Noticias del mercado

-

18:46

Dallas Federal Reserve President Robert Kaplan could vote for an interest rate hike in June or July if the U.S. economy continues to improve

Dallas Federal Reserve President Robert Kaplan said on Friday that he could vote for an interest rate hike in June or July if the U.S. economy continued to improve, adding that the Fed should rise its interest rate gradually.

"As we continue to make progress in achieving our dual mandate, I will advocate that we take actions to remove some amount of accommodation. However, I will also advocate that we take these steps in a gradual and patient manner," he said.

"We will see what meeting, whether that means June or July or what else," Kaplan noted.

Kaplan is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

17:16

European Central Bank Executive Board member Peter Praet: there is a limit in lowering interest rates

The European Central Bank (ECB) Executive Board member Peter Praet said in an interview with the Spanish newspaper Expansión on Friday that there was a limit in lowering interest rates.

"It's clear that negative rates cannot be reduced indefinitely to ever lower levels," he said.

He added that the central bank would only cut its interest rate further if the inflation outlook worsened significantly.

"I don't think we're going to see these conditions materialising in the near future," Praet noted.

He also said that the banking union was needed, and the recent central bank's measures needed more time to show the effect.

Praet pointed out that the ECB did not discuss helicopter money.

-

17:00

Central Bank of Russia keeps its key interest rate unchanged at 11.0% in April

The Central Bank of Russia (CBR) kept its interest rate unchanged at 11.0% on Friday. The central bank noted that inflation risks remained elevated.

"The Board of Directors sees the positive processes of inflation slowdown and inflation expectations decline, as well as shifts in the economy which anticipate the beginning of its recovery growth," the CBR said.

The central bank pointed out that risks to inflation were "declining inflation expectations against the target, uncertainty in parameters of the national budget, and ambiguity of the observed movements in nominal wages".

The CBR expects inflation to be about 5% in April 2017 and 4% in late 2017, while the quarterly GDP was expected to be positive in the second half of the year or in early 2017.

"Should inflation risks fall as much as to ensure with greater certainty that the Bank of Russia achieves its inflation target, the Bank of Russia will resume a gradual lowering of its key rate at one of its forthcoming Board meetings," the CBR said.

The next meeting of the CBR is scheduled to be June 10, 2016.

-

16:45

U.S. employment cost index rises 0.6% in first quarter

The U.S. Bureau of Labour Statistics released its employment cost index on Friday. The U.S. employment cost index rose 0.6% in first quarter, after a 0.5% gain in fourth quarter.

Wages and salaries increased 0.7% in the first quarter, after a 0.6% rise in the fourth quarter, while benefits payments climbed 0.5% in the first quarter, after a 0.7% increase in the fourth quarter.

-

16:35

Spanish current account deficit widens to €1.46 billion in February

The Bank of Spain released its current account data on Friday. Spain's current account deficit widened to €1.46 billion in February from €0.66 billion in January.

The surplus on trade in goods and services totalled €1.0 billion in February, while the deficit on primary and second income totalled €2.4 billion.

-

16:31

Thomson Reuters/University of Michigan final consumer sentiment index declines to 89.0 in April

The Thomson Reuters/University of Michigan final consumer sentiment index decreased to 89.0 in April from 91.0 in March, down from the preliminary estimate of 89.7 and missing expectations a rise to 90.0.

"All of the April decline was in the Expectations component, which fell by 4.8% from one month ago and by 12.6% from a year ago and by 14.7% from its January 2015 peak. The retreat from the 2015 peaks was evident across a wide range of expectations about prospects for the national economy," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

"The size of the decline, while troublesome, is still far short of indicating an impending recession," he added.

The current economic conditions index increased to 106.7 in April from 105.6 in March, up from the preliminary reading of 105.4.

The index of consumer expectations declined to 77.6 in April from 81.5 in March, down from a preliminary reading of 79.6.

The one-year inflation expectations rose to 2.8% in April from 2.7% in March, up from the preliminary reading of 2.7%.

-

16:19

Chicago purchasing managers' index slides to 50.4 in April

The Institute for Supply Management released its Chicago purchasing managers' index on Friday. The Chicago purchasing managers' index slid to 50.4 in April from 53.6 in March, missing expectations for a decrease to 53.0.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decrease was mainly driven by drops in new orders and drop in order backlogs. New orders were down to 51.0 in April from 55.6 in March, order backlogs plunged to 38.7 from 49.7.

The production index rose to 54.0 in April from 53.7 in March, while the employment index fell to 47.5 from 52.8.

"This was a disappointing start to the second quarter, with the Barometer barely above the neutral 50 mark in April. Against a backdrop of softer domestic demand and the slowdown abroad, panellists are now more worried about the impact a rate hike might have on business than they were at the same time last year," Chief Economist of MNI Indicators Philip Uglow said.

-

16:00

Producer prices in Italy increase 0.2% in March

The Italian statistical office Istat released its producer price inflation data for Italy on Friday. Italian producer prices increased 0.2% in March, after a 0.5% decline in February. February's figure was revised down from a 0.4% fall.

Producer price rose by 0.2% on domestic market and by 0.1% on non-domestic market in March.

On a yearly basis, Italian PPI fell 3.4% in March, after a 3.6% drop in February. February's figure was revised down from a 3.5% decline.

Producer price slid 3.9% on domestic market and by 1.8% on non-domestic market in March.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, April 89 (forecast 90)

-

15:54

Preliminary consumer prices in Italy are flat in April

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Friday. Preliminary consumer prices in Italy were flat in April, after a 0.2% rise in March.

The monthly rises of prices of non-regulated energy products, services related to recreation, including repair and personal care and of services related to transport offset declines of prices of regulated energy products.

On a yearly basis, consumer prices fell 0.4% in April, after a 0.2% decrease in March.

The decline was driven by lower prices for regulated energy products, which slid 4.7% year-on-year in April.

Prices for goods declined 1.0% year-on-year in April, while services prices rose 0.4%.

Consumer price inflation excluding unprocessed food and energy prices fell to 0.5% year-on-year in April from 0.6% in March.

-

15:49

Option expiries for today's 10:00 ET NY cut

USDJPY 105.00 106.10 (1.11bn) 107.75/80 108.00, 108.50, 108.80 109.90 (523m) 110.00 (864m)

EURUSD 1.1150 (558m) 1.1200 (699m) 1.1220 1.1227/30 1.1235 1.1245 1.1250 (604m) 1.1270 1.1300 1.1325 1.1350 (610m) 1.1400 (1.02bn) 1.1433 (727m) 1.1500

GBPUSD 1.4400 1.4600 (1.1bn)

USDCAD 1.2550 1.2615

AUDUSD 0.7650 0.7700

NZDUSD 0.6800 (802m) 0.6890 0.6900 (430m), 0.6960

AUDNZD 1.0850 (296m) 1.1150 (302m)

AUDJPY 84.00 84.50

EURJPY 122.00 124.00 125.55 126.00

-

15:46

Italy’s unemployment rate falls to 11.4% in March

The Italian statistical office Istat released its unemployment data on Friday. The seasonally adjusted unemployment rate decreased to 11.4% in March from 11.6% in February. It was the lowest rate since November 2012.

February's figure was revised down from 11.7%.

The number of unemployed people was 2.895 million in March, down 2.1% from the month before.

The youth unemployment rate decreased to 36.7 in March from 38.2% in February.

The employment rate rose to 56.7% in March from 56.5% in February.

-

15:45

U.S.: Chicago Purchasing Managers' Index , April 50.4 (forecast 53)

-

15:39

Spain’s economy expands 0.8% the first quarter

The Spanish statistical office INE released its preliminary gross domestic product (GDP) for Spain on Friday. Spain's economy expanded 0.8% the first quarter, after a 0.8% growth in the fourth quarter. It was the eleventh consecutive increase.

On a yearly, GDP grew 3.4% in the first quarter, after a 3.5% in the fourth quarter.

-

15:33

The ANZ business confidence index for New Zealand climbs to 6.2% in March

ANZ Bank released its latest business sentiment survey for New Zealand on Friday. The ANZ business confidence index for New Zealand climbed to 6.2% in March from 3.2% in February. The index means that 6.2% of respondents expected the country's economy to improve over the coming year.

"Winter may be coming but it's business as usual across the broader survey; firms continue to get on with it despite low headline confidence," the ANZ Chief Economist Cameron Bagrie said.

-

15:29

Building permits in New Zealand plunge 9.8% in March

Statistics New Zealand released its building permits data on late Thursday evening. Building permits in New Zealand plunged 9.8% in March, after a 10.0% gain in February. February's figure was revised down from a 10.8% rise.

Residential work rose 10% year-on-year in March, while non-residential work climbed 7.8%.

"The trend for the number of new dwellings consented shows signs of easing, but is still near the highest level since mid-2004," Statistics New Zealand said in its statement.

-

15:21

French final GDP rises 0.5% in the first quarter

The French statistical office Insee released its preliminary gross domestic product data for France on Friday. The French preliminary GDP rose 0.5% in the first quarter, after a 0.3% increase in the fourth quarter of 2015.

Household spending climbed 1.2% in the first quarter, after a 0.1% fall in the fourth quarter of 2015, while government spending rose 0.4%, after a 0.5% gain in the fourth quarter.

Business investment rose 0.9% in the first quarter, after a 0.7% increase in the fourth quarter

Total production in goods and services was up 0.6% in the first quarter, after a 0.6% rise in the fourth quarter.

Export decreased 0.2% in the first quarter, while imports rose 0.5%.

-

15:12

French preliminary consumer price inflation increases 0.1% in April

The French statistical office Insee released its preliminary consumer price inflation for France on Friday. The French consumer price inflation increased 0.1% in April, after a 0.7% rise in March.

The monthly increase was mainly driven by higher prices for services and petroleum products.

On a yearly basis, the consumer price declined to -0.2% in April from -0.1% in March.

The annual drop was driven by a fall in energy prices.

Food prices rose 0.4% year-on-year in April, services prices climbed 0.9%, while energy prices dropped by 6.8%.

-

15:07

German adjusted retail sales fall 1.1% in March

Destatis released its retail sales for Germany on Friday. German adjusted retail sales slid 1.1% in March, missing forecasts of a 0.3% gain, after a 0.4% decrease in February.

On a yearly basis, German unadjusted retail sales increased 0.7% in March, missing expectations for a 2.2% gain, after a 5.5% rise in February. February's figure was revised up from a 5.4% increase.

Sales of non-food products decreased at an annual rate of 1.1% in March, while sales of food, beverages and tobacco products rose by 2.7%.

-

14:59

U.S. personal spending rises 0.1% in March

The U.S. Commerce Department released personal spending and income figures on Friday. Personal spending rose 0.1% in March, missing expectations for a 0.2% gain, after a 0.2% increase in February. February's figure was revised up from a 0.1% rise.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 1.9% in the first quarter, the slowest pace since the first quarter of 2015, after a 2.4% increase in the fourth quarter.

This data suggests that American consumers remained cautious.

The saving rate climbed 5.4% in March from 5.1% in February.

Personal income increased 0.4% in March, exceeding expectations for 0.3% rise, after a 0.1% gain in February. February's figure was revised down from a 0.2% increase.

Wages and salaries were up 0.7% in March.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in March, in line with forecasts, after a 0.2% gain in February. February's figure was revised up from a 0.1% gain.

On a yearly basis, the PCE price index excluding food and index fell to 1.6% in March from 1.7% in February.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

14:45

Canada's GDP falls 0.1% in February

Statistics Canada released GDP (gross domestic product) growth data on Friday. Canada's GDP growth fell 0.1% in February, in line with expectations, after a 0.6% increase in January.

The decrease was mainly driven by a drop in the output of goods-producing industries, which slid 0.6% in February.

The output of service-producing industries was flat in February.

The mining, quarrying, and oil and gas extraction sector fell 0.8% in February, manufacturing output decreased 0.8%, while the retail trade sector climbed 1.4%.

-

14:39

Canadian industrial product prices drop 0.6% in March

Statistics Canada released its industrial product and raw materials price indexes on Friday. The Industrial Product Price Index (IPPI) dropped 0.6% in March, missing expectations for a 0.1% rise, after a 1.0% decline in February. February's figure was revised up from a 1.1% fall.

The decrease was mainly driven by lower prices for motorized and recreational vehicles, which plunged 2.9% in March.

18 of the 21 commodity groups decreased, while 3 rose.

The Raw Materials Price Index (RMPI) climbed 4.5% in March, after a 0.7% increase in February. February's figure was revised up from a 2.6% drop.

The rise was driven by higher prices for crude energy products. Crude energy products jumped by 14.3% in March.

3 of the 6 commodity groups rose and 3 decreased.

-

14:31

U.S.: PCE price index ex food, energy, Y/Y, March 1.6%

-

14:31

U.S.: Personal spending , March 0.1% (forecast 0.2%)

-

14:31

U.S.: PCE price index ex food, energy, m/m, March 0.1% (forecast 0.1%)

-

14:30

U.S.: Personal Income, m/m, March 0.4% (forecast 0.3%)

-

14:30

Canada: Industrial Product Price Index, m/m, March -0.6% (forecast 0.1%)

-

14:30

Canada: GDP (m/m) , February -0.1% (forecast -0.1%)

-

14:30

Canada: Industrial Product Price Index, y/y, March -2.1%

-

14:14

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 New Zealand ANZ Business Confidence April 3.2 6.2

01:30 Australia Producer price index, q / q Quarter I 0.3% 0.2% -0.2%

01:30 Australia Producer price index, y/y Quarter I 1.9% 1.2%

01:30 Australia Private Sector Credit, m/m March 0.6% 0.6% 0.4%

01:30 Australia Private Sector Credit, y/y March 6.6% 6.4%

02:30 Australia RBA Assist Gov Debelle Speaks

06:00 Germany Retail sales, real adjusted March -0.4% 0.3% -1.1%

06:00 Germany Retail sales, real unadjusted, y/y March 5.5% Revised From 5.4% 2.2% 0.7%

07:00 Switzerland KOF Leading Indicator April 102.8 Revised From 102.5 102.8 102.7

08:00 Switzerland SNB Chairman Jordan Speaks

08:30 United Kingdom Mortgage Approvals March 73.19 Revised From 73.87 74.5 71.36

08:30 United Kingdom Consumer credit, mln March 1392 Revised From 1287 1300 1883

08:30 United Kingdom Net Lending to Individuals, bln March 4.9 9.3

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) April 1% 0.9% 0.8%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) April 0.0% -0.1% -0.2%

09:00 Eurozone Unemployment Rate March 10.4% Revised From 10.3% 10.3% 10.2%

12:00 United Kingdom BOE Deputy Governor for Financial Stability Jon Cunliffe speaks

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic later in the day. The personal consumer expenditures (PCE) price index excluding food and energy is expected to increase 0.1% in March, after a 0.1% rise in February.

Personal income in the U.S. is expected to rise 0.3% in March, after a 0.2% gain in February.

Personal spending in the U.S. is expected to gain 0.2% in March, after a 0.1% increase in February.

The Chicago purchasing managers' index is expected to decrease to 53.0 in April from 53.6 in March.

The euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone declined to -0.2% year-on-year in April from 0.0 % in March, missing expectations for a fall to -0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.8% in April from 1.0% in March. Analysts had expected the index to decrease to 0.9%.

Food, alcohol and tobacco prices were up 0.8% in April, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.0%, while energy prices dropped 8.6%.

Eurozone's preliminary flash gross domestic product (GDP) increased by 0.6% in the first quarter, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.6% in the first quarter, after a 1.6% gain in the fourth quarter

Eurozone's unemployment rate declined to 10.2% in March from 10.4% in February, beating expectations for a fall to 10.3%. It was the lowest reading since August 2011. February's figure was revised up from 10.3%. The lowest unemployment rate in the Eurozone in March was recorded in Germany (4.2%) and the highest in Greece (24.4% in January 2016) and Spain (20.4%).

The British pound traded lower against the U.S. dollar. The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Friday. The number of mortgages approvals in the U.K. was down to 71,357 in March from 73,195 in February, missing expectations for a decrease to 74,500. February's figure was revised down from 73,871.

Consumer credit in the U.K. rose by £1.883 billion in March, exceeding expectations for an £1.300 billion increase, after a £1.392 billion gain in February. February's figure was revised up from £1.287 billion.

Net lending to individuals in the U.K. increased by £9.3 billion in March, after a £5.0 billion gain in February. February's figure was revised up from a £4.9 rise.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian GDP data. Canada's GDP growth is expected to decline 0.1% in February, after a 0.6% gain in January.

The Industrial Product Price Index (IPPI) is expected to rise 0.1% in March, after a 1.1% drop in February.

The Swiss franc traded mixed against the U.S. dollar. The Swiss National Bank (SNB) Chairman Thomas Jordan said in a speech on Friday that inflation in Switzerland remained negative, driven by a stronger Swiss franc and a decline in oil prices. He added that inflation was expected to be positive in 2017.

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Friday. The KOF leading indicator fell to 102.7 in April from 102.8 in March. March's figure was revised up from 102.5. Analysts had expected the index to remain unchanged at 102.8. The decline was mainly driven by negative signals from the financial sector, the exporting industries and construction.

EUR/USD: the currency pair traded mixed

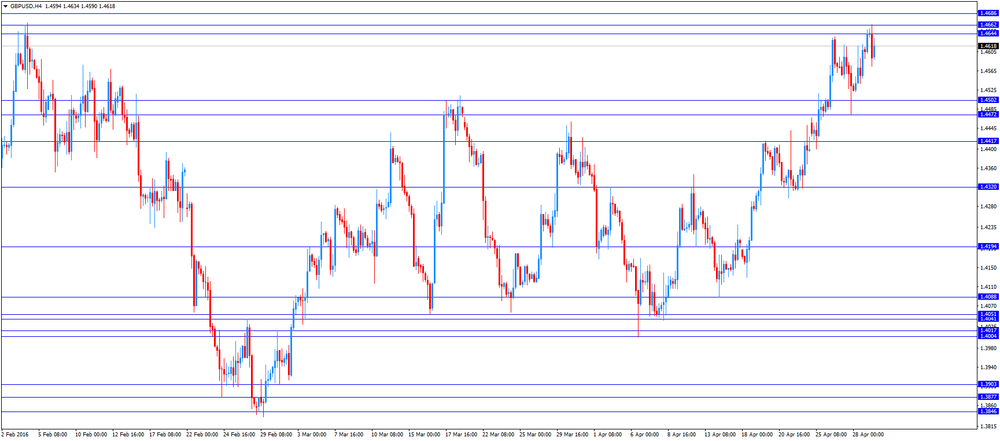

GBP/USD: the currency pair declined to $1.4575

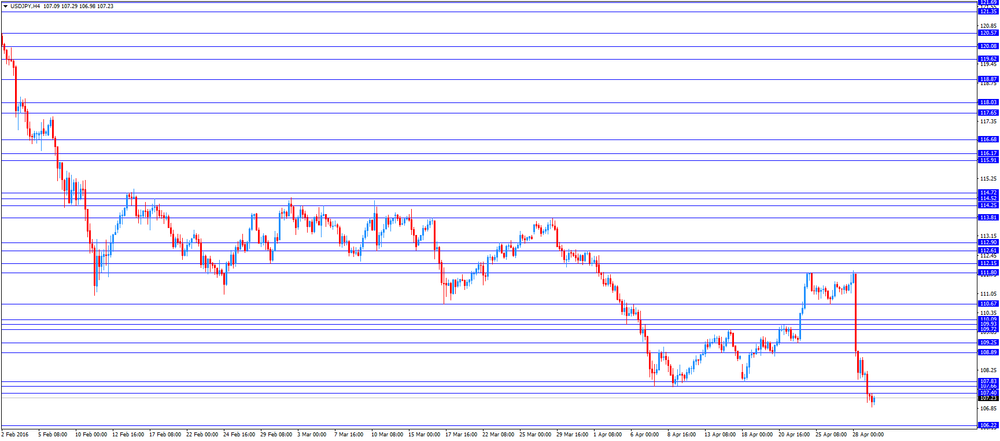

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada GDP (m/m) February 0.6% -0.1%

12:30 U.S. Personal Income, m/m March 0.2% 0.3%

12:30 U.S. Personal spending March 0.1% 0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y March 1.7%

12:30 U.S. PCE price index ex food, energy, m/m March 0.1% 0.1%

13:45 U.S. Chicago Purchasing Managers' Index April 53.6 53

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) April 91 90

-

13:59

Swiss National Bank Chairman Thomas Jordan: inflation in Switzerland remains negative

The Swiss National Bank (SNB) Chairman Thomas Jordan said in a speech on Friday that inflation in Switzerland remained negative, driven by a stronger Swiss franc and a decline in oil prices. He added that inflation was expected to be positive in 2017.

-

13:53

KOF leading indicator for Switzerland falls to 102.7 in April

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Friday. The KOF leading indicator fell to 102.7 in April from 102.8 in March. March's figure was revised up from 102.5.

Analysts had expected the index to remain unchanged at 102.8.

The decline was mainly driven by negative signals from the financial sector, the exporting industries and construction.

"The largely unchanged Barometer reading of just below 103 signals a continuation of the positive development of the Swiss economy in the coming months," the KOF said.

-

13:45

Orders

EUR/USD

Offers 1.1420/25 1.1440/50 1.1480 1.1500

Bids 1.1365/70 1.1350 1.1340 1.1315/20 1.1300/10 1.1280

GBP/USD

Offers 1.4620 1.4630 1.4650 1.4665/70 1.4680 1.4700 1.4715/20

Bids 1.4565/70 1.4540 1.4520/25 1.4500/10 1.4480 1.4460

EUR/JPY

Offers 122.30 122.50 122.75 123.00

Bids 121.80 121.65/70 121.50 121.20/25 121.00

EUR/GBP

Offers 0.7825-30 07850 0.7880-85 0.7900

Bids 0.7730- 35 0.7720 0.7700 0.7685 0.7650

USD/JPY

Offers 107.20 107.50 108.00

Bids 107.00 106.90 106.50 106.00

AUD/USD

Offers 0.7650/60 0.7670 0.7690 0.7700

Bids 0.7620 0.7600/10 0.7575/80 0.7550

-

12:28

Number of mortgages approvals in the U.K. declines to 71,357 in March

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Friday. The number of mortgages approvals in the U.K. was down to 71,357 in March from 73,195 in February, missing expectations for a decrease to 74,500. February's figure was revised down from 73,871.

Consumer credit in the U.K. rose by £1.883 billion in March, exceeding expectations for an £1.300 billion increase, after a £1.392 billion gain in February. February's figure was revised up from £1.287 billion.

Net lending to individuals in the U.K. increased by £9.3 billion in March, after a £5.0 billion gain in February. February's figure was revised up from a £4.9 rise.

-

12:23

Eurozone’s economy expands at 0.6% in the first quarter

Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary flash gross domestic product (GDP) increased by 0.6% in the first quarter, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.6% in the first quarter, after a 1.6% gain in the fourth quarter.

Eurostat released no details of the component breakdown of GDP.

The U.S. economy grew 0.5% in the first quarter, after a 1.4% growth in fourth quarter.

-

12:16

Eurozone's unemployment rate drops to 10.2% in March, the lowest reading since August 2011

Eurostat released its unemployment data for the Eurozone on Friday. Eurozone's unemployment rate declined to 10.2% in March from 10.4% in February, beating expectations for a fall to 10.3%. It was the lowest reading since August 2011.

February's figure was revised up from 10.3%.

There were 16.437 million unemployed in the Eurozone in March, down by 226.000 from January.

The lowest unemployment rate in the Eurozone in March was recorded in Germany (4.2%) and the highest in Greece (24.4% in January 2016) and Spain (20.4%).

The youth unemployment rate was 21.2% in the Eurozone in March, compared to 22.7% in March a year ago.

-

12:10

Preliminary consumer price inflation in the Eurozone declines to -0.2% year-on-year in April

Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone declined to -0.2% year-on-year in April from 0.0 % in March, missing expectations for a fall to -0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.8% in April from 1.0% in March. Analysts had expected the index to decrease to 0.9%.

Food, alcohol and tobacco prices were up 0.8% in April, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.0%, while energy prices dropped 8.6%.

-

11:00

Eurozone: Harmonized CPI, Y/Y, April -0.2% (forecast -0.1%)

-

11:00

Eurozone: Unemployment Rate , March 10.2% (forecast 10.3%)

-

11:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, April 0.8% (forecast 0.9%)

-

10:32

United Kingdom: Net Lending to Individuals, bln, March 9.3

-

10:30

United Kingdom: Consumer credit, mln, March 1883 (forecast 1300)

-

10:30

United Kingdom: Mortgage Approvals, March 71.36 (forecast 74.5)

-

10:25

French producer prices increase 0.3% in March

French statistical office INSEE released its producer price index (PPI) data on Friday. French producer prices increased 0.3% in March, after a 0.5% drop in February.

The increase was mainly driven a rise in prices for coke and refined petroleum products, which climbed 15.5% in March.

On a yearly basis, French PPI fell 4.0% in March.

The annual drop was driven by a decline in prices for coke and refined petroleum products, which slid 33.3 year-on-year in March.

Import prices rose 1.1% in March, after a 0.6% fall in February.

-

10:18

French consumer spending rises 0.2% in March

French statistical office INSEE released its consumer spending data on Friday. French consumer spending rose 0.2% in March, after a 0.5% gain in February. February's figure was revised down from a 0.6% increase.

The increase was mainly driven by a rise in expenditure on energy. Spending on energy climbed by 3.5% in March, while spending on food fell 0.6%.

On a yearly basis, consumer spending climbed 1.9% in March.

-

10:03

Producer prices in Australia decrease 0.2% in the first quarter

The Australian Bureau of Statistics released its producer prices data on Friday. Producer prices in Australia decreased 0.2% in the first quarter, missing expectations for a 0.2% rise, after a 0.3% gain in the fourth quarter.

The decrease was mainly driven by falls in prices for petroleum refining and petroleum fuel manufacturing, other agriculture and pharmaceutical and medicinal product manufacturing.

On a yearly basis, producer prices climbed 1.2% in the first quarter, after a 1.9% increase in the fourth quarter.

-

10:01

Option expiries for today's 10:00 ET NY cut

USD/JPY 107.50 (USD 625m) 109.00 (626m) 110.00 (1.15bln) 111.00 (745m) 112.00 (700m) 113.00 (1.09bln)

EUR/USD: 1.1275-80 (EUR 417m) 1.1300 (235m) 1.1315 (290m) 1.1325 (230m) 1.1330 (213m) 1.1340 (417m) 1.1365 (346m) 1.1500 (303m)

GBP/USD 1.4550 (GBP 220m)

AUD/USD 0.7700 (AUD 490m)

USD/CAD 1.2490-2500 (USD 332m) 1.2700 (300m) 1.2920 (295m0

NZD/USD 0.6920 (NZD 231m)

AUD/NZD 1.1000 (AUD 200m)

-

09:54

Private sector credit in Australia rises 0.4% in March

The Reserve Bank of Australia (RBA) released its private sector credit data on Friday. The total value of private sector credit in Australia rose 0.4% in March, missing expectations for a 0.6% gain, after a 0.6% increase in February.

Housing credit increased 0.5% in March, personal credit declined 0.3%, while business credit rose 0.3%.

On a yearly basis, the private sector credit in Australia jumped 6.4% in March, after a 6.6% rise in February.

-

09:32

GfK’s U.K. consumer confidence index drops to -3 in April

Gfk released its consumer confidence index for the U.K. on late Thursday evening. GfK's U.K. consumer confidence index fell to -3 in April from 0 in March, missing expectations for a decline to -1. It was the lowest level since December 2014.

All 5 measures fell in April.

"Mixed-messages about a post-Brexit world and the on-going Eurozone crisis are casting a cloud over our economy," Joe Staton, Head of Market Dynamics at GfK, said.

"Trends in confidence show our degree of optimism about the state of the economy and this indicator will make for interesting reading between now and the EU referendum on June 23rd," he added.

-

09:13

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 43.5 in in the week ended April 24

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy rose to 43.5 in in the week ended April 24 from 42.9 the prior week.

The increase was driven by rises in all sub-indexes. The measure of views of the economy was up to 33.5 from 33.4, the buying climate index rose to 40.0 from 39.6, while the personal finances index increased to 56.8 from 55.6.

-

09:00

Switzerland: KOF Leading Indicator, April 102.7 (forecast 102.8)

-

08:38

Options levels on friday, April 29, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1470 (2947)

$1.1435 (6002)

$1.1407 (3602)

Price at time of writing this review: $1.1385

Support levels (open interest**, contracts):

$1.1329 (2565)

$1.1276 (3531)

$1.1237 (4023)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 41793 contracts, with the maximum number of contracts with strike price $1,1400 (6002);

- Overall open interest on the PUT options with the expiration date May, 6 is 58607 contracts, with the maximum number of contracts with strike price $1,1000 (10026);

- The ratio of PUT/CALL was 1.40 versus 1.54 from the previous trading day according to data from April, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.4901 (340)

$1.4802 (994)

$1.4704 (1216)

Price at time of writing this review: $1.4643

Support levels (open interest**, contracts):

$1.4592 (241)

$1.4496 (870)

$1.4398 (1463)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 25332 contracts, with the maximum number of contracts with strike price $1,4500 (2152);

- Overall open interest on the PUT options with the expiration date May, 6 is 33993 contracts, with the maximum number of contracts with strike price $1,3850 (4025);

- The ratio of PUT/CALL was 1.34 versus 1.31 from the previous trading day according to data from April, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:23

Asian session: The dollar pared losses against the yen

The U.S. dollar and euro were on track to post their biggest daily losses against the yen in more than five years on Thursday in the wake of the Bank of Japan's surprise decision not to further ease monetary policy.

The BOJ decided to hold monetary policy steady on Thursday in the face of soft global demand and a sharp rise in the yen, defying expectations for increased stimulus measures to fight deflation.

The dollar pared losses against the yen on stronger-than expected U.S. first-quarter consumer spending and core inflation, but later retraced losses.

EUR/USD: during the Asian session the pair rose to $1.1385

GBP/USD: during the Asian session the pair rose to $1.4655

USD/JPY: during the Asian session the pair fell to Y107.05

Based on Reuters materials

-

08:01

Germany: Retail sales, real unadjusted, y/y, March 0.7% (forecast 2.2%)

-

08:00

Germany: Retail sales, real adjusted , March -1.1% (forecast 0.3%)

-

03:32

Australia: Private Sector Credit, y/y, March 6.4%

-

03:32

Australia: Producer price index, q / q, Quarter I -0.2% (forecast 0.2%)

-

03:32

Australia: Producer price index, y/y, Quarter I 1.2%

-

03:31

Australia: Private Sector Credit, m/m, March 0.4% (forecast 0.6%)

-

03:01

New Zealand: ANZ Business Confidence, April 6.2

-

01:06

United Kingdom: Gfk Consumer Confidence, April -3 (forecast -1)

-

00:45

New Zealand: Building Permits, m/m, March -9.8%

-

00:33

Currencies. Daily history for Apr 28’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1352 +0,25%

GBP/USD $1,4606 +0,50%

USD/CHF Chf0,9664 -0,50%

USD/JPY Y108,12 -3,08%

EUR/JPY Y122,74 -2,83%

GBP/JPY Y157,93 -2,55%

AUD/USD $0,7629 +0,46%

NZD/USD $0,6960 +0,69%

USD/CAD C$1,256 -0,25%

-

00:02

Schedule for today,Friday, Apr 29’2016:

(time / country / index / period / previous value / forecast)

01:00 New Zealand ANZ Business Confidence April 3.2

01:30 Australia Producer price index, q / q Quarter I 0.3%

01:30 Australia Producer price index, y/y Quarter I 1.9%

01:30 Australia Private Sector Credit, m/m March 0.6% 0.6%

01:30 Australia Private Sector Credit, y/y March 6.6%

02:30 Australia RBA Assist Gov Debelle Speaks

06:00 Germany Retail sales, real adjusted March -0.4% 0.3%

06:00 Germany Retail sales, real unadjusted, y/y March 5.4% 2.2%

07:00 Switzerland KOF Leading Indicator April 102.5 102.8

08:00 Switzerland SNB Chairman Jordan Speaks

08:30 United Kingdom Mortgage Approvals March 73.87 74.5

08:30 United Kingdom Consumer credit, mln March 1287 1300

08:30 United Kingdom Net Lending to Individuals, bln March 4.9

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) April 1% 0.9%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) April 0.0% -0.1%

09:00 Eurozone Unemployment Rate March 10.3% 10.3%

12:00 United Kingdom BOE Deputy Governor for Financial Stability Jon Cunliffe speaks

12:30 Canada Industrial Product Price Index, m/m March -1.1% 0.1%

12:30 Canada Industrial Product Price Index, y/y March -1.4%

12:30 Canada GDP (m/m) February 0.6% -0.1%

12:30 U.S. Personal Income, m/m March 0.2% 0.3%

12:30 U.S. Personal spending March 0.1% 0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y March 1.7%

12:30 U.S. PCE price index ex food, energy, m/m March 0.1% 0.1%

13:45 U.S. Chicago Purchasing Managers' Index April 53.6 53

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) April 91 90

-