Noticias del mercado

-

21:00

DJIA 18507.75 -39.55 -0.21%, NASDAQ 5232.23 -27.85 -0.53%, S&P 500 2179.54 -7.36 -0.34%

-

18:00

European stocks closed: FTSE 6835.78 -32.73 -0.48%, DAX 10622.97 30.09 0.28%, CAC 4435.47 14.02 0.32%

-

17:39

WSE: Session Results

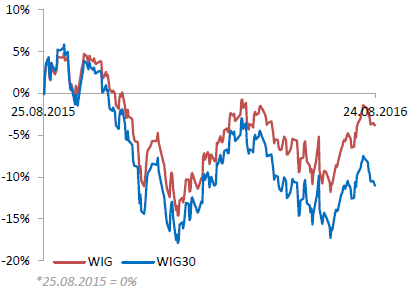

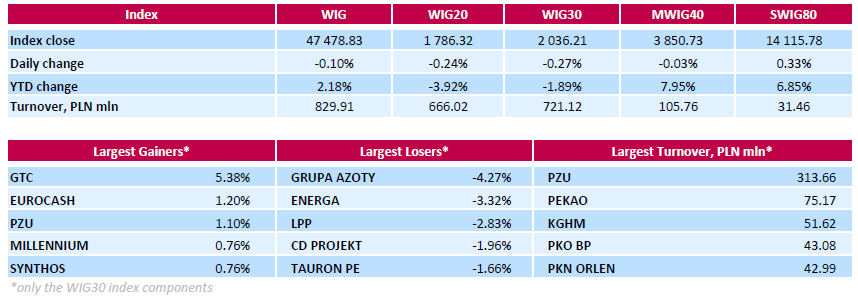

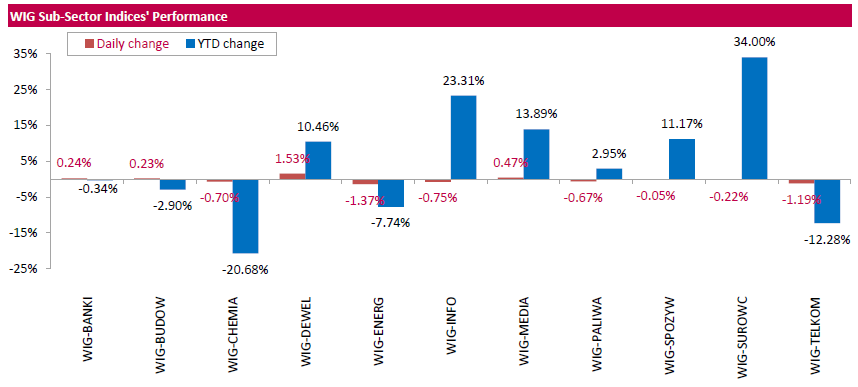

Polish equity market closed lower on Wednesday. The broad market benchmark, the WIG Index, fell by 0.1%. Sector performance in the WIG Index was mixed. Utilities (-1.37%) recorded the biggest decline, while developing sector (+1.53%) outpaced.

The large-cap stocks' measure, the WIG30 Index, lost 0.27%. In the index basket, chemical producer GRUPA AZOTY (WSE: ATT) tumbled the most, down 4.27%, as the company posted lower-than-expected Q2 earnings. Its net income amounted to PLN 44.4 mln in Q2, down 62.6% y/y and well below analysts' consensus estimate of PLN 118.8 mln. Meanwhile, the company's revenues fell by 5.2% y/y to PLN 2.16 bln in Q2, but beat analysts' consensus estimate of PLN 2.04 bln. Given weak Q2 earnings, GRUPA AZOTY cut its FY16 capital expenditure target by 20% to PLN 1.6 bln. Other major decliners were genco ENERGA (WSE: ENG), clothing retailer LPP (WSE: LPP) and videogame developer CD PROJEKT (WSE: CDR), plunging by 3.32%, 2.83% and 1.96% respectively. On the other side of the ledger, property developer GTC (WSE: GTC) led the gainers, climbing by 5.38%, as the company's quarterly financial report revealed it returned to profit in the Q2, helped by lower financial costs and revaluation of assets and real estate development projects. GTC posted net income for Q2 of EUR 18.8 mln, a turnaround from a loss of EUR 1.9 mln for the same three-month period last year. The bottom-line result was generally in-line with analysts' consensus estimate of EUR 18.3 mln.

-

17:24

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Wednesday as investors kept up their wait for Federal Reserve Chair Janet Yellen's speech on Friday for clues on the timing of an interest rate hike.

Most of Dow stocks in negative area (21 of 30). Top gainer - NIKE, Inc. (NKE, +0.92%). Top loser - Verizon Communications Inc. (VZ, -0.80%).

S&P sectors also in negative area. Top loser - Basic Materials (-0.7%).

At the moment:

Dow 18484.00 -44.00 -0.24%

S&P 500 2180.75 -4.50 -0.21%

Nasdaq 100 4809.50 -7.50 -0.16%

Oil 46.80 -1.30 -2.70%

Gold 1329.90 -16.20 -1.20%

U.S. 10yr 1.56 +0.01

-

15:47

WSE: After start on Wall Street

Behind us quiet neutral opening on Wall Street. No major shift seems to be a good strategy when the markets are waiting for Janet Yellen speech in Jackson Hole. The S&P500 index consolidates in the area of records in the trend and a week before the end of the month has not sinned with force and rather looking for tranquility. The opening in America did not affect in any way the quotation on the Warsaw market. For about an hour before the end of the session the WIG20 index was at the level of 1,782 points (-0.48%).

-

15:32

U.S. Stocks open: Dow -0.15%, Nasdaq -0.12%, S&P -0.11%

-

15:27

Before the bell: S&P futures +0.02%, NASDAQ futures +0.07%

U.S. stock-index futures were little changed as investors awaited Friday's speech from Federal Reserve Chair Janet Yellen for clues on when to expect higher borrowing costs.

Global Stocks:

Nikkei 16,597.30 +99.94 +0.61%

Hang Seng 22,820.78 -178.15 -0.77%

Shanghai 3,085.82 -3.88 -0.13%

FTSE 6,852.33 -16.18 -0.24%

CAC 4,449.92 +28.47 +0.64%

DAX 10,647.13 +54.25 +0.51%

Crude $47.29 (-1.68%)

Gold $1336.60 (-0.71%)

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.77

0.00(0.00%)

60466

ALCOA INC.

AA

10.43

-0.07(-0.6667%)

1603

ALTRIA GROUP INC.

MO

66.5

0.04(0.0602%)

133526

Amazon.com Inc., NASDAQ

AMZN

762.98

0.53(0.0695%)

2995

American Express Co

AXP

65.65

-0.03(-0.0457%)

300

AMERICAN INTERNATIONAL GROUP

AIG

59.02

0.00(0.00%)

128505

Apple Inc.

AAPL

108.96

0.11(0.1011%)

12685

AT&T Inc

T

40.85

-0.00(-0.00%)

551

Barrick Gold Corporation, NYSE

ABX

19.89

-0.20(-0.9955%)

88662

Boeing Co

BA

134.14

0.00(0.00%)

36686

Caterpillar Inc

CAT

84.01

0.00(0.00%)

519

Chevron Corp

CVX

101.16

-0.52(-0.5114%)

2600

Cisco Systems Inc

CSCO

30.92

-0.06(-0.1937%)

240

Citigroup Inc., NYSE

C

46.68

0.09(0.1932%)

3427

Deere & Company, NYSE

DE

87.9

-0.19(-0.2157%)

1456

E. I. du Pont de Nemours and Co

DD

70.425

-0.015(-0.0213%)

45798

Exxon Mobil Corp

XOM

87.58

-0.14(-0.1596%)

794

Facebook, Inc.

FB

124.52

0.15(0.1206%)

18458

FedEx Corporation, NYSE

FDX

168.59

0.00(0.00%)

11857

Ford Motor Co.

F

12.39

-0.03(-0.2415%)

6105

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.85

-0.13(-1.0851%)

110735

General Electric Co

GE

31.29

0.06(0.1921%)

3865

General Motors Company, NYSE

GM

31.85

-0.05(-0.1567%)

296120

Goldman Sachs

GS

166.1

0.02(0.012%)

3257

Google Inc.

GOOG

771.13

-0.95(-0.123%)

59684

Hewlett-Packard Co.

HPQ

14.64

0.07(0.4804%)

2748

Home Depot Inc

HD

135.8

-0.42(-0.3083%)

2663

HONEYWELL INTERNATIONAL INC.

HON

116.81

-0.20(-0.1709%)

200

Intel Corp

INTC

35.31

-0.09(-0.2542%)

219

International Business Machines Co...

IBM

160.26

0.00(0.00%)

71104

International Paper Company

IP

46.96

0.00(0.00%)

49149

Johnson & Johnson

JNJ

119.44

0.00(0.00%)

294876

JPMorgan Chase and Co

JPM

65.77

0.00(0.00%)

222243

McDonald's Corp

MCD

115.2

0.01(0.0087%)

750

Merck & Co Inc

MRK

63.64

0.06(0.0944%)

261822

Microsoft Corp

MSFT

57.9

0.01(0.0173%)

5849

Nike

NKE

59.84

0.22(0.369%)

7307

Pfizer Inc

PFE

35.33

0.24(0.684%)

5792

Procter & Gamble Co

PG

87.59

0.19(0.2174%)

180

Starbucks Corporation, NASDAQ

SBUX

56.86

0.46(0.8156%)

25501

Tesla Motors, Inc., NASDAQ

TSLA

226

1.16(0.5159%)

8398

The Coca-Cola Co

KO

43.9

0.05(0.114%)

1967

Travelers Companies Inc

TRV

116.63

0.00(0.00%)

25934

Twitter, Inc., NYSE

TWTR

18.79

0.10(0.5351%)

30241

United Technologies Corp

UTX

108.03

0.03(0.0278%)

43919

UnitedHealth Group Inc

UNH

142

-0.01(-0.007%)

150

Verizon Communications Inc

VZ

52.64

0.01(0.019%)

2924

Visa

V

80.96

0.16(0.198%)

2200

Wal-Mart Stores Inc

WMT

72.12

0.15(0.2084%)

1852

Walt Disney Co

DIS

96

0.03(0.0313%)

350

Yahoo! Inc., NASDAQ

YHOO

42.53

-0.07(-0.1643%)

658

Yandex N.V., NASDAQ

YNDX

22.44

0.00(0.00%)

1125

-

13:06

WSE: Mid session comment

The morning trading phase brought recovery on European markets. The market in Frankfurt rebounded from a session bottom of around 1 percent and helps bulls in Warsaw. On the Warsaw market is worth to note reflection on PZU and Pekao shares. These leaders of the morning supply grow by approx. 1 per cent and correct a negative impact of Tuesday's session. Investor activity focuses today on the values of PZU, which account for almost half of today's trading on the WIG20. As we approach the mid-session, the demand side has become more daring. Contribute to the general sentiment is also persistent approach in Euroland.

In the mid-session, the WIG20 index was at the level of 1,788 points (-0.13%) and with the turnover of PLN 300 million.

-

13:02

Major stock indices in Europe little changed

European stock indices show a predominantly positive trend, heading to third consecutive session increases. The growth of indices helps to gradually improve investor confidence.

The final report, published by the Statistical Office Destatis, showed that the German economy in the 2nd quarter increased by 0.4% compared to the previous three months, when GDP grew by 0.7%. In annual terms, the economy has added 3.1%. The last change (as in the quarterly and on an annual basis) in line with expectations. At the end of the 2nd quarter, German exports increased by 1.2% and imports decreased by 0.1%. Meanwhile, consumer spending rose by 0.2% after rising 0.3% in the 1st quarter.

A certain pressure on the index has decline of oil prices, due to concerns about growth in US oil inventories. Recent data from API revealed that for the past week US crude inventories rose by 4.5 mln barrels. Analysts had forecast a decline to 0.5 mln barrels. Gasoline inventories fell by 2.2 million barrels, while distillates -. 834 million barrels.. Later, the official statistics from the US Department of Energy will be released today. It is predicted that crude oil inventories fell by 0.85 million barrels

The composite index of Europe's largest enterprises Stoxx 600 added 0.5 percent. volatility gauge shows the minimum monthly fluctuations since March 2015, as traders await clarity from the Fed regarding the prospects for a rate hike.

While most industry groups showing growth, shares of commodity producers falling on the background of the renewed drop in oil prices.

Quotes of Glencore Plc tumbled 5.7 percent after the company reported a drop in profit margins in the first half of this year.

The cost of Svenska Cellulosa AB increased by 11 percent on news that the company will be divided into two parts.

Shares of H. Lundbeck A / S rose 2.5 percent after the Danish pharmaceutical company raised its forecasts for sales and earnings for 2016.

Price of WPP Plc shares increased by 5.6 percent as sales beat forecasts in the first half.

At the moment:

FTSE 100 6852.59 -15.92 -0.23%

DAX +26.68 10619.56 + 0.25%

CAC 40 +19.74 4441.19 + 0.45%

-

09:45

Major stock exchanges began trading mixed: FTSE 100 6,832.55 + 4.01 + 0.06%, DAX 10,521.32-71.56-0.68%

-

09:18

WSE: After opening

WIG20 index opened at 1787.89 points (-0.15%)*

WIG 47376.54 -0.31%

WIG30 2031.57 -0.50%

mWIG40 3840.91 -0.29%

*/ - change to previous close

The September futures series on the WIG20 index (WSE: FW20U1620) started the day losing 0.2 per cent which was affected by moderate cons on European contracts. The Deputy Prime Minister and Development Minister Mateusz Morawiecki announced today that PZU and Polish Development Fund will not conduct negotiations on the purchase of Pekao shares from UniCredit, although it does not reduce the pressure of the supply on yesterday's negative hero - PZU. That company is responsible now for a half of the turnover in the index and it shows that, at least in the first phase of the session, the PZU will determine the mood in the WIG20. Technically looking drop of the WIG20 into area of 1,788 points means that the index draws new downward wave lows.

-

08:26

WSE: Before opening

Tuesday's session on Wall Street ended with modest increases in the major indexes. The main ones gained from 0.1 to 0.3 percent and the wide S&P500 having increased by 0.2 percent. Night trading of contracts on the S&P500 did not bring new impulses. Thus start of sessions in Europe may bring discounts induced by withdrawal on Wall Street at the end of the session but the potential drop will be rather cosmetic.

The macro calendar today is quite empty, therefore, to the rank of events increases the Friday speech of the Fed head, J. Yellen and investors are hoping for a more concrete signal about interest rates hike.

On the Warsaw market, yesterday's session in the basket of blue chips was dominated by discount of PZU and Pekao shares triggered by fears that the first will take over the second. Quite better acted the smaller companies. In conjunction with the breaking of the support in the region of 1,800 points the way to descend the WIG20 into area of 1,750 points was opened. In other words technique supports the continuation of the depreciation of the index of the largest companies, and fears about the future of PZU & Pekao does not help for the demand side for the deceleration of started last week correction.

Wednesday's morning trading on the currency market does not bring major changes in the valuation of the zloty against foreign currency. Polish currency is valued by investors as follows: EURPLN 4.3017, USDPLN 3.8150. Polish debt yields amount to 2,684% for 10-year bonds.

-

08:25

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.5%, CAC40 + 0.4%, FTSE + 0.4%

-

07:21

Global Stocks

European stocks finished higher Tuesday, with strong eurozone economic indicators and advances in the mining and financial sectors pushing the market to a second day of gains.

The Stoxx Europe 600 SXXP, +0.93% picked up 0.9% to close at 343.60, marking its biggest percentage gain since Aug. 5.

U.K. stocks pushed higher Tuesday and posted their biggest gain in nearly two weeks, with mining sector heavyweight BHP Billiton PLC and supermarket chain Tesco PLC among the shares moving firmly higher.

The FTSE 100 UKX, +0.59% rose 0.6% to close at 6,868.51, marking its best day since Aug. 11.

U.S. stocks closed in positive territory on Tuesday, but off the best levels of the session, after upbeat data on U.S. new-home sales and a stronger-than-expected gauge of European private-sector activity.

The Nasdaq Composite briefly hit an all-time intraday high, while the S&P 500 flirted with its own intraday record. Both the S&P 500 and Nasdaq had traded at levels that would have given them new closing highs Tuesday, but fell short by the close.

Asian stocks consolidated recent gains on Wednesday, helped by Wall Street's rise overnight, even as oil prices slid after a surprise build in U.S. crude stocks.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS eased 0.3 percent in early trade. It has risen more than 14 percent since late June to hit a 1-year high last week.

Japan's Nikkei .N225 rose 0.4 percent.

Elsewhere in the region, Hong Kong .HSI slid as investors sold financials, while mainland China markets .SSEC inched higher.

-

01:04

Stocks. Daily history for Aug 23’2016:

(index / closing price / change items /% change)

Nikkei 225 16,497.36 -100.83 -0.61%

Shanghai Composite 3,090.63 +5.83 +0.19%

S&P/ASX 200 5,553.77 +38.72 +0.70%

FTSE 100 6,868.51 +39.97 +0.59%

CAC 40 4,421.45 +31.51 +0.72%

Xetra DAX 10,592.88 +98.53 +0.94%

S&P 500 2,186.90 +4.26 +0.20%

Dow Jones Industrial Average 18,547.30 +17.88 +0.10%

S&P/TSX Composite 14,764.77 +16.58 +0.11%

-