Noticias del mercado

-

22:06

The main US stock indexes ended the session mostly in positive territory

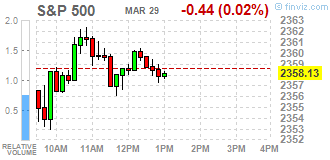

The main US stock indexes mostly rose during today's trading. The profits of the energy and health sectors supported the S & P 500 and Nasdaq, but the Dow Jones Industrial Average declined due to losses in the financial sector.

A certain influence on the dynamics of trading was provided by the US. As it became known today, the number of signed contracts for the sale of houses grew in February and was at the second highest level in a decade. Unfinished transactions for the sale of housing in February rose by 5.5% after falling by 2.8% in January, the National Association of Realtors (NAR) reported. The report said that the stock market growth and permanent hiring contributed to an increase, as well as fears of home buyers for rising interest rates. The NAR added that the warmest February for decades also played a role. NAR predicts a 2.3% increase in sales on the secondary housing market and a 4% increase in average house prices in 2017.

At the same time, the cost of oil jumped by more than 2% against the background of the report of the US Energy Ministry, which reflected a weaker increase in oil reserves and a reduction in gasoline and distillate stocks. The market was also supported by a violation of supplies of Libyan oil and the growing likelihood of an extension of the agreement on production reduction.

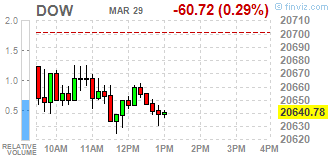

The components of the DOW index mostly decreased (18 out of 30). More shares fell UnitedHealth Group Incorporated (UNH, -1.09%). The leader of growth were shares of Chevron Corporation (CVX, + 0.72%).

Most sectors of the S & P index ended the session in positive territory. The leader of growth was the sector of basic materials (+ 1.0%). The financial sector fell most (-0.4%).

At closing:

DJIA -0.20% 20.660.55 -40.95

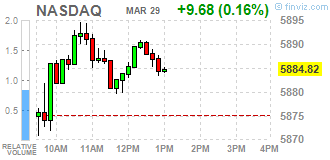

Nasdaq + 0.38% 5,897.55 +22.41

S & P + 0.11% 2,361.18 +2.61

-

21:00

DJIA -0.11% 20,677.72 -23.78 Nasdaq +0.38% 5,897.70 +22.56 S$P +0.15% 2,362.12 +3.55

-

19:06

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed. Gains in energy and consumer discretionary stocks propped up the S&P 500 and the Nasdaq on Wednesday, but the Dow Jones Industrial Average slipped due to losses in financial stocks.

Most of Dow stocks in positive area (22 of 30). Top loser, UnitedHealth Group Incorporated (UNH, -1.50%). Top gainer - Merck & Co., Inc. (MRK, +1.06%).

Most of S&P sectors also in positive area. Top loser Financials (-0.5%). Top gainer - Basic Materials (+0.8%).

At the moment:

Dow 20586.00 -39.00 -0.19%

S&P 500 2355.25 +3.75 +0.16%

Nasdaq 100 5420.50 +15.50 +0.29%

Oil 49.38 +1.01 +2.09%

Gold 1251.50 -4.10 -0.33%

U.S. 10yr 2.38 -0.02

-

18:00

European stocks closed: FTSE 100 +30.30 7373.72 +0.41% DAX +53.58 12203.00 +0.44% CAC 40 +22.84 5069.04 +0.45%

-

16:36

U.S. commercial crude oil inventories rose less than expected

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 0.9 million barrels from the previous week. At 534.0 million barrels, U.S. crude oil inventories are at the upper limit of the average range for this time of year.

Total motor gasoline inventories decreased by 3.7 million barrels last week, but are in the upper half of the average range. Both finished gasoline inventories and blending components inventories decreased last week. Distillate fuel inventories decreased by 2.5 million barrels last week but are in the upper half of the average range for this time of year. Propane/propylene inventories fell 1.5 million barrels last week but are in the middle of the average range. Total commercial petroleum inventories decreased by 3.9 million barre ls last week.

-

16:30

U.S.: Crude Oil Inventories, March 0.867

-

16:10

US pending home sales rebounded sharply in February to their highest level in nearly a year

Pending home sales rebounded sharply in February to their highest level in nearly a year and second-highest level in over a decade, according to the National Association of Realtors. All major regions saw a notable hike in contract activity last month.

Lawrence Yun, NAR chief economist, says February's convincing bump in pending sales is proof that demand is rising with spring on the doorstep. "Buyers came back in force last month as a modest, seasonal uptick in listings were enough to fuel an increase in contract signings throughout the country," he said. "The stock market's continued rise and steady hiring in most markets is spurring significant interest in buying, as well as the expectation from some households that delaying their home search may mean paying higher interest rates later this year."

-

16:00

U.S.: Pending Home Sales (MoM) , February 5.5% (forecast 2.4%)

-

15:42

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0675 (EUR 402m) 1.0710 (435m) 1.0730 (578m) 1.0750 (404m) 1.0800 (306m) 1.0900 (257m) 1.0960 (204m)

USDJPY: 109.80-90 (USD 395m) 110.00 (240m) 110.80 (635m) 111.00 (456m) 112.00 (656m) 112.20 (360m) 112.40-50 (780m)

GBPUSD: 1.2500 (GBP 185m) 1.2550 (310m)

EURGBP 0.8750 (EUR 205m)

AUDUSD: 0.7470 (AUD 525m) 0.7500 (420m) 0.7550 (195m) 0.7597 (685m) 0.7740-50 (395m)

USDCAD 1.3275 (USD 225m) 1.3300 (351m) 1.3350-60 (275m) 1.3550 (240m)

NZDUSD 0.6950 (NZD 205m)

EURJPY 120.50 (EUR 220m)

-

15:31

U.S. Stocks open: Dow -0.17%, Nasdaq 0.00%, S&P -0.11%

-

15:27

Fed's Evans says he sees notable upside risks to growth

-

Sees inflation reaching 2 pct goal by 2019

-

Good progress toward Fed's goals explains his support for rate hikes

-

An inflation rate of 2.5 pct for a time is consistent with goals

-

Tax reform unlikely to sustainably boost low productivity growth

-

-

15:24

Before the bell: S&P futures +0.03%, NASDAQ futures +0.12%

U.S. stock-index futures were flat, as investors turned their attention to Europe, where Britain formally launched the process for leaving the European Union (EU).

Global Stocks:

Nikkei 19,217.48 +14.61 +0.08%

Hang Seng 24,392.05 +46.18 +0.19%

Shanghai 3,241.31 -11.63 -0.36%

FTSE 7,331.07 -12.35 -0.17%

CAC 5,055.71 +9.51 +0.19%

DAX 12,208.93 +59.51 +0.49%

Crude $48.58 (+0.43%)

Gold $1,252.60 (-0.24%)

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

859.55

3.55(0.41%)

21800

Apple Inc.

AAPL

143.63

-0.17(-0.12%)

83716

AT&T Inc

T

41.63

0.07(0.17%)

1262

Caterpillar Inc

CAT

92.5

-0.45(-0.48%)

2612

Cisco Systems Inc

CSCO

34.01

-0.01(-0.03%)

6384

Citigroup Inc., NYSE

C

59.55

0.13(0.22%)

32371

Exxon Mobil Corp

XOM

81.75

-0.09(-0.11%)

1862

Facebook, Inc.

FB

141.85

0.09(0.06%)

43616

Ford Motor Co.

F

11.77

0.12(1.03%)

50967

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.55

-0.02(-0.16%)

26228

General Electric Co

GE

29.59

-0.03(-0.10%)

3557

General Motors Company, NYSE

GM

35.54

-0.02(-0.06%)

10519

Goldman Sachs

GS

229.6

0.27(0.12%)

2427

Google Inc.

GOOG

825

4.08(0.50%)

1544

International Business Machines Co...

IBM

174.42

-0.09(-0.05%)

371

JPMorgan Chase and Co

JPM

88.64

0.04(0.05%)

17802

McDonald's Corp

MCD

129.35

-0.10(-0.08%)

529

Merck & Co Inc

MRK

63.54

0.20(0.32%)

1014

Microsoft Corp

MSFT

65.2

-0.09(-0.14%)

1280

Nike

NKE

56.3

-0.32(-0.57%)

3713

Pfizer Inc

PFE

34.06

-0.10(-0.29%)

706

Procter & Gamble Co

PG

90.56

-0.20(-0.22%)

178

Tesla Motors, Inc., NASDAQ

TSLA

278

0.55(0.20%)

21376

The Coca-Cola Co

KO

42.33

-0.10(-0.24%)

250

Twitter, Inc., NYSE

TWTR

14.89

-0.05(-0.33%)

101231

Walt Disney Co

DIS

112.85

-0.20(-0.18%)

543

Yahoo! Inc., NASDAQ

YHOO

46.7

0.13(0.28%)

2000

Yandex N.V., NASDAQ

YNDX

22.57

0.14(0.62%)

5350

-

14:50

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Boeing (BA) initiated with a Buy at Berenberg; target $202

Amazon (AMZN) initiated with a Overweight at Barclays

Alphabet A (GOOGL) initiated with a Overweight at Barclays

Facebook (FB) initiated with a Overweight at Barclays

Twitter (TWTR) initiated with a Underweight at Barclays

Arconic (ARNC) initiated with a Market Perform at Cowen

-

14:31

Money markets show chance of ECB rate rise in december below 50 pct, from 70 pct previously - ECB Watch

-

13:43

EU's Tusk has received Article 50 letter from UK @Reuters

-

13:07

Fitch on U.S Border adjustment tax proposal: believes U.S Dollar would "appreciate markedly" if reform proposals become law

-

Proposed introduction of bat could raise burden of U.S dollar-denominated debt in ems, precipitate strains on U.S dollar-linked exchange rate regimes

-

Proposed introduction of bat could worsen current account balances and gdp growth for major exporters to U.S, reduce FDI inflows

-

Would lead to loss in row corporate tax revenues, owing to lower company profits from exports to U.S

-

U.S border adjustment tax poses risks to global sovereigns

-

-

12:13

UK court rules in pre-trial hearing that Ukraine has no "justifiable defence" in case against Russia's claim for $3 bln bond, says would not be right to let case go to full trial

-

11:39

Russia's Novak says current oil price allows to maintain supply-demand balance - Tass

-

11:19

Leaked EU statement reiterates focus on exit arrangements (ie divorce costs) over trade/transition deal @JamCSmi

-

10:38

UK money supply and lending lower than expected in February

Broad money, M4 excluding intermediate other financial corporations, increased by £7.3 billion in February with positive flows for all sectors. Together, flows for households and private non-financial corporations (PNFCs) were similar to last month.

Sterling lending to the UK private sector excluding intermediate other financial corporations, M4Lex, increased by £9.6 billion in February. There was positive net lending to all sectors, with lending to households and PNFCs broadly similar to last month.

Lending secured on dwellings rose by £3.5 billion in February, similar to the flows in recent months.

Approvals of loans secured on dwellings fell slightly in February. This was the first decline since August 2016, but at 125,622 they remain above the recent six-month average.

The net flow of consumer credit was £1.4 billion in February. The twelve-month growth rate remained at 10.5%.

Loans to non-financial businesses decreased by £1.8 billion in February, compared to the recent average increase of £0.9 billion. Loans to small and medium-sized enterprises (SMEs) increased by £0.6 billion in February.

-

10:32

United Kingdom: Net Lending to Individuals, bln, February 4.9 (forecast 4.9)

-

10:31

United Kingdom: Consumer credit, mln, February 1441 (forecast 1300)

-

10:30

United Kingdom: Mortgage Approvals, February 68.32 (forecast 69.9)

-

10:00

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.0675 (EUR 402m) 1.0710 (435m) 1.0730 (578m) 1.0750 (404m) 1.0800 (306m) 1.0900 (257m) 1.0960 (204m)

USDJPY: 109.80-90 (USD 395m) 110.00 (240m) 110.80 (635m) 111.00 (456m) 112.00 (656m) 112.20 (360m) 112.40-50 (780m)

GBPUSD: 1.2500 (GBP 185m) 1.2550 (310m)

EURGBP 0.8750 (EUR 205m)

AUDUSD: 0.7470 (AUD 525m) 0.7500 (420m) 0.7550 (195m) 0.7597 (685m) 0.7740-50 (395m)

USDCAD 1.3275 (USD 225m) 1.3300 (351m) 1.3350-60 (275m) 1.3550 (240m)

NZDUSD 0.6950 (NZD 205m)

EURJPY 120.50 (EUR 220m)

-

09:40

UK finance minister says we accept that we will not be full members of the European Customs union

-

I am very confident we will not get a worst-case outcome

-

We're confident we'll be able to negotiate a customs arrangement that makes borders as frictionless as possible after Brexit

-

We understand we can't cherry-pick in Brexit talks

-

Nobody wants to see hard border between Northern Ireland and Irish Republic after Brexit

-

We simply do not recognise some of the very large numbers being bandied about in Brussels for what UK will have to pay to EU during Brexit

-

-

09:37

Major stock markets in Europe trading in the green zone: FTSE 7372.04 +28.62 + 0.39%, DAX 12203.83 +54.41 + 0.45%, CAC 5067.36 +21.16 + 0.42%

-

08:55

Former french socialist PM Valls says plan to vote for Macron does not mean he is joining his camp for presidential election

-

08:46

France: Consumer confidence , March 100 (forecast 100)

-

08:39

Options levels on wednesday, March 29, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0943 (734)

$1.0920 (1026)

$1.0902 (118)

Price at time of writing this review: $1.0799

Support levels (open interest**, contracts):

$1.0741 (631)

$1.0696 (517)

$1.0641 (764)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 43051 contracts, with the maximum number of contracts with strike price $1,1450 (3940);

- Overall open interest on the PUT options with the expiration date June, 9 is 47470 contracts, with the maximum number of contracts with strike price $1,0350 (3812);

- The ratio of PUT/CALL was 1.10 versus 1.13 from the previous trading day according to data from March, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.2711 (873)

$1.2615 (326)

$1.2519 (769)

Price at time of writing this review: $1.2390

Support levels (open interest**, contracts):

$1.2287 (259)

$1.2190 (527)

$1.2092 (583)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 15255 contracts, with the maximum number of contracts with strike price $1,3000 (1206);

- Overall open interest on the PUT options with the expiration date June, 9 is 17475 contracts, with the maximum number of contracts with strike price $1,1500 (3055);

- The ratio of PUT/CALL was 1.15 versus 1.12 from the previous trading day according to data from March, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:37

A positive start of trading on the main European stock markets is expected: DAX + 0.3%, CAC40 + 0.4%, FTSE + 0.3%

-

08:35

Swiss consumption indicator rose to 1.50 points in February drove by tourism

The UBS consumption indicator climbed to 1.50 points in February from 1.44. Domestic tourism drove the rise still recovering from the consequences of the franc shock in early 2015.

The number of overnight hotel stays was up by 5.5% the same month in the previous year. In January, plenty of snow and the start of the skiing holidays lured many Swiss into the mountains.

The tourist regions of Graubünden (+12.0%) and Valais (+7.5%) recorded strong growth, while the number of overnight stays fell significantly in the Basel region (-22.1%).

-

08:33

Japan's retail sales rose less than expected in February

Retail sales in Japan were up a seasonally adjusted 0.2 percent on month in February, the Ministry of Economy, Trade and Industry cited by rttnews.

That missed forecasts for 0.3 percent but was unchanged from the January reading following a downward revision from 0.5 percent.

On a yearly basis, retail sales added just 0.1 percent - again shy of expectations for 0.7 percent and down from 1.0 percent in the previous month.

Sales from large retailers sank an annual 2.7 percent versus forecasts for a fall of 1.8 percent after sliding 1.1 percent a month earlier.

-

08:30

German import prices increased by 7.4% in February 2017

As reported by the Federal Statistical Office (Destatis), the index of import prices increased by 7.4% in February 2017 compared with the corresponding month of the preceding year. This was the highest increase of a yearly rate of change since April 2011 (+7.6%). In January 2017 and in December 2016 the annual rates of change were

+6.0% and +3.5%, respectively. From January 2017 to February 2017 the index rose by 0.7%.

The index of import prices, excluding crude oil and mineral oil products, increased by 4.5% compared with the level of a year earlier.

The index of export prices increased by 2.5% in February 2017 compared with the corresponding month of the preceding year. In January 2017 and in December 2016 the annual rates of change were +1.8% and +1.1%, respectively. From January 2017 to February 2017 the export price index rose by 0.2%.

-

08:00

Switzerland: UBS Consumption Indicator, February 1.50

-

07:28

Global Stocks

European stocks finished higher Tuesday, as analysts said worries were abating over whether the Trump administration will be able to push through pro-growth reforms in the world's largest economy. The pan-European benchmark slid on Monday along with equities worldwide after a Republican overhaul of the U.S. health care system fizzled, sparking worries about President Donald Trump's other business-friendly plans.

U.S. stocks posted broad-based gains Tuesday, with the Dow Jones Industrial Average snapping its eight-day losing streak, as investors cheered better-than-expected economic data. Attracting the most attention was a reading of consumer confidence in March, which soared to the highest level in more than 16 years. Separately, U.S. house prices roared to their highest in nearly three years as demand remains brisk.

Investors in Asian equities regained some of their risk appetite Wednesday following strong gains in the U.S., where better-than-expected economic data sparked optimism. In currencies, the pound continued to plunge against the dollar after U.K. Prime Minister Theresa May signed the formal letter that will trigger the nation's official separation from the economic bloc when it is delivered to European Council President Donald Tusk later Wednesday.

-

01:50

Japan: Retail sales, y/y, February 0.1% (forecast 0.5%)

-

00:29

Commodities. Daily history for Mar 28’02’2017:

(raw materials / closing price /% change)

Oil 48.44 +0.14%

Gold 1,251.40 -0.33%

-

00:28

Stocks. Daily history for Mar 28’2017:

(index / closing price / change items /% change)

Nikkei +217.28 19202.87 +1.14%

TOPIX +20.44 1544.83 +1.34%

Hang Seng +152.17 24345.87 +0.63%

CSI 300 -8.23 3469.81 -0.24%

Euro Stoxx 50 +27.93 3465.07 +0.81%

FTSE 100 +49.92 7343.42 +0.68%

DAX +153.35 12149.42 +1.28%

CAC 40 +28.77 5046.20 +0.57%

DJIA +150.52 20701.50 +0.73%

S&P 500 +16.98 2358.57 +0.73%

NASDAQ +34.77 5875.14 +0.60%

S&P/TSX +92.35 15598.57 +0.60%

-

00:27

Currencies. Daily history for Mar 28’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0812 -0,47%

GBP/USD $1,2456 -0,81%

USD/CHF Chf0,992 +0,66%

USD/JPY Y111,06 +0,39%

EUR/JPY Y120,09 -0,07%

GBP/JPY Y138,33 -0,42%

AUD/USD $0,7633 +0,26%

NZD/USD $0,7014 -0,40%

USD/CAD C$1,3379 -0,01%

-

00:00

Schedule for today,Wednesday, Mar 29’2017 (GMT0)

06:00 Switzerland UBS Consumption Indicator February 1.43

06:45 France Consumer confidence March 100 100

08:30 United Kingdom Consumer credit, mln February 1416 1300

08:30 United Kingdom Mortgage Approvals February 69.93 69.9

08:30 United Kingdom Net Lending to Individuals, bln February 4.8 4.9

12:00 United Kingdom Article 50 Brexit Process Starts

13:20 U.S. FOMC Member Charles Evans Speaks

14:00 U.S. Pending Home Sales (MoM) February -2.8% 2.4%

14:30 U.S. Crude Oil Inventories March 4.954

15:30 U.S. FOMC Member Rosengren Speaks

16:15 Eurozone ECB's Peter Praet Speaks

17:15 U.S. FOMC Member Williams Speaks

-