P 500 and the Dow Jones Industrial Average clung to April gains to score the second monthly rise in a row. While the earnings flow was light during the day, stocks were still reeling from a sharp selloff in the second half of a Thursday session that was driven by a number of factors-including a weak reading on U.S. first-quarter gross domestic product and a surprise decision by the Bank of Japan to leave monetary policy on hold. Dow industrials had stumbled more than 200 points on Thursday for their worst drop in two months.

Japanese stocks fell sharply early Monday, leading declines in the rest of Asia, on the yen's surge to a new 1½-year high against the dollar, weak earnings results from several firms and selling after the Bank of Japan's inaction on Thursday.

Based on MarketWatch materials

-

04:23

Nikkei 225 16,067.5 -598.55 -3.59 %, S&P/ASX 200 5,194.2 -58.02 -1.10 %, Topix 1,294.06 -46.49 -3.47 %

-

00:45

Stocks. Daily history for Sep Apr 29’2016:

(index / closing price / change items /% change)

Hang Seng 21,067.05 -320.98 -1.50 %

S&P/ASX 200 5,252.22 +26.79 +0.51 %

Shanghai Composite 2,938.45 -7.14 -0.24 %

Topix 1,340.55 -43.75 -3.16 %

FTSE 100 6,241.89 -80.51 -1.27 %

CAC 40 4,428.96 -128.40 -2.82 %

Xetra DAX 10,038.97 -282.18 -2.73 %

S&P 500 2,065.3 -10.51 -0.51 %

NASDAQ Composite 4,775.36 -29.93 -0.62 %

Dow Jones 17,773.64 -57.12 -0.32 %

-