Noticias del mercado

-

22:06

Major US stock indexes rose moderately

Major US stock indexes finished trading above the zero mark after Fed Chairman Yellen said the strengthening of the prerequisites for raising interest rates.

Yellen said on Friday that the Fed is close to meeting its goals of maximum employment and price stability, speaking about consumer spending. However, the vice-chairman of the Fed's Fisher said that the Central Bank may raise interest rates in September. With regard to the question of whether the Fed will raise rates in September and the second time before the end of the year, Fisher said Yellen statements give a positive answer to this question. According to the futures market, the probability of a Fed rate is 21% in September. Meanwhile, the possibility of increasing rates in the framework of the December meeting is estimated at 41.4% against 44.4% the previous day.

As it became known today, personal income increased by $ 71.6 billion (0.4%) in July, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $ 60.1 billion (0.4%), and personal consumption expenditures (the PCE) increased $ 42.0 billion (0.3%). Real DPI increased 0.4% in July and a real PCE increased 0.3%. PCE price index was unchanged from June. Excluding food and energy, PCE price index increased by 0.1% in July.

Oil futures fell more than 1%, has come under pressure because of the increase in reports of oil production in the Middle East. On Saturday, Iraqi Oil Minister said that his country will continue to increase oil production. In addition, two representatives of the state-owned South Oil Company said that oil exports from Iraq's southern ports reached an average of 3.205 million. Barrels per day in August, exceeding the average of July (3.202 million. Barrels per day). Recall, Iraq is a major crude oil producers in the world, ranking second in its production among the member states of the

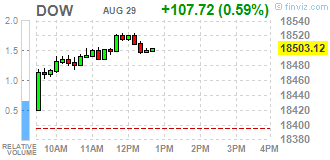

Most components of the DOW index finished trading in positive territory (27 of 30). More rest up shares The Travelers Companies, Inc. (TRV, + 1.06%). Outsider were shares of NIKE, Inc. (NKE, -0.70%).

All Sector S & P Index showed an increase. The leader turned conglomerates sector (+ 2.1%).

At the close:

Dow + 0.59% 18,503.81 +108.41

Nasdaq + 0.26% 5,232.33 +13.41

S & P + 0.52% 2,180.42 +11.38

-

21:00

Dow +0.60% 18,505.59 +110.19 Nasdaq +0.37% 5,238.30 +19.38 S&P +0.56% 2,181.19 +12.15

-

18:44

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Monday morning, helped by financial stocks that gained a day after Federal Reserve Chair Janet Yellen said the case for an interest rate hike had strengthened. Yellen, addressing a gathering of global central bankers on Friday, said the central bank was close to meeting its goals of maximum employment and stable prices, while describing consumer spending as "solid". Yellen gave little indication of when the Fed would move but Vice Chairman Stanley Fischer suggested that a move as soon as next month could be possible.

Most of Dow stocks in positive area (28 of 30). Top gainer The Travelers Companies, Inc. (TRV, +1.22%). Top loser - The Walt Disney Company (DIS, -0.74%).

All S&P sectors also in positive area. Top gainer - Conglomerates (+2.5%).

At the moment:

Dow 18478.00 +98.00 +0.53%

S&P 500 2180.00 +11.50 +0.53%

Nasdaq 100 4800.50 +14.75 +0.31%

Oil 46.79 -0.85 -1.78%

Gold 1326.40 +0.50 +0.04%

U.S. 10yr 1.58 -0.05

-

18:00

European stocks closed: FTSE 100 Closed DAX -43.33 10544.44 -0.41% CAC 40 -17.62 4424.25 -0.40%

-

17:51

Oil declined today

Oil futures fell by about 2 percent coming under pressure because of the increase in reports of oil production in the Middle East.

On Saturday, Iraqi Oil Minister said that his country will continue to increase oil production. In addition, two officials of the state-owned South Oil Company said that oil exports from Iraq's southern ports reached an average of 3.205 million barrels per day in August, exceeding the average of July (3.202 million. Barrels per day). Recall, Iraq is one of the main producers of crude oil in the world, ranking second in its production among the member states of the Organization of Petroleum Exporting Countries (OPEC). "The uncertainty of oil price prospects is high enough, - said Robert Bosley of Boslego Risk Services - the oil reserves continue to reach new highs and it is not yet clear whether OPEC members intervene in the market if the prices will drop back to $ 40."

Recall OPEC countries are planning to hold an informal meeting on the sidelines of the 15th International Energy Forum in Algeria. At that meeting, OPEC is likely to resume negotiations on freezing oil with countries within and outside the cartel. On Friday, Iran's oil minister said that Iran will help other oil producers to stabilize the world market, if other its market share will be restored. Iran is the third largest producer in OPEC to increase production after the removal of Western sanctions in January.

The cost of the October futures for WTI fell to 46.82 dollars per barrel.

October futures price for North Sea petroleum mix of mark Brent fell to 49.35 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:40

WSE: Session Results

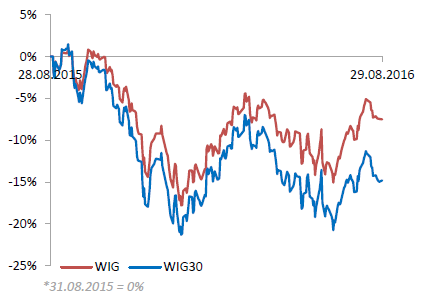

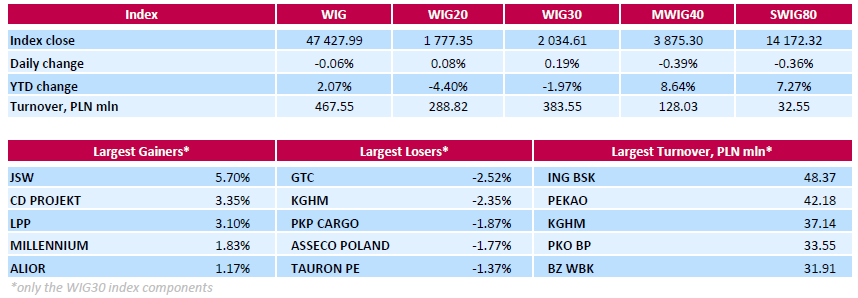

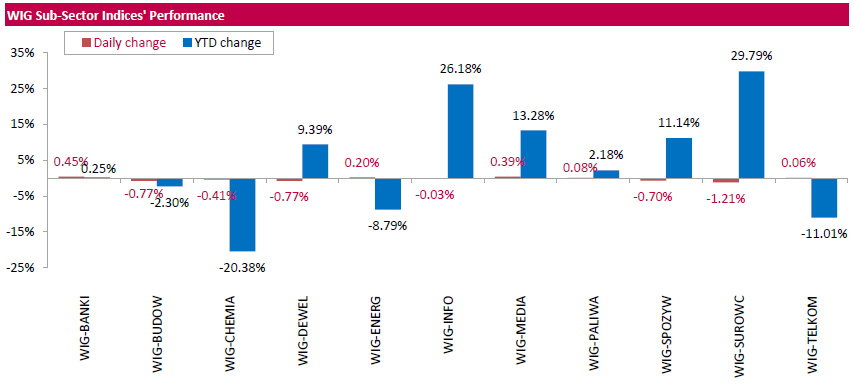

Polish equity market closed flat on Monday. The broad market measure, the WIG Index, inched down 0.06%. Sector performance within the WIG Index was mixed. Materials (-1.21%) demonstrated the worst dynamics, while banking sector (+0.45%) outperformed.

The large-cap stocks' measure, the WIG30 Index, added 0.19%. Within the WIG30 Index components, coking coal miner JSW (WSE: JSW) managed to record the best daily result, climbing by 5.7% on the back of the presented restructuring plan, aimed at helping the company become profitable in the long-term. This plan envisages sale of selected assets and reduction in costs by PLN 1.6 bln by 2025. Other noticeable gainers were videogame developer CD PROJEKT (WSE: CDR) and clothing retailer LPP (WSE: LPP), jumping by 3.35% and 3.31% respectively. On the other side of the ledger, property developer GTC (WSE: GTC) and copper producer KGHM (WSE: KGH) fared the worst, slumping 2.52% and 2.35% respectively. They were followed by railway freight transport operator PKP CARGO (WSE: PKP) and IT-company ASSECO POLAND (WSE: ACP), which lost a respective 1.87% and 1.77%.

-

17:28

Gold price unchanged for the day

Gold prices little changed in a low activity monday market.

Speaking at the annual symposium in Jackson Hole, Yellen said that against the background of improved economic conditions in the labor market, the probability of raising interest rates rose. However, she clarified that the next steps will be based on macroeconomic data. "Our decisions always depend on the extent to which the next data continue to confirm the Fed's forecasts", - said Yellen. Judging by the comments, if rates are not increased in September, it is expected to rise at a future meeting.

"The pressure on gold is likely to increase as approaching September, and market participants are now increasingly expect a rate hike", - INTL FC Stone said.

In addition, data from Commodity Futures Trading Commission showed that in the week to 23 August, hedge funds and money managers increased their net long position in gold.

The cost of the August gold futures on COMEX fell to $ 1319.0 per ounce.

-

16:22

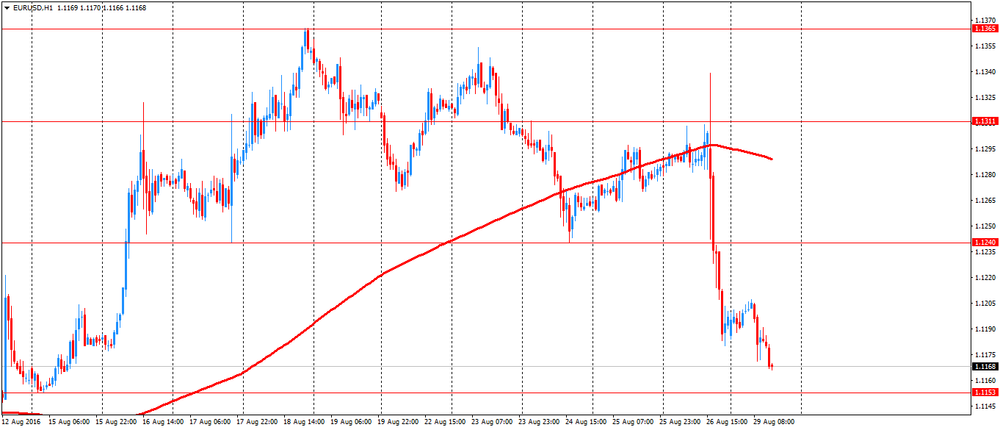

Here Is Why EUR/USD Will Trade Within A Narrow Range For Now - Societe Generale

"1) You get the biggest bang for you buck from a rise in US 10year yields being long USD/JPY but you also get decent gains against AUD, NZD and SGD.

2) The correlation between US 10yr yields and GBP/USD and USD/MXN is fine, but the sign's wrong. However, GBP/USD does respond very well to moves at the front end of the curve, reinforcing my bearish bias.

3) Higher US yields do correlate with falling EUR/USD, which is more than can be said for the Euros reaction to relative rate moves this year.

There is no significant correlation in 2016 between EUR/USD and either 2yr rate spreads, or 10year yield differentials (real or nominal), mostly because EUR/USD doesn't actually move.

So I hold out little hope of EUR/USD doing more than meandering down within a narrow range, but I can see a case here, for longs in USD and MXN against either JPY, or AUD or SGD".

Copyright © 2016 Societe Generale, eFXnews™

-

15:52

WSE: After start on Wall Street

The afternoon data from the US came out as expected, which means good. Expenditure of the Americans are growing the fourth consecutive month, also strongly grew revenues. From the point of view of the Federal Reserve it does not bring any new to the situation, except that there are no negative surprises. In our market today's holiday in the UK shows the share of foreign trade on our parquet. An hour before the close of trading turnover on the WIG20 is suddenly PLN 200 million. The only hope for starting of trading in America, but there's also the fact of inactive, one of the major financial centers may discourage some active trade. The US market began from growth, however, it has no influence on our the WIG20, which one hour before the end of the session was on the level of 1,774 points (-0,07%).

-

15:51

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 355m) 1.1150 (256m) 1.1175 (204m) 1.1190 (200m) 1.1200 (310m 1.1250(269m) 1.1300 (493m) 1.1350 (556m) 1.1375 (231m) 1.1400 (212m)

USD/JPY: 99.50 (USD 264m) 99.75 (330m) 100.00 (644m) 100.50 (292m) 101.00 (211m) 102.35-40 (340m) 103.00 (684m)

GBP/USD: 1.3100 (GBP 269m) 1.3360 (292m)

AUD/USD: 0.7450 (AUD 306m) 0.7500 ( 990m) 0.7684 (324m) 0.7750 (520m)

NZD/USD: 0.7035 (NZD 278m)

USD/CAD: 1.3025 (USD 200m)

-

15:32

U.S. Stocks open: Dow +0.16%, Nasdaq +0.13%, S&P +0.18%

-

15:26

Before the bell: S&P futures +0.08%, NASDAQ futures +0.06%

U.S. stock-index futures were little changed amid consumer spending data that indicated continued strength in the American economy as investors assess the timing of Federal Reserve policy moves.

Global Stocks:

Nikkei 16,737.49 +376.78 +2.30%

Hang Seng 22,821.34 -88.20 -0.38%

Shanghai 3,070.35 +0.0383 0.00%

FTSE Closed

CAC 4,411.88 -29.99 -0.68%

DAX 10,536.79 -50.98 -0.48%

Crude $47.05 (-1.24%)

Gold $1323.10 (-0.21%)

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.41

0.00(0.00%)

13960

ALCOA INC.

AA

10

0.00(0.00%)

3735

ALTRIA GROUP INC.

MO

65.83

0.00(0.00%)

84317

Amazon.com Inc., NASDAQ

AMZN

769

0.00(0.00%)

4827

American Express Co

AXP

64.97

0.18(0.2778%)

155

AMERICAN INTERNATIONAL GROUP

AIG

59.02

0.00(0.00%)

148974

Apple Inc.

AAPL

107

0.06(0.0561%)

47939

AT&T Inc

T

40.68

0.00(0.00%)

4864

Barrick Gold Corporation, NYSE

ABX

18.06

-0.14(-0.7692%)

78016

Boeing Co

BA

132.23

0.00(0.00%)

47899

Caterpillar Inc

CAT

82.52

-0.14(-0.1694%)

1000

Chevron Corp

CVX

101.32

0.00(0.00%)

2100

Cisco Systems Inc

CSCO

31.35

0.00(0.00%)

1561

Citigroup Inc., NYSE

C

47.3

0.19(0.4033%)

8951

Deere & Company, NYSE

DE

86.75

0.01(0.0115%)

505

E. I. du Pont de Nemours and Co

DD

69.65

0.00(0.00%)

18603

Exxon Mobil Corp

XOM

87.27

-0.00(-0.00%)

545

Facebook, Inc.

FB

125.05

0.09(0.072%)

25081

FedEx Corporation, NYSE

FDX

164.95

0.00(0.00%)

4178

Ford Motor Co.

F

12.44

0.06(0.4846%)

8059

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.83

-0.06(-0.551%)

72793

General Electric Co

GE

31.2

-0.03(-0.0961%)

15751

General Motors Company, NYSE

GM

31.87

0.34(1.0783%)

3182

Goldman Sachs

GS

165.97

0.00(0.00%)

5670

Google Inc.

GOOG

769.26

-0.28(-0.0364%)

1286

Hewlett-Packard Co.

HPQ

14.4

0.01(0.0695%)

1000

Home Depot Inc

HD

134.36

0.00(0.00%)

54085

HONEYWELL INTERNATIONAL INC.

HON

116.75

0.00(0.00%)

46493

Intel Corp

INTC

35.3

0.04(0.1134%)

400

International Business Machines Co...

IBM

158.32

0.00(0.00%)

41449

International Paper Company

IP

48.89

0.00(0.00%)

25026

Johnson & Johnson

JNJ

119.05

0.01(0.0084%)

701

JPMorgan Chase and Co

JPM

66.61

0.39(0.5889%)

200

McDonald's Corp

MCD

114.47

0.03(0.0262%)

1609

Merck & Co Inc

MRK

62.85

0.00(0.00%)

508053

Microsoft Corp

MSFT

58.05

0.02(0.0345%)

13435

Nike

NKE

59.01

0.01(0.0169%)

47811

Pfizer Inc

PFE

34.9

0.08(0.2298%)

440

Procter & Gamble Co

PG

87.69

0.11(0.1256%)

73360

Starbucks Corporation, NASDAQ

SBUX

57.19

-0.10(-0.1746%)

40996

Tesla Motors, Inc., NASDAQ

TSLA

219.75

-0.24(-0.1091%)

5455

The Coca-Cola Co

KO

43.33

0.01(0.0231%)

2857

Travelers Companies Inc

TRV

117.14

0.00(0.00%)

3487

Twitter, Inc., NYSE

TWTR

18.34

0.04(0.2186%)

32025

United Technologies Corp

UTX

107.31

0.00(0.00%)

45498

UnitedHealth Group Inc

UNH

136.9

0.28(0.2049%)

110

Verizon Communications Inc

VZ

52.25

0.18(0.3457%)

4460

Visa

V

80.78

0.21(0.2606%)

529

Wal-Mart Stores Inc

WMT

70.9

-0.24(-0.3374%)

1585

Walt Disney Co

DIS

95.21

-0.00(-0.00%)

1436

Yahoo! Inc., NASDAQ

YHOO

42.27

0.00(0.00%)

135265

Yandex N.V., NASDAQ

YNDX

22.14

0.00(0.00%)

2400

-

14:42

European session review: the US dollar continues to rise

The following data was published:

(Time / country / index / period / previous value / forecast)

The US dollar is rising moderately after the sharp rise on Friday as upbeat comments from US Federal Reserve's Janet Yellen on the state of the US economy have increased expectations of a rate hike.

During the annual conference of the representatives of the world's central bankers in Jackson Hole, Wyoming, Yellen said that the possibility of rate hike has increased in recent months against the backdrop of the recovery of the labor market and the economy.

Yellen not called the timing of rate increases, but the Fed Vice Chair Stanley Fischer said that her comments correspond to the growth expectations of the likely increase in 2016.

"The dynamics of the markets influenced not so much by Yellen as Fisher", - said Ayako Sera of Sumitomo Mitsui Trust Bank.

Futures on interest rates indicate that market participants estimate the probability of a rate hike in September at more than 30 percent instead of 18% before Yellen and Fisher showed FedWatch data from CME Group. The probability of a rate hike has grown to more than 60 percent in December from 57 percent on Friday.

According to analysts, now markets attach great importance to data on the number of jobs in the US (NFP), to be published on Friday.

US Dollar "increased significantly" after "comments that indicate a tendency to tighten policy," said analysts of Danske Bank and added that the employment data in the United States "will have a decisive influence on the short-term prospects for the US dollar."

The pound weakened against the US dollar while investors await important statistics from Britain.

On Tuesday, the Bank of England will publish data on lending to households and businesses in July, which will help understand whether the market disturbances have a negative impact on lending in the UK.

On Thursday, the PMI index will be released for the manufacturing sector. Markets hope that he will clarify how strongly the manufacturers recover.

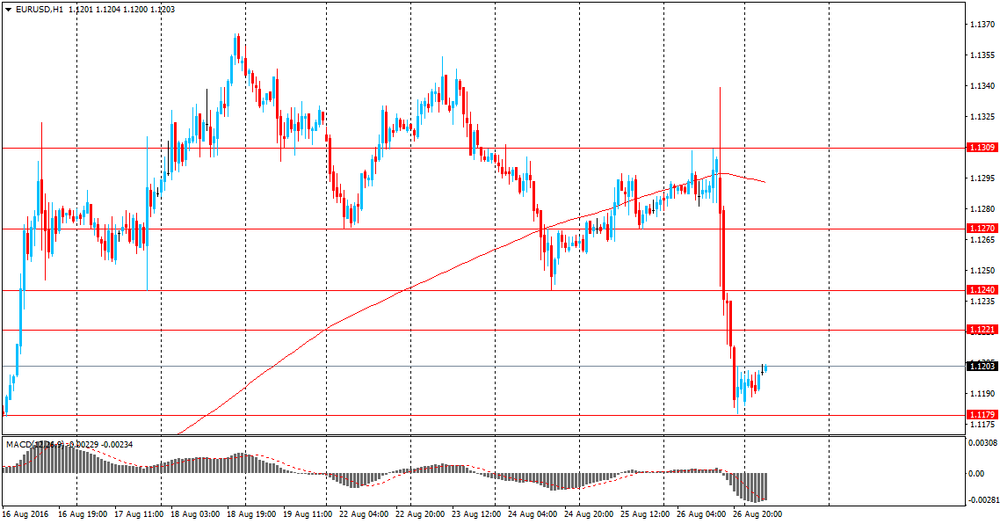

EUR / USD: during the European session, the pair fell to $ 1.1166

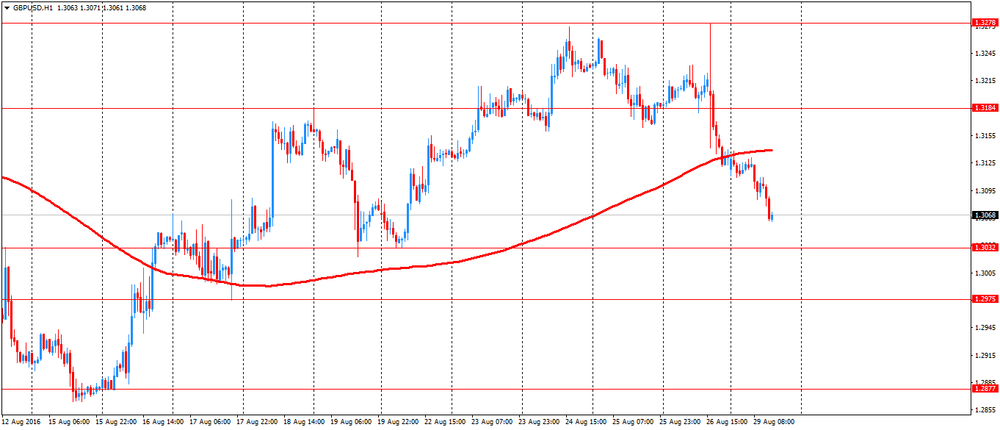

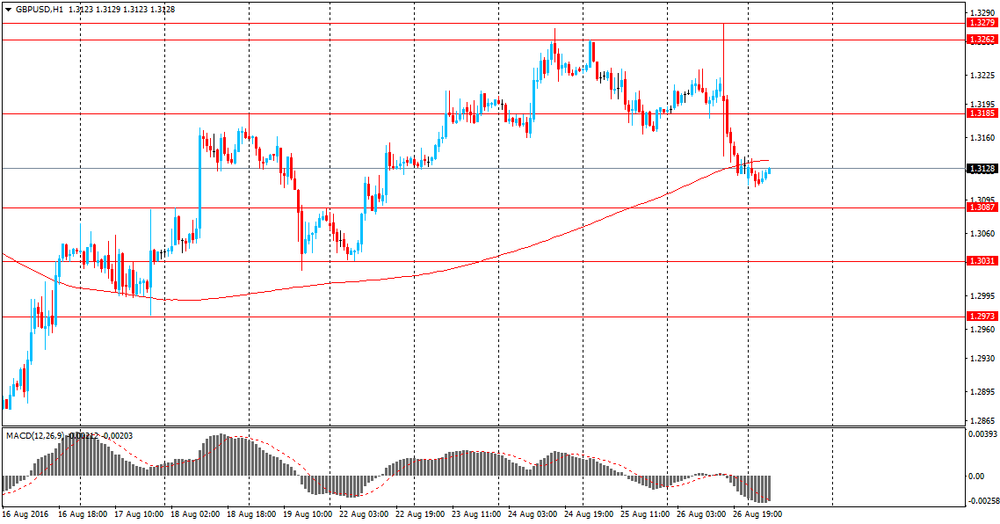

GBP / USD: during the European session, the pair fell to $ 1.3061

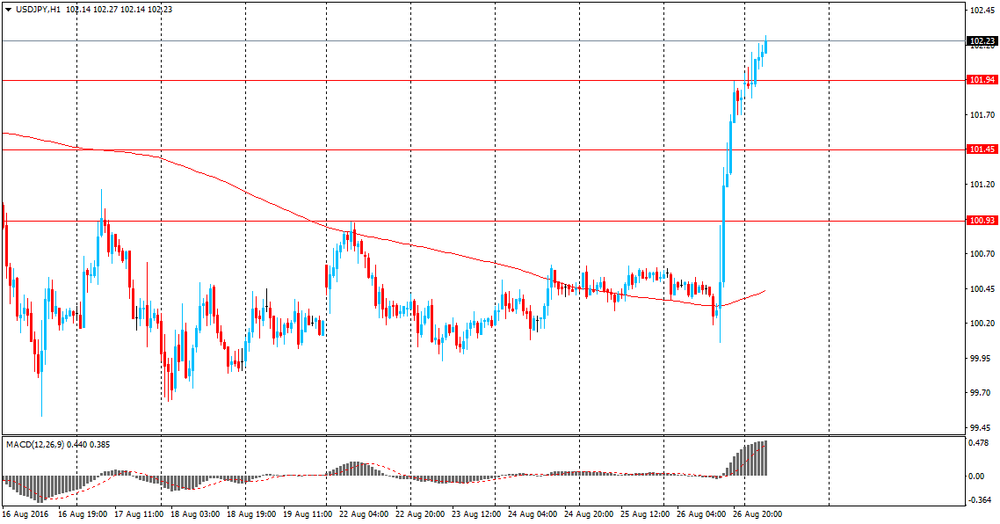

USD / JPY: during the European session, the pair rose to Y102.38 and retreated

-

14:34

US Core PCE price index up 1.6% in July

Personal income increased $71.6 billion (0.4 percent) in July according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $60.1 billion (0.4 percent) and personal consumption expenditures (PCE) increased $42.0 billion (0.3 percent).

Real DPI increased 0.4 percent in July and Real PCE increased 0.3 percent. The PCE price index was unchanged from June. Excluding food and energy, the PCE price index increased 0.1 percent in July.The increase in personal income in July primarily reflected increases in wages and salaries and personal current transfer receipts.

The increase in real PCE in July reflected increases in spending for new motor vehicles and for services that was partially offset by a decrease in spending for nondurable goods. -

14:30

U.S.: Personal Income, m/m, July 0.4% (forecast 0.4%)

-

14:30

U.S.: PCE price index ex food, energy, Y/Y, July 1.6%

-

14:30

U.S.: Personal spending , July 0.3% (forecast 0.3%)

-

14:30

U.S.: PCE price index ex food, energy, m/m, July 0.1% (forecast 0.1%)

-

13:51

Orders

EUR/USD

Offers : 1.1200 1.1225-30 1.1250 1.1280 1.1300 1.1320-25 1.1350-55

Bids : 1.1170 1.1150 1.1120 1.1100 1.1080 1.1050 1.1030 1.1000

GBP/USD

Offers : 1.3120 1.3135 1.3150 1.3180 1.3200 1.3235 1.3250 1.3280 1.3300

Bids : 1.3085 1.3050 1.3030 1.3000 1.2980 1.2950 1.2930 1.2900

EUR/GBP

Offers : 0.8550 0.8565 0.8580 0.8600 0.8625-30 0.8655-6

Bids : 0.8525-30 0.8500 0.8480-85 0.8465 0.8450 0.8430 0.8400

EUR/JPY

Offers : 113.60 113.80 114.00 114.30 114.50 114.75 115.00

Bids : 113.30 113.00 112.75-80 112.50 112.30 112.00-10

USD/JPY

Offers : 102.50 102.80 103.00 103.30 103.50 103.75 104.00

Bids : 102.00 101.80 101.65 101.50 101.30 101.00 100.80 100.50 100.20 100.00

AUD/USD

Offers :0.7565 0.7580 0.7600 0.7625-30 0.7650 0.7680 0.7700

Bids : 0.7530 0.7500 0.7485 0.7450 0.7430 0.7400

-

13:48

German trade association: Brexit to impact exports massively in the near future

-

German exports are set for stagnation, possibly as early as 2017.

-

cites global uncertainties including Brexit.

-

cuts forecast for 2016 export growth to 1.8-2.0% vs 4.5% previously.

*via forexlive

-

-

13:09

WSE: Mid session comment

Today's morning on Europe exchanges was dominated by the color red, although the entrance to the southern phase of the trade takes place with index levels slightly higher than those established approx. 10:00 o'clock. The Warsaw market today is very shallow. After 4 hours of trading in the WIG20 the recorded turnover was approx. PLN 122 mln. Adding to this the 10 points of the volatility quite well reflects the attractiveness of today's trading. Nothing happens, and the southern phase of session usually has little chance to bring any major breakthrough. Indisposition of the WIG20 today is not something surprising, because it is basically a continuation of the previous behavior of the blue chips sector.

In the middle of trading the WG20 index reached the level of 1,776 points (+ 0.02%).

-

12:42

Major stock indices in Europe down moderately

European stocks fall as investors assess optimistic comments about the US economy and the chances of an early rate hike by the Federal Reserve.

On Friday, European shares rose on the statement by Janet Yellen that Fed intends to adhere to the gradual approach to raising rates amid recovery of the US economy, expressed by the strengthening of the labor market and inflation acceleration.

The composite index of the largest companies in the region Stoxx Europe 600 fell during trading 0,5% - to 342.08 points. UK stock market closed today in connection with the summer bank holiday.

Shares of mining companies lower against the backdrop of cheaper metals prices. ArcelorMittal Share prices fell by 1%.

The market value of Alstom SA increased by 2.4% on news that the firm is commissioned to design and manufacture high-speed trains for the American corporation Amtrak.

Shares of fashion house Prada rose 2% after the statements that in the next year the company will return to growth in profit and revenue.

Stada's shares were down 1.3% as Active Ownership Capital investor were able to convince the shareholders to vote for the resignation of Stada Chairman of the Supervisory Board of the company, but did not achieve the appointment of its own candidate.

At the moment:

FTSE Closed

DAX 10504.34 -83.43 -0.79%

CAC 4396.01 -45.86 -1.03%

-

12:25

Germany’s Schaeuble has spoken out against the low interest rates

German Finance Minister Wolfgang Schaeuble warned against continued low interest rates in the euro area. "In the long term effects of low interest rates or even negative is harmful" - he said in an interview with German newspaper Frankfurter Allgemeine Sonntagszeitung. At the same time he believes that to complete a soft monetary policy is possible only through the implementation of structural reforms and investment growth.

The era of low interest rates could last for quite some time, writes Deutsche Welle. Economist Peter Bofinger expects this in the next five years. "Low interest rates can be kept for a long time in Japan, they have been around for over 20 years." - Martin Hellwig, director of the Bonn Institute of the Max Planck Society.

The Governing Council of the European Central Bank lowered its key interest rate to 0 percent in March 2016. Germany criticized the ECB's policy. Earlier Schaeuble has repeatedly said that it leads to an increase in the number of eurosceptics. A deputy chairman of the CDU / CSU in the Bundestag Hans-Peter Friedrich said that the next head of the ECB will be a German.

-

11:22

Yellen gives hope to USD bulls

According to rttnews, Federal Reserve Chairman Janet Yellen says the case for another interest-rate hike has strengthened.

"In light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months," Yellen said in a speech prepared for delivery to the Jackson Hole summit.

However, the Fed's decision "always depends on the degree to which incoming data continues to confirm the Fed policy committee's outlook."

There will be no second speech from J.Yellen today. From the price action in the coming days we can evaluate how much a rate hike of 0.25% is already priced in.

-

10:23

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 355m) 1.1150 (256m) 1.1175 (204m) 1.1190 (200m) 1.1200 (310m 1.1250(269m) 1.1300 (493m) 1.1350 (556m) 1.1375 (231m) 1.1400 (212m)

USD/JPY: 99.50 (USD 264m) 99.75 (330m) 100.00 (644m) 100.50 (292m) 101.00 (211m) 102.35-40 (340m) 103.00 (684m)

GBP/USD: 1.3100 (GBP 269m) 1.3360 (292m)

AUD/USD: 0.7450 (AUD 306m) 0.7500 ( 990m) 0.7684 (324m) 0.7750 (520m)

NZD/USD: 0.7035 (NZD 278m)

USD/CAD: 1.3025 (USD 200m)

-

10:14

Oil much lower in early trading

This morning, New York crude oil futures for WTI fell by -1.64% to $ 46.85 and Brent oil futures were down -1.62% to $ 49.35 per barrel. Thus, the black gold is traded lower on the background of growth of oil production in Iraq, and after Iran presented conditions of cooperation with OPEC to stabilize the oil market. Analysts said that prices have fallen in relation to data on production growth in the Middle East. Oil exports from Iraq's southern ports reached an average of 3.205 million barrels per day in August, exceeding July's average.

Iran has announced its readiness to help other oil producers to stabilize the world market only if it will redeem its market share. According to experts, due to disagreement within OPEC, particularly between Saudi Arabia and Iran, there's not expect a significant impact of negotiations on prices.

-

10:10

Italian business confidence declines moderately in August

The index recorded a value slightly lower than forecasts at 101.1 (102.5 forecast) and the previous value revised down to 102. 9. The consumer confidence declines to 109.2 form 111.2 the previos month.

Business Confidence rates the current level of business conditions. It helps to analyze the economic situation in the short term. A rising trend indicates an increase in business investment which may lead to higher levels of output.

-

09:24

Major stock markets trading lower: DAX -0.8%, CAC40 -0.5%, FTMIB -0.4%, IBEX -0.6%

-

09:19

WSE: After opening

WIG20 index opened at 1772.66 points (-0.18%)*

WIG 47371.62 -0.18%

WIG30 2026.79 -0.20%

mWIG40 3883.70 -0.18%

*/ - change to previous close

The futures market (WSE: FW20U1620) started the new week with a discount of 0.28% to 1,774 points. The cash market (the WIG20 index) opened with a drop of 0.18% to 1,772 points, which means a breach of support from last week. The German DAX lost at the opening of approx. 0.6%. It is the clear reaction to the words of Janet Yellen. After a few minutes of trading on European markets appeared gains, which helped to relieve the negative sentiment on the cash market and our index WIG20 went on the green side of the market.

After the recent attempts to calm the confusion surrounding about PZU / Pekao by Deputy Minister Mateusz Morawiecki, who said that there is no plans to buy stake in Bank Pekao by PZU, the theme returns through the publication of The Financial Times. Anonymous sources have reported that haggling over the price still continues, and the transaction would be made by the end of October.

-

09:18

Today’s events

At 15:30 GMT the United States will hold an auction of 3- and 6-month bills.

UK bank holiday.

-

08:44

Asian session review: the US dollar traded in a narrow range

The US dollar traded in a narrow range against the euro. On friday comments by Fed's Janet Yellen caused choppy conditions but eur/usd was traded lower. She did not specify exactly when the rates may be increased, in September or in December, but noted that the grounds for increasing rates increased.

Yellen said that against the backdrop of continuing positive momentum in the labor market and the outlook for economic activity and inflation, the arguments in favor of raising interest rates have increased in recent months. The decision on raising rates, as before, will depend on the extent to which the incoming statistical data confirm this forecast, stressed Yellen.

Other Fed officials also support the rate hike, although, like Yellen, they did not give predictions on the timing of further policy tightening. The next Fed meeting will be held on September 20-21. Some analysts believe that rates will be raised at this meeting.

As reported today by Bloomberg, the probability of a rate hike at the September meeting rose to 42% from 22% a week ago, and the probability of a rate hike at the December meeting rose to 65%.

During today's Asian session, the yen continued to decline after the Bank of Japan's head Haruhiko Kuroda, said that the Bank of Japan will act "without hesitation" to revive inflation.

"The Bank of Japan will continue to closely study the risks and take additional easing measures without hesitation"

The Australian dollar fell against the background of the widespread increase in the US dollar and, to some extent, on the negative data on new home sales. Sales of new homes published by the Association of the housing industry, fell by -9.7% in July, after rising 8.2% in June. This indicator expresses the volume of new home sales in Australia and assesses conditions in the housing market.

EUR / USD: during the Asian session, the pair was trading in 1.1190-1.1210 range.

GBP / USD: during the Asian session, the pair was trading in the $ 1.3110-40 range.

USD / JPY: during the Asian session, the pair was trading in Y101.80-102.40 range.

-

08:34

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0,1%

-

08:33

Scenarios for September BoJ meeting - Deutsche Bank

"In Japan, the BoJ will conduct a comprehensive assessment of policy on 21 September, but we see scant chance that it will cut its 2% price stability target or admit that its monetary policy is at its limits.

The markets broadly expect the following. (1) The BoJ will shift its price stability target date from its effectively abandoned two-year period to more flexible phrasing. (2) It will give itself greater latitude in its JGB purchasing operations to address doubts over sustainability, widening its annual target from ¥80trn, e.g. to ¥70-90trn. (3) It will reiterate that its monetary policy remains effective and does not face any near-term limits. A summary of the scenario for BoJ monetary policy is offered in

We believe that if multiple Fed rate hikes come to be seen as a certainty amid the strength of the US economy, the USD/JPY should regain some of its lost ground. The upside for the rate should grow further if the BoJ should carry out additional easing action. However, we see a 25% chance of such favorable conditions coming together and the USD/JPY settling at ¥100-110.

If uncertainties arise, including policy events in the US or Japan, the rate could see greater downside. A steep drop into the ¥90s could prompt stronger technical resistance at ¥100. We would rate this risk at 75%".

Copyright © 2016 DB, eFXnews™

-

08:27

New homes sales in Australia fell

The Australian dollar fell after the publication of data on new home sales. Published by the Association of the housing industry the index fell by -9.7% in July, after rising 8.2% in June. This indicator expresses the volume of new home sales in Australia and assesses conditions in the housing market. It also stimulates the demand for goods, services and workers, as buyers spend money on furnishing and financing their homes.

-

08:26

WSE: Before opening

The last week ended with a long-awaited speech by Janet Yellen in Jackson Hole, who spoke positively about the economic situation. But surely her statement corresponded with earlier words of the members of the FOMC. It seems that investors have turned their attention to the statements of the deputy head of the Federal Reserve, Stanley Fischer, who asked whether the words of Yellen mean that we may expect increases in September and one more before the end of the year, replied that, yes, but still it depends on the incoming data .

As a result, the market probability of increase the cost of money in September increased from 21% to 33%, and in December from 51.8% to 59.1%.

Wall Street finally moved down by 0.16%. The WSE in fear of a decrease in the attractiveness of emerging markets also showed a decline.

Today morning trading in Asia is still run under the dictation of Friday pulses. The weakening of the yen will well up the Nikkei by more than 2%. In turn, other parquets are dominated by the red colour, although to a small extent. Contracts in the US are stable, and investors seem now to wait for data from this week. The monthly report from the US labor market, which will be published on Friday, may prove to be decisive as to the possible movement at the September meeting of the Federal Open Market Committee.

Today's calendar will be modest. Due to holidays in the UK we may expect, especially on the Warsaw Stock Exchange and to some extent in Europe, a lower activity.

The beginning of the new week of trading on the exchange market did not bring any significant changes to the valuation of the national currency against foreign currency. The zloty is quoted in the market as follows: PLN 4.3250 per euro, 3.8633 PLN against the US dollar. Yields on Polish debt are as follows: 2,692% in the case of 10-year bonds.

-

08:19

Bank of Japan Governor Haruhiko Kuroda: The Bank of Japan will act without hesitation

- The Bank of Japan will act "without hesitation" to revive inflation.

- The recent decline in inflation could mean that inflation expectations have not yet fixed the target level of 2%

- The Bank of Japan will approve or more quantitative easing or reduction of negative interest rates without hesitation.

- The Bank of Japan will continue to closely study the risks and take additional measures.

- Combining quantitative easing and negative rates the bank has a strong action scheme and will act decisively.

-

08:16

Los Angeles airport police confirm reports of shots fired in the facility were a false alarm

-

07:27

Global Stocks

European stocks swung higher Friday, with investors taking remarks from Federal Reserve Chairwoman Janet Yellen as a sign of confidence in economic growth world-wide.

The Stoxx Europe 600 SXXP, +0.50% closed up 0.5% at 343.72, but it had been creeping up shortly before the text of Yellen's speech in Jackson Hole, Wyo., was released. All but the consumer-services sector Q0E, -0.09% ended higher.

The FTSE 100 UKX, +0.31% rose 0.3% to 6,838.05, but the health care, consumer-goods and consumer-services sectors lost ground. Miners popped up after being under pressure this week.

Yellen, at the Fed's summer summit, signaled that the U.S. central bank is preparing to increase interest rates as soon as next month.

"In light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal-funds rate has strengthened in recent months," she said.

The blue-chips index started to pick up a bit of steam before the text of Yellen's speech in Jackson Hole, Wyo., was released.

The Dow Jones Industrial Average and the S&P 500 index finished lower Friday after comments from Fed Vice Chairman Stanley Fischer doubled down on a speech by Federal Reserve Chairwoman Janet Yellen that asserted the case for a rate increase is gathering steam.

The Dow Jones Industrial Average DJIA, -0.29% fell 53.01 points, or 0.3%, to finish at 18,395.40, backing off an earlier 124-point gain, but paring a 113-point loss.

The S&P 500 index SPX, -0.16% fell 3.43 points, or 0.2%, to close at 2,169.04, after trading up as many as 16 points earlier and bouncing back from a 12-point deficit.

The Nasdaq Composite Index COMP, +0.13% rose 6.71 points, or 0.1%, to finish at 5,218.92, after being up about 41 points earlier and down as low as 20 points during the session.

Japanese stocks surged to 1-1/2-week highs on Monday morning as the yen weakened after U.S. Federal Reserve Chair Janet Yellen signalled an interest rate hike remains on the cards this year, lifting insurers and exporters.

Speaking at the annual gathering of central bankers in Jackson Hole, Wyoming, Yellen said the case for raising U.S. interest rates had strengthened thanks to improvements in the labour market and expectations for moderate economic growth.

The Nikkei share average soared 2.2 percent to 16,721.23 in midmorning trade, after rising as high as 16,737.95, the highest since August 17.

Insurers staged a rally as higher U.S. rates would allow them to reap yield gains from their investments in U.S. bonds, while their domestic stock portfolio would also benefit from Nikkei's uptick.

-

07:04

Options levels on monday, August 29, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1414 (4546)

$1.1333 (4451)

$1.1271 (4178)

Price at time of writing this review: $1.1203

Support levels (open interest**, contracts):

$1.1125 (2503)

$1.1063 (4268)

$1.1025 (5383)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52182 contracts, with the maximum number of contracts with strike price $1,1250 (4745);

- Overall open interest on the PUT options with the expiration date September, 9 is 57330 contracts, with the maximum number of contracts with strike price $1,1000 (5784);

- The ratio of PUT/CALL was 1.10 versus 1.11 from the previous trading day according to data from August, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.3402 (2075)

$1.3304 (2653)

$1.3207 (1662)

Price at time of writing this review: $1.3121

Support levels (open interest**, contracts):

$1.2995 (2108)

$1.2897 (1861)

$1.2799 (2673)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32620 contracts, with the maximum number of contracts with strike price $1,3300 (2653);

- Overall open interest on the PUT options with the expiration date September, 9 is 26610 contracts, with the maximum number of contracts with strike price $1,2800 (2673);

- The ratio of PUT/CALL was 0.82 versus 0.82 from the previous trading day according to data from August, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:30

Commodities. Daily history for Aug 26’2016:

(raw materials / closing price /% change)

Oil 47.29 -0.73%

Gold 1,324.00 -0.14%

-

00:29

Stocks. Daily history for Aug 26’2016:

(index / closing price / change items /% change)

Nikkei 225 16,360.71 -195.24 -1.18%

Shanghai Composite 3,070.48 +2.15 +0.07%

S&P/ASX 200 5,515.47 -26.42 -0.48%

FTSE 100 6,838.05 +21.15 +0.31%

CAC 40 4,441.87 +35.26 +0.80%

Xetra DAX 10,587.77 +58.18 +0.55%

S&P 500 2,169.04 -3.43 -0.16%

Dow Jones Industrial Average 18,395.40 -53.01 -0.29%

S&P/TSX Composite 14,639.88 +9.16 +0.06%

-

00:29

Currencies. Daily history for Aug 26’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1197 -0,78%

GBP/USD $1,3131 -0,43%

USD/CHF Chf0,978 +1,07%

USD/JPY Y101,82 +1,27%

EUR/JPY Y114,00 +0,50%

GBP/JPY Y133,75 +0,88%

AUD/USD $0,7562 -0,70%

NZD/USD $0,7234 -0,87%

USD/CAD C$1,3003 +0,67%

-