Noticias del mercado

-

23:59

Schedule for today, Wednesday, Jul 1’2015:

(time / country / index / period / previous value / forecast)

01:00 China Manufacturing PMI June 50.2 50.3

01:00 China Non-Manufacturing PMI June 53.2

01:30 Australia Building Permits, m/m May -4.4% 1%

01:35 Japan Manufacturing PMI (Finally) June 50.9 49.9

01:45 China HSBC Manufacturing PMI (Finally) June 49.2

07:30 Switzerland Manufacturing PMI June 49.4 50.1

07:50 France Manufacturing PMI (Finally) June 49.4 50.5

07:55 Germany Manufacturing PMI (Finally) June 51.1 51.9

08:00 Eurozone Manufacturing PMI (Finally) June 52.2 52.5

08:30 United Kingdom Purchasing Manager Index Manufacturing June 52.0 52.5

09:00 Eurozone Eurogroup Meetings

09:30 United Kingdom BOE Financial Stability Report

09:30 United Kingdom BOE Gov Mark Carney Speaks

11:00 U.S. MBA Mortgage Applications June 1.6%

12:00 Canada Bank holiday

12:15 U.S. ADP Employment Report June 201 217

13:45 U.S. Manufacturing PMI (Finally) June 54.0 53.4

14:00 U.S. Construction Spending, m/m May 2.2% 0.6%

14:00 U.S. ISM Manufacturing June 52.8 53.1

14:30 U.S. Crude Oil Inventories June -4.934

20:45 U.S. Total Vehicle Sales, mln June 17.8 17.2

-

21:00

Dow +0.28% 17,645.27 +48.92 Nasdaq +0.70% 4,993.13 +34.66 S&P +0.44% 2,066.78 +9.14

-

20:20

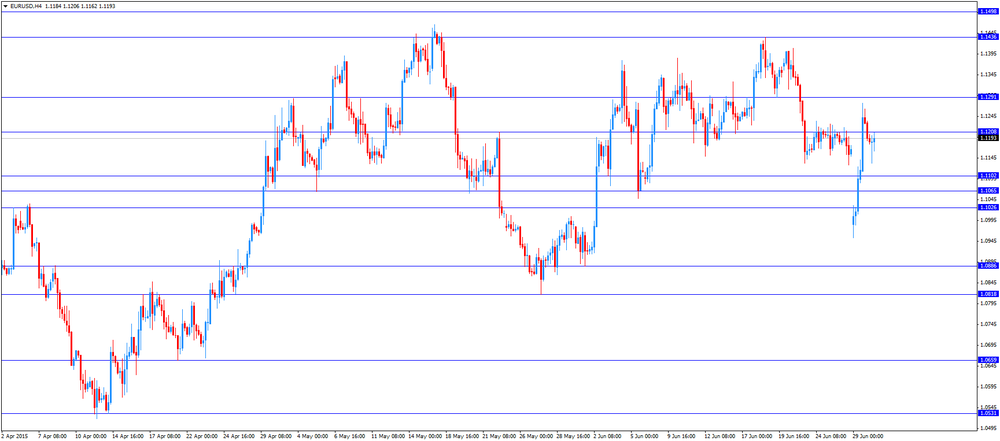

American focus: the dollar rose significantly against the Swiss franc

The dollar strengthened against the euro sharply, recouping all the previously lost ground, and updating the maximum session. Experts say this is due to an increased demand for the greenback at the end of the quarter, as well as news on Greece. Athens almost certainly not pay today IMF debt of € 1.6 billion. At midnight expires and validity of the current program of financial aid to Greece. Meanwhile, today gave Greece a new package of proposals to creditors, including the launch of a 2-year program of financial assistance to the parallel debt restructuring. This program is supposed to be implemented within the framework of ESM and fully cover the country's needs in financing. This proposal is not expected to participate IMF was sent to Brussels, and the latest reports, this evening Eurogroup conference call. In addition, the media reported that Greece appealed to creditors with a request to extend the validity of the second program to avoid default. However, German Chancellor Angela Merkel on Tuesday expressed skepticism about the possibility of a deal between creditors and Greece at the last moment. Merkel said she sees no reliable signal for it and can accurately claim that the validity of the current aid program expires in the night from Tuesday to Wednesday. "I can only repeat what I said yesterday. Duration of the aid program expires today at midnight Central European Time," - she said. - I do not know of any other reliable signals. "She added that Berlin is open to talks with Greece after Tuesday, when it's the end of the term of the tranche of European aid programs.

The dollar also provided data on consumer confidence. Recall index of US consumer confidence from the Conference Board rose in June to the level of 101.4 points versus 94.6 points in May (revised from 95.4 points). Economists had expected the index was 97.1 points. The report said that the expectations index rose to 94.6 in June from 86.2 in May, while the current situation index rose to 111.6 points from 107.1 points.

The Canadian dollar fell close to 100 points against its US counterpart, reaching a minimum at the same time from June 8. The pressure on the currency was weaker GDP data. Real gross domestic product in Canada fell by 0.1% in April, the fourth consecutive monthly noting a decrease. Reduced output in industries producing goods outweighed the increase in the service sector. Production of goods decreased by 0.8% in April, down a fourth consecutive month, primarily by reducing the mining, quarrying and oil and gas. The decrease was also recorded in the manufacturing sector, communal services and construction. By contrast, the sector of agriculture and forestry increased. Release service industries in April noted an increase for the third month in a row, they rose 0.3%. The gain in April led the trade. There were also marked increases in the public sector, which combines education, health and public administration, as well as services in the accommodation and food, and professional services. On the other hand, there is a noticeable decline in the financial and insurance sector, and retailing.

The Swiss franc continued to fall against the dollar, losing all positions earned during yesterday's session. Traders say the dollar is currently in high demand as a safe haven. Meanwhile, the franc is cheaper on fears of another SNB intervention in the case of the further growth of the currency against the background of uncertainty about Greece. Also on the franc under pressure as previously reported. As previously reported, the economic sentiment in Switzerland unexpectedly eased in June to its lowest level in three and a half years, mainly due to the negative performance of the industrial sector. The index of leading economic indicators from the KOF fell to 89.7 from a level of 92.7 in May, which was revised up from 93.1. Economists had expected the index to rise for the second month in a row to a higher level of 93.6. The last reading was the lowest since December 2011, when the index was 87.2. "The outlook for the Swiss economy, according to the indicator, have become more negative in the coming months," said KOF. Negative sentiment manifested in almost all industrial categories with the largest negative contribution coming from the sector of metal and wood.

-

18:16

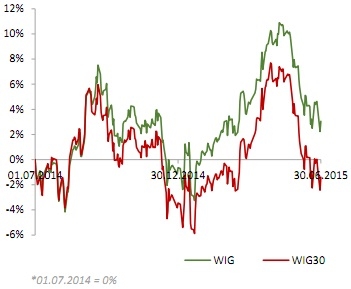

WSE: Session Results

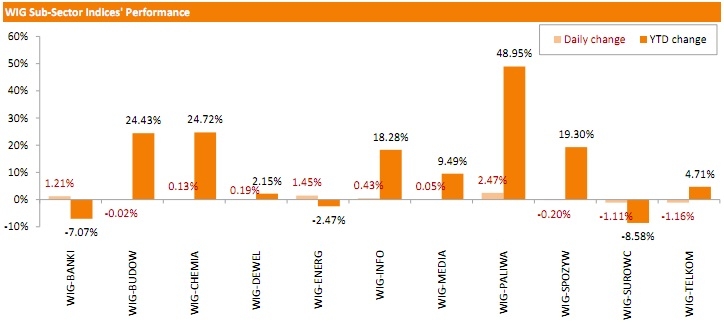

Polish equity market demonstrated an upward tendency on Tuesday. The broad market measure, the WIG Index, added 0.80%. Oil and gas stocks (+2.47%) and utilities names (+1.45%) performed best within the WIG Index, while telecommunications (-1.16%) and materials (-1.11%) sectors were the weakest performers.

The large-cap stocks' measure, the WIG30 Index, outperformed the broad market, returning 1.06%. BZ WBK (WSE: BZW), PGNIG (WSE: PGN), PKN ORLEN (WSE: PKN) and ENERGA (WSE: ENG) were among the best performers in the WIG30 Index, recording gains of 2.43%-2.79%. On the other side of the ledger, BOGDANKA (WSE: LWB) continued to fall (-3.98%), hitting a new historical low of PLN 51.85. It was followed by KERNEL (WSE: KER) and SYNTHOS (WSE: SNS), declining 1.67% and 1.27% respectively.

-

18:04

European stocks close: stocks closed lower despite hopes for a last-minute deal between Athens and its lenders

Stock indices closed lower despite hopes for a last-minute deal between Athens and its lenders. According to a statement from the office of the Prime Minister Alexis Tsipras, the Greek government has requested a 2-year bailout programme from the European Stability Mechanism (ESM) to fully cover its financing needs, including restructuring of debt.

Athens said that it will continue debt talks seeking a "viable agreement" within the Eurozone.

The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that Eurozone finance ministers will have a teleconference today at 17:00 GMT to discuss the latest proposals from Greece to keep the bailout negotiations going.

"Extraordinary Eurogroup teleconference tonight 19:00 Brussels time to discuss official request of Greek government received this afternoon", he twitted.

Meanwhile, the economic data from the Eurozone was mixed. The preliminary consumer price inflation in the Eurozone fell to an annual rate of 0.2% in June from 0.3% in May, in line with expectations.

The decrease was driven by lower energy prices and by a softer increase in food and services prices.

Eurozone's unemployment rate remained unchanged at 11.1% in May, in line with expectations. It was the lowest level since March 2012.

The final U.K. GDP expanded at 0.4% in the first quarter, beating May's estimate of a 0.3% gain, after a 0.8% rise in the fourth quarter.

The upward revision was driven by methodological changes in construction.

On a yearly basis, the revised U.K. GDP rose 2.9% in the first quarter, eating May's estimate of a 2.4% increase, after a 3.4% gain in the fourth quarter.

The U.K. current account deficit narrowed to £26.5 billion in the first quarter from £28.93 billion in the fourth quarter. The fourth quarter's figure was revised down from a deficit of £25.3 billion.

Analysts had expected the current account deficit to decrease to £23.25 billion.

The first quarter's current account deficit amounted to 5.8% of GDP, after 6.4% of GDP in the fourth quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,520.98 -99.50 -1.50 %

DAX 10,944.97 -138.23 -1.25 %

CAC 40 4,790.2 -79.62 -1.63 %

-

18:00

European stocks closed: FTSE 100 6,520.98 -99.50 -1.50% CAC 40 4,790.2 -79.62 -1.63% DAX 10,944.97 -138.23 -1.25%

-

17:42

Oil prices rise ahead of the release of U.S. crude oil inventories data

Oil prices rose ahead of the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

Hopes for a last-minute deal between Athens and its lenders supported oil prices. According to a statement from the office of the Prime Minister Alexis Tsipras, the Greek government has requested a 2-year bailout programme from the European Stability Mechanism (ESM) to fully cover its financing needs, including restructuring of debt.

Athens said that it will continue debt talks seeking a "viable agreement" within the Eurozone.

The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that Eurozone finance ministers will have a teleconference today at 17:00 GMT to discuss the latest proposals from Greece to keep the bailout negotiations going.

"Extraordinary Eurogroup teleconference tonight 19:00 Brussels time to discuss official request of Greek government received this afternoon", he twitted.

Traders also expect the results of talks on the Iranian nuclear program. Talks will continue as it is unlikely that all issues can be resolved before June 30.

WTI crude oil for August delivery increased to $58.81 a barrel on the New York Mercantile Exchange.

Brent crude oil for August rose to $63.01 a barrel on ICE Futures Europe.

-

17:39

Wall Street. Major U.S. stock-indexes rose

Major U.S. stocks rose on Tuesday, rebounding sharply from Monday's losses, as investors hoped Greece would strike a last-minute deal to avoid an exit from the euro zone. Greece is hours away from defaulting on a 1.6 billion euro repayment to the International Monetary Fund. The European Commission made its final push to try to persuade Greek Prime Minister Alexis Tsipras to accept a bailout deal he has rejected before.

Most of Dow stocks in positive area (21 of 30). Top looser Pfizer Inc. (PFE, -0.51%). Top gainer - The Walt Disney Company (DIS, +1.11).

Almost all of S&P index sectors in positive area. Top gainer - Financial (+0,6%). Top looser - Utilities (-0.2%).

At the moment:

Dow 17570.00 +50.00 +0.29%

S&P 500 2058.75 +8.25 +0.40%

Nasdaq 100 4397.25 +19.25 +0.44%

10-year yield 2.34% +0.01

Oil 58.69 +0.36 +0.62%

Gold 1168.70 -10.30 -0.87%

-

17:27

Gold traded lower on a stronger U.S. dollar

Gold traded lower on a stronger U.S. dollar. The greenback rose against the other major currencies after the release of the better-than-expected U.S. consumer confidence index. The Conference Board's consumer confidence index for the U.S. rose to 101.4 in June from 94.6 in May, exceeding expectations for a rise to 97.2. May's figure was revised down from 95.4.

The increase was driven by the better outlook for both current conditions and expectations for the next six months.

"Over the past two months, consumers have grown more confident about the current state of business and employment conditions. Overall, consumers are in considerably better spirits and their renewed optimism could lead to a greater willingness to spend in the near-term," the director of economic indicators at The Conference Board, Lynn Franco, said.

The Greek debt crisis remained in focus. According to a statement from the office of the Prime Minister Alexis Tsipras, the Greek government has requested a 2-year bailout programme from the European Stability Mechanism (ESM) to fully cover its financing needs, including restructuring of debt.

Athens said that it will continue debt talks seeking a "viable agreement" within the Eurozone.

The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that Eurozone finance ministers will have a teleconference today at 17:00 GMT to discuss the latest proposals from Greece to keep the bailout negotiations going.

"Extraordinary Eurogroup teleconference tonight 19:00 Brussels time to discuss official request of Greek government received this afternoon", he twitted.

August futures for gold on the COMEX today declined to 1168.20 dollars per ounce.

-

17:07

U.S. consumer confidence index jumps to 101.4 in June

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index rose to 101.4 in June from 94.6 in May, exceeding expectations for a rise to 97.2. May's figure was revised down from 95.4.

The increase was driven by the better outlook for both current conditions and expectations for the next six months.

The present conditions index climbed to 111.6 in June from 107.1 in May.

The Conference Board's consumer expectations index for the next six months increased to 94.6 in June from 86.2 in May.

"Over the past two months, consumers have grown more confident about the current state of business and employment conditions. Overall, consumers are in considerably better spirits and their renewed optimism could lead to a greater willingness to spend in the near-term," the director of economic indicators at The Conference Board, Lynn Franco, said.

The percentage of consumers expecting more jobs in the coming months was up to 17.8% in June from 14.7% in May.

-

16:52

Head of the Eurogroup Jeroen Dijsselbloem: Eurozone finance ministers will have a teleconference today at 17:00 GMT

The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that Eurozone finance ministers will have a teleconference today at 17:00 GMT to discuss the latest proposals from Greece to keep the bailout negotiations going.

"Extraordinary Eurogroup teleconference tonight 19:00 Brussels time to discuss official request of Greek government received this afternoon", he twitted.

-

16:37

Greek government requests a 2-year bailout programme from the European Stability Mechanism

According to a statement from the office of the Prime Minister Alexis Tsipras, the Greek government has requested a 2-year bailout programme from the European Stability Mechanism (ESM) to fully cover its financing needs, including restructuring of debt.

Athens said that it will continue debt talks seeking a "viable agreement" within the Eurozone.

-

16:17

Chicago purchasing managers' index rises to 49.4 in June

The Institute for Supply Management released its Chicago purchasing managers' index on Tuesday. The index climbed to 49.4 in June from 46.2 in May, missing expectations for an increase to 50.1.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The rise was partly driven by an increase in new orders. The new orders index was up to 51.7 in May from 47.5 in May.

The production index jumped by 8.7% in June, while the employment index declined to its lowest level since November of 2009.

-

16:04

Preliminary consumer prices in Italy increase 0.1% in June

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Tuesday. Preliminary consumer prices in Italy increased 0.1% in June, after a 0.1% gain May.

Services prices related to transport increased 0.2% in June, while services prices to recreation, including repair and personal care, gained 0.4%.

On a yearly basis, consumer prices climbed 0.1% in June, after a 0.1% increase in May.

Services prices related to transport were up at an annual rate of 0.3% in June, tobacco prices rose 4.0%, while non energy industrial goods - durables prices were flat.

-

16:00

U.S.: Consumer confidence , June 101.4 (forecast 97.2)

-

15:50

German Chancellor Angela Merkel says she has heard nothing about any progress in debt talks with Greece

German Chancellor Angela Merkel said in Berlin on Tuesday that she has heard nothing about any progress in debt talks with Greece. She added that Greece's bailout program expires at midnight.

Merkel pointed out that debt talks can be continued.

"The door is open for talks - that is all I can say at this hour," she said.

-

15:45

U.S.: Chicago Purchasing Managers' Index , June 49.4 (forecast 50.1)

-

15:34

S&P/Case-Shiller home price index rises 4.9% in April

The S&P/Case-Shiller home price index increased 4.9% in April, missing expectations for a 5.5% rise, after a 4.9% gain in March.

San Francisco and Denver were the largest contributors to the rise, where prices climbed by 10.0% and 10.3%, respectively.

"Home prices continue to rise across the country, but the pace is not accelerating," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index climbed by a seasonally adjusted 0.3% in April, after a 1.0% rise in March.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:32

U.S. Stocks open: Dow +0.69%, Nasdaq +0.75%, S&P +0.65%

-

15:31

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E809mn), $1.1050(E663mn), $1.1150/60(E430mn), $1.1185(E446mn), $1.1200(E465mn)

USD/JPY: Y122.00($2.0bn)

USD/CAD: Cad1.2250($315mn), Cad1.2330($337mn), Cad1.2400($264mn)

AUD/USD: $0.7630(A$339mn)

EUR/CHF: Chf1.0325(E200mn), Chf1.0460(E217mn)

-

15:27

Before the bell: S&P futures +0.74%, NASDAQ futures +0.56%

U.S. stock-index futures advanced, indicating equities will climb, after posting their longest losing streak since March amid Greece worsening debt crisis.

Nikkei 20,235.73 +125.78 +0.63%

Hang Seng 26,250.03 +283.05 +1.09%

Shanghai Composite 4,277.79 +224.76 +5.55%

FTSE 6,588.99 -31.49 -0.48%

CAC 4,876.99 +7.17 +0.15%

DAX 11,102.86 +19.66 +0.18%

Crude oil $58.72 (+0.67%)

Gold $1170.70 (-0.70%)

-

15:18

French producer prices decrease 0.5% in May

French statistical office INSEE released its producer price index (PPI) data on Tuesday. French producer prices decreased 0.5% in May, after a 0.4% decline in April.

The decline was driven a fall in prices for mining and quarrying products, energy and water.

On a yearly basis, French PPI fell 1.7% in May.

Import prices rose 0.4% in May, after a 0.6% gain in April.

-

15:09

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

3M Co

MMM

154.50

+0.36%

0.8K

Procter & Gamble Co

PG

78.64

+0.41%

0.9K

The Coca-Cola Co

KO

39.60

+0.51%

2.7K

International Business Machines Co...

IBM

163.81

+0.52%

1.4K

Wal-Mart Stores Inc

WMT

71.79

+0.52%

1K

HONEYWELL INTERNATIONAL INC.

HON

102.41

+0.55%

0.4K

Deere & Company, NYSE

DE

95.50

+0.57%

4.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.49

+0.57%

1.1K

Exxon Mobil Corp

XOM

83.30

+0.58%

10.5K

Pfizer Inc

PFE

33.79

+0.60%

13.1K

United Technologies Corp

UTX

112.20

+0.60%

1.5K

Verizon Communications Inc

VZ

47.05

+0.60%

8.3K

McDonald's Corp

MCD

96.02

+0.61%

0.1K

Cisco Systems Inc

CSCO

27.71

+0.62%

0.9K

ALCOA INC.

AA

10.42

+0.62%

14.3K

Microsoft Corp

MSFT

44.65

+0.63%

3.7K

AT&T Inc

T

36.00

+0.64%

11.2K

General Electric Co

GE

26.81

+0.64%

35.4K

UnitedHealth Group Inc

UNH

121.98

+0.65%

0.3K

Chevron Corp

CVX

97.33

+0.66%

8.0K

Nike

NKE

108.39

+0.67%

3.8K

ALTRIA GROUP INC.

MO

49.00

+0.68%

5.0K

Intel Corp

INTC

30.60

+0.69%

280.8K

E. I. du Pont de Nemours and Co

DD

64.10

+0.72%

7.1K

Walt Disney Co

DIS

113.86

+0.72%

2.8K

Home Depot Inc

HD

111.35

+0.73%

0.8K

Goldman Sachs

GS

209.18

+0.74%

1.2K

Boeing Co

BA

139.75

+0.74%

0.1K

Johnson & Johnson

JNJ

98.40

+0.74%

15.8K

Facebook, Inc.

FB

86.44

+0.75%

157.1K

Google Inc.

GOOG

525.50

+0.76%

3.0K

Amazon.com Inc., NASDAQ

AMZN

433.15

+0.77%

3.9K

Starbucks Corporation, NASDAQ

SBUX

53.96

+0.77%

2.2K

Ford Motor Co.

F

15.14

+0.80%

190.7K

JPMorgan Chase and Co

JPM

67.75

+0.82%

12.2K

Merck & Co Inc

MRK

57.77

+0.84%

0.3K

Apple Inc.

AAPL

125.58

+0.84%

360.9K

Twitter, Inc., NYSE

TWTR

34.50

+0.85%

42.2K

Citigroup Inc., NYSE

C

55.36

+0.87%

4.1K

General Motors Company, NYSE

GM

33.55

+0.96%

6.1K

Visa

V

67.37

+0.97%

0.6K

Travelers Companies Inc

TRV

97.10

+1.00%

0.2K

Yahoo! Inc., NASDAQ

YHOO

39.30

+1.00%

4.0K

Caterpillar Inc

CAT

86.19

+1.04%

0.6K

Yandex N.V., NASDAQ

YNDX

15.00

+1.08%

5.1K

Tesla Motors, Inc., NASDAQ

TSLA

266.50

+1.71%

31.6K

Hewlett-Packard Co.

HPQ

29.97

0.00%

2.8K

Barrick Gold Corporation, NYSE

ABX

10.76

-0.19%

11.9K

-

15:05

French consumer spending increases 0.1% in May

French statistical office INSEE released its consumer spending data on Tuesday. French consumer spending increased 0.1% in May, after a flat reading in April. April's figure was revised down from a 0.1% gain.

Spending on food was flat in May, spending on automobiles rose 0.2%, spending on household durables was up 0.2%, while spending on energy rose 0.3%.

Spending on manufactured goods increased 0.1% in May.

On a yearly basis, consumer spending climbed 1.8% in May.

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, April 4.9% (forecast 5.5%)

-

14:54

KOF leading indicator for Switzerland drops to 89.7 in June, the lowest level since December 2011

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Tuesday. The KOF leading indicator dropped to 89.7 in June from 92.7 in May, missing expectations for a rise to 93.6. May's figure was revised down from 93.1.

It was the lowest level since December 2011.

The decline was driven by a negative sentiment in all industrial sub-categories.

"The perspectives for the Swiss economy, according to the Barometer, have become more negative for the coming months," the KOF said.

-

14:44

Canada's GDP declines 0.1% in April

Statistics Canada released GDP (gross domestic product) growth data on Tuesday. Canada's GDP growth declined 0.1% in April, missing expectations for a 0.1% rise, after a 0.2% drop in March. It was the fourth consecutive decline.

The decline was driven by a drop in in the output of goods-producing industries. Goods production decreased 0.8% in April, driven by a contraction in mining, quarrying, and oil and gas extraction.

The output of service-providing industries climbed 0.3% in April, driven by wholesale trade.

-

14:30

Canada: GDP (m/m) , April -0.1% (forecast 0.1%)

-

14:19

Foreign exchange market. European session: the euro traded higher against the U.S. dollar on hopes for a last-minute deal between Athens and its creditors

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia HIA New Home Sales, m/m May 0.6% -2.3%

01:00 New Zealand ANZ Business Confidence June 15.7 -2.3

01:30 Australia Private Sector Credit, y/y May 6.1% 6.2%

01:30 Australia Private Sector Credit, m/m May 0.3% 0.5% 0.5%

01:30 Japan Labor Cash Earnings, YoY May 0.7% Revised From 0.9% 0.6%

05:00 Japan Housing Starts, y/y May 0.4% 5.8% 5.8%

06:00 Germany Retail sales, real unadjusted, y/y May 1.1% Revised From 1.0% 2.5% -0.4%

06:00 Germany Retail sales, real adjusted May 1.3% Revised From 1.7% 0.0% 0.5%

07:00 Switzerland KOF Leading Indicator June 92.7 Revised From 93.1 93.6 89.7

07:55 Germany Unemployment Change June -5 -5 -1

07:55 Germany Unemployment Rate s.a. June 6.4% 6.4% 6.4%

08:30 United Kingdom Current account, bln Quarter I -28.93 Revised From -25.3 -23.25 -26.6

08:30 United Kingdom GDP, q/q (Finally) Quarter I 0.8% Revised From 0.6% 0.4% 0.4%

08:30 United Kingdom GDP, y/y (Finally) Quarter I 3.4% Revised From 3.0% 2.5% 2.9%

08:40 Australia RBA's Governor Glenn Stevens Speech

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) June 0.3% 0.2% 0.2%

09:00 Eurozone Unemployment Rate May 11.1% 11.1% 11.1%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The S&P/Case-Shiller home price index is expected to rise by 5.5% in April, after a 5.0% gain in March.

The U.S. consumer confidence is expected to decline to 97.2 in June from 95.4 from May.

The Chicago purchasing managers' index is expected to rise to 50.1 in June from 46.2 in May.

The euro traded higher against the U.S. dollar on hopes for a last-minute deal between Athens and its creditors. Greek finance minister, Yanis Varoufakis, said on Tuesday that Athens hopes to reach a deal before the deadline.

German Finance Minister Wolfgang Schaeuble said on Monday that the impact of Greece's debt crisis on other countries from the Eurozone is limited.

The rating agency Standard & Poor's on Monday downgraded Greece's sovereign debt rating to CCC- from CCC. The outlook is negative.

Meanwhile, the economic data from the Eurozone was mixed. The preliminary consumer price inflation in the Eurozone fell to an annual rate of 0.2% in June from 0.3% in May, in line with expectations.

The decrease was driven by lower energy prices and by a softer increase in food and services prices.

Eurozone's unemployment rate remained unchanged at 11.1% in May, in line with expectations. It was the lowest level since March 2012.

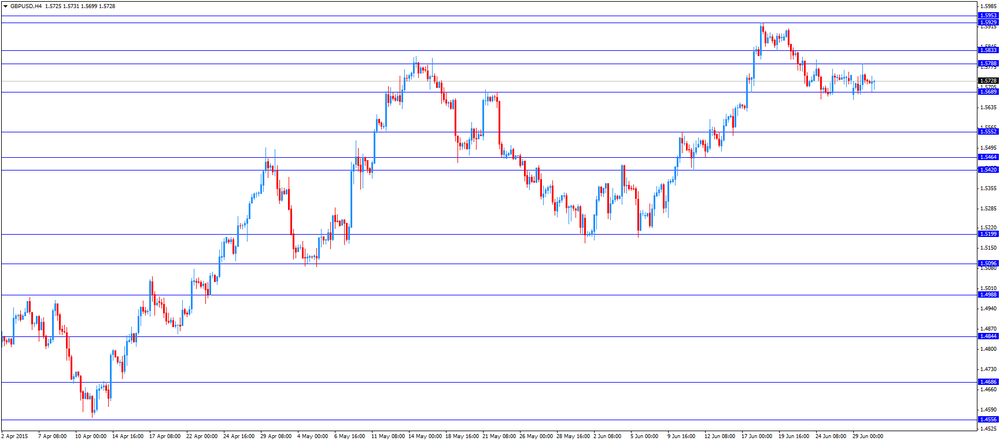

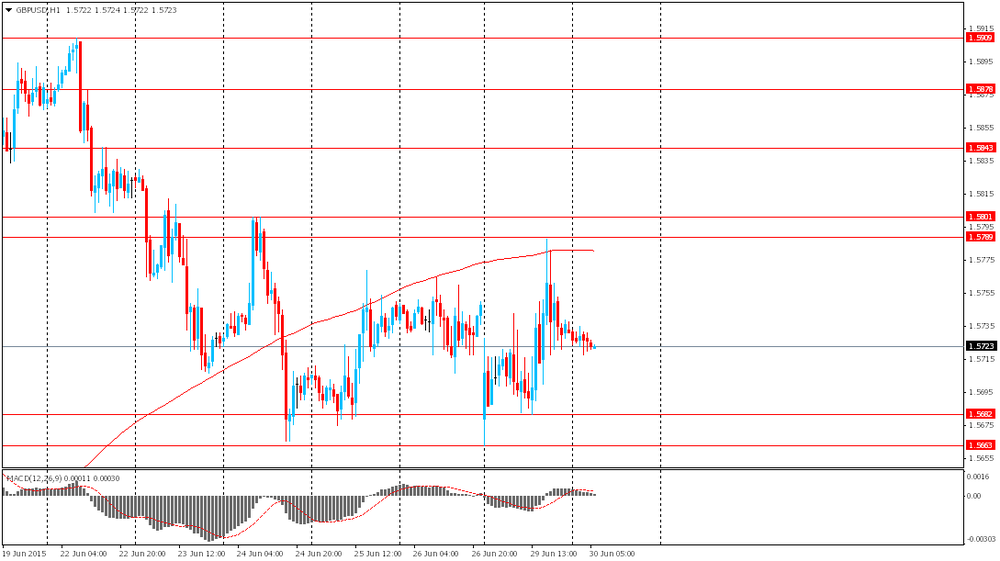

The British pound traded mixed against the U.S. dollar after the release of the economic data from the U.K. The final U.K. GDP expanded at 0.4% in the first quarter, beating May's estimate of a 0.3% gain, after a 0.8% rise in the fourth quarter.

The upward revision was driven by methodological changes in construction.

On a yearly basis, the revised U.K. GDP rose 2.9% in the first quarter, eating May's estimate of a 2.4% increase, after a 3.4% gain in the fourth quarter.

The U.K. current account deficit narrowed to £26.5 billion in the first quarter from £28.93 billion in the fourth quarter. The fourth quarter's figure was revised down from a deficit of £25.3 billion.

Analysts had expected the current account deficit to decrease to £23.25 billion.

The first quarter's current account deficit amounted to 5.8% of GDP, after 6.4% of GDP in the fourth quarter.

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian gross domestic product (GDP) data. Canada's GDP is expected to grow at an annual rate of 0.1% in April, after a 0.2% decline in March.

The Swiss franc traded higher against the U.S. dollar after the release of KOF leading indicator. The KOF leading indicator dropped to 89.7 in June from 92.7 in May, missing expectations for a rise to 93.6. May's figure was revised down from 93.1.

EUR/USD: the currency pair increased to $1.1206

GBP/USD: the currency pair traded mixed

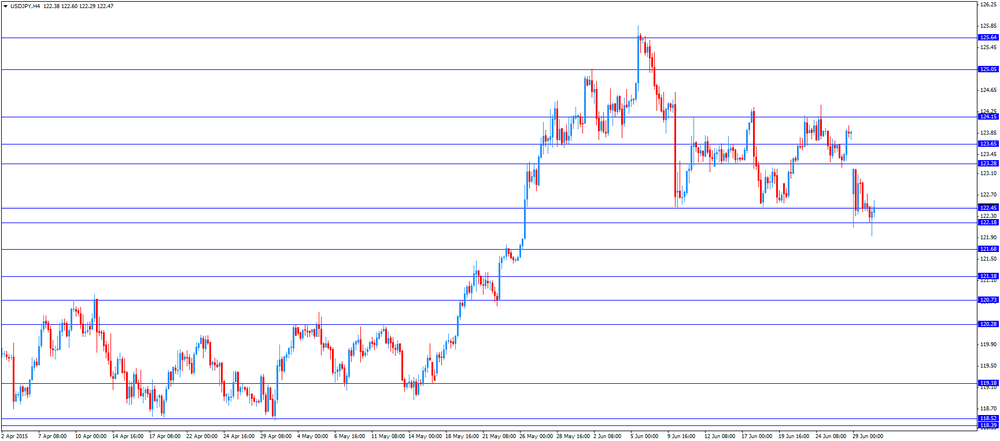

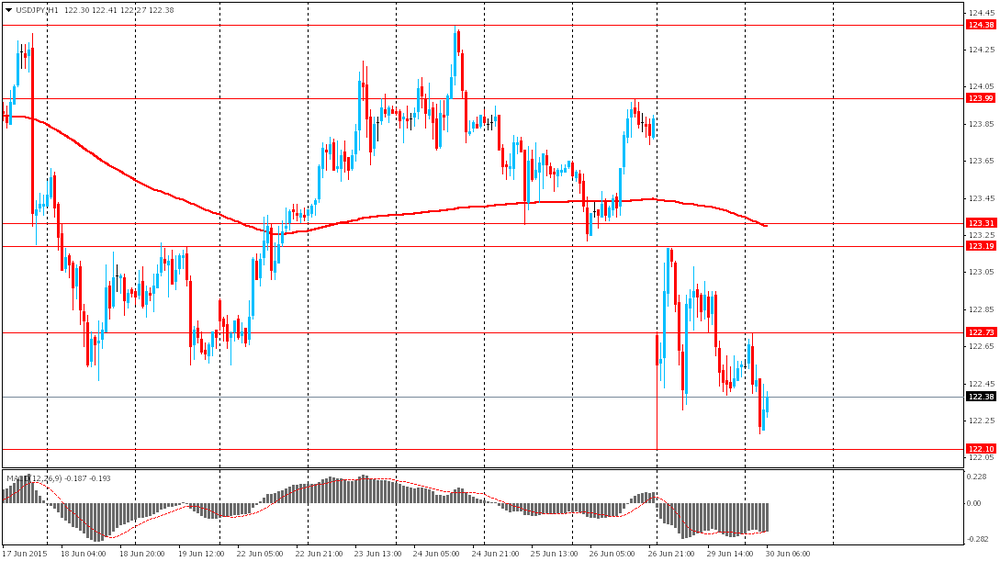

USD/JPY: the currency pair rose to Y122.60

The most important news that are expected (GMT0):

12:30 Canada GDP (m/m) April -0.2% 0.1%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April 5.0% 5.5%

13:45 U.S. Chicago Purchasing Managers' Index June 46.2 50.1

14:00 U.S. Consumer confidence June 95.4 97.2

23:50 Japan BoJ Tankan. Manufacturing Index Quarter II 12 12

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter II 19 22

-

14:00

Orders

EUR/USD

Offers 1.1200 1.1220-25 1.1245 1.1280 1.1300 1.1330 1.1350

Bids 1.1125 1.1100 1.1080 1.1050 1.1030 1.1000 1.0980 1.0960 1.0930 1.0900

GBP/USD

Offers 1.5750-55 1.5780 1.5800 1.5820-25 1.5850 1.5875 1.5900

Bids 1.5700 1.5670-75 1.5650 1.5630 1.5600 1.5585 1.5570 1.5550

EUR/GBP

Offers 0.7125-30 0.7150 0.7170 0.7180-85 0.7200

Bids 0.7100 0.7085 0.7060 0.7040 0.7020 0.7000 0.6985 0.6965 0.6950

EUR/JPY

Offers 136.80 137.00 137.30 137.50 137.80 138.00 138.50

Bids 136.30 136.00 135.80 135.60 135.20 135.00 134.85

USD/JPY

Offers 122.50 122.70 122.85 123.00 123.20 123.50 123.75 124.00

Bids 122.00-10 121.80 121.65 121.50

AUD/USD

Offers 0.7700 0.7730 0.7750-60 0.7785 0.7800

Bids 0.7650 0.7630 0.7600 0.7585 0.7550

-

12:07

European stock markets mid session: stocks traded lower on Greece’s debt crisis

Stock indices traded lower on Greece's debt crisis. A Greek government official confirmed on Monday that Athens will not repay €1.538 billion IMF loans by June 30.

German Finance Minister Wolfgang Schaeuble said on Monday that the impact of Greece's debt crisis on other countries from the Eurozone is limited.

The rating agency Standard & Poor's on Monday downgraded Greece's sovereign debt rating to CCC- from CCC. The outlook is negative.

Meanwhile, the economic data from the Eurozone was mixed. The preliminary consumer price inflation in the Eurozone fell to an annual rate of 0.2% in June from 0.3% in May, in line with expectations.

The decrease was driven by lower energy prices and by a softer increase in food and services prices.

Eurozone's unemployment rate remained unchanged at 11.1% in May, in line with expectations. It was the lowest level since March 2012.

The final U.K. GDP expanded at 0.4% in the first quarter, beating May's estimate of a 0.3% gain, after a 0.8% rise in the fourth quarter.

The upward revision was driven by methodological changes in construction.

On a yearly basis, the revised U.K. GDP rose 2.9% in the first quarter, eating May's estimate of a 2.4% increase, after a 3.4% gain in the fourth quarter.

The U.K. current account deficit narrowed to £26.5 billion in the first quarter from £28.93 billion in the fourth quarter. The fourth quarter's figure was revised down from a deficit of £25.3 billion.

Analysts had expected the current account deficit to decrease to £23.25 billion.

The first quarter's current account deficit amounted to 5.8% of GDP, after 6.4% of GDP in the fourth quarter.

Current figures:

Name Price Change Change %

FTSE 100 6,578.99 -41.49 -0.63 %

DAX 11,041.33 -41.87 -0.38 %

CAC 40 4,857.49 -12.33 -0.25 %

-

11:53

Preliminary consumer price inflation in the Eurozone declines to 0.2% in June

Eurostat released its consumer price inflation data for the Eurozone on Tuesday. The preliminary consumer price inflation in the Eurozone fell to an annual rate of 0.2% in June from 0.3% in May, in line with expectations.

The decrease was driven by lower energy prices and by a softer increase in food and services prices.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco decreased to an annual rate of 0.8% in June from 0.9% in May.

Food, alcohol and tobacco prices were up 1.2% in June, non-energy industrial goods prices gained 0.4%, and services prices climbed 1.0%, while energy prices dropped 5.1%.

-

11:44

Eurozone's unemployment rate remains unchanged at 11.1% in May

Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate remained unchanged at 11.1% in May, in line with expectations. It was the lowest level since March 2012.

There were 17.726 million unemployed in the Eurozone in May, down 35,000 from April.

The lowest unemployment rate in the Eurozone in April was recorded in Germany (4.7%), and the highest in Greece (25.6% in March 2015) and Spain (22.5%).

The youth unemployment rate was 22.1% in the Eurozone in May, compared to 23.8% in May a year ago.

-

11:37

Final U.K. GDP grows at 0.4% in the first quarter

The Office for National Statistics (ONS) released its final gross domestic product (GDP) data on Tuesday. The final U.K. GDP expanded at 0.4% in the first quarter, beating May's estimate of a 0.3% gain, after a 0.8% rise in the fourth quarter.

The upward revision was driven by methodological changes in construction.

On a yearly basis, the revised U.K. GDP rose 2.9% in the first quarter, eating May's estimate of a 2.4% increase, after a 3.4% gain in the fourth quarter.

The service sector climbed 0.4% in the first quarter, the construction sector dropped 0.2%, while the production sector was up 0.2%.

-

11:27

U.K. current account deficit narrows to £26.5 billion in the first quarter

The U.K.'s National Statistics Office (ONS) released its current account data for the U.K. on Tuesday. The U.K. current account deficit narrowed to £26.5 billion in the first quarter from £28.93 billion in the fourth quarter. The fourth quarter's figure was revised down from a deficit of £25.3 billion.

Analysts had expected the current account deficit to decrease to £23.25 billion.

The first quarter's current account deficit amounted to 5.8% of GDP, after 6.4% of GDP in the fourth quarter.

Declines in the deficit on the secondary income account and the primary income account partially offset a rise in the deficit on the trade account.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E809mn), $1.1050(E663mn), $1.1150/60(E430mn), $1.1185(E446mn), $1.1200(E465mn)

USD/JPY: Y122.00($2.0bn)

USD/CAD: Cad1.2250($315mn), Cad1.2330($337mn), Cad1.2400($264mn)

AUD/USD: $0.7630(A$339mn)

EUR/CHF: Chf1.0325(E200mn), Chf1.0460(E217mn)

-

11:14

German adjusted retail sales are up 0.5% in May

Destatis released its retail sales for Germany on Tuesday. German adjusted retail sales rose 0.5% in May, beating forecasts of a flat reading, after a 1.3% increase in April. April's figure was revised down from a 1.7% gain.

On a yearly basis, German retail sales fell 0.4% in May, missing expectations for a 2.5% gain, after a 1.1% rise in April. April's figure was revised up from a 1.0% increase.

Sales of non-food products increased at an annual rate of 0.2% in May, while sales of food products declined by 1.1%.

-

11:03

Number of unemployed people in Germany declines by 1,000 in June

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany declined by 1,000 in June, missing expectations for a 5,000 decline, after a 5,000 drop in May.

The number of unemployed people was 2.786 million in June, the lowest level since December 1991.

Germany's adjusted unemployment rate remained unchanged at 6.4% in June, in line with expectations.

-

11:00

Eurozone: Harmonized CPI, Y/Y, June 0.2% (forecast 0.2%)

-

11:00

Eurozone: Unemployment Rate , May 11.1% (forecast 11.1%)

-

10:55

Standard & Poor’s downgrades Greece’s sovereign debt rating to CCC-

The rating agency Standard & Poor's on Monday downgraded Greece's sovereign debt rating to CCC- from CCC. The outlook is negative.

The rating agency said that the likelihood is 50% that Greece eventually exits the Eurozone. Standard & Poor's forecasts a default within six months.

"In our view, the Greek government's decision to hold a national referendum on official creditors' loan proposals indicates that Prime Minister Alexis Tsipras will prioritize domestic politics over the country's financial and economic stability, commercial debt service, and membership of the Eurozone," the agency said.

-

10:45

Greek government official confirms Athens will not repay €1.538 billion IMF loans by June 30

A Greek government official confirmed on Monday that Athens will not repay €1.538 billion IMF loans by June 30.

IMF Managing Director Christine Lagarde said earlier this month that Greece would be in default as of July 1 if it failed to repay loans.

-

10:34

German Chancellor Angela Merkel: Europe should be able to find a common compromise

German Chancellor Angela Merkel said on Monday that Europe should be able to find a common compromise. She warned that if the "euro fails, Europe fails". But Merkel added that that Europe's principles "need to be fought for".

"Again and again we hear the question: 'can't we, just for once, shelve the principles?' And here we have to say: 'No we cannot' ... and that's because we want Europe to emerge from this crisis stronger than it was when it went into the crisis," she said.

-

10:31

United Kingdom: Current account, bln , Quarter I -26.6 (forecast -23.25)

-

10:30

United Kingdom: GDP, q/q, Quarter I 0.4% (forecast 0.4%)

-

10:30

United Kingdom: GDP, y/y, Quarter I 2.9% (forecast 2.5%)

-

10:18

Earnings in Japan climb 0.6% in May

Japan's Ministry of Health, Labor and Welfare released its labour cash earnings data on Tuesday. Total earnings in Japan climbed 0.6% year-over-year in May, after a 0.7% rise in April.

Total real wage fell 0.1% in May, after a 0.1% decline in April.

-

10:10

German vice chancellor Sigmar Gabriel: a Greek referendum could make sense

Germany's vice chancellor Sigmar Gabriel said in an interview on Saturday that a Greek referendum could make sense.

"We'd be advised not to dismiss this suggestion from Mr. Tsipras out of hand and say 'that's just a trick.' But rather if the questions are clearly framed…then it could make sense," he said.

-

09:55

Germany: Unemployment Rate s.a. , June 6.4% (forecast 6.4%)

-

09:55

Germany: Unemployment Change, June -1 (forecast -5)

-

09:13

Gold slid despite Greek drama

Gold slid to $1,176.40 (-0.22%) an ounce despite Greece default fears. The country is expected to default on its €1.6 billion debt payment to the International Monetary Fund today. However it seems that the influence of today's rebound in stocks matters more. A relatively strong dollar and Fed rates outlook also weighs on bullion.

Investors are traditionally attracted to gold at times of crisis or uncertainty. However this time bullion's gains are modest and short-lived. The situation may change if default crisis spreads to other countries in any part of the world. -

09:08

Oil: prices slightly fell amid Greece crisis

West Texas Intermediate futures for August delivery slid to $58.23 (-0.17%). Meanwhile Brent crude for August is staying around $62.04 (+0.05%) a barrel. Prices are weighed by Greece default fears as the country is going to miss today's deadline on a €1.6 billion debt payment to the IMF.

At the same time Iran nuclear deal deadline is also expected to be missed today. However some sources said that a deal could be reached within days. If sanctions are lifted, Iran, OPEC's fifth-largest producer, can double its exports within half a year. Supplies are already excessive and extra crude from Iran could intensify this issue. -

09:00

Switzerland: KOF Leading Indicator, June 89.7 (forecast 93.6)

-

08:53

Global Stocks: US indices declined

A sharp stocks selloff was recorded on Monday worldwide, including Wall Street. Investors are preparing themselves for Greek default. At the same time they are concerned that a similar scenario can happen to other financially weak countries around the globe.

The Dow Jones industrial average dropped by 350.33 points, or 1.95%, to 17,596.35 (the biggest one-day decline since June 2013, which erased all of the gains made by the index this year). The Standard & Poor's 500 declined by 43.85 points, or 2.10%, to 2,057.64. The Nasdaq Composite fell by 122.04 points, or 2.40%, to close at 4,958.47.

Experts say that a default would definitely shake markets, but it would not be as painful as the 2008 crisis.

This morning in Asia Hong Kong Hang Seng rose by 1.24%, or 322.65 points, to 26,289.63 despite Greek drama. China Shanghai Composite Index advanced by 1.96%, or 79.64 points, to 4,132.67. Meanwhile the Nikkei gained 0.49%, or 99.43 points, to 20,209.38 with airlines leading the gains amid lower fuel prices.

Chinese stocks volatility is likely to persist in the coming weeks.

Investors are waiting for statements from the European Central Bank. Some believe that it can boost its QE program to help markets overcome Greek drama.

-

08:38

Foreign exchange market. Asian session: the euro declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:00 Australia HIA New Home Sales, m/m May 0.6% -2.3%

01:00 New Zealand ANZ Business Confidence June 15.7 -2.3

01:30 Australia Private Sector Credit, y/y May 6.1% 6.2%

01:30 Australia Private Sector Credit, m/m May 0.3% 0.5% 0.5%

01:30 Japan Labor Cash Earnings, YoY May 0.7% 0.6%

05:00 Japan Housing Starts, y/y May 0.4% 5.8% 5.8%

06:00 Germany Retail sales, real unadjusted, y/y May 1.1% 2.5% -0.4%

06:00 Germany Retail sales, real adjusted May 1.7% 0.0% 0.5%

The euro slid as today Greece is supposed to make a €1.6 billion debt payment to the International Monetary Fund and it is not able to do it. Yesterday the single currency rose up to $1.1278 during the American session, because investors close their short positions after the euro had fallen down to $1.0954 amid Greece default prospects. Standard and Poor's cut Greece's sovereign debt rating to CCC- and noted that there is a 50% probability it would leave the single currency area.

The yen continued gaining amid demand for this safe-haven currency. Greece is likely to default on its €1.6 billion payment to the IMF and leave the euro zone. Investors are waiting for a Greek referendum scheduled for July the 5th. Many market participants expect Greeks to say 'yes' to austerity measures. If they vote 'no', the yen will strengthen more.

The New Zealand Dollar declined after ANZ business confidence data showed that the corresponding index fell to -2.3 in May (the weakest result in four years) from 15.7 reported previously. This sharp decline means lack of business investment.

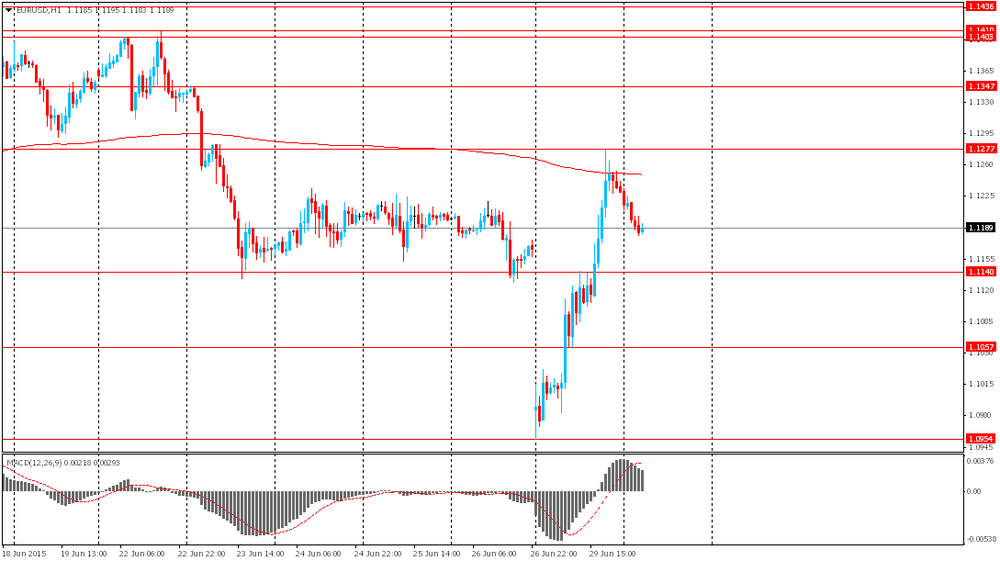

EUR/USD: the pair fell to $1.1180 this morning

USD/JPY: the pair fell to Y122.20GBP/USD: the pair traded around $1.5715-35

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Switzerland KOF Leading Indicator June 93.1 93.6

07:55 Germany Unemployment Change June -5 -5

07:55 Germany Unemployment Rate s.a. June 6.4% 6.4%

08:30 United Kingdom Current account, bln Quarter I -25.3 -23.25

08:30 United Kingdom GDP, q/q(Finally) Quarter I 0.6% 0.4%

08:30 United Kingdom GDP, y/y(Finally) Quarter I 3.0% 2.5%

08:40 Australia RBA's Governor Glenn Stevens Speech

09:00 Eurozone Harmonized CPI, Y/Y(Preliminary) June 0.3% 0.2%

09:00 Eurozone Unemployment Rate May 11.1% 11.1%

12:30 Canada GDP (m/m) April -0.2% 0.1%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April 5.0% 5.5%

13:45 U.S. Chicago Purchasing Managers' Index June 46.2 50.1

14:00 U.S. Consumer confidence June 95.4 97.2

20:30 U.S. API Crude Oil Inventories June -3.2

23:30 Australia AIG Manufacturing Index June 52.3

23:50 Japan BoJ Tankan. Manufacturing Index Quarter II 12 12

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter II 19 22 -

08:23

Options levels on tuesday, June 30, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1337 (3167)

$1.1303 (1448)

$1.1271 (927)

Price at time of writing this review: $1.1195

Support levels (open interest**, contracts):

$1.1147 (3888)

$1.1073 (5861)

$1.0987 (13973)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 62357 contracts, with the maximum number of contracts with strike price $1,1500 (5615);

- Overall open interest on the PUT options with the expiration date July, 2 is 90096 contracts, with the maximum number of contracts with strike price $1,1000 (13973);

- The ratio of PUT/CALL was 1.44 versus 1.46 from the previous trading day according to data from June, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.6000 (546)

$1.5901 (815)

$1.5803 (1404)

Price at time of writing this review: $1.5726

Support levels (open interest**, contracts):

$1.5695 (869)

$1.5598 (866)

$1.5499 (700)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 22808 contracts, with the maximum number of contracts with strike price $1,5500 (2543);

- Overall open interest on the PUT options with the expiration date July, 2 is 27033 contracts, with the maximum number of contracts with strike price $1,5300 (2149);

- The ratio of PUT/CALL was 1.19 versus 1.19 from the previous trading day according to data from June, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Retail sales, real unadjusted, y/y, May -0.4% (forecast 2.5%)

-

08:00

Germany: Retail sales, real adjusted , May 0.5% (forecast 0.0%)

-

07:01

Japan: Housing Starts, y/y, May 5.8% (forecast 5.8%)

-

04:01

Nikkei 225 20,178.04 +68.09 +0.34 %, Hang Seng 26,021.21 +54.23 +0.21 %, Shanghai Composite 4,022.92 -30.11 -0.74 %

-

03:31

Japan: Labor Cash Earnings, YoY, May 0.6%

-

03:30

Australia: Private Sector Credit, m/m, May 0.5% (forecast 0.5%)

-

03:30

Australia: Private Sector Credit, y/y, May 6.2%

-

03:00

New Zealand: ANZ Business Confidence, June -2.3

-

03:00

Australia: HIA New Home Sales, m/m, May -2.3%

-

01:09

United Kingdom: Gfk Consumer Confidence, June 7 (forecast 2)

-

00:45

New Zealand: Building Permits, m/m, May 0.0%

-

00:30

Commodities. Daily history for Jun 29’2015:

(raw materials / closing price /% change)

Oil 58.27 -0.10%

Gold 1,179.60 +0.05%

-

00:29

Stocks. Daily history for Jun 29’2015:

(index / closing price / change items /% change)

Nikkei 225 20,109.95 -596.20 -2.88 %

Hang Seng 25,966.98 -696.89 -2.61 %

S&P/ASX 200 5,422.49 -123.40 -2.23 %

Shanghai Composite 4,054.86 -138.02 -3.29 %

FTSE 100 6,620.48 -133.22 -1.97 %

CAC 40 4,869.82 -189.35 -3.74 %

Xetra DAX 11,083.2 -409.23 -3.56 %

S&P 500 2,057.64 -43.85 -2.09 %

NASDAQ Composite 4,958.47 -122.04 -2.40 %

Dow Jones 17,596.35 -350.33 -1.95 %

-

00:28

Currencies. Daily history for Jun 29’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1229 +0,56%

GBP/USD $1,5731 -0,11%

USD/CHF Chf0,9248 -0,88%

USD/JPY Y122,55 -1,09%

EUR/JPY Y137,62 -0,48%

GBP/JPY Y192,78 -1,16%

AUD/USD $0,7676 +0,25%

NZD/USD $0,6840 -0,01%

USD/CAD C$1,2400 +0,64%

-

00:00

Schedule for today, Tuesday, Jun 30’2015:

(time / country / index / period / previous value / forecast)

01:00 Australia HIA New Home Sales, m/m May 0.6%

01:00 New Zealand ANZ Business Confidence June 15.7

01:30 Australia Private Sector Credit, y/y May 6.1%

01:30 Australia Private Sector Credit, m/m May 0.3% 0.5%

01:30 Japan Labor Cash Earnings, YoY May 0.9%

05:00 Japan Housing Starts, y/y May 0.4% 5.8%

06:00 Germany Retail sales, real unadjusted, y/y May 1.0% 2.5%

06:00 Germany Retail sales, real adjusted May 1.7% 0.0%

07:00 Switzerland KOF Leading Indicator June 93.1 93.6

07:55 Germany Unemployment Change June -5 -5

07:55 Germany Unemployment Rate s.a. June 6.4% 6.4%

08:30 United Kingdom Current account, bln Quarter I -25.3 -23.25

08:30 United Kingdom GDP, q/q (Finally) Quarter I 0.6% 0.4%

08:30 United Kingdom GDP, y/y (Finally) Quarter I 3.0% 2.5%

08:40 Australia RBA's Governor Glenn Stevens Speech

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) June 0.3% 0.2%

09:00 Eurozone Unemployment Rate May 11.1% 11.1%

12:30 Canada GDP (m/m) April -0.2% 0.1%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April 5.0% 5.5%

13:45 U.S. Chicago Purchasing Managers' Index June 46.2 50.1

14:00 U.S. Consumer confidence June 95.4 97.2

20:30 U.S. API Crude Oil Inventories June -3.2

23:30 Australia AIG Manufacturing Index June 52.3

23:50 Japan BoJ Tankan. Manufacturing Index Quarter II 12 12

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter II 19 22

-