Noticias del mercado

-

22:09

Major US stock indexes closed below zero

Major US stock indexes fell on Thursday after data pointed to slowing jobs growth in June. The number of Americans who first applied for unemployment benefits rose last week, but the level remains historically low. In the United States, employers have continued to add jobs in June, but wages remained unchanged, and the level of participation has fallen, suggesting that signs of weakness remain in the labor market. The number of people employed in non-agricultural sectors of the economy increased from a seasonally adjusted 223,000 in June, the Labor Department said Thursday. This revised earlier data showed a weak job creation this spring than originally anticipated. Employers added 254,000 jobs in May compared with the initially reported 280 000. The April gain was revised up to 187,000 from 221,000.

However, initial applications for unemployment benefits, an indicator of layoffs throughout the US economy has increased by 10,000 and reached a seasonally adjusted 281,000 in the week ended June 27. Economists expected 270,000 initial claims last week. The level of applications in the previous week remained unchanged at 271 000. The Labor Department said that no special factors did not affect the latest data on applications.

It should also be noted that US factory orders fell in May, the most in three months, while the key category indicates that business investment plans fell for a second month in a row. Factory orders fell by 1% in May from April, when orders fell by 0.7%. Orders in the category, which serves as an indicator of business investment decreased by 0.4% after a 0.7% decrease in April.

Most components of the index DOW finished trading in negative territory (16 of 30). Outsider shares were EI du Pont de Nemours and Company (DD, -2.21%). Most remaining shares rose Intel Corporation (INTC, + 1.47%).

Sector of the S & P closed mostly below zero. Outsiders were conglomerates sector (-1.6%). Most of the basic materials sector increased (+ 0.8%).

At the close:

Dow -0.16% 17,729.08 -28.83

Nasdaq -0.08% 5,009.21 -3.91

S & P -0.04% 2,076.67 -0.75

-

21:00

Dow -0.23% 17,716.55 -41.36 Nasdaq -0.20% 5,002.99 -10.13 S&P -0.13% 2,074.80 -2.62

-

20:20

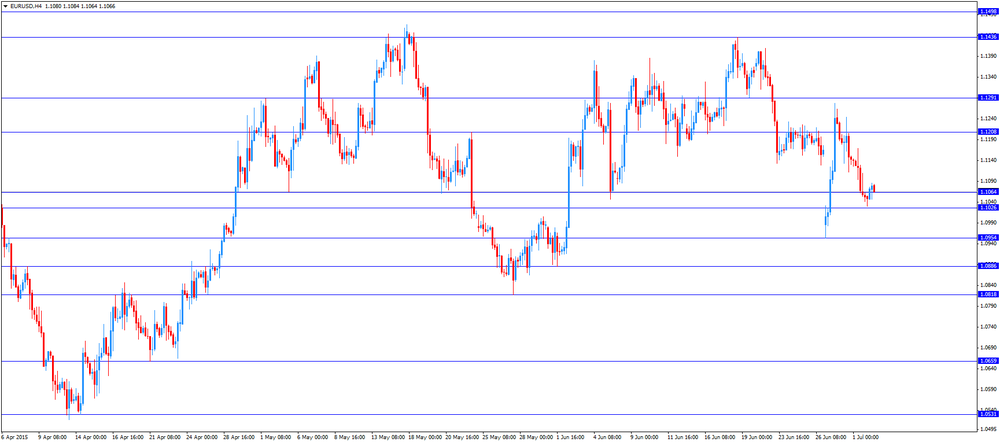

American focus: the dollar fell markedly against the backdrop of statistics on the US labor market

The dollar depreciated significantly against most major currencies, was under pressure mixed statistics on the US labor market. The Labor Department said the number of people employed in non-agricultural sectors of the economy increased from a seasonally adjusted 223,000 in June. This revised earlier data showed a weak job creation this spring than originally anticipated. Employers added 254,000 jobs in May compared with the initially reported 280 000. The April gain was revised up to 187,000 from the previously reported 221 000. The unemployment rate, which is obtained from a separate survey of US households, fell to 5.3% in June, compared with 5.5% in the previous month. It was the lowest since April 2008, but it reflects the fact that fewer Americans are looking for work. Economists predicted that employment will increase by 230,000 in June and the unemployment rate will fall to 5.4%. Average hourly wages of private sector workers has not changed in the last month and remained at $ 24.95. Meanwhile, the percentage of Americans participating in the labor force, fell to 62.6% in June from 62.9% in May. This figure was the lowest since 1977.

Meanwhile, another report showed that initial applications for unemployment benefits, an indicator of layoffs throughout the US economy has increased by 10,000 and reached a seasonally adjusted 281,000 in the week ended June 27. Economists expected 270,000 initial claims last week. The level of applications in the previous week remained unchanged at 271 000. The moving average for the four weeks of initial claims, which smooths weekly volatility, rose slightly on 1000 274750. The report also showed that the number of people continuing to receive unemployment benefits increased by 15,000 to 2.3 million in the week ended June 20th.

The pound rebounded against the US dollar stabilized near the level of opening of the session. Pressure on the dollar was data on factory orders and the US labor market. Recall, US factory orders fell in May, the most in three months, while the key category indicates that business investment plans fell for a second month in a row. The Commerce Department reported that factory orders fell by 1 percent in May from April, when orders fell by 0.7 percent. Orders in the category, which serves as an indicator of business investment, fell 0.4 percent after falling 0.7 percent in April. Most of the decline in May, is associated with a large 35.3-percent decline in demand for commercial aircraft. But even outside the volatile transportation category, orders rose only by 0.1 percent. Weak evidence suggests that production is still struggling with problems such as lower energy prices and a stronger dollar, which puts pressure on exports.

Meanwhile, the weak employment data in the US lowered expectations of Fed rate hikes. Federal funds futures show that at the moment the likelihood that the Fed will raise rates in September, 27% versus 35% on Wednesday.

-

18:01

European stocks close: stocks closed mixed on the uncertainty over Greece's debt crisis

Stock indices closed mixed on the uncertainty over Greece's debt crisis. Greek Prime Minister Alexis Tsipras said in a speech on Wednesday that Greeks should vote "no" in Sunday's referendum. He added that "no" would not mean that Greece have to leave the Eurozone.

The head of the Eurogroup Jeroen Dijsselbloem said on Thursday that if Greeks vote "No" on Sunday, it could mean that Greece have to leave the Eurozone. He added that Greeks should not expect better conditions if they vote "No".

Greek Finance Minister Yannis Varoufakis signalled on Thursday that he will resign if Greeks vote "Yes" in the referendum on Sunday.

Earlier, he said that a deal with Greece's creditors on Monday.

Meanwhile, the producer price inflation in the Eurozone improved slightly in May. Eurozone's producer price index was flat in May, missing expectations for a 0.1% increase, after a 0.1% decline in April.

On a yearly basis, Eurozone's producer price index dropped 2.0% in May, in line with expectations, after a 2.2% fall in April.

Eurozone's producer prices excluding energy fell 0.3% year-on-year in May. Energy prices dropped 6.4%.

The European Central Bank's (ECB) its minutes of March meeting on Thursday. According to the minutes, the ECB said in its minutes that there is no need to increase its bond-buying programme. The central bank added that it could adjust its bond-buying programme if needed.

The ECB wants to "look through recent volatility in financial markets and maintain a steady monetary policy course.

The ECB Chief Economist Peter Praet said that Eurozone's economy continued to improve.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 58.1 in June from 55.9 in May, exceeding expectations for a rise to 56.5.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a rise in the house-building sector, but both commercial and civil engineering activity also increased.

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices declined 0.2% in June, missing expectations for a 0.5 percent rise, after a 0.2% rise in May. May's figure was revised down from a 0.3% increase.

On a yearly basis, house prices fell to 3.3% in June from 4.6 percent in May, missing forecast of a 4.3% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,630.47 +21.88 +0.33 %

DAX 11,099.35 -81.15 -0.73 %

CAC 40 4,835.56 -47.63 -0.98 %

-

18:00

European stocks closed: FTSE 100 6,630.47 +21.88 +0.33% CAC 40 4,835.56 -47.63 -0.98% DAX 11,099.35 -81.15 -0.73%

-

17:53

WSE: Session Results

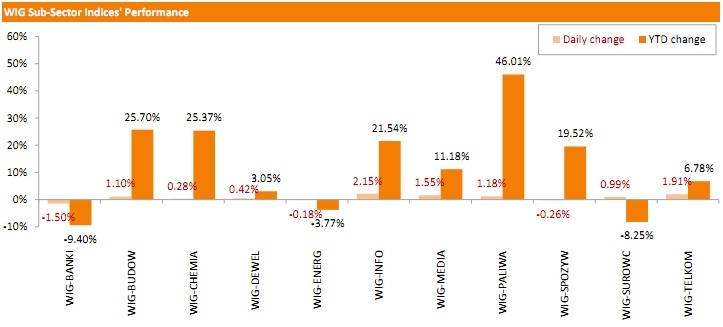

Polish equity market finished Thursday on a positive note, with the broad market benchmark, the WIG Index, inching up 0.15 %. 8 out of 11 sectors in the WIG Index increased, led by information technology sector stocks, which rose by 2.15%.

The WIG30 Index of the largest listed companies added 0.19%. Within the Index components, the advancers pack was led by coal miner BOGDANKA (WSE: LWB) with gains of 4.38%, followed by ASSECO POLAND (WSE: ACP), which soared 3.88%. Quotations of PGNIG (WSE: PGN), ORANGE POLSKA (WSE: OPL) and TVN (WSE: TVN) also were on upstream, recording gains of 2.44%, 2.33% and 2.31% respectively. On the contrary, banking stocks PEKAO (WSE: PEO), MBANK (WSE: MBK), BZ WBK (WSE: BZW), ALIOR (WSE: ALR) and PKO BP (WSE: PKO), as well as utilities name ENEA (WSE: ENA) were the weakest performers, suffering losses of 1.59%-2.18%.

-

17:42

Oil prices rise on a weaker U.S. dollar

Oil prices rose on a weaker U.S. dollar. The U.S. dollar declined against other major currencies after the release of the U.S. labour market data. The U.S. economy added 223,000 jobs in June, missing expectations for a rise of 230,000 jobs, after a gain of 254,000 jobs in May. May's figure was revised down from a rise of 280,000 jobs.

The U.S. unemployment rate dropped to 5.3% in June from 5.5% in May. It was the lowest level since April 2008.

Analysts had expected the unemployment rate to decline to 5.4%.

Gains were limited due to yesterday's U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 2.4 million barrels to 465.4 million in the week to June 26.

Traders expect the results of talks on the Iranian nuclear program. Talks will continue until July 07.

WTI crude oil for August delivery increased to $57.77 a barrel on the New York Mercantile Exchange.

Brent crude oil for August rose to $62.71 a barrel on ICE Futures Europe.

-

17:24

Wall Street. Major U.S. stock-indexes fell

U.S. stocks slightly fell on Thursday after data showed job growth slowed in June.

Nonfarm payrolls increased 223,000 last month, below the 230,000 that economists polled by Reuters had expected.

Most of Dow stocks in positive area (19 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -1.33%). Top looser - Intel Corporation (INTC, +1.92).

S&P index sectors mixed. Top gainer - Basic materials (+1,0%). Top looser - Services (-0.2%).

At the moment:

Dow 17642.00 -29.00 -0.16%

S&P 500 2067.00 -4.00 -0.19%

Nasdaq 100 4414.25 -7.75 -0.18%

10-year yield 2.38% -0.04

Oil 57.82 +0.86 +1.51%

Gold 1162.30 -7.00 -0.60%

-

17:24

Gold traded lower, recovering a part of its losses as the U.S. dollar declined after the release of the U.S. labour market data

Gold traded lower, recovering a part of its losses as the U.S. dollar declined after the release of the U.S. labour market data. The U.S. economy added 223,000 jobs in June, missing expectations for a rise of 230,000 jobs, after a gain of 254,000 jobs in May. May's figure was revised down from a rise of 280,000 jobs.

The strongest job gains showed the services sector. Retailers added 33,000 jobs in June, the health-care sector added 40,000, while leisure and hospitality rose by 22,000.

The manufacturing sector added only 4,000 jobs.

The U.S. unemployment rate dropped to 5.3% in June from 5.5% in May. It was the lowest level since April 2008.

Analysts had expected the unemployment rate to decline to 5.4%.

The decline was driven by fewer people were looking for work.

Average hourly earnings were flat in June, missing forecast of a 0.2% gain, after a 0.2% rise in May. May's figure was revised down from a 0.3% increase.

The labour-force participation rate plunged to 62.6% in June from 62.9% in May. It was the lowest level since October 1977.

These figures are signs that the U.S. job growth slowed. The Fed may delay to hike its interest rate due to the weak wage growth figures and low inflation.

The Greek debt crisis remains in focus. According to traders, the demand for gold could increase if Greece leaves the Eurozone, or if Italy, Spain or Portugal will be affected by Greece's problems. Greek Prime Minister Alexis Tsipras said in a speech on Wednesday that Greeks should vote "no" in Sunday's referendum.

August futures for gold on the COMEX today declined to 1161.30 dollars per ounce.

-

17:05

ECB Monetary Policy Meeting Account: there is no need to increase its bond-buying programme

The European Central Bank's (ECB) its minutes of March meeting on Thursday. According to the minutes, the ECB said in its minutes that there is no need to increase its bond-buying programme. The central bank added that it could adjust its bond-buying programme if needed.

The ECB wants to "look through recent volatility in financial markets and maintain a steady monetary policy course.

"As stated on previous occasions, the design of the APP (Asset Purchase Programme) provided sufficient flexibility for it to be adapted if circumstances were to change and should the need arise," the central bank said.

The ECB Chief Economist Peter Praet said that Eurozone's economy continued to improve.

The ECB decided on January 22 to launch an expanded asset purchase programme of 60 billion euro a month starting from March 2015 until September 2016.

-

16:52

Head of the Eurogroup Jeroen Dijsselbloem said on Thursday that if Greeks vote “No” on Sunday, it could mean that Greece have to leave the Eurozone

The head of the Eurogroup Jeroen Dijsselbloem said on Thursday that if Greeks vote "No" on Sunday, it could mean that Greece have to leave the Eurozone. He added that Greeks should not expect better conditions if they vote "No".

"One illusion must be swept from the table: that if the outcome is negative then everything can be renegotiated and you will end up with an easier and more attractive package," Dijsselbloem said.

"If people say they don't want that, there is not only no basis for a new programme, there is also no basis for Greece in the euro zone," the head of the Eurogroup pointed out.

Dijsselbloem noted that Eurozone countries will help Greece if Greeks vote "Yes" on Sunday.

-

16:28

U.S. factory orders drop 1.0% in May

The U.S. Commerce Department released factory orders data on Thursday. Factory orders in the U.S. declined 1.0% in May, missing expectations for a 0.5% fall, after a 0.7% decrease in April. April's figure was revised down from a 0.4% decline.

The drop was driven by lower orders for durable goods, which declined by 2.2% in May.

Non-durable goods orders were up 0.2% in May.

Orders for transportation equipment plunged by 6.5% in May.

-

16:03

European Central Bank decides not to raise the amount of emergency funding (ELA) on Wednesday

The European Central Bank (ECB) decided not to raise the amount of emergency funding (ELA) on Wednesday. The amount the Greek central bank can lend its banks totals around €89 billion.

The ECB wants to await the outcome of the Sunday's referendum.

The Greek government last Sunday announced its decision to shut the country's banks and to impose capital controls to avert the collapse of its financial system. Banks will be closed until July 06.

Daily cash withdrawals has been limited to 60 euros and payments and transfers abroad has been banned.

-

16:00

U.S.: Factory Orders , May -1% (forecast -0.5%)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E702mn), $1.1125/30(E1.5bn), $1.1200(E3.2bn)

USD/JPY: Y122.70($2.7bn), Y123.00($1.25bn), Y124.00($660mn)

GBP/USD: $1.5675(stg597mn)

EUR/JPY: Y136.50(E637mn)

AUD/JPY: Y95.20(A$300mn)

AUD/USD: $0.7550(A$776mn)

USD/CAD: Cad1.2400($353mn), Cad1.2525($220mn)

USD/CHF: Chf0.9330($430mn)

EUR/CHF: Chf1.0450(E271mn)

-

15:41

International Monetary Fund Managing Director Christine Lagarde: Greece should implement economic reforms before debt relief

International Monetary Fund Managing Director Christine Lagarde said in an interview with Reuters on Wednesday that Greece should implement economic reforms before debt relief.

"Given where we are, my suspicion is it would be much preferable to see a deliberate move towards reforms (and) for that to be followed through by the other side of the balance," she said.

-

15:35

-

15:32

U.S. Stocks open: Dow +0.27%, Nasdaq +0.28%, S&P +0.33%

-

15:27

Before the bell: S&P futures +0.28%, NASDAQ futures +0.33%

U.S. stock-index futures edged higher on Thursday as investors digested weaker-than-expected monthly jobs report along with weekly jobless claims.

Nikkei 20,522.5 +193.18 +0.95%

Hang Seng 26,282.32 +32.29 +0.12%

Shanghai Composite 3,912.32 -141.38 -3.49%

FTSE 6,629.77 +21.18 +0.32%

CAC 4,871.3 -11.89 -0.24%

DAX 11,180.32 -0.18 0.00%

Crude oil $57.17 (+0.40%)

Gold $1162.10 (-0.61%)

-

15:18

Sweden's central bank unexpectedly lowers its interest rate to -0.35%

Sweden's central bank unexpectedly lowered its interest rate to -0.35% from -0.25%. The central bank also extended its bond-buying programme by a further SEK45 billion with effect from September and until the end of 2015.

"The Eurozone economy is strengthening, but the past days' events in Greece have created a good deal of uncertainty. Consequences for the Eurozone, and for Sweden, are difficult to estimate," the central bank said.

-

15:13

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

JPMorgan Chase and Co

JPM

68.10

+0.04%

5.1K

McDonald's Corp

MCD

95.81

+0.05%

1.8K

Apple Inc.

AAPL

126.70

+0.08%

132.7K

Goldman Sachs

GS

210.13

+0.09%

2.0K

Citigroup Inc., NYSE

C

55.73

+0.09%

15.0K

Barrick Gold Corporation, NYSE

ABX

10.46

+0.10%

43.8K

American Express Co

AXP

78.52

+0.15%

3.0K

Google Inc.

GOOG

522.62

+0.15%

599.5K

Yahoo! Inc., NASDAQ

YHOO

39.40

+0.18%

0.2K

Travelers Companies Inc

TRV

99.50

+0.20%

931.0K

Pfizer Inc

PFE

33.76

+0.21%

125.0K

Amazon.com Inc., NASDAQ

AMZN

438.41

+0.23%

0.8K

International Business Machines Co...

IBM

164.90

+0.25%

1.0K

Wal-Mart Stores Inc

WMT

72.07

+0.26%

7.0K

Ford Motor Co.

F

15.03

+0.27%

0.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

18.45

+0.27%

52.8K

General Electric Co

GE

26.74

+0.30%

0.2K

Exxon Mobil Corp

XOM

82.62

+0.31%

2.7K

Chevron Corp

CVX

96.41

+0.33%

1.4K

Nike

NKE

109.80

+0.34%

0.2K

Walt Disney Co

DIS

115.53

+0.35%

0.2K

Verizon Communications Inc

VZ

47.17

+0.36%

0.2K

Intel Corp

INTC

30.29

+0.37%

0.6K

Cisco Systems Inc

CSCO

27.46

+0.40%

0.5K

Twitter, Inc., NYSE

TWTR

35.54

+0.40%

10.1K

Visa

V

68.13

+0.41%

3.0K

Procter & Gamble Co

PG

80.05

+0.41%

0.5K

ALTRIA GROUP INC.

MO

49.30

+0.41%

13.5K

Home Depot Inc

HD

112.55

+0.43%

5.6K

Hewlett-Packard Co.

HPQ

30.66

+0.46%

0.1K

Microsoft Corp

MSFT

44.69

+0.55%

0.2K

Starbucks Corporation, NASDAQ

SBUX

54.20

+0.58%

1.9K

UnitedHealth Group Inc

UNH

124.14

+0.62%

17.0K

Facebook, Inc.

FB

87.46

+0.63%

60.2K

AT&T Inc

T

35.91

+0.96%

31.7K

Tesla Motors, Inc., NASDAQ

TSLA

280.27

+4.13%

171.5K

The Coca-Cola Co

KO

39.50

0.00%

0.1K

ALCOA INC.

AA

11.07

0.00%

2.1K

E. I. du Pont de Nemours and Co

DD

61.20

-0.37%

16.8K

Caterpillar Inc

CAT

83.40

-0.66%

0.3K

-

15:04

U.S. unemployment rate drops to 5.3% in June, 223,000 jobs are added

The U.S. Labor Department released the labour market data on Thursday. The U.S. economy added 223,000 jobs in June, missing expectations for a rise of 230,000 jobs, after a gain of 254,000 jobs in May. May's figure was revised down from a rise of 280,000 jobs.

The strongest job gains showed the services sector. Retailers added 33,000 jobs in June, the health-care sector added 40,000, while leisure and hospitality rose by 22,000.

The manufacturing sector added only 4,000 jobs.

The U.S. unemployment rate dropped to 5.3% in June from 5.5% in May. It was the lowest level since April 2008.

Analysts had expected the unemployment rate to decline to 5.4%.

The decline was driven by fewer people were looking for work.

Average hourly earnings were flat in June, missing forecast of a 0.2% gain, after a 0.2% rise in May. May's figure was revised down from a 0.3% increase.

The labour-force participation rate plunged to 62.6% in June from 62.9% in May. It was the lowest level since October 1977.

These figures are signs that the U.S. job growth slowed. The Fed may delay to hike its interest rate due to the weak wage growth figures and low inflation.

-

15:03

Upgrades and downgrades before the market open

Upgrades:

AT&T (T) upgraded to Outperform from Market Perform at Cowen

Downgrades:

Other:

Tesla Motors (TSLA) reiterated at an Underperform at BofA/Merrill, target raised to $180 from $65

Starbucks (SBUX) reiterated at Buy at Argus, target raised to $64 from $59

DuPont (DD) reiterated at Sector Perform at RBC Capital Mkts, target lowered from $69 to $64

Verizon (VZ) initiated at Neutral at Buckingham Research, target $51

AT&T (T) initiated at Buy at Buckingham Research, target $41

-

14:42

Initial jobless claims climb by 10,000 to 281,000 in the week ending June 27

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending June 27 in the U.S. increased by 10,000 to 281,000 from 271,000 in the previous week.

Analysts had expected the number of initial jobless claims to be 270,000.

Jobless claims remained below 300,000 the 17th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims rose by 15,000 to 2,264,000 in the week ended June 20.

-

14:31

U.S.: Average workweek, June 34.5 (forecast 34.5)

-

14:30

U.S.: Initial Jobless Claims, June 281 (forecast 270)

-

14:30

U.S.: Average hourly earnings , June 0.0% (forecast 0.2%)

-

14:30

U.S.: Unemployment Rate, June 5.3% (forecast 5.4%)

-

14:30

U.S.: Nonfarm Payrolls, June 223 (forecast 230)

-

14:30

U.S.: Continuing Jobless Claims, June 2264 (forecast 2236)

-

14:24

Jobless claims in Spain decline by 94,727 in June

Spain's labour ministry release its labour market figures on Thursday. Jobless claims in Spain declined by 94,727 in June. It was the fifth consecutive decline.

Services showed a drop of 61,887 people in June, while industry and construction a combined 25,845.

There were around 4.12 million people out of work in June.

According to the National Statistics Institute (INE), the unemployment rate in Spain was 23.8% in the first quarter.

-

14:13

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar on the uncertainty over Greece's debt crisis

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Trade Balance May -4.13 Revised From -3.89 -2.2 -2.75

06:00 United Kingdom Nationwide house price index, y/y June 4.6% 4.3% 3.3%

06:00 United Kingdom Nationwide house price index June 0.2% Revised From 0.3% 0.5% -0.2%

08:30 United Kingdom PMI Construction June 55.9 56.5 58.1

09:00 Eurozone Producer Price Index, MoM May -0.1% 0.1% 0%

09:00 Eurozone Producer Price Index (YoY) May -2.2% -2.0% -2%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. labour market data. The U.S. unemployment rate is expected to decline to 5.4% in June from 5.5% in May.

The U.S. economy is expected to add 232,000 jobs in June, after adding 280,000 jobs in May.

The number of initial jobless claims in the U.S. is expected to decrease by 1,000 to 270,000 last week.

Factory orders in the U.S. are expected to fall 0.5% in May after a 0.4% decline in April.

The euro traded mixed against the U.S. dollar on the uncertainty over Greece's debt crisis. Greek Prime Minister Alexis Tsipras said in a speech on Wednesday that Greeks should vote "no" in Sunday's referendum. He added that "no" would not mean that Greece have to leave the Eurozone.

The head of the Eurogroup Jeroen Dijsselboem said after the telephone conference on Wednesday that there is no reason to continue the debt talks before the referendum on Sunday.

Greek Finance Minister Yannis Varoufakis signalled on Thursday that he will resign if Greeks vote "Yes" in the referendum on Sunday.

Earlier, he said that a deal with Greece's creditors on Monday.

Meanwhile, the producer price inflation in the Eurozone improved slightly in May. Eurozone's producer price index was flat in May, missing expectations for a 0.1% increase, after a 0.1% decline in April.

On a yearly basis, Eurozone's producer price index dropped 2.0% in May, in line with expectations, after a 2.2% fall in April.

Eurozone's producer prices excluding energy fell 0.3% year-on-year in May. Energy prices dropped 6.4%.

The European Central Bank's (ECB) its minutes of March meeting on Thursday. According to the minutes, the ECB said in its minutes that there is no need to increase its bond-buying programme. The central bank added that it could adjust its bond-buying programme if needed.

The ECB President Mario Draghi is scheduled to speak at 15:10 GMT.

The British pound traded lower against the U.S. dollar after the release of the construction PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 58.1 in June from 55.9 in May, exceeding expectations for a rise to 56.5.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a rise in the house-building sector, but both commercial and civil engineering activity also increased.

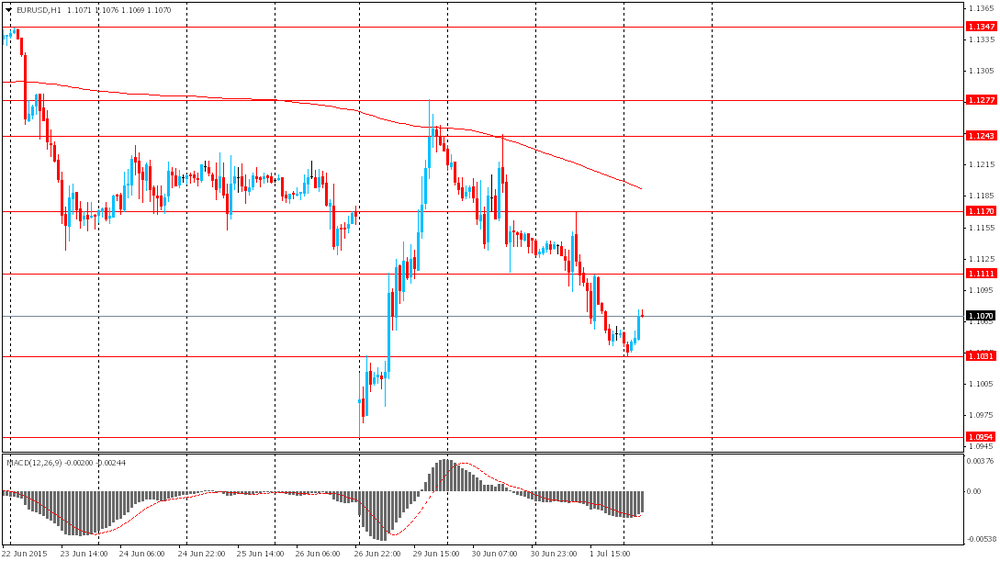

EUR/USD: the currency pair traded mixed

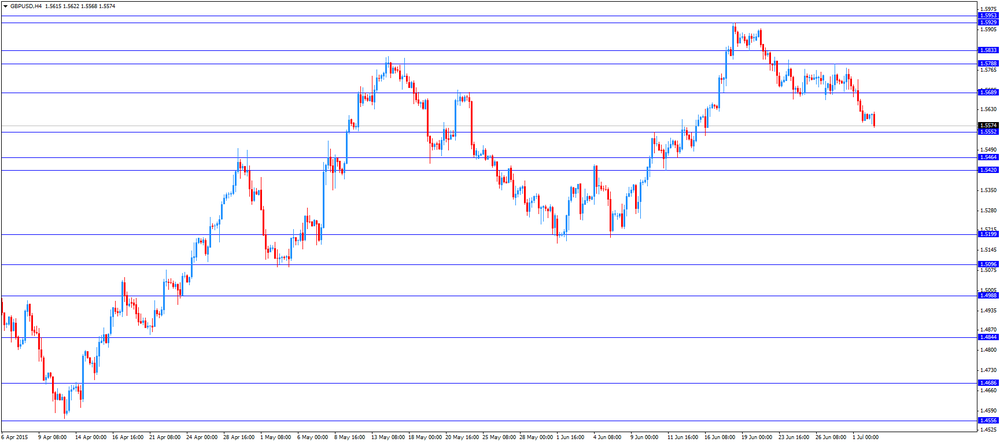

GBP/USD: the currency pair declined to $1.5568

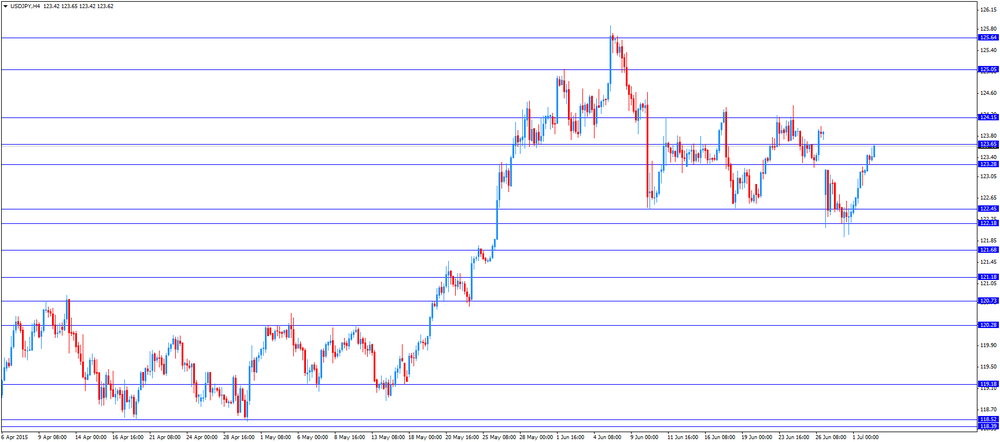

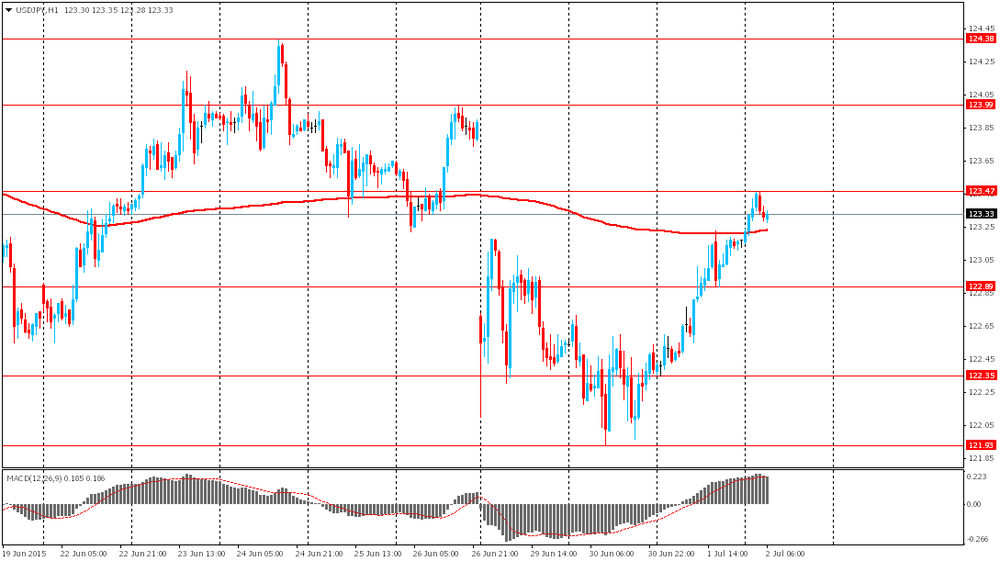

USD/JPY: the currency pair rose to Y123.65

The most important news that are expected (GMT0):

12:30 U.S. Average hourly earnings June 0.3% 0.2%

12:30 U.S. Initial Jobless Claims June 271 270

12:30 U.S. Nonfarm Payrolls June 280 230

12:30 U.S. Unemployment Rate June 5.5% 5.4%

14:00 U.S. Factory Orders May -0.4% -0.5%

15:10 Eurozone ECB President Mario Draghi Speaks

-

14:00

Orders

EUR/USD

Offers 1.1080 1.1120 1.1145-50 1.1180 1.1200 1.1220-25 1.1245 1.1280 1.1300

Bids 1.1050 1.1030 1.1000 1.0980 1.0960 1.0930 1.0900

GBP/USD

Offers 1.5725 1.5750-55 1.5780 1.5800 1.5820-25 1.5850 1.5875 1.5900

Bids 1.5670-75 1.5650 1.5630 1.5600 1.5585 1.5570 1.5550

EUR/GBP

Offers 0.7100 0.7125-30 0.7150 0.7170 0.7180-85 0.7200

Bids 0.7075 0.7060 0.7040 0.7020 0.7000 0.6985 0.6965 0.6950

EUR/JPY

Offers 136.70 137.00 137.30 137.50 137.80 138.00 138.50

Bids 136.30 136.00 135.80 135.60 135.20 135.00 134.85

USD/JPY

Offers 123.70-75 124.00 124.20 124.50 124.80 125.00

Bids 123.20 123.00 122.80 122.50 122.25 122.00 121.80 121.65 121.50 121.00

AUD/USD

Offers 0.7640 0.7660 0.7680 0.7700 0.7725-30 0.7750-60 0.7785 0.780

Bids 0.7600 0.7585 0.7550 0.7530 0.7500

-

12:00

European stock markets mid session: stocks traded slightly lower on the uncertainty over Greece's debt crisis

Stock indices traded slightly lower on the uncertainty over Greece's debt crisis. Greek Prime Minister Alexis Tsipras said in a speech on Wednesday that Greeks should vote "no" in Sunday's referendum. He added that "no" would not mean that Greece have to leave the Eurozone.

The head of the Eurogroup Jeroen Dijsselboem said after the telephone conference on Wednesday that there is no reason to continue the debt talks before the referendum on Sunday.

Greek Finance Minister Yannis Varoufakis signalled on Thursday that he will resign if Greeks vote "Yes" in the referendum on Sunday.

Earlier, he said that a deal with Greece's creditors on Monday.

Meanwhile, the producer price inflation in the Eurozone improved slightly in May. Eurozone's producer price index was flat in May, missing expectations for a 0.1% increase, after a 0.1% decline in April.

On a yearly basis, Eurozone's producer price index dropped 2.0% in May, in line with expectations, after a 2.2% fall in April.

Eurozone's producer prices excluding energy fell 0.3% year-on-year in May. Energy prices dropped 6.4%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 58.1 in June from 55.9 in May, exceeding expectations for a rise to 56.5.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a rise in the house-building sector, but both commercial and civil engineering activity also increased.

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices declined 0.2% in June, missing expectations for a 0.5 percent rise, after a 0.2% rise in May. May's figure was revised down from a 0.3% increase.

On a yearly basis, house prices fell to 3.3% in June from 4.6 percent in May, missing forecast of a 4.3% gain.

Current figures:

Name Price Change Change %

FTSE 100 6,608.4 -0.19 0.00%

DAX 11,162.78 -17.72 -0.16 %

CAC 40 4,874.32 -8.87 -0.18 %

-

11:47

Greek Finance Minister Yannis Varoufakis signals he will resign if Greeks vote “Yes” in the referendum on Sunday

Greek Finance Minister Yannis Varoufakis signalled on Thursday that he will resign if Greeks vote "Yes" in the referendum on Sunday.

Earlier, he said that a deal with Greece's creditors on Monday.

-

11:37

Eurozone's producer price index is flat in May

Eurostat released its producer price index for the Eurozone on Thursday. Eurozone's producer price index was flat in May, missing expectations for a 0.1% increase, after a 0.1% decline in April.

On a yearly basis, Eurozone's producer price index dropped 2.0% in May, in line with expectations, after a 2.2% fall in April.

Eurozone's producer prices excluding energy fell 0.3% year-on-year in May. Energy prices dropped 6.4%.

Intermediate goods prices declined 0.6% in May, non-durable consumer goods prices decreased by 1.1%, and capital goods prices rose 0.7%, while durable consumer goods prices climbed 0.9%.

-

11:23

Nationwide: UK house prices decline 0.2% in June

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices declined 0.2% in June, missing expectations for a 0.5 percent rise, after a 0.2% rise in May. May's figure was revised down from a 0.3% increase.

On a yearly basis, house prices fell to 3.3% in June from 4.6 percent in May, missing forecast of a 4.3% gain.

"House price growth continues to outpace earnings, but the gap is closing, helped by a pickup in annual wage growth, which moved up to 2.7% in the three months to April from 1.9% at the start of the year," Nationwide's chief economist, Robert Gardner, said.

-

11:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E702mn), $1.1125/30(E1.5bn), $1.1200(E3.2bn)

USD/JPY: Y122.70($2.7bn), Y123.00($1.25bn), Y124.00($660mn)

GBP/USD: $1.5675(stg597mn)

EUR/JPY: Y136.50(E637mn)

AUD/JPY: Y95.20(A$300mn)

AUD/USD: $0.7550(A$776mn)

USD/CAD: Cad1.2400($353mn), Cad1.2525($220mn)

USD/CHF: Chf0.9330($430mn)

EUR/CHF: Chf1.0450(E271mn)

-

11:08

UK construction PMI climbs to 58.1 in June

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 58.1 in June from 55.9 in May, exceeding expectations for a rise to 56.5.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a rise in the house-building sector, but both commercial and civil engineering activity also increased.

"The extent of the recent rise in construction optimism is partly down to relief that pre-election uncertainty has now passed, but it also suggests that firms are infused with confidence that underlying demand will continue to recover," an economist at financial data company Markit, Tim Moore, said.

-

11:00

Eurozone: Producer Price Index, MoM , May 0.0% (forecast 0.1%)

-

11:00

Eurozone: Producer Price Index (YoY), May -2% (forecast -2.0%)

-

10:52

Moody's downgrades Greece's government bond rating to Caa3

Moody's Investors Service has downgraded Greece's government bond rating to Caa3 from Caa2 on Wednesday. The agency placed the rating on review for further downgrade.

Moody's said that it cut the rating because the probability of support continuing to be provided over the medium-term has fallen since April.

"Moody's believes that without ongoing support from official creditors, Greece will default on its privately-held debt. Events of recent months have illustrated the distance between what Greece's official creditors will demand as a condition of continued support over the coming years, and what Greece's institutions are able to do to meet those demands with further meaningful economic and fiscal reforms. This creates significant difficulties for the achievement of a long-lasting support agreement," the agency noted.

Moody's added that a "no" vote in the referendum would increase risk of the exit from the Eurozone which could lead to significant losses on private sector creditors.

-

10:46

United Kingdom: PMI Construction, June 58.1 (forecast 56.5)

-

10:37

Head of the Eurogroup Jeroen Dijsselboem: there is no reason to continue the debt talks before the referendum on Sunday.

The head of the Eurogroup Jeroen Dijsselboem said that there is no reason to continue the debt talks before the referendum on Sunday.

"There will be no talks in the coming days, either at Eurogroup level or between the Greek authorities and the institutions on proposals or financial arrangements. We will simply await now the outcome of the referendum on Sunday and take into account the outcome of that referendum," he said.

-

10:27

German Chancellor Angela Merkel: Greece should implement far-reaching reforms to outcome it economic problems

German Chancellor Angela Merkel said on Wednesday that Greece should implement far-reaching reforms to outcome it economic problems.

"We agree that the doors for talks will stay open. But of course a situation is needed where far-reaching reforms get tackled in order to achieve sustainable growth," she said.

Merkel lauded Italy's effort to implement economic reforms.

Asked whether there is a disagreement between Germany and France over when to continue debt talks with Greece, she said that there is "no difference in opinion that talks must be conducted at a certain point and that's what counts".

-

10:14

Australia’s trade deficit narrows to A$2.75 billion in May

The Australian Bureau of Statistics released its trade data. Australia's trade deficit narrowed to A$2.75 billion in May from A$4.13 billion in April, missing expectations for a decline to a deficit of A$2.2 billion.

April's figure was revised down from a deficit of A$3.89 billion.

Exports rose by 1% in May, while imports dropped by 4%.

-

09:11

Oil: prices declined amid Greece crisis

West Texas Intermediate futures for August delivery advanced to $57.12 (+0.28%) after yesterday's decline. This decline was caused by data from the Energy Information Administration, which showed that U.S. crude inventories rose by 2.4 million barrels in the week ending June the 26th (the first weeks increase since April). Meanwhile Brent crude for August advanced to $62.28 (+0.44%) a barrel.

The stockpiles data came in after the previous report showed that U.S. oil production rose by 0.2%. Supply from the Organization of the Petroleum Exporting Countries rose to a three-year high of 31.60 million barrels a day in June from 31.30 million barrels a day in May.

The Energy Information Administration also reported that distillate stockpiles, which include diesel and heating oil, rose 392,000 barrels. Gasoline stocks fell 1.8 million barrels.

-

09:08

Gold declined slightly

Gold is currently at $1,166.90 (-0.21%) an ounce. Investors put concerns over Greece aside and concentrated on today's U.S. payrolls report. Investors will be looking for clues to the timing of the data-determined rate hike by the Fed. Strong data would mean that there is a continuous improvement in labor market, which is required to justify a rate hike.

Gold may become more attractive if Greece leaves the euro zone or a similar scenario happens in other European countries.

-

09:06

Global Stocks: U.S. indices posted moderate gains

U.S. stocks advanced on Wednesday, though by the end of the session they retreated from earlier highs amid declines in energy stocks and absence of clear progress in Greece's debt crisis.

The Dow Jones Industrial Average rose by 138.40 points, or 0.8%, to 17757.91. The Nasdaq Composite added 26.26 points, or 0.5%, to 5013.12 and the S&P 500 index gained 14.31 points, or 0.7%, to 2077.42 (data, which showed an increase of U.S. crude stockpiles, pushed energy shares down and wiped out some of the gains of the index).

Investors are waiting for Greek referendum (July the 5th) and U.S. payrolls data (Thursday, 12:30 GMT). Earlier reports have shown that U.S. private employers added 237,000 jobs in June, the best result since December.

This morning in Asia Shanghai Composite Index declined by 1.94%, or 78.57 points, to 3,975.12. Hong Kong Hang Seng gained 0.45%, or 118.44 points, to 26,368.47. Meanwhile the Nikkei added 1.12%, or 227.86 points, to 20,557.18.Asian stocks mostly ignored concerns over Greece and advanced ahead of U.S. payrolls data anticipating a strong report. Shanghai Composite continued falling. It has lost almost a quarter since a June 12 peak.

-

08:59

Foreign exchange market. Asian session: the euro remained under pressure

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia Trade Balance May -4.13 -2.2 -2.75

06:00 United Kingdom Nationwide house price index, y/y June 4.6% 4.3% 3.3%

06:00 United Kingdom Nationwide house price index June 0.3% 0.5% -0.2%The euro remains under pressure as investors await Greece's referendum, which will be held this Sunday. A survey conducted June 28-30 and published in Efimerida ton Syntakton showed that 54% of Greeks intend to say 'no' to lenders' conditions and 33% plan to vote 'yes'. However it's worth taking a look at polls conducted before and after the implementation of capital controls. Before this decision 57% of respondents said they would oppose lenders' conditions and 30% would agree. After the implementation of capital controls the numbers changed to 46% and 37% respectively.

Strong U.S. employment data would put additional pressure on the single currency. Yesterday ADP reported that employers added 7,000 jobs to 237,000 vs expectations of an increase to 220,000.

The Australian dollar declined after weak trade balance data. The Australian Bureau of Statistics reported that the country's trade balance expanded to -2.75 billion AUD in May vs -2.2 billion AUD expected. Exports rose by 1%, while imports declined by 4%.

EUR/USD: the pair traded around $1.1050 this morning

USD/JPY: the pair advanced to Y123.45

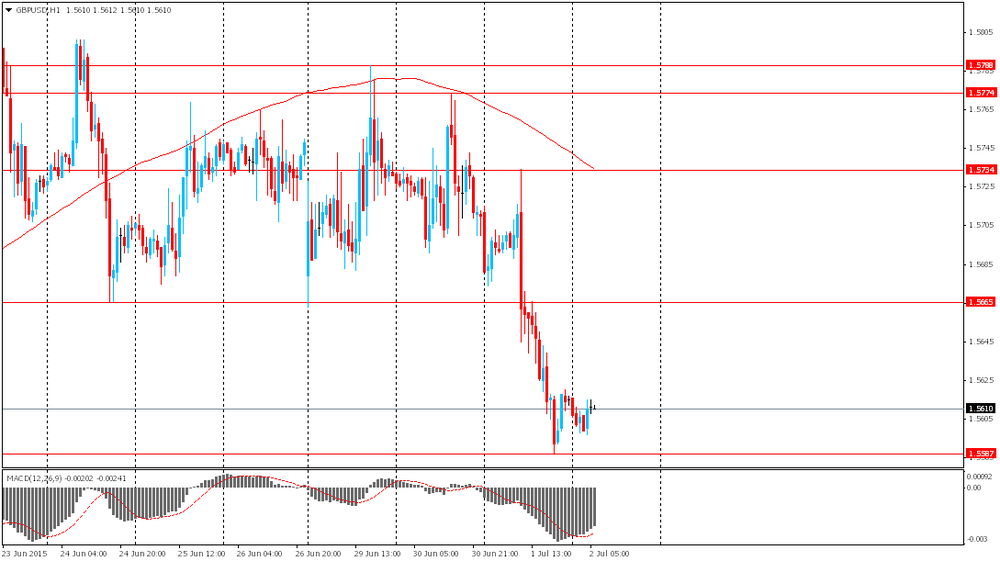

GBP/USD: the pair traded around $1.5600-15

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom PMI Construction June 55.9 56.5

09:00 Eurozone Producer Price Index, MoM May -0.1% 0.1%

09:00 Eurozone Producer Price Index (YoY) May -2.2% -2.0%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 U.S. Average workweek June 34.5 34.5

12:30 U.S. Continuing Jobless Claims June 2247 2236

12:30 U.S. Average hourly earnings June 0.3% 0.2%

12:30 U.S. Initial Jobless Claims June 271 270

12:30 U.S. Nonfarm Payrolls 280 230

12:30 U.S. Unemployment Rate June 5.5% 5.4%

14:00 U.S. Factory Orders May -0.4% -0.5%

15:10 Eurozone ECB President Mario Draghi Speaks

23:30 Australia AIG Services Index June 49.6 -

08:27

Options levels on thursday, July 2, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1205 (3316)

$1.1161 (1444)

$1.1125 (1646)

Price at time of writing this review: $1.1062

Support levels (open interest**, contracts):

$1.1011 (3326)

$1.0979 (13187)

$1.0939 (2928)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 61494 contracts, with the maximum number of contracts with strike price $1,1500 (5262);

- Overall open interest on the PUT options with the expiration date July, 2 is 88394 contracts, with the maximum number of contracts with strike price $1,1000 (13187);

- The ratio of PUT/CALL was 1.44 versus 1.44 from the previous trading day according to data from July, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.5900 (625)

$1.5800 (1424)

$1.5701 (695)

Price at time of writing this review: $1.5604

Support levels (open interest**, contracts):

$1.5499 (662)

$1.5400 (1744)

$1.5300 (2151)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 23040 contracts, with the maximum number of contracts with strike price $1,5500 (2537);

- Overall open interest on the PUT options with the expiration date July, 2 is 27089 contracts, with the maximum number of contracts with strike price $1,5300 (2151);

- The ratio of PUT/CALL was 1.18 versus 1.18 from the previous trading day according to data from July, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:03

United Kingdom: Nationwide house price index, y/y, June 3.3% (forecast 4.3%)

-

08:02

United Kingdom: Nationwide house price index , June -0.2% (forecast 0.5%)

-

04:05

Nikkei 225 20,568.57 +239.25 +1.18 %, Hang Seng 26,355.78 +105.75 +0.40 %, Shanghai Composite 4,064.28 +10.58 +0.26 %

-

03:31

Australia: Trade Balance , May -2.75 (forecast -2.2)

-

00:32

Commodities. Daily history for Jul 1’2015:

(raw materials / closing price /% change)

Oil 56.87 -0.16%

Gold 1,167.80 -0.13%

-

00:31

Stocks. Daily history for Jul 1’2015:

(index / closing price / change items /% change)

S&P/ASX 200 5,515.7 +56.69 +1.04%

TOPIX 1,636.41 +6.01 +0.37%

SHANGHAI COMP 4,053.7 -223.52 -5.23%

HANG SENG 26,250.03 +283.05 +1.09%

FTSE 100 6,608.59 +87.61 +1.34 %

CAC 40 4,883.19 +92.99 +1.94 %

Xetra DAX 11,180.5 +235.53 +2.15 %

S&P 500 2,077.42 +14.31 +0.69 %

NASDAQ Composite 5,013.12 +26.26 +0.53 %

Dow Jones 17,757.91 +138.40 +0.79 %

-

00:30

Currencies. Daily history for Jul 1’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1053 -0,81%

GBP/USD $1,5615 -0,61%

USD/CHF Chf0,9478 +1,39%

USD/JPY Y123,17 +0,63%

EUR/JPY Y136,15 -0,18%

GBP/JPY Y192,32 +0,02%

AUD/USD $0,7647 -0,72%

NZD/USD $0,6733 -0,56%

USD/CAD C$1,2583 +0,75%

-

00:01

Schedule for today, Thursday, Jul 2’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Trade Balance May -3.89 -2.2

06:00 United Kingdom Nationwide house price index, y/y June 4.6% 4.2%

06:00 United Kingdom Nationwide house price index June 0.3% 0.5%

08:30 United Kingdom PMI Construction June 55.9 56.5

09:00 Eurozone Producer Price Index, MoM May -0.1% 0.1%

09:00 Eurozone Producer Price Index (YoY) May -2.2% -2.0%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 U.S. Average workweek June 34.5 34.5

12:30 U.S. Continuing Jobless Claims June 2247 2233

12:30 U.S. Average hourly earnings June 0.3% 0.2%

12:30 U.S. Initial Jobless Claims June 271 270

12:30 U.S. Nonfarm Payrolls 280 232

12:30 U.S. Unemployment Rate June 5.5% 5.4%

14:00 U.S. Factory Orders May -0.4% -0.5%

15:10 Eurozone ECB President Mario Draghi Speaks

23:30 Australia AIG Services Index June 49.6

-