Noticias del mercado

-

16:38

Fed, Kaplan: Case for hiking rates 'strengthening'

-

Bond market predominantly driven by global search for yield

-

We are making progress on employment, slow progress on inflation

-

Case for hiking rates 'strengthening'

-

Hesitant to raise Fed's 2% inflation target

-

Debate about Fed monetary policy and targets is 'healthy'

-

Liquidity is fundamental force driving bond market

-

Case for removing accommodation in strengthening

-

-

15:57

Weakest rise in US services activity since February - Markit

According to Markit Economics, payroll numbers expand at slowest pace for 20 months Business expectations remain stronger than the survey-record low seen in June

U.S. service providers indicated another month of lacklustre growth in August, with business activity, new orders and employment all rising at a slower pace than in July. Survey respondents generally cited subdued underlying demand conditions and uncertainty ahead of the presidential election as factors that had dampened growth in August. Nonetheless, the balance of service sector firms expecting a rise in business activity over the year ahead remained well above the survey-record low seen in June.

-

15:52

Option expiries for today's 10:00 ET NY cut

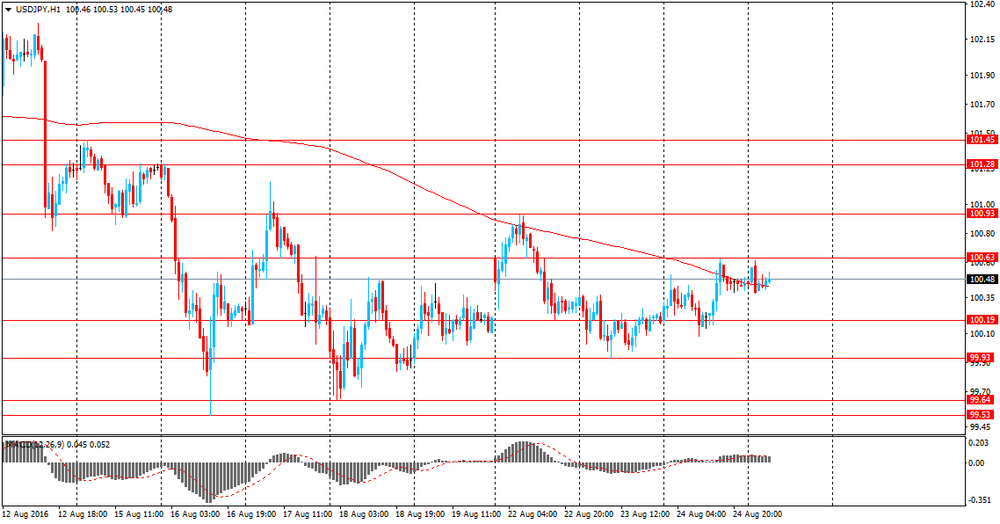

USDJPY 98.00, 98.85 99.05, 99.25/30, 99.50/59, 99.75, 99.85 100.00, 100.30, 100.50, 100.60 101.00 (843m), 101.20/25/30/35 (785m), 101.45, 101.55, 101.60 102.00/05, 102.50 103.00/05 103.50

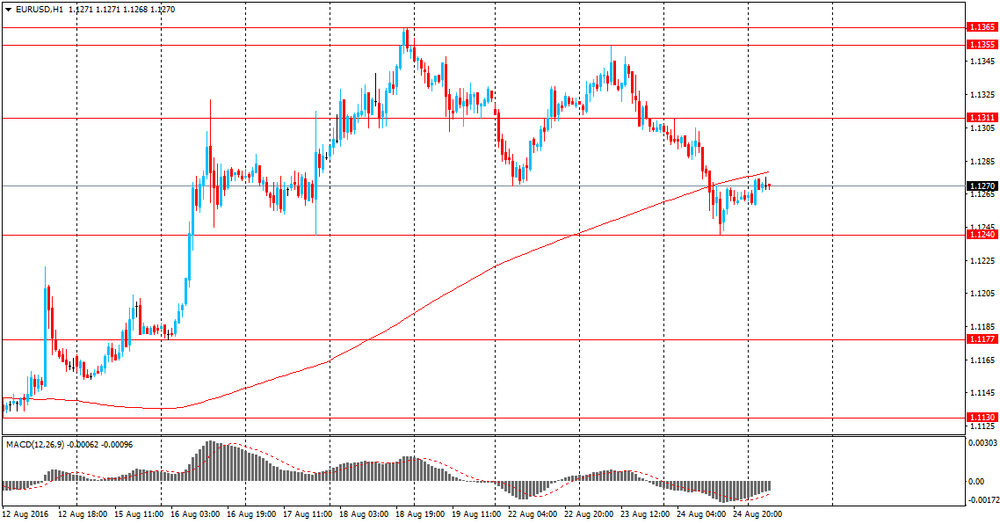

EURUSD 1.0950 (640m), 1.0975 (517m) 1.1000/03, 1.1040, 1.1090 1.1100, 1.1115, 1.1160, 1.1180, 1.1190 1.1200, 1.1240, 1.1260 1.1350 (652m), 1.1385/90 1.1400 1.1470

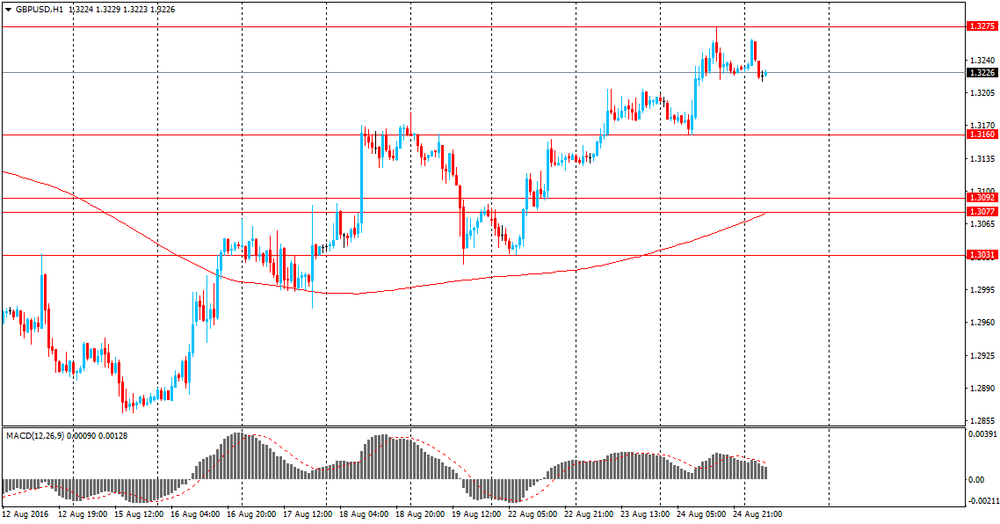

GBPUSD 1.2800 1.2900 1.3100, 1.3140

EURGBP 0.8125 (710m) 0.8200 0.8300 0.8620 (499m), 0.8650

AUDUSD 0.7400 (441m), 0.7450, 0.7470/75 (538m) 0.7595 0.7750

NZDUSD 0.8285

AUDNZD 1.0710 (330m)

USDCAD 1.3010/20/25

EURJPY 112.20

-

15:45

U.S.: Services PMI, August 50.9 (forecast 52.0)

-

14:40

Durable goods orders in US up 4.4% in July

New orders for manufactured durable goods in July increased $9.7 billion or 4.4 percent to $228.9 billion, the U.S. Census Bureau announced today. This increase, up following two consecutive monthly decreases, followed a 4.2 percent June decrease. Excluding transportation, new orders increased 1.5 percent. Excluding defense, new orders increased 3.8 percent. Transportation equipment, also up following two consecutive monthly decreases, led the increase, $7.5 billion or 10.5 percent to $78.9 billion.

Inventories of manufactured durable goods in July, up following six consecutive monthly decreases, increased $1.2 billion or 0.3 percent to $383.0 billion. This followed a 0.1 percent June decrease - US Census Bureau.

-

14:36

Canadian corporate profits declined less than the previous month

According to Statcan, Canadian corporations earned $72.9 billion in operating profits in the second quarter, down 3.4% from the previous quarter. The decrease was attributable to a $3.2 billion decline in profits for insurance carriers.

Year over year, overall operating profits for Canadian corporations fell 15.3% compared with the second quarter of 2015.

The oil and gas extraction industry reported an operating loss of $4.2 billion in the second quarter.

Petroleum and coal product manufacturing posted its second consecutive quarterly operating loss, recording an operating loss of $788 million in the second quarter, following an operating loss of $858 million in the first quarter.

-

14:33

US initial unemployment claims continue to decline

In the week ending August 20, the advance figure for seasonally adjusted initial claims was 261,000, a decrease of 1,000 from the previous week's unrevised level of 262,000. The 4-week moving average was 264,000, a decrease of 1,250 from the previous week's unrevised average of 265,250.

There were no special factors impacting this week's initial claims. This marks 77 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

14:30

U.S.: Initial Jobless Claims, 261 (forecast 265)

-

14:30

U.S.: Durable Goods Orders , July 4.4% (forecast 3.3%)

-

14:30

U.S.: Continuing Jobless Claims, 2145 (forecast 2153)

-

14:30

U.S.: Durable Goods Orders ex Transportation , July 1.5% (forecast 0.5%)

-

14:30

U.S.: Durable goods orders ex defense, July 3.8%

-

14:00

Orders

EUR/USD

Offers 1.1280 1.1300 1.1320-25 1.1350-55 1.1380-85 1.1400

Bids 1.1250 1.1230 1.1200 1.1185 1.1150 1.1130 1.1100

GBP/USD

Offers 1.3235 1.3250 1.3280 1.3300 1.3320 1.3350

Bids 1.3200 1.3180 1.3160 1.3150 1.3130 1.3100 1.3085 1.3050

EUR/GBP

Offers 0.8535 0.8550 0.8580 0.8600 0.8625-30 0.8655-60 0.8685 0.8700

Bids 0.8520 0.8500 0.8480-85 0.8465 0.8450 0.8430 0.8400

EUR/JPY

Offers 113.50 113.80 114.00 114.30 114.50 114.75 115.00

Bids 113.00 112.75-80 112.50 112.30 112.00-10

USD/JPY

Offers 100.50 100.65 100.85 101.00 101.25-30 101.50 101.75-80 102.00

Bids 100.30 100.25 100.00 99.85 99.6599.50 99.30 99.00 98.80 98.50

AUD/USD

Offers 0.7650-55 0.7680 0.7700 0.7725-30 0.7750-55

Bids 0.7620 0.7600 0.7585 0.7565 0.7550 0.7500

-

13:48

Fed's George: Removing `Some of this Accommodation Would Be Appropriate'

- Inflation `Beginning to Stir'.

- there's every reason to expect 2016 US GDP growth of 2%.

- 3% GDP possible in H2.

-

12:26

UK: the volume of sales grew modestly - CBI

According to the CBI survey of 131 firms, of which 58 were retailers, showed that the volume of sales grew modestly over the year, beating expectations for a further fall this month. However, sales volumes look set to be broadly flat over the next month.

Investment intentions for the year ahead turned positive following the most negative results since 2013 in the previous quarter. Year-on-year employment was again flat in the year to August, although retailers expect a small cut in headcount in September.

Anna Leach, CBI Head of Economic Analysis and Surveys, said:

"The summer weather has brought shoppers out onto the high street with retailers reporting that sales growth has risen, outdoing expectations, although firms do expect sales growth to ease next month.

"While the fall in Sterling has boosted visitor numbers to the UK, it is likely to push up the price of imported goods over time which will mean households will be more likely to rein back spending on non-essentials."

-

12:00

United Kingdom: CBI retail sales volume balance, August 9 (forecast -5)

-

11:25

Net migration to the UK fell

-

Net migration to the UK was 327k, -9k vs prior year

-

Net EU migration to the UK was 180k, -4k vs last year

*via forexlive -

-

10:40

Option expiries for today's 10:00 ET NY cut

USD/JPY 98.00, 98.85,99.05, 99.25/30, 99.50/59, 99.75, 99.85,100.00,100.30, 100.50, 100.60,101.00 (843m), 101.20/25/30/35,(785m), 101.45, 101.55, 101.60,102.00/05, 102.50,103.00/05,103.50

EUR/USD 1.0950 (640m), 1.0975 (517m)

1.1000/03, 1.1040, 1.1090,1.1100, 1.1115, 1.1160, 1.1180, 1.1190,1.1200, 1.1240, 1.1260,1.1350 (652m), 1.1385/90,1.1400,1.1470

GBP/USD 1.2800,1.2900,1.3100, 1.3140

EUR/GBP 0.8125 (710m),0.8200,0.8300,0.8620 (499m), 0.8650

AUD/USD 0.7400 (441m), 0.7450, 0.7470/75 (538m),0.7595,0.7750

NZD/USD 0.8285

AUD/NZD 1.0710 (330m)

USD/CAD 1.3010/20/25

EUR/JPY 112.20

-

10:28

German Ifo business climate index lower in August

According to rttnews, German business confidence dropped unexpectedly in August, reports said citing survey results from Ifo on Thursday.

The business sentiment index dropped to 106.2 in August from 108.3 in July. The reading was expected to rise to 108.5.

Similarly, the current conditions index fell to 112.8 from 114.8 a month ago, while economists forecast an improvement to 114.9.

The expectations index slid to 100.1 in August, below the expected level of 102.4.

-

10:01

Germany: IFO - Expectations , August 100.1 (forecast 102.5)

-

10:00

Germany: IFO - Business Climate, August 106.2 (forecast 108.5)

-

10:00

Germany: IFO - Current Assessment , August 112.8 (forecast 114.9)

-

09:33

Keep an eye on statements from Jackson Hole. Today is the first day of the meeting

-

09:10

Today’s events:

At 17:00 GMT the United States will hold an auction on placement of 7-year bonds.

Day 1 of the annual symposium in Jackson Hole.

The Economic Symposium, held in Jackson Hole, Wyoming, is attended by central bankers, finance ministers, academics, and financial market participants from around the world. The meetings are closed to the press but officials usually talk with reporters throughout the day. Comments and speeches from central bankers and other influential officials can create significant market volatility.

-

09:08

Asian session review: the dollar traded in a narrow range

The US dollar traded in a narrow range against the euro and the yen after yesterday's growth, helped by US economic data, as well as the expectation that later this weekthe Federal Reserve will express a tendency to further tighten policy.

Sales in the primary US housing market in July reached the highest level in almost a decade, as evidenced by the data published on Tuesday This indicates the strong momentum of the recovery in the housing market. Positive data boosted expectations of what Fed Chairman Janet Yellen could say in the speech in Jackson.

Futures on interest rates showed that investors see a 24% chance of a rate hike in September, while the probability of such an events was 12%, earlier this month.

"Yellen's speech on Friday could have a serious impact on the dollar, and we still expect to continue to improve," - according to BNP Paribas analysts.

The yen briefly rose after the Nikkei news agency reported that the Japanese government will introduce Y4,52 trillion in the economy in the current fiscal year.

The main infusion will be in the form of public construction projects. a supplementary budget proposal was approved on Wednesday

Japanese investment in foreign bonds fell along with the number of foreign investments in Japanese stocks. According to data released by Japan's Ministry of Finance, foreign bonds investment in August, totaled ¥ 433,1 mld, lower than the previous value of ¥ 1 297,6 mld.

The report estimates the volume of debt securities issued by foreign issuers and placed on the domestic market of Japan. This report reflects the dynamics of capital from the public sector, excluding the Bank of Japan. The net result shows a difference between the rates of inflow and outflow of capital. Despite the positive value, data indicates a decline in the outflow of capital.

Foreign investment in Japanese equities fell in August to ¥ -229,6mlrd after rising ¥ 94mlrd in July.

According to J.P. Of Morgan, after the meeting in Jackson Hole, the US currency will weaken again and USD / JPY is likely to test Y99,55.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1260-80 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3220-60 range

USD / JPY: during the Asian session, the pair was trading in the Y100.40-65 range

-

08:39

New RBA Governor A Reluctant Rate Cutter - Credit Agricole

"Australian construction work done data show further contraction in the sector as declines in engineering construction continue to more than offset firm growth in residential and non-residential construction. The end to the mining boom remains a significant drag on the economy. Anecdotal evidence about Australia's residential property market is mixed. While auction clearance rates in Melbourne and Sydney remain high, in other centres they are weakening. Sydney's weekend auction clearance rates hit boom-time highs over the recent weekend and even weekday auctions are seeing strong bidding, largely driven by the RBA's latest rate cut.

The bar for further rate cuts in Australia is likely high. New RBA Governor, Phil Lowe, is a system stability expert and likely a reluctant rate cutter.

So AUD's fortunes are increasingly tied to the Fed. AUD/USD continues to rest against trend-line support ahead of Yellen's speech on Friday".

*Credit Agricole maintains a short AUD/USD position from 0.7674.

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

08:36

Japanese investment in foreign bonds fell

Japanese investment in foreign bonds fell along with the number of foreign investments in Japanese stocks. According to data released by Japan's Ministry of Finance, foreign bonds investment in August, totaled ¥ 433,1 mld, lower than the previous value of ¥ 1 297,6 mld.

The report estimates the volume of debt securities issued by foreign issuers and placed on the domestic market of Japan. This report reflects the dynamics of capital from the public sector, excluding the Bank of Japan. The net result shows a difference between the rates of inflow and outflow of capital. Despite the positive value, data indicates a decline in the outflow of capital.

Foreign investment in Japanese equities fell in August to ¥ -229,6mlrd after rising ¥ 94mlrd in July.

-

08:32

Sumitomo Mitsui Banking Corp: USDJPY could undo all the Abenomic gains to fall to 85.00

-

BOJ may drop inflation target time frame at September meeting

-

May flag external factors like oil and slower global growth as impediments to hitting inflation goal, even while saying the correct policy actions have been taken

-

BOJ may change QQE range to ¥70-90tn from current ¥80tn

-

Would be difficult for BOJ to cut rates further into the negative

-

USDJPY could undo all the Abenomic gains to fall to 85.00

-

-

08:31

Options levels on thursday, August 25, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1433 (4488)

$1.1368 (4542)

$1.1324 (4205)

Price at time of writing this review: $1.1272

Support levels (open interest**, contracts):

$1.1205 (2376)

$1.1150 (2757)

$1.1115 (3258)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52228 contracts, with the maximum number of contracts with strike price $1,1250 (4638);

- Overall open interest on the PUT options with the expiration date September, 9 is 57754 contracts, with the maximum number of contracts with strike price $1,1000 (5763);

- The ratio of PUT/CALL was 1.11 versus 1.09 from the previous trading day according to data from August, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.3503 (1942)

$1.3405 (2523)

$1.3308 (2631)

Price at time of writing this review: $1.3219

Support levels (open interest**, contracts):

$1.3094 (1009)

$1.2997 (2023)

$1.2898 (1937)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32392 contracts, with the maximum number of contracts with strike price $1,3300 (2631);

- Overall open interest on the PUT options with the expiration date September, 9 is 26425 contracts, with the maximum number of contracts with strike price $1,2800 (2675);

- The ratio of PUT/CALL was 0.82 versus 0.81 from the previous trading day according to data from August, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

Reuters: 60% of economists expect the Bank of Japan easing policy in September

60% of economists surveyed by Reuters expected easing of monetary policy from the Bank of Japan in September and 40% of respondents take a neutral position on this issue.

More than 50% of economists predict the introduction of a flexible inflation target.

-

08:19

Producer prices in Japan were up 0.4 percent in July

According to rttnews, producer prices in Japan were up 0.4 percent on year in July, the Bank of Japan said on Thursday.

That beat expectations for an increase of 0.1 percent following the 0.2 percent gain in June.

On a monthly basis, process also jumped 0.4 percent following the flat reading in the previous month.

Among the individual components, prices increased for advertising, communications and leasing - while they were down for transportation and postal activities.

-

00:29

Currencies. Daily history for Aug 24’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1262 -0,40%

GBP/USD $1,3230 +0,23%

USD/CHF Chf0,9668 +0,44%

USD/JPY Y100,45 +0,27%

EUR/JPY Y113,13 -0,13%

GBP/JPY Y132,88 +0,48%

AUD/USD $0,7610 -0,05%

NZD/USD $0,7305 +0,19%

USD/CAD C$1,2927 +0,09%

-

00:00

Schedule for today, Thursday, Aug 25’2016

(time / country / index / period / previous value / forecast)

01:30 Australia Private Capital Expenditure Quarter II -5.2%

08:00 Germany IFO - Business Climate August 108.3 108.5

08:00 Germany IFO - Current Assessment August 114.7 114.9

08:00 Germany IFO - Expectations August 102.2 102.5

10:00 United Kingdom CBI retail sales volume balance August -14 -5

12:30 U.S. Continuing Jobless Claims 2175 2153

12:30 U.S. Durable Goods Orders July -4% 3.3%

12:30 U.S. Durable Goods Orders ex Transportation July -0.5% 0.5%

12:30 U.S. Durable goods orders ex defense July -3.9%

12:30 U.S. Initial Jobless Claims 262 265

23:30 Japan Tokyo Consumer Price Index, y/y August -0.4%

23:30 Japan Tokyo CPI ex Fresh Food, y/y August -0.4% -0.3%

23:30 Japan National Consumer Price Index, y/y July -0.4%

23:30 Japan National CPI Ex-Fresh Food, y/y July -0.5% -0.4%

-