Noticias del mercado

-

21:00

DJIA 18361.78 -86.63 -0.47%, NASDAQ 5199.89 -12.31 -0.24%, S&P 500 2163.45 -9.02 -0.42%

-

18:00

European stocks closed: FTSE 6838.05 21.15 0.31%, DAX 10587.77 58.18 0.55%, CAC 4441.87 35.26 0.80%

-

17:35

WSE: Session Results

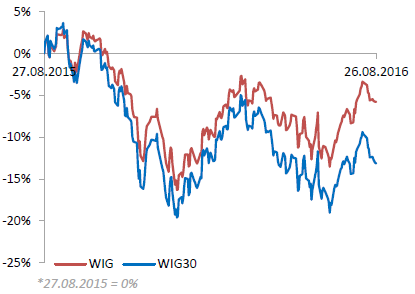

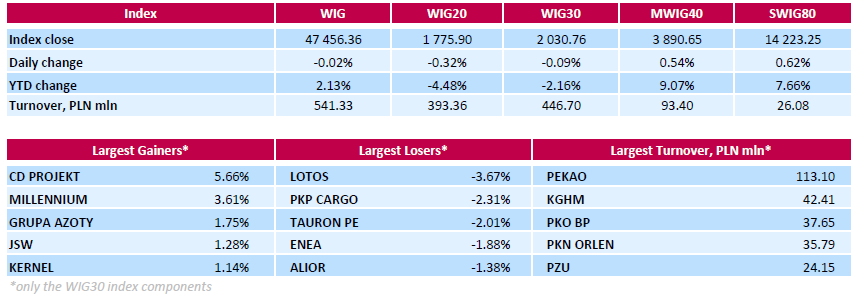

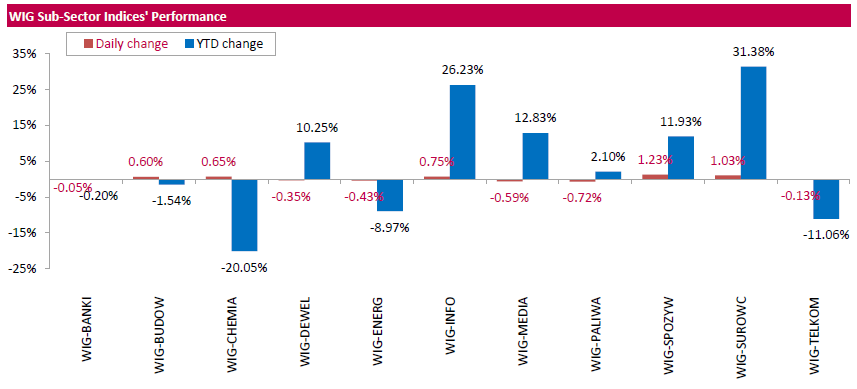

Polish equity market closed flat on Friday. The broad market measure, the WIG Index, edged down 0.02%. Sector performance within the WIG Index was mixed. Oil and gas (-0.72%) was the weakest group, while food sector (+1.23%) outperformed.

The large-cap stocks' measure, the WIG30 index, inched down 0.09%. In the index basket, oil refiner LOTOS (WSE: LTS) led the decliners with a 3.67% drop, followed by railway freight transport operator PKP CARGO (WSE: PKP) and two gencos TAURON PE (WSE: TPE) and ENEA (WSE: ENA), retreating by 2.31%, 2.01% and 1.88% respectively. On the country, videogame developer CD PROJEKT (WSE: CDR), bank MILLENNIUM (WSE: MIL) and chemical producer GRUPA AZOTY (WSE: ATT) were the biggest advancers, gaining 5.66%, 3.61% and 1.75% respectively.

-

17:15

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Friday morning after Federal Reserve Chair Janet Yellen said the case for raising U.S. interest rates has strengthened in recent months. Yellen, speaking before a gathering of global central bankers did not indicate when the Fed would raise rates, but said the central bank thinks future hikes should be "gradual".

Most of Dow stocks in positive area (28 of 30). Top gainer - Intel Corporation (INTC, +1.35%). Top loser - NIKE, Inc. (NKE, -0.19%).

All S&P sectors also in positive area. Top gainer - Basic Materials (+1.1%).

At the moment:

Dow 18515.00 +67.00 +0.36%

S&P 500 2181.75 +8.25 +0.38%

Nasdaq 100 4804.75 +22.50 +0.47%

Oil 47.80 +0.47 +0.99%

Gold 1336.60 +12.00 +0.91%

U.S. 10yr 1.54 -0.03

-

15:49

WSE: After start on Wall Street

The first bars on Wall Street give a little more optimism to investors than it might seem. Both contracts on the S&P500 as well as the same index slightly lean toward the north. For larger interest of course we will wait until 16:00 (Warsaw time), but trade with each minute should already be more interesting.

-

15:33

U.S. Stocks open: Dow +0.24%, Nasdaq +0.21%, S&P +0.28%

-

15:23

Before the bell: S&P futures +0.01%, NASDAQ futures -0.09%

U.S. stock-index futures were little changed before a speech by Federal Reserve Chair Janet Yellen that may help gauge prospects for the economy and the outlook for interest-rate increases.

Global Stocks:

Nikkei 16,360.71 -195.24 -1.18%

Hang Seng 22,909.54 +94.59 +0.41%

Shanghai 3,070.48 +2.15 +0.07%

FTSE 6,823.78 +6.88 +0.10%

CAC 4,413.26 +6.65 +0.15%

DAX 10,522.91 -6.68 -0.06%

Crude $47.36 (+0.06%)

Gold $1332.50 (+0.60%)

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.58

0.00(0.00%)

21677

ALCOA INC.

AA

10.14

0.06(0.5952%)

13973

ALTRIA GROUP INC.

MO

66.04

0.12(0.182%)

98931

Amazon.com Inc., NASDAQ

AMZN

757.5

-1.72(-0.2265%)

670

American Express Co

AXP

65.23

0.23(0.3539%)

2500

AMERICAN INTERNATIONAL GROUP

AIG

58.9

-0.04(-0.0679%)

100

Apple Inc.

AAPL

107.36

-0.21(-0.1952%)

19537

AT&T Inc

T

41.19

0.12(0.2922%)

555

Barrick Gold Corporation, NYSE

ABX

18.74

0.46(2.5164%)

158739

Boeing Co

BA

132.98

0.00(0.00%)

13751

Caterpillar Inc

CAT

82.84

0.00(0.00%)

11037

Chevron Corp

CVX

102

0.11(0.108%)

51183

Cisco Systems Inc

CSCO

31.27

-0.02(-0.0639%)

2028

Citigroup Inc., NYSE

C

46.94

0.22(0.4709%)

5828

Deere & Company, NYSE

DE

87.29

0.00(0.00%)

19522

E. I. du Pont de Nemours and Co

DD

70.5

0.26(0.3702%)

965

Exxon Mobil Corp

XOM

87.52

0.06(0.0686%)

158

Facebook, Inc.

FB

123.78

-0.11(-0.0888%)

21951

FedEx Corporation, NYSE

FDX

165.7

0.17(0.1027%)

350

Ford Motor Co.

F

12.47

0.00(0.00%)

1302

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.16

0.07(0.6312%)

49682

General Electric Co

GE

31.17

-0.04(-0.1282%)

1181

General Motors Company, NYSE

GM

31.54

0.00(0.00%)

882621

Goldman Sachs

GS

166.33

0.43(0.2592%)

690

Google Inc.

GOOG

769.22

-0.19(-0.0247%)

450

Hewlett-Packard Co.

HPQ

14.36

-0.01(-0.0696%)

908

Home Depot Inc

HD

135.43

0.00(0.00%)

788

HONEYWELL INTERNATIONAL INC.

HON

116.77

0.00(0.00%)

13346

Intel Corp

INTC

35.09

0.00(0.00%)

1182

International Business Machines Co...

IBM

158.43

-0.20(-0.1261%)

36281

International Paper Company

IP

48.3

-0.09(-0.186%)

500

Johnson & Johnson

JNJ

118.89

0.32(0.2699%)

1703

JPMorgan Chase and Co

JPM

66.27

0.20(0.3027%)

1013

McDonald's Corp

MCD

115.5

0.07(0.0606%)

28793

Merck & Co Inc

MRK

62.32

0.00(0.00%)

8120

Microsoft Corp

MSFT

58.1

-0.07(-0.1203%)

2901

Nike

NKE

58.94

-0.30(-0.5064%)

11654

Pfizer Inc

PFE

34.81

0.04(0.115%)

3927

Procter & Gamble Co

PG

87.92

0.02(0.0228%)

3899

Starbucks Corporation, NASDAQ

SBUX

57.25

-0.04(-0.0698%)

5400

Tesla Motors, Inc., NASDAQ

TSLA

221.1

0.14(0.0634%)

2759

The Coca-Cola Co

KO

43.74

0.07(0.1603%)

100

Travelers Companies Inc

TRV

117.75

0.00(0.00%)

11067

Twitter, Inc., NYSE

TWTR

18.4

0.08(0.4367%)

25904

United Technologies Corp

UTX

107.72

0.00(0.00%)

15550

UnitedHealth Group Inc

UNH

136.87

-0.43(-0.3132%)

95133

Verizon Communications Inc

VZ

52.75

0.00(0.00%)

337085

Visa

V

80.35

0.03(0.0373%)

73865

Wal-Mart Stores Inc

WMT

71.55

0.33(0.4634%)

1301

Walt Disney Co

DIS

95.54

-0.01(-0.0105%)

38633

Yahoo! Inc., NASDAQ

YHOO

42.03

0.00(0.00%)

40179

Yandex N.V., NASDAQ

YNDX

22.01

-0.13(-0.5872%)

328

-

14:57

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

NIKE (NKE) downgraded to Neutral from Buy at B. Riley & Co

Other:

-

13:11

WSE: Mid session comment

The forenoon trading phase on Warsaw Stock Exchange was dominated by boredom. Minor changes and the lack of specific direction is an image not only of our parquet but also for the major European markets. This, of course, the effect of waiting for the event of the week, which is the head of the Fed speech today at 16.00 (Warsaw time). We have a little more going on in the second line, but the change of the mWIG40 by 0.3 percent is also cosmetics.

The WIG20 index stuck to well-known from the previous session level of 1,780 points. We hope, therefore, that the second half of the session will bring some new content.

At the halfway point of quotations the WIG20 index was at 1,781 points (+ 0.02%) wit turnover of PLN 20 million.

-

13:05

European indices traded flat

European indices traded flat as investors are cautious on the eve of today's speech byJanet Yellen, which may contain clues regarding monetary policy prospects.

A slight effect on the dynamics of trade had data on the euro zone and Britain. The report, published by the ECB showed that money supply growth in the euro area slowed down moderately in July, exceeding the estimates, while the annual growth of private sector credit growth remained unchanged, and in line with forecasts. According to the data, the monetary aggregate M3 increased in July by 4.8 percent year on year, which was slower than the increase of 5.0 percent in June. Forecasts indicated growth to slow to 4.9 percent. On average over the past three months to JulyM3 growth was 4.9 percent. In addition, it was reported that the total lending to the private sector increased by 1.4 percent compared to 1.5 percent in June. Lending to households increased by 1.8 percent, in line with the change from the previous month and the estimates of experts. At the same time, non-financial corporate loan growth accelerated to 1.9 percent from 1.7 percent in June.

Revised data published by the ONS showed that in the second quarter UK GDP grew by 0.6 percent relative to the previous three-month period and increased by 2.2 percent in annual terms. The last change was in line with the preliminary readings and forecasts. Household spending rose in the 2nd quarter by 0.9 percent compared to the first three months of 2016. In annual terms, the increase in household expenditure (+3.0 percent) was the strongest since the end of 2007. Business investment rose by 0.5 percent q/q, despite the predicted fall. This change helped offset the decline in the first three months of this year. On an annual basis, business investment fell by 0.8 per cent, which corresponds to a change in the 1st quarter.

The composite index of Europe's largest enterprises in Europe Stoxx 600 fell 0.1 percent, reducing its weekly gain to 0.5 percent. Since the beginning of 2016 the index lost 6.6 percent, which was mainly due to the fall of the banking sector shares. The trading volume today is about 38 percent lower than the average of 30 days.

FTSE MIB index fell 0.5 percent, leading the decline among the markets in the region.

Shares of UniCredit SpA, Banca Popolare di Milanoand Banco Popolare SC fell more than 2 percent. Vivendi SA shares- a French media company - fell 5 percent after it became known that the volume of quarterly earnings did not meet analysts' estimates.

The cost of Hennes & Mauritz AB fell 2.2 percent as HSBC Holdings Plc downgraded shares of the companies to "hold."

At the moment:

FTSE 100 -0.85 6817.75 -0.01

DAX -23.36 10506.23 -0.22

CAC 40 -5.23 4401.38 -0.12

-

09:32

Major stock exchanges trading mixed: FTSE -0.1%, DAX -0.1%, CAC40 -0.2%, FTMIB + 0.2% being the odd one out, IBEX -0.2%

-

09:19

WSE: After opening

WIG20 index opened at 1783.26 points (+0.09%)*

WIG 47377.37 -0.18%

WIG30 2026.74 -0.29%

mWIG40 3873.70 0.10%

*/ - change to previous close

The cosmetic plus on the WIG20 index in early trading corresponded to the prior atmosphere on the September series contracts.

Today's opening with increase of 0.1 percent again placed the index at around 1,780 points, but after the first exchanges appeared to be known from previous sessions withdrawal, which is partly a response of the WSE to declines in Europe, where the German DAX - after opening - lost 0.3 percent. Quick return on the advantages in Germany will stabilize influence on the WSE. Technically looking there is no change this morning. The WIG20 index remains at levels that were played in the previous sessions.

Today, the Warsaw market should just wait for the 16:00 hour (Warsaw time) and during the speech of Janet Yellen react to it like other European and American markets.

-

08:25

Expected negative start of trading on the major stock exchanges in Europe: DAX -0.1%, CAC40 -0,2%, FTSE -0,1%

-

08:23

WSE: Before opening

Thursday's session on Wall Street brought a slight discounts in the most important indices (about 0.1 percent). Europe presented yesterday poorly, and the decline of the German DAX of nearly 0.9 percent took into account these cosmetically red behavior in the USA. It seems that today's quotations in all markets will be dominated by looking in the direction of Jackson Hole.

Macro calendar today contains important reading of GDP growth in the US, but each report will remain in the shadow of what today will say Yellen, the occurrence of which will also be the most important event of the day in Warsaw. Emerging markets are sensitive to Fed policy and a signal of a possible rate hike in the US as early as mid-September will be nervously perceived on the WSE.

Friday, morning trading on the currency market brings an attempt to stabilize the quotations of PLN after yesterday, surprising, weakened. The polish zloty is valued by the market as follows: PLN 4.3293 per euro, PLN 3.8378 against the US dollar. Yields on domestic debt amounts to 2,684% for 10-year bonds.

There are rumors that PLN fell after the release of preliminary official assumptions for the budget year 2017r., where the primary risk is the assumption of PLN 59.3 billion deficit. An addition to this may be the publication by Moody's, which said that the escalation of the crisis around the Constitutional Tribunal (CT) is negative for Polish rating. The report agency refers to the start of the investigation concerning President of CT.

-

07:04

Global Stocks

European stocks slumped on Thursday as German shares extended losses after a key survey showed an unexpected drop in business sentiment in the country.

The pan-European index extended its losses as a selloff in German equities accelerated after the release of the Ifo index for August. The closely watched survey of the business climate in Europe's largest economy came in at 106.2, compared with 108.3 in July. Economists polled by The Wall Street Journal had expected a print of 108.5.

Germany's DAX 30 DAX, -0.88% fell by as much as 1.4% after the report, but since pared the loss to 0.9% at 10,529.59.

U.K. stocks pulled back Thursday, with losses for drugmakers and commodity producers leading the market's benchmark to a second straight decline.

The FTSE 100 UKX, -0.28% lost 0.3% to close at 6,816.90, ending off its intraday low.

U.S. stocks ended slightly lower Thursday, with investors reluctant to make big bets the day before a much-anticipated speech by Federal Reserve Chairwoman Janet Yellen that will be picked apart for clues to the central bank's next rate move.

The Dow Jones Industrial Average DJIA, -0.18% slid 33.07 points, or 0.2%, to close at 18,448.41.

The S&P 500 index SPX, -0.14% fell 2.97 points, or 0.1%, to close at 2,172.47, with the health-care sector leading the decline, while the Nasdaq Composite Index COMP, -0.11% shed 5.49 points, or 0.1%, to end at 5,212.20.

Asian stocks were steady on Friday with modest losses in some markets and gains in others reflecting nervousness before a keenly anticipated speech by U.S. Federal Reserve Chair Janet Yellen.

The Asia-Pacific benchmark is on track for a 0.25 percent loss for the week.

Japan's Nikkei .N225 extended losses to 0.7 percent, set for a weekly drop of 0.6 percent.

Chinese shares, however, were higher, with the CSI 300 index .CSI300 and the Shanghai Composite .SSEC each rising 0.4 percent. They're on track for declines of 1.2 percent and 0.8 percent respectively.

Hong Kong's Hang Seng was also higher, up 0.6 percent and set to finish the week flat.

-

00:30

Stocks. Daily history for Aug 25’2016:

(index / closing price / change items /% change)

Nikkei 225 16,555.95 -41.35 -0.25%

Shanghai Composite 3,068.23 -17.65 -0.57%

S&P/ASX 200 5,541.89 -19.78 -0.36%

FTSE 100 6,816.90 -18.88 -0.28%

CAC 40 4,406.61 -28.86 -0.65%

Xetra DAX 10,529.59 -93.38 -0.88%

S&P 500 2,172.47 -2.97 -0.14%

Dow Jones Industrial Average 18,448.41 -33.07 -0.18%

S&P/TSX Composite 14,630.72 +4.48 +0.03%

-