Noticias del mercado

-

20:00

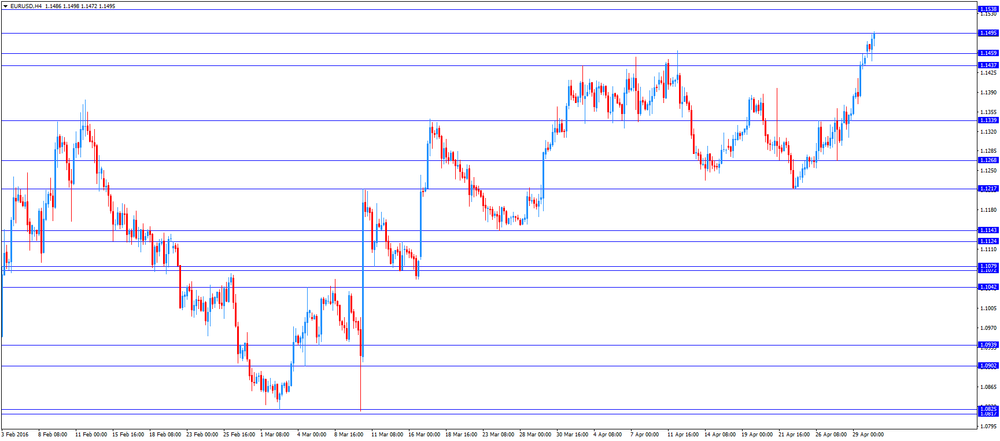

American focus: The US dollar weakened against most major currencies

The US dollar depreciated significantly against the euro, reaching a minimum of 26 August 2015, which was caused by technical factors and the publication of weak US statistics. Final data presented at Markit, showed: the seasonally adjusted manufacturing PMI index fell to 50.8 in April from 51.5 in March. The value coincided with the preliminary estimate and forecasts. However, the index dropped below the average for the 1st quarter of 2016 (51.7), and pointed to the weakest improvement in the general conditions for a little more than 6.5 years. Production remained almost unchanged in April, but the pace of expansion was the weakest since October 2009. The Markit said that weak customer demand, uncertainty about the economic outlook and lower capital costs for an energetic sector put pressure on industrial production in April. Meanwhile, manufacturers are once again recorded a slight increase in orders, but the growth rate was the weakest since December 2015. The volume of new orders from abroad fell at the fastest pace in 1.5 years, while the number of unfilled orders decreased for the third time in a row, recording the highest growth since September 2009. Against this background, the pace of job creation turned out to be the weakest in nearly three years.

Meanwhile, a report published by the Institute for Supply Management, showed that the manufacturing index fell to 50.8 in April from 51.8 in March. It was expected that the rate will drop to 51.5. Activity in the manufacturing sector fell from the end of 2014 because of the collapse in oil prices and lower export demand, which was the cause of the deterioration of the economic situation abroad and the strengthening of the dollar.

On the trading dynamics also affect the application of the ECB Draghi. He noted that in conditions of extremely low inflation is no alternative to a soft monetary policy. Draghi also said that in the medium term depositors of banks benefit from low interest rates. "To date, our policy can stimulate the eurozone economy in the conditions of falling output and extremely low inflation due to the fact that interest rates remain below their long-term levels," - he said.

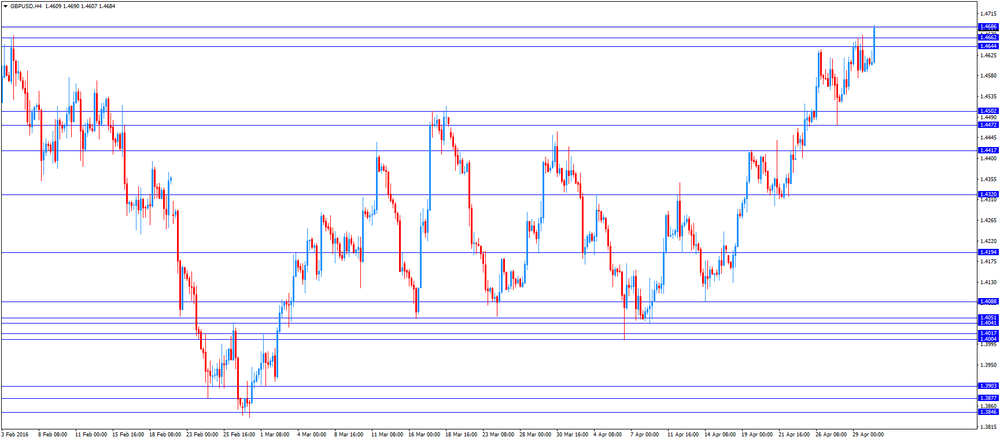

The British pound strengthened against the US dollar, reaching its highest level since 5 January. Experts point out that the current increase of the pair was due to a widespread weakening of the US currency. The dollar began to actively become cheaper after last Wednesday, the Fed left rates at the same level and did not give a clear signal as to whether to wait for the growth rate in June. This decision was taken by the central bank on a background of mixed signals from the global economy and the slowdown in inflation in the United States. Preservation of low interest rates has a negative impact on the US currency, making it less attractive to investors. Today futures on interest rates Fed indicate that the probability of a rate hike of 17% in June.

Later this week, investors will be watching UK data on business activity in the manufacturing sector, the construction sector and the service sector. It is expected that the manufacturing index rose in April to 51.2 from 51.0, the PMI index for the construction sector fell to 54.0 from 54.2, while the PMI index for the services sector fell to 53.6 from 53.7.

-

18:16

European Central Bank Executive Board member Benoit Coeure: the ECB’s stimulus measures are working

European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview with on radio station France Inter on Monday that the central bank's stimulus measures were working, but more time was needed.

"That's working and creating growth, but where we're still waiting for results is on inflation, because it takes time and because energy prices are still low," he said.

-

18:13

European Central Bank Executive Board member Benoit Coeure: the central bank is acting to fulfil its price stability mandate

European Central Bank (ECB) Executive Board member Benoit Coeure said in opinion piece in the German newspaper Frankfurter Allgemeine Sonntagszeitung on Sunday that the central bank was acting to fulfil its price stability mandate.

He noted that inflation would rise only gradually.

Coeure defended the ECB's quantitative easing.

"People are not just savers - they are also employees, taxpayers and borrowers, as such benefiting from the low level of interest rates," he said.

-

17:42

European Central Bank President Mario Draghi: there is no alternative to the central bank’s quantitative easing

European Central Bank (ECB) President Mario Draghi said on Monday that there was no alternative to the central bank's quantitative easing.

"There is simply no alternative to this today," he said.

Draghi noted that savers would benefit from the central bank's monetary policy in the medium term.

"It might seem at first glance that this policy is tantamount to penalising savers in favour of borrowers. But in the medium-term, expansionary policy is actually very much to the benefit of savers," the ECB president said.

-

17:28

European Central Bank Governing Council member Jens Weidmann: quantitative easing is appropriate as inflation is low

European Central Bank (ECB) Governing Council member Jens Weidmann said on Monday that quantitative easing was appropriate as inflation was low, adding that quantitative easing for a longer period could entail risks and side effects.

He pointed out that global economy needed supply side demand reforms not stimulus measures.

-

17:21

Standard & Poor's affirms the U.K.’s AA+ credit rating with a negative outlook

Standard & Poor's (S&P) affirmed the U.K.'s AAA credit rating on Friday. The outlook is negative.

According to S&P analysts, Britons will vote to remain in the European Union (EU).

"Our affirmation of the rating reflects our assumption that, by a small majority, the referendum will deliver a vote to remain in the EU", the agency said.

But S&P added that a possible leave weighed on Britain's creditworthiness.

-

17:10

MI Inflation gauge for Australia rises 0.1% in April

The Melbourne Institute (MI) released its monthly inflation data for Australia on Monday. MI Inflation gauge for Australia rose 0.1% in April, after a flat reading in March.

On a yearly basis, inflation gauge climbed 1.5% in April, after a 1.7% increase in March.

Prices for fruit and vegetables climbed 3.4% in April, medical and hospital services prices rose 3.5% and automotive fuel prices jumped 3.7%, while prices for holiday travel and accommodation slid 4.3%, prices for insurance and financial services fell 0.4% and household furniture & equipment prices were down 0.2%.

-

16:58

National Australia Bank’s business confidence index falls to 5 points in April

The National Australia Bank (NAB) released its business confidence index for Australia on Monday. The index fell to 5 points in April from 6 points in March.

"Even though business conditions eased this month, they have remained well above average levels for the past year. With consistently good results like these from our survey it is difficult not to have a degree of confidence in the near-term outlook," NAB Group Chief Economist Alan Oster said.

The main business conditions index decreased to 9 points in April from 12 points in March, while employment remained uncaged at 4 points.

-

16:52

Australian Industry Group’s manufacturing purchasing managers’ index for Australia drops to 53.4 in April

The Australian Industry Group (AiG) released its manufacturing purchasing managers' index (PMI) for Australia on the late Sunday evening. The index dropped to 53.4 in April from 58.1 in March. It was the highest level since April 2004.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

A stronger Australian dollar weighed on the activity in the manufacturing sector.

-

16:45

European Central Bank purchases €17.55 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €17.55 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.24 billion of covered bonds, and the value of asset-backed securities fell by €132 million.

In April as whole, the central bank purchased €78.5 billion of government and agency bonds, €6.6 billion of covered bonds, and €50 million of asset-backed securities

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion.

-

16:28

Construction spending in the U.S. is up 0.3% in March

The U.S. Commerce Department released construction spending data on Monday. Construction spending in the U.S. increased 0.3% in March, in line with expectations, after a 1.0% rise in February. February's figure was revised up from a 0.5% decline.

The increase was mainly driven by a rise in total private spending. Total public construction spending slid 1.9% in March, while total spending on private construction projects increased 1.1%.

-

16:09

ISM manufacturing purchasing managers’ index slides to 50.8 in April

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index slid to 50.8 in April from 51.8 in March. Analysts had expected the index to decrease to 51.5.

A reading above 50 indicates expansion, below indicates contraction.

The decrease was mainly driven by falls in production and new orders. The production index dropped to 54.2 in April from 55.3 in March, while the new orders index plunged to 55.8 from 58.3.

The employment index was up to 49.2 in April from 48.1 in March.

The price index jumped to 59.0 in April from 51.5 in March.

-

16:00

U.S.: Construction Spending, m/m, March 0.3% (forecast 0.3%)

-

16:00

U.S.: ISM Manufacturing, April 50.8 (forecast 51.5)

-

15:55

U.S. final manufacturing purchasing managers' index (PMI) decreases to 50.8 in April

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. final manufacturing purchasing managers' index (PMI) decreased to 50.8 in April from 51.5 in March, in line with the preliminary estimate.

A reading above 50 indicates expansion in economic activity.

The index was driven by a slower pace of growth in output and new business.

"The April PMI data suggest there's no end in sight to the current downturn in manufacturing activity," Markit's Chief Economist Chris Williamson said.

"Rather than reviving after a disappointingly weak first quarter, the data flow therefore appears to be worsening in the second quarter, raising question marks over whether GDP growth will improve on the near-stalling seen in the first three months of the year," he added.

-

15:45

U.S.: Manufacturing PMI, April 50.8 (forecast 50.8)

-

15:43

Canadian manufacturing PMI rises to 52.2 in April

Royal Bank of Canada (RBC), the Supply Chain Management Association (SCMA) and Markit Economics released their RBC Canadian manufacturing PMI on Monday. The index rose to 52.2 in April from 51.5 in March. It was the highest level since December 2014.

The rise was mainly driven by increases in output, new orders and employment.

"The recent trend in Canadian manufacturing is encouraging with an improvement in output, new orders and employment. This pickup in activity has come alongside solid U.S. domestic demand and a more competitive currency which supports export activity," RBC senior vice-president and chief economist, Craig Wright, said.

-

15:40

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1400 (EUR 340m) 1.1475 (275m) 1.1500 (1.33bln)

GBPUSD 1.4650 (GBP 759m)

AUDUSD 0.7700 (AUD 294m) 0.7715 (505m)

-

15:12

Final Markit/Nikkei manufacturing purchasing managers' index for Japan rises to 48.2 in April

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan rose to 48.2 in April from 48.0 in March, up from the preliminary reading of 48.0. It was the lowest level since January 2013.

March's figure was revised down from 49.1.

A reading above 50 indicates expansion, a reading below 50 indicates contraction of activity.

Output, new orders and input prices declined at a faster pace in April.

"Latest survey data signalled a marked deterioration in operating conditions at Japanese manufacturers, partly a consequence of the two earthquakes which struck one of Japan's key manufacturing regions," economist at Markit, Amy Brownbill, said.

-

14:51

Spain’s manufacturing PMI is up to 53.5 in April

Markit Economics released its manufacturing purchasing managers' index (PMI) for Spain on Monday. Spain's manufacturing purchasing managers' index (PMI) was up to 53.5 in April from 53.4 in March.

The increase was mainly driven by a faster growth in output, while input costs declined at a slower pace.

"There were mixed signals from the latest Spanish manufacturing PMI, with output growth accelerating but other key variables such as new orders and employment increasing at slower rates. There was also a noticeable weakening in the pace of cost deflation in April in a sign that inflationary pressures may be returning," a senior economist at Markit Andrew Harker said.

-

14:37

Italy’s manufacturing PMI increases to 53.9 in April

Markit Economics released its manufacturing purchasing managers' index (PMI) for Italy on Monday. Italy's Markit/ADACI manufacturing PMI increased to 53.9 in April from 53.5 in March.

The increase was driven by a faster growth in output, new orders, exports and job creation, while output and input prices fell at a slower pace.

"The manufacturing economy showed signs of improved health in April. The PMI moved to its highest level in 2016 so far, as accelerating inflows of new orders led to a robust increase in production as well as the creation of more jobs at factories," Markit economist Phil Smith said.

-

14:16

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the mostly positive final manufacturing PMI data for the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

01:00 Australia MI Inflation Gauge, m/m 0.0% 0.1%

02:00 Japan Manufacturing PMI (Finally) April 48.0 Revised From 49.1 48.0 48.2

06:00 United Kingdom Bank holiday

07:15 Switzerland Retail Sales (MoM) March -0.6% Revised From -0.4% -0.3%

07:15 Switzerland Retail Sales Y/Y March -0.4% Revised From -0.2% -1.3%

07:30 Switzerland Manufacturing PMI April 53.2 54.7

07:50 France Manufacturing PMI (Finally) April 49.6 48.3 48

07:55 Germany Manufacturing PMI (Finally) April 50.7 51.9 51.8

08:00 Eurozone Manufacturing PMI (Finally) April 51.6 51.5 51.7

09:30 Eurozone ECB's Jens Weidmann Speaks

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the U.S. economic later in the day. The final manufacturing purchasing managers' index is expected to rise to 50.8 in April from 51.5 in March.

The ISM manufacturing purchasing managers' index is expected to decrease to 51.5 in April from 51.8 in March.

The euro traded higher against the U.S. dollar after the release of the mostly positive final manufacturing purchasing managers' index (PMI) data for the Eurozone. Markit Economics released its final manufacturing PMI for the Eurozone on Monday. Eurozone's final manufacturing PMI climbed to 51.7 in April from 51.6 in March, up from the preliminary reading of 51.5.

The rise was driven by a faster growth in employment and as deflationary pressures moderated.

"The survey is signalling an anaemic annual rate of growth of manufacturing production of just less than 1%, which is half the pace seen in the months leading up to the recent slowdown," Chris Williamson, Chief Economist at Markit said.

"The survey data therefore so far show no signs of ECB stimulus or the weaker euro helping to revive the manufacturing sector, at least for the euro area as a whole," he added.

Germany's final Markit/BME manufacturing PMI rose to 51.8 in April from 50.7 in March, down from the preliminary reading of 51.9. The index was mainly driven by rises in new business and employment.

France's final manufacturing PMI decreased to 48.0 in April from 49.6 in March, down the preliminary reading of 48.3. The index was driven by drops in new business, output and output prices. Output prices slid a fastest pace since July 2009.

The British pound traded higher against the U.S. dollar in the absence of any major economic data from the U.K. Markets in the U.K. are closed for a public holiday.

The Swiss franc traded higher against the U.S. dollar. The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland were down at an annual rate of 1.3% in March, after a 0.4% decrease in February. February's figure was revised down from a 0.2% fall. On a monthly basis, retail sales fell by 0.3% in March, after a 0.6% drop in February. February's figure was revised down from a 0.4% fall.

Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The manufacturing purchasing managers' index in Switzerland climbed to 54.7 in April from 53.2 in March, hitting the 2-year high. The increase was mainly driven by rises in output and backlog of orders sub-indexes. The production increased to 59.4 in April from 58.0 in March, while the backlog of orders sub-index jumped to 57.6 from 54.9.

EUR/USD: the currency pair rose to $1.1498

GBP/USD: the currency pair increased to $1.4690

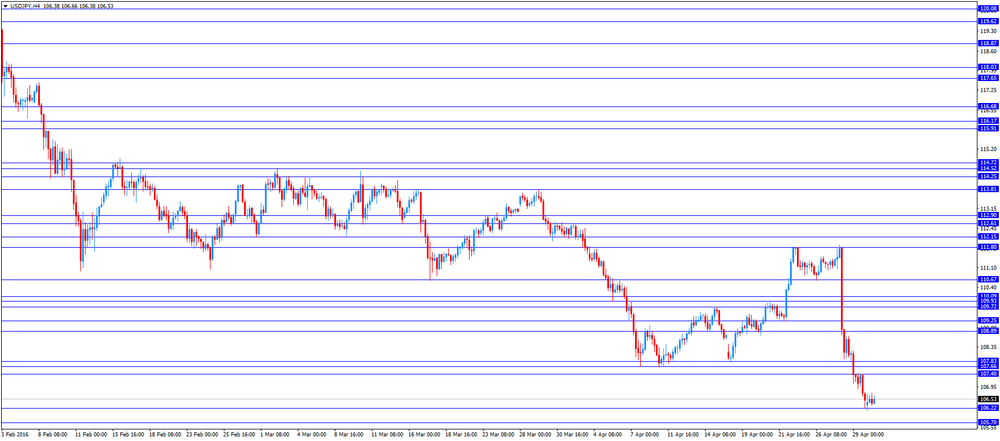

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:45 U.S. Manufacturing PMI (Finally) April 51.5 50.8

14:00 U.S. Construction Spending, m/m March -0.5% 0.3%

14:00 U.S. ISM Manufacturing April 51.8 51.5

15:00 Eurozone ECB President Mario Draghi Speaks

16:30 Switzerland SNB Chairman Jordan Speaks

-

11:49

Swiss manufacturing PMI climbs to 54.7 in April

Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The manufacturing purchasing managers' index in Switzerland climbed to 54.7 in April from 53.2 in March, hitting the 2-year high.

A reading above 50 indicates expansion.

The increase was mainly driven by rises in output and backlog of orders sub-indexes. The production increased to 59.4 in April from 58.0 in March, while the backlog of orders sub-index jumped to 57.6 from 54.9.

Purchase prices were up to 47.3 in April from 47.0 in March.

Employment rose to 49.1 in April from 46.1 in March.

-

11:41

Swiss retail sales decline 1.3% year-on-year in March

The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland were down at an annual rate of 1.3% in March, after a 0.4% decrease in February. February's figure was revised down from a 0.2% fall.

Sales of food, beverages and tobacco climbed at an annual rate of 1.5% in March, while non-food sales dropped 5.7%.

On a monthly basis, retail sales fell by 0.3% in March, after a 0.6% drop in February. February's figure was revised down from a 0.4% fall.

Sales of food, beverages and tobacco declined 0.3% in March, while non-food sales dropped 1.6%.

-

11:34

France’s final manufacturing PMI decreases to 48.0 in April

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) decreased to 48.0 in April from 49.6 in March, down the preliminary reading of 48.3.

The index was driven by drops in new business, output and output prices. Output prices slid a fastest pace since July 2009.

"The French manufacturing sector slipped further into contraction during April, precipitated by a steeper reduction in new order intakes. This was despite output prices being cut at the steepest rate since mid-2009, highlighting the sector's struggles in the face of persistently weak demand," Markit Senior Economist Jack Kennedy said.

-

11:30

Germany’s final manufacturing PMI rises to 51.8 in April

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's final Markit/BME manufacturing purchasing managers' index (PMI) rose to 51.8 in April from 50.7 in March, down from the preliminary reading of 51.9.

The index was mainly driven by rises in new business and employment.

"Although some relief was offered by today's survey results, the German manufacturing sector remains stuck in a low gear at the start of the second quarter," Markit economist Oliver Kolodseike said.

-

11:26

Eurozone’s final manufacturing PMI climbs to 51.7 in April

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) climbed to 51.7 in April from 51.6 in March, up from the preliminary reading of 51.5.

The rise was driven by a faster growth in employment and as deflationary pressures moderated.

"The survey is signalling an anaemic annual rate of growth of manufacturing production of just less than 1%, which is half the pace seen in the months leading up to the recent slowdown," Chris Williamson, Chief Economist at Markit said.

"The survey data therefore so far show no signs of ECB stimulus or the weaker euro helping to revive the manufacturing sector, at least for the euro area as a whole," he added.

-

10:24

Canada’s budget surplus narrows in February

Canada's government said on Friday that budget surplus narrowed to C$3.2 billion ($2.56 billion) in February. For 11 months of the fiscal year 2015-16, revenue climbed by 6.2%, program expenses increased by 7.0%, while public debt charges dropped 5.0%.

The government said in March that it expected budget deficits in the coming years.

-

10:13

Official data: Chinese manufacturing PMI declines to 50.1 in April

The Chinese manufacturing PMI fell to 50.1 in April from 50.2 in March, according to the Chinese government. Analysts had expected the index to increase to 50.4.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decrease was driven by falls in output, new orders and employment. The production sub-index declined to 52.2 in April from 52.3 in March, the new orders sub-index was down to 51 from 51.4, and the new exports sub-index fell to 50.1 from 50.2, while the employment sub-index decreased to 47.8 from 48.1.

The services PMI decreased to 53.5 in April from 53.8 in March.

-

10:00

Eurozone: Manufacturing PMI, April 51.7 (forecast 51.5)

-

09:55

Germany: Manufacturing PMI, April 51.8 (forecast 51.9)

-

09:50

France: Manufacturing PMI, April 48 (forecast 48.3)

-

09:31

Switzerland: Manufacturing PMI, April 54.7

-

09:16

Switzerland: Retail Sales (MoM), March -0.3%

-

09:15

Switzerland: Retail Sales Y/Y, March -1.3%

-

08:28

Asian session: The yen hit a fresh 18-month high against the dollar

The yen hit a fresh 18-month high against the dollar, hurting the profit outlook for exporters and other shares that benefit from a weaker yen. The U.S. Treasury put Japan on a new currency monitoring list along with four other countries that have large trade surpluses with the United States. The report could make it harder for Japan to intervene in currency markets to stem the yen's gains. Japan's major automakers, which rely heavily on export sales for profits, underperformed the sagging Nikkei index. Toyota Motor Corp shares fell 3.8 percent while Nissan Motor Co Ltd tumbled 5 percent and Honda Motor Co Ltd declined 4 percent.

A private-sector gauge of Australian consumer prices showed inflation slowed further in April despite a pick up in petrol and heath care costs, underlining the case for a cut in interest rates perhaps as early as this week. Monday's survey from the Melbourne Institute showed consumer prices edged up 0.1 percent in April, after a flat outcome in March.

EUR/USD: during the Asian session the pair rose to $1.1480

GBP/USD: during the Asian session the pair traded in the range of $1.4590-20

USD/JPY: during the Asian session the pair traded in the range of Y106.15-75

Based on Reuters materials

-

07:05

Options levels on monday, May 2, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1544 (5905)

$1.1515 (2742)

$1.1481 (3594)

Price at time of writing this review: $1.1466

Support levels (open interest**, contracts):

$1.1400 (885)

$1.1371 (2732)

$1.1334 (3390)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 42916 contracts, with the maximum number of contracts with strike price $1,1500 (5905);

- Overall open interest on the PUT options with the expiration date May, 6 is 59175 contracts, with the maximum number of contracts with strike price $1,1000 (10024);

- The ratio of PUT/CALL was 1.38 versus 1.40 from the previous trading day according to data from April, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.4901 (348)

$1.4802 (921)

$1.4704 (1054)

Price at time of writing this review: $1.4605

Support levels (open interest**, contracts):

$1.4497 (880)

$1.4399 (1462)

$1.4299 (831)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 24946 contracts, with the maximum number of contracts with strike price $1,4400 (2063);

- Overall open interest on the PUT options with the expiration date May, 6 is 34125 contracts, with the maximum number of contracts with strike price $1,3850 (4025);

- The ratio of PUT/CALL was 1.37 versus 1.34 from the previous trading day according to data from April, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:00

Japan: Manufacturing PMI, April 48.2 (forecast 48.0)

-

02:59

Australia: MI Inflation Gauge, m/m, 0.0%

-

01:33

Australia: AIG Manufacturing Index, April 53.4

-

00:41

Currencies. Daily history for Apr 29’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1451 +0,86%

GBP/USD $1,4607 +0,01%

USD/CHF Chf0,9593 -0,74%

USD/JPY Y106,49 -1,53%

EUR/JPY Y121,74 -0,82%

GBP/JPY Y155,33 -1,67%

AUD/USD $0,7604 -0,33%

NZD/USD $0,6976 +0,23%

USD/CAD C$1,2551 -0,07%

-

00:00

Schedule for today, Monday, May 2’2016:

(time / country / index / period / previous value / forecast)

01:00 Australia MI Inflation Gauge, m/m 0.0%

01:00 Australia HIA New Home Sales, m/m March -5.3%

01:45 China Markit/Caixin Manufacturing PMI April 49.7

02:00 Japan Manufacturing PMI (Finally) April 49.1 48.0

07:15 Switzerland Retail Sales (MoM) March -0.4%

07:15 Switzerland Retail Sales Y/Y March -0.2%

07:30 Switzerland Manufacturing PMI April 53.2

07:50 France Manufacturing PMI (Finally) April 49.6 48.3

07:55 Germany Manufacturing PMI (Finally) April 50.7 51.9

08:00 Eurozone Manufacturing PMI (Finally) April 51.6 51.5

13:45 U.S. Manufacturing PMI (Finally) April 51.5 50.8

14:00 U.S. Construction Spending, m/m March -0.5% 0.3%

14:00 U.S. ISM Manufacturing April 51.8 51.5

-