Noticias del mercado

-

22:06

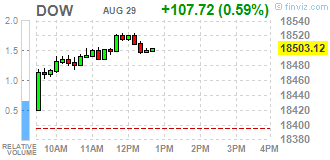

Major US stock indexes rose moderately

Major US stock indexes finished trading above the zero mark after Fed Chairman Yellen said the strengthening of the prerequisites for raising interest rates.

Yellen said on Friday that the Fed is close to meeting its goals of maximum employment and price stability, speaking about consumer spending. However, the vice-chairman of the Fed's Fisher said that the Central Bank may raise interest rates in September. With regard to the question of whether the Fed will raise rates in September and the second time before the end of the year, Fisher said Yellen statements give a positive answer to this question. According to the futures market, the probability of a Fed rate is 21% in September. Meanwhile, the possibility of increasing rates in the framework of the December meeting is estimated at 41.4% against 44.4% the previous day.

As it became known today, personal income increased by $ 71.6 billion (0.4%) in July, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $ 60.1 billion (0.4%), and personal consumption expenditures (the PCE) increased $ 42.0 billion (0.3%). Real DPI increased 0.4% in July and a real PCE increased 0.3%. PCE price index was unchanged from June. Excluding food and energy, PCE price index increased by 0.1% in July.

Oil futures fell more than 1%, has come under pressure because of the increase in reports of oil production in the Middle East. On Saturday, Iraqi Oil Minister said that his country will continue to increase oil production. In addition, two representatives of the state-owned South Oil Company said that oil exports from Iraq's southern ports reached an average of 3.205 million. Barrels per day in August, exceeding the average of July (3.202 million. Barrels per day). Recall, Iraq is a major crude oil producers in the world, ranking second in its production among the member states of the

Most components of the DOW index finished trading in positive territory (27 of 30). More rest up shares The Travelers Companies, Inc. (TRV, + 1.06%). Outsider were shares of NIKE, Inc. (NKE, -0.70%).

All Sector S & P Index showed an increase. The leader turned conglomerates sector (+ 2.1%).

At the close:

Dow + 0.59% 18,503.81 +108.41

Nasdaq + 0.26% 5,232.33 +13.41

S & P + 0.52% 2,180.42 +11.38

-

21:00

Dow +0.60% 18,505.59 +110.19 Nasdaq +0.37% 5,238.30 +19.38 S&P +0.56% 2,181.19 +12.15

-

18:44

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Monday morning, helped by financial stocks that gained a day after Federal Reserve Chair Janet Yellen said the case for an interest rate hike had strengthened. Yellen, addressing a gathering of global central bankers on Friday, said the central bank was close to meeting its goals of maximum employment and stable prices, while describing consumer spending as "solid". Yellen gave little indication of when the Fed would move but Vice Chairman Stanley Fischer suggested that a move as soon as next month could be possible.

Most of Dow stocks in positive area (28 of 30). Top gainer The Travelers Companies, Inc. (TRV, +1.22%). Top loser - The Walt Disney Company (DIS, -0.74%).

All S&P sectors also in positive area. Top gainer - Conglomerates (+2.5%).

At the moment:

Dow 18478.00 +98.00 +0.53%

S&P 500 2180.00 +11.50 +0.53%

Nasdaq 100 4800.50 +14.75 +0.31%

Oil 46.79 -0.85 -1.78%

Gold 1326.40 +0.50 +0.04%

U.S. 10yr 1.58 -0.05

-

18:00

European stocks closed: FTSE 100 Closed DAX -43.33 10544.44 -0.41% CAC 40 -17.62 4424.25 -0.40%

-

17:40

WSE: Session Results

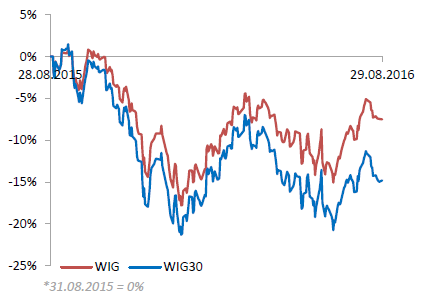

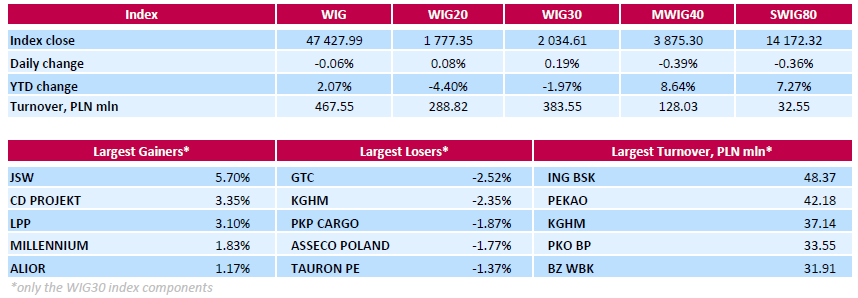

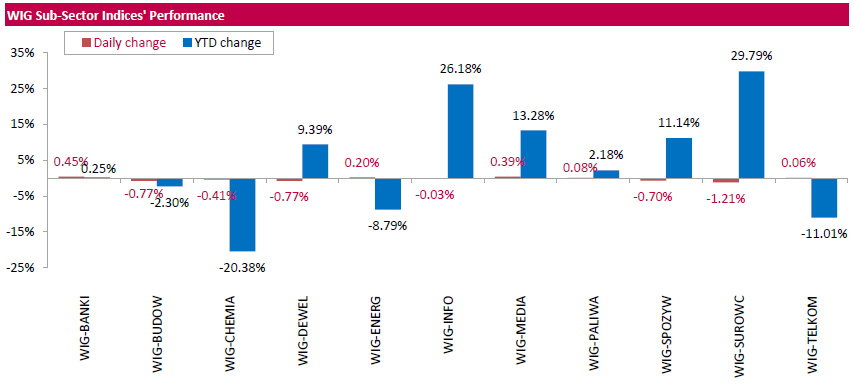

Polish equity market closed flat on Monday. The broad market measure, the WIG Index, inched down 0.06%. Sector performance within the WIG Index was mixed. Materials (-1.21%) demonstrated the worst dynamics, while banking sector (+0.45%) outperformed.

The large-cap stocks' measure, the WIG30 Index, added 0.19%. Within the WIG30 Index components, coking coal miner JSW (WSE: JSW) managed to record the best daily result, climbing by 5.7% on the back of the presented restructuring plan, aimed at helping the company become profitable in the long-term. This plan envisages sale of selected assets and reduction in costs by PLN 1.6 bln by 2025. Other noticeable gainers were videogame developer CD PROJEKT (WSE: CDR) and clothing retailer LPP (WSE: LPP), jumping by 3.35% and 3.31% respectively. On the other side of the ledger, property developer GTC (WSE: GTC) and copper producer KGHM (WSE: KGH) fared the worst, slumping 2.52% and 2.35% respectively. They were followed by railway freight transport operator PKP CARGO (WSE: PKP) and IT-company ASSECO POLAND (WSE: ACP), which lost a respective 1.87% and 1.77%.

-

15:52

WSE: After start on Wall Street

The afternoon data from the US came out as expected, which means good. Expenditure of the Americans are growing the fourth consecutive month, also strongly grew revenues. From the point of view of the Federal Reserve it does not bring any new to the situation, except that there are no negative surprises. In our market today's holiday in the UK shows the share of foreign trade on our parquet. An hour before the close of trading turnover on the WIG20 is suddenly PLN 200 million. The only hope for starting of trading in America, but there's also the fact of inactive, one of the major financial centers may discourage some active trade. The US market began from growth, however, it has no influence on our the WIG20, which one hour before the end of the session was on the level of 1,774 points (-0,07%).

-

15:32

U.S. Stocks open: Dow +0.16%, Nasdaq +0.13%, S&P +0.18%

-

15:26

Before the bell: S&P futures +0.08%, NASDAQ futures +0.06%

U.S. stock-index futures were little changed amid consumer spending data that indicated continued strength in the American economy as investors assess the timing of Federal Reserve policy moves.

Global Stocks:

Nikkei 16,737.49 +376.78 +2.30%

Hang Seng 22,821.34 -88.20 -0.38%

Shanghai 3,070.35 +0.0383 0.00%

FTSE Closed

CAC 4,411.88 -29.99 -0.68%

DAX 10,536.79 -50.98 -0.48%

Crude $47.05 (-1.24%)

Gold $1323.10 (-0.21%)

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.41

0.00(0.00%)

13960

ALCOA INC.

AA

10

0.00(0.00%)

3735

ALTRIA GROUP INC.

MO

65.83

0.00(0.00%)

84317

Amazon.com Inc., NASDAQ

AMZN

769

0.00(0.00%)

4827

American Express Co

AXP

64.97

0.18(0.2778%)

155

AMERICAN INTERNATIONAL GROUP

AIG

59.02

0.00(0.00%)

148974

Apple Inc.

AAPL

107

0.06(0.0561%)

47939

AT&T Inc

T

40.68

0.00(0.00%)

4864

Barrick Gold Corporation, NYSE

ABX

18.06

-0.14(-0.7692%)

78016

Boeing Co

BA

132.23

0.00(0.00%)

47899

Caterpillar Inc

CAT

82.52

-0.14(-0.1694%)

1000

Chevron Corp

CVX

101.32

0.00(0.00%)

2100

Cisco Systems Inc

CSCO

31.35

0.00(0.00%)

1561

Citigroup Inc., NYSE

C

47.3

0.19(0.4033%)

8951

Deere & Company, NYSE

DE

86.75

0.01(0.0115%)

505

E. I. du Pont de Nemours and Co

DD

69.65

0.00(0.00%)

18603

Exxon Mobil Corp

XOM

87.27

-0.00(-0.00%)

545

Facebook, Inc.

FB

125.05

0.09(0.072%)

25081

FedEx Corporation, NYSE

FDX

164.95

0.00(0.00%)

4178

Ford Motor Co.

F

12.44

0.06(0.4846%)

8059

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.83

-0.06(-0.551%)

72793

General Electric Co

GE

31.2

-0.03(-0.0961%)

15751

General Motors Company, NYSE

GM

31.87

0.34(1.0783%)

3182

Goldman Sachs

GS

165.97

0.00(0.00%)

5670

Google Inc.

GOOG

769.26

-0.28(-0.0364%)

1286

Hewlett-Packard Co.

HPQ

14.4

0.01(0.0695%)

1000

Home Depot Inc

HD

134.36

0.00(0.00%)

54085

HONEYWELL INTERNATIONAL INC.

HON

116.75

0.00(0.00%)

46493

Intel Corp

INTC

35.3

0.04(0.1134%)

400

International Business Machines Co...

IBM

158.32

0.00(0.00%)

41449

International Paper Company

IP

48.89

0.00(0.00%)

25026

Johnson & Johnson

JNJ

119.05

0.01(0.0084%)

701

JPMorgan Chase and Co

JPM

66.61

0.39(0.5889%)

200

McDonald's Corp

MCD

114.47

0.03(0.0262%)

1609

Merck & Co Inc

MRK

62.85

0.00(0.00%)

508053

Microsoft Corp

MSFT

58.05

0.02(0.0345%)

13435

Nike

NKE

59.01

0.01(0.0169%)

47811

Pfizer Inc

PFE

34.9

0.08(0.2298%)

440

Procter & Gamble Co

PG

87.69

0.11(0.1256%)

73360

Starbucks Corporation, NASDAQ

SBUX

57.19

-0.10(-0.1746%)

40996

Tesla Motors, Inc., NASDAQ

TSLA

219.75

-0.24(-0.1091%)

5455

The Coca-Cola Co

KO

43.33

0.01(0.0231%)

2857

Travelers Companies Inc

TRV

117.14

0.00(0.00%)

3487

Twitter, Inc., NYSE

TWTR

18.34

0.04(0.2186%)

32025

United Technologies Corp

UTX

107.31

0.00(0.00%)

45498

UnitedHealth Group Inc

UNH

136.9

0.28(0.2049%)

110

Verizon Communications Inc

VZ

52.25

0.18(0.3457%)

4460

Visa

V

80.78

0.21(0.2606%)

529

Wal-Mart Stores Inc

WMT

70.9

-0.24(-0.3374%)

1585

Walt Disney Co

DIS

95.21

-0.00(-0.00%)

1436

Yahoo! Inc., NASDAQ

YHOO

42.27

0.00(0.00%)

135265

Yandex N.V., NASDAQ

YNDX

22.14

0.00(0.00%)

2400

-

13:09

WSE: Mid session comment

Today's morning on Europe exchanges was dominated by the color red, although the entrance to the southern phase of the trade takes place with index levels slightly higher than those established approx. 10:00 o'clock. The Warsaw market today is very shallow. After 4 hours of trading in the WIG20 the recorded turnover was approx. PLN 122 mln. Adding to this the 10 points of the volatility quite well reflects the attractiveness of today's trading. Nothing happens, and the southern phase of session usually has little chance to bring any major breakthrough. Indisposition of the WIG20 today is not something surprising, because it is basically a continuation of the previous behavior of the blue chips sector.

In the middle of trading the WG20 index reached the level of 1,776 points (+ 0.02%).

-

12:42

Major stock indices in Europe down moderately

European stocks fall as investors assess optimistic comments about the US economy and the chances of an early rate hike by the Federal Reserve.

On Friday, European shares rose on the statement by Janet Yellen that Fed intends to adhere to the gradual approach to raising rates amid recovery of the US economy, expressed by the strengthening of the labor market and inflation acceleration.

The composite index of the largest companies in the region Stoxx Europe 600 fell during trading 0,5% - to 342.08 points. UK stock market closed today in connection with the summer bank holiday.

Shares of mining companies lower against the backdrop of cheaper metals prices. ArcelorMittal Share prices fell by 1%.

The market value of Alstom SA increased by 2.4% on news that the firm is commissioned to design and manufacture high-speed trains for the American corporation Amtrak.

Shares of fashion house Prada rose 2% after the statements that in the next year the company will return to growth in profit and revenue.

Stada's shares were down 1.3% as Active Ownership Capital investor were able to convince the shareholders to vote for the resignation of Stada Chairman of the Supervisory Board of the company, but did not achieve the appointment of its own candidate.

At the moment:

FTSE Closed

DAX 10504.34 -83.43 -0.79%

CAC 4396.01 -45.86 -1.03%

-

09:24

Major stock markets trading lower: DAX -0.8%, CAC40 -0.5%, FTMIB -0.4%, IBEX -0.6%

-

09:19

WSE: After opening

WIG20 index opened at 1772.66 points (-0.18%)*

WIG 47371.62 -0.18%

WIG30 2026.79 -0.20%

mWIG40 3883.70 -0.18%

*/ - change to previous close

The futures market (WSE: FW20U1620) started the new week with a discount of 0.28% to 1,774 points. The cash market (the WIG20 index) opened with a drop of 0.18% to 1,772 points, which means a breach of support from last week. The German DAX lost at the opening of approx. 0.6%. It is the clear reaction to the words of Janet Yellen. After a few minutes of trading on European markets appeared gains, which helped to relieve the negative sentiment on the cash market and our index WIG20 went on the green side of the market.

After the recent attempts to calm the confusion surrounding about PZU / Pekao by Deputy Minister Mateusz Morawiecki, who said that there is no plans to buy stake in Bank Pekao by PZU, the theme returns through the publication of The Financial Times. Anonymous sources have reported that haggling over the price still continues, and the transaction would be made by the end of October.

-

08:34

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0,1%

-

08:26

WSE: Before opening

The last week ended with a long-awaited speech by Janet Yellen in Jackson Hole, who spoke positively about the economic situation. But surely her statement corresponded with earlier words of the members of the FOMC. It seems that investors have turned their attention to the statements of the deputy head of the Federal Reserve, Stanley Fischer, who asked whether the words of Yellen mean that we may expect increases in September and one more before the end of the year, replied that, yes, but still it depends on the incoming data .

As a result, the market probability of increase the cost of money in September increased from 21% to 33%, and in December from 51.8% to 59.1%.

Wall Street finally moved down by 0.16%. The WSE in fear of a decrease in the attractiveness of emerging markets also showed a decline.

Today morning trading in Asia is still run under the dictation of Friday pulses. The weakening of the yen will well up the Nikkei by more than 2%. In turn, other parquets are dominated by the red colour, although to a small extent. Contracts in the US are stable, and investors seem now to wait for data from this week. The monthly report from the US labor market, which will be published on Friday, may prove to be decisive as to the possible movement at the September meeting of the Federal Open Market Committee.

Today's calendar will be modest. Due to holidays in the UK we may expect, especially on the Warsaw Stock Exchange and to some extent in Europe, a lower activity.

The beginning of the new week of trading on the exchange market did not bring any significant changes to the valuation of the national currency against foreign currency. The zloty is quoted in the market as follows: PLN 4.3250 per euro, 3.8633 PLN against the US dollar. Yields on Polish debt are as follows: 2,692% in the case of 10-year bonds.

-

07:27

Global Stocks

European stocks swung higher Friday, with investors taking remarks from Federal Reserve Chairwoman Janet Yellen as a sign of confidence in economic growth world-wide.

The Stoxx Europe 600 SXXP, +0.50% closed up 0.5% at 343.72, but it had been creeping up shortly before the text of Yellen's speech in Jackson Hole, Wyo., was released. All but the consumer-services sector Q0E, -0.09% ended higher.

The FTSE 100 UKX, +0.31% rose 0.3% to 6,838.05, but the health care, consumer-goods and consumer-services sectors lost ground. Miners popped up after being under pressure this week.

Yellen, at the Fed's summer summit, signaled that the U.S. central bank is preparing to increase interest rates as soon as next month.

"In light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal-funds rate has strengthened in recent months," she said.

The blue-chips index started to pick up a bit of steam before the text of Yellen's speech in Jackson Hole, Wyo., was released.

The Dow Jones Industrial Average and the S&P 500 index finished lower Friday after comments from Fed Vice Chairman Stanley Fischer doubled down on a speech by Federal Reserve Chairwoman Janet Yellen that asserted the case for a rate increase is gathering steam.

The Dow Jones Industrial Average DJIA, -0.29% fell 53.01 points, or 0.3%, to finish at 18,395.40, backing off an earlier 124-point gain, but paring a 113-point loss.

The S&P 500 index SPX, -0.16% fell 3.43 points, or 0.2%, to close at 2,169.04, after trading up as many as 16 points earlier and bouncing back from a 12-point deficit.

The Nasdaq Composite Index COMP, +0.13% rose 6.71 points, or 0.1%, to finish at 5,218.92, after being up about 41 points earlier and down as low as 20 points during the session.

Japanese stocks surged to 1-1/2-week highs on Monday morning as the yen weakened after U.S. Federal Reserve Chair Janet Yellen signalled an interest rate hike remains on the cards this year, lifting insurers and exporters.

Speaking at the annual gathering of central bankers in Jackson Hole, Wyoming, Yellen said the case for raising U.S. interest rates had strengthened thanks to improvements in the labour market and expectations for moderate economic growth.

The Nikkei share average soared 2.2 percent to 16,721.23 in midmorning trade, after rising as high as 16,737.95, the highest since August 17.

Insurers staged a rally as higher U.S. rates would allow them to reap yield gains from their investments in U.S. bonds, while their domestic stock portfolio would also benefit from Nikkei's uptick.

-

00:29

Stocks. Daily history for Aug 26’2016:

(index / closing price / change items /% change)

Nikkei 225 16,360.71 -195.24 -1.18%

Shanghai Composite 3,070.48 +2.15 +0.07%

S&P/ASX 200 5,515.47 -26.42 -0.48%

FTSE 100 6,838.05 +21.15 +0.31%

CAC 40 4,441.87 +35.26 +0.80%

Xetra DAX 10,587.77 +58.18 +0.55%

S&P 500 2,169.04 -3.43 -0.16%

Dow Jones Industrial Average 18,395.40 -53.01 -0.29%

S&P/TSX Composite 14,639.88 +9.16 +0.06%

-