Noticias del mercado

-

22:07

Major US stock indices closed above zero

US stocks rose on Wednesday after the Greek Prime Minister is showing signs of willingness to accept the majority view and make a deal with creditors and US data pointed to a strong economy. In addition to the positive background, the financial sector rose after news of the takeover by the Swiss insurance giant ACE insurer Chubb for $ 28.3 billion.

As shown by the data submitted by Automatic Data Processing (ADP), private sector employment has grown stronger in June than in May, while the increase was more than the expectations of experts. According to a report last month, the number of employees increased by 237 thousand. Man compared with a revised upward index for May at the level of 203 thousand. (Originally reported 201 thousand.). According to forecasts of the value of this indicator was to reach 217 thousand.

In addition, in June manufacturing activity in the US has improved, beating forecasts a slight improvement. A report published by the Institute of Supply Management (ISM), showed that the PMI index for the US manufacturing in June amounted to 53.5 points against 52.8 points in May. The latter value was higher than the estimates of experts - is expected to increase to 53.1 points.

At the same time, spending on construction in the US increased by the end of May, exceeding the forecasts of experts, and reached its highest level in a little more than 6.5 years. According to the Ministry of Trade, in May construction spending rose by 0.8% to $ 1.04 trillion. on an annualized basis. It is worth emphasizing the last value was the highest since October 2008.

Most components of the index DOW traded in positive territory (23 of 30). Outsider shares in EI du Pont de Nemours and Company (DD, -4.00%). Most remaining shares rose The Travelers Companies, Inc. (TRV, + 2.50%).

The S & P mainly in positive territory. Most of the financial sector increased (+ 0.8%). The outsider is the sector of basic materials (-1.5%).

At the close:

Dow + 0.80% 17,759.91 +140.40

Nasdaq + 0.53% 5,013.12 +26.25

S & P + 0.70% 2,077.65 +14.54

-

21:00

Dow +0.57% 17,720.23 +100.72 Nasdaq +0.29% 5,001.45 +14.58 S&P +0.46% 2,072.70 +9.59

-

20:20

American focus: the dollar continued to strengthen against the Swiss franc

The dollar has appreciated significantly against the euro, breaking the mark of $ 1.1100, which was caused by the publication of positive statistics on the US and the fading optimism about the resolution of the Greek crisis. As part of his live televised prime Tsipras reiterated that the referendum will take place on Sunday, saying the vote "against" is a necessary step for an agreement on more favorable terms. Yesterday the IMF confirmed that Greece had not repaid the payment of $ 1.538 billion. Euros, which marked the first seventy years of the fund, when a country with a developed economy defaulted on its obligations. Greece default puts it on a par with countries such as Afghanistan, Haiti and Zimbabwe, which are also not paid on time debt to the IMF.

With regard to the data in the Automatic Data Processing (ADP) said: employment in the US private sector has grown stronger in June than in May, while the increase was more than the expectations of experts. According to a report last month, the number of employees increased by 237 thousand. Man compared with a revised upward index for May at the level of 203 thousand. (Originally reported 201 thousand.). According to forecasts of the value of this indicator was to reach 217 thousand.

Meanwhile, data from the Institute for Supply Management (ISM) showed in June manufacturing activity in the US has improved, beating forecasts of a slight improvement. PMI index for the US manufacturing in June was 53.5 points versus 52.8 points in May. The latter value was higher than the estimates of experts - is expected to increase to 53.1 points.

The pound depreciated significantly against the US dollar, by updating the two-week minimum. Pressure on the pound was weaker data on the manufacturing PMI Britain, and optimistic figures for the United States, which led to a general strengthening of the dollar. Earlier reports said the British manufacturing sector expanded twenty-seventh consecutive month in June, although the pace of growth unexpectedly slowed to the weakest in 26 months due to reduction in the rate of growth of production and new orders. The seasonally adjusted purchasing managers' index from Markit / CIPS fell to 51.4 in June from 51.9 in May, which was revised down from 52. Economists had expected the index to improve to 52.5. The value of PMI above 50 indicates expansion in the sector. The survey also showed that the increase in production in the second quarter, on average, was the weakest since the first three months of 2013.

Meanwhile, US data have shown that the volume of construction costs increased by the end of May, exceeding the forecasts of experts, and reached its highest level in a little more than 6.5 years. This was reported in the Ministry of Trade. According to the report, in May construction spending rose by 0.8 percent, reaching 1.04 trillion $. on an annualized basis. It is worth emphasizing the last value was the highest since October 2008. Meanwhile, the increase in spending in April was revised downward - to 2.1 percent from 2.2 percent. Economists forecast that spending rose by 0.6 percent. The Ministry of Commerce noted that the May change was supported by the growth of spending in the private sector (0.9 per cent, the maximum rate in June). Meanwhile, the cost of private housing construction rose by 0.3 percent. Spending on private non-residential construction projects rose by 1.5 percent to its highest level since December 2008.

The Swiss franc fell against the US dollar, approaching to the lowest since June 5. In the course of trade affected by these PMI, which were worse than expected, as well as fears of another SNB intervention in the case of the further growth of the franc. Recall manufacturing activity in Switzerland has stabilized in June after declining for five months. Purchasing Managers' Index rose to procure.ch from 50 in June from 49.4 in May. The value indicates a neutral level of activity performance. It was the highest score since December, when the index was 53.6. The expected value was 50.1. Six months after the rejection of the minimum exchange rate of the Swiss National Bank in mid-January, the decline in industrial pulse stopped. Production increased for the third month in a row in June, the index rose by 3.1 points to 54.8. Stocks of purchases in June remained virtually unchanged compared to May, while the delivery times of suppliers rose again in June, but only with a weak pulse. The sub-index of the order book decreased slightly by 0.3 points to 51.1 in June. The sub-index of employment rose for the first time after six months of falling. The index reached 41.6 points compared to 40.7 in May.

-

18:49

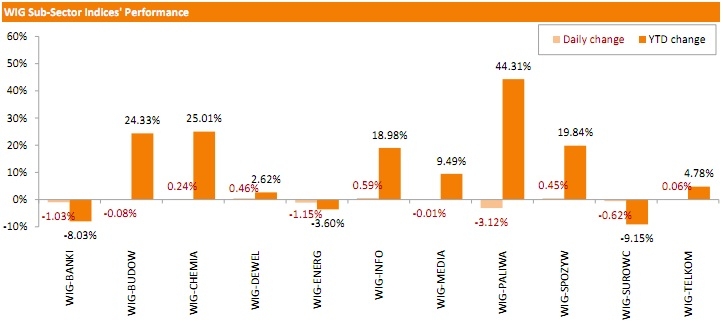

WSE: Session Results

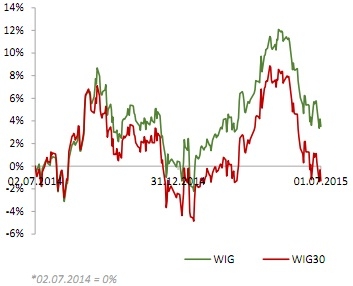

Polish equity market declined on Wednesday. The broad market measure, the WIG Index, slumped by 0.63%. Sector-wise, oil and gas stocks (-3.12%) lagged behind, while technologies names (+0.59%) were the strongest group.

The large-cap stocks fell by 0.98%, as measured by the WIG30 Index. Oil and gas names PKN ORLEN (WSE: PKN) and LOTOS (WSE: LTS) led the decliners, correcting down 4.37% and 3.63% respectively. BZ WBK (WSE: BZW) plummeted by 3.88%, reversing gains from the previous trading session. On the other side of the ledger, BOGDANKA (WSE: LWB) led the risers, rebounding by 5.69% after closing at an all-time low the previous session. It was followed by SYNTHOS (WSE: SNS), posting gains of 4.09% on speculation the company may cut its CAPEX and increase dividend payments instead of this. Elsewhere, retailers CCC (WSE: CCC) and LPP (WSE: LPP) added 2.87% and 1.77% respectively on reported good sales results for June.

-

18:08

European stocks close: stocks closed higher on hopes for a deal between Athens and its lenders

Stock indices closed higher on hopes for a deal between Athens and its lenders. Greek Prime Minister Alexis Tsipras said in a speech on Wednesday that Greeks should vote "no" in Sunday's referendum. He added that "no" would not mean that Greece have to leave the Eurozone.

Earlier, Greek prime minister signalled that he was ready to accept the most spending cuts demanded by the country's creditors.

German Finance Minister Wolfgang Schaeuble said on Wednesday that there was no basis to have further negotiations with Greece.

EU leaders have different opinions. German Chancellor Angela Merkel said on Wednesday that she would wait until the Greek referendum on Sunday is over before starting to negotiate with Greece again. But French President Francois Hollande said on Wednesday that a deal between Greece and its creditors should be reached before the referendum on Sunday.

Meanwhile, the economic data from the Eurozone was solid. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.5 in June from 52.2 in May, in line with a preliminary reading. It was the highest level since April 2014.

The Netherlands was the strongest performer.

Markit's Chief Economist Chris Williamson said that June's PMI was "representing a major improvement compared to the malaise seen at the end of last year".

Germany's final manufacturing purchasing managers' index (PMI) rose to 51.9 in June from 51.1 in May, in line with a preliminary reading.

The increase was driven by a rise in output at consumer goods producers and in output in new orders.

"The overall expansions in output and new business were, however, well below levels seen at the start of last year," Markit economist Oliver Kolodseike said.

France's final manufacturing purchasing managers' index (PMI) rose to 50.7 in June from 49.4 in May, up from the preliminary reading of 50.5. It was the first reading above 50 since April 2014.

"The French manufacturing sector edged further in the right direction during June, with output and new orders broadly stabilizing. This was reflected in firms' hiring decisions, with the rate of job shedding easing to a marginal pace," Markit economist Jack Kennedy said.

Markit Economics also released its manufacturing purchasing managers' index (PMI) for the U.K. on Wednesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.4 in June from 51.9 in May, missing expectations for a rise to 52.5. It was the lowest level since April 2013.

The decline was driven by declines in output and new orders.

"The UK manufacturing sector had a disappointing second quarter overall. Growth trends in output and new orders were the weakest since the opening quarter of 2013, as a strong sterling exchange rate and subdued demand from mainland Europe offset the continued solidity of the domestic market," Markit's Senior Economist Rob Dobson said.

The Bank of England Governor Mark Carney said on Wednesday that UK banks' direct exposure to Greece is very small. He noted that the economic growth in the U.K. has been solid and the burden of household debt has continued to decline.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,608.59 +87.61 +1.34 %

DAX 11,180.5 +235.53 +2.15 %

CAC 40 4,883.19 +92.99 +1.94 %

-

18:02

German Chancellor Angela Merkel would wait until the Greek referendum on Sunday is over before starting to negotiate with Greece again

German Chancellor Angela Merkel said on Wednesday that she would wait until the Greek referendum on Sunday is over before starting to negotiate with Greece again. She signalled that the German parliament will approve any future bailout programme would come under the umbrella of the European Stability Mechanism (ESM).

-

18:00

European stocks closed: FTSE 100 6,601.86 +80.88 +1.24% CAC 40 4,883.19 +92.99 +1.94% DAX 11,180.5 +235.53 +2.15%

-

17:57

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Wednesday after Greece's prime minister signaled he was prepared to accept most of creditors' bailout terms and a raft of U.S. data pointed to a stronger economy. Adding to the positive tone, financial stocks rallied after Swiss insurance giant ACE snagged a deal to buy upmarket property insurer Chubb for $28.3 billion.

Most of Dow stocks in positive area (22 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -3.77%). Top gainer - The Travelers Companies, Inc. (TRV, +2.67).

Almost all of S&P index sectors in positive area. Top gainer - Financial (+1,0%). Top looser - Basic materials (-0.7%).

At the moment:

Dow 17643.00 +120.00 +0.68%

S&P 500 2067.00 +12.50 +0.61%

Nasdaq 100 4416.75 +26.50 +0.60%

10-year yield 2.41% +0.07

Oil 57.63 -1.84 -3.09%

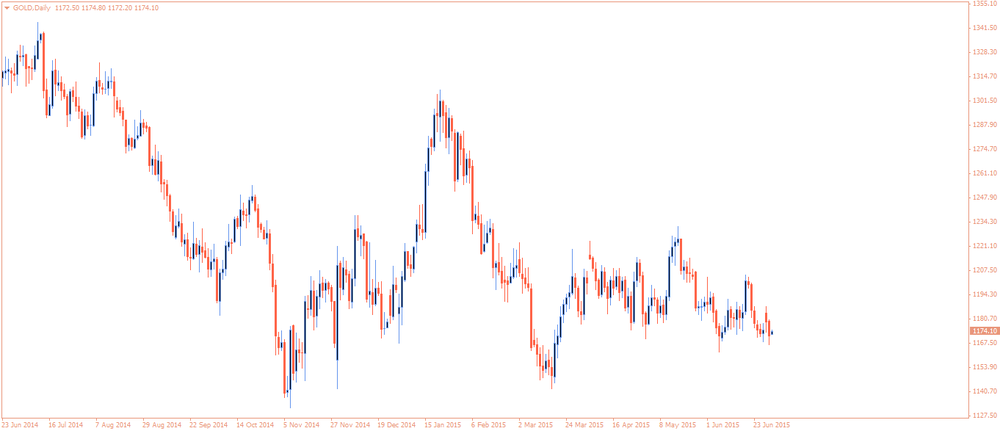

Gold 1169.40 -2.40 -0.20%

-

17:55

French President Francois Hollande: a deal between Greece and its creditors should be reached before the referendum on Sunday

French President Francois Hollande said on Wednesday that a deal between Greece and its creditors should be reached before the referendum on Sunday. He added that the failure to reach a deal before the referendum could lead to "a period of turmoil and the unknown".

"It is our duty to keep Greece in the euro zone. That depends on Greece ... But it also depends on us. As a European, I don't want the euro zone to come apart, I am not into intransigent comments, into brutal rifts," Hollande said.

-

17:47

German Finance Minister Wolfgang Schaeuble: there was no basis to have further negotiations with Greece

German Finance Minister Wolfgang Schaeuble said on Wednesday that there was no basis to have further negotiations with Greece.

"First of all Greece must clarify its position on what it wants, and then we will have to talk about it, under conditions that are now far more difficult," he said.

-

17:41

Oil prices decline after the release of U.S. crude oil inventories data

Oil prices decline after the release of U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 2.4 million barrels to 465.4 million in the week to June 26.

Gasoline inventories declined by 1.8 million barrels to 216.7 million barrels last week, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 123,000 barrels to 56.4 million barrels.

U.S. crude oil imports rose by 748,000 barrels per day.

Refineries in the U.S. were running at 95.0% of capacity, up from 94.0% the previous week.

The Greek debt crisis also weighed on oil prices. The International Monetary Fund (IMF) confirmed that Greece has not repaid €1.538 billion IMF loans. A Greek default would be the first by an advanced economy in the IMF's seven-decade history, putting the country on a par with countries such as Afghanistan, Haiti and Zimbabwe, which also not paid IMF loans on time.

News that OPEC increased oil production in June also weighed on oil prices. According to a Reuters survey, OPEC supply rose in June to 31.60 million barrels per day from a revised 31.30 million barrels per day in May.

Traders expect the results of talks on the Iranian nuclear program. Talks will continue until July 07.

WTI crude oil for August delivery decreased to $57.98 a barrel on the New York Mercantile Exchange.

Brent crude oil for August declined to $62.61 a barrel on ICE Futures Europe.

-

17:25

Gold traded lower on a stronger U.S. dollar

Gold traded lower on a stronger U.S. dollar. The greenback rose against the other major currencies after the release of the mostly better-than-expected U.S. economic data. The Institute for Supply Management's manufacturing purchasing managers' index for the U.S. climbed to 53.5 in June from 52.8 in May, exceeding expectations for a gain to 53.1. It was the highest level since January.

Construction spending in the U.S. rose 0.8% in May, exceeding expectations for a 0.6% gain, after a 2.1% increase in April. April's figure was revised down from a 2.2% rise.

Private sector in the U.S. added 237,000 jobs in June, according the ADP report on Wednesday. It was the biggest increase since December 2014.

The U.S. final manufacturing purchasing managers' index (PMI) fell to 53.6 in June from 54.0 in May, beating the previous estimate of a decline to 53.4. It was the lowest level since October 2013.

The Greek debt crisis remained in focus. Greek Prime Minister Alexis Tsipras said in a speech on Wednesday that Greeks should vote "no" in Sunday's referendum. He added that "no" would not mean that Greece have to leave the Eurozone.

Earlier, Greek prime minister signalled that he was ready to accept the most spending cuts demanded by the country's creditors.

German Finance Minister Wolfgang Schaeuble said on Wednesday that there was no basis to have further negotiations with Greece.

August futures for gold on the COMEX today declined to 1168.90 dollars per ounce.

-

17:15

Greek Prime Minister Alexis Tsipras: Greeks should vote “no” in Sunday’s referendum

Greek Prime Minister Alexis Tsipras said in a speech on Wednesday that Greeks should vote "no" in Sunday's referendum. He added that "no" would not mean that Greece have to leave the Eurozone.

Tsipras reassured Greeks that their deposits were safe.

He also said that he would continue to negotiate with the country's lenders.

Earlier, Greek prime minister signalled that he was ready to accept the most spending cuts demanded by the country's creditors.

-

17:03

U.S. crude inventories rise by 2.4 million barrels to 465.4 million in the week to June 26

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 2.4 million barrels to 465.4 million in the week to June 26.

Gasoline inventories declined by 1.8 million barrels to 216.7 million barrels last week, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 123,000 barrels to 56.4 million barrels.

U.S. crude oil imports rose by 748,000 barrels per day.

Refineries in the U.S. were running at 95.0% of capacity, up from 94.0% the previous week.

-

16:51

ISM manufacturing purchasing managers’ index climbs to 53.5 in June

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Wednesday. The index climbed to 53.5 in June from 52.8 in May, exceeding expectations for a gain to 53.1. It was the highest level since January.

A reading above 50 indicates expansion, below indicates contraction.

The increase was driven by higher employment in the manufacturing sector. The employment index climbed to 55.5 in June from 51.7 in May.

The production index fell to 54.0 in June from 54.5 in May.

The new orders index was up to 56.0 in June from 55.8 in May.

The prices paid index remained unchanged at 49.5 in June.

-

16:34

Construction spending in the U.S. jumps 0.8% in May

The U.S. Commerce Department released construction spending data on Wednesday. Construction spending in the U.S. rose 0.8% in May, exceeding expectations for a 0.6% gain, after a 2.1% increase in April. April's figure was revised down from a 2.2% rise.

The rise was driven by an increase in private and public construction. Private construction spending gained 0.9% in May, while public construction spending increased 0.7%.

-

16:30

U.S.: Crude Oil Inventories, June 2.386

-

16:18

U.S. final manufacturing purchasing managers' index (PMI) declines to 53.6 in June, the lowest level since October 2013

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Wednesday. The U.S. final manufacturing purchasing managers' index (PMI) fell to 53.6 in June from 54.0 in May, beating the previous estimate of a decline to 53.4. It was the lowest level since October 2013.

A reading above 50 indicates expansion in economic activity.

The Markit Chief Economist Chris Williamson said that the reading suggests the U.S. economy was slowing again.

"The slowdown is largely linked to a third consecutive monthly fall in exports, in turn attributed by many companies to the strong dollar undermining international competitiveness," he added.

-

16:07

Bank of England’s Governor Mark Carney: the outlook of U.K. financial stability worsened due to the Greek debt crisis

The Bank of England Governor Mark Carney said on Wednesday that the outlook of U.K. financial stability worsened due to the Greek debt crisis, but UK banks' direct exposure to Greece is very small.

"The footprint of Greek banks in the United Kingdom is tiny compared with the size of our economy. In contrast, our economic and financial exposure to the euro area is considerable," he noted.

Carney also said that the economic growth in the U.K. has been solid and the burden of household debt has continued to decline.

-

16:00

U.S.: ISM Manufacturing, June 53.5 (forecast 53.1)

-

16:00

U.S.: Construction Spending, m/m, May 0.8% (forecast 0.6%)

-

15:54

Bank of England’s Financial Stability Report: the outlook remained broadly unchanged

The Bank of England (BoE) released its Financial Stability Report on Wednesday. The outlook remained broadly unchanged. The central bank said that risks from Greece increased, but other risks declined.

UK banks' direct exposure to Greece is very small, the BoE noted.

"The Financial Policy Committee will continue to monitor developments and remains alert to the possibility that a deepening of the Greek crisis could prompt a broader reassessment of risk in financial markets," the BoE said.

-

15:45

U.S.: Manufacturing PMI, June 53.6 (forecast 53.4)

-

15:40

Greece’s final manufacturing PMI drops to 46.9 in June

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Greec on Wednesday. Greece's manufacturing purchasing managers' index (PMI) dropped to 46.9 in June from 48.0 in May. It was tenth consecutive decline.

The decline was driven by falls in output and new orders.

"The accelerated contraction in goods production in June ended the worst quarter for the Greek manufacturing sector for two years. With negotiations over a debt deal ongoing in June demand was subdued, leading new orders - both from domestic and international clients - to fall even faster than May," Markit economist Phil Smith said.

-

15:32

U.S. Stocks open: Dow +0.67%, Nasdaq +0.84%, S&P +0.60%

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E1.2bn), $1.1200(E1.3bn), $1.1250(E531mn)

USD/JPY: Y121.90($280mn), Y122.35($1.0bn), Y123.00($410mn)

EUR/JPY: Y135.00(E400mn)

AUD/JPY: Y95.80(A$270mn)

USD/CAD: Cad1.2240($200mn), Cad1.2500($270mn)

AUD/USD: $0.7550(A$475mn), $0.7600(A$500mn)

NZD/USD: $0.6880/00(NZ$420mn)

-

15:28

Before the bell: S&P futures +0.79%, NASDAQ futures +0.84%

U.S. index futures advanced as investors watched for signs of compromise on Greek debt negotiations and data showed a stronger-than-forecast monthly gain in private payrolls.

Nikkei 20,329.32 +93.59 +0.46%

Shanghai Composite 4,053.7 -223.52 -5.23%

FTSE 6,610.13 +89.15 +1.37%

CAC 4,904.98 +114.78 +2.40%

DAX 11,224.77 +279.80 +2.56%

Crude oil $58.66 (-1.38%)

Gold $1169.60 (-0.20%)

-

15:18

Spain’s final manufacturing PMI falls to 54.5 in June

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Spain on Wednesday. Spain's manufacturing purchasing managers' index (PMI) declined to 54.5 in June from 55.8 in May.

The decline was driven by lower output and new orders.

-

15:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Chevron Corp

CVX

96.53

+0.06%

4.3K

Pfizer Inc

PFE

33.56

+0.09%

11.7K

Starbucks Corporation, NASDAQ

SBUX

53.70

+0.16%

66.0K

AT&T Inc

T

35.60

+0.23%

86.7K

Verizon Communications Inc

VZ

46.75

+0.30%

19.9K

Wal-Mart Stores Inc

WMT

71.27

+0.48%

1.3K

Yandex N.V., NASDAQ

YNDX

15.30

+0.53%

1.2K

Nike

NKE

108.60

+0.54%

1.8K

General Electric Co

GE

26.75

+0.67%

120.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

18.75

+0.70%

14.2K

Intel Corp

INTC

30.63

+0.71%

39.0K

Johnson & Johnson

JNJ

98.15

+0.71%

7.6K

Home Depot Inc

HD

112.00

+0.78%

3.2K

General Motors Company, NYSE

GM

33.61

+0.84%

37.4K

Yahoo! Inc., NASDAQ

YHOO

39.62

+0.84%

4.8K

ALCOA INC.

AA

11.25

+0.90%

10.1K

Amazon.com Inc., NASDAQ

AMZN

438.15

+0.94%

1.2K

Procter & Gamble Co

PG

78.99

+0.96%

5.5K

Cisco Systems Inc

CSCO

27.53

+1.03%

91.2K

Apple Inc.

AAPL

126.80

+1.10%

280.8K

Google Inc.

GOOG

526.25

+1.10%

0.1K

Citigroup Inc., NYSE

C

55.86

+1.12%

19.4K

Ford Motor Co.

F

15.18

+1.12%

43.0K

Goldman Sachs

GS

211.15

+1.13%

1.7K

JPMorgan Chase and Co

JPM

68.10

+1.16%

33.8K

Facebook, Inc.

FB

86.84

+1.25%

129.6K

UnitedHealth Group Inc

UNH

123.60

+1.31%

3.2K

Tesla Motors, Inc., NASDAQ

TSLA

271.88

+1.35%

20.4K

Travelers Companies Inc

TRV

100.40

+3.87%

6.8K

American Express Co

AXP

77.72

0.00%

1.7K

Visa

V

67.15

0.00%

0.8K

Caterpillar Inc

CAT

84.82

0.00%

1.2K

Exxon Mobil Corp

XOM

83.20

0.00%

11.0K

International Business Machines Co...

IBM

162.66

0.00%

2.7K

McDonald's Corp

MCD

95.07

0.00%

8.9K

Microsoft Corp

MSFT

44.15

0.00%

55.2K

The Coca-Cola Co

KO

39.23

0.00%

7.6K

United Technologies Corp

UTX

110.93

0.00%

4.9K

Walt Disney Co

DIS

113.48

0.00%

5.7K

AMERICAN INTERNATIONAL GROUP

AIG

61.82

0.00%

2.6K

Deere & Company, NYSE

DE

97.05

0.00%

10.3K

FedEx Corporation, NYSE

FDX

170.40

0.00%

0.8K

HONEYWELL INTERNATIONAL INC.

HON

101.97

0.00%

1.5K

Hewlett-Packard Co.

HPQ

30.01

0.00%

5.6K

International Paper Company

IP

47.59

0.00%

17.1K

ALTRIA GROUP INC.

MO

48.91

0.00%

3.8K

Twitter, Inc., NYSE

TWTR

36.22

0.00%

129.7K

Merck & Co Inc

MRK

56.87

-0.11%

5.7K

Barrick Gold Corporation, NYSE

ABX

10.64

-0.19%

6.6K

E. I. du Pont de Nemours and Co

DD

61.04

-4.36%

30.0K

-

15:05

Italy’s final manufacturing PMI declines to 54.1 in June

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Italy on Wednesday. Italy's manufacturing purchasing managers' index (PMI) fell to 54.1 in June from 54.8 in May.

The output rose in June, the employment growth remained unchanged, while input cost inflation climbed.

"The headline index's average over the second quarter as a whole was the highest since the first quarter of 2011, pointing to a positive contribution from manufacturing to overall GDP growth," Markit economist Phil Smith said.

-

14:59

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

AT&T (T) target raised to $40 from $36 at Oppenheimer

Facebook (FB) target raised to $100 from $92 at Cantor Fitzgerald

-

14:51

Swiss manufacturing PMI rises to 50.0 in June

Credit Suisse released its manufacturing purchasing managers' index (PMI) for Switzerland on Wednesday. The manufacturing purchasing managers' index in Switzerland rose to 50.0 in June from 49.4 in May, missing expectations for an increase to 50.1.

The increase was driven by a rise in production. Production rose 3.1 points to 54.8 in June.

The backlog of orders sub-index declined by 0.3 points to 51.1 in June, while the employment sub-index increased to 41.6in June from 40.7 in May.

-

14:41

ADP report: private sector adds 237,000 jobs in June

Private sector in the U.S. added 237,000 jobs in June, according the ADP report on Wednesday. It was the biggest increase since December 2014.

May's figure was revised up to 203,000 jobs from a previous reading of 201,000 jobs.

Analysts expected the private sector to add 217,000 jobs.

The increase was driven by a job creation in the professional and business service.

"The U.S. job machine remains in high gear," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Thursday. Analysts expect that U.S. unemployment rate is expected to decline to 5.4% in June from 5.5% in May. The U.S. economy is expected to add 232,000 jobs in June, after adding 280,000 jobs in May.

-

14:25

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite hopes for a deal between Athens and its creditors

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Manufacturing PMI June 50.2 50.3 50.2

01:00 China Non-Manufacturing PMI June 53.2 53.8

01:30 Australia Building Permits, m/m May -5.2% Revised From -4.4% 1% 2.4%

01:35 Japan Manufacturing PMI (Finally) June 50.9 49.9 50.1

01:45 China HSBC Manufacturing PMI (Finally) June 49.2 49.4

07:30 Switzerland Manufacturing PMI June 49.4 50.1 50

07:50 France Manufacturing PMI (Finally) June 49.4 50.5 50.7

07:55 Germany Manufacturing PMI (Finally) June 51.1 51.9 51.9

08:00 Eurozone Manufacturing PMI (Finally) June 52.2 52.5 52.5

08:30 United Kingdom Purchasing Manager Index Manufacturing June 51.9 Revised From 52.0 52.5 51.4

09:00 Eurozone Eurogroup Meetings

09:30 United Kingdom BOE Financial Stability Report

09:30 United Kingdom BOE Gov Mark Carney Speaks

11:00 U.S. MBA Mortgage Applications June 1.6% -4.7%

12:00 Canada Bank holiday

12:15 U.S. ADP Employment Report June 203 Revised From 201 217 237

The U.S. dollar traded higher against the most major currencies after the release of the U.S. ADP jobs data. Private sector in the U.S. added 237,000 jobs in June, according the ADP report on Wednesday. May's figure was revised up to 203,000 jobs from a previous reading of 201,000 jobs. Analysts expected the private sector to add 217,000 jobs.

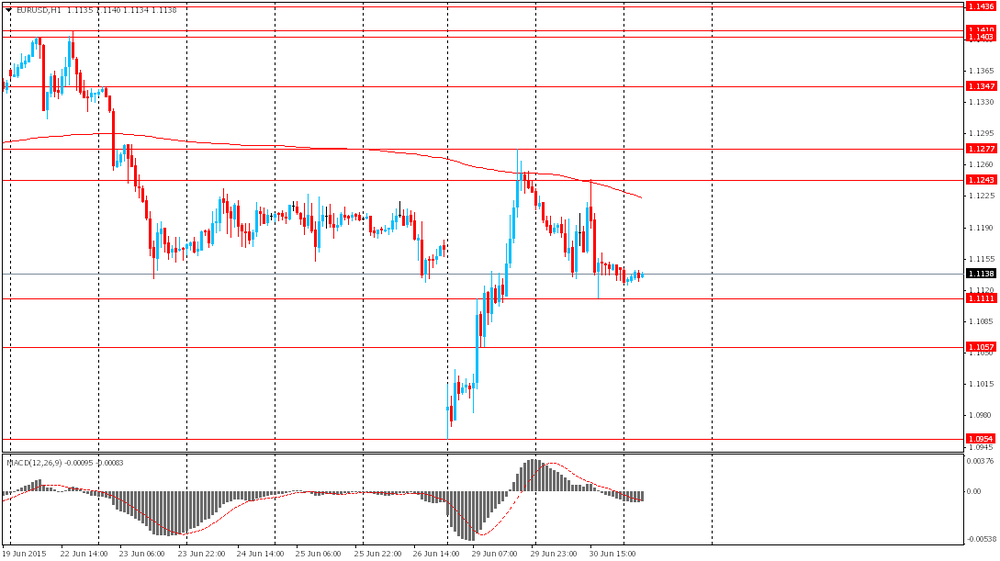

The euro traded lower against the U.S. dollar despite hopes for a deal between Athens and its creditors. Greek Prime Minister Alexis Tsipras signalled that he was ready to accept the most spending cuts demanded by the country's creditors.

But German Finance Minister Wolfgang Schaeuble said on Wednesday that there was no basis to have further negotiations with Greece.

The International Monetary Fund (IMF) confirmed that Greece has not repaid €1.538 billion IMF loans. A Greek default would be the first by an advanced economy in the IMF's seven-decade history, putting the country on a par with countries such as Afghanistan, Haiti and Zimbabwe, which also not paid IMF loans on time.

Another Eurogroup meeting has been called for today to discuss the latest proposal from Greece. The Head of the Eurogroup Jeroen Dijsselbloem said that the Eurogroup will discuss the request for a third bailout programme only after the referendum on Sunday. He also warns that new aid programme for Greece may have tougher conditions.

Meanwhile, the economic data from the Eurozone was solid. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.5 in June from 52.2 in May, in line with a preliminary reading. It was the highest level since April 2014.

The Netherlands was the strongest performer.

Markit's Chief Economist Chris Williamson said that June's PMI was "representing a major improvement compared to the malaise seen at the end of last year".

Germany's final manufacturing purchasing managers' index (PMI) rose to 51.9 in June from 51.1 in May, in line with a preliminary reading.

The increase was driven by a rise in output at consumer goods producers and in output in new orders.

"The overall expansions in output and new business were, however, well below levels seen at the start of last year," Markit economist Oliver Kolodseike said.

France's final manufacturing purchasing managers' index (PMI) rose to 50.7 in June from 49.4 in May, up from the preliminary reading of 50.5. It was the first reading above 50 since April 2014.

"The French manufacturing sector edged further in the right direction during June, with output and new orders broadly stabilizing. This was reflected in firms' hiring decisions, with the rate of job shedding easing to a marginal pace," Markit economist Jack Kennedy said.

The British pound traded mixed against the U.S. dollar after the release of the manufacturing PMI from the U.K. Markit Economics also released its manufacturing purchasing managers' index (PMI) for the U.K. on Wednesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.4 in June from 51.9 in May, missing expectations for a rise to 52.5. It was the lowest level since April 2013.

The decline was driven by declines in output and new orders.

"The UK manufacturing sector had a disappointing second quarter overall. Growth trends in output and new orders were the weakest since the opening quarter of 2013, as a strong sterling exchange rate and subdued demand from mainland Europe offset the continued solidity of the domestic market," Markit's Senior Economist Rob Dobson said.

The Bank of England Governor Mark Carney said on Wednesday that UK banks' direct exposure to Greece is very small. He noted that the economic growth in the U.K. has been solid and the burden of household debt has continued to decline.

The Swiss franc traded lower against the U.S. dollar after the weaker-than-expected manufacturing PMI from Switzerland. The manufacturing purchasing managers' index in Switzerland rose to 50.0 in June from 49.4 in May, missing expectations for an increase to 50.1.

The increase was driven by a rise in production.

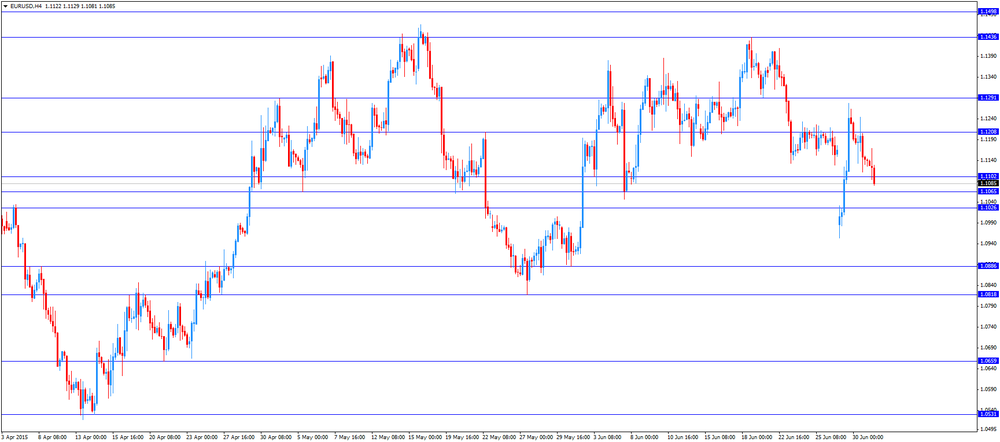

EUR/USD: the currency pair increased to $1.1081

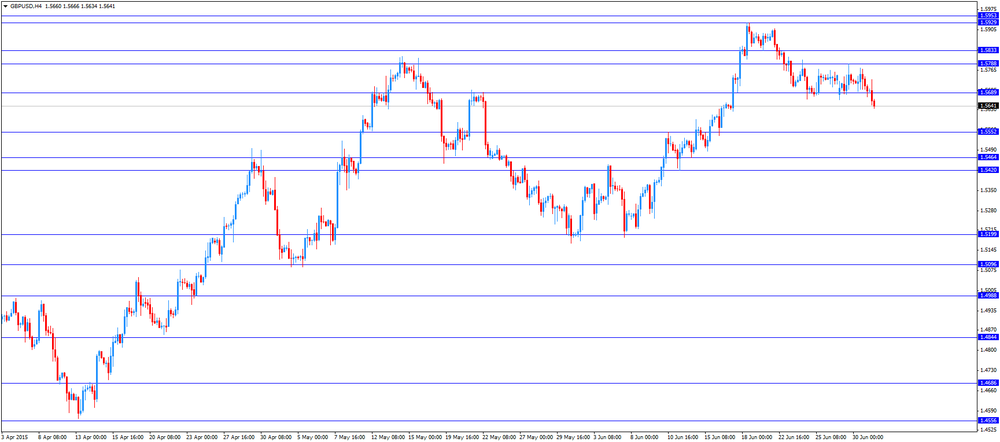

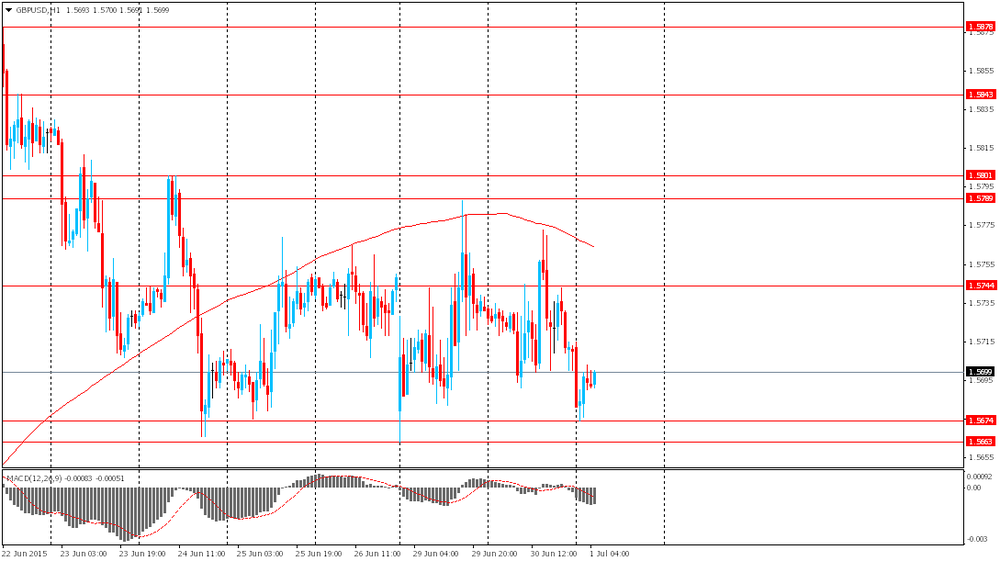

GBP/USD: the currency pair declined to $1.5634

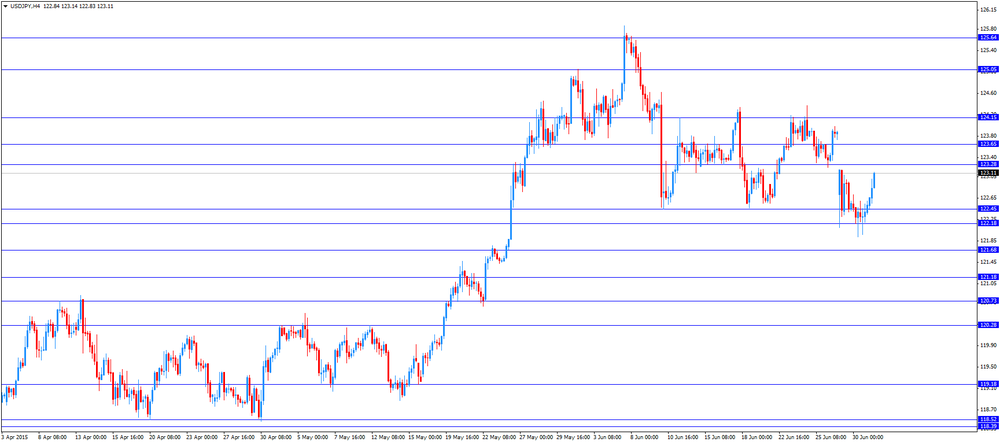

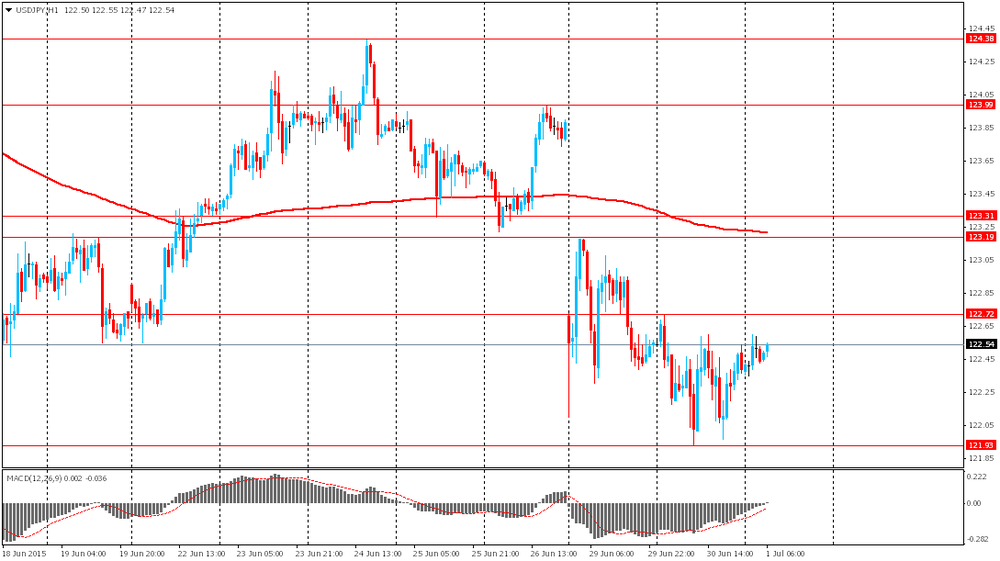

USD/JPY: the currency pair rose to Y123.14

The most important news that are expected (GMT0):

13:45 U.S. Manufacturing PMI (Finally) June 54.0 53.4

14:00 U.S. ISM Manufacturing June 52.8 53.1

-

14:15

U.S.: ADP Employment Report, June 237 (forecast 217)

-

13:45

Orders

EUR/USD

Offers 1.1150 1.1180 1.1200 1.1220-25 1.1245 1.1280 1.1300 1.1330 1.1350

Bids 1.1100 1.1080 1.1050 1.1030 1.1000 1.0980 1.0960 1.0930 1.0900

GBP/USD

Offers 1.5725 1.5750-55 1.5780 1.5800 1.5820-25 1.5850 1.5875 1.5900

Bids 1.5670-75 1.5650 1.5630 1.5600 1.5585 1.5570 1.5550

EUR/GBP

Offers 0.7125-30 0.7150 0.7170 0.7180-85 0.7200

Bids 0.7100 0.7085 0.7060 0.7040 0.7020 0.7000 0.6985 0.6965 0.6950

EUR/JPY

Offers 136.70 137.00 137.30 137.50 137.80 138.00 138.50

Bids 136.00 135.80 135.60 135.20 135.00 134.85

USD/JPY

Offers 122.85 123.00 123.20 123.50 123.75 124.00

Bids 122.25 122.00 121.80 121.65 121.50 121.00

AUD/USD

Offers 0.7720 0.7735 0.7750-60 0.7785 0.7800

Bids 0.7685 0.7650 0.7630 0.7600 0.7585 0.7550

-

13:01

U.S.: MBA Mortgage Applications, June -4.7%

-

12:04

European stock markets mid session: stocks traded higher despite Greece's debt crisis

Stock indices traded higher despite Greece's debt crisis. The International Monetary Fund (IMF) confirmed that Greece has not repaid €1.538 billion IMF loans. A Greek default would be the first by an advanced economy in the IMF's seven-decade history, putting the country on a par with countries such as Afghanistan, Haiti and Zimbabwe, which also not paid IMF loans on time.

Another Eurogroup meeting has been called for today to discuss the latest proposal from Greece. The Head of the Eurogroup Jeroen Dijsselbloem said that the Eurogroup will discuss the request for a third bailout programme only after the referendum on Sunday. He also warns that new aid programme for Greece may have tougher conditions.

Germany's Finance Minister Wolfgang Schaeuble said on Tuesday that Greece can stay in the Eurozone even if it says "No" to the bailout programme in the referendum on Sunday.

Meanwhile, the economic data from the Eurozone was solid. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.5 in June from 52.2 in May, in line with a preliminary reading. It was the highest level since April 2014.

The Netherlands was the strongest performer.

Markit's Chief Economist Chris Williamson said that June's PMI was "representing a major improvement compared to the malaise seen at the end of last year".

Germany's final manufacturing purchasing managers' index (PMI) rose to 51.9 in June from 51.1 in May, in line with a preliminary reading.

The increase was driven by a rise in output at consumer goods producers and in output in new orders.

"The overall expansions in output and new business were, however, well below levels seen at the start of last year," Markit economist Oliver Kolodseike said.

France's final manufacturing purchasing managers' index (PMI) rose to 50.7 in June from 49.4 in May, up from the preliminary reading of 50.5. It was the first reading above 50 since April 2014.

"The French manufacturing sector edged further in the right direction during June, with output and new orders broadly stabilizing. This was reflected in firms' hiring decisions, with the rate of job shedding easing to a marginal pace," Markit economist Jack Kennedy said.

Markit Economics also released its manufacturing purchasing managers' index (PMI) for the U.K. on Wednesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.4 in June from 51.9 in May, missing expectations for a rise to 52.5. It was the lowest level since April 2013.

The decline was driven by declines in output and new orders.

"The UK manufacturing sector had a disappointing second quarter overall. Growth trends in output and new orders were the weakest since the opening quarter of 2013, as a strong sterling exchange rate and subdued demand from mainland Europe offset the continued solidity of the domestic market," Markit's Senior Economist Rob Dobson said.

The Bank of England Governor Mark Carney said on Wednesday that UK banks' direct exposure to Greece is very small. He noted that the economic growth in the U.K. has been solid and the burden of household debt has continued to decline.

Current figures:

Name Price Change Change %

FTSE 100 6,615.79 +94.81 +1.45 %

DAX 11,165.43 +220.46 +2.01 %

CAC 40 4,899.62 +109.42 +2.28 %

-

11:47

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. drops to 51.4 in June, the lowest level since April 2013

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Wednesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.4 in June from 51.9 in May, missing expectations for a rise to 52.5. It was the lowest level since April 2013.

May's figure was revised down from 52.0.

A reading above 50 indicates expansion.

The decline was driven by declines in output and new orders.

"The UK manufacturing sector had a disappointing second quarter overall. Growth trends in output and new orders were the weakest since the opening quarter of 2013, as a strong sterling exchange rate and subdued demand from mainland Europe offset the continued solidity of the domestic market," Markit's Senior Economist Rob Dobson said.

-

11:37

France’s final manufacturing PMI climbs to 50.7 in June

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Wednesday. France's final manufacturing purchasing managers' index (PMI) rose to 50.7 in June from 49.4 in May, up from the preliminary reading of 50.5. It was the first reading above 50 since April 2014.

"The French manufacturing sector edged further in the right direction during June, with output and new orders broadly stabilizing. This was reflected in firms' hiring decisions, with the rate of job shedding easing to a marginal pace," Markit economist Jack Kennedy said.

-

11:28

Germany’s final manufacturing PMI increases to 51.9 in June

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Wednesday. Germany's final manufacturing purchasing managers' index (PMI) rose to 51.9 in June from 51.1 in May, in line with a preliminary reading.

The increase was driven by a rise in output at consumer goods producers and in output in new orders.

"The overall expansions in output and new business were, however, well below levels seen at the start of last year," Markit economist Oliver Kolodseike said.

-

11:23

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E1.2bn), $1.1200(E1.3bn), $1.1250(E531mn)

USD/JPY: Y121.90($280mn), Y122.35($1.0bn), Y123.00($410mn)

EUR/JPY: Y135.00(E400mn)

AUD/JPY: Y95.80(A$270mn)

USD/CAD: Cad1.2240($200mn), Cad1.2500($270mn)

AUD/USD: $0.7550(A$475mn), $0.7600(A$500mn)

NZD/USD: $0.6880/00(NZ$420mn)

-

11:15

Eurozone’s final manufacturing PMI rises to 52.5 in June

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.5 in June from 52.2 in May, in line with a preliminary reading. It was the highest level since April 2014.

The Netherlands was the strongest performer.

Markit's Chief Economist Chris Williamson said that June's PMI was "representing a major improvement compared to the malaise seen at the end of last year".

-

11:07

Federal Reserve Vice Chairman Stanley Fischer: the U.S. consumer demand rebounds and economic growth is improving

Federal Reserve Vice Chairman Stanley Fischer said on Tuesday that the U.S. consumer demand rebounds and economic growth is improving. But he did not mentioned the timing of interest rate hikes.

Fischer noted that the Fed's monetary policy will depend on the incoming economic data. He pointed out that inflation and employment data will determine the pace of interest rate hikes.

Fed vice chairman expects the U.S. economy to grow at an annual rate of about 2.5% in the second quarter.

The Fed is working to minimize the likelihood of surprises that could result after the release of the Fed's monetary policy, he said.

-

10:54

Moody's upgrades Iceland's sovereign debt rating by a notch to Baa2

Rating agency Moody's has upgraded Iceland's sovereign debt rating by a notch to Baa2 after Iceland's government removed capital controls. The outlook is stable.

"The gradual removal of the capital controls and the reduction of the external and economic vulnerabilities posed by the failed banks' estates constitute a significant milestone in Iceland's recovery and represent important upside risks for future growth, public debt reduction and normalization of the financial system," the agency said.

-

10:44

International Monetary Fund confirms Greece has not repaid €1.538 billion IMF loans

The International Monetary Fund (IMF) confirmed that Greece has not repaid €1.538 billion IMF loans. The country can receive further financing from the IMF after the repayment of its loans. IMF Director of Communications Gerry Rice also confirmed that the IMF received Greece's request for an extension of the loan payment deadline.

"I can also confirm that the IMF received a request today from the Greek authorities for an extension of Greece's repayment obligation that fell due today, which will go to the IMF's Executive Board in due course," IMF Director of Communications Gerry Rice said.

-

10:35

Fitch Ratings downgrades Greece's sovereign debt rating by one notch to 'CC'

The rating agency Fitch Ratings has downgraded Greece's sovereign debt rating by one notch to 'CC' from 'CCC'.

"The breakdown of the negotiations between the Greek government and its creditors has significantly increased the risk that Greece will not be able to honour its debt obligations in the coming months, including bonds held by the private sector. We now view a default on government debt held by private creditors as probable," the agency said.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , June 51.4 (forecast 52.5)

-

10:23

Chinese final HSBC manufacturing purchasing managers’ index rises to 49.4 in June

The Chinese final HSBC manufacturing purchasing managers' index (PMI) rose to 49.4 in June from 49.2 in May, down from the preliminary estimate of 49.6.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

"The final reading of the HSBC China Manufacturing PMI pointed to a further decline in the health of the manufacturing sector in June. This was predominantly driven by the sharpest rate of job shedding across the sector since early-2009, while output also fell slightly on the month," Markit Economics economist Annabel Fiddes said.

-

10:14

Germany's Finance Minister Wolfgang Schaeuble: Greece can stay in the Eurozone even if it says "No" to the bailout programme in the referendum

Germany's Finance Minister Wolfgang Schaeuble said on Tuesday that Greece can stay in the Eurozone even if it says "No" to the bailout programme in the referendum on Sunday. He also said that the European Central Bank would do what is necessary to support the euro.

-

10:00

Eurozone: Manufacturing PMI, June 52.5 (forecast 52.5)

-

09:55

Germany: Manufacturing PMI, June 51.9 (forecast 51.9)

-

09:50

France: Manufacturing PMI, June 50.7 (forecast 50.5)

-

09:30

Switzerland: Manufacturing PMI, June 50 (forecast 50.1)

-

09:11

Oil: prices declined amid Greece crisis

West Texas Intermediate futures for August delivery dropped to $58.64 (-1.40%). Meanwhile Brent crude for August fell to $62.92 (-1.05%) a barrel. Greece was unable to make its payment to the International Monetary Fund. This default pushed the U.S. dollar up and crude prices down as dollar-denominated oil imports got more expensive.

At the same time crude production rose in both the OPEC and the U.S.. Some analysts believe that OPEC crude oil output advanced to 32.1 million barrels per day vs a target of 30 million bpd. On the whole production by the cartel rose to a three-year high of 31.60 million bpd in June from 31.30 million bpd in May (according to Reuters). In addition to that the U.S. Energy Information Administration reported on Tuesday that the country's crude production rose 9,000 barrels a day to 9.701 million barrels a day in April. Crude inventories rose by 1.9 million barrels in the week to 468.9 million, while they were expected to decline by 2.000 million barrels.

-

09:08

Gold shows weak activity

Gold is currently at $1,172.90 (+0.09%) an ounce. This traditional safe-haven asset is unusually calm considering the ongoing problems surrounding Greece and thus the euro zone. Nevertheless analysts said that U.S. demand for physical gold advanced in the recent weeks. Terry Hanlon, president of Dillon Gage Metals, a wholesale precious metals trader in Dallas, said he had seen volumes rise by 70% in June from May. Prices have not reflected these increases as futures speculation is not synchronized with trades of physical gold.

-

09:04

Global Stocks: U.S. indices rebounded

U.S. stock indices rebounded on Tuesday despite tensions in Europe. Some investors are still hoping for a last-minute deal that would help Greece pay its debts and stay in the single currency area. U.S. companies have limited exposure to Greece, however there's some uncertainty about the way Europe would be affected if Greece leaves the euro zone.

Yesterday's consumer confidence report supported U.S. stocks as the corresponding index rose to 101.4 in June vs 97.2 expected and 94.6 previous.

The Dow Jones industrial average rose 50.32 points, or 0.29%, to 17,646.67. The Standard & Poor's 500 gained 9.44 points, or 0.46%, to 2,067.08 (8 out of its 10 major sectors advanced) and the Nasdaq Composite added 35.06 points, or 0.71%, to 4,993.53.

This morning in Asia Shanghai Composite Index declined by 1.21%, or 51.86 points, to 4,225.36. Meanwhile the Nikkei gained 0.31%, or 63.21 points, to 20,298.94. Hong Kong markets are on holiday.

Asian stocks mostly rebounded after recent sharp declines. This morning the latest Markit survey of Japanese manufacturers showed that economic activity in the sector expanded. Meanwhile Chinese data were mixed: industrial activity remained sluggish (49.4 vs 49.2 prev.), but the services sector picked up in June (53.8 vs 53.2 prev.). Chinese stocks volatility is still high.

-

09:00

Foreign exchange market. Asian session: euro’s declines are limited by hopes for a solution

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:00 China Manufacturing PMI June 50.2 50.3 50.2

01:00 China Non-Manufacturing PMI June 53.2 53.8

01:30 Australia Building Permits, m/m May -5.2% 1% 2.4%

01:35 Japan Manufacturing PMI (Finally) June 50.9 49.9 50.1

01:45 China HSBC Manufacturing PMI (Finally) June 49.2 49.4The euro slid on Wednesday morning after Greece had missed the deadline of its €1.6 billion debt payment to the IMF on Tuesday. However there's still some uncertainty as at the last moment Greece asked for an emergency repayment extension and the IMF said it would consider it in due course.

Today European finance ministers will meet to discuss Greek PM Alexis Tsipras' request for a new two-year loan to pay debts, which are slightly below €30 billion euros.The Australian dollar advanced against the U.S. dollar after positive data from Australia and China. Today the Australian Bureau of Statistics reported that building permits rose by seasonally adjusted 2.4% in May after a 5.2% contraction in April. Meanwhile China Non-Manufacturing PMI rose to 53.8 in June from 53.2 reported previously. China is Australia's largest trading partner.

EUR/USD: the pair traded around $1.1125-45 this morning

USD/JPY: the pair traded around Y122.35-60

GBP/USD: the pair fell to $1.5675

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:30 Switzerland Manufacturing PMI June 49.4 50.1

07:50 France Manufacturing PMI(Finally) June 49.4 50.5

07:55 Germany Manufacturing PMI(Finally) June 51.1 51.9

08:00 Eurozone Manufacturing PMI(Finally) June 52.2 52.5

08:30 United Kingdom Purchasing Manager Index Manufacturing June 52.0 52.5

09:00 Eurozone Eurogroup Meetings

09:30 United Kingdom BOE Financial Stability Report

09:30 United Kingdom BOE Gov Mark Carney Speaks

11:00 U.S. MBA Mortgage Applications June 1.6%

12:15 U.S. ADP Employment Report June 201 217

13:45 U.S. Manufacturing PMI(Finally) June 54.0 53.4

14:00 U.S. Construction Spending, m/m May 2.2% 0.6%

14:00 U.S. ISM Manufacturing June 52.8 53.1

14:30 U.S. Crude Oil Inventories June -4.934

20:45 U.S. Total Vehicle Sales, mln June 17.8 17.2 -

08:30

Options levels on wednesday, July 1, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1276 (3345)

$1.1216 (1513)

$1.1172 (1954)

Price at time of writing this review: $1.1120

Support levels (open interest**, contracts):

$1.1060 (5654)

$1.1024 (3242)

$1.0984 (12785)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 61723 contracts, with the maximum number of contracts with strike price $1,1500 (5261);

- Overall open interest on the PUT options with the expiration date July, 2 is 88621 contracts, with the maximum number of contracts with strike price $1,1000 (12785);

- The ratio of PUT/CALL was 1.44 versus 1.44 from the previous trading day according to data from June, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.6000 (548)

$1.5901 (616)

$1.5802 (1443)

Price at time of writing this review: $1.5701

Support levels (open interest**, contracts):

$1.5599 (888)

$1.5500 (700)

$1.5400 (1748)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 22972 contracts, with the maximum number of contracts with strike price $1,5500 (2541);

- Overall open interest on the PUT options with the expiration date July, 2 is 27107 contracts, with the maximum number of contracts with strike price $1,5300 (2151);

- The ratio of PUT/CALL was 1.18 versus 1.19 from the previous trading day according to data from June, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:00

Nikkei 225 +21.10 +0.10 %, Hang Seng 26,250.03 +283.05 +1.09 %, Shanghai Composite 4,280.06 +2.84 +0.07 %

-

03:47

Japan: Manufacturing PMI, June 50.1 (forecast 49.9)

-

03:45

China: HSBC Manufacturing PMI, June 49.4

-

03:30

Australia: Building Permits, m/m, May 2.4% (forecast 1%)

-

03:02

China: Manufacturing PMI , June 50.2 (forecast 50.3)

-

03:02

China: Non-Manufacturing PMI, June 53.8

-

01:52

Japan: BoJ Tankan. Non-Manufacturing Index, Quarter II 23 (forecast 22)

-

01:51

Japan: BoJ Tankan. Manufacturing Index, Quarter II 15 (forecast 12)

-

01:31

Australia: AIG Manufacturing Index, June 44.2

-

00:32

Commodities. Daily history for Jun 30’2015:

(raw materials / closing price /% change)

Oil 58.95 -0.87%

Gold 1,171.80 +0.03%

-

00:30

Stocks. Daily history for Jun 30’2015:

(index / closing price / change items /% change)

Nikkei 225 20,235.73 +125.78 +0.63 %

Hang Seng 26,250.03 +283.05 +1.09 %

S&P/ASX 200 5,459.01 +36.52 +0.67 %

Shanghai Composite 4,277.79 +224.76 +5.55 %

FTSE 100 6,520.98 -99.50 -1.50 %

CAC 40 4,790.2 -79.62 -1.63 %

Xetra DAX 10,944.97 -138.23 -1.25 %

S&P 500 2,063.11 +5.47 +0.27 %

NASDAQ Composite 4,986.87 +28.40 +0.57 %

Dow Jones 17,619.51 +23.16 +0.13 %

-

00:29

Currencies. Daily history for Jun 30’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1143 -0,77%

GBP/USD $1,5710 -0,13%

USD/CHF Chf0,9346 +1,05%

USD/JPY Y122,39 -0,13%

EUR/JPY Y136,39 -0,90%

GBP/JPY Y192,29 -0,25%

AUD/USD $0,7702 +0,34%

NZD/USD $0,6771 -1,02%

USD/CAD C$1,2488 +0,70%

-