Noticias del mercado

-

22:09

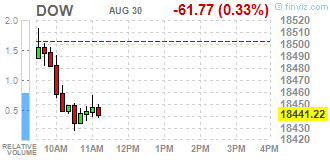

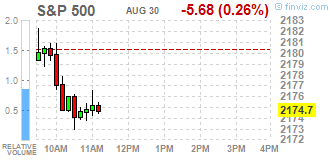

Major US stock indexes finished trading below zero

Major stock indexes in Wall Street declined slightly, as investors are waiting for a catalyst that will move the markets, while maintaining a focus on the timing of the next rate hike.

Investors expect the monthly data on the number of jobs on Friday to assess whether they are comparable to the statements by the Fed. According to forecasts, the number of people employed in non-agricultural sectors of the economy increased in August by 185 thousand. After increasing by 255 thousand. In July. The unemployment rate is likely to decline to 4.8% from 4.9%. Meanwhile, the growth rate of the average hourly rate is estimated to have slowed to 0.2% from 0.3%.

However, today's report from S & P / Case-Shiller showed that the national index of housing prices in the US rose by 5.1% annually in June, unchanged from the previous month. A composite index for the 10 megacities US reported an annual growth of 4.3%, compared with 4.4% in the previous month.

In addition, it was reported that the consumer confidence index from the Conference Board, which decreased slightly in July, increased in August. The index is currently 101.1 compared to 96.7 in July. the present situation index rose to 118.8 from 123.0, while the expectations index rose to 82.0 last month to 86.4.

Most components of the DOW index finished trading in negative territory (24 of 30). Outsider were shares of The Boeing Company (BA, -1.60%). More rest up shares The Goldman Sachs Group, Inc. (GS, + 1.16%).

Most of the S & P sectors showed a decline. Most utilities sector fell (-0.9%). The leader turned out to be the financial sector (+ 0.6%).

At the close:

Dow -0.26% 18,454.30 -48.69

Nasdaq -0.18% 5,222.99 -9.34

S & P -0.19% 2,176.13 -4.25

-

21:00

Dow -0.37% 18,433.92 -69.07 Nasdaq -0.37% 5,212.93 -19.40 S&P -0.32% 2,173.31 -7.07

-

18:00

European stocks closed: FTSE 100 -17.26 6820.79 -0.25% DAX +113.20 10657.64 +1.07% CAC 40 +33.24 4457.49 +0.75%

-

17:48

Oil continue to decline

Oil futures cheaper for a second day on the strengthening of the US dollar and renewed concerns about the global oil market glut.

The dollar index, which measures the greenback against a basket of major currencies, hit session high after the release of US consumer confidence data. The consumer confidence index from the Conference Board rose to 101.1 in August from 96.7 in July. The present situation index rose to 118.8 from 123.0, while the expectations index rose from 82.0 to 86.4. "Consumer confidence improved to its highest level in nearly a year, after a moderate decline in July - Lynn Franco the director of economic indicators in the Conference Board. Consumers estimation on current business conditions as well as conditions in the labor market was significantly more favorable than in July. The short-term expectations regarding business and employment conditions as well as prospects of individuals' income also improved, suggesting the possibility of a moderate acceleration of growth in the coming months. "

Statements by deputy oil minister of Iran Moazami that the country intends to increase the volume of oil production from 3.8 million barrels / d to 4.75 million, alos put preasure on prices. He added that by the end of this year plans to increase production to 4 mln b / d.

The cost of the October futures for WTI fell to 46.48 dollars per barrel.

October futures for Brent fell to 48.70 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:36

WSE: Session Results

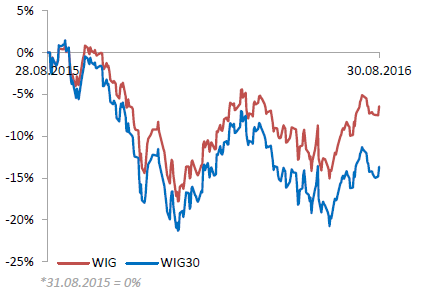

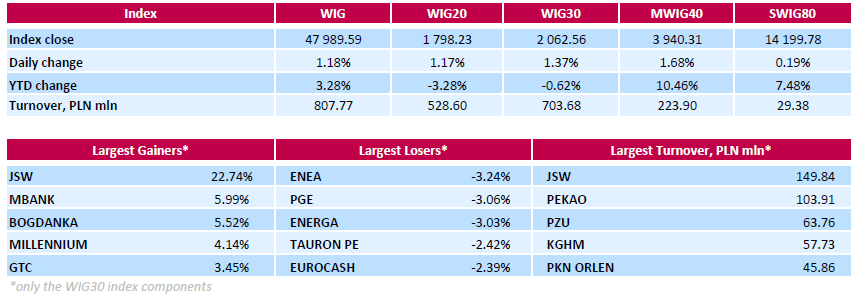

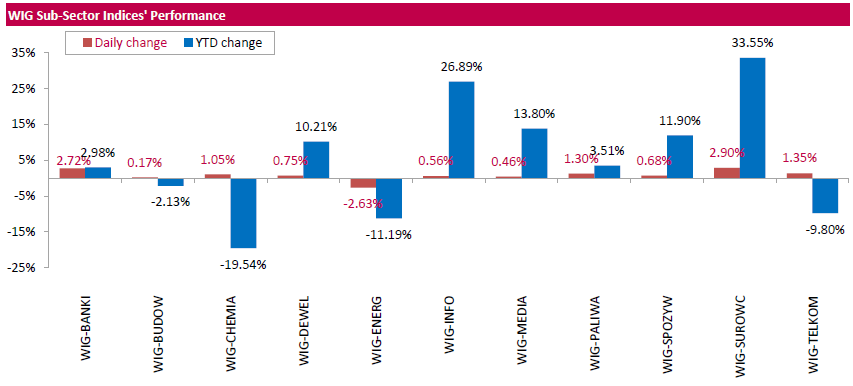

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 1.18%. Utilities sector (-2.63%) was sole decliner within the WIG Index, while materials (+2.90%) outpaced.

The large-cap stocks' measure, the WIG30 Index, surged by 1.37%. Coking coal miner JSW (WSE: JSW) was the standout performer in the WIG30 Index basket, skyrocketing by 22.74% on announcement the company had agreed with its bondholders to extend the payments from JSW's bond by five years until 2025. The agreement concerns two JSW bonds worth PLN 700 mln and $164 mln, respectively. Other notable gainers were three banking names MBANK (WSE: MBK), MILLENNIUM (WSE: MIL) and PEKAO (WSE: PEO), thermal coal miner BOGDANKA (WSE: LWB) and property developer GTC (WSE: GTC), advancing by 3.35%-5.99%. On the other side of the ledger, four utilities names ENEA (WSE: ENA), PGE (WSE: PGE), ENERGA (WSE: EMG) and TAURON PE (WSE: TPE) recorded the biggest declines, tumbling by 2.42%-3.24%.

-

17:29

Gold traded lower

Gold moderately cheaper, returning to five-week low, movecaused by the strengthening of the dollar and the recent comments by Fed officials on rate hikes.

The dollar index, which shows the relationship of the US dollar against a basket of six major currencies, rose 0.5%. Generally, a strong dollar puts pressure on gold, as it reduces the metal's appeal as an alternative asset and increases the price of dollar-denominated commodities for holders of other currencies.

Today, Fischer noted that the pace of rate hikes will depend entirely on the situation in the economy. " We determine the rate based on the incoming data. I do not think that at the time when we start to raise rates, we will know whether it will be one hike or more. It all depends on what will happen in the economy ", - he said. According to the futures market, the probability of a rate hike is 24% in September and 53.6% in December.

"As investors are pricing in an increasing chance of a hike before the end of the year, gold is likely to continue to remain under pressure" - said MKS experts.

Gradually, the market's attention shifted to Friday's data on US labor market, which will help understand whether the Fed will raise rates in the near future.

The cost of October futures for gold on COMEX fell to $ 1317.4 per ounce.

-

17:19

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Tuesday morning as investors looked for catalysts to drive the markets while keeping one eye on clues for the timing of the next interest rate hike. Federal Reserve Chair Janet Yellen painted a rosy picture of the U.S. economy at an economic symposium on Friday and said the case for a rate hike was strengthening, but gave little indication on when the central bank could move. Investors are awaiting a report on monthly payrolls data due on Friday to assess whether it supports the hawkish tone that Fed officials have taken.

Most of Dow stocks in negative area (23 of 30). Top gainer - JPMorgan Chase & Co. (JPM, +0.28%). Top loser - The Boeing Company (BA, -1.51%).

Most of S&P sectors also in negative area. Top gainer - Conglomerates (+0.4%). Top loser - Utilities (-0.7%).

At the moment:

Dow 18447.00 -42.00 -0.23%

S&P 500 2174.75 -4.50 -0.21%

Nasdaq 100 4778.00 -15.25 -0.32%

Oil 46.45 -0.53 -1.13%

Gold 1321.40 -5.70 -0.43%

U.S. 10yr 1.57 +0.00

-

17:14

Iraq to support oil output freeze at OPEC meeting - Abadi

-

16:23

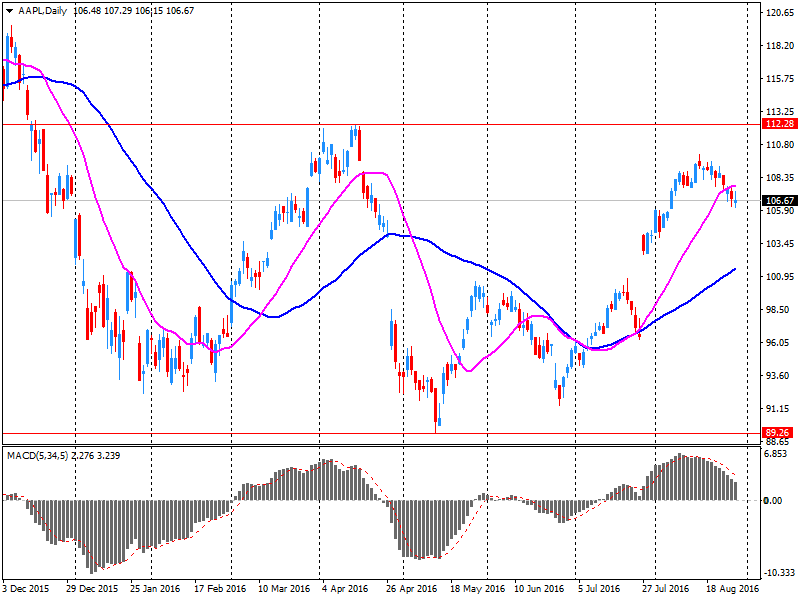

Company news: The European Commission requires Apple (AAPL) to pay tax in amount of about 13 billion euros

According to the European Commission's material published on the official website of the authority, a thorough investigation, which began in June 2014, found that Ireland has granted Apple's unjustified tax breaks of 13 billion euro. This is contrary to the rules of public support in the EU, as it allowed the American corporation to pay much less in taxes than other companies. Now, Apple is expected to return Ireland unpaid taxes plus interest.

According to the Anti-Monopoly Policy EU Commissioner Margaret Vestager, Ireland showed "selective attitude" to Apple and has enabled the company during the period from 2003 to 2014 to pay from 0.005% to 1% income tax from operations in Europe.

AAPL shares fell in premarket trading to $ 105.74 (-1.01%).

-

16:03

US consumer confidence improved in August to its highest level in nearly a year

The Conference Board Consumer Confidence Index®, which had decreased slightly in July, increased in August. The Index now stands at 101.1 (1985=100), compared to 96.7 in July. The Present Situation Index rose from 118.8 to 123.0, while the Expectations Index improved from 82.0 last month to 86.4.

"Consumer confidence improved in August to its highest level in nearly a year, after a marginal decline in July," said Lynn Franco, Director of Economic Indicators at The Conference Board. "Consumers' assessment of both current business and labor market conditions was considerably more favorable than last month. Short-term expectations regarding business and employment conditions, as well as personal income prospects, also improved, suggesting the possibility of a moderate pick-up in growth in the coming months."

-

16:00

U.S.: Consumer confidence , August 101.1 (forecast 97)

-

15:52

WSE: After start on Wall Street

Increases in indices of the Warsaw Stock Exchange as for now persist, which goes hand in hand with more or less the same behavior of European markets. However, while an increase of more than 1% of the WIG20 index after two weeks of weakness is not surprising, as much similar achievements of medium companies, which for the last two months were not practically down, it is an admirable result. In the afternoon phase of the session was a noticeable weakening in the market of the zloty, which began to weaken against major currencies.

The opening of trading in the US was held at neutral, and at the moment, has no influence into the picture of the situation on the Warsaw market. An hour before the end of listing the WIG 20 index rising by 1.28% (1,800 pts).

-

15:44

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 355m) 1.1150 (256m) 1.1175 (204m) 1.1190 (200m) 1.1200 (310m 1.1250(269m) 1.1300 (493m) 1.1350 (556m) 1.1375 (231m) 1.1400 (212m)

USD/JPY: 99.50 (USD 264m) 99.75 (330m) 100.00 (644m) 100.50 (292m) 101.00 (211m) 102.35-40 (340m) 103.00 (684m)

GBP/USD: 1.3100 (GBP 269m) 1.3360 (292m)

AUD/USD: 0.7450 (AUD 306m) 0.7500 ( 990m) 0.7684 (324m) 0.7750 (520m)

NZD/USD: 0.7035 (NZD 278m)

USD/CAD: 1.3025 (USD 200m)

-

15:38

US House Price Index S & P / Case-Shiller rose in June

The leading measure of prices for residential real estate in the United States continued to rise across the country during the last 12 months.

National index S & P / Case-Shiller in the US - an index that covers all nine US census regions, reported an annual growth of 5.1% in June, unchanged from the previous month.

A composite index for the 10 megacities reported an annual growth of 4.3%, compared with 4.4% in the previous month.

The composite index for 20 US metropolises reported an annual growth of 5.1%, compared with 5.3% in May.

Portland, Seattle, Denver reported the highest increases compared with the previous year among the 20 cities. In June, the Portland prices rose by 12.6% compared to the same period last year, followed by Seattle, with growth of 11.0% and Denver with an increase of 9.2%.

Six cities reported a big increase in prices for the year ending in June 2016

-

15:33

U.S. Stocks open: Dow +0.02%, Nasdaq +0.01%, S&P +0.04%

-

15:28

Before the bell: S&P futures -0.07%, NASDAQ futures -0.24%

U.S. stock-index futures were little changed as investors awaited jobs data due this week for further clues on the path of Federal Reserve policy.

Global Stocks:

Nikkei 16,725.36 -12.13 -0.07%

Hang Seng 23,016.11 +194.77 +0.85%

Shanghai 3,076.20 +6.17 +0.20%

FTSE 6,836.58 -1.47 -0.02%

CAC 4,461.66 +37.41 +0.85%

DAX 10,649.07 +104.63 +0.99%

Crude $47.34 (+0.77%)

Gold $1322.80 (-0.32%)

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, June 5.1% (forecast 5.2%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

180.5

0.00(0.00%)

65021

ALCOA INC.

AA

10.24

-0.02(-0.1949%)

4800

ALTRIA GROUP INC.

MO

66.25

0.15(0.2269%)

250

Amazon.com Inc., NASDAQ

AMZN

770.89

-0.40(-0.0519%)

4236

American Express Co

AXP

65.67

0.15(0.2289%)

201

AMERICAN INTERNATIONAL GROUP

AIG

59.43

0.00(0.00%)

49499

Apple Inc.

AAPL

105.65

-1.17(-1.0953%)

783832

AT&T Inc

T

41.1

0.10(0.2439%)

1030

Barrick Gold Corporation, NYSE

ABX

18.23

-0.16(-0.87%)

90918

Boeing Co

BA

132.9

0.00(0.00%)

32734

Caterpillar Inc

CAT

83.15

0.05(0.0602%)

700

Chevron Corp

CVX

102.05

0.00(0.00%)

92351

Cisco Systems Inc

CSCO

31.69

0.11(0.3483%)

3378

Citigroup Inc., NYSE

C

47.26

-0.00(-0.00%)

8913

Deere & Company, NYSE

DE

87.1

0.17(0.1956%)

550

E. I. du Pont de Nemours and Co

DD

70.45

0.00(0.00%)

23195

Exxon Mobil Corp

XOM

87.84

0.00(0.00%)

1322210

Facebook, Inc.

FB

126.48

-0.06(-0.0474%)

70677

FedEx Corporation, NYSE

FDX

165.17

0.00(0.00%)

63982

Ford Motor Co.

F

12.5

0.03(0.2406%)

15700

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.98

-0.00(-0.00%)

47225

General Electric Co

GE

31.37

0.01(0.0319%)

3997

General Motors Company, NYSE

GM

31.81

0.00(0.00%)

115012

Goldman Sachs

GS

166.36

0.14(0.0842%)

456

Google Inc.

GOOG

771.7

-0.45(-0.0583%)

992

Hewlett-Packard Co.

HPQ

14.4

-0.03(-0.2079%)

700

Home Depot Inc

HD

134.73

0.18(0.1338%)

260

HONEYWELL INTERNATIONAL INC.

HON

117.17

0.00(0.00%)

30476

Intel Corp

INTC

35.55

-0.00(-0.00%)

1025

International Business Machines Co...

IBM

159.72

0.00(0.00%)

157285

International Paper Company

IP

48.9

0.00(0.00%)

16161

Johnson & Johnson

JNJ

119.92

0.00(0.00%)

160

JPMorgan Chase and Co

JPM

67

0.05(0.0747%)

2251

McDonald's Corp

MCD

115.5

0.98(0.8557%)

24260

Merck & Co Inc

MRK

63.01

0.00(0.00%)

82910

Microsoft Corp

MSFT

58.1

-0.00(-0.00%)

14506

Nike

NKE

58.5

-0.13(-0.2217%)

950

Pfizer Inc

PFE

35.05

-0.06(-0.1709%)

407

Procter & Gamble Co

PG

88.3

0.00(0.00%)

113281

Starbucks Corporation, NASDAQ

SBUX

56.6

-0.20(-0.3521%)

119

Tesla Motors, Inc., NASDAQ

TSLA

215.5

0.30(0.1394%)

3064

The Coca-Cola Co

KO

43.54

0.00(0.00%)

388855

Travelers Companies Inc

TRV

118.48

0.00(0.00%)

11316

Twitter, Inc., NYSE

TWTR

18.57

0.10(0.5414%)

18930

United Technologies Corp

UTX

107.97

0.00(0.00%)

24409

UnitedHealth Group Inc

UNH

137.27

0.00(0.00%)

83486

Verizon Communications Inc

VZ

52.62

0.12(0.2286%)

620

Visa

V

80.82

-0.05(-0.0618%)

520

Wal-Mart Stores Inc

WMT

71.4

0.00(0.00%)

1000

Walt Disney Co

DIS

94.9

0.03(0.0316%)

447

Yahoo! Inc., NASDAQ

YHOO

42.31

0.05(0.1183%)

1500

Yandex N.V., NASDAQ

YNDX

22.22

0.00(0.00%)

200

-

14:43

Upgrades and downgrades before the market open

Upgrades:

McDonald's (MCD) upgraded to Outperform from Neutral at Robert W. Baird; target raised to $128 from $126

Downgrades:

Other:

-

14:38

Canadian Industrial Product Price rose mostly due to non-ferrous metal products

The Industrial Product Price Index (IPPI) rose 0.2% in July. Higher prices for primary non-ferrous metal products were largely moderated by a decline in prices for energy and petroleum products. The Raw Materials Price Index (RMPI) decreased 2.7%, as a result of lower prices for crude energy products.

The IPPI edged up 0.2% in July, after rising 0.7% in June. Of the 21 major commodity groups, 13 were up, 5 were down and 3 were unchanged.

The largest downward contribution to the IPPI in July came from energy and petroleum products (-3.5%), which posted their first decline since February 2016 (-4.1%). The fall was led by lower prices for motor gasoline (-6.4%) and, to a lesser extent, diesel fuel (-4.2%) and light fuel oils (-3.4%). The IPPI excluding energy and petroleum products rose 0.7% in July.

-

14:36

Canada's current account deficit increased $ 3.3 billion in the second quarter

Canada's current account deficit (on a seasonally adjusted basis) increased $ 3.3 billion in the second quarter to $ 19.9 billion, as the trade in goods deficit continued to widen.

In the financial account (unadjusted for seasonal variation), foreign investment in Canadian securities remained strong in the quarter and led the inflow of funds in the economy.

Overall, exports of goods decreased $6.6 billion to $123.6 billion in the second quarter. Exports of motor vehicles and parts were down $2.3 billion on lower prices and volumes. Exports of consumer goods declined $1.7 billion on lower volumes. In contrast, exports of energy products increased $0.7 billion, as higher prices for crude oil and crude bitumen more than offset the decline in volumes exported.

Total imports of goods decreased $1.8 billion to $134.8 billion. The largest reduction was in consumer goods, down $1.0 billion on lower prices. Industrial machinery, equipment and parts also contributed to the decline, down $0.9 billion as a result of lower prices and volumes. Moderating this decrease, energy products advanced $1.2 billion, mostly on higher prices. Aircraft and other transportation equipment and parts gained $0.8 billion, all on higher volumes - Statistics Canada.

-

14:33

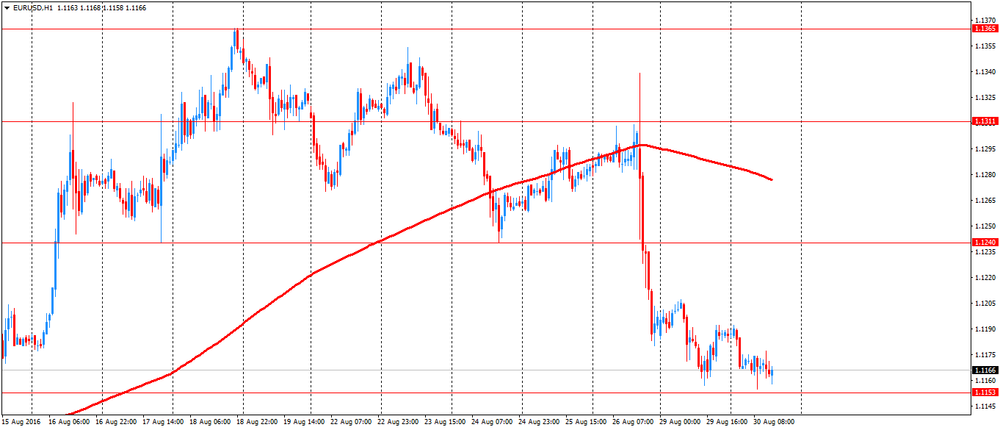

European session review: Euro moderately weakened against the US dollar

The following data was published:

(Time / country / index / period / previous value / forecast)

7:00 Switzerland index of leading economic indicators from the KOF August 103.5 102.7 102.0 Revised from 99.8

8:30 UK approved applications for mortgage loans, thousand. Revised July 64.15 to 64.77 61.9 60.91

8:30 Volume UK net lending to individuals, 5.2 billion in July 4.9 3.8

8:30 UK Changing the volume of consumer lending, one million in July 1857 Revised 1837 1700 1181

9:00 Eurozone index of sentiment in the economy in August 104.5 104.6 104.1 Revised from 103.5

9:00 Eurozone consumer confidence index (final data) August -7.9 -8.5 -8.5

9:00 Eurozone Sentiment Index in the business community with the Revised August 0.38 0.39 0.36 0.02

9:00 Eurozone business confidence index in industry in August -2.6 -2.4 -2.7 Revised to -4.4

10:30 US Fed Speech Stanley Fischer, Vice-Chairman

12:00 Germany Consumer Price Index m / m (provisional) in August 0.3% 0.1% 0.0%

12:00 Germany Consumer Price Index y / y (provisional) in August 0.4% 0.5% 0.4%

The single currency shows a slight decline against the US dollar on the background of lower sentiment in the euro zone. Confidence in the economy deteriorated in August, European Commission survey showed.

Sentiment in the economy fell to 103.5 from 104.5 in July. The expected value was 104.1.

The index of business optimism in industry fell to -4.4 vs. -2.6 in July. The dramatic decline in confidence in industry was caused by the drastic deterioration of the current total portfolio levels.

The indicator of consumer sentiment fell to -8.5, according to a preliminary estimate, from -7.9 in July. The weakness reflects a more pessimistic view of the future unemployment.

Confidence in the retail trade fell in August due to the negative attitudes of managers on the current and expected business situation. The corresponding index fell to -1.0 from 1.7 last month.

Deteriorating confidence in the services sector due to a significant decline in demand and expectations, and to a lesser extent, the last assessment of demand and the past business situation. Sentiment in the service sector fell to 10 from 11.2 a month ago.

Another study showed that the index of sentiment in the business circles decreased slightly to 0.02 from 0.38 in July. Economists had expected the index to fall slightly to 0.36.

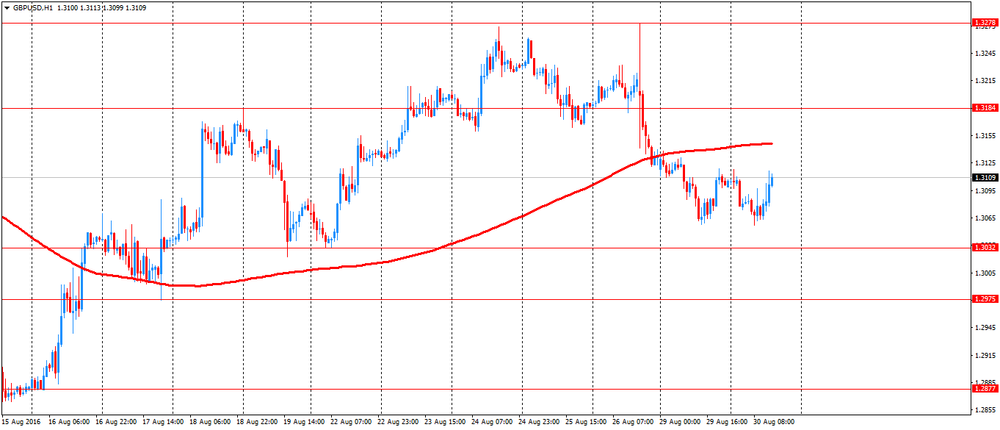

The pound weakened earlier in the session against the US dollar, but then recovered and rose to the opening level of the day. The decline was due to the weak data on lending by the Bank of England. In the UK, the number of mortgage approvals fell to the lowest level since the beginning of 2015.

The number of mortgage approvals fell to 60,912 in July from 64,152 in June. It was the lowest since January 2015.

Consumer loans grew by 1.2 billion pounds in July, compared with an increase of 1.9 billion pounds in June.

EUR / USD: during the European session, the pair fell to $ 1.1155

GBP / USD: during the European session, the pair fell to $ 1.3057, and then rose to $ 1.3116

USD / JPY: during the European session, the pair rose to Y102.44

-

14:30

Canada: Industrial Product Price Index, y/y, July -1.3%

-

14:30

Canada: Industrial Product Price Index, m/m, July 0.2% (forecast -0.1%)

-

14:30

Canada: Current Account, bln, Quarter II -19.9 (forecast -20.5)

-

14:25

Lower German CPI in August

The inflation rate in Germany as measured by the consumer price index is expected to be +0.4% in August 2016. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to remain unchanged from July. The harmonised index of consumer prices for Germany, which is calculated for European purposes, is expected to be up 0.3% in August 2016 year on year. Compared with July 2016, it is expected to decline by 0.1%. The final results for August 2016 will be released on 13 September 2016.

-

14:00

Germany: CPI, y/y , August 0.4% (forecast 0.5%)

-

14:00

Germany: CPI, m/m, August 0.0% (forecast 0.1%)

-

13:38

Fed vice-chairman Fischer: fiscal policy changes likely but uncertain in 2017-18

-

employment close to full

-

US Fed probably the most important of central banks

-

we're sensitive to what's going on around the world

-

not planning to go to negative rates

-

negative rates are very difficult for savers

-

we're in a world where negative rates seem to work

-

CBs with negative rates see success with them

-

USD isn't most fundamental factor in productivity

-

fiscal policy changes likely but uncertain in 2017-18

*via forexlive

-

-

13:05

WSE: Mid session comment

The positive hero of today's session on the Warsaw market is the coal company JSW. After yesterday's quotations, the company announced an agreement with bondholders vs. repayment of the securities at PLN 1.3 billion. Today, the company's management presented the main assumptions of the restructuring of the JSW group and its results for the first half of the year. Till 2025, through the implementation of about 130 savings initiatives, the group is expected to reduce operating costs by a total of approx. PLN 1.6 billion (excluding the effects of the agreements with the bondholders in February and September 2015). As a result, the company's shares rise more than 18%. In conjunction with the good behavior of companies Sanok (WSE: SNK) and Forte (WSE: FTE) after the publication of the results it leads to rise of the mWIG40 to the new year's maximum. The index of blue chips supported today by stronger behavior of exchanges in Euroland and return to the game of investors from London also presents much better itself, reaching in the halfway point of today's trading the level of 1,800 points (+1,29%) with the turnover of PLN 286 mln.

-

12:43

Major stock indices in Europe show a moderate growth

European stocks are rising and can finish in positive territory for the second month in a row. Investors continue to assess the chances of a rate hike by the Federal Reserve.

According CME Group fed futures point to a 33% probability of a hike in September and 61% in December.

On Tuesday and Wednesday, market participants are waiting for statements by Stanley Fischer, who is a "hawk" among the leaders of the US Central Bank.

The composite index of the largest companies in the region Stoxx Europe 600 rose during trading 0,6% - to 345.13 points.

Shares of mining companies become cheaper amid lower prices for metals and strengthening of the US dollar. Stock prices of Antofagasta Plc, Randgold Resources Ltd. and Glencore Plc fell more than 3% in London trading, Rio Tinto - 4%.

The market value of Bunzl Plc increased by 1.5% due to an increase in quarterly revenue and operating profit margin.

Shares of the German sporting goods manufacturer Adidas and Dutch retailer Ahold Delhaize rose by 0.6%. In an estimated by LBBW analysts, both companies can be included in the index of the largest enterprises in the euro zone, replacing Carrefour and Unicredit.

Shares of German Wirecard rose by 4.1% as Barclays raised their rating.

Thyssenkrupp AG shares rose 0.6% on reports that the German company signed a contract for the manufacture, supply, installation and maintenance of more than 500 elevators and escalators for Qatar Doha Metro.

At the moment:

FTSE 6850.42 12.37 0.18%

DAX 10653.02 108.58 1.03%

CAC 4466.45 42.20 0.95%

-

11:52

German government: G20 yet to decide on whether to discuss currencies

-

still need to discuss how the issue of Brexit will go in the G20 summit document.

-

-

11:05

Economic Sentiment decreases in both the euro area and the EU. Eur/Usd unchanged so far

In August, the Economic Sentiment Indicator (ESI) decreased in the euro area (by 1.0 points to 103.5) and the EU (by 0.9 points to 103.8).

-

11:00

Eurozone: Economic sentiment index , August 103.5 (forecast 104.1)

-

11:00

Eurozone: Business climate indicator , August 0.02 (forecast 0.36)

-

11:00

Eurozone: Industrial confidence, August -4.4 (forecast -2.7)

-

11:00

Eurozone: Consumer Confidence, August -8.5 (forecast -8.5)

-

10:46

UK money and credit survey

According to the Bank of England M4 increased by £25.4 billion in July, compared to the average monthly increase of £11.7 billion over the previous six months. The three-month annualised and twelve-month growth rates were 14.7% and 6.9% respectively.

Households' holdings of M4 increased by £8.9 billion in July, compared to the average monthly increase of £7.5 billion over the previous six months. The three-month annualised and twelve-month growth rates were 7.4% and 6.7% respectively.

Loans to financial and non-financial businesses decreased by £2.7 billion in July, compared to the average monthly increase of £10.8 billion over the previous six months. The decrease was mainly in loans to businesses in the financial services industry (-£4.7 billion). The twelve-month growth rate was 2.3%.

Total lending to individuals increased by £3.8 billion in July, compared to the average of £5.1 billion over the previous six months. The three-month annualised and twelve-month growth rates were 3.7% and 4.1% respectively.

The number of loan approvals for house purchase was 60,912 in July, compared to the average of 68,775 over the previous six months. The number of approvals for remortgaging was 43,084, compared to the average of 41,887 over the previous six months. The number of approvals for other purposes was 12,635, in line with the average over the previous six months.

-

10:31

United Kingdom: Consumer credit, mln, July 1181 (forecast 1700)

-

10:31

United Kingdom: Net Lending to Individuals, bln, July 3.8 (forecast 4.9)

-

10:31

United Kingdom: Mortgage Approvals, July 60.91 (forecast 61.9)

-

10:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 355m) 1.1150 (256m) 1.1175 (204m) 1.1190 (200m) 1.1200 (310m 1.1250(269m) 1.1300 (493m) 1.1350 (556m) 1.1375 (231m) 1.1400 (212m)

USD/JPY: 99.50 (USD 264m) 99.75 (330m) 100.00 (644m) 100.50 (292m) 101.00 (211m) 102.35-40 (340m) 103.00 (684m)

GBP/USD: 1.3100 (GBP 269m) 1.3360 (292m)

AUD/USD: 0.7450 (AUD 306m) 0.7500 ( 990m) 0.7684 (324m) 0.7750 (520m)

NZD/USD: 0.7035 (NZD 278m)

USD/CAD: 1.3025 (USD 200m)

-

10:11

Italian retail sales in line with expectations in June

The retail trade index measures the monthly evolution of the turnover at current prices of enterprises with retail sale outlets. With effect from January 2013 the indices are calculated with reference to the base year 2010 using the Ateco 2007 classification (Italian edition of Nace Rev. 2). In June 2016 the seasonally adjusted retail trade index increased by 0.2% with respect to May 2016 (-0.1% for food goods and 0.4% for non-food goods). The average of the last three months increased with respect to the previous three months (+0.1%). The unadjusted index increased by 0.8% with respect to June 2015.

-

10:09

Oil little changed in early trading

This morning, New York crude oil futures for WTI rose by + 0.13% to $ 47.04 and Brent oil futures were down -0.10% to $ 49.40 per barrel. Thus, the black gold trading flat on the background of the dollar's decline and is waiting for new signals about a possible oil producers agreement to freeze oil output at a meeting in September. The US currency moved away from the highs on Monday as traders await employment data in the US, which, according to the deputy chairman of the Federal Reserve Stanley Fischer, will be an important factor for an early rate hike. The weakness of the dollar makes purchasing oil cheaper for holders of other currencies, potentially fueling demand.

In addition, analysts doubt the possibility of real joint OPEC action and so are closely watching the commentaries of producer countries.

-

09:49

Major stock exchanges trading mixed: FTSE - 0.1%, DAX + 0.6%, CAC40 + 0.3%, FTMIB + 0.4%, IBEX + 0.3%

-

09:19

WSE: After opening

WIG20 index opened at 1776.41 points (-0.05%)*

WIG 47442.34 0.03%

WIG30 2033.16 -0.07%

mWIG40 3886.26 0.28%

*/ - change to previous close

The futures market opened with an increase of 0.23% to 1,778 points.

The beginning of the session on the cash market (the WIG20 index) was without any major deviations of both the index and its components. At the same time, the European markets are gaining, indicating that is extremely hard to break our spot market out of stagnation.

Over the time we will probably also see something more about the turnover that after today's London return to the game should already be noticeably higher in relation to yesterday's level of activity. The beginning of trading is under the sign of continuing of improvement in sentiment after a little worse Friday on the Warsaw Stock Exchange.

-

09:07

Today’s events

At 09:00 GMT Italy will hold an auction of 10-and 5-year government bonds.

At 15:30 GMT the United States will hold an auction of 4-week bills.

At 20:30 GMT report of the American Petroleum Institute (API) on oil stocks.

-

09:05

Spanish CPI down 0.1% y/y

Spanish CPI inflation was lower in August 2016 compared to August 2015 by 0.1%. The Consumer Price Index (CPI) is a statistical measure of the evolution of the prices of goods and services consumed by the population that reside in family dwellings in Spain.

The combination of goods and services that conform the shopping basket is basically obtained from the consumption of families, and the importance of each one of these within the calculation of the CPI is determined by said consumption.

-

09:00

Switzerland: KOF Leading Indicator, August 99.8 (forecast 102.0)

-

08:44

Moody's affirms Japan's A1 rating; outlook stable

Moody's Investors Service has today affirmed the Government of Japan's issuer rating at A1. The rating outlook is maintained at stable.

The affirmation reflects:

• The slow but continuing progress in developing a policy and reform framework which could ultimately reflate the Japanese economy and reverse the rise in government debt.

• Our expectation that funding costs for the government will remain low and stable.

Moody's notes that the recent waning of economic momentum has prompted a pause in fiscal policy tightening, which we expect to lead to a rise in the Japanese government's debt burden. However, we expect that Japan's credit profile will continue to be consistent with an A1 rating, and the rating outlook remains stable.

-

08:27

Credit Suisse Trade Of The Week: Buy NZD/USD

"We think higher-yielding currencies in G10 can tactically strengthen against the USD. NZD provides the cleanest near-term pairing, in our view. This week's economic data calendar in New Zealand is lighter than Australia, and there are no scheduled RBNZ speeches this week either (whereas RBA Deputy Governor is speaking on Wednesday).

While markets may be cautious of chasing AUDUSD strength into the soon-approaching RBA meeting (6 September), the RBNZ is relatively far away for now (21 September). There is also no noise from Fonterra milk auctions next week - the next scheduled auction is on 6 September.

The main risk to this trade is if markets retrace towards broad-based USD strength".

CS is long NZD/USD from 0.7220 targeting a move to 0.7390.

Copyright © 2016 Credit Suisse, eFXnews™

-

08:25

WSE: Before opening

Yesterday's trading on Wall Street ended with a rise in the broad S&P500 index by 0.5%. Most of this increase took place during the European session and will not be surprising for the early morning on these exchanges. It seems that investors are waiting for Friday's data from the US labor market, which will determine the likelihood of interest rate increases, however good behavior of the banking sector on Wall Street indicated that investors are betting a rate hike scenario.

Asian markets, excluding Japan, are dominated by the green color. The Japanese Nikkei, as well as contracts in the US, are currently traded on the light-cons, which should lead to a peaceful start of the European session.

Today's macro calendar is once again not too rich. More attention could attract only the consumer confidence index in the US, the Conference Board.

Today's morning trading on the currency market brings to maintain light pressure on the valuation of the zloty against foreign currency. The Polish zloty is valued by the market as follows: PLN 4,3407 per euro, PLN 3.8873 against the US dollar.

-

08:25

Mixed start expected on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0,3%, FTSE -0,3%

-

08:23

Japan's unemployment rate down to 3.0%

The number of employed persons in July 2016 was 64.79 million, an increase of 980 thousand or 1.5% from the previous year.

The number of unemployed persons in July 2016 was 2.03 million, a decrease of 190 thousand or 8.6% from the previous year.

The unemployment rate, seasonally adjusted, was 3.0%.

-

08:23

Options levels on tuesday, August 30, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1293 (4827)

$1.1265 (4001)

$1.1216 (2172)

Price at time of writing this review: $1.1166

Support levels (open interest**, contracts):

$1.1102 (3133)

$1.1068 (4261)

$1.1029 (5363)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 51723 contracts, with the maximum number of contracts with strike price $1,1250 (4827);

- Overall open interest on the PUT options with the expiration date September, 9 is 57013 contracts, with the maximum number of contracts with strike price $1,1000 (5737);

- The ratio of PUT/CALL was 1.10 versus 1.10 from the previous trading day according to data from August, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.3303 (2676)

$1.3206 (1637)

$1.3110 (1342)

Price at time of writing this review: $1.3071

Support levels (open interest**, contracts):

$1.2995 (2080)

$1.2897 (1854)

$1.2799 (2677)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32625 contracts, with the maximum number of contracts with strike price $1,3300 (2676);

- Overall open interest on the PUT options with the expiration date September, 9 is 26590 contracts, with the maximum number of contracts with strike price $1,2800 (2677);

- The ratio of PUT/CALL was 0.82 versus 0.82 from the previous trading day according to data from August, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

Japan: slow economic growth and negative inflation kept consumers on the sidelines for yet another month

According to rttnews, retail sales in Japan fell 0.2 percent on year in July, the Ministry of Internal Affairs and Communications said on Tuesday.

That beat forecasts for a decline of 0.9 percent following the upwardly revised 1.3 percent contraction in June (originally -1.4 percent).

Sales from large retailers climbed 0.6 percent on year - missing expectations for 0.9 percent after tumbling 1.5 percent in the previous month.

On a monthly basis, retail sales jumped 1.4 percent - beating forecasts for 0.8 percent and up from 0.3 percent a month earlier.

-

08:17

Australian building approvals recovers in July

The trend estimate for total dwellings approved rose 0.2% in July and has risen for eight months.

The seasonally adjusted estimate for total dwellings approved rose 11.3% in July after falling for two months.

The trend estimate of the value of total building approved rose 1.9% in July and has risen for seven months. The value of residential building rose 0.9% and has risen for eight months. The value of non-residential building rose 3.9% and has risen for five months.

The seasonally adjusted estimate of the value of total building approved rose 3.2% in July and has risen for two months. The value of residential building rose 6.2% after falling for two months. The value of non-residential building fell 2.5% following a rise of 16.5% in the previous month.

-

08:12

German import prices up 0.1% in July

As reported by the Federal Statistical Office (Destatis), the index of import prices decreased by 3.8% in July 2016 compared with the corresponding month of the preceding year. In June and in May 2016 the annual rates of change were -4.6% and -5.5%, respectively. From June to July 2016 the index rose slightly by 0.1%.

The index of import prices, excluding crude oil and mineral oil products, decreased by 2.4% compared with the level of a year earlier.

The index of export prices decreased by 1.2% in July 2016 compared with the corresponding month of the preceding year. In June and in May 2016 the annual rates of change were -1.3% and -1.6%, respectively. From June to July 2016 the index rose by 0.2%.

-

07:28

Global Stocks

European stocks on Monday finished in negative territory, kicking off the week lower as rising expectations the U.S. Federal Reserve will lift interest rates later this year poked the air out of a recent rally.

The Stoxx Europe 600 index SXXP, -0.15% lost 0.2% to close at 343.20, pulling back after a 1.1% climb last week.

The pan-European benchmark settled 0.5% higher on Friday, after Fed Chairwoman Janet Yellen, at a closely watched speech at Jackson Hole, Wyo., said the U.S. economy is improving, seen as a sign of confidence in economic growth world-wide. However, the central-bank boss also hinted a rate increase is on the cards in coming months, which weighed on U.S. markets on Friday and dragged stocks in most of Asia and Europe lower on Monday.

U.S. stocks closed higher Monday, led higher by financial stocks as investors warmed up to the possibility of a Federal Reserve rate hike this year. The Dow Jones Industrial Average [ s: djia] closed up 107.59 points, or 0.6%, at 18,502.99, with Travelers Cos. TRV, +1.14% American Express Co AXP, +1.13% J.P. Morgan Chase & Co. JPM, +1.10% and DuPont DD, +1.15% all finishing up more than 1%. The S&P 500 Index SPX, +0.52% finished up 11.34 points, or 0.5%, at 2,180.38, as the financial sector gained 1%, followed by a rise in materials stocks. The Nasdaq Composite Index COMP, +0.26% rose 13.41 points, or 0.3%, to close at 5,232.33.

Asian shares bounced on Tuesday as doubts the Federal Reserve really would hike interest rates as soon as September restrained the dollar, while investors continued to count on more policy stimulus elsewhere in the world.

Japan's Nikkei .N225 went flat as the yen stopped falling following a sharp drop late last week.

A raft of Japanese data, from unemployment to retail sales, mostly beat analysts' forecasts but did nothing to change expectations the Bank of Japan would eventually have to ease further.

-

03:30

Australia: Building Permits, m/m, July 11.3% (forecast 0.0%)

-

01:50

Japan: Retail sales, y/y, July -0.2% (forecast -0.9%)

-

01:30

Japan: Household spending Y/Y, July -0.5% (forecast -0.9%)

-

01:30

Japan: Unemployment Rate, July 3.0% (forecast 3.1%)

-

00:45

New Zealand: Building Permits, m/m, July -10.5%

-

00:31

Commodities. Daily history for Aug 29’2016:

(raw materials / closing price /% change)

Oil 46.95 -0.06%

Gold 1,327.10 0.00%

-

00:30

Stocks. Daily history for Aug 29’2016:

(index / closing price / change items /% change)

Nikkei 225 16,737.49 +376.78 +2.30%

Shanghai Composite 3,070.35 +0.0383 0.00%

S&P/ASX 200 5,469.22 -46.25 -0.84%

FTSE 100 6,838.05 +21.15 +0.31%

CAC 40 4,424.25 -17.62 -0.40%

Xetra DAX 10,544.44 -43.33 -0.41%

S&P 500 2,180.38 +11.34 +0.52%

Dow Jones Industrial Average 18,502.99 +107.59 +0.58%

S&P/TSX Composite 14,681.97 +42.09 +0.29%

-

00:29

Currencies. Daily history for Aug 29’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1186 -0,10%

GBP/USD $1,3105 -0,20%

USD/CHF Chf0,9781 +0,01%

USD/JPY Y101,88 +0,06%

EUR/JPY Y113,97 -0,03%

GBP/JPY Y133,52 -0,17%

AUD/USD $0,7574 +0,16%

NZD/USD $0,7253 +0,26%

USD/CAD C$1,3013 +0,08%

-

00:00

Schedule for today, Tuesday, Aug 30’2016

(time / country / index / period / previous value / forecast)

01:30 Australia Building Permits, m/m July -2.9%

07:00 Switzerland KOF Leading Indicator August 102.7 102.4

08:30 United Kingdom Mortgage Approvals July 64.77 62

08:30 United Kingdom Net Lending to Individuals, bln July 5.2

08:30 United Kingdom Consumer credit, mln July 1837 1600

09:00 Eurozone Economic sentiment index August 104.6 104.2

09:00 Eurozone Consumer Confidence (Finally) August -7.9 -8.5

09:00 Eurozone Business climate indicator August 0.39

09:00 Eurozone Industrial confidence August -2.4 -3

12:00 Germany CPI, m/m (Preliminary) August 0.3% 0.1%

12:00 Germany CPI, y/y (Preliminary) August 0.4% 0.5%

12:30 Canada Industrial Product Price Index, m/m July 0.6%

12:30 Canada Industrial Product Price Index, y/y July -0.8%

12:30 Canada Current Account, bln Quarter II -16.8

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y June 5.2% 5.1%

14:00 U.S. Consumer confidence August 97.3 97

23:05 United Kingdom Gfk Consumer Confidence August -12 -8

23:50 Japan Industrial Production (MoM) (Preliminary) July 2.3% 0.8%

23:50 Japan Industrial Production (YoY) (Preliminary) July -1.5%

-