Noticias del mercado

-

21:00

Dow +1.82% 16,362.27 +292.63 Nasdaq +1.56% 4,577.07 +70.39 S&P +1.78% 1,927.08 +33.72

-

18:59

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Friday after weak GDP data raised expectations that the U.S. Federal Reserve would go slow on future interest rate hikes. U.S. gross domestic product rose 0,7% in the fourth quarter, below the 0,8% expected, as a strong dollar and tepid global demand hurt exports. While the Fed has not ruled out another rate hike in March, the current turmoil could force it to wait until June.

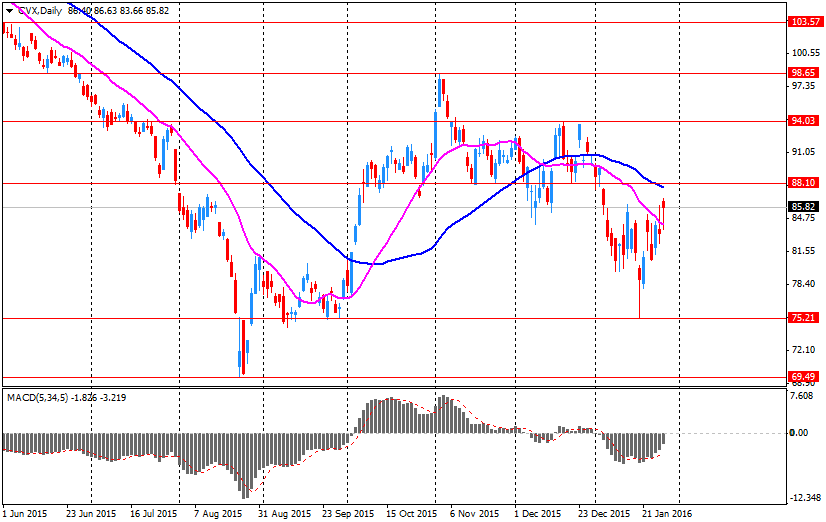

Most of Dow stocks in positive area (26 of 30). Top looser - Chevron Corporation (CVX, -1,25%). Top gainer - Microsoft Corporation (MSFT, +5,61%).

All S&P sectors in positive area. Top gainer - Technology (+2,4%).

At the moment:

Dow 16262.00 +290.00 +1.82%

S&P 500 1918.75 +38.00 +2.02%

Nasdaq 100 4239.75 +86.00 +2.07%

Oil 33.51 +0.29 +0.87%

Gold 1116.80 +0.70 +0.06%

U.S. 10yr 1.92 -0.06

-

18:00

European stocks closed: FTSE 100 6,059.5 +127.72 +2.2% CAC 40 4,417.02 +94.86 +2.2% DAX 9,798.11 +158.52 +1.6%

-

17:59

European stocks close: stocks closed higher on the Bank of Japan's interest rate decision

Stock indices closed higher on the Bank of Japan's (BoJ) interest rate decision. The central bank on Friday lowered its interest rate for the first time ever to -0.1% from 0.1%, adding that it could cut its interest rate further if needed. Analysts did not expect this decision.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone rose to 0.4% year-on-year in January from 0.2% in December, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco climbed to an annual rate of 1.0% in January from 0.9% in December. Analysts had expected the index to remain unchanged at 0.9%.

Food, alcohol and tobacco prices were up 1.1% in January, non-energy industrial goods prices gained 0.7%, and services prices climbed 1.2%, while energy prices dropped 5.3%.

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 4.7% in December from last year, missing expectations for a 5.2% gain, after a 5.1 % increase in November.

Loans to the private sector in the Eurozone climbed 1.4% in December from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

Credit to the private sector dropped to 0.8% year-on-year in December from 1.2% in November.

European Central Bank (ECB) Governing Council member Jens Weidmann said in an interview with the German newspaper Frankfurter Allgemeine Zeitung published on Friday that the central bank should not add further stimulus measures as inflation excluding volatile energy and food prices was rising. He noted that low oil prices weigh on inflation.

Weidmann warned that the ECB's asset-buying programme could have the same effect as buying government bonds directly from issuer countries, adding that it is forbidden.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,059.5 +127.72 +2.15 %

DAX 9,798.11 +158.52 +1.64 %

CAC 40 4,417.02 +94.86 +2.19 %

-

17:54

Oil prices fall on concerns over the global oil oversupply

Oil prices declined on concerns over the global oil oversupply. Dow Jones reported that according to an Iranian oil official, the country would not cooperate to reduce oil output until its oil exports rise by 1.5 million barrels per day (bpd).

Reuters reported that according to its survey, OPEC's oil output climbed to 32.60 million bpd from a revised 32.31 million bpd in December due to higher output from Iran.

Earlier, oil prices increased on speculation that top oil producer could lower their oil output.

Market participants are also awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported on last Friday that the number of active U.S. rigs declined by 5 rigs to 510 last week. It was the lowest level since April 2010.

WTI crude oil for March delivery fell to $33.31 a barrel on the New York Mercantile Exchange.

Brent crude oil for March declined to $32.77 a barrel on ICE Futures Europe.

-

17:44

WSE: Session Results

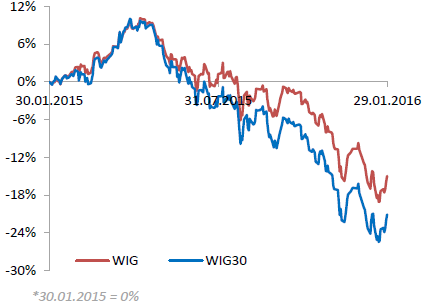

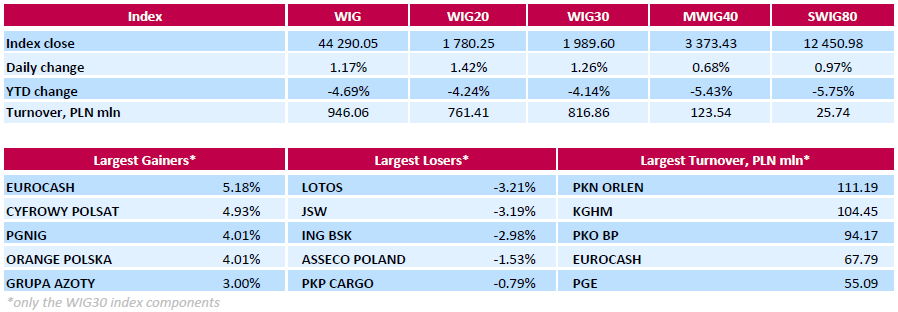

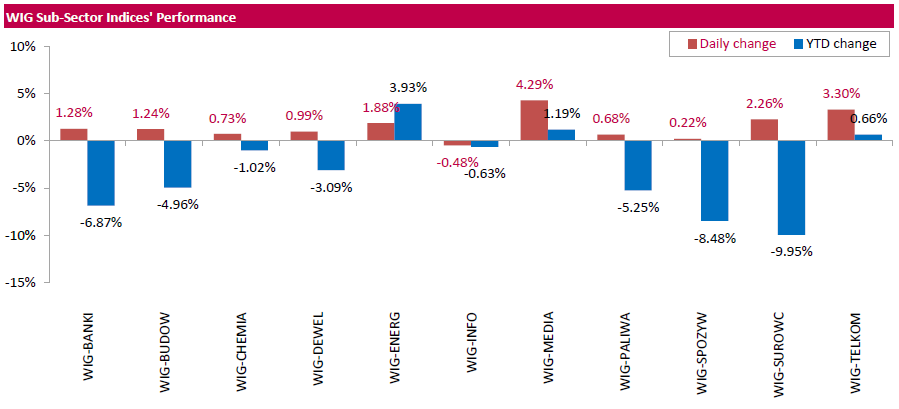

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, added 1.17%. All sectors, but for IT industry (-0.48%), did well with media sector stocks (+4.29%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced by 1.26%. In the WIG30 index, the strongest performers were FMCG wholesaler EUROCASH (WSE: EUR), oil and gas producer PGNIG (WSE: PGN), media and telecommunications group CYFROWY POLSAT (WSE: CPS), telecommunication services provider ORANGE POLSKA (WSE: OPL) and oil and gas producer PGNIG (WSE: PGN), gaining 4.01%-5.18%. On the other side of the ledger, oil refiner LOTOS (WSE: LTS) led the decliners with a 3.21% decline, followed by coking coal miner JSW (WSE: JSW) and bank ING BSK (WSE: ING), plunging by 3.19% and 2.98% respectively.

-

17:36

Gold rise despite a stronger U.S. dollar

Gold price rose despite a stronger U.S. dollar. The Bank of Japan's (BoJ) interest rate decision supported gold. The central bank on Friday lowered its interest rate to -0.1% from 0.1%, adding that it could cut its interest rate further if needed. Analysts did not expect this decision.

Market participants also eyed today's U.S. economic data. The U.S. Commerce Department released gross domestic product data on Friday. The U.S. preliminary gross domestic product increased by 0.7% in the fourth quarter, missing expectations for a 0.8% gain, after a 2.0% rise in the third quarter.

The slower rise was mainly driven by a slower rise in consumer spending.

Consumer spending grew 2.2% in the fourth quarter, after a 3.0% increase in the third quarter.

Exports declined 2.5% in fourth quarter as a strong U.S. dollar weighed on exports, while imports increased 1.1%.

In 2015 as whole, the U.S. economy expanded 2.4%, after a 2.4% growth in 2014.

February futures for gold on the COMEX today increased to 1117.40 dollars per ounce.

-

17:22

Central Bank of Russia keeps its key interest rate unchanged at 11.0% in January

The Central Bank of Russia (CBR) kept its interest rate unchanged at 11.0% on Friday. This decision was expected by analysts.

The central bank noted that monthly consumer inflation stabilised at high levels due to a further drop in oil prices.

Risks to price stability escalating since the last meeting, the CBR said.

"The deterioration in the global commodity markets will require a further adjustment of the Russian economy," the CBR said.

"The key rate decision has been made in recognition of the current economic situation, with elevated risks of continued recession provoked by falling oil prices," the central bank added.

The central bank expects the consumer price inflation to be below 7% as early as January 2017, and 4% by late 2017.

The central bank cut its interest rate five times in 2015.

The next meeting of the CBR is scheduled to be March 18, 2016.

-

17:08

Bank of Japan Governor Haruhiko Kuroda: negative interest rate does not replace the current quantitative easing

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a press conference on Friday that negative interest rate does not replace the current quantitative easing, adding that its additional stimulus measure.

The central bank on Friday lowered its interest rate to -0.1% from 0.1%, added that it could cut its interest rate further if needed. Analysts did not expect this decision.

Only 5 of 9 board members voted for the interest rate cut.

-

16:53

The People's Bank of China injects 100 billion yuan into market

The People's Bank of China (PBoC) on Friday injected 100 billion yuan ($15 billion) into market to boost liquidity via seven-day reverse repos and 28-day reverse repos.

The central bank's injection this week totalled 690 billion yuan.

The central bank usually injects extra money before the Lunar New Year holiday.

-

16:44

U.S. employment cost index rises 0.6% in fourth quarter

The U.S. Bureau of Labour Statistics released its employment cost index on Friday. The U.S. employment cost index rose 0.6% in fourth quarter, after a 0.6% gain in third quarter.

The increase was driven by higher benefits payments for state and local government employees.

Wages and salaries increased 0.6% in the fourth quarter, after a 0.6% rise in the third quarter, while benefits payments climbed 0.7% in the fourth quarter, after a 0.5% increase in the third quarter.

-

16:33

Producer prices in Australia increase 0.3% in the fourth quarter

The Australian Bureau of Statistics released its producer prices data on Friday. Producer prices in Australia increased 0.3% in the fourth quarter, missing expectations for a 0.6% rise, after a 0.9% gain in the third quarter.

The increase was mainly driven by rises in the prices received for building construction, other transport equipment manufacturing and sheep, beef cattle grain farming and dairy farming.

On a yearly basis, producer prices climbed 1.9% in the fourth quarter, after a 1.7% increase in the third quarter.

-

16:26

Housing starts in Japan fall 1.3% year-on-year in December

Japan's Ministry of Land, Infrastructure, Transport and Tourism released its housing starts data on Friday. Housing starts in Japan fell 1.3% year-on-year in December, missing expectations for a 0.5% gain, after a 1.7% increase in November.

On a yearly basis, housing starts were down to 860,000 in December from 879,000 in November.

Construction orders jumped 14.8% year-on-year in December, after 5.7% rise in November.

-

16:18

Thomson Reuters/University of Michigan final consumer sentiment index declines to 92.0 in January

The Thomson Reuters/University of Michigan final consumer sentiment index decreased to 92.0 in January from 92.6 in December, down from the preliminary estimate of 93.3 and missing expectations a rise to 93.0.

"The small downward revisions were due to stock market declines that were reflected in the erosion of household wealth, as well as weakened prospects for the national economy," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

The current economic conditions index declined to 106.4 in January from 108.1 in December, up from a preliminary reading of 105.1.

The index of consumer expectations remained unchanged at 82.7 in January, down from a preliminary reading of 85.7.

-

16:08

Chicago purchasing managers' index jumps to 55.6 in January

The Institute for Supply Management released its Chicago purchasing managers' index on Friday. The Chicago purchasing managers' index climbed to 55.6 in January from 42.9 in December, exceeding expectations for an increase to 42.9.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The increase was driven by a rise in production and in new orders. The production index posted a double digit growth in January, while the new orders index was up to 58.8 from 38.6.

The employment index rose moderately.

"While the surge in activity in January marks a positive start to the year, it follows significant weakness in the previous two months, with the latest rise not sufficient to offset the previous falls in output and orders," Chief Economist of MNI Indicators Philip Uglow said.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, January 92 (forecast 93)

-

15:59

Private sector credit in Australia rises 0.5% in December

The Reserve Bank of Australia (RBA) released its private sector credit data on Friday. The total value of private sector credit in Australia rose 0.5% in December, missing expectations for a 0.6% gain, after a 0.4% increase in November.

Housing credit increased 0.5% in December, personal credit was flat, while business credit rose 0.5%.

On a yearly basis, the private sector credit in Australia jumped 6.6% in December, after a 6.6% in November.

-

15:45

U.S.: Chicago Purchasing Managers' Index , January 55.6 (forecast 45)

-

15:40

Japan’s unemployment rate remains unchanged 3.3% in December

Japan's Ministry of Internal Affairs and Communications released its unemployment rate on late Thursday evening. Unemployment rate in Japan remained unchanged 3.3% in December, in line with expectations.

The number of unemployed persons fell by 60,000 in December to 2.04 million.

The number of employed persons rose by 280,000 in December to 63.85 million.

-

15:34

U.S. Stocks open: Dow +0.60%, Nasdaq +0.19%, S&P +0.44%

-

15:31

Spanish current account deficit narrows to €2.11 billion in November

The Bank of Spain released its current account data on Monday. Spain's current account surplus narrowed to €2.11 billion in November from €2.40 billion in October.

The surplus on trade in goods and services totalled €2.0 billion in November, while the deficit on primary and second income totalled €0.1 billion.

-

15:30

Before the bell: S&P futures +0.69%, NASDAQ futures +0.48%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 17,518.3 +476.85 +2.8%

Hang Seng 19,683.11 +487.28 +2.5%

Shanghai Composite 2,737.65 +81.98 +3.1%

FTSE 5,993.86 +62.08 +1.0%

CAC 4,350.63 +28.47 +0.7%

DAX 9,679.57 +39.98 +0.4%

Crude oil $33.77 (+1.66%)

Gold $1113.90 (-0.15%)

-

15:19

Greek retail sales slides 4.7% in November

The Greek statistical office Hellenic Statistical Authority released its retail sales data on Friday. Greek retail sales slid 4.7% in November.

On a yearly basis, Greek retail sales fell by 4.5% in November, after a 2.4% drop in October. October's figure was revised up from a 2.5% decline.

Sales of food products decreased by 5.3% year-on-year in November, sales of non-food products fell by 1.2%, while sales of automotive fuel dropped by 14.9%.

-

15:14

Greek producer prices decrease 3.0% in December

The Hellenic Statistical Authority released its producer price index (PPI) data on Friday. Greek producer prices decreased 3.0% in December.

Domestic market prices fell by 2.3% in December, while foreign market prices slid 5.3%.

On a yearly basis, Greek PPI plunged 7.8% in December, after a 8.5% drop in November.

Domestic market prices slid 5.7% year-on-year in December, while foreign market prices dropped 14.0%.

Energy prices plunged 14.9% year-on-year in December, while non-durable consumer goods industrial prices were up 0.4%.

In 2015 as whole, Greek producer prices slid 7.2%, after a 1.2% fall in 2014.

-

15:06

Producer prices in Italy decrease 0.7% in December

The Italian statistical office Istat released its producer price inflation data for Italy on Friday. Italian producer prices decreased 0.7% in December, after a 0.4% decline in November. November's figure was revised up from a 0.5% drop.

Producer price declined by 0.7% on domestic market and by 0.5% on non-domestic market in December.

On a yearly basis, Italian PPI fell 3.3% in December, after a 3.2% drop in November. November's figure was revised up from a 3.3% fall.

Producer price slid 4.0% on domestic market and by 0.9% on non-domestic market in December.

-

15:01

U.S. economy expands at 0.7% in the fourth quarter

The U.S. Commerce Department released gross domestic product data on Friday. The U.S. preliminary gross domestic product increased by 0.7% in the fourth quarter, missing expectations for a 0.8% gain, after a 2.0% rise in the third quarter.

The slower rise was mainly driven by a slower rise in consumer spending.

Consumer spending grew 2.2% in the fourth quarter, after a 3.0% increase in the third quarter.

Exports declined 2.5% in fourth quarter as a strong U.S. dollar weighed on exports, while imports increased 1.1%.

In 2015 as whole, the U.S. economy expanded 2.4%, after a 2.4% growth in 2014.

The personal consumption expenditures (PCE) price index rose 0.1% in the fourth quarter, missing expectations for a 0.7% gain, after a 1.3% increase in the third quarter.

The personal consumption expenditures (PCE) price index excluding food and energy increased 1.2% in the fourth quarter, in line with forecasts, after a 1.4% gain in the third quarter.

The personal consumption expenditures (PCE) price index is the Fed's preferred measure for inflation. The Fed's inflation target is 2%.

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Microsoft Corp

MSFT

54.22

4.16%

190.5K

Merck & Co Inc

MRK

50.25

2.13%

3.7K

Yandex N.V., NASDAQ

YNDX

13.38

1.90%

3.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

4.50

1.81%

72.1K

HONEYWELL INTERNATIONAL INC.

HON

99.05

1.10%

1.3K

Yahoo! Inc., NASDAQ

YHOO

29.00

0.87%

2.0K

Twitter, Inc., NYSE

TWTR

16.62

0.79%

3.6K

International Business Machines Co...

IBM

123.11

0.73%

2.3K

Ford Motor Co.

F

11.79

0.68%

5.2K

Cisco Systems Inc

CSCO

23.25

0.63%

23.8K

E. I. du Pont de Nemours and Co

DD

52.34

0.63%

69.1K

Citigroup Inc., NYSE

C

40.64

0.62%

8.9K

Visa

V

69.75

0.61%

25.8K

Caterpillar Inc

CAT

61.45

0.61%

783.0K

Intel Corp

INTC

30.13

0.53%

2.9K

Boeing Co

BA

118.60

0.50%

1.2K

McDonald's Corp

MCD

122.99

0.50%

1.3K

Pfizer Inc

PFE

30.35

0.50%

10.3K

General Electric Co

GE

28.34

0.46%

20.6K

ALCOA INC.

AA

7.03

0.43%

2.1K

Travelers Companies Inc

TRV

104.91

0.42%

1.8K

Verizon Communications Inc

VZ

49.21

0.41%

0.6K

Home Depot Inc

HD

122.75

0.38%

14.6K

Wal-Mart Stores Inc

WMT

64.46

0.37%

9.4K

Starbucks Corporation, NASDAQ

SBUX

59.50

0.36%

1.3K

AT&T Inc

T

35.65

0.34%

10.0K

ALTRIA GROUP INC.

MO

59.82

0.32%

2.3K

Goldman Sachs

GS

157.50

0.28%

14.1K

Walt Disney Co

DIS

93.75

0.24%

14.9K

Apple Inc.

AAPL

94.32

0.24%

112.9K

Nike

NKE

61.33

0.21%

0.1K

Procter & Gamble Co

PG

79.95

0.16%

2.5K

Johnson & Johnson

JNJ

102.35

0.08%

0.2K

American Express Co

AXP

52.90

0.04%

1.1K

Exxon Mobil Corp

XOM

76.95

-0.05%

8.8K

Facebook, Inc.

FB

109.00

-0.10%

163.0K

AMERICAN INTERNATIONAL GROUP

AIG

54.53

-0.33%

0.2K

Google Inc.

GOOG

727.49

-0.47%

8.8K

Tesla Motors, Inc., NASDAQ

TSLA

188.37

-0.70%

1.9K

Chevron Corp

CVX

84.75

-1.36%

64.4K

Barrick Gold Corporation, NYSE

ABX

9.50

-1.66%

17.1K

Amazon.com Inc., NASDAQ

AMZN

571.00

-10.13%

137.2K

-

14:53

Upgrades and downgrades before the market open

Upgrades:

Bank of America (BAC) upgraded to Outperform at Credit Agricole

Downgrades:

Other:

Microsoft (MSFT) target raised to $40 from $39 at Jefferies

Microsoft (MSFT) target raised to $63 from $60 at FBR Capital

Microsoft (MSFT) target raised to $55 from $50 at Wunderlich

Microsoft (MSFT) target lowered to $58 from $64 at BMO Capital Markets

Amazon (AMZN) target lowered to $685 from $720 at Mizuho

Alphabet A (GOOGL) target raised to $800 from $740 at Wedbush

-

14:51

-

14:48

Canada's GDP rises 0.3% in November

Statistics Canada released GDP (gross domestic product) growth data on Friday. Canada's GDP growth rose 0.3% in November, in line with expectations, after a flat reading in October.

The increase was driven by rises in manufacturing, mining, quarrying, and oil and gas extraction, and wholesale and retail trade sector.

The mining, quarrying, and oil and gas extraction sector rose 0.6% in November, manufacturing output increased 0.4%, and wholesale output gained 1.3%, while the retail trade sector climbed 1.2%.

-

14:45

Option expiries for today's 10:00 ET NY cut

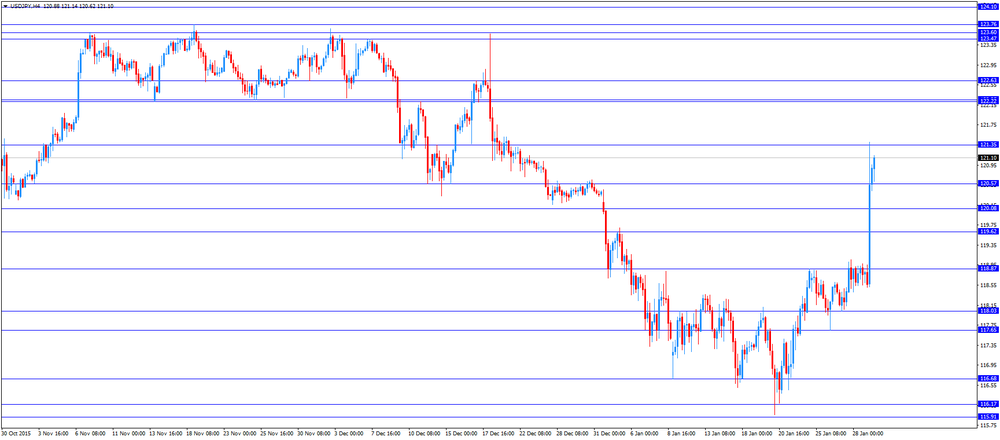

USD/JPY 118.00 (USD 1.2bln) 118.50 (641m) 119.00 (3.3bln) 120.00 (3.4bln)

EUR/USD 1.0900 (705m) 1.0950 (271m) 1.0970 (309m) 1.1000 (1.2bln)

USD/CAD 1.4000 (USD 600m)

AUD/USD 0.7000 (AUD 554m) 0.7085 (100m) 0.7100 (202m) 0.7110 (364m)

NZD/USD 0.6400 (NZD 243m) 0.6500 (110m)

EUR/JPY 129.00 (EUR 672m)

-

14:42

Canadian industrial product and raw materials prices decline in December

Statistics Canada released its industrial product and raw materials price indexes on Friday. The Industrial Product Price Index (IPPI) fell 0.2% in December, beating forecasts for a 0.3% drop, after a 0.3% decline in November. November's figure was revised down from 0.2% decrease.

The decrease was mainly driven by lower prices for energy and petroleum products, which slid 5.4% in December.

16 of the 21 commodity groups increased and 5 declined.

The Raw Materials Price Index (RMPI) dropped 5.0% in December, after a 4.1% fall in November. November's figure was revised down from a 4.0% decline.

The drop was driven by lower prices for crude energy products. Crude energy products plunged by 11.9% in December.

3 of the 6 commodity groups rose and 3 decreased.

-

14:31

U.S.: PCE price index ex food, energy, q/q, Quarter IV 1.2% (forecast 1.2%)

-

14:31

U.S.: PCE price index, q/q, Quarter IV 0.1% (forecast 0.7%)

-

14:30

Canada: Industrial Product Price Index, m/m, December -0.2% (forecast -0.3%)

-

14:30

Canada: GDP (m/m) , November 0.3% (forecast 0.3%)

-

14:30

U.S.: GDP, q/q, Quarter IV 0.7% (forecast 0.8%)

-

14:30

Canada: Industrial Product Price Index, y/y, December 1.1%

-

14:26

Building permits in New Zealand increase 2.3% in December

Statistics New Zealand released its building permits data on late Thursday evening. Building permits in New Zealand increased 2.3% in December, after a 2.4% gain in November. November's figure was revised up from a 1.8% rise.

Residential work rose 22% year-on-year in December, while non-residential work climbed 29%.

"Last year was the ninth-highest year on record for dwelling consents, beaten only by the building booms in the 1970s and early 2000s. The largest increases in 2015 were for townhouses and apartments. Consents for houses also increased, while retirement village units decreased very slightly," business indicators manager Clara Eatherley said.

-

14:20

Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 United Kingdom Gfk Consumer Confidence January 2 1 4

00:30 Australia Producer price index, q / q Quarter IV 0.9% 0.6% 0.3%

00:30 Australia Producer price index, y/y Quarter IV 1.7% 1.9%

00:30 Australia Private Sector Credit, m/m December 0.4% 0.6% 0.5%

00:30 Australia Private Sector Credit, y/y December 6.6% 6.6%

04:00 Japan BoJ Interest Rate Decision 0% -0.1%

04:00 Japan Bank of Japan Monetary Base Target 275 275

04:00 Japan BoJ Monetary Policy Statement

05:00 Japan Housing Starts, y/y December 1.7% 0.5% -1.3%

05:00 Japan Construction Orders, y/y December 5.7% 14.8%

06:30 France GDP, q/q (Preliminary) Quarter IV 0.3% 0.2% 0.2%

06:30 France GDP, Y/Y (Preliminary) Quarter IV 1.1% 1.5%

06:30 Japan BOJ Press Conference

07:00 Germany Retail sales, real adjusted December 0.4% Revised From 0.2% 0.5% -0.2%

07:00 Germany Retail sales, real unadjusted, y/y December 2.4% Revised From 2.3% 2% 1.5%

08:00 Switzerland KOF Leading Indicator January 96.8 Revised From 96.6 96 100.3

09:00 Eurozone Private Loans, Y/Y December 1.4% 1.5% 1.4%

09:00 Eurozone M3 money supply, adjusted y/y December 5.1% 5.2% 4.7%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) January 0.2% 0.4% 0.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) January 0.9% 0.9% 1.0%

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. economic data. The U.S. preliminary GDP is expected to rise 0.8% in fourth quarter, after a 2.0% growth in the third quarter.

The Chicago purchasing managers' index is expected to increase to 45.0 in January from 42.9 in December.

The euro traded higher against the U.S. dollar despite the release of the mixed economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone rose to 0.4% year-on-year in January from 0.2% in December, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco climbed to an annual rate of 1.0% in January from 0.9% in December. Analysts had expected the index to remain unchanged at 0.9%.

Food, alcohol and tobacco prices were up 1.1% in January, non-energy industrial goods prices gained 0.7%, and services prices climbed 1.2%, while energy prices dropped 5.3%.

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 4.7% in December from last year, missing expectations for a 5.2% gain, after a 5.1 % increase in November.

Loans to the private sector in the Eurozone climbed 1.4% in December from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

Credit to the private sector dropped to 0.8% year-on-year in December from 1.2% in November.

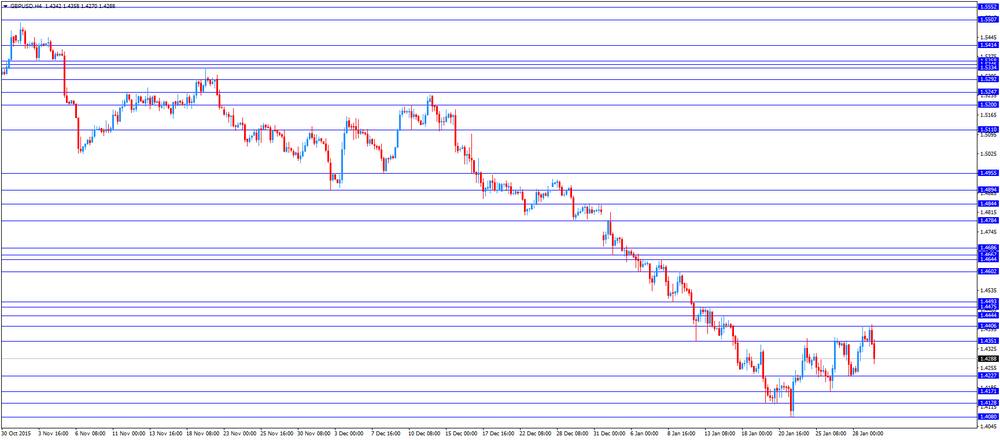

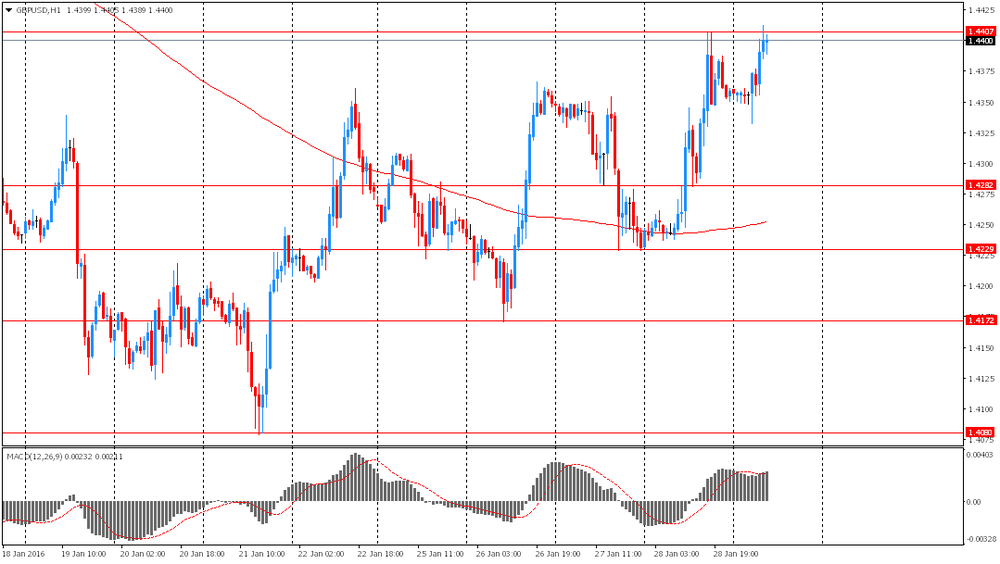

The British pound traded lower against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data. Canada's GDP growth is expected to rise 0.3% in November, after a flat reading in October.

The Industrial Product Price Index is expected to decline 0.3% in December, after a 0.2% fall in October.

The Swiss franc traded lower against the U.S. dollar. The Swiss Economic Institute KOF released its leading indicator for Switzerland on Friday. The KOF leading indicator climbed to 100.3 in January from 96.8 in December, beating expectations for a fall to 96.0. December's figure was revised up from 96.6.

The increase was mainly driven by the manufacturing industry.

EUR/USD: the currency pair rose to $1.0925

GBP/USD: the currency pair fell to $1.4270

USD/JPY: the currency pair increased to Y121.14

The most important news that are expected (GMT0):

13:30 Canada Industrial Product Price Index, m/m December -0.2% -0.3%

13:30 Canada GDP (m/m) November 0.0% 0.3%

13:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter IV 1.4% 1.2%

13:30 U.S. PCE price index, q/q (Preliminary) Quarter IV 1.3% 0.7%

13:30 U.S. GDP, q/q (Preliminary) Quarter IV 2.0% 0.8%

14:45 U.S. Chicago Purchasing Managers' Index January 42.9 45

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) January 92.6 93

-

13:59

Orders

EUR/USD

Offers 1.0925 1.0945-50 1.0985 1.1000 1.1025 1.1050 1.1080 1.1100

Bids 1.0870 1.0850 1.0830 1.0800 1.0780-85 1.0765 1.0750 1.0730 1.0700

GBP/USD

Offers 1.4400 1.4425-30 1.4450 1.4480 1.4500 1.4525 1.4550

Bids 1.4350 1.4330 1.4300 1.4280 1.4250 1.4225-30 1.4200

EUR/GBP

Offers 0.7600 0.7620 0.7655-60 0.7680 0.7700 0.7720-25 0.7750-55

Bids 0.7575-80 0.7560 0.7530 0.7500 0.7485 0.7450

EUR/JPY

Offers 131.85 132.00 132.30 132.50 132.80 133.00

Bids 131.30 131.00 130.80 130.40 130.00 129.80 129.50

USD/JPY

Offers 121.00 121.25 121.50 121.75-80 122.00 122.30 122.50

Bids 120.55-60 120.25 120.00 119.80 119.50 119.25-30 119.00 118.85 118.50

AUD/USD

Offers 0.7120-25 0.7150 0.7180 0.7200

Bids 0.7075 0.7050 0.7030 0.70150.7000 0.6980 0.6950

-

13:52

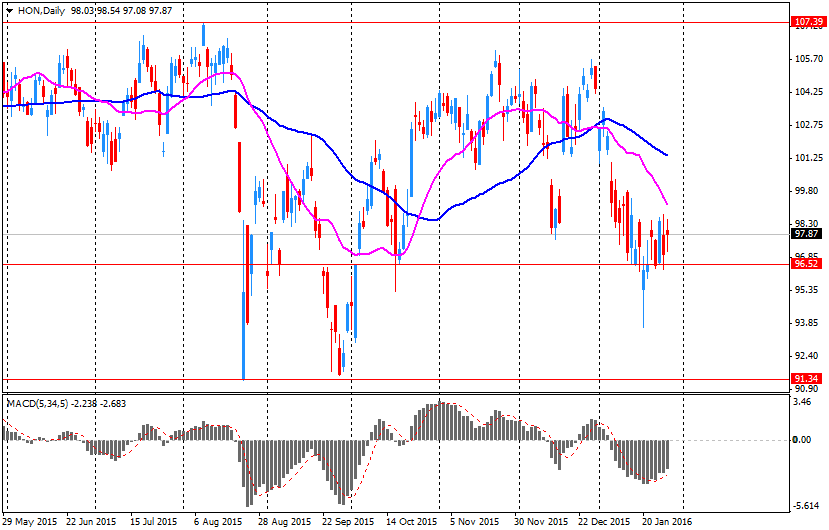

Company News: Honeywell (HON) Q4 Earnings Miss Expectations

Honeywell reported Q4 FY 2015 earnings of $1.58 per share (versus $1.43 in Q4 FY 2014), missing analysts' consensus of $1.59.

The company's quarterly revenues amounted to $9.982 bln (-2.8% y/y), in line with consensus estimate of $9.984 bln.

Honeywell reaffirmed guidance for FY 2016, projecting EPS of $6.45-6.70 (versus analysts' consensus of $6.57) and revenues of $39.9-40.9 bln (versus analysts' consensus of $40.52 bln).

HON rose to $97.97 (+1.04%) in yesterday's trading.

-

12:27

European stock markets mid session: stocks traded higher on the Bank of Japan’s interest rate decision

Stock indices traded higher on the Bank of Japan's (BoJ) interest rate decision. The central bank on Friday lowered its interest rate for the first time ever to -0.1% from 0.1%, adding that it could cut its interest rate further if needed. Analysts did not expect this decision.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone rose to 0.4% year-on-year in January from 0.2% in December, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco climbed to an annual rate of 1.0% in January from 0.9% in December. Analysts had expected the index to remain unchanged at 0.9%.

Food, alcohol and tobacco prices were up 1.1% in January, non-energy industrial goods prices gained 0.7%, and services prices climbed 1.2%, while energy prices dropped 5.3%.

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 4.7% in December from last year, missing expectations for a 5.2% gain, after a 5.1 % increase in November.

Loans to the private sector in the Eurozone climbed 1.4% in December from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

Credit to the private sector dropped to 0.8% year-on-year in December from 1.2% in November.

Current figures:

Name Price Change Change %

FTSE 100 5,993.79 +62.01 +1.05 %

DAX 9,694.09 +54.50 +0.57 %

CAC 40 4,357.57 +35.41 +0.82 %

-

12:22

French economy expands 0.2% in the fourth quarter

The French statistical office Insee released its gross domestic product (GDP) growth for France on Friday. France's preliminary GDP climbed 0.2% in the fourth quarter, in line with expectations, after a 0.3% rise in the third quarter.

Total production in goods and services was up 0.5% in the fourth quarter, after a 0.3% rise in the third quarter.

Households' spending decline 0.4% in the fourth quarter, after a 0.3% gain in the third quarter.

Export increased 0.6% in the fourth quarter, while imports rose 1.6%.

On a yearly basis, France's GDP rose to 1.5% in the fourth quarter from 1.1% in the third quarter.

In 2015 as whole, the French economy expanded 1.1%, after a 0.2% growth in 2014.

-

12:16

French consumer spending rises 0.7% in December

French statistical office INSEE released its consumer spending data on Friday. French consumer spending rose 0.7% in December, after a 1.4% drop in November. November's figure was revised down from a 1.1% decline.

The increase was mainly driven by a rise in purchases of engineered goods. Spending on engineered goods climbed by 1.6% in December, driven by higher textile-clothing purchases.

Spending on food rose 1.2% in December, while spending on energy fell 2.5%.

On a yearly basis, consumer spending climbed 0.3% in December.

In 2015 as whole, consumer spending rose 1.8%, driven by the rebound in energy consumption.

-

12:08

French producer prices decrease 1.2% in December

French statistical office INSEE released its producer price index (PPI) data on Friday. French producer prices decreased 1.2% in December, after a 0.2% rise in November.

The increase was driven a rise in prices for mining and quarrying products, energy and water, and in manufactured industry.

On a yearly basis, French PPI fell 2.8% in December.

The annual drop was driven by a decline in prices for coke and refined petroleum products, which slid 28.8 year-on-year in December.

Import prices decreased 1.7% in December, after a 0.1% increase in November.

-

11:59

French preliminary consumer price inflation declines 1.0% in January

The French statistical office Insee released its preliminary consumer price inflation for France on Friday. The French consumer price inflation declined 1.0% in January, after a 0.2% rise in December.

On a yearly basis, the consumer price index rose 0.2% in January, after a 0.2% increase in December.

Fresh food prices rose 2.2% year-on-year in January, services prices climbed 1.0%, while energy prices dropped by 4.0%.

-

11:52

GfK’s U.K. consumer confidence index increases to 4 in January

Gfk released its consumer confidence index for the U.K. on Friday. GfK's U.K. consumer confidence index increased to 4 in January from 2 in December. Analysts had expected the index to decline to 1.

4 of 5 measures increased and 1 was unchanged.

"UK consumers remain resiliently bullish this month with no sign of the January Blues denting their view on the state of their personal finances for both the past year and also for the rest of 2016," Joe Staton, Head of Market Dynamics at GfK, said.

-

11:46

Preliminary consumer price inflation in Spain slides 1.9% in January

The Spanish statistical office INE released its preliminary consumer price inflation data on Friday. Consumer price inflation in Spain slides 1.9% in January, after a 0.3% fall in December.

On a yearly basis, consumer prices fell by 0.3% in January, after a flat reading in December.

The annual decline was mainly driven by the drop in in the prices of electricity.

-

11:42

Spain’s economy expands 0.8% the fourth quarter

The Spanish statistical office INE released its preliminary gross domestic product (GDP) for Spain on Friday. Spain's economy expanded 0.8% the fourth quarter, after a 0.8% growth in the third quarter. It was the tenth consecutive increase.

On a yearly, GDP grew 3.5% in the fourth quarter, after a 3.4% in the third quarter. It was the fastest growth since the fourth quarter of 2007.

In 2015 as whole, Spain's economy expanded 3.2%.

-

11:35

German adjusted retail sales decrease 0.2% in December

Destatis released its retail sales for Germany on Friday. German adjusted retail sales decreased 0.2% in December, missing forecasts of a 0.5% gain, after a 0.4% rise in November. November's figure was revised up from a 0.2% increase.

On a yearly basis, German unadjusted retail sales jumped 1.5% in December, missing expectations for a 2.0% gain, after a 2.4% rise in November. November's figure was revised up from a 2.3% increase.

Sales of non-food products increased at an annual rate of 1.0% in December, while sales of food, beverages and tobacco products climbed by 2.0%.

In 2015 as whole, retail sales in real terms rose 2.7%, after a 1.2% increase in 2014.

-

11:27

M3 money supply in the Eurozone rises 4.7% in December from last year

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 4.7% in December from last year, missing expectations for a 5.2% gain, after a 5.1 % increase in November.

Loans to the private sector in the Eurozone climbed 1.4% in December from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

Credit to the private sector dropped to 0.8% year-on-year in December from 1.2% in November.

Loans to non-financial corporations fell to 0.3% year-on-year in December from 0.7% in November.

-

11:20

Preliminary consumer price inflation in the Eurozone rises to 0.4% year-on-year in January

Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone rose to 0.4% year-on-year in January from 0.2% in December, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco climbed to an annual rate of 1.0% in January from 0.9% in December. Analysts had expected the index to remain unchanged at 0.9%.

Food, alcohol and tobacco prices were up 1.1% in January, non-energy industrial goods prices gained 0.7%, and services prices climbed 1.2%, while energy prices dropped 5.3%.

-

11:02

KOF leading indicator for Switzerland climbs to 100.3 in January

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Friday. The KOF leading indicator climbed to 100.3 in January from 96.8 in December, beating expectations for a fall to 96.0. December's figure was revised up from 96.6.

The increase was mainly driven by the manufacturing industry.

"The momentum of the Swiss economy in the near future can be expected to evolve close to its long-term average," the KOF said.

-

11:00

Eurozone: Harmonized CPI, Y/Y, January 0.4% (forecast 0.4%)

-

11:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, January 1.0% (forecast 0.9%)

-

10:57

European Central Bank Governing Council member Jens Weidmann: the central bank should not add further stimulus measures as inflation excluding volatile energy and food prices was rising

European Central Bank (ECB) Governing Council member Jens Weidmann said in an interview with the German newspaper Frankfurter Allgemeine Zeitung published on Friday that the central bank should not add further stimulus measures as inflation excluding volatile energy and food prices was rising. He noted that low oil prices weigh on inflation.

Weidmann warned that the ECB's asset-buying programme could have the same effect as buying government bonds directly from issuer countries, adding that it is forbidden.

-

10:57

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.00 (USD 1.2bln) 118.50 (641m) 119.00 (3.3bln) 120.00 (3.4bln)

EUR/USD 1.0900 (705m) 1.0950 (271m) 1.0970 (309m) 1.1000 (1.2bln)

USD/CAD 1.4000 (USD 600m)

AUD/USD 0.7000 (AUD 554m) 0.7085 (100m) 0.7100 (202m) 0.7110 (364m)

NZD/USD 0.6400 (NZD 243m) 0.6500 (110m)

EUR/JPY 129.00 (EUR 672m)

-

10:48

Bank of Japan cuts its interest rate to -0.1% from 0.1% in January

The Bank of Japan (BoJ) released its interest rate decision on Friday. The central bank lowered its interest rate to -0.1% from 0.1%, added that it could cut its interest rate further if needed. Analysts did not expect this decision.

Only 5 of 9 board members voted for the interest rate cut.

The BoJ tries to boost inflation toward its 2% target. The central bank expects inflation to reach 2% target in the first half of the fiscal year 2017.

The BoJ lowered its inflation forecasts. Inflation is expected to be 0.8% in the fiscal year 2016, down from the previous estimate of 1.4%.

The central bank upgraded its growth forecast for the fiscal year 2016 to 1.5% from 1.4%.

-

10:33

Preliminary industrial production in Japan drops 1.4% in December

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Thursday evening. Preliminary industrial production in Japan dropped 1.4% in December, after a 0.9% fall in November.

The drop was mainly driven by declines in general-purpose, production and business oriented machinery, electronic parts and devices, and transport equipment.

According to a survey by the ministry, industrial production is expected to rise 7.6% in January, and to decline 4.1% in February.

On a yearly basis, Japan's industrial production was down 1.6% in December, after a 1.7% rise in November.

-

10:26

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 44.6 in in the week ended January 24

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy rose to 44.6 in in the week ended January 24 from 44.0 the prior week.

The increase was driven by rises in buying climate and personal finances sub-indexes. The measure of views of the economy declined to 37.2 from 37.7, the buying climate index was up to 40.2 from 39.2, while the personal finances index climbed to 56.3 from 55.0.

-

10:16

Eurozone: Private Loans, Y/Y, December 1.4% (forecast 1.5%)

-

10:11

Japan's national CPI declines to an annual rate of 0.2% in December

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Thursday evening. Japan's national consumer price index (CPI) declined to an annual rate of 0.2% in December from 0.3% in November, in line with expectations.

The slower increase was mainly driven by declines in fuel, light and water charges, and transportation and communication prices.

Japan's national CPI excluding fresh food remained unchanged at an annual rate of 0.1% in December, in line with expectations.

The Bank of Japan's inflation target is 2%.

Household spending in Japan fell 4.4% year-on-year in December, missing expectations of a 2.4% drop, after a 2.9% decline in November.

-

10:00

Eurozone: M3 money supply, adjusted y/y, December 4.7% (forecast 5.2%)

-

09:00

Switzerland: KOF Leading Indicator, January 100.3 (forecast 96)

-

08:32

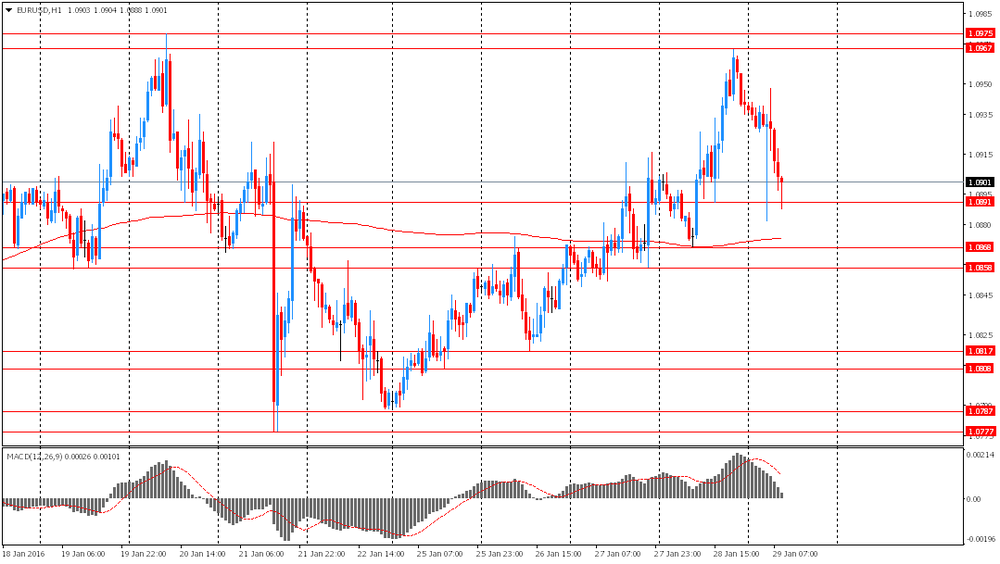

Options levels on friday, January 29, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1002 (4747)

$1.0987 (1750)

$1.0970 (1372)

Price at time of writing this review: $1.0895

Support levels (open interest**, contracts):

$1.0865 (3407)

$1.0830 (4863)

$1.0789 (9852)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 43308 contracts, with the maximum number of contracts with strike price $1,1000 (5876);

- Overall open interest on the PUT options with the expiration date February, 5 is 66733 contracts, with the maximum number of contracts with strike price $1,0800 (9852);

- The ratio of PUT/CALL was 1.54 versus 1.53 from the previous trading day according to data from January, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.4701 (3102)

$1.4602 (1931)

$1.4504 (2050)

Price at time of writing this review: $1.4391

Support levels (open interest**, contracts):

$1.4294 (1027)

$1.4197 (1231)

$1.4098 (1045)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 25791 contracts, with the maximum number of contracts with strike price $1,4700 (3102);

- Overall open interest on the PUT options with the expiration date February, 5 is 23369 contracts, with the maximum number of contracts with strike price $1,4550 (1987);

- The ratio of PUT/CALL was 0.91 versus 0.91 from the previous trading day according to data from January, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

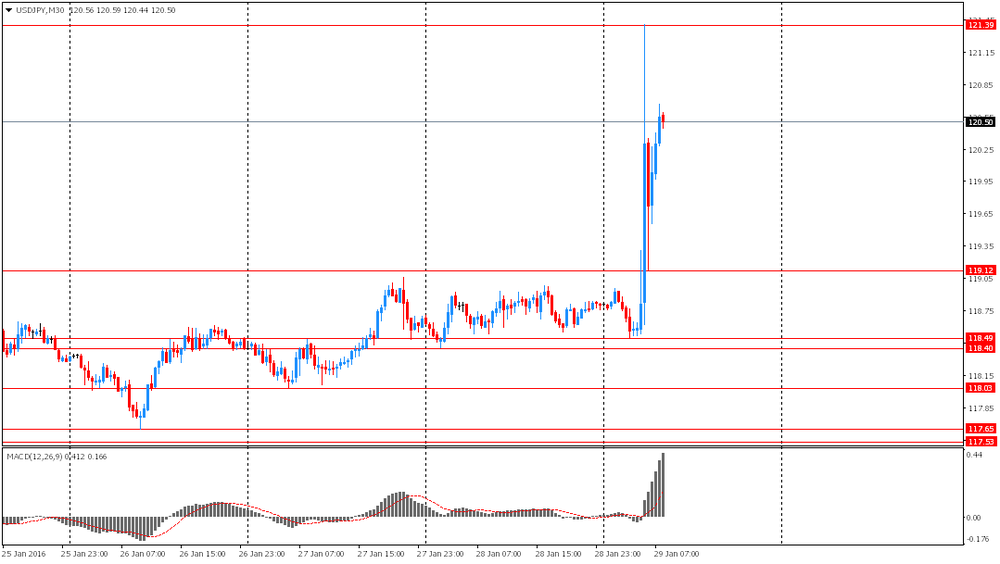

Foreign exchange market. Asian session: the yen fell

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:05 United Kingdom Gfk Consumer Confidence January 2 1 4

00:30 Australia Producer price index, q / q Quarter IV 0.9% 0.6% 0.3%

00:30 Australia Producer price index, y/y Quarter IV 1.7% 1.9%

00:30 Australia Private Sector Credit, m/m December 0.4% 0.6% 0.5%

00:30 Australia Private Sector Credit, y/y December 6.6% 6.6%

04:00 Japan BoJ Interest Rate Decision 0% -0.1%

04:00 Japan Bank of Japan Monetary Base Target 275 275

04:00 Japan BoJ Monetary Policy Statement

05:00 Japan Housing Starts, y/y December 1.7% 0.5% -1.3%

05:00 Japan Construction Orders, y/y December 5.7% 14.8%

06:30 France GDP, q/q (Preliminary) Quarter IV 0.3% 0.2% 0.2%

06:30 France GDP, Y/Y (Preliminary) Quarter IV 1.1% 1.5%

06:30 Japan BOJ Press Conference

The euro declined ahead of today's inflation data. Economists expect the consumer price index to have risen by 0.4% y/y in January from 0.2% in December. If data meet expectations this would mean that inflation may start to pick up pace in 2016.

The yen declined against the U.S. dollar and the euro after the Bank of Japan introduced negative interest rates. Board members voted 5 to 4 to adopt negative 0.1% interest for excess reserves financial institutions keep at the central bank. The bank said this step was taken in order to stimulate inflation growth. According to the statement, the BOJ would keep the rate negative for "as long as it is necessary for maintaining that target in a stable manner."

The Australian dollar rose amid rising oil prices. Recent weak data on the U.S. economy weighed on the greenback and contributed to gains in the AUD.

EUR/USD: the pair fell to $1.0890 in Asian trade

USD/JPY: the pair rose to Y121.40

GBP/USD: the pair rose to $1.4405

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Retail sales, real adjusted December 0.2% 0.5%

07:00 Germany Retail sales, real unadjusted, y/y December 2.3% 2%

08:00 Switzerland KOF Leading Indicator January 96.6 96

09:00 Eurozone Private Loans, Y/Y December 1.4% 1.5%

09:00 Eurozone M3 money supply, adjusted y/y December 5.1% 5.2%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) January 0.2% 0.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) January 0.9% 0.9%

13:30 Canada Industrial Product Price Index, m/m December -0.2% -0.3%

13:30 Canada Industrial Product Price Index, y/y December -0.2%

13:30 Canada GDP (m/m) November 0.0% 0.3%

13:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter IV 1.4% 1.2%

13:30 U.S. PCE price index, q/q (Preliminary) Quarter IV 1.3% 0.7%

13:30 U.S. GDP, q/q (Preliminary) Quarter IV 2.0% 0.8%

14:45 U.S. Chicago Purchasing Managers' Index January 42.9 45

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) January 92.6 93

-

08:00

Germany: Retail sales, real adjusted , December -0.2% (forecast 0.5%)

-

08:00

Germany: Retail sales, real unadjusted, y/y, December 1.5% (forecast 2%)

-

07:55

Oil prices posted significant gains

West Texas Intermediate futures for March delivery rose to $33.89 (+2.02%), while Brent crude jumped to $35.83 (+5.83%) amid speculation that oil producers will discuss output cuts in order to support prices. However analysts say that a deal between producers is unlike and fundamentals will most probably weaken further.

Yesterday Russian officials said that Saudi Arabia had proposed oil production cuts of up to 5%. However analysts say that even if this happens it would not be enough to bring the market back to balance.

-

07:43

Gold steadied

Gold is currently at $1,114.70 (-0.13%). Bullion is on track to make January its best month in a year. Recent weak data on the U.S. economy and talks of Federal Reserve's inability to raise interest rates in March supported the non-interest-paying precious metal.

Despite recent gains Barclays still forecasts gold to cost $1,075 an ounce in the first quarter and $1,054 in 2016 in general.

-

07:31

France: GDP, q/q, Quarter IV 0.2% (forecast 0.2%)

-

07:30

France: GDP, Y/Y, Quarter IV 1.5%

-

07:23

Global Stocks: U.S. stock indices rose

U.S. stock indices followed oil prices and rose on Thursday.

The Dow Jones Industrial Average gained 125.18 points, or 0.8%, to 16,069.64. The S&P 500 climbed 10.41 points, or 0.6%, to 1,893.36 (health care was the only sector to finish lower with a 2.3% decline). The Nasdaq Composite rose 38.51 points, or 0.9%, to 4,506.68.

Analysts expect profits of S&P's companies to have declined by 6.3% in the fourth quarter compared to a decline of 7% expected a week ago.

Meanwhile the Department of Commerce reported that U.S. durable goods orders fell in December partly because of a sharp decline in demand for aircrafts. Orders fell by 5.1% after a 0.5% in November. Economists had expected a 0.6% decline.

This morning in Asia Hong Kong Hang Seng rose 1.80%, or 346.39, to 19,542.22. China Shanghai Composite Index surged 2.49%, or 66.16, to 2,721.82. The Nikkei gained 2.51%, or 428.26, to 17,469.71.

Asian stock indices rose. The Bank of Japan unexpectedly introduced negative rates cutting the deposit rate to -0.1% from 0.1%. The bank said this step was taken in order to stimulate inflation growth. According to the statement, the BOJ would keep the rate negative for "as long as it is necessary for maintaining that target in a stable manner."

Some analysts say that many market participants might have thought that the BOJ was running out of tools.

-

06:02

Japan: Construction Orders, y/y, December 14.8%

-

06:01

Japan: Housing Starts, y/y, December -1.3% (forecast 0.5%)

-

04:45

Japan: BoJ Interest Rate Decision, -0.1%

-

03:02

Nikkei 225 16,994.81 -46.64 -0.27 %, Hang Seng 19,271.28 +75.45 +0.39 %, Shanghai Composite 2,661.6 +5.94 +0.22 %

-

01:31

Australia: Private Sector Credit, y/y, December 6.6%

-

01:30

Australia: Producer price index, q / q, Quarter IV 0.3% (forecast 0.6%)

-

01:30

Australia: Producer price index, y/y, Quarter IV 1.9%

-

01:29

Australia: Private Sector Credit, m/m, December 0.4% (forecast 0.6%)

-

01:05

United Kingdom: Gfk Consumer Confidence, January 4 (forecast 1)

-

01:04

Commodities. Daily history for Jan 28’2016:

(raw materials / closing price /% change)

Oil 33.71 +1.48%

Gold 1,114.70 -0.08%

-

01:04

Stocks. Daily history for Sep Jan 28’2016:

(index / closing price / change items /% change)

Nikkei 225 17,041.45 -122.47 -0.71 %

Hang Seng 19,195.83 +143.38 +0.75 %

Shanghai Composite 2,655.66 -79.90 -2.92 %

FTSE 100 5,931.78 -58.59 -0.98 %

CAC 40 4,322.16 -58.20 -1.33 %

Xetra DAX 9,639.59 -241.23 -2.44 %

S&P 500 1,893.36 +10.41 +0.55 %

NASDAQ Composite 4,506.68 +38.51 +0.86 %

Dow Jones 16,069.64 +125.18 +0.79 %

-

01:03

Currencies. Daily history for Jan 28’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0940 +0,44%

GBP/USD $1,4359 +0,88%

USD/CHF Chf1,0136 -0,14%

USD/JPY Y118,80 +0,10%

EUR/JPY Y129,97 +0,55%

GBP/JPY Y170,59 +0,99%

AUD/USD $0,7082 +0,80%

NZD/USD $0,6479 +0,76%

USD/CAD C$1,4027 -0,45%

-

00:32

Japan: Tokyo CPI ex Fresh Food, y/y, January -0.1% (forecast 0.1%)

-

00:31

Japan: National CPI Ex-Fresh Food, y/y, December 0.1% (forecast 0.1%)

-

00:31

Japan: National CPI Ex-Fresh Food, y/y, December 0.1% (forecast 0.1%)

-

00:30

Japan: National Consumer Price Index, y/y, December 0.2% (forecast 0.2%)

-

00:30

Japan: Tokyo Consumer Price Index, y/y, January -0.3%

-

00:30

Japan: Household spending Y/Y, December -4.4% (forecast -2.4%)

-

00:30

Japan: Unemployment Rate, December 3.3% (forecast 3.3%)

-

00:01

Schedule for today, Friday, Jan 29’2016:

(time / country / index / period / previous value / forecast)

00:05 United Kingdom Gfk Consumer Confidence January 2 1

00:30 Australia Producer price index, q / q Quarter IV 0.9% 0.6%

00:30 Australia Producer price index, y/y Quarter IV 1.7%

00:30 Australia Private Sector Credit, m/m December 0.4% 0.6%

00:30 Australia Private Sector Credit, y/y December 6.6%

04:00 Japan BoJ Interest Rate Decision 0%

04:00 Japan Bank of Japan Monetary Base Target 275

04:00 Japan BoJ Monetary Policy Statement

05:00 Japan Housing Starts, y/y December 1.7% 0.5%

05:00 Japan Construction Orders, y/y December 5.7%

06:30 France GDP, q/q (Preliminary) Quarter IV 0.3% 0.2%

06:30 France GDP, Y/Y (Preliminary) Quarter IV 1.1%

06:30 Japan BOJ Press Conference

07:00 Germany Retail sales, real adjusted December 0.2% 0.5%

07:00 Germany Retail sales, real unadjusted, y/y December 2.3% 2%

08:00 Switzerland KOF Leading Indicator January 96.6 96

09:00 Eurozone Private Loans, Y/Y December 1.4% 1.5%

09:00 Eurozone M3 money supply, adjusted y/y December 5.1% 5.2%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) January 0.2% 0.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) January 0.9% 0.9%

13:30 Canada Industrial Product Price Index, m/m December -0.2% -0.3%

13:30 Canada Industrial Product Price Index, y/y December -0.2%

13:30 Canada GDP (m/m) November 0.0% 0.3%

13:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter IV 1.4% 1.2%

13:30 U.S. PCE price index, q/q (Preliminary) Quarter IV 1.3% 0.7%

13:30 U.S. GDP, q/q (Preliminary) Quarter IV 2.0% 0.8%

14:45 U.S. Chicago Purchasing Managers' Index January 42.9 45

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) January 92.6 93

-