Noticias del mercado

-

17:55

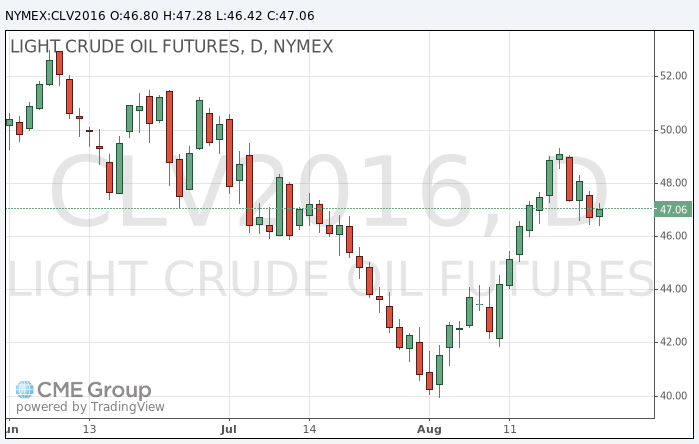

Oil rose slightly today

US National Center for tracking hurricanes issued a warning about the formation in the next couple of days of a tropical storm.

This news, as well as some weakness of the US dollar on the currency market will support oil quotes and become drivers of growth observed today. If a tropical storm is indeed formed, and will go towards the United States, it will happen on the weekend. Investors do not want to stay in such conditions in short positions and prefer to partially or completely reduce the risks by cutting the volume of shorts.

Earlier, Iran's oil minister said he will participate in an informal meeting of OPEC in September in Algeria. It is also a favorable factor for the price, although the prevailing majority of experts did not believe that the results of the meeting will be of any effective agreements.

Many analysts and traders believe that the production freeze will not signed. Even in the case of the signing of such agreement strong doubts remain about the implementation.

It is difficult to keep a large amount of short positions, says Kyle Cooper of Ion Energy Group. " Is in the interest of OPEC to make at least some statement on the results of the meeting, so that prices may continue to grow", - adds the analyst.

However, the rise in oil prices on Thursday is relatively small, and the overall trend of the market over the last four trading sessions is down.

-

17:30

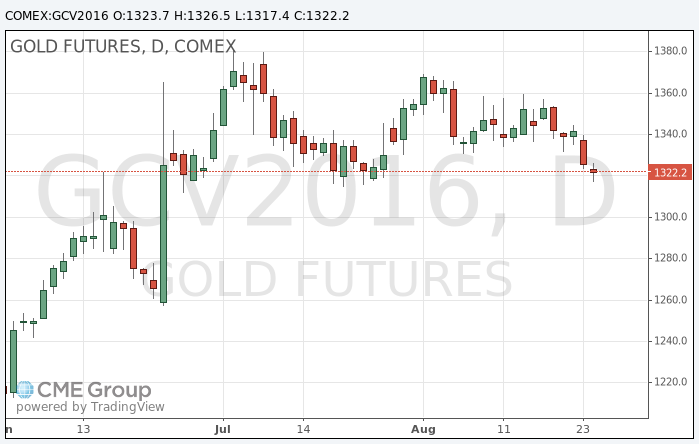

Gold price moderately lower

Gold is slightly cheaper, but traded in a narrow range in anticipation os Fed's Janet Yellen speech tomorrow which could give clues about the prospects for US monetary policy.

Investors are hoping that Yellen will give a clear signal about the timing of interest rate increases, when she will speak on Friday at a meeting of leaders of the world's central bankers in Jackson Hole, Wyoming.

Strong US employment data gave grounds to assume that rates could rise in September, although the views of officials of the central bank in the United States during the last session are divided.

"After the publication of the Fed meeting minutes the gold reacted very well, but after a few days there were comments of some officials, who believe that in fact the Fed has time to raise interest rates - said Capital Economics analyst Simon Gambarini -. This led to a decrease in the price of gold . Now all took a wait and see atitude for further comments, which will be able to move the market. "

CME FedWatch showed that the futures market estimates a 18 percent chance of the Fed hike next month, and about 50 percent in December.

The cost of the October futures for gold on the COMEX fell to $ 1317.4 per ounce.

-

10:25

Oil almost flat in early trading

This morning, New York crude oil futures for WTI rose by + 0.13% to $ 46.83 and Brent oil fell slightly to -0.08% to $ 49.02 per barrel. Thus, the black gold is trading without any important changes, showing the preservation of oversupply in the market. According to data published on Wednesday oil inventories in US increased by 2.5 million barrels last week, while analysts expected on average a reduction of 850 thousand. Gasoline stocks rose by 36 thousand barrels, distillates +122 th. barrels, and oil reserves in the United States 8% above last year's levels.

-

00:31

Commodities. Daily history for Aug 24’2016:

(raw materials / closing price /% change)

Oil 46.79 +0.04%

Gold 1,327.80 -0.14%

-