Noticias del mercado

-

21:00

DJIA 18036.34 46.02 0.26%, NASDAQ 4847.56 -40.72 -0.83%, S&P 500 2092.82 1.12 0.05%

-

18:29

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed on Wednesday, ahead of a policy decision by the U.S. Federal Reserve, after Apple's first revenue decline in over a decade aroused worries about the health of corporate earnings. Apple's (AAPL) shares were down 6% and were set for their biggest one-day fall in more than two years. Investors are also awaiting a Fed decision on rates. No change in rates is expected but the Fed may signal its intention to tighten policy this year.

Most of Dow stocks in positive area (22 of 30). Top looser - Apple Inc. (AAPL, -6,14%). Top gainer - The Boeing Company (BA, +1,85%).

S&P sectors mixed. Top looser - Consumer goods (-0,9%). Top gainer - Utilities (+0,9%).

At the moment:

Dow 17927.00 +8.00 +0.04%

S&P 500 2082.75 -5.75 -0.28%

Nasdaq 100 4393.50 -59.00 -1.33%

Oil 44.40 +0.36 +0.82%

Gold 1251.40 +8.00 +0.64%

U.S. 10yr 1.90 -0.04

-

18:01

European stocks close: stocks traded higher ahead of the Fed's interest rate decision

Stock indices traded mixed ahead the release of the Fed's interest rate decision later in the day. Analysts expect the Fed to keep it monetary policy unchanged.

Market participants also eyed the economic data from the Eurozone. The European Central Bank (ECB) released its M3 money supply figures on Wednesday. M3 money supply rose 5.0% in March from last year, in line with expectations, after a 4.9 % increase in February. February's figure was revised down from a 5.0% rise.

Loans to the private sector in the Eurozone climbed 1.6% in March from the last year, missing expectations for a 1.7% rise, after a 1.6% gain in February.

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index climbed to 9.7 in May from 9.4 in April. Analysts had expected the index to remain unchanged at 9.4.

"Consumers are clearly assuming that the German economy will regain some momentum in the coming months," Gfk noted.

ECB Executive Board member Benoit Coeure said in an interview with the Italian newspaper Il Sole 24 Ore Wednesday that the central bank's stimulus measures were working. Coeure pointed out that the ECB did not discuss helicopter money and further stimulus measures. He also said that a sharp appreciation in the euro would be a problem for the central bank.

The Office for National Statistics released its U.K. GDP data on Wednesday. The preliminary U.K. gross domestic product (GDP) climbed 0.4% in the first quarter, in line with expectations, after a 0.6% rise in the third quarter.

The growth was mainly driven by a strong output in the services sector, which climbed 0.6% in the first quarter.

Construction fell 0.9% in the first quarter, production declined 0.4%, while agriculture decreased 0.1%.

On a yearly basis, the preliminary U.K. GDP increased 2.1% in the first quarter, beating forecasts of a 2.0% rise, after a 2.1% gain in the fourth quarter.

The Confederation of British Industry (CBI) released its retail sales balance data on Wednesday. The CBI retail sales balance plunged to -13% in April from +7% in March, missing expectations for a rise to +12%. It was the fastest pace since January 2012.

The decline was driven by drops in department stores and the clothing sales.

Sales are expected to rebound next month, while orders are expected to fall.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,319.91 +35.39 +0.56 %

DAX 10,299.83 +40.24 +0.39 %

CAC 40 4,559.4 +26.22 +0.58 %

-

18:00

European stocks closed: FTSE 6319.91 35.39 0.56%, DAX 10299.83 40.24 0.39%, CAC 40 4559.40 26.22 0.58%

-

17:54

The Bank of England Governor Mark Carney: Britain’s exit from the European Union (EU) could lead to a higher inflation and a lower economic growth

The Bank of England (BoE) Governor Mark Carney said in a letter to Andrew Tyrie, the Treasury Select Committee (TSC) chairman, on Wednesday that Britain's exit from the European Union (EU) could lead to a higher inflation and a lower economic growth.

"There are plausible scenarios where the combined effects of the exchange rate move and its drivers on aggregate demand, aggregate supply and exchange rate pass through lead to a lower path for growth and a higher path for inflation," he said.

"Firms can ultimately be expected to pass through higher costs to consumers, resulting in higher prices," Carney added.

The BoE governor noted that the depreciation of the pound could lead to higher consumer price inflation.

"A persistent 10% depreciation (or appreciation) of the sterling effective exchange rate (ERI) increases (or decreases) annual consumer price inflation by around 0.75% over the baseline path after two to three years, and the price level by around 2.75% over four years.

-

17:38

WSE: Session Results

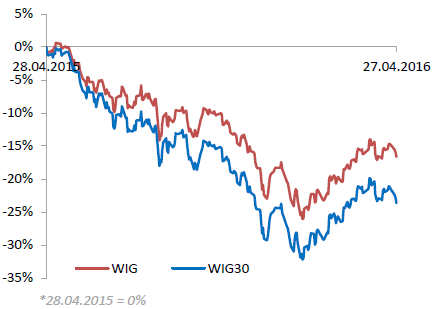

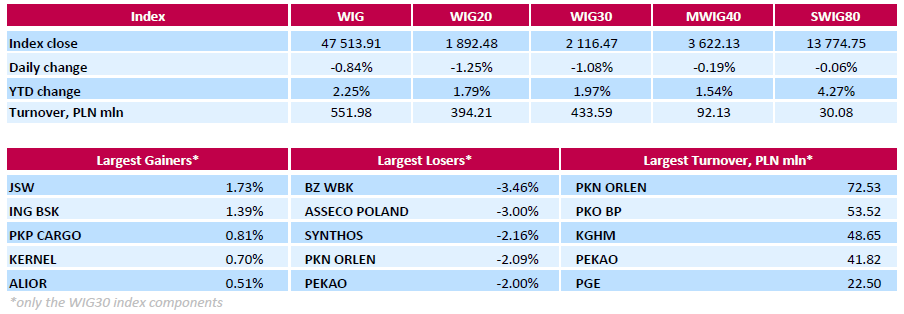

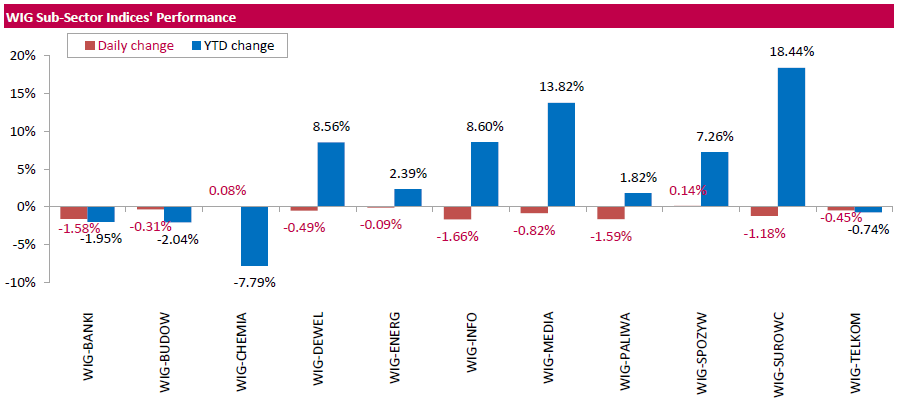

Polish equity market closed lower on Wednesday. The broad market benchmark, the WIG Index, lost 0.84%. Except for food sector (+0.14%) and chemicals (+0.08%), every sector in the WIG Index declined, with informational technology sector (-1.66%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, fell by 1.08%. Within the WIG30 Index components, BZ WBK (WSE: BZW) was hit the hardest, down 3.46%, after the bank reported a 46% y/y decline in its Q1 net profit to PLN 556 mln, but above analysts' expectations of PLN 506 mln. Other biggest laggards included IT-company ASSECO POLAND (WSE: ACP), chemical producer SYNTHOS (WSE: SNS) and oil refiner PKN ORLEN (WSE: PKN), plunging by 3%, 2.16% and 2.09% respectively.

On the other side of the ledger, coking coal producer JSW (WSE: JSW) jumped by 1.73%, partially paring yesterday's losses. It was followed by bank ING BSK (WSE: ING), railway freight transport operator PKP CARGO (WSE: PKP) and agricultural producer KERNEL (WSE: KER), advancing 1.39%, 0.81% and 0.7% respectively.

-

17:20

OECD: Britain’s exit from the European Union (‘Brexit’) would be like a tax for Britain

The Organisation for Economic Co-operation and Development (OECD) said on Wednesday that Britain's exit from the European Union ('Brexit') would be like a tax for Britain.

"Leaving Europe would impose a Brexit tax on generations to come. Instead of funding public services, this tax would be a pure deadweight loss, with no economic benefit," OECD Secretary-General Angel Gurría said.

The referendum on Britain's membership in the European Union (EU) will take place on June 23.

Brexit could cost households £3,200 per year by 2030, the OECD said.

According to the OECD, the U.K. GDP would be more than 3% by 2020 and more than 5% lower by 2030 if Britain leaves the EU.

-

16:17

U.S. pending home sales increases 1.4% in March

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Wednesday. Pending home sales in the U.S. increased 1.4% in March, exceeding expectations for a 0.5% gain, after a 3.4% rise in February. February's figure was revised down from a 3.5% gain.

The increase was mainly lead by rises in almost all regions. Only pending home sales in the West region declined in March.

"Despite supply deficiencies in plenty of areas, contract activity was fairly strong in a majority of markets in March," the NAR's chief economist Lawrence Yun said.

"This spring's surprisingly low mortgage rates are easing some of the affordability pressures potential buyers are experiencing and are taking away some of the sting from home prices that are still rising too fast and above wage growth," he added.

-

16:00

Spaniards have to elect new parliament

Spain's King Felipe VI said on Tuesday evening that he would give up the search for a new prime minister. That means new parliament elections on June 26.

The parties were unable to form a new government since December.

-

15:42

Profits of industrial companies in China jump 11.1% in March from a year earlier

China's National Bureau of Statistics (NBS) said on Wednesday that profits of industrial companies in China jumped 11.1% in March from a year earlier.

For the first quarter of 2016, industrial profits climbed 7.4% from a year earlier.

NBS official He Ping said in a statement that the rise profits of industrial companies in March was partly driven by an improving economy. He added that it was not a balanced and stable recovery.

-

15:37

WSE: After start on Wall Street

10 minutes before opening of Wall Street, futures on the S&P 500 and the Nasdaq indices heralded downward pressure for the first phase of trade. For both indices, as well as for the DJIA, considerable influence is exercised by Apple, following their weaker than expected quarterly results (a drop in phone sales and a decline in revenues by 16 and 13 percent y/y).

In the case of the DJIA, a counterweight can be fuel companies, which until the end of the week will announce quarterly results, but today will likely respond to the crude prices increase to over $ 45 / barrel.

U.S. Stocks open: Dow -0.20%, Nasdaq -0.59%, S&P -0.15%

-

15:32

Japan’s all industry activity index slides 1.2% in February

Japan's Ministry of Economy, Trade and Industry (METI) released its all industry activity index on Wednesday. The index slid 1.2% in February, beating expectations for a 1.3% drop, after a 1.2% rise in January. January's figure was revised down from a 2.0% increase.

Construction industry activity index fell 0.2% in February, industrial production index dropped 5.2%, while tertiary industry activity decreased 0.1%.

-

15:32

U.S. Stocks open: Dow -0.20%, Nasdaq -0.59%, S&P -0.15%

-

15:19

Before the bell: S&P futures -0.28%, NASDAQ futures -1.07%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 17,290.49 -62.79 -0.36%

Hang Seng 21,361.6 -45.67 -0.21%

Shanghai Composite 2,954.01 -10.69 -0.36%

FTSE 6,291.89 +7.37 +0.12%

CAC 4,550.01 +16.83 +0.37%

DAX 10,300.64 +41.05 +0.40%

Crude $45.01 (+2.20%)

Gold $1250.50 (+0.57%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.81

0.15(1.4071%)

135396

Amazon.com Inc., NASDAQ

AMZN

612

-4.88(-0.7911%)

7017

AMERICAN INTERNATIONAL GROUP

AIG

56.53

-0.02(-0.0354%)

1004

Apple Inc.

AAPL

96.03

-8.32(-7.9732%)

3419991

AT&T Inc

T

37.75

-0.34(-0.8926%)

14207

Barrick Gold Corporation, NYSE

ABX

16.66

0.18(1.0922%)

47933

Boeing Co

BA

132.5

-0.74(-0.5554%)

36630

Caterpillar Inc

CAT

77.5

-0.15(-0.1932%)

2785

Chevron Corp

CVX

102.72

0.43(0.4204%)

1988

Cisco Systems Inc

CSCO

28.38

-0.07(-0.246%)

4100

Citigroup Inc., NYSE

C

47

-0.10(-0.2123%)

14668

Exxon Mobil Corp

XOM

87.89

0.26(0.2967%)

11031

Facebook, Inc.

FB

107.97

-0.79(-0.7264%)

175612

Ford Motor Co.

F

13.64

0.04(0.2941%)

23531

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.65

0.17(1.4808%)

275914

General Electric Co

GE

30.9

-0.00(-0.00%)

2593

Goldman Sachs

GS

165.52

-0.32(-0.193%)

2250

Google Inc.

GOOG

705.5

-2.64(-0.3728%)

1677

Intel Corp

INTC

31.27

-0.13(-0.414%)

8755

International Paper Company

IP

43.85

0.48(1.1068%)

4085

JPMorgan Chase and Co

JPM

63.82

-0.11(-0.1721%)

5502

McDonald's Corp

MCD

127.71

-0.00(-0.00%)

436

Microsoft Corp

MSFT

51.35

-0.09(-0.175%)

16037

Nike

NKE

59.63

0.09(0.1512%)

2369

Pfizer Inc

PFE

33.06

0.01(0.0303%)

7365

Procter & Gamble Co

PG

79.5

-0.05(-0.0629%)

200

Starbucks Corporation, NASDAQ

SBUX

57.5

-0.22(-0.3812%)

1817

Tesla Motors, Inc., NASDAQ

TSLA

252.54

-1.20(-0.4729%)

11236

The Coca-Cola Co

KO

44.5

-0.03(-0.0674%)

259

Twitter, Inc., NYSE

TWTR

15.18

-2.57(-14.4789%)

3231699

United Technologies Corp

UTX

106.4

1.60(1.5267%)

3130

Verizon Communications Inc

VZ

50.3

-0.14(-0.2776%)

400

Visa

V

78.25

-0.28(-0.3566%)

1311

Walt Disney Co

DIS

104.74

-0.15(-0.143%)

5288

Yahoo! Inc., NASDAQ

YHOO

36.96

-0.15(-0.4042%)

10812

-

14:52

New Zealand’s trade surplus narrows to NZ$117 million in March

Statistics New Zealand released its trade data on late Tuesday evening. New Zealand's trade surplus narrowed to NZ$117 million in March from NZ$367 million in February. February's figure was revised up from a surplus of NZ$339 million.

Analysts had expected the surplus to rise to NZ$405 million.

Exports dropped 14.0% year-on-year in March, mainly driven by milk powder, while imports decreased by 3.7%.

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Twitter (TWTR) downgraded to Underperform from Neutral at BofA/Merrill; target $15

Twitter (TWTR) downgraded to Neutral from Overweight at JP Morgan; target lowered to $18 from $26

Apple (AAPL) downgraded to Perform from Outperform at Oppenheimer

DuPont (DD) downgraded to Underperform from Outperform at Credit Agricole

Travelers (TRV) downgraded to Hold from Buy at Argus

Other:

Apple (AAPL) target lowered to $153 from $172 at Piper Jaffray

Apple (AAPL) target lowered to $136 from $155 at Goldman

Apple (AAPL) target lowered to $125 from $135 at Cowen

Apple (AAPL) target lowered to $117 from $130 at BMO Capital

Apple (AAPL) target lowered to 120 from $130 at RBC Capital

Apple (AAPL) target lowered to $157 from $162 at Maxim

Apple (AAPL) target lowered to $112 from $117 at Macquarie

Twitter (TWTR) target lowered to $27 from $39 at Pivotal Research Group

Twitter (TWTR) target lowered to $20 from $23 at RBC Capital

-

14:16

CBI retail sales balance declines to -13% in April

The Confederation of British Industry (CBI) released its retail sales balance data on Wednesday. The CBI retail sales balance plunged to -13% in April from +7% in March, missing expectations for a rise to +12%. It was the fastest pace since January 2012.

The decline was driven by drops in department stores and the clothing sales.

Sales are expected to rebound next month, while orders are expected to fall.

"Cold weather put a chill in sales of spring and summer ranges with a reported dip in retail sales in the year to April, but with the near-term outlook for household spending holding up the sector expects a modest rise in sales next month," CBI Director of Economics, Rain Newton-Smith, said.

-

13:50

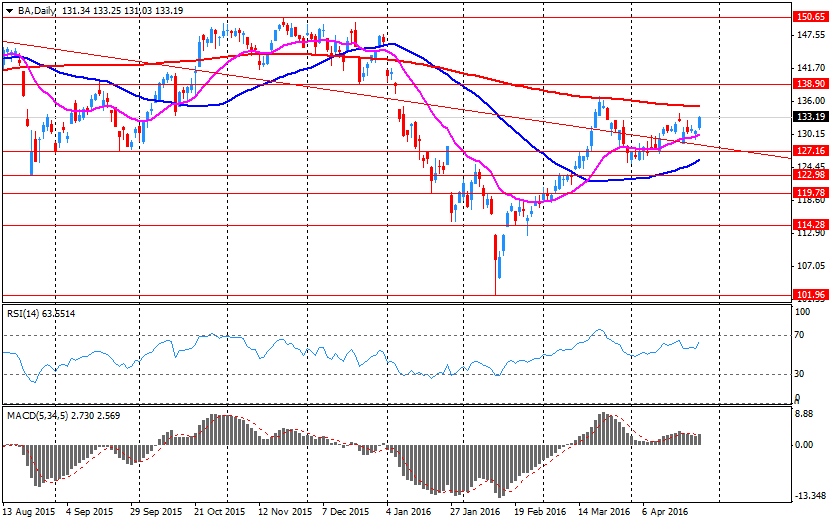

Company News: Boeing (BA) Q1 earnings miss analysts’ forecasts

Boeing reported Q1 FY 2016 earnings of $1.74 per share (versus $1.97 in Q1 FY 2015), missing analysts' consensus of $1.84.

The company's quarterly revenues amounted to $22.632 bln (+2.2% y/y), beating consensus estimate of $21.497 bln.

Boeing reaffirmed guidance for FY 2016, projecting EPS of $8.15-8.35 (versus analysts' consensus of $8.49) and revenues of $93-95 bln (versus analysts' consensus of $93.9 bln).

BA fell to $130.90 (-1.76%) in pre-market trading.

-

13:36

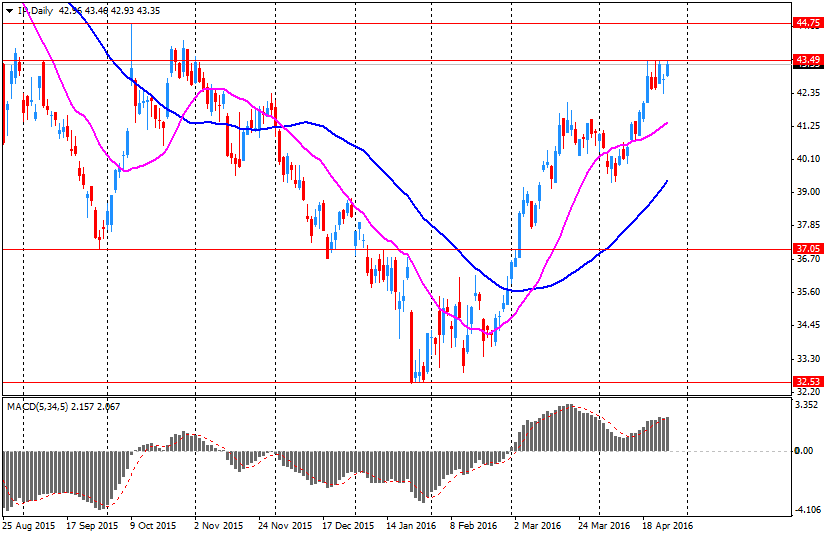

Company News: International Paper Co. (IP) Q1 earnings beat analysts’ expectations

International Paper Co. reported Q1 FY 2016 earnings of $0.80 per share (versus $0.84 in Q1 FY 2015), beating analysts' consensus of $0.69.

The company's quarterly revenues amounted to $5.110 bln (-7.4% y/y), missing consensus estimate of $5.201 bln.

IP closed yesterday's trading session at $43.37 (+1.21%).

-

13:28

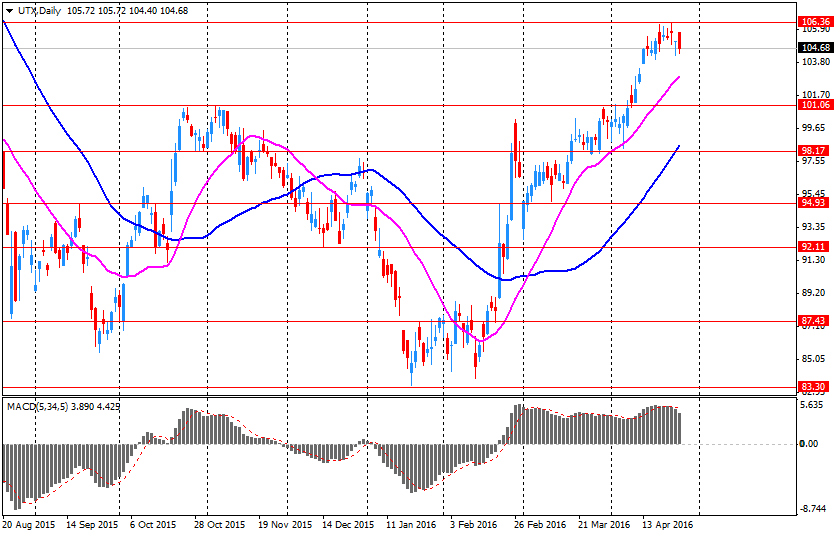

Company News: United Technologies Corp. (UTX) quarterly results beat analysts’ forecasts

United Technologies Corp. reported Q1 FY 2016 earnings of $1.47 per share (versus $1.51 in Q1 FY 2015), beating analysts' consensus of $1.40.

The company's quarterly revenues amounted to $13.357 bln (+0.3% y/y), beating consensus estimate of $13.186 bln.

United Technologies Corp. reaffirmed guidance for FY 2016, projecting EPS of $6.30-6.60 (versus analysts' consensus estimate of $6.50) and revenues of $56-58 bln (versus analysts' consensus estimate of $57.01 bln).

UTX closed yesterday's trading session at $104.80 (-0.38%).

-

13:07

WSE: Mid session comment

In the first half of today's session, the WIG20 index went down to yet new lows, which was contributed by further restatement of PKO BP. This suggests transition to a more unfavorable scenario for the bullish participants. The Warsaw market dipped below yesterday's low, further prompting that the support in the area of 1,900 points may be challenged. If we add to this the weakening of the PLN that reduced the magnitude of possible corrections after the substantial declines in recent days, the situation is even less welcoming to the bulls.

The level of 1900 points on the WIG20 was breached exactly in the middle of the session and at the halfway point of today's trading, the WIG20 index was at 1,899 points (-0.87%) and with turnover at PLN 125 mln.

-

12:09

European stock markets mid session: stocks traded mixed ahead of the Fed's interest rate decision

Stock indices traded mixed ahead the release of the Fed's interest rate decision later in the day. Analysts expect the Fed to keep it monetary policy unchanged.

Market participants also eyed the economic data from the Eurozone. The European Central Bank (ECB) released its M3 money supply figures on Wednesday. M3 money supply rose 5.0% in March from last year, in line with expectations, after a 4.9 % increase in February. February's figure was revised down from a 5.0% rise.

Loans to the private sector in the Eurozone climbed 1.6% in March from the last year, missing expectations for a 1.7% rise, after a 1.6% gain in February.

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index climbed to 9.7 in May from 9.4 in April. Analysts had expected the index to remain unchanged at 9.4.

"Consumers are clearly assuming that the German economy will regain some momentum in the coming months," Gfk noted.

ECB Executive Board member Benoit Coeure said in an interview with the Italian newspaper Il Sole 24 Ore Wednesday that the central bank's stimulus measures were working. Coeure pointed out that the ECB did not discuss helicopter money and further stimulus measures. He also said that a sharp appreciation in the euro would be a problem for the central bank.

The Office for National Statistics released its U.K. GDP data on Wednesday. The preliminary U.K. gross domestic product (GDP) climbed 0.4% in the first quarter, in line with expectations, after a 0.6% rise in the third quarter.

The growth was mainly driven by a strong output in the services sector, which climbed 0.6% in the first quarter.

Construction fell 0.9% in the first quarter, production declined 0.4%, while agriculture decreased 0.1%.

On a yearly basis, the preliminary U.K. GDP increased 2.1% in the first quarter, beating forecasts of a 2.0% rise, after a 2.1% gain in the fourth quarter.

Current figures:

Name Price Change Change %

FTSE 100 6,276.68 -7.84 -0.12 %

DAX 10,282.39 +22.80 +0.22 %

CAC 40 4,539.93 +6.75 +0.15 %

-

12:04

European Central Bank Executive Board member Benoit Coeure: the central bank’s stimulus measures are working, a sharp appreciation in the euro would be a problem

European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview with the Italian newspaper Il Sole 24 Ore Wednesday that the central bank's stimulus measures were working.

"Our monetary policy is working: credit is improving significantly, both in the volume and cost of loans, and economic activity is recovering. Not strongly enough, but it is steadily increasing," he said.

Coeure pointed out that the ECB did not discuss helicopter money and further stimulus measures.

He also said that a sharp appreciation in the euro would be a problem for the central bank.

"The euro has stabilised over the last month after a clear depreciation. It is not an obstacle to our monetary policy. Only if there was a sharp appreciation of the euro would that be a concern," Coeure noted.

-

11:51

German import prices are up 0.2% in March

Destatis released its import prices data for Germany on Wednesday. German import prices declined by 5.9% in March from last year, after a 5.7% fall in February. It was the biggest drop since October 2009.

The decline was driven by a drop in energy prices, which plunged 29.8% year-on-year in March.

Import prices decline since January 2013.

On a monthly base, import prices increased 0.7% in March, after a 0.6% fall in February.

On a yearly base, import prices excluding crude oil and mineral oil products fell by 3.6% in March.

Export prices dropped 1.6% year-on-year in March, after a 1.2% decrease in February.

On a monthly base, export prices were up 0.2% in March, after a 0.5% fall in February.

-

11:46

German Gfk consumer confidence index climbs to 9.7 in May

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index climbed to 9.7 in May from 9.4 in April. Analysts had expected the index to remain unchanged at 9.4.

The economic expectations index increased by 5.8 points to 6.3 points in April, while the willingness to buy index rose by 5.4 points to 55.4.

The income expectations index were up by 7.0 points to 57.5 in April.

"Consumers are clearly assuming that the German economy will regain some momentum in the coming months," Gfk noted.

-

11:40

Retail sales in Spain rise at a seasonally adjusted rate of 0.5% in March

The Spanish statistical office INE released its retail sales data on Wednesday. Retail sales in Spain rose at a seasonally adjusted rate of 0.5% in March, after a flat reading in February. February's reading was revised down from a 0.2% rise.

Food sales were down 1.0% in March, while non-food sales increased by 0.9%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 4.4% in March, after a 4.1% rise in February. February's figure was revised up from a 3.9% gain.

Sales of non-food products jumped 5.1% in March from a year ago, while food sales rose 1.4%.

-

11:32

Italian consumer confidence index decreases to 114.2 in April

The Italian statistical office Istat released its consumer confidence index for Italy on Wednesday. The Italian consumer confidence index decreased to 114.2 in April from 114.9 in March. March's figure was revised down from 115.0.

The decrease was driven by declines in all components.

The business confidence index rose to 102.7 in April from 102.2 in March.

The rise was driven by an increase in production expectations.

-

11:26

UBS consumption index rises to 1.51 in March

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.51 in March from 1.45 in February. February's figure was revised down from 1.53.

The increase was driven by improved retailer sentiment and the tourism sector.

Demand for automobiles fell slightly in March.

-

11:21

French consumer confidence index remains unchanged at 94 in April

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index remained unchanged at 94 in April. Analysts had expected the index to rise to 95.

The index of the outlook on consumers' saving capacity rose to -9 in April from -10 in March.

The index of households' assessment of their financial situation in the past twelve months remained unchanged at -25 in April.

The index of the outlook on consumers' financial situation for next twelve months decreased to -14 in April from -13 in March.

The index of the outlook on unemployment rising in coming months climbed to 49 in April from 43 in March.

The index for future inflation expectations remained unchanged at -36 in April.

-

11:02

M3 money supply in the Eurozone rises 5.0% in March from last year

The European Central Bank (ECB) released its M3 money supply figures on Wednesday. M3 money supply rose 5.0% in March from last year, in line with expectations, after a 4.9 % increase in February. February's figure was revised down from a 5.0% rise.

Loans to the private sector in the Eurozone climbed 1.6% in March from the last year, missing expectations for a 1.7% rise, after a 1.6% gain in February.

Total credit to euro area residents decreased to 3.1% year-on-year in March from 3.2% in February.

Loans to non-financial corporations rose to 1.1% year-on-year in March from 1.0% in February.

-

10:55

U.K. gross domestic product (GDP) climbs 0.4% in the first quarter

The Office for National Statistics released its U.K. GDP data on Wednesday. The preliminary U.K. gross domestic product (GDP) climbed 0.4% in the first quarter, in line with expectations, after a 0.6% rise in the third quarter.

The growth was mainly driven by a strong output in the services sector, which climbed 0.6% in the first quarter.

Construction fell 0.9% in the first quarter, production declined 0.4%, while agriculture decreased 0.1%.

On a yearly basis, the preliminary U.K. GDP increased 2.1% in the first quarter, beating forecasts of a 2.0% rise, after a 2.1% gain in the fourth quarter.

-

10:23

Consumer prices in Australia fall 0.2% in the first quarter

The Australian Bureau of Statistics released its consumer inflation data on Wednesday. The consumer price inflation in Australia fell 0.2% in the first quarter, missing expectations for a 0.3% gain, after a 0.4% increase in the fourth quarter.

The quarterly inflation was mainly driven by lower prices for clothing and footwear and transport.

On a yearly basis, Australia's consumer price inflation slid to 1.3% in the first quarter from 1.7% in the fourth quarter, missing expectations for an increase to 1.8%.

The annual inflation was mainly driven by higher prices for alcohol and tobacco, education and health care.

The trimmed mean consumer price index (CPI) (the Reserve Bank of Australia's (RBA) main indicator of inflation) dropped to 1.7% year-on-year in the first quarter from 2.1% in the fourth quarter, missing expectations for a fall to 2.0%.

-

10:09

Number of unemployed people in France declines 1.7% in March

The French Labour Ministry released its labour market data on Tuesday. The number of unemployed people in France fell by 1.7% or by 60,000 in March compared with the previous month.

The total number of unemployed people was 3,531,000 in March, up 0.5% from a year ago.

The French government is struggling to bring down unemployment despite a rise in economic growth.

-

09:10

WSE: After opening

The WIG20 futures (WSE: FW20M16) took off neutral, with only one point loss compared to yesterday's close. Similarly behave morning futures on major indexes in Euroland, which clearly indicates a state of the markets waiting for today's evening message after the 2-day meeting of the Fed, which tone will be crucial for the preservation of the markets in the coming weeks.

The WIG20 index opened at 1913.09 points (-0.17%)

The first transactions on the spot market traditionally bring a decline of the WIG20 as the negation of pulled out the final fixing of the previous session. On a start of the day we are going to the area of yesterday's lows, but for now these are a barrier on the way to the level of 1900 points. This is already visible even after the contracts that try to escape upwards above the level from opening of the session.

-

08:29

WSE: Before opening

Tuesday's session on Wall Street had modest changes in the major indexes. In the case of the S&P500 index the growth was amounted by 0.1 percent. After the session, the Apple Company released its results, far worse than expected. The company's shares in after-session quotations lost about 8 percent .Therefore it is expected that such a large fall in prices for the major in indexes company will be reflected in the market.

This morning for the WSE and European exchanges will mainly be an adaptation of the region to the expected decline on Wall Street, but soon we should see a stabilization and waiting for the next turn in the USA. Investors will also seek clues on the currency market. In other words, the day in Europe will be dominated by peering toward other markets and the WSE should not be an exception.

-

06:08

Global Stocks

European stock markets rose for the first time in four sessions on Tuesday, aided by a round of well-received earnings reports, including results from oil giant BP PLC and telecom company Orange SA.

U.S. stocks closed mixed Tuesday as caution prevailed ahead of a barrage of tech earnings and an updated policy statement from the Federal Reserve. Tech stocks, many of them so-called momentum names which posted double-digit gains last year, have largely lagged behind the broader market this year, said Kent Engelke, chief economic strategist at Capitol Securities Management Inc.

Asian stocks were subdued on Wednesday, as investors stayed cautious ahead of U.S. and Japanese central bank policy decisions, while crude oil prices hovered near 2016 highs. Japan's Nikkei lost 0.6 percent as Japan-based suppliers of iPhone parts fell after Apple Inc reported its first-ever decline in iPhone sales and its first revenue drop in over a decade overnight.

Based on MarketWatch materials

-

03:56

Nikkei 225 17,270.6 -82.68 -0.48 %, Hang Seng 21,289.66 -117.61 -0.55 %, Shanghai Composite 2,964.68 -0.02%

-

01:01

Stocks. Daily history for Sep Apr 26’2016:

(index / closing price / change items /% change)

Nikkei 225 17,353.28 -86.02 -0.49 %

Hang Seng 21,407.27 +102.83 +0.48 %

Shanghai Composite 2,965.4 +18.73 +0.64 %

FTSE 100 6,284.52 +23.60 +0.38 %

CAC 40 4,533.18 -12.94 -0.28 %

Xetra DAX 10,259.59 -34.76 -0.34 %

FTSE 100 6,284.52 +23.60 +0.38 %

CAC 40 4,533.18 -12.94 -0.28 %

Xetra DAX 10,259.59 -34.76 -0.34 %

-