Noticias del mercado

-

16:22

Here Is Why EUR/USD Will Trade Within A Narrow Range For Now - Societe Generale

"1) You get the biggest bang for you buck from a rise in US 10year yields being long USD/JPY but you also get decent gains against AUD, NZD and SGD.

2) The correlation between US 10yr yields and GBP/USD and USD/MXN is fine, but the sign's wrong. However, GBP/USD does respond very well to moves at the front end of the curve, reinforcing my bearish bias.

3) Higher US yields do correlate with falling EUR/USD, which is more than can be said for the Euros reaction to relative rate moves this year.

There is no significant correlation in 2016 between EUR/USD and either 2yr rate spreads, or 10year yield differentials (real or nominal), mostly because EUR/USD doesn't actually move.

So I hold out little hope of EUR/USD doing more than meandering down within a narrow range, but I can see a case here, for longs in USD and MXN against either JPY, or AUD or SGD".

Copyright © 2016 Societe Generale, eFXnews™

-

15:51

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 355m) 1.1150 (256m) 1.1175 (204m) 1.1190 (200m) 1.1200 (310m 1.1250(269m) 1.1300 (493m) 1.1350 (556m) 1.1375 (231m) 1.1400 (212m)

USD/JPY: 99.50 (USD 264m) 99.75 (330m) 100.00 (644m) 100.50 (292m) 101.00 (211m) 102.35-40 (340m) 103.00 (684m)

GBP/USD: 1.3100 (GBP 269m) 1.3360 (292m)

AUD/USD: 0.7450 (AUD 306m) 0.7500 ( 990m) 0.7684 (324m) 0.7750 (520m)

NZD/USD: 0.7035 (NZD 278m)

USD/CAD: 1.3025 (USD 200m)

-

14:42

European session review: the US dollar continues to rise

The following data was published:

(Time / country / index / period / previous value / forecast)

The US dollar is rising moderately after the sharp rise on Friday as upbeat comments from US Federal Reserve's Janet Yellen on the state of the US economy have increased expectations of a rate hike.

During the annual conference of the representatives of the world's central bankers in Jackson Hole, Wyoming, Yellen said that the possibility of rate hike has increased in recent months against the backdrop of the recovery of the labor market and the economy.

Yellen not called the timing of rate increases, but the Fed Vice Chair Stanley Fischer said that her comments correspond to the growth expectations of the likely increase in 2016.

"The dynamics of the markets influenced not so much by Yellen as Fisher", - said Ayako Sera of Sumitomo Mitsui Trust Bank.

Futures on interest rates indicate that market participants estimate the probability of a rate hike in September at more than 30 percent instead of 18% before Yellen and Fisher showed FedWatch data from CME Group. The probability of a rate hike has grown to more than 60 percent in December from 57 percent on Friday.

According to analysts, now markets attach great importance to data on the number of jobs in the US (NFP), to be published on Friday.

US Dollar "increased significantly" after "comments that indicate a tendency to tighten policy," said analysts of Danske Bank and added that the employment data in the United States "will have a decisive influence on the short-term prospects for the US dollar."

The pound weakened against the US dollar while investors await important statistics from Britain.

On Tuesday, the Bank of England will publish data on lending to households and businesses in July, which will help understand whether the market disturbances have a negative impact on lending in the UK.

On Thursday, the PMI index will be released for the manufacturing sector. Markets hope that he will clarify how strongly the manufacturers recover.

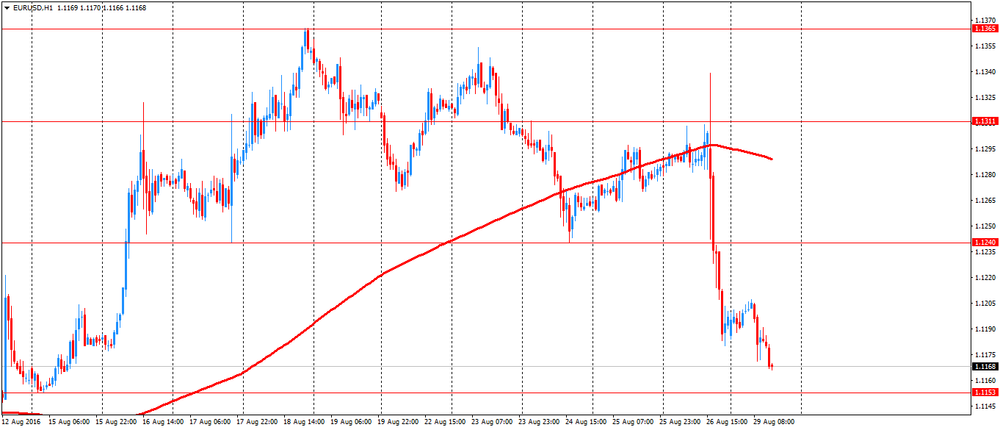

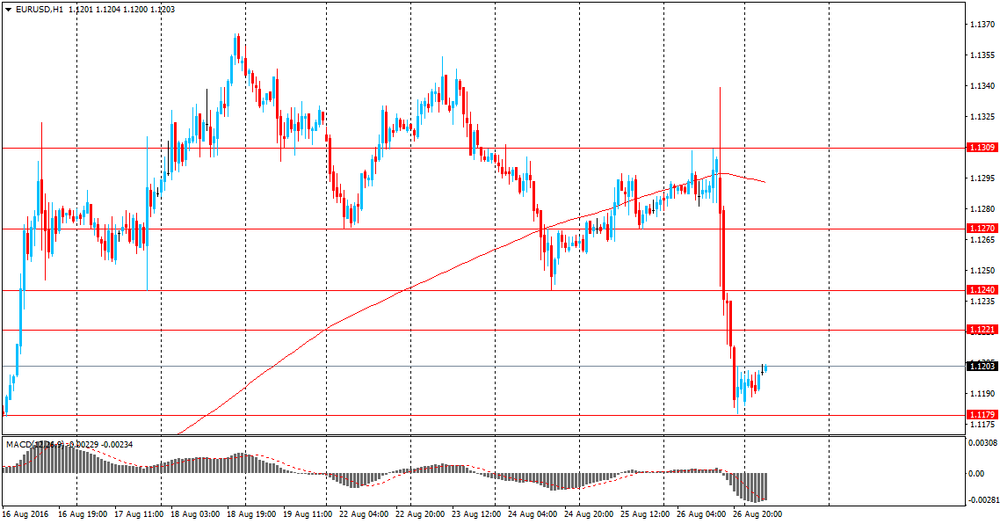

EUR / USD: during the European session, the pair fell to $ 1.1166

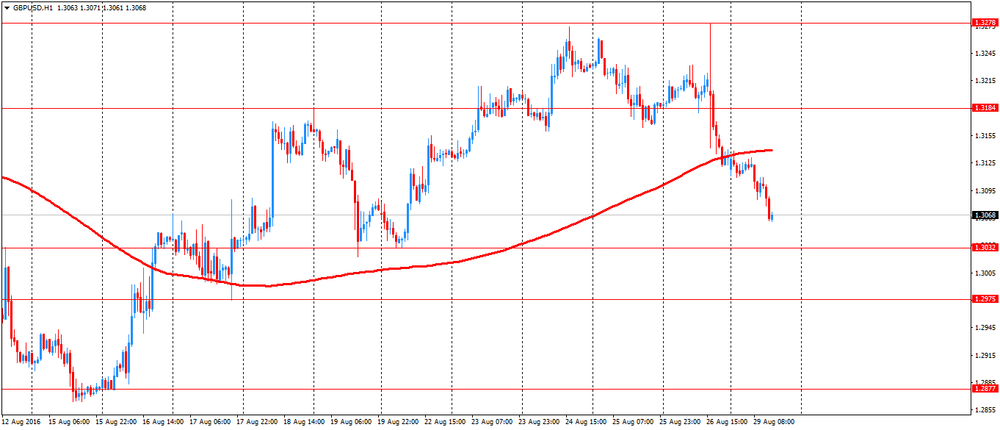

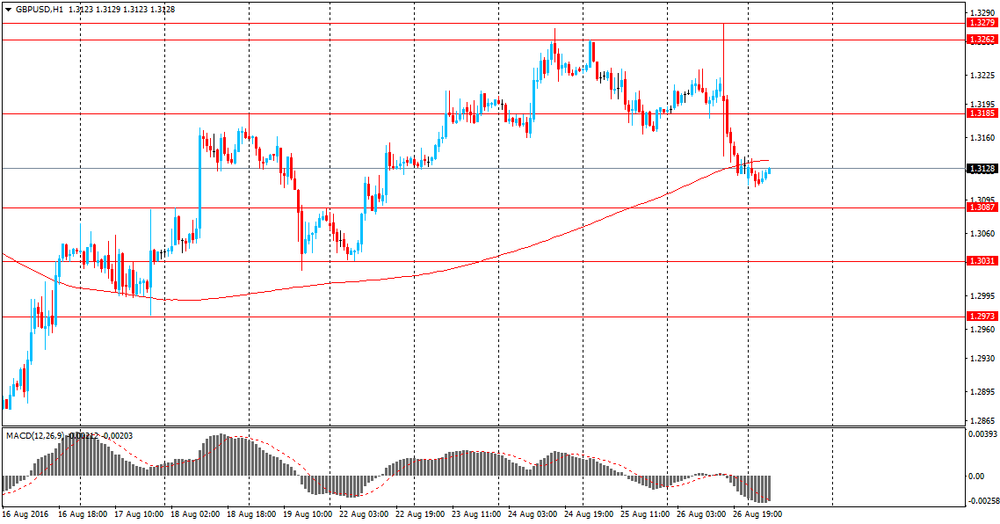

GBP / USD: during the European session, the pair fell to $ 1.3061

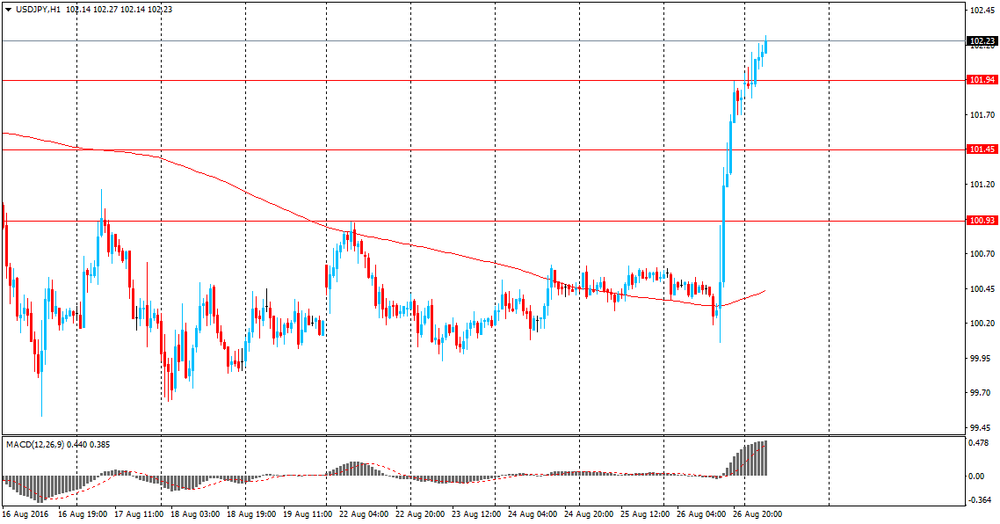

USD / JPY: during the European session, the pair rose to Y102.38 and retreated

-

14:34

US Core PCE price index up 1.6% in July

Personal income increased $71.6 billion (0.4 percent) in July according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $60.1 billion (0.4 percent) and personal consumption expenditures (PCE) increased $42.0 billion (0.3 percent).

Real DPI increased 0.4 percent in July and Real PCE increased 0.3 percent. The PCE price index was unchanged from June. Excluding food and energy, the PCE price index increased 0.1 percent in July.The increase in personal income in July primarily reflected increases in wages and salaries and personal current transfer receipts.

The increase in real PCE in July reflected increases in spending for new motor vehicles and for services that was partially offset by a decrease in spending for nondurable goods. -

14:30

U.S.: Personal Income, m/m, July 0.4% (forecast 0.4%)

-

14:30

U.S.: PCE price index ex food, energy, Y/Y, July 1.6%

-

14:30

U.S.: Personal spending , July 0.3% (forecast 0.3%)

-

14:30

U.S.: PCE price index ex food, energy, m/m, July 0.1% (forecast 0.1%)

-

13:51

Orders

EUR/USD

Offers : 1.1200 1.1225-30 1.1250 1.1280 1.1300 1.1320-25 1.1350-55

Bids : 1.1170 1.1150 1.1120 1.1100 1.1080 1.1050 1.1030 1.1000

GBP/USD

Offers : 1.3120 1.3135 1.3150 1.3180 1.3200 1.3235 1.3250 1.3280 1.3300

Bids : 1.3085 1.3050 1.3030 1.3000 1.2980 1.2950 1.2930 1.2900

EUR/GBP

Offers : 0.8550 0.8565 0.8580 0.8600 0.8625-30 0.8655-6

Bids : 0.8525-30 0.8500 0.8480-85 0.8465 0.8450 0.8430 0.8400

EUR/JPY

Offers : 113.60 113.80 114.00 114.30 114.50 114.75 115.00

Bids : 113.30 113.00 112.75-80 112.50 112.30 112.00-10

USD/JPY

Offers : 102.50 102.80 103.00 103.30 103.50 103.75 104.00

Bids : 102.00 101.80 101.65 101.50 101.30 101.00 100.80 100.50 100.20 100.00

AUD/USD

Offers :0.7565 0.7580 0.7600 0.7625-30 0.7650 0.7680 0.7700

Bids : 0.7530 0.7500 0.7485 0.7450 0.7430 0.7400

-

13:48

German trade association: Brexit to impact exports massively in the near future

-

German exports are set for stagnation, possibly as early as 2017.

-

cites global uncertainties including Brexit.

-

cuts forecast for 2016 export growth to 1.8-2.0% vs 4.5% previously.

*via forexlive

-

-

12:25

Germany’s Schaeuble has spoken out against the low interest rates

German Finance Minister Wolfgang Schaeuble warned against continued low interest rates in the euro area. "In the long term effects of low interest rates or even negative is harmful" - he said in an interview with German newspaper Frankfurter Allgemeine Sonntagszeitung. At the same time he believes that to complete a soft monetary policy is possible only through the implementation of structural reforms and investment growth.

The era of low interest rates could last for quite some time, writes Deutsche Welle. Economist Peter Bofinger expects this in the next five years. "Low interest rates can be kept for a long time in Japan, they have been around for over 20 years." - Martin Hellwig, director of the Bonn Institute of the Max Planck Society.

The Governing Council of the European Central Bank lowered its key interest rate to 0 percent in March 2016. Germany criticized the ECB's policy. Earlier Schaeuble has repeatedly said that it leads to an increase in the number of eurosceptics. A deputy chairman of the CDU / CSU in the Bundestag Hans-Peter Friedrich said that the next head of the ECB will be a German.

-

11:22

Yellen gives hope to USD bulls

According to rttnews, Federal Reserve Chairman Janet Yellen says the case for another interest-rate hike has strengthened.

"In light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months," Yellen said in a speech prepared for delivery to the Jackson Hole summit.

However, the Fed's decision "always depends on the degree to which incoming data continues to confirm the Fed policy committee's outlook."

There will be no second speech from J.Yellen today. From the price action in the coming days we can evaluate how much a rate hike of 0.25% is already priced in.

-

10:23

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 355m) 1.1150 (256m) 1.1175 (204m) 1.1190 (200m) 1.1200 (310m 1.1250(269m) 1.1300 (493m) 1.1350 (556m) 1.1375 (231m) 1.1400 (212m)

USD/JPY: 99.50 (USD 264m) 99.75 (330m) 100.00 (644m) 100.50 (292m) 101.00 (211m) 102.35-40 (340m) 103.00 (684m)

GBP/USD: 1.3100 (GBP 269m) 1.3360 (292m)

AUD/USD: 0.7450 (AUD 306m) 0.7500 ( 990m) 0.7684 (324m) 0.7750 (520m)

NZD/USD: 0.7035 (NZD 278m)

USD/CAD: 1.3025 (USD 200m)

-

10:10

Italian business confidence declines moderately in August

The index recorded a value slightly lower than forecasts at 101.1 (102.5 forecast) and the previous value revised down to 102. 9. The consumer confidence declines to 109.2 form 111.2 the previos month.

Business Confidence rates the current level of business conditions. It helps to analyze the economic situation in the short term. A rising trend indicates an increase in business investment which may lead to higher levels of output.

-

09:18

Today’s events

At 15:30 GMT the United States will hold an auction of 3- and 6-month bills.

UK bank holiday.

-

08:44

Asian session review: the US dollar traded in a narrow range

The US dollar traded in a narrow range against the euro. On friday comments by Fed's Janet Yellen caused choppy conditions but eur/usd was traded lower. She did not specify exactly when the rates may be increased, in September or in December, but noted that the grounds for increasing rates increased.

Yellen said that against the backdrop of continuing positive momentum in the labor market and the outlook for economic activity and inflation, the arguments in favor of raising interest rates have increased in recent months. The decision on raising rates, as before, will depend on the extent to which the incoming statistical data confirm this forecast, stressed Yellen.

Other Fed officials also support the rate hike, although, like Yellen, they did not give predictions on the timing of further policy tightening. The next Fed meeting will be held on September 20-21. Some analysts believe that rates will be raised at this meeting.

As reported today by Bloomberg, the probability of a rate hike at the September meeting rose to 42% from 22% a week ago, and the probability of a rate hike at the December meeting rose to 65%.

During today's Asian session, the yen continued to decline after the Bank of Japan's head Haruhiko Kuroda, said that the Bank of Japan will act "without hesitation" to revive inflation.

"The Bank of Japan will continue to closely study the risks and take additional easing measures without hesitation"

The Australian dollar fell against the background of the widespread increase in the US dollar and, to some extent, on the negative data on new home sales. Sales of new homes published by the Association of the housing industry, fell by -9.7% in July, after rising 8.2% in June. This indicator expresses the volume of new home sales in Australia and assesses conditions in the housing market.

EUR / USD: during the Asian session, the pair was trading in 1.1190-1.1210 range.

GBP / USD: during the Asian session, the pair was trading in the $ 1.3110-40 range.

USD / JPY: during the Asian session, the pair was trading in Y101.80-102.40 range.

-

08:33

Scenarios for September BoJ meeting - Deutsche Bank

"In Japan, the BoJ will conduct a comprehensive assessment of policy on 21 September, but we see scant chance that it will cut its 2% price stability target or admit that its monetary policy is at its limits.

The markets broadly expect the following. (1) The BoJ will shift its price stability target date from its effectively abandoned two-year period to more flexible phrasing. (2) It will give itself greater latitude in its JGB purchasing operations to address doubts over sustainability, widening its annual target from ¥80trn, e.g. to ¥70-90trn. (3) It will reiterate that its monetary policy remains effective and does not face any near-term limits. A summary of the scenario for BoJ monetary policy is offered in

We believe that if multiple Fed rate hikes come to be seen as a certainty amid the strength of the US economy, the USD/JPY should regain some of its lost ground. The upside for the rate should grow further if the BoJ should carry out additional easing action. However, we see a 25% chance of such favorable conditions coming together and the USD/JPY settling at ¥100-110.

If uncertainties arise, including policy events in the US or Japan, the rate could see greater downside. A steep drop into the ¥90s could prompt stronger technical resistance at ¥100. We would rate this risk at 75%".

Copyright © 2016 DB, eFXnews™

-

08:27

New homes sales in Australia fell

The Australian dollar fell after the publication of data on new home sales. Published by the Association of the housing industry the index fell by -9.7% in July, after rising 8.2% in June. This indicator expresses the volume of new home sales in Australia and assesses conditions in the housing market. It also stimulates the demand for goods, services and workers, as buyers spend money on furnishing and financing their homes.

-

08:19

Bank of Japan Governor Haruhiko Kuroda: The Bank of Japan will act without hesitation

- The Bank of Japan will act "without hesitation" to revive inflation.

- The recent decline in inflation could mean that inflation expectations have not yet fixed the target level of 2%

- The Bank of Japan will approve or more quantitative easing or reduction of negative interest rates without hesitation.

- The Bank of Japan will continue to closely study the risks and take additional measures.

- Combining quantitative easing and negative rates the bank has a strong action scheme and will act decisively.

-

08:16

Los Angeles airport police confirm reports of shots fired in the facility were a false alarm

-

07:04

Options levels on monday, August 29, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1414 (4546)

$1.1333 (4451)

$1.1271 (4178)

Price at time of writing this review: $1.1203

Support levels (open interest**, contracts):

$1.1125 (2503)

$1.1063 (4268)

$1.1025 (5383)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52182 contracts, with the maximum number of contracts with strike price $1,1250 (4745);

- Overall open interest on the PUT options with the expiration date September, 9 is 57330 contracts, with the maximum number of contracts with strike price $1,1000 (5784);

- The ratio of PUT/CALL was 1.10 versus 1.11 from the previous trading day according to data from August, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.3402 (2075)

$1.3304 (2653)

$1.3207 (1662)

Price at time of writing this review: $1.3121

Support levels (open interest**, contracts):

$1.2995 (2108)

$1.2897 (1861)

$1.2799 (2673)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32620 contracts, with the maximum number of contracts with strike price $1,3300 (2653);

- Overall open interest on the PUT options with the expiration date September, 9 is 26610 contracts, with the maximum number of contracts with strike price $1,2800 (2673);

- The ratio of PUT/CALL was 0.82 versus 0.82 from the previous trading day according to data from August, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:29

Currencies. Daily history for Aug 26’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1197 -0,78%

GBP/USD $1,3131 -0,43%

USD/CHF Chf0,978 +1,07%

USD/JPY Y101,82 +1,27%

EUR/JPY Y114,00 +0,50%

GBP/JPY Y133,75 +0,88%

AUD/USD $0,7562 -0,70%

NZD/USD $0,7234 -0,87%

USD/CAD C$1,3003 +0,67%

-