Noticias del mercado

-

21:00

Dow +1.82% 16,362.27 +292.63 Nasdaq +1.56% 4,577.07 +70.39 S&P +1.78% 1,927.08 +33.72

-

18:59

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Friday after weak GDP data raised expectations that the U.S. Federal Reserve would go slow on future interest rate hikes. U.S. gross domestic product rose 0,7% in the fourth quarter, below the 0,8% expected, as a strong dollar and tepid global demand hurt exports. While the Fed has not ruled out another rate hike in March, the current turmoil could force it to wait until June.

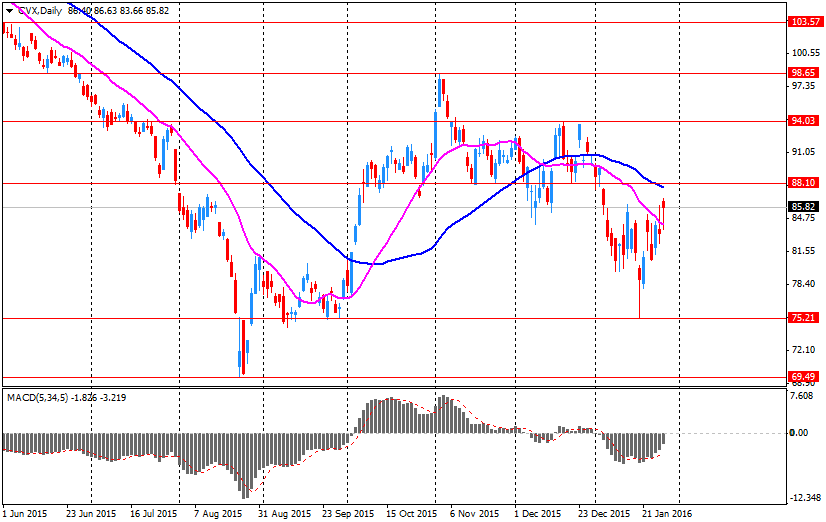

Most of Dow stocks in positive area (26 of 30). Top looser - Chevron Corporation (CVX, -1,25%). Top gainer - Microsoft Corporation (MSFT, +5,61%).

All S&P sectors in positive area. Top gainer - Technology (+2,4%).

At the moment:

Dow 16262.00 +290.00 +1.82%

S&P 500 1918.75 +38.00 +2.02%

Nasdaq 100 4239.75 +86.00 +2.07%

Oil 33.51 +0.29 +0.87%

Gold 1116.80 +0.70 +0.06%

U.S. 10yr 1.92 -0.06

-

17:59

European stocks close: stocks closed higher on the Bank of Japan's interest rate decision

Stock indices closed higher on the Bank of Japan's (BoJ) interest rate decision. The central bank on Friday lowered its interest rate for the first time ever to -0.1% from 0.1%, adding that it could cut its interest rate further if needed. Analysts did not expect this decision.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone rose to 0.4% year-on-year in January from 0.2% in December, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco climbed to an annual rate of 1.0% in January from 0.9% in December. Analysts had expected the index to remain unchanged at 0.9%.

Food, alcohol and tobacco prices were up 1.1% in January, non-energy industrial goods prices gained 0.7%, and services prices climbed 1.2%, while energy prices dropped 5.3%.

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 4.7% in December from last year, missing expectations for a 5.2% gain, after a 5.1 % increase in November.

Loans to the private sector in the Eurozone climbed 1.4% in December from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

Credit to the private sector dropped to 0.8% year-on-year in December from 1.2% in November.

European Central Bank (ECB) Governing Council member Jens Weidmann said in an interview with the German newspaper Frankfurter Allgemeine Zeitung published on Friday that the central bank should not add further stimulus measures as inflation excluding volatile energy and food prices was rising. He noted that low oil prices weigh on inflation.

Weidmann warned that the ECB's asset-buying programme could have the same effect as buying government bonds directly from issuer countries, adding that it is forbidden.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,059.5 +127.72 +2.15 %

DAX 9,798.11 +158.52 +1.64 %

CAC 40 4,417.02 +94.86 +2.19 %

-

17:44

WSE: Session Results

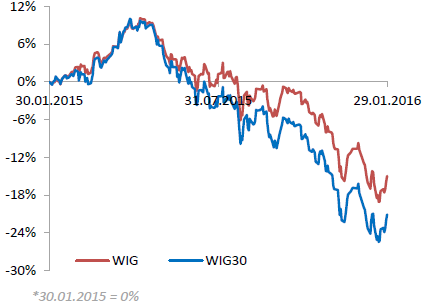

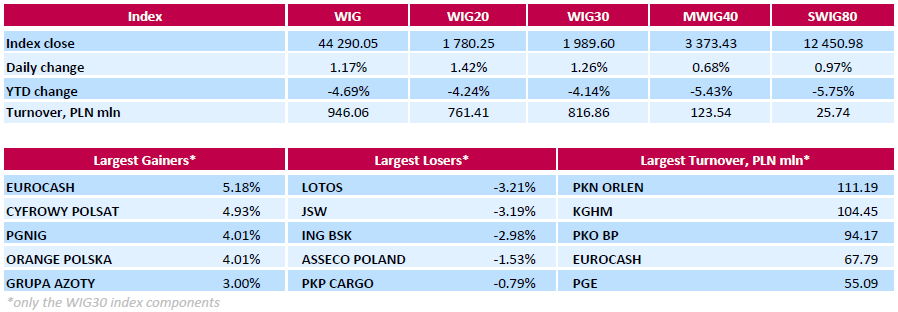

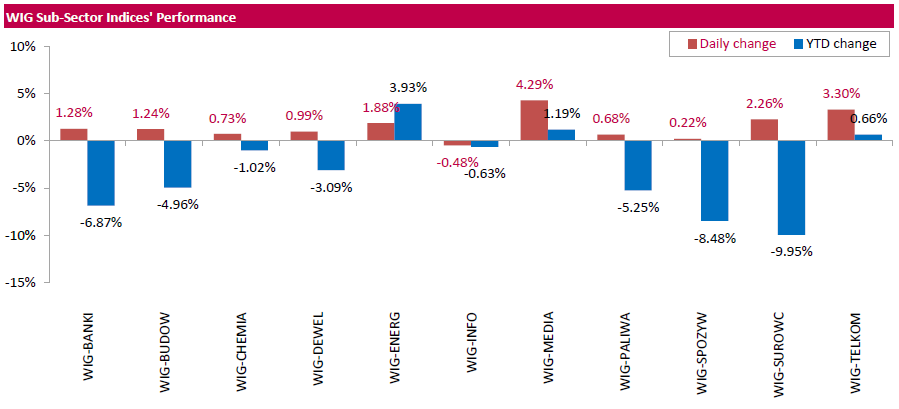

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, added 1.17%. All sectors, but for IT industry (-0.48%), did well with media sector stocks (+4.29%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced by 1.26%. In the WIG30 index, the strongest performers were FMCG wholesaler EUROCASH (WSE: EUR), oil and gas producer PGNIG (WSE: PGN), media and telecommunications group CYFROWY POLSAT (WSE: CPS), telecommunication services provider ORANGE POLSKA (WSE: OPL) and oil and gas producer PGNIG (WSE: PGN), gaining 4.01%-5.18%. On the other side of the ledger, oil refiner LOTOS (WSE: LTS) led the decliners with a 3.21% decline, followed by coking coal miner JSW (WSE: JSW) and bank ING BSK (WSE: ING), plunging by 3.19% and 2.98% respectively.

-

17:08

Bank of Japan Governor Haruhiko Kuroda: negative interest rate does not replace the current quantitative easing

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a press conference on Friday that negative interest rate does not replace the current quantitative easing, adding that its additional stimulus measure.

The central bank on Friday lowered its interest rate to -0.1% from 0.1%, added that it could cut its interest rate further if needed. Analysts did not expect this decision.

Only 5 of 9 board members voted for the interest rate cut.

-

16:53

The People's Bank of China injects 100 billion yuan into market

The People's Bank of China (PBoC) on Friday injected 100 billion yuan ($15 billion) into market to boost liquidity via seven-day reverse repos and 28-day reverse repos.

The central bank's injection this week totalled 690 billion yuan.

The central bank usually injects extra money before the Lunar New Year holiday.

-

16:44

U.S. employment cost index rises 0.6% in fourth quarter

The U.S. Bureau of Labour Statistics released its employment cost index on Friday. The U.S. employment cost index rose 0.6% in fourth quarter, after a 0.6% gain in third quarter.

The increase was driven by higher benefits payments for state and local government employees.

Wages and salaries increased 0.6% in the fourth quarter, after a 0.6% rise in the third quarter, while benefits payments climbed 0.7% in the fourth quarter, after a 0.5% increase in the third quarter.

-

16:33

Producer prices in Australia increase 0.3% in the fourth quarter

The Australian Bureau of Statistics released its producer prices data on Friday. Producer prices in Australia increased 0.3% in the fourth quarter, missing expectations for a 0.6% rise, after a 0.9% gain in the third quarter.

The increase was mainly driven by rises in the prices received for building construction, other transport equipment manufacturing and sheep, beef cattle grain farming and dairy farming.

On a yearly basis, producer prices climbed 1.9% in the fourth quarter, after a 1.7% increase in the third quarter.

-

16:26

Housing starts in Japan fall 1.3% year-on-year in December

Japan's Ministry of Land, Infrastructure, Transport and Tourism released its housing starts data on Friday. Housing starts in Japan fell 1.3% year-on-year in December, missing expectations for a 0.5% gain, after a 1.7% increase in November.

On a yearly basis, housing starts were down to 860,000 in December from 879,000 in November.

Construction orders jumped 14.8% year-on-year in December, after 5.7% rise in November.

-

16:18

Thomson Reuters/University of Michigan final consumer sentiment index declines to 92.0 in January

The Thomson Reuters/University of Michigan final consumer sentiment index decreased to 92.0 in January from 92.6 in December, down from the preliminary estimate of 93.3 and missing expectations a rise to 93.0.

"The small downward revisions were due to stock market declines that were reflected in the erosion of household wealth, as well as weakened prospects for the national economy," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

The current economic conditions index declined to 106.4 in January from 108.1 in December, up from a preliminary reading of 105.1.

The index of consumer expectations remained unchanged at 82.7 in January, down from a preliminary reading of 85.7.

-

16:08

Chicago purchasing managers' index jumps to 55.6 in January

The Institute for Supply Management released its Chicago purchasing managers' index on Friday. The Chicago purchasing managers' index climbed to 55.6 in January from 42.9 in December, exceeding expectations for an increase to 42.9.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The increase was driven by a rise in production and in new orders. The production index posted a double digit growth in January, while the new orders index was up to 58.8 from 38.6.

The employment index rose moderately.

"While the surge in activity in January marks a positive start to the year, it follows significant weakness in the previous two months, with the latest rise not sufficient to offset the previous falls in output and orders," Chief Economist of MNI Indicators Philip Uglow said.

-

15:59

Private sector credit in Australia rises 0.5% in December

The Reserve Bank of Australia (RBA) released its private sector credit data on Friday. The total value of private sector credit in Australia rose 0.5% in December, missing expectations for a 0.6% gain, after a 0.4% increase in November.

Housing credit increased 0.5% in December, personal credit was flat, while business credit rose 0.5%.

On a yearly basis, the private sector credit in Australia jumped 6.6% in December, after a 6.6% in November.

-

15:40

Japan’s unemployment rate remains unchanged 3.3% in December

Japan's Ministry of Internal Affairs and Communications released its unemployment rate on late Thursday evening. Unemployment rate in Japan remained unchanged 3.3% in December, in line with expectations.

The number of unemployed persons fell by 60,000 in December to 2.04 million.

The number of employed persons rose by 280,000 in December to 63.85 million.

-

15:34

U.S. Stocks open: Dow +0.60%, Nasdaq +0.19%, S&P +0.44%

-

15:31

Spanish current account deficit narrows to €2.11 billion in November

The Bank of Spain released its current account data on Monday. Spain's current account surplus narrowed to €2.11 billion in November from €2.40 billion in October.

The surplus on trade in goods and services totalled €2.0 billion in November, while the deficit on primary and second income totalled €0.1 billion.

-

15:30

Before the bell: S&P futures +0.69%, NASDAQ futures +0.48%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 17,518.3 +476.85 +2.8%

Hang Seng 19,683.11 +487.28 +2.5%

Shanghai Composite 2,737.65 +81.98 +3.1%

FTSE 5,993.86 +62.08 +1.0%

CAC 4,350.63 +28.47 +0.7%

DAX 9,679.57 +39.98 +0.4%

Crude oil $33.77 (+1.66%)

Gold $1113.90 (-0.15%)

-

15:19

Greek retail sales slides 4.7% in November

The Greek statistical office Hellenic Statistical Authority released its retail sales data on Friday. Greek retail sales slid 4.7% in November.

On a yearly basis, Greek retail sales fell by 4.5% in November, after a 2.4% drop in October. October's figure was revised up from a 2.5% decline.

Sales of food products decreased by 5.3% year-on-year in November, sales of non-food products fell by 1.2%, while sales of automotive fuel dropped by 14.9%.

-

15:14

Greek producer prices decrease 3.0% in December

The Hellenic Statistical Authority released its producer price index (PPI) data on Friday. Greek producer prices decreased 3.0% in December.

Domestic market prices fell by 2.3% in December, while foreign market prices slid 5.3%.

On a yearly basis, Greek PPI plunged 7.8% in December, after a 8.5% drop in November.

Domestic market prices slid 5.7% year-on-year in December, while foreign market prices dropped 14.0%.

Energy prices plunged 14.9% year-on-year in December, while non-durable consumer goods industrial prices were up 0.4%.

In 2015 as whole, Greek producer prices slid 7.2%, after a 1.2% fall in 2014.

-

15:06

Producer prices in Italy decrease 0.7% in December

The Italian statistical office Istat released its producer price inflation data for Italy on Friday. Italian producer prices decreased 0.7% in December, after a 0.4% decline in November. November's figure was revised up from a 0.5% drop.

Producer price declined by 0.7% on domestic market and by 0.5% on non-domestic market in December.

On a yearly basis, Italian PPI fell 3.3% in December, after a 3.2% drop in November. November's figure was revised up from a 3.3% fall.

Producer price slid 4.0% on domestic market and by 0.9% on non-domestic market in December.

-

15:01

U.S. economy expands at 0.7% in the fourth quarter

The U.S. Commerce Department released gross domestic product data on Friday. The U.S. preliminary gross domestic product increased by 0.7% in the fourth quarter, missing expectations for a 0.8% gain, after a 2.0% rise in the third quarter.

The slower rise was mainly driven by a slower rise in consumer spending.

Consumer spending grew 2.2% in the fourth quarter, after a 3.0% increase in the third quarter.

Exports declined 2.5% in fourth quarter as a strong U.S. dollar weighed on exports, while imports increased 1.1%.

In 2015 as whole, the U.S. economy expanded 2.4%, after a 2.4% growth in 2014.

The personal consumption expenditures (PCE) price index rose 0.1% in the fourth quarter, missing expectations for a 0.7% gain, after a 1.3% increase in the third quarter.

The personal consumption expenditures (PCE) price index excluding food and energy increased 1.2% in the fourth quarter, in line with forecasts, after a 1.4% gain in the third quarter.

The personal consumption expenditures (PCE) price index is the Fed's preferred measure for inflation. The Fed's inflation target is 2%.

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Microsoft Corp

MSFT

54.22

4.16%

190.5K

Merck & Co Inc

MRK

50.25

2.13%

3.7K

Yandex N.V., NASDAQ

YNDX

13.38

1.90%

3.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

4.50

1.81%

72.1K

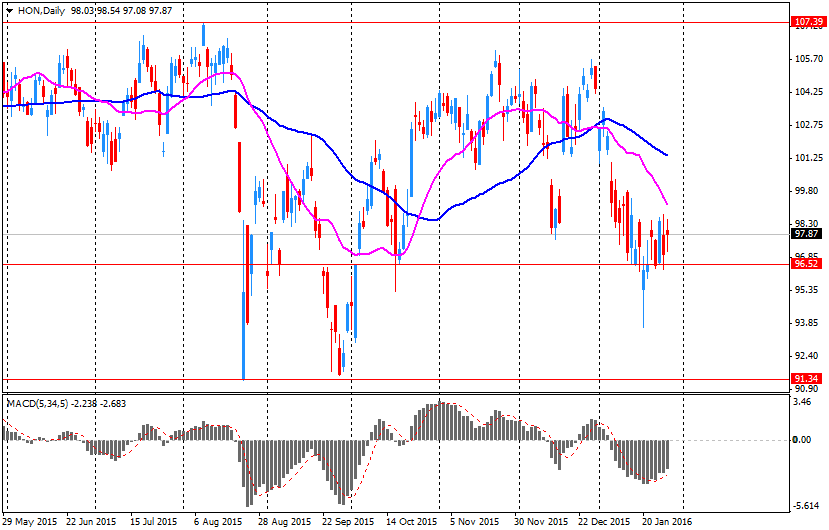

HONEYWELL INTERNATIONAL INC.

HON

99.05

1.10%

1.3K

Yahoo! Inc., NASDAQ

YHOO

29.00

0.87%

2.0K

Twitter, Inc., NYSE

TWTR

16.62

0.79%

3.6K

International Business Machines Co...

IBM

123.11

0.73%

2.3K

Ford Motor Co.

F

11.79

0.68%

5.2K

Cisco Systems Inc

CSCO

23.25

0.63%

23.8K

E. I. du Pont de Nemours and Co

DD

52.34

0.63%

69.1K

Citigroup Inc., NYSE

C

40.64

0.62%

8.9K

Visa

V

69.75

0.61%

25.8K

Caterpillar Inc

CAT

61.45

0.61%

783.0K

Intel Corp

INTC

30.13

0.53%

2.9K

Boeing Co

BA

118.60

0.50%

1.2K

McDonald's Corp

MCD

122.99

0.50%

1.3K

Pfizer Inc

PFE

30.35

0.50%

10.3K

General Electric Co

GE

28.34

0.46%

20.6K

ALCOA INC.

AA

7.03

0.43%

2.1K

Travelers Companies Inc

TRV

104.91

0.42%

1.8K

Verizon Communications Inc

VZ

49.21

0.41%

0.6K

Home Depot Inc

HD

122.75

0.38%

14.6K

Wal-Mart Stores Inc

WMT

64.46

0.37%

9.4K

Starbucks Corporation, NASDAQ

SBUX

59.50

0.36%

1.3K

AT&T Inc

T

35.65

0.34%

10.0K

ALTRIA GROUP INC.

MO

59.82

0.32%

2.3K

Goldman Sachs

GS

157.50

0.28%

14.1K

Walt Disney Co

DIS

93.75

0.24%

14.9K

Apple Inc.

AAPL

94.32

0.24%

112.9K

Nike

NKE

61.33

0.21%

0.1K

Procter & Gamble Co

PG

79.95

0.16%

2.5K

Johnson & Johnson

JNJ

102.35

0.08%

0.2K

American Express Co

AXP

52.90

0.04%

1.1K

Exxon Mobil Corp

XOM

76.95

-0.05%

8.8K

Facebook, Inc.

FB

109.00

-0.10%

163.0K

AMERICAN INTERNATIONAL GROUP

AIG

54.53

-0.33%

0.2K

Google Inc.

GOOG

727.49

-0.47%

8.8K

Tesla Motors, Inc., NASDAQ

TSLA

188.37

-0.70%

1.9K

Chevron Corp

CVX

84.75

-1.36%

64.4K

Barrick Gold Corporation, NYSE

ABX

9.50

-1.66%

17.1K

Amazon.com Inc., NASDAQ

AMZN

571.00

-10.13%

137.2K

-

14:53

Upgrades and downgrades before the market open

Upgrades:

Bank of America (BAC) upgraded to Outperform at Credit Agricole

Downgrades:

Other:

Microsoft (MSFT) target raised to $40 from $39 at Jefferies

Microsoft (MSFT) target raised to $63 from $60 at FBR Capital

Microsoft (MSFT) target raised to $55 from $50 at Wunderlich

Microsoft (MSFT) target lowered to $58 from $64 at BMO Capital Markets

Amazon (AMZN) target lowered to $685 from $720 at Mizuho

Alphabet A (GOOGL) target raised to $800 from $740 at Wedbush

-

14:51

-

14:48

Canada's GDP rises 0.3% in November

Statistics Canada released GDP (gross domestic product) growth data on Friday. Canada's GDP growth rose 0.3% in November, in line with expectations, after a flat reading in October.

The increase was driven by rises in manufacturing, mining, quarrying, and oil and gas extraction, and wholesale and retail trade sector.

The mining, quarrying, and oil and gas extraction sector rose 0.6% in November, manufacturing output increased 0.4%, and wholesale output gained 1.3%, while the retail trade sector climbed 1.2%.

-

14:42

Canadian industrial product and raw materials prices decline in December

Statistics Canada released its industrial product and raw materials price indexes on Friday. The Industrial Product Price Index (IPPI) fell 0.2% in December, beating forecasts for a 0.3% drop, after a 0.3% decline in November. November's figure was revised down from 0.2% decrease.

The decrease was mainly driven by lower prices for energy and petroleum products, which slid 5.4% in December.

16 of the 21 commodity groups increased and 5 declined.

The Raw Materials Price Index (RMPI) dropped 5.0% in December, after a 4.1% fall in November. November's figure was revised down from a 4.0% decline.

The drop was driven by lower prices for crude energy products. Crude energy products plunged by 11.9% in December.

3 of the 6 commodity groups rose and 3 decreased.

-

14:26

Building permits in New Zealand increase 2.3% in December

Statistics New Zealand released its building permits data on late Thursday evening. Building permits in New Zealand increased 2.3% in December, after a 2.4% gain in November. November's figure was revised up from a 1.8% rise.

Residential work rose 22% year-on-year in December, while non-residential work climbed 29%.

"Last year was the ninth-highest year on record for dwelling consents, beaten only by the building booms in the 1970s and early 2000s. The largest increases in 2015 were for townhouses and apartments. Consents for houses also increased, while retirement village units decreased very slightly," business indicators manager Clara Eatherley said.

-

13:52

Company News: Honeywell (HON) Q4 Earnings Miss Expectations

Honeywell reported Q4 FY 2015 earnings of $1.58 per share (versus $1.43 in Q4 FY 2014), missing analysts' consensus of $1.59.

The company's quarterly revenues amounted to $9.982 bln (-2.8% y/y), in line with consensus estimate of $9.984 bln.

Honeywell reaffirmed guidance for FY 2016, projecting EPS of $6.45-6.70 (versus analysts' consensus of $6.57) and revenues of $39.9-40.9 bln (versus analysts' consensus of $40.52 bln).

HON rose to $97.97 (+1.04%) in yesterday's trading.

-

12:27

European stock markets mid session: stocks traded higher on the Bank of Japan’s interest rate decision

Stock indices traded higher on the Bank of Japan's (BoJ) interest rate decision. The central bank on Friday lowered its interest rate for the first time ever to -0.1% from 0.1%, adding that it could cut its interest rate further if needed. Analysts did not expect this decision.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone rose to 0.4% year-on-year in January from 0.2% in December, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco climbed to an annual rate of 1.0% in January from 0.9% in December. Analysts had expected the index to remain unchanged at 0.9%.

Food, alcohol and tobacco prices were up 1.1% in January, non-energy industrial goods prices gained 0.7%, and services prices climbed 1.2%, while energy prices dropped 5.3%.

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 4.7% in December from last year, missing expectations for a 5.2% gain, after a 5.1 % increase in November.

Loans to the private sector in the Eurozone climbed 1.4% in December from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

Credit to the private sector dropped to 0.8% year-on-year in December from 1.2% in November.

Current figures:

Name Price Change Change %

FTSE 100 5,993.79 +62.01 +1.05 %

DAX 9,694.09 +54.50 +0.57 %

CAC 40 4,357.57 +35.41 +0.82 %

-

12:22

French economy expands 0.2% in the fourth quarter

The French statistical office Insee released its gross domestic product (GDP) growth for France on Friday. France's preliminary GDP climbed 0.2% in the fourth quarter, in line with expectations, after a 0.3% rise in the third quarter.

Total production in goods and services was up 0.5% in the fourth quarter, after a 0.3% rise in the third quarter.

Households' spending decline 0.4% in the fourth quarter, after a 0.3% gain in the third quarter.

Export increased 0.6% in the fourth quarter, while imports rose 1.6%.

On a yearly basis, France's GDP rose to 1.5% in the fourth quarter from 1.1% in the third quarter.

In 2015 as whole, the French economy expanded 1.1%, after a 0.2% growth in 2014.

-

12:16

French consumer spending rises 0.7% in December

French statistical office INSEE released its consumer spending data on Friday. French consumer spending rose 0.7% in December, after a 1.4% drop in November. November's figure was revised down from a 1.1% decline.

The increase was mainly driven by a rise in purchases of engineered goods. Spending on engineered goods climbed by 1.6% in December, driven by higher textile-clothing purchases.

Spending on food rose 1.2% in December, while spending on energy fell 2.5%.

On a yearly basis, consumer spending climbed 0.3% in December.

In 2015 as whole, consumer spending rose 1.8%, driven by the rebound in energy consumption.

-

12:08

French producer prices decrease 1.2% in December

French statistical office INSEE released its producer price index (PPI) data on Friday. French producer prices decreased 1.2% in December, after a 0.2% rise in November.

The increase was driven a rise in prices for mining and quarrying products, energy and water, and in manufactured industry.

On a yearly basis, French PPI fell 2.8% in December.

The annual drop was driven by a decline in prices for coke and refined petroleum products, which slid 28.8 year-on-year in December.

Import prices decreased 1.7% in December, after a 0.1% increase in November.

-

11:59

French preliminary consumer price inflation declines 1.0% in January

The French statistical office Insee released its preliminary consumer price inflation for France on Friday. The French consumer price inflation declined 1.0% in January, after a 0.2% rise in December.

On a yearly basis, the consumer price index rose 0.2% in January, after a 0.2% increase in December.

Fresh food prices rose 2.2% year-on-year in January, services prices climbed 1.0%, while energy prices dropped by 4.0%.

-

11:52

GfK’s U.K. consumer confidence index increases to 4 in January

Gfk released its consumer confidence index for the U.K. on Friday. GfK's U.K. consumer confidence index increased to 4 in January from 2 in December. Analysts had expected the index to decline to 1.

4 of 5 measures increased and 1 was unchanged.

"UK consumers remain resiliently bullish this month with no sign of the January Blues denting their view on the state of their personal finances for both the past year and also for the rest of 2016," Joe Staton, Head of Market Dynamics at GfK, said.

-

11:46

Preliminary consumer price inflation in Spain slides 1.9% in January

The Spanish statistical office INE released its preliminary consumer price inflation data on Friday. Consumer price inflation in Spain slides 1.9% in January, after a 0.3% fall in December.

On a yearly basis, consumer prices fell by 0.3% in January, after a flat reading in December.

The annual decline was mainly driven by the drop in in the prices of electricity.

-

11:42

Spain’s economy expands 0.8% the fourth quarter

The Spanish statistical office INE released its preliminary gross domestic product (GDP) for Spain on Friday. Spain's economy expanded 0.8% the fourth quarter, after a 0.8% growth in the third quarter. It was the tenth consecutive increase.

On a yearly, GDP grew 3.5% in the fourth quarter, after a 3.4% in the third quarter. It was the fastest growth since the fourth quarter of 2007.

In 2015 as whole, Spain's economy expanded 3.2%.

-

11:35

German adjusted retail sales decrease 0.2% in December

Destatis released its retail sales for Germany on Friday. German adjusted retail sales decreased 0.2% in December, missing forecasts of a 0.5% gain, after a 0.4% rise in November. November's figure was revised up from a 0.2% increase.

On a yearly basis, German unadjusted retail sales jumped 1.5% in December, missing expectations for a 2.0% gain, after a 2.4% rise in November. November's figure was revised up from a 2.3% increase.

Sales of non-food products increased at an annual rate of 1.0% in December, while sales of food, beverages and tobacco products climbed by 2.0%.

In 2015 as whole, retail sales in real terms rose 2.7%, after a 1.2% increase in 2014.

-

11:27

M3 money supply in the Eurozone rises 4.7% in December from last year

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 4.7% in December from last year, missing expectations for a 5.2% gain, after a 5.1 % increase in November.

Loans to the private sector in the Eurozone climbed 1.4% in December from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

Credit to the private sector dropped to 0.8% year-on-year in December from 1.2% in November.

Loans to non-financial corporations fell to 0.3% year-on-year in December from 0.7% in November.

-

11:20

Preliminary consumer price inflation in the Eurozone rises to 0.4% year-on-year in January

Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone rose to 0.4% year-on-year in January from 0.2% in December, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco climbed to an annual rate of 1.0% in January from 0.9% in December. Analysts had expected the index to remain unchanged at 0.9%.

Food, alcohol and tobacco prices were up 1.1% in January, non-energy industrial goods prices gained 0.7%, and services prices climbed 1.2%, while energy prices dropped 5.3%.

-

11:02

KOF leading indicator for Switzerland climbs to 100.3 in January

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Friday. The KOF leading indicator climbed to 100.3 in January from 96.8 in December, beating expectations for a fall to 96.0. December's figure was revised up from 96.6.

The increase was mainly driven by the manufacturing industry.

"The momentum of the Swiss economy in the near future can be expected to evolve close to its long-term average," the KOF said.

-

10:57

European Central Bank Governing Council member Jens Weidmann: the central bank should not add further stimulus measures as inflation excluding volatile energy and food prices was rising

European Central Bank (ECB) Governing Council member Jens Weidmann said in an interview with the German newspaper Frankfurter Allgemeine Zeitung published on Friday that the central bank should not add further stimulus measures as inflation excluding volatile energy and food prices was rising. He noted that low oil prices weigh on inflation.

Weidmann warned that the ECB's asset-buying programme could have the same effect as buying government bonds directly from issuer countries, adding that it is forbidden.

-

10:48

Bank of Japan cuts its interest rate to -0.1% from 0.1% in January

The Bank of Japan (BoJ) released its interest rate decision on Friday. The central bank lowered its interest rate to -0.1% from 0.1%, added that it could cut its interest rate further if needed. Analysts did not expect this decision.

Only 5 of 9 board members voted for the interest rate cut.

The BoJ tries to boost inflation toward its 2% target. The central bank expects inflation to reach 2% target in the first half of the fiscal year 2017.

The BoJ lowered its inflation forecasts. Inflation is expected to be 0.8% in the fiscal year 2016, down from the previous estimate of 1.4%.

The central bank upgraded its growth forecast for the fiscal year 2016 to 1.5% from 1.4%.

-

10:33

Preliminary industrial production in Japan drops 1.4% in December

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Thursday evening. Preliminary industrial production in Japan dropped 1.4% in December, after a 0.9% fall in November.

The drop was mainly driven by declines in general-purpose, production and business oriented machinery, electronic parts and devices, and transport equipment.

According to a survey by the ministry, industrial production is expected to rise 7.6% in January, and to decline 4.1% in February.

On a yearly basis, Japan's industrial production was down 1.6% in December, after a 1.7% rise in November.

-

10:26

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 44.6 in in the week ended January 24

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy rose to 44.6 in in the week ended January 24 from 44.0 the prior week.

The increase was driven by rises in buying climate and personal finances sub-indexes. The measure of views of the economy declined to 37.2 from 37.7, the buying climate index was up to 40.2 from 39.2, while the personal finances index climbed to 56.3 from 55.0.

-

10:11

Japan's national CPI declines to an annual rate of 0.2% in December

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Thursday evening. Japan's national consumer price index (CPI) declined to an annual rate of 0.2% in December from 0.3% in November, in line with expectations.

The slower increase was mainly driven by declines in fuel, light and water charges, and transportation and communication prices.

Japan's national CPI excluding fresh food remained unchanged at an annual rate of 0.1% in December, in line with expectations.

The Bank of Japan's inflation target is 2%.

Household spending in Japan fell 4.4% year-on-year in December, missing expectations of a 2.4% drop, after a 2.9% decline in November.

-

07:23

Global Stocks: U.S. stock indices rose

U.S. stock indices followed oil prices and rose on Thursday.

The Dow Jones Industrial Average gained 125.18 points, or 0.8%, to 16,069.64. The S&P 500 climbed 10.41 points, or 0.6%, to 1,893.36 (health care was the only sector to finish lower with a 2.3% decline). The Nasdaq Composite rose 38.51 points, or 0.9%, to 4,506.68.

Analysts expect profits of S&P's companies to have declined by 6.3% in the fourth quarter compared to a decline of 7% expected a week ago.

Meanwhile the Department of Commerce reported that U.S. durable goods orders fell in December partly because of a sharp decline in demand for aircrafts. Orders fell by 5.1% after a 0.5% in November. Economists had expected a 0.6% decline.

This morning in Asia Hong Kong Hang Seng rose 1.80%, or 346.39, to 19,542.22. China Shanghai Composite Index surged 2.49%, or 66.16, to 2,721.82. The Nikkei gained 2.51%, or 428.26, to 17,469.71.

Asian stock indices rose. The Bank of Japan unexpectedly introduced negative rates cutting the deposit rate to -0.1% from 0.1%. The bank said this step was taken in order to stimulate inflation growth. According to the statement, the BOJ would keep the rate negative for "as long as it is necessary for maintaining that target in a stable manner."

Some analysts say that many market participants might have thought that the BOJ was running out of tools.

-

03:02

Nikkei 225 16,994.81 -46.64 -0.27 %, Hang Seng 19,271.28 +75.45 +0.39 %, Shanghai Composite 2,661.6 +5.94 +0.22 %

-

01:04

Stocks. Daily history for Sep Jan 28’2016:

(index / closing price / change items /% change)

Nikkei 225 17,041.45 -122.47 -0.71 %

Hang Seng 19,195.83 +143.38 +0.75 %

Shanghai Composite 2,655.66 -79.90 -2.92 %

FTSE 100 5,931.78 -58.59 -0.98 %

CAC 40 4,322.16 -58.20 -1.33 %

Xetra DAX 9,639.59 -241.23 -2.44 %

S&P 500 1,893.36 +10.41 +0.55 %

NASDAQ Composite 4,506.68 +38.51 +0.86 %

Dow Jones 16,069.64 +125.18 +0.79 %

-