Noticias del mercado

-

21:00

DJIA 18361.78 -86.63 -0.47%, NASDAQ 5199.89 -12.31 -0.24%, S&P 500 2163.45 -9.02 -0.42%

-

18:00

European stocks closed: FTSE 6838.05 21.15 0.31%, DAX 10587.77 58.18 0.55%, CAC 4441.87 35.26 0.80%

-

17:51

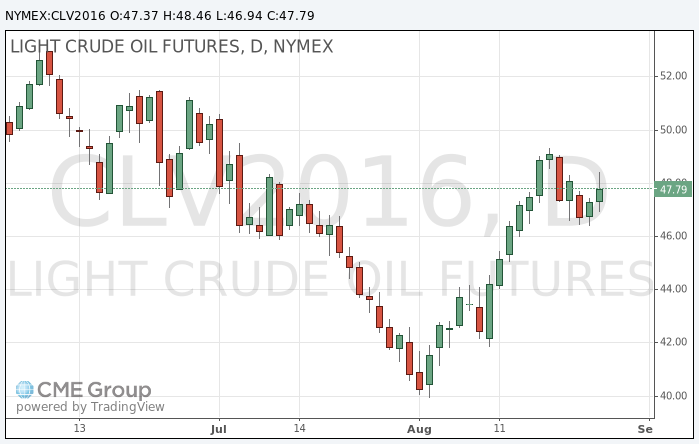

Oil rose due to the weakening of the dollar

Oil prices are rising amid statements of the chairwoman of the Federal Reserve Janet Yellen. During his speech oil prices fell, and then began to grow due to the weakening dollar. Yellen expressed the view that interest rates may be increased in the following weeks or months, but this evaluation did not differ much from what traders had expected, said Bart Melek of TD Securities.

"The Fed did not say that is necessarily raise rates in September," - says Melek. According to him, there was a correction on oil after an up move, but then it ended.

Rising interest rates in the US could strengthen the dollar, which makes oil more expensive for holders of other currencies. The dollar index recently fell by 0.5%.

"It's all about the dollar," - said Mark Waggoner, president of Excel Futures. He also drew attention to the low volume of transactions on Yellen's speech and a high volume after the speech. "Traders do not like uncertainty. They listened, and now want to return to the market.", - he added.

The Bank of America Merrill Lynch keeps Brent oil price forecast at $ 61 a barrel as the emerging shortage of supply is accompanied by "a moderate rise in global demand." The bank expects that the growth in global oil demand next year will amount to 1.2 million barrels per day from 1.4 million barrels per day this year and 1.6 million barrels last year.

The cost of the October futures for WTI rose to 48.46 dollars per barrel.

October futures for Brent crude rose to 50.76 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:35

WSE: Session Results

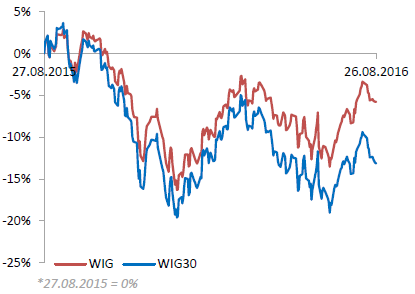

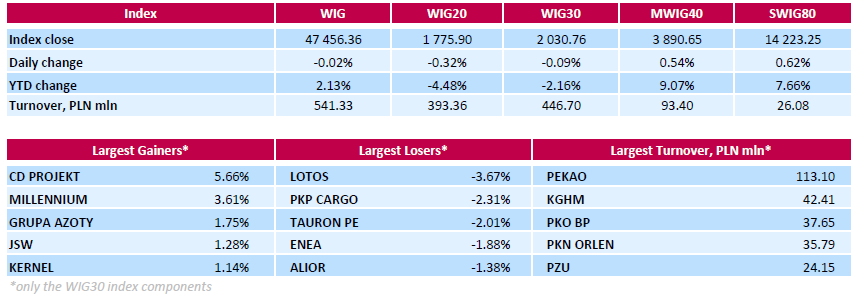

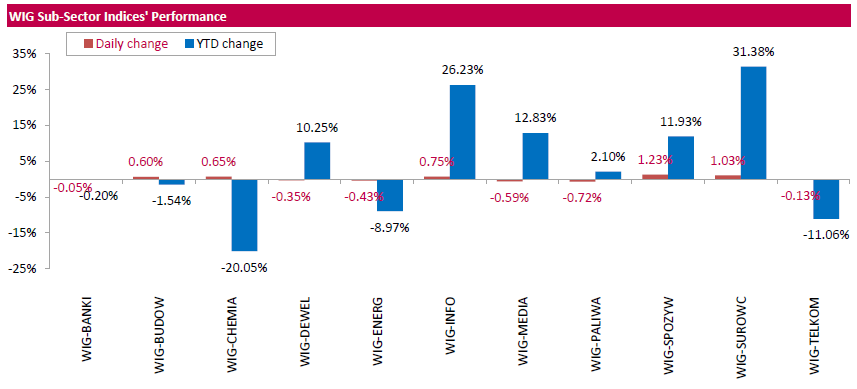

Polish equity market closed flat on Friday. The broad market measure, the WIG Index, edged down 0.02%. Sector performance within the WIG Index was mixed. Oil and gas (-0.72%) was the weakest group, while food sector (+1.23%) outperformed.

The large-cap stocks' measure, the WIG30 index, inched down 0.09%. In the index basket, oil refiner LOTOS (WSE: LTS) led the decliners with a 3.67% drop, followed by railway freight transport operator PKP CARGO (WSE: PKP) and two gencos TAURON PE (WSE: TPE) and ENEA (WSE: ENA), retreating by 2.31%, 2.01% and 1.88% respectively. On the country, videogame developer CD PROJEKT (WSE: CDR), bank MILLENNIUM (WSE: MIL) and chemical producer GRUPA AZOTY (WSE: ATT) were the biggest advancers, gaining 5.66%, 3.61% and 1.75% respectively.

-

17:31

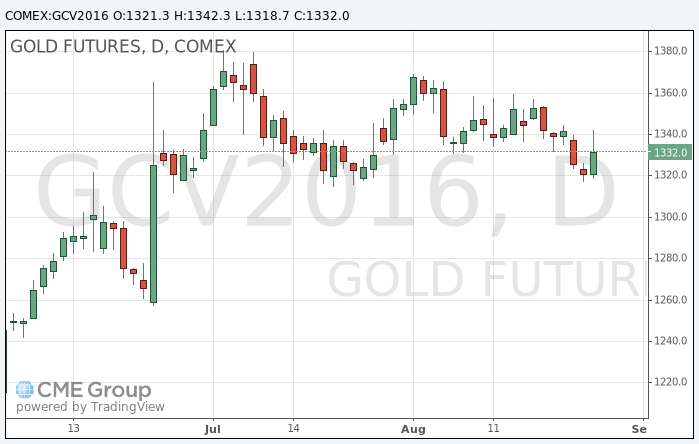

Gold price rose

Gold rose on Yellen's statement after some choppy trading.

Indicators of inflation and unemployment in the United States are moving towards the levels desired by the Federal Reserve, said the head of FED Janet Yellen, speaking at a symposium in Jackson Hole.

"Based on this forecast, the Federal Open Market Committee (FOMC) still consider justified a gradual increase in interest rates of federal funds rate. And in light of the good labor market performance and our expectations regarding economic activity i am sure that the arguments in favor of a rate hike have become more persuasive in the past few months. " These comments were mostly priced in.

The decision will depend on the extent to which the incoming statistical data confirm this forecast, stressed Yellen.

The cost of the October futures for gold on COMEX rose to $ 1342.3 per ounce.

-

17:15

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Friday morning after Federal Reserve Chair Janet Yellen said the case for raising U.S. interest rates has strengthened in recent months. Yellen, speaking before a gathering of global central bankers did not indicate when the Fed would raise rates, but said the central bank thinks future hikes should be "gradual".

Most of Dow stocks in positive area (28 of 30). Top gainer - Intel Corporation (INTC, +1.35%). Top loser - NIKE, Inc. (NKE, -0.19%).

All S&P sectors also in positive area. Top gainer - Basic Materials (+1.1%).

At the moment:

Dow 18515.00 +67.00 +0.36%

S&P 500 2181.75 +8.25 +0.38%

Nasdaq 100 4804.75 +22.50 +0.47%

Oil 47.80 +0.47 +0.99%

Gold 1336.60 +12.00 +0.91%

U.S. 10yr 1.54 -0.03

-

16:25

US consumer sentiment worsened slightly in August

The final results of the studies submitted by Thomson-Reuters and the Institute of Michigan revealed that in August US consumers feel more pessimistic about the economy than last month.

Consumer sentiment index fell to 89.8 points compared with a reading of 90.0 in July. The index is a leading indicator of consumer sentiment. The indicator is calculated by adding 100 to the difference between the number of optimists and pessimists, expressed as a percentage.

Also the results have shown:

- 12-month inflation expectations + 2.5%, + 2.7% in July.

- 5-year inflation expectations + 2.5% versus + 2.6% in July.

- final expectations index in August was 78.7 compared to 77.8 in July.

- final current conditions index in August was 107.0, which was worse than the value of 109.0 in July.

-

16:16

The dollar changed course while statements are being analyzed. Not so hawkish after all or already priced in

-

16:04

Yellen speaks at Jackson Hole: Our ability to predict Fed rate path is quite limited

Case for interest rate increase has strengthened in recent months

Economyc nearing Fed's employment and inflation goals

Our ability to predict Fed rate path is quite limited

Gradual hikes over time are 'appropriate'

Fed expects inflation to rise to 2% goal in next few years

Fed depends on data, not on a preset course

Range of possible rate hikes paths is wide, shocks could change path

-

16:02

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, August 89.8 (forecast 90.6)

-

15:49

WSE: After start on Wall Street

The first bars on Wall Street give a little more optimism to investors than it might seem. Both contracts on the S&P500 as well as the same index slightly lean toward the north. For larger interest of course we will wait until 16:00 (Warsaw time), but trade with each minute should already be more interesting.

-

15:45

Option expiries for today's 10:00 ET NY cut

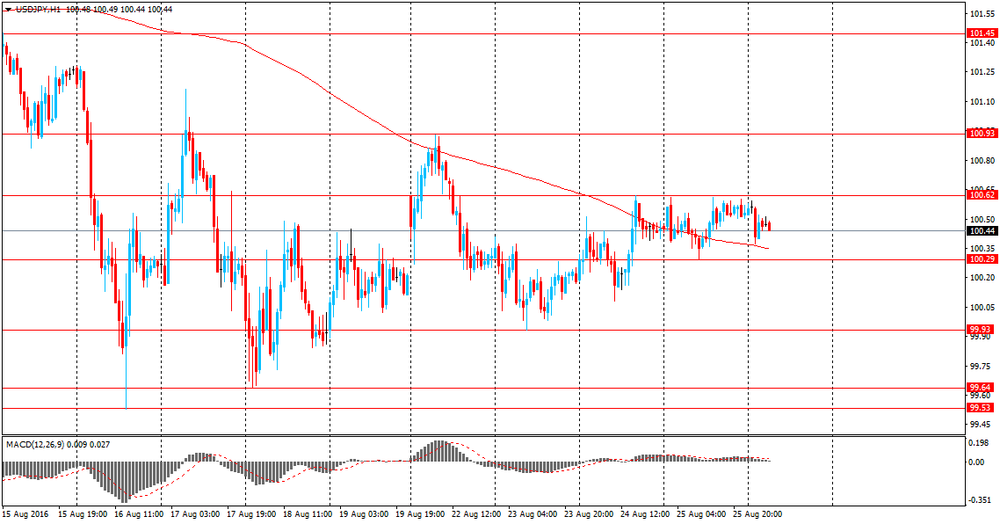

USDJPY 99.00, 99.45/50 100.00, 100.25, 100.70/71/75 (485m) 101.00 104.50 105.00

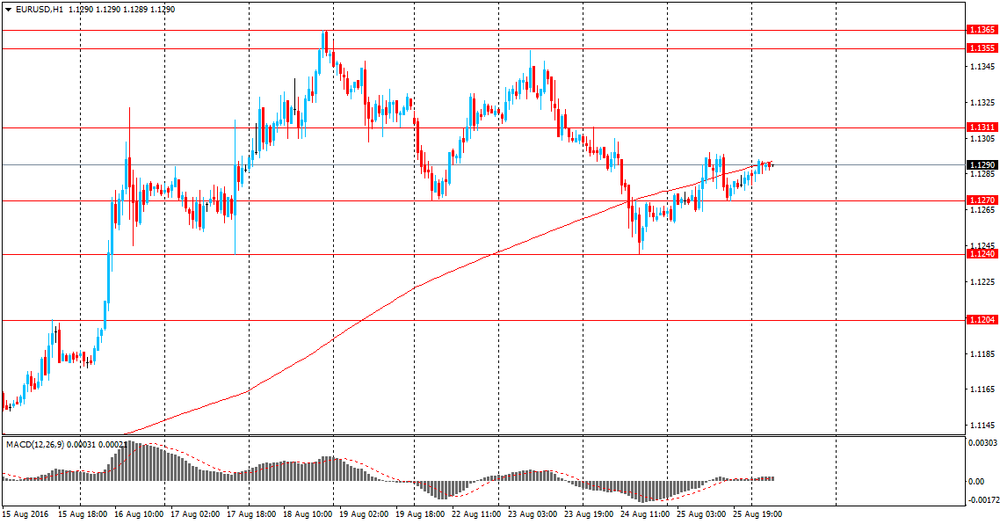

EURUSD 1.0950 1.1015 1.1150 (407m) 1.1225, 1.1285/90 1.1350

GBPUSD 1.2750 1.3000 1.3700

AUDUSD 0.9163 (592m) 0.7375 0.7580 0.7600 (541m), 0.7615, 0.7675 (720m) 0.7850

NZDUSD 0.7165

EURGBP 0.8400

USDCAD 0.1650 1.2800 (507m) 1.2900, 1.2945/50/55, 1.2965 (458m) 1.3025 1.3100

-

15:33

U.S. Stocks open: Dow +0.24%, Nasdaq +0.21%, S&P +0.28%

-

15:23

Before the bell: S&P futures +0.01%, NASDAQ futures -0.09%

U.S. stock-index futures were little changed before a speech by Federal Reserve Chair Janet Yellen that may help gauge prospects for the economy and the outlook for interest-rate increases.

Global Stocks:

Nikkei 16,360.71 -195.24 -1.18%

Hang Seng 22,909.54 +94.59 +0.41%

Shanghai 3,070.48 +2.15 +0.07%

FTSE 6,823.78 +6.88 +0.10%

CAC 4,413.26 +6.65 +0.15%

DAX 10,522.91 -6.68 -0.06%

Crude $47.36 (+0.06%)

Gold $1332.50 (+0.60%)

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.58

0.00(0.00%)

21677

ALCOA INC.

AA

10.14

0.06(0.5952%)

13973

ALTRIA GROUP INC.

MO

66.04

0.12(0.182%)

98931

Amazon.com Inc., NASDAQ

AMZN

757.5

-1.72(-0.2265%)

670

American Express Co

AXP

65.23

0.23(0.3539%)

2500

AMERICAN INTERNATIONAL GROUP

AIG

58.9

-0.04(-0.0679%)

100

Apple Inc.

AAPL

107.36

-0.21(-0.1952%)

19537

AT&T Inc

T

41.19

0.12(0.2922%)

555

Barrick Gold Corporation, NYSE

ABX

18.74

0.46(2.5164%)

158739

Boeing Co

BA

132.98

0.00(0.00%)

13751

Caterpillar Inc

CAT

82.84

0.00(0.00%)

11037

Chevron Corp

CVX

102

0.11(0.108%)

51183

Cisco Systems Inc

CSCO

31.27

-0.02(-0.0639%)

2028

Citigroup Inc., NYSE

C

46.94

0.22(0.4709%)

5828

Deere & Company, NYSE

DE

87.29

0.00(0.00%)

19522

E. I. du Pont de Nemours and Co

DD

70.5

0.26(0.3702%)

965

Exxon Mobil Corp

XOM

87.52

0.06(0.0686%)

158

Facebook, Inc.

FB

123.78

-0.11(-0.0888%)

21951

FedEx Corporation, NYSE

FDX

165.7

0.17(0.1027%)

350

Ford Motor Co.

F

12.47

0.00(0.00%)

1302

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.16

0.07(0.6312%)

49682

General Electric Co

GE

31.17

-0.04(-0.1282%)

1181

General Motors Company, NYSE

GM

31.54

0.00(0.00%)

882621

Goldman Sachs

GS

166.33

0.43(0.2592%)

690

Google Inc.

GOOG

769.22

-0.19(-0.0247%)

450

Hewlett-Packard Co.

HPQ

14.36

-0.01(-0.0696%)

908

Home Depot Inc

HD

135.43

0.00(0.00%)

788

HONEYWELL INTERNATIONAL INC.

HON

116.77

0.00(0.00%)

13346

Intel Corp

INTC

35.09

0.00(0.00%)

1182

International Business Machines Co...

IBM

158.43

-0.20(-0.1261%)

36281

International Paper Company

IP

48.3

-0.09(-0.186%)

500

Johnson & Johnson

JNJ

118.89

0.32(0.2699%)

1703

JPMorgan Chase and Co

JPM

66.27

0.20(0.3027%)

1013

McDonald's Corp

MCD

115.5

0.07(0.0606%)

28793

Merck & Co Inc

MRK

62.32

0.00(0.00%)

8120

Microsoft Corp

MSFT

58.1

-0.07(-0.1203%)

2901

Nike

NKE

58.94

-0.30(-0.5064%)

11654

Pfizer Inc

PFE

34.81

0.04(0.115%)

3927

Procter & Gamble Co

PG

87.92

0.02(0.0228%)

3899

Starbucks Corporation, NASDAQ

SBUX

57.25

-0.04(-0.0698%)

5400

Tesla Motors, Inc., NASDAQ

TSLA

221.1

0.14(0.0634%)

2759

The Coca-Cola Co

KO

43.74

0.07(0.1603%)

100

Travelers Companies Inc

TRV

117.75

0.00(0.00%)

11067

Twitter, Inc., NYSE

TWTR

18.4

0.08(0.4367%)

25904

United Technologies Corp

UTX

107.72

0.00(0.00%)

15550

UnitedHealth Group Inc

UNH

136.87

-0.43(-0.3132%)

95133

Verizon Communications Inc

VZ

52.75

0.00(0.00%)

337085

Visa

V

80.35

0.03(0.0373%)

73865

Wal-Mart Stores Inc

WMT

71.55

0.33(0.4634%)

1301

Walt Disney Co

DIS

95.54

-0.01(-0.0105%)

38633

Yahoo! Inc., NASDAQ

YHOO

42.03

0.00(0.00%)

40179

Yandex N.V., NASDAQ

YNDX

22.01

-0.13(-0.5872%)

328

-

14:57

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

NIKE (NKE) downgraded to Neutral from Buy at B. Riley & Co

Other:

-

14:42

Fed’s Mester: it's appropriate to raise rates

-

Looks at the path of interest rates. Thinks that path is to higher rates

-

Does not mean every meeting is a hike

-

Fed perhaps not communicating as well as it could

-

Economy is still on track for pickup growth, inflation rising and employment falling

-

Appropriate to raise rates but not giving an exact number

-

There is a potential for instability in environment for potential bubbles.

-

Not saying there is a bubble in the stock market

-

Commercial real estate is a little bit frothy, but not an imminent problem

*via forexlive. -

-

14:34

No improvement for US GDP on the second estimate, but prices were up

Real gross domestic product increased at an annual rate of 1.1 percent in the second quarter of 2016, according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.8 percent.

Real gross domestic income (GDI) increased 0.2 percent in the second quarter, compared with an increase of 0.8 percent in the first (revised). The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 0.6 percent in the second quarter, compared with an increase of 0.8 percent in the first

The price index for gross domestic purchases increased 2.1 percent in the second quarter, compared with an increase of 0.2 percent in the first. The PCE price index increased 2.0 percent, compared with an increase of 0.3 percent. Excluding food and energy prices, the PCE price index increased 1.8 percent, compared with an increase of 2.1 percent

-

14:30

U.S.: GDP, q/q, Quarter II 1.1% (forecast 1.1%)

-

14:27

European session review: US dollar steady ahead of GDP data

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany consumer confidence index from the GfK September 10 9.9 10.2

8:00 Changing the Eurozone lending to the private sector, the y / y in July 1.8% 1.8% 1.8%

8:00 Eurozone M3 Money Supply, y / y in July 5% 4.9% 4.8%

8:30 UK GDP q / q (revised data) II quarter 0.4% 0.6% 0.6%

8:30 UK GDP y / y (revised data) II q 2% 2.2% 2.2%

The pound fell moderately against the US dollar retreated from a session high, ahead of the data on US GDP and the speech by Fed Yellen. Limited impact on the pound provided statistics on Britain's GDP, which coincided with forecasts.Revised data published by the ONS showed that in the second quarter UK GDP grew by 0.6 percent relative to the previous three-month period and increased by 2.2 percent in annual terms. The last change was in line with the preliminary readings and forecasts. Household spending rose in the 2nd quarter by 0.9 percent compared to the first three months of 2016. In annual terms, the increase in household expenditure (+3.0 percent) was the strongest since the end of 2007. Business investment rose by 0.5 percent q/q, despite the predicted fall. This change helped offset the decline in the first three months of this year. On an annual basis, business investment fell by 0.8 per cent, which corresponds to a change in the 1st quarter.

The dollar consolidated against the euro while remaining near the opening level of the day. Consumer confidence data in Germany gave little support, while the situation on the stock markets is flat. In general, experts point out that many investors prefer not to risks, waiting for the Fed's Yellen speech. Traders believe that the further tightening of monetary policy the Fed is unlikely against the backdrop of weak data on GDP growth and productivity. However, the positive comments from the Federal Reserve voiced in recent days have increased hopes for a rate hike.

EUR / USD: during the European session, the pair traded in a narrow range

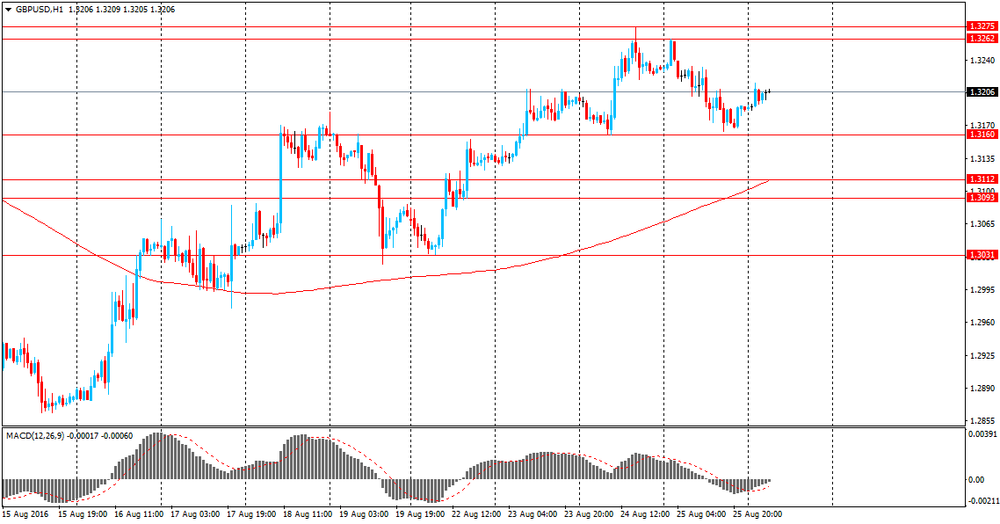

GBP / USD: during the European session, the pair rose to $ 1.3232, but then fell back slightly

USD / JPY: during the European session, the pair consolidated in a narrow range

-

13:51

Orders

EUR/USD

Offers 1.1320-25 1.1350-55 1.1380-85 1.1400

Bids 1.1280 1.1250 1.1230 1.1200 1.1185 1.1150

GBP/USD

Offers 1.3235 1.3250 1.3280 1.3300 1.3320 1.3350 1.3380 1.3400

Bids 1.3200 1.3185 1.3165 1.3150 1.3130 1.3100 1.3085 1.3050

EUR/GBP

Offers 0.8560-65 0.8580 0.8600 0.8625-30 0.8655-60 0.8685 0.8700

Bids 0.8520 0.8500 0.8480-85 0.8465 0.8450 0.8430 0.8400

EUR/JPY

Offers 113.60 113.80 114.00 114.30 114.50 114.75 115.00

Bids 113.30 113.00 112.75-80 112.50 112.30 112.00-10

USD/JPY

Offers 100.65 100.85 101.00 101.25-30 101.50 101.75-80 102.00

Bids 100.30 100.20 100.00 99.85 99.65 99.50 99.30 99.00 98.80 98.50

AUD/USD

Offers 0.7650-55 0.7680 0.7700 0.7725-30 0.7750-55

Bids 0.7620 0.7600 0.7585 0.7565 0.7550 0.7500

-

13:40

Rusian Minister of Energy and the Secretary General of OPEC to discuss freezing oil production in Algeria

Russian Federation Energy Minister Alexander Novak and OPEC's Mohamed Barkindo may hold a meeting at the Energy Forum in Algiers on 26-28 September. This was announced today by Russia's permanent representative at the OPEC Vladimir Voronkov after a meeting with the head of the cartel.

"We agreed that Burkindo and Novak will discuss in the near future during the International Energy Forum in Algiers on 26-28 September," - he said.

At the end of September in Algeria will be held the International Energy Forum, in which countries - exporters of oil are going to negotiate the "freezing" of production. The initiators of the discussion are the Venezuela, Ecuador and Kuwait. Ministers of Saudi Arabia, Iraq and Iran have already confirmed their participation in private talks.

-

13:11

WSE: Mid session comment

The forenoon trading phase on Warsaw Stock Exchange was dominated by boredom. Minor changes and the lack of specific direction is an image not only of our parquet but also for the major European markets. This, of course, the effect of waiting for the event of the week, which is the head of the Fed speech today at 16.00 (Warsaw time). We have a little more going on in the second line, but the change of the mWIG40 by 0.3 percent is also cosmetics.

The WIG20 index stuck to well-known from the previous session level of 1,780 points. We hope, therefore, that the second half of the session will bring some new content.

At the halfway point of quotations the WIG20 index was at 1,781 points (+ 0.02%) wit turnover of PLN 20 million.

-

13:05

European indices traded flat

European indices traded flat as investors are cautious on the eve of today's speech byJanet Yellen, which may contain clues regarding monetary policy prospects.

A slight effect on the dynamics of trade had data on the euro zone and Britain. The report, published by the ECB showed that money supply growth in the euro area slowed down moderately in July, exceeding the estimates, while the annual growth of private sector credit growth remained unchanged, and in line with forecasts. According to the data, the monetary aggregate M3 increased in July by 4.8 percent year on year, which was slower than the increase of 5.0 percent in June. Forecasts indicated growth to slow to 4.9 percent. On average over the past three months to JulyM3 growth was 4.9 percent. In addition, it was reported that the total lending to the private sector increased by 1.4 percent compared to 1.5 percent in June. Lending to households increased by 1.8 percent, in line with the change from the previous month and the estimates of experts. At the same time, non-financial corporate loan growth accelerated to 1.9 percent from 1.7 percent in June.

Revised data published by the ONS showed that in the second quarter UK GDP grew by 0.6 percent relative to the previous three-month period and increased by 2.2 percent in annual terms. The last change was in line with the preliminary readings and forecasts. Household spending rose in the 2nd quarter by 0.9 percent compared to the first three months of 2016. In annual terms, the increase in household expenditure (+3.0 percent) was the strongest since the end of 2007. Business investment rose by 0.5 percent q/q, despite the predicted fall. This change helped offset the decline in the first three months of this year. On an annual basis, business investment fell by 0.8 per cent, which corresponds to a change in the 1st quarter.

The composite index of Europe's largest enterprises in Europe Stoxx 600 fell 0.1 percent, reducing its weekly gain to 0.5 percent. Since the beginning of 2016 the index lost 6.6 percent, which was mainly due to the fall of the banking sector shares. The trading volume today is about 38 percent lower than the average of 30 days.

FTSE MIB index fell 0.5 percent, leading the decline among the markets in the region.

Shares of UniCredit SpA, Banca Popolare di Milanoand Banco Popolare SC fell more than 2 percent. Vivendi SA shares- a French media company - fell 5 percent after it became known that the volume of quarterly earnings did not meet analysts' estimates.

The cost of Hennes & Mauritz AB fell 2.2 percent as HSBC Holdings Plc downgraded shares of the companies to "hold."

At the moment:

FTSE 100 -0.85 6817.75 -0.01

DAX -23.36 10506.23 -0.22

CAC 40 -5.23 4401.38 -0.12

-

11:53

Morgan Stanley Targeting 1.16 on EUR/USD

"Lower USD, higher EUR: A weaker USD, looser financial conditions and the Brexit risk event out of the way have meant that there are signs of businesses starting to grow around the world. We are not saying that all is rosy and that growth rates will reach average pre-2007 levels, but we believe that the FX markets right now will respond to changes in economic circumstances and surprises. In fact, the MSCI world equity index has become more correlated with global economic surprises, as noted by our equity colleagues.Economic data divergence between the eurozone and US should help EURUSD to break beyond the previous high at 1.1366, opening room towards our 1.16 target.

US investment down, eurozone investment up: The regional Fed surveys have also been pointing towards a flat reading in July. In contrast, eurozone activity has been stabilising, with the WSJ reporting that eurozone companies are planning to raise investment spending even after the Brexit vote. A larger proportion of companies in Germany, France and Spain were planning to increase capital spending relative to the previous survey in February. The ECB's corporate bond purchases pushing down borrowing costs and money supply data released tomorrow expected to have grown by 5%Y (M3) in July support the case for EUR-USD data divergence".

Copyright © 2016 Morgan Stanley, eFXnews

-

11:00

Option expiries for today's 10:00 ET NY cut

USD/JPY 99.00, 99.45/50, 100.00, 100.25, 100.70/71/75 (485m),101.00,104.50,105.00

EUR/USD 1.0950,1.1015,1.1150 (407m),1.1225, 1.1285/90,1.1350

GBP/USD 1.2750,1.3000,1.3700

AUD/USD 0.9163 (592m),0.7375,0.7580,0.7600 (541m), 0.7615, 0.7675 (720m),0.7850

NZD/USD 0.7165

EUR/GBP 0.8400

-

10:58

Oil little changed in early trading

This morning, New York crude oil futures for WTI rose slightly by + 0.08% to $ 47.38 and Brent oil futures were down -0.26% to $ 49.54 per barrel.

Analysts doubt the possibility of effective action by the producing countries to stabilize prices. Oil Minister of Saudi Arabia stated that, in general, he does not consider it necessary to intervene in the operation of the market, indicating that the market itself is already "moving in the right direction." Also, OPEC's Mohammed Barkindo said he sees the increasing willingness of member countries of the cartel to agree, as they are suffering losses due to the current low prices. Iran announced its intention to participate in the OPEC meeting, but not ready to freeze production.

-

10:49

UK index of services increased more than forecasts

ONS: the Index of Services was estimated to have increased by 2.4% in June 2016 compared with June 2015. All of the 4 main components of the services industries increased in the most recent month compared with the same month a year ago.

The largest contribution to total growth came from business services and finance, which contributed 1.1 percentage points.

The latest Index of Services estimates show that output increased by 0.2% between May 2016 and June 2016. This follows flat growth of 0.0% between April 2016 and May 2016.

-

10:47

UK GDP unchanged after second estimate

The reporting period for this release covers Quarter 2 (Apr to June) 2016, and therefore includes data for a short period after the EU referendum. There is very little anecdotal evidence at present to suggest that the referendum has had an impact on GDP in Quarter 2 2016.

According to ONS, UK gross domestic product in volume terms was estimated to have increased by 0.6% between Quarter 1 (Jan to Mar) 2016 and Quarter 2 2016, unrevised from the preliminary estimate of gross domestic product published on 27 July 2016. This is the 14th consecutive quarter of positive growth since Quarter 1 2013.

Between Quarter 2 2015 and Quarter 2 2016, GDP in volume terms increased by 2.2%, unrevised from the previously published estimate.

GDP in current prices increased by 1.6% between Quarter 1 2016 and Quarter 2 2016.

GDP per head in volume terms was estimated to have increased by 0.4% between Quarter 1 2016 and Quarter 2 2016.

-

10:30

United Kingdom: GDP, y/y, Quarter II 2.2% (forecast 2.2%)

-

10:30

United Kingdom: GDP, q/q, Quarter II 0.6% (forecast 0.6%)

-

10:05

OPEC Sec. General: ‘No Action Approach’ Doesn’t Allow ‘Just Price’ For All Parties - Livesquawk

-

10:04

Euro Zone broad monetary aggregate M3 decreased to 4.8% in July

According to ECB, the annual growth rate of the broad monetary aggregate M3 decreased to 4.8% in July 2016, from 5.0% in June, averaging 4.9% in the three months up to July. The components of M3 showed the following developments. The annual growth rate of the narrower aggregate, including currency in circulation and overnight deposits (M1), decreased to 8.4% in July, from 8.7% in June. The annual growth rate of short-term deposits other than overnight deposits (M2-M1) stood at -1.4% in July, compared with -1.5% in June.

The annual growth rate of marketable instruments (M3-M2) decreased to 4.9% in July, from 6.5% in June. Within M3, the annual growth rate of deposits placed by households stood at 4.8% in July, compared with 4.7% in June, while the annual growth rate of deposits placed by non-financial corporations decreased to 7.3% in July, from 7.8% in June. Finally, the annual growth rate of deposits placed by non-monetary financial corporations (excluding insurance corporations and pension funds) decreased to 0.4% in July, from 2.8% in June.

-

10:01

Eurozone: Private Loans, Y/Y, July 1.9% (forecast 1.8%)

-

10:00

Eurozone: M3 money supply, adjusted y/y, July 4.8% (forecast 4.9%)

-

09:32

Major stock exchanges trading mixed: FTSE -0.1%, DAX -0.1%, CAC40 -0.2%, FTMIB + 0.2% being the odd one out, IBEX -0.2%

-

09:19

WSE: After opening

WIG20 index opened at 1783.26 points (+0.09%)*

WIG 47377.37 -0.18%

WIG30 2026.74 -0.29%

mWIG40 3873.70 0.10%

*/ - change to previous close

The cosmetic plus on the WIG20 index in early trading corresponded to the prior atmosphere on the September series contracts.

Today's opening with increase of 0.1 percent again placed the index at around 1,780 points, but after the first exchanges appeared to be known from previous sessions withdrawal, which is partly a response of the WSE to declines in Europe, where the German DAX - after opening - lost 0.3 percent. Quick return on the advantages in Germany will stabilize influence on the WSE. Technically looking there is no change this morning. The WIG20 index remains at levels that were played in the previous sessions.

Today, the Warsaw market should just wait for the 16:00 hour (Warsaw time) and during the speech of Janet Yellen react to it like other European and American markets.

-

09:15

Today’s events

At 14:00 GMT the Federal Reserve Board of Governors Chairwoman Janet Yellen will deliver a speech.

At 14:50 GMT deputy Governor of the Bank of England and the banking Nemat Shafik will deliver a speech.

-

09:01

Asian session review: tight ranges as "hawkish" comments from Fed not enough

The following data was published:

23:30 Japan Consumer Price Index in the region of Tokyo y / y in August -0.4% -0.5%

23:30 Japan Consumer Price Index with the exception of the price of fresh produce in the region of Tokyo y / y in August -0.4% -0.3% -0.4%

23:30 Japan National CPI y / y in July -0.4% -0.4%

23:30 Japan National Consumer Price Index with the exception of the price of fresh food, y / y in July -0.5% -0.4% -0.5%

06:00 Germany consumer confidence index from the GfK September 10 9.9 10.2

The US dollar continues to decline against major currencies in anticipation of Fed's Yellen speech.

Traders consider a further tightening of monetary policy unlikely in the background of weak data on economic growth and productivity. However, the positive comments from the Federal Reserve's officials in recent days have increased hopes for a rate hike.

Esther George said it is time to change the interest rate. Consumer spending and the labor market - the bright spots of the US economy, but business investment continues to disappoint. George agreed to the plan to gradually raise interest rates.

Fed funds futures indicates that investors see a 54% chance of a rate hike in December, according to the CME Group.

The yen is trading in a narrow range. Data published today show that consumer prices in Japan continued to fall in July, which means that the Bank of Japan may be forced to act to stimulate inflation.

Japan National Consumer Price Index in July, year on year, down by -0.4%, in line with economists' forecast and the previous value. In August, the indicator for Tokyo area fell by -0.5%. The largest drop in July showed prices for electricity and gasoline.

The data are an assessment of price movements obtained by comparison of the retail prices of the relevant basket of goods and services. CPI - the most important barometer of changes in purchasing trends. Inflation reduces the purchasing power of the yen.

National CPI, except for the price of fresh food, decreased by 0.5%, after declining by 0.4% in June. The consumer price index except fresh products in the region of Tokyo, declined by -0.4% year on year, while economists forecasts -0.3%

The national consumer price index excluding food and energy for the period from January to July rose by 0.3% after rising 0.5% in the same period a year earlier

EUR / USD: during the Asian session, the pair was trading in the 1.1280-1.1310 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3180-1.3220 range

USD / JPY: during the Asian session, the pair was trading in the Y100.40-60 range

-

08:35

Options levels on friday, August 26, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1433 (4476)

$1.1399 (3346)

$1.1347 (4587)

Price at time of writing this review: $1.1303

Support levels (open interest**, contracts):

$1.1240 (1364)

$1.1192 (1855)

$1.1160 (2556)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 51979 contracts, with the maximum number of contracts with strike price $1,1250 (4587);

- Overall open interest on the PUT options with the expiration date September, 9 is 57605 contracts, with the maximum number of contracts with strike price $1,1000 (5790);

- The ratio of PUT/CALL was 1.11 versus 1.11 from the previous trading day according to data from August, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.3502 (1942)

$1.3403 (2354)

$1.3305 (2583)

Price at time of writing this review: $1.3217

Support levels (open interest**, contracts):

$1.3093 (1012)

$1.2996 (2084)

$1.2898 (1905)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32123 contracts, with the maximum number of contracts with strike price $1,3300 (2583);

- Overall open interest on the PUT options with the expiration date September, 9 is 26462 contracts, with the maximum number of contracts with strike price $1,2800 (2695);

- The ratio of PUT/CALL was 0.82 versus 0.82 from the previous trading day according to data from August, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:25

Expected negative start of trading on the major stock exchanges in Europe: DAX -0.1%, CAC40 -0,2%, FTSE -0,1%

-

08:23

WSE: Before opening

Thursday's session on Wall Street brought a slight discounts in the most important indices (about 0.1 percent). Europe presented yesterday poorly, and the decline of the German DAX of nearly 0.9 percent took into account these cosmetically red behavior in the USA. It seems that today's quotations in all markets will be dominated by looking in the direction of Jackson Hole.

Macro calendar today contains important reading of GDP growth in the US, but each report will remain in the shadow of what today will say Yellen, the occurrence of which will also be the most important event of the day in Warsaw. Emerging markets are sensitive to Fed policy and a signal of a possible rate hike in the US as early as mid-September will be nervously perceived on the WSE.

Friday, morning trading on the currency market brings an attempt to stabilize the quotations of PLN after yesterday, surprising, weakened. The polish zloty is valued by the market as follows: PLN 4.3293 per euro, PLN 3.8378 against the US dollar. Yields on domestic debt amounts to 2,684% for 10-year bonds.

There are rumors that PLN fell after the release of preliminary official assumptions for the budget year 2017r., where the primary risk is the assumption of PLN 59.3 billion deficit. An addition to this may be the publication by Moody's, which said that the escalation of the crisis around the Constitutional Tribunal (CT) is negative for Polish rating. The report agency refers to the start of the investigation concerning President of CT.

-

08:22

Jackson Hole: Yellen To Retain The Optionality Of Hiking Next Month - Deutsche Bank

"Fed Chair Yellen's speech at Jackson Hole should strike a moderately positive tone with respect to the near-term economic outlook.

While we do not expect Yellen to explicitly pre-commit to raising interest rates at the September 20-21 FOMC meeting, she will no doubt want to retain the optionality of hiking next month if economic and financial conditions permit.

To be sure, Yellen may couch any potential discussion of the near-term trajectory of interest rates within the context of a significantly lower terminal rate. The topic of this year's Jackson Hole Symposium is "Designing Resilient Monetary Policy Frameworks for the Future". Therefore, Yellen's speech will likely focus on some of the themes outlined last week by San Francisco Fed President Williams.

...We anticipate that Yellen's speech will outline the rationale for taking another step in the policy normalization process, but will also discuss the broader ramifications of a potentially lower equilibrium real rate".

Copyright © 2016 DB, eFXnews™

-

08:20

Fed’s George Wants to Raise Short-Term Rates to Around 3% Over Next Two or Three Years

According to the Wall Street Journal:

"Today my views are it is time to move"

"Where I was in July made sense to me and it still makes sense to me."

"I don't see better outcomes from waiting."

-

08:18

Fed's Fischer says the Federal Reserve is discussing the issue of overheating - Reuters

-

08:16

Consumer price inflation in Japan was down 0.4 percent

According to rttnews, consumer prices in Japan were down 0.4 percent on year in July, the Ministry of Internal Affairs and Communications said on Friday - in line with expectations and unchanged from June's annual reading.

Core CPI, which excludes volatile food costs, slid 0.5 percent on year - missing forecasts for -0.4 percent, which would have been unchanged.

On a monthly basis, overall inflation and core CPI both dipped 0.2 percent.

Overall inflation in Tokyo, considered a leading indicator for the nationwide trend, slipped 0.5 percent on year in August. That missed expectations for 0.4 percent, which would have been unchanged.

Core CPI in August was down an annual 0.4 percent - matching expectations and the same as in the previous month.

-

08:14

Consumer sentiment in Germany developed positively - GFK

Consumer sentiment in Germany developed positively on the whole in August, with consumers appearing to digest the shocking Brexit news very well. The overall index for consumer climate is forecasting 10.2 points for September, following 10.0 points in August. Income expectations and propensity to buy are seeing improvements, while economic expectations suffered slight losses.

The Brits' decision to leave the EU only seems to have caused temporary uncertainty among German consumers. This is signaled by the increases in both income expectations and propensity to buy. Economic expectations, on the other hand, once again suffered slight losses, following significant losses in the previous month.

-

08:00

Germany: Gfk Consumer Confidence Survey, September 10.2 (forecast 9.9)

-

07:04

Global Stocks

European stocks slumped on Thursday as German shares extended losses after a key survey showed an unexpected drop in business sentiment in the country.

The pan-European index extended its losses as a selloff in German equities accelerated after the release of the Ifo index for August. The closely watched survey of the business climate in Europe's largest economy came in at 106.2, compared with 108.3 in July. Economists polled by The Wall Street Journal had expected a print of 108.5.

Germany's DAX 30 DAX, -0.88% fell by as much as 1.4% after the report, but since pared the loss to 0.9% at 10,529.59.

U.K. stocks pulled back Thursday, with losses for drugmakers and commodity producers leading the market's benchmark to a second straight decline.

The FTSE 100 UKX, -0.28% lost 0.3% to close at 6,816.90, ending off its intraday low.

U.S. stocks ended slightly lower Thursday, with investors reluctant to make big bets the day before a much-anticipated speech by Federal Reserve Chairwoman Janet Yellen that will be picked apart for clues to the central bank's next rate move.

The Dow Jones Industrial Average DJIA, -0.18% slid 33.07 points, or 0.2%, to close at 18,448.41.

The S&P 500 index SPX, -0.14% fell 2.97 points, or 0.1%, to close at 2,172.47, with the health-care sector leading the decline, while the Nasdaq Composite Index COMP, -0.11% shed 5.49 points, or 0.1%, to end at 5,212.20.

Asian stocks were steady on Friday with modest losses in some markets and gains in others reflecting nervousness before a keenly anticipated speech by U.S. Federal Reserve Chair Janet Yellen.

The Asia-Pacific benchmark is on track for a 0.25 percent loss for the week.

Japan's Nikkei .N225 extended losses to 0.7 percent, set for a weekly drop of 0.6 percent.

Chinese shares, however, were higher, with the CSI 300 index .CSI300 and the Shanghai Composite .SSEC each rising 0.4 percent. They're on track for declines of 1.2 percent and 0.8 percent respectively.

Hong Kong's Hang Seng was also higher, up 0.6 percent and set to finish the week flat.

-

01:31

Japan: Tokyo Consumer Price Index, y/y, August -0.5%

-

01:31

Japan: Tokyo CPI ex Fresh Food, y/y, August -0.4% (forecast -0.3%)

-

01:30

Japan: National CPI Ex-Fresh Food, y/y, July -0.5% (forecast -0.4%)

-

01:30

Japan: National Consumer Price Index, y/y, July -0.4%

-

00:30

Commodities. Daily history for Aug 25’2016:

(raw materials / closing price /% change)

Oil 47.38 +0.11%

Gold 1,325.10 +0.04%

-

00:30

Stocks. Daily history for Aug 25’2016:

(index / closing price / change items /% change)

Nikkei 225 16,555.95 -41.35 -0.25%

Shanghai Composite 3,068.23 -17.65 -0.57%

S&P/ASX 200 5,541.89 -19.78 -0.36%

FTSE 100 6,816.90 -18.88 -0.28%

CAC 40 4,406.61 -28.86 -0.65%

Xetra DAX 10,529.59 -93.38 -0.88%

S&P 500 2,172.47 -2.97 -0.14%

Dow Jones Industrial Average 18,448.41 -33.07 -0.18%

S&P/TSX Composite 14,630.72 +4.48 +0.03%

-

00:29

Currencies. Daily history for Aug 25’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1284 +0,19%

GBP/USD $1,3187 -0,33%

USD/CHF Chf0,9675 +0,07%

USD/JPY Y100,53 +0,08%

EUR/JPY Y113,43 +0,26%

GBP/JPY Y132,57 -0,23%

AUD/USD $0,7615 +0,07%

NZD/USD $0,7297 -0,11%

USD/CAD C$1,2916 -0,09%

-

00:00

Schedule for today, Friday, Aug 26’2016

(time / country / index / period / previous value / forecast)

06:00 Germany Gfk Consumer Confidence Survey September 10 9.9

08:00 Eurozone Private Loans, Y/Y July 1.7% 1.8%

08:00 Eurozone M3 money supply, adjusted y/y July 5% 4.9%

08:30 United Kingdom GDP, q/q (Revised) Quarter II 0.4% 0.6%

08:30 United Kingdom GDP, y/y (Revised) Quarter II 2% 2.2%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) August 90 90.6

18:00 U.S. Jackson Hole Symposium

-