Noticias del mercado

-

17:51

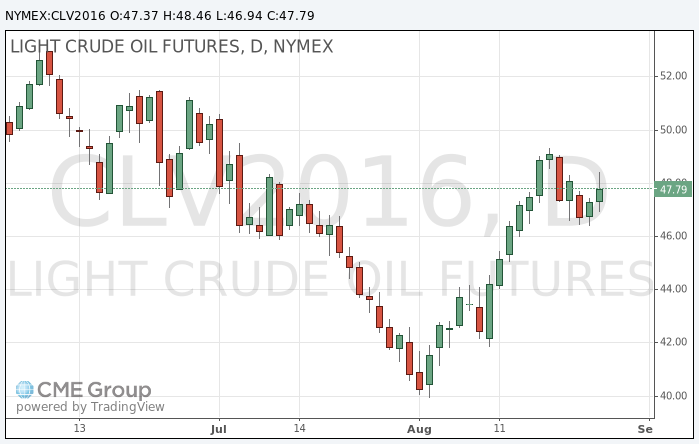

Oil rose due to the weakening of the dollar

Oil prices are rising amid statements of the chairwoman of the Federal Reserve Janet Yellen. During his speech oil prices fell, and then began to grow due to the weakening dollar. Yellen expressed the view that interest rates may be increased in the following weeks or months, but this evaluation did not differ much from what traders had expected, said Bart Melek of TD Securities.

"The Fed did not say that is necessarily raise rates in September," - says Melek. According to him, there was a correction on oil after an up move, but then it ended.

Rising interest rates in the US could strengthen the dollar, which makes oil more expensive for holders of other currencies. The dollar index recently fell by 0.5%.

"It's all about the dollar," - said Mark Waggoner, president of Excel Futures. He also drew attention to the low volume of transactions on Yellen's speech and a high volume after the speech. "Traders do not like uncertainty. They listened, and now want to return to the market.", - he added.

The Bank of America Merrill Lynch keeps Brent oil price forecast at $ 61 a barrel as the emerging shortage of supply is accompanied by "a moderate rise in global demand." The bank expects that the growth in global oil demand next year will amount to 1.2 million barrels per day from 1.4 million barrels per day this year and 1.6 million barrels last year.

The cost of the October futures for WTI rose to 48.46 dollars per barrel.

October futures for Brent crude rose to 50.76 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:31

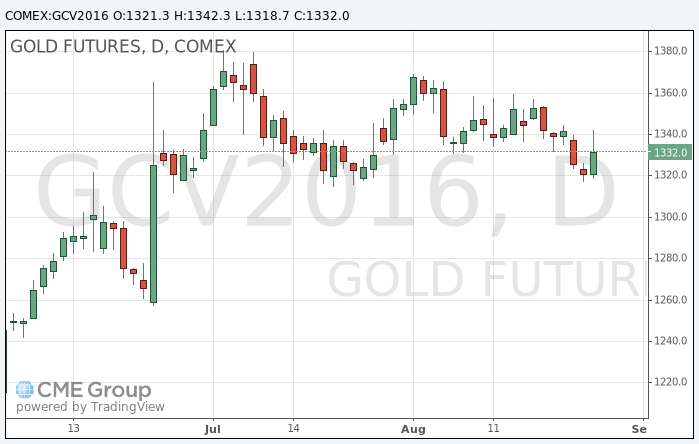

Gold price rose

Gold rose on Yellen's statement after some choppy trading.

Indicators of inflation and unemployment in the United States are moving towards the levels desired by the Federal Reserve, said the head of FED Janet Yellen, speaking at a symposium in Jackson Hole.

"Based on this forecast, the Federal Open Market Committee (FOMC) still consider justified a gradual increase in interest rates of federal funds rate. And in light of the good labor market performance and our expectations regarding economic activity i am sure that the arguments in favor of a rate hike have become more persuasive in the past few months. " These comments were mostly priced in.

The decision will depend on the extent to which the incoming statistical data confirm this forecast, stressed Yellen.

The cost of the October futures for gold on COMEX rose to $ 1342.3 per ounce.

-

13:40

Rusian Minister of Energy and the Secretary General of OPEC to discuss freezing oil production in Algeria

Russian Federation Energy Minister Alexander Novak and OPEC's Mohamed Barkindo may hold a meeting at the Energy Forum in Algiers on 26-28 September. This was announced today by Russia's permanent representative at the OPEC Vladimir Voronkov after a meeting with the head of the cartel.

"We agreed that Burkindo and Novak will discuss in the near future during the International Energy Forum in Algiers on 26-28 September," - he said.

At the end of September in Algeria will be held the International Energy Forum, in which countries - exporters of oil are going to negotiate the "freezing" of production. The initiators of the discussion are the Venezuela, Ecuador and Kuwait. Ministers of Saudi Arabia, Iraq and Iran have already confirmed their participation in private talks.

-

10:58

Oil little changed in early trading

This morning, New York crude oil futures for WTI rose slightly by + 0.08% to $ 47.38 and Brent oil futures were down -0.26% to $ 49.54 per barrel.

Analysts doubt the possibility of effective action by the producing countries to stabilize prices. Oil Minister of Saudi Arabia stated that, in general, he does not consider it necessary to intervene in the operation of the market, indicating that the market itself is already "moving in the right direction." Also, OPEC's Mohammed Barkindo said he sees the increasing willingness of member countries of the cartel to agree, as they are suffering losses due to the current low prices. Iran announced its intention to participate in the OPEC meeting, but not ready to freeze production.

-

00:30

Commodities. Daily history for Aug 25’2016:

(raw materials / closing price /% change)

Oil 47.38 +0.11%

Gold 1,325.10 +0.04%

-