Noticias del mercado

-

22:06

The main US stock indexes ended the session mostly in positive territory

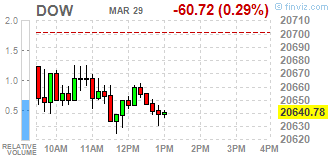

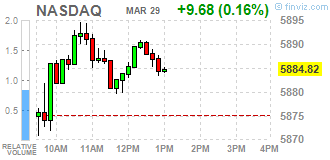

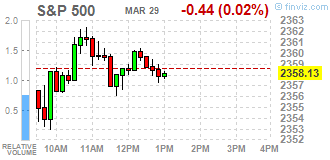

The main US stock indexes mostly rose during today's trading. The profits of the energy and health sectors supported the S & P 500 and Nasdaq, but the Dow Jones Industrial Average declined due to losses in the financial sector.

A certain influence on the dynamics of trading was provided by the US. As it became known today, the number of signed contracts for the sale of houses grew in February and was at the second highest level in a decade. Unfinished transactions for the sale of housing in February rose by 5.5% after falling by 2.8% in January, the National Association of Realtors (NAR) reported. The report said that the stock market growth and permanent hiring contributed to an increase, as well as fears of home buyers for rising interest rates. The NAR added that the warmest February for decades also played a role. NAR predicts a 2.3% increase in sales on the secondary housing market and a 4% increase in average house prices in 2017.

At the same time, the cost of oil jumped by more than 2% against the background of the report of the US Energy Ministry, which reflected a weaker increase in oil reserves and a reduction in gasoline and distillate stocks. The market was also supported by a violation of supplies of Libyan oil and the growing likelihood of an extension of the agreement on production reduction.

The components of the DOW index mostly decreased (18 out of 30). More shares fell UnitedHealth Group Incorporated (UNH, -1.09%). The leader of growth were shares of Chevron Corporation (CVX, + 0.72%).

Most sectors of the S & P index ended the session in positive territory. The leader of growth was the sector of basic materials (+ 1.0%). The financial sector fell most (-0.4%).

At closing:

DJIA -0.20% 20.660.55 -40.95

Nasdaq + 0.38% 5,897.55 +22.41

S & P + 0.11% 2,361.18 +2.61

-

21:00

DJIA -0.11% 20,677.72 -23.78 Nasdaq +0.38% 5,897.70 +22.56 S$P +0.15% 2,362.12 +3.55

-

19:06

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed. Gains in energy and consumer discretionary stocks propped up the S&P 500 and the Nasdaq on Wednesday, but the Dow Jones Industrial Average slipped due to losses in financial stocks.

Most of Dow stocks in positive area (22 of 30). Top loser, UnitedHealth Group Incorporated (UNH, -1.50%). Top gainer - Merck & Co., Inc. (MRK, +1.06%).

Most of S&P sectors also in positive area. Top loser Financials (-0.5%). Top gainer - Basic Materials (+0.8%).

At the moment:

Dow 20586.00 -39.00 -0.19%

S&P 500 2355.25 +3.75 +0.16%

Nasdaq 100 5420.50 +15.50 +0.29%

Oil 49.38 +1.01 +2.09%

Gold 1251.50 -4.10 -0.33%

U.S. 10yr 2.38 -0.02

-

18:00

European stocks closed: FTSE 100 +30.30 7373.72 +0.41% DAX +53.58 12203.00 +0.44% CAC 40 +22.84 5069.04 +0.45%

-

15:31

U.S. Stocks open: Dow -0.17%, Nasdaq 0.00%, S&P -0.11%

-

15:24

Before the bell: S&P futures +0.03%, NASDAQ futures +0.12%

U.S. stock-index futures were flat, as investors turned their attention to Europe, where Britain formally launched the process for leaving the European Union (EU).

Global Stocks:

Nikkei 19,217.48 +14.61 +0.08%

Hang Seng 24,392.05 +46.18 +0.19%

Shanghai 3,241.31 -11.63 -0.36%

FTSE 7,331.07 -12.35 -0.17%

CAC 5,055.71 +9.51 +0.19%

DAX 12,208.93 +59.51 +0.49%

Crude $48.58 (+0.43%)

Gold $1,252.60 (-0.24%)

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

859.55

3.55(0.41%)

21800

Apple Inc.

AAPL

143.63

-0.17(-0.12%)

83716

AT&T Inc

T

41.63

0.07(0.17%)

1262

Caterpillar Inc

CAT

92.5

-0.45(-0.48%)

2612

Cisco Systems Inc

CSCO

34.01

-0.01(-0.03%)

6384

Citigroup Inc., NYSE

C

59.55

0.13(0.22%)

32371

Exxon Mobil Corp

XOM

81.75

-0.09(-0.11%)

1862

Facebook, Inc.

FB

141.85

0.09(0.06%)

43616

Ford Motor Co.

F

11.77

0.12(1.03%)

50967

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.55

-0.02(-0.16%)

26228

General Electric Co

GE

29.59

-0.03(-0.10%)

3557

General Motors Company, NYSE

GM

35.54

-0.02(-0.06%)

10519

Goldman Sachs

GS

229.6

0.27(0.12%)

2427

Google Inc.

GOOG

825

4.08(0.50%)

1544

International Business Machines Co...

IBM

174.42

-0.09(-0.05%)

371

JPMorgan Chase and Co

JPM

88.64

0.04(0.05%)

17802

McDonald's Corp

MCD

129.35

-0.10(-0.08%)

529

Merck & Co Inc

MRK

63.54

0.20(0.32%)

1014

Microsoft Corp

MSFT

65.2

-0.09(-0.14%)

1280

Nike

NKE

56.3

-0.32(-0.57%)

3713

Pfizer Inc

PFE

34.06

-0.10(-0.29%)

706

Procter & Gamble Co

PG

90.56

-0.20(-0.22%)

178

Tesla Motors, Inc., NASDAQ

TSLA

278

0.55(0.20%)

21376

The Coca-Cola Co

KO

42.33

-0.10(-0.24%)

250

Twitter, Inc., NYSE

TWTR

14.89

-0.05(-0.33%)

101231

Walt Disney Co

DIS

112.85

-0.20(-0.18%)

543

Yahoo! Inc., NASDAQ

YHOO

46.7

0.13(0.28%)

2000

Yandex N.V., NASDAQ

YNDX

22.57

0.14(0.62%)

5350

-

14:50

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Boeing (BA) initiated with a Buy at Berenberg; target $202

Amazon (AMZN) initiated with a Overweight at Barclays

Alphabet A (GOOGL) initiated with a Overweight at Barclays

Facebook (FB) initiated with a Overweight at Barclays

Twitter (TWTR) initiated with a Underweight at Barclays

Arconic (ARNC) initiated with a Market Perform at Cowen

-

09:37

Major stock markets in Europe trading in the green zone: FTSE 7372.04 +28.62 + 0.39%, DAX 12203.83 +54.41 + 0.45%, CAC 5067.36 +21.16 + 0.42%

-

07:28

Global Stocks

European stocks finished higher Tuesday, as analysts said worries were abating over whether the Trump administration will be able to push through pro-growth reforms in the world's largest economy. The pan-European benchmark slid on Monday along with equities worldwide after a Republican overhaul of the U.S. health care system fizzled, sparking worries about President Donald Trump's other business-friendly plans.

U.S. stocks posted broad-based gains Tuesday, with the Dow Jones Industrial Average snapping its eight-day losing streak, as investors cheered better-than-expected economic data. Attracting the most attention was a reading of consumer confidence in March, which soared to the highest level in more than 16 years. Separately, U.S. house prices roared to their highest in nearly three years as demand remains brisk.

Investors in Asian equities regained some of their risk appetite Wednesday following strong gains in the U.S., where better-than-expected economic data sparked optimism. In currencies, the pound continued to plunge against the dollar after U.K. Prime Minister Theresa May signed the formal letter that will trigger the nation's official separation from the economic bloc when it is delivered to European Council President Donald Tusk later Wednesday.

-

00:28

Stocks. Daily history for Mar 28’2017:

(index / closing price / change items /% change)

Nikkei +217.28 19202.87 +1.14%

TOPIX +20.44 1544.83 +1.34%

Hang Seng +152.17 24345.87 +0.63%

CSI 300 -8.23 3469.81 -0.24%

Euro Stoxx 50 +27.93 3465.07 +0.81%

FTSE 100 +49.92 7343.42 +0.68%

DAX +153.35 12149.42 +1.28%

CAC 40 +28.77 5046.20 +0.57%

DJIA +150.52 20701.50 +0.73%

S&P 500 +16.98 2358.57 +0.73%

NASDAQ +34.77 5875.14 +0.60%

S&P/TSX +92.35 15598.57 +0.60%

-