Noticias del mercado

-

17:41

Oil prices decline after the release of U.S. crude oil inventories data

Oil prices decline after the release of U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 2.4 million barrels to 465.4 million in the week to June 26.

Gasoline inventories declined by 1.8 million barrels to 216.7 million barrels last week, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 123,000 barrels to 56.4 million barrels.

U.S. crude oil imports rose by 748,000 barrels per day.

Refineries in the U.S. were running at 95.0% of capacity, up from 94.0% the previous week.

The Greek debt crisis also weighed on oil prices. The International Monetary Fund (IMF) confirmed that Greece has not repaid €1.538 billion IMF loans. A Greek default would be the first by an advanced economy in the IMF's seven-decade history, putting the country on a par with countries such as Afghanistan, Haiti and Zimbabwe, which also not paid IMF loans on time.

News that OPEC increased oil production in June also weighed on oil prices. According to a Reuters survey, OPEC supply rose in June to 31.60 million barrels per day from a revised 31.30 million barrels per day in May.

Traders expect the results of talks on the Iranian nuclear program. Talks will continue until July 07.

WTI crude oil for August delivery decreased to $57.98 a barrel on the New York Mercantile Exchange.

Brent crude oil for August declined to $62.61 a barrel on ICE Futures Europe.

-

17:25

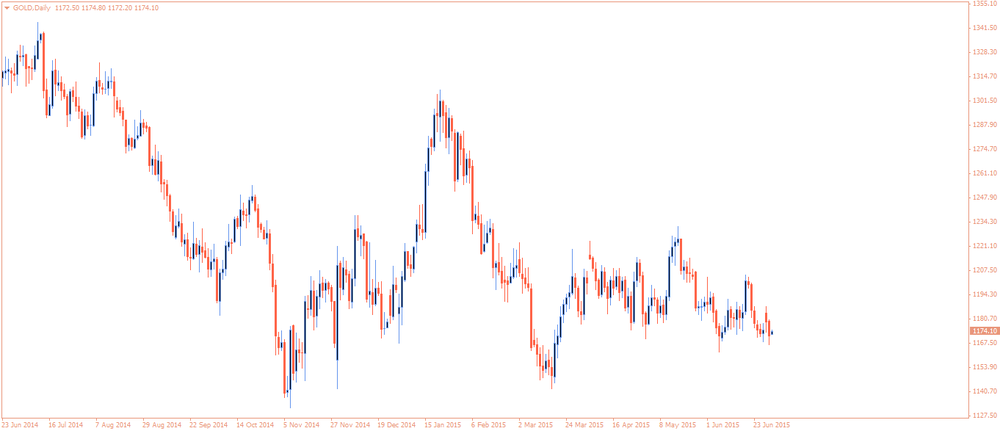

Gold traded lower on a stronger U.S. dollar

Gold traded lower on a stronger U.S. dollar. The greenback rose against the other major currencies after the release of the mostly better-than-expected U.S. economic data. The Institute for Supply Management's manufacturing purchasing managers' index for the U.S. climbed to 53.5 in June from 52.8 in May, exceeding expectations for a gain to 53.1. It was the highest level since January.

Construction spending in the U.S. rose 0.8% in May, exceeding expectations for a 0.6% gain, after a 2.1% increase in April. April's figure was revised down from a 2.2% rise.

Private sector in the U.S. added 237,000 jobs in June, according the ADP report on Wednesday. It was the biggest increase since December 2014.

The U.S. final manufacturing purchasing managers' index (PMI) fell to 53.6 in June from 54.0 in May, beating the previous estimate of a decline to 53.4. It was the lowest level since October 2013.

The Greek debt crisis remained in focus. Greek Prime Minister Alexis Tsipras said in a speech on Wednesday that Greeks should vote "no" in Sunday's referendum. He added that "no" would not mean that Greece have to leave the Eurozone.

Earlier, Greek prime minister signalled that he was ready to accept the most spending cuts demanded by the country's creditors.

German Finance Minister Wolfgang Schaeuble said on Wednesday that there was no basis to have further negotiations with Greece.

August futures for gold on the COMEX today declined to 1168.90 dollars per ounce.

-

17:03

U.S. crude inventories rise by 2.4 million barrels to 465.4 million in the week to June 26

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 2.4 million barrels to 465.4 million in the week to June 26.

Gasoline inventories declined by 1.8 million barrels to 216.7 million barrels last week, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 123,000 barrels to 56.4 million barrels.

U.S. crude oil imports rose by 748,000 barrels per day.

Refineries in the U.S. were running at 95.0% of capacity, up from 94.0% the previous week.

-

10:23

Chinese final HSBC manufacturing purchasing managers’ index rises to 49.4 in June

The Chinese final HSBC manufacturing purchasing managers' index (PMI) rose to 49.4 in June from 49.2 in May, down from the preliminary estimate of 49.6.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

"The final reading of the HSBC China Manufacturing PMI pointed to a further decline in the health of the manufacturing sector in June. This was predominantly driven by the sharpest rate of job shedding across the sector since early-2009, while output also fell slightly on the month," Markit Economics economist Annabel Fiddes said.

-

09:11

Oil: prices declined amid Greece crisis

West Texas Intermediate futures for August delivery dropped to $58.64 (-1.40%). Meanwhile Brent crude for August fell to $62.92 (-1.05%) a barrel. Greece was unable to make its payment to the International Monetary Fund. This default pushed the U.S. dollar up and crude prices down as dollar-denominated oil imports got more expensive.

At the same time crude production rose in both the OPEC and the U.S.. Some analysts believe that OPEC crude oil output advanced to 32.1 million barrels per day vs a target of 30 million bpd. On the whole production by the cartel rose to a three-year high of 31.60 million bpd in June from 31.30 million bpd in May (according to Reuters). In addition to that the U.S. Energy Information Administration reported on Tuesday that the country's crude production rose 9,000 barrels a day to 9.701 million barrels a day in April. Crude inventories rose by 1.9 million barrels in the week to 468.9 million, while they were expected to decline by 2.000 million barrels.

-

09:08

Gold shows weak activity

Gold is currently at $1,172.90 (+0.09%) an ounce. This traditional safe-haven asset is unusually calm considering the ongoing problems surrounding Greece and thus the euro zone. Nevertheless analysts said that U.S. demand for physical gold advanced in the recent weeks. Terry Hanlon, president of Dillon Gage Metals, a wholesale precious metals trader in Dallas, said he had seen volumes rise by 70% in June from May. Prices have not reflected these increases as futures speculation is not synchronized with trades of physical gold.

-

00:32

Commodities. Daily history for Jun 30’2015:

(raw materials / closing price /% change)

Oil 58.95 -0.87%

Gold 1,171.80 +0.03%

-