Noticias del mercado

-

17:52

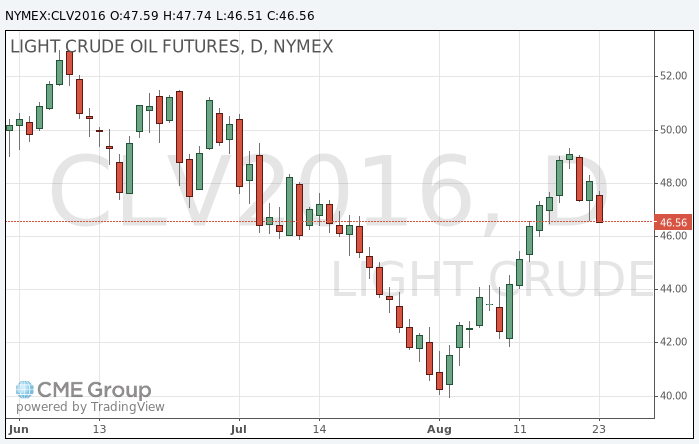

Oil fell on US stocks data

Oil prices continued to fall after the US Department's of Energy weekly data showed an increase in total reserves of oil and petroleum products to a new record high.

Inventory data for the week of 13-19 August grew by 6.6 million barrels to 1.4 billion barrels, and it signals the preservation of oversupply in the market.

In the reporting week, US crude oil inventories rose by 2.5 million barrels, while analysts had expected a small decrease in stocks.

Inventories of gasoline, distillates (including diesel) propane and ethanol also rose.

Total stocks of oil and oil products "all continue to grow," stated Jim Ritterbusch of Ritterbusch & Associates. Usually at this time of the year crude oil stocks are reduced, since refineries are actively processed oil into gasoline to meet demand. "This growth is unusual," - added the analyst.

US domestic oil production fell to 49,000 barrels a day to 8.5 million barrels a day. Last week production unexpectedly rose, but the Energy Information Administration Energy explained this by a "change in algorithm".

On Tuesday, oil prices rose amid reports that Iran intends to participate in the OPEC meeting scheduled for September, to discuss coordinated production constraints. Similar negotiations that took place in April, ended without result, because Iran refused to limit production.

Many analysts still showing skepticism about Iran's participation in the agreement.

The cost of the October futures for US light crude oil WTI fell to 46.45 dollars per barrel.

October futures price for North Sea petroleum mix of Brent crude rose to 48.68 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:29

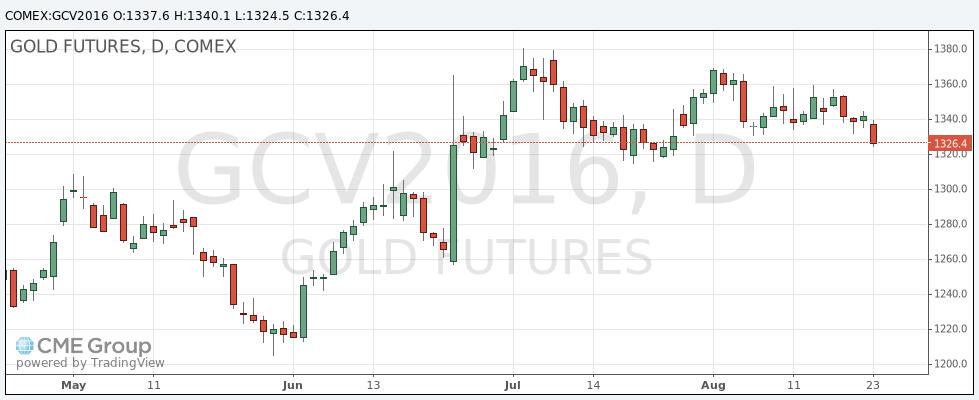

Gold price decrease today

Gold prices fell to 4 weeks low as investors closed their positions on the background of the Jackson Hole meeting on friday.

Traders are waiting for the symposium during which will Fed Chairwoman Janet Yellen will deliver a speech. It is expected that signals about the possible timing of the Fed's interest rate increase can be served at the event. The market does not expect an immediate increase in interest rates, but any surprises in the speech may catch investors off guard and put pressure on the gold market.

A stronger dollar also makes gold prices which are set in US currency less attractive for holders of other currencies.

The dollar index, which tracks the US currency against a basket of other currencies, rose 0.1% to 85.79.

In preparation for the Fed symposium investors reduce the number of positions said Peter Hug from Kitco Metals.

"Traders may be too carried away with long positions now and not want to be caught off guard and thus closed some bets." - adds Hag.

Since the beginning of the year the price of gold rose more than 25%, as the comments from the central bank contributed to the reduction of expectations of rising interest rates, and investors preferred to invest money in safe-haven assets.

The cost of the October futures on COMEX rose to $ 1,324.50 an ounce.

-

16:38

US crude oil inventories way above forecasts. Oil trading lower

U.S. crude oil refinery inputs averaged 16.7 million barrels per day during the week ending August 19, 2016, 186,000 barrels per day less than the previous week's average. Refineries operated at 92.5% of their operable capacity last week. Gasoline production decreased last week, averaging over 10.0 million barrels per day. Distillate fuel production decreased last week, averaging over 4.8 million barrels per day.

U.S. crude oil imports averaged over 8.6 million barrels per day last week, up by 449,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged 8.5 million barrels per day, 13.3% above the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 801,000 barrels per day. Distillate fuel imports averaged 224,000 barrels per day last week. U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.5 million barrels from the previous week. At 523.6 million barrels,

U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories remained unchanged last week, and are well above the upper limit of the average range. Finished gasoline inventories increased while blending components inventories decreased last week. Distillate fuel inventories increased by 0.1 million barrels last week and are near the upper limit of the average range for this time of year. Propane/propylene inventories rose 2.4 million barrels last week and are above the upper limit of the average range. Total commercial petroleum inventories increased by 6.6 million barrels last week.

-

08:14

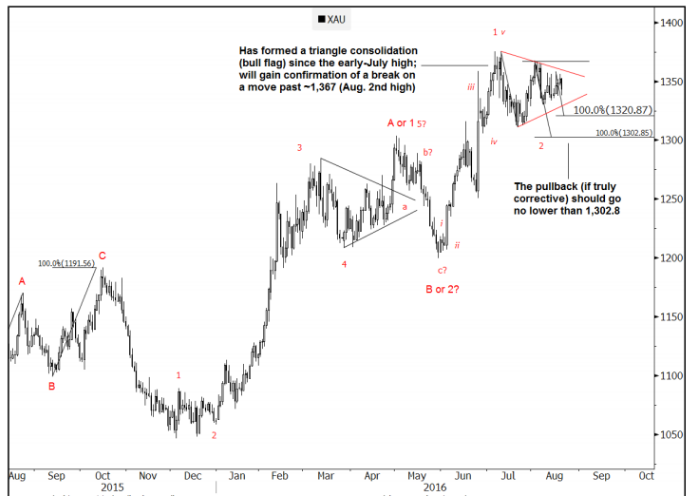

Here’s why Goldman Sachs adds to gold longs above $1367

"Gold has formed a triangle like consolidation since the July 11th high. Initial support comes in at 1,321. If this is truly a corrective pattern, it should go no lower than 1,302.85 (ABC from July 11th).

Will gain confirmation of an upside break through the Aug. 2 nd high which is up at 1,367.

Once a complete correction is in place, the level to target is 1,457; an ABC equality taken from the Dec. '15 low. Will re-assess the impulsive or corrective nature of the rally if/once the market does reach this 1,457 pivot. In other words, breaking past 1,457 will suggest that a more meaningful rally could be developing (i.e. wave III of V).

View: Sideways/ overlapping initially. Add to bullish exposure above 1,367, with an initial upside target at 1,457. Should go no lower than 1,302.85 (ABC from July 11th)".

Copyright © 2016 Goldman Sachs, eFXnews™

-

01:05

Commodities. Daily history for Aug 23’2016:

(raw materials / closing price /% change)

Oil 47.57 -1.10%

Gold 1,341.40 -0.35%

-