Noticias del mercado

-

21:00

DJIA 18438.51 -42.97 -0.23%, NASDAQ 5204.77 -12.93 -0.25%, S&P 500 2170.47 -4.97 -0.23%

-

18:59

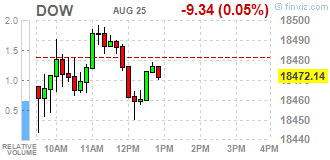

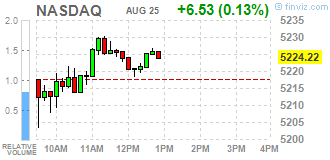

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday morning as financial stocks gained after two more Federal Reserve officials said the case for an interest rate hike was strengthening. Their comments followed the hawkish tone set by key Fed policymakers in recent days and came ahead of Fed Chair Janet Yellen's speech on Friday at Jackson Hole, which will be assessed to see if she takes an aggressive stance.

Most of Dow stocks in positive area (18 of 30). Top gainer - Cisco Systems, Inc. (CSCO, +0.98%). Top loser - Wal-Mart Stores Inc. (WMT, -1.34%).

Most of S&P sectors also in positive area. Top gainer - Technology (+0.3%). Top loser - Services (-0.1%).

At the moment:

Dow 18454.00 -18.00 -0.10%

S&P 500 2175.25 +0.25 +0.01%

Nasdaq 100 4790.00 +3.75 +0.08%

Oil 47.12 +0.35 +0.75%

Gold 1325.20 -4.50 -0.34%

U.S. 10yr 1.56 +0.01

-

18:00

European stocks closed: FTSE 6816.90 -18.88 -0.28%, DAX 10529.59 -93.38 -0.88%, CAC 4406.61 -28.86 -0.65%

-

17:40

WSE: Session Results

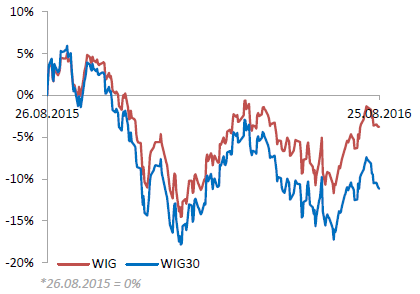

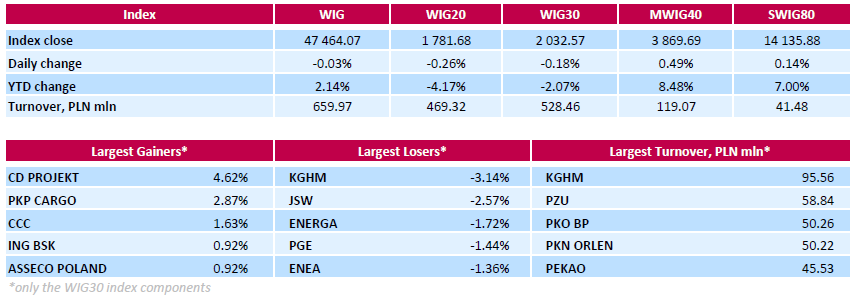

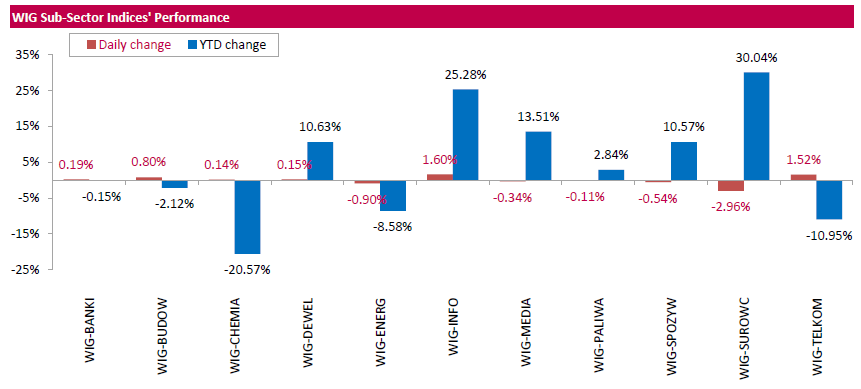

Polish equity market closed flat on Thursday. The broad market measure, the WIG Index, inched down 0.03%. Sector performance in the WIG index was mixed. Information technology (+1.60%) outperformed, while materials (-2.96%) lagged behind.

The large-cap stocks lost 0.18%, as measured by the WIG30 Index. Within the index components, copper producer KGHM (WSE: KGH) and coking coal miner JSW (WSE: JSW) recorded the largest declines, tumbling by a respective 3.14% and 2.57%. They were followed by three gencos ENERGA (WSE: ENG), PGE (WSE: PGE) and ENEA (WSE: ENA), losing between 1.36% and 1.72%. At the same time, videogame developer CD PROJEKT (WSE: CDR) and footwear retailer CCC (WSE: CCC) were among growth leaders, climbing by 4.62% and 1.63% respectively, helped by better-than-expected Q2 earnings results. The former reported net income of PLN 102.1 mln (-57.7% y/y) versus analysts' consensus estimate of PLN 77.2 mln, while the latter posted net profit of PLN 131.6 mln (+25% y/y) versus analysts' consensus estimate of PLN 100.9 mln. Other noticeable gainers were railway freight transport operator PKP CARGO (WSE: PKP), IT-company ASSECO POLAND (WSE: ACP) and two banks ING BSK (WSE: ING) and PEKAO (WSE: PEO), which added between 0.84% and 2.87%.

-

15:50

WSE: After start on Wall Street

The series of US data brought favorable news. While the good behavior of the labor market should no longer surprise anyone, information on orders for durable goods are more suggestive. The data, however, passed unnoticed, because everyone is waiting now to Yellen. The data was also overlap by words of the Fed head in Kansas City, Esther George, who said that it is time for a rate hike.

The market in the United States opened with a slight decrease of 0.12%. Investors clearly begins to fear of tomorrow's words of Janet Yellen.

An hour before the close of trading, the WIG20 index was at the level of 1,777 points (-0,48%).

-

15:34

U.S. Stocks open: Dow -0.12%, Nasdaq -0.18%, S&P -0.14%

-

15:12

Before the bell: S&P futures -0.17%, NASDAQ futures -0.17%

U.S. stock-index futures slipped as investors awaited Friday's speech from Federal Reserve Chair Janet Yellen for clues on when to expect higher borrowing costs.

Global Stocks:

Nikkei 16,555.95 -41.35 -0.25%

Hang Seng 22,814.95 -5.83 -0.03%

Shanghai 3,068.23 -17.65 -0.57%

FTSE 6,825.58 -10.20 -0.15%

CAC 4,402.86 -32.61 -0.74%

DAX 10,526.05 -96.92 -0.91%

Crude $46.61 (-0.34%)

Gold $1322.00 (-0.58%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.41

0.00(0.00%)

44687

ALCOA INC.

AA

10.11

0.07(0.6972%)

40326

ALTRIA GROUP INC.

MO

66.67

0.51(0.7709%)

114

Amazon.com Inc., NASDAQ

AMZN

756.2

-1.05(-0.1387%)

1270

American Express Co

AXP

64.99

-0.17(-0.2609%)

999

AMERICAN INTERNATIONAL GROUP

AIG

58.91

0.00(0.00%)

18614

Apple Inc.

AAPL

107.66

-0.37(-0.3425%)

40642

AT&T Inc

T

40.83

-0.04(-0.0979%)

2170

Barrick Gold Corporation, NYSE

ABX

18.15

-0.02(-0.1101%)

111399

Boeing Co

BA

133.29

0.00(0.00%)

15559

Caterpillar Inc

CAT

83

-0.15(-0.1804%)

16499

Chevron Corp

CVX

102.17

-0.03(-0.0294%)

326859

Cisco Systems Inc

CSCO

30.94

-0.12(-0.3863%)

708

Citigroup Inc., NYSE

C

46.6

-0.06(-0.1286%)

5130

Deere & Company, NYSE

DE

87.02

-0.40(-0.4576%)

462

E. I. du Pont de Nemours and Co

DD

70.37

0.00(0.00%)

118086

Exxon Mobil Corp

XOM

88.15

0.13(0.1477%)

2682

Facebook, Inc.

FB

123.27

-0.21(-0.1701%)

15512

FedEx Corporation, NYSE

FDX

168.23

0.00(0.00%)

14358

Ford Motor Co.

F

12.32

0.02(0.1626%)

14668

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.02

-0.06(-0.5415%)

183292

General Electric Co

GE

31.26

0.04(0.1281%)

6756

General Motors Company, NYSE

GM

31.78

0.00(0.00%)

483

Goldman Sachs

GS

165.19

-0.11(-0.0665%)

1020

Google Inc.

GOOG

770

0.36(0.0468%)

478

Hewlett-Packard Co.

HPQ

13.55

-0.85(-5.9028%)

310098

Home Depot Inc

HD

134.85

-0.21(-0.1555%)

647

HONEYWELL INTERNATIONAL INC.

HON

116.76

0.00(0.00%)

133134

Intel Corp

INTC

35.08

-0.07(-0.1991%)

700

International Business Machines Co...

IBM

158.7

-0.35(-0.2201%)

300

International Paper Company

IP

46.56

0.00(0.00%)

4795

Johnson & Johnson

JNJ

118.56

-0.15(-0.1264%)

278555

JPMorgan Chase and Co

JPM

66.08

0.13(0.1971%)

86095

McDonald's Corp

MCD

114.87

0.00(0.00%)

500

Merck & Co Inc

MRK

62.35

-0.38(-0.6058%)

1086

Microsoft Corp

MSFT

57.95

0.00(0.00%)

1630271

Nike

NKE

59.84

-0.38(-0.631%)

5104

Pfizer Inc

PFE

34.7

-0.12(-0.3446%)

31921

Procter & Gamble Co

PG

87.31

0.00(0.00%)

372941

Starbucks Corporation, NASDAQ

SBUX

57.19

0.10(0.1752%)

84478

Tesla Motors, Inc., NASDAQ

TSLA

223.5

0.88(0.3953%)

5015

The Coca-Cola Co

KO

43.85

0.00(0.00%)

62952

Travelers Companies Inc

TRV

117.11

0.00(0.00%)

13965

Twitter, Inc., NYSE

TWTR

18.41

0.16(0.8767%)

106064

United Technologies Corp

UTX

108.0278

0.0678(0.0628%)

53427

UnitedHealth Group Inc

UNH

139.87

0.00(0.00%)

76678

Verizon Communications Inc

VZ

52.75

0.22(0.4188%)

645

Visa

V

79.74

-0.55(-0.685%)

424

Wal-Mart Stores Inc

WMT

72.1

-0.13(-0.18%)

3735

Walt Disney Co

DIS

95.82

0.00(0.00%)

31194

Yahoo! Inc., NASDAQ

YHOO

41.86

-0.05(-0.1193%)

425

Yandex N.V., NASDAQ

YNDX

22.54

0.17(0.76%)

300

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

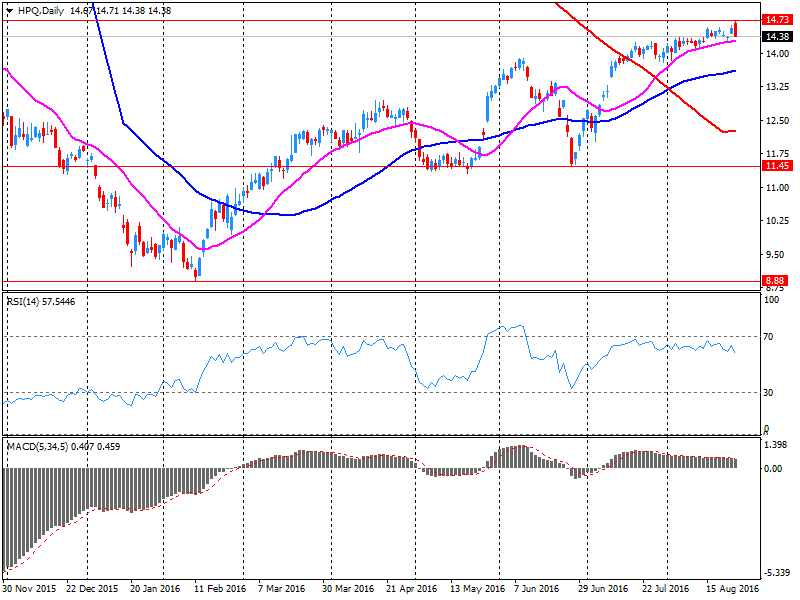

HP (HPQ) downgraded to Hold from Buy at Maxim Group; target lowered to $15 from $17

Other:

HP (HPQ) reiterated with Sector Perform with a target $14 at RBC Capital Mkts

-

14:24

Company News: HP Inc. (HPQ) Q3 results beat analysts’ expectations

HP Inc. reported Q3 FY 2016 earnings of $0.48 per share, beating analysts' consensus estimate of $0.45.

The company's quarterly revenues amounted to $11.892 bln (-3.8% y/y), beating analysts' consensus estimate of $11.492 bln.

HP issued downside guidance for Q4, projecting EPS of $0.34-0.37 versus analysts' consensus estimate of $0.40. It also lowered FY16 EPS to $1.59-1.62 from $1.59-1.65 versus analysts' consensus of $1.61.

HPQ fell to $13.60 (-5.56%) in pre-market trading.

-

13:02

WSE: Mid session comment

The reading of the German Ifo index surprised negatively. These data exacerbated the already strained mood and the German DAX lost after reading more than 1%. Weaker data from Germany, combined with the expectation of tomorrow's speech by Janet Yellen noticeably worsened the condition of the environment and stable Stock Exchange in the half of second hour of trading slightly surrendered and the WIG20 quickly went down to yesterday's lows.

In the southern phase of trading European parquets come to slightly higher levels. Thus, the German DAX limited losses to 0.9% and the French CAC40 to 0.8%. The weakest are doing today the companies of raw materials (including our KGHM, which shares lost more than 3% today) and related to the automotive sector. Our market is traditionally less eager to change the chosen direction and the WIG20 from their session lows is not unduly moved away. In the mid-session the WIG20 index reached the level of 1,775 points (-0,61%). The turnover in the basket of the largest companies was amounted to PLN 200 mln.

-

12:54

Major stock indexes in Europe show a negative trend

European stocks are down moderately, ending a three-day rally, due to concerns over the outlook for economic growth and expectations of the Fed speech.

The data published by research institute IFO, showed that the index of business climate in Germany unexpectedly fell in August to 106.2 points from 108.3 points in July. Analysts had expected the index rising to 108.5 points. In addition, the current conditions index fell to 112.8 points from 114.8 points in July, while economists had forecast an improvement to 114.9. The expectations index fell to 100.1 points from 102.1 points, which was lower than expected level of 102.5. Yesterday the Germany's GDP in the 2nd quarter increased by 0.4% compared to the previous 3 months. In annual terms, the economy has added 3.1%.

However, today, the Statistical Office Insee reported that the index of manufacturing sentiment in France fell in August to 101 from 103 in July. Economists had forecast that the index would remain unchanged. A similar low value was recorded for the last time in June 2015. Business managers in the industrial sector were less optimistic about the general prospects of production than in July - the corresponding indicator fell to 2 points from a month earlier.

The composite index of Europe's largest enterprises Stoxx 600 fell 0.7 percent.

Shares of mining companies shows the greatest decline among the 19 industry groups. Shares of Glencore Plc and Anglo American fell 4 percent and 1.5 percent respectively.

Shares of energy companies also in negative territory, as oil traded near a week low. Total SA Quotes decreased by 0.3 percent.

Price of Playtech Plc shares rose 3.4 percent after the supplier of gaming software reported an increase in revenues in the 1st half of the year and announced a special dividend.

Capitalization of Jimmy Choo Plc jumped 5.3 The company noted that it is still optimistic about the prospects for this year.

CRH Plc shares rose by 2.6 per cent, as the Irish construction company recorded higher-than-expected figures for profits and sales in the 1st half of the year.

At the moment:

FTSE 100 6813.77 -22.01 -0.32%

DAX -100.64 10522.33 -0.95%

CAC 40 4401.39 -34.08 -0.77%

-

09:17

WSE: After opening

WIG20 index opened at 1788.99 points (+0.15%)*

WIG 47535.17 0.12%

WIG30 2039.62 0.17%

mWIG40 3865.46 0.38%

*/ - change to previous close

The futures market opened with increase of 0.11% to 1,789 points.

The cash market opens with slight increase by 0.13% to 1,788 points. The German DAX starts a session low, as already goes down by 0.5%, which means that waiting for Janet Yellen is not generally favorable for the bulls

However it is hard to expect today, on the eve of speech of Janet Yellen, any major changes in indexes and exchange rates. On markets (also on the WSE) should reign waiting. Perhaps a little mess will bring the OCCP (Office of Competition and Consumer Protection), which at 10:00 (Warsaw time) is expected to present its, called as "significant", view on the dispute of owner of currency loans with the banks. It may harm banks.

-

08:28

Expected negative start of trading on the major stock exchanges in Europe: DAX -0.1%, CAC40 -0,05%, FTSE -0,06%

-

08:21

WSE: Before opening

Yesterday's session on Wall Street ended with slight declines and the S&P500 index ended trading with a discount of 0.5%. In Asia, the mood is not the worst, and only China is clearly dominated by the red color, index in Shanghai discounts up to 1%. The Japanese Nikkei lost cosmetically and on other parquets we may see the light increases. Futures market in the US looks quite stable.

Today begins a symposium in Jackson Hole, and yesterday we could see the first changes in the markets in view of possible incoming impulses from there. Strengthened the US dollar and on equity markets investors have become more cautious.

In today's macro calendar in the morning will be announced macro data from Germany in the form of the Ifo institute index. In the afternoon in the US will be announced orders for durable goods.

The Warsaw market is fighting to stop the downward movement. Upcoming speech by Janet Yellen will not help, but on the other hand, the global situation is not so tense to seriously interfered with at least stabilization of the market over the level of 1,775 points.

Thursday morning trading on the currency market does not bring any significant changes to the valuation of the zloty against foreign currency. Polish currency is valued by the market as follows: PLN 4.3084 per euro, 3.8230 PLN against the US dollar. Yields on Polish debt amounts to 2,663% for 10-year bonds.

-

07:21

Global Stocks

European stocks advanced on Wednesday after a choppy start to the day, as a rally for banks and advertising giant WPP PLC outweighed pressure from falling commodity prices.

The Stoxx Europe 600 index SXXP, +0.39% gained 0.4% to 344.93, closing in positive for a third straight session.

U.K. stocks closed in the red Wednesday, with resource companies leading the charge south on the back of a slide in commodity prices and a mixed earnings report from mining giant Glencore PLC.

The FTSE 100 UKX, -0.48% dropped 0.5% to finish at 6,835.78, partly erasing a 0.6% gain from Tuesday.

The S&P 500 and Dow industrials on Wednesday finished at their lowest levels since early August as selling in health-care shares, sparked by intensifying outrage over the pricing of a lifesaving drug by Mylan, put pressure on the broader market.

The slump in Mylan nudged the health-care sector lower and weighed on the exchange-traded iShares Nasdaq Biotechnology ETF IBB, -3.36% which was down 3.4%-its worst daily slide in two months, according to FactSet data.

The Nasdaq Composite Index COMP, -0.81% suffered the brunt of the market's retreat, trading down 42.38 points, or about 0.8%, to close at 5,217.69. The tech-heavy index closed at its lowest level since Aug. 8., and experienced its worst daily slump in three weeks.

Asian stocks edged higher on Thursday but clung to recent well-worn trading ranges while the greenback held firm against regional currencies ahead of a speech by Federal Reserve Chair Janet Yellen at a global central bankers' meeting.

Market expectations have increased that Yellen might indicate a clearer timeframe for the next U.S. rate hike after strong housing data this week and hawkish comments by other Fed officials, but many analysts expect her to strike a more neutral stance.

On Wednesday, futures markets were indicating just an 18 percent chance the U.S. central bank would hike rates at its policy meeting next month, and roughly 50 percent odds of a rate increase in December, according to CME Group's FedWatch tool.

-

00:29

Stocks. Daily history for Aug 24’2016:

(index / closing price / change items /% change)

Nikkei 225 16,597.30 +99.94 +0.61%

Shanghai Composite 3,085.82 -3.88 -0.13%

S&P/ASX 200 5,561.67 +7.90 +0.14%

FTSE 100 6,835.78 -32.73 -0.48%

CAC 40 4,435.47 +14.02 +0.32%

Xetra DAX 10,622.97 +30.09 +0.28%

S&P 500 2,175.44 -11.46 -0.52%

Dow Jones Industrial Average 18,481.48 -65.82 -0.35%

S&P/TSX Composite 14,626.24 -138.53 -0.94%

-