Noticias del mercado

-

21:00

Dow +0.28% 17,645.27 +48.92 Nasdaq +0.70% 4,993.13 +34.66 S&P +0.44% 2,066.78 +9.14

-

18:16

WSE: Session Results

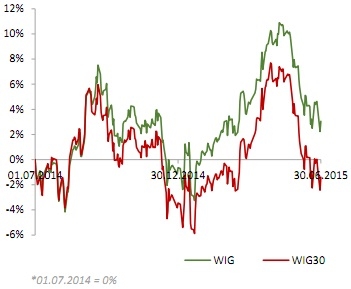

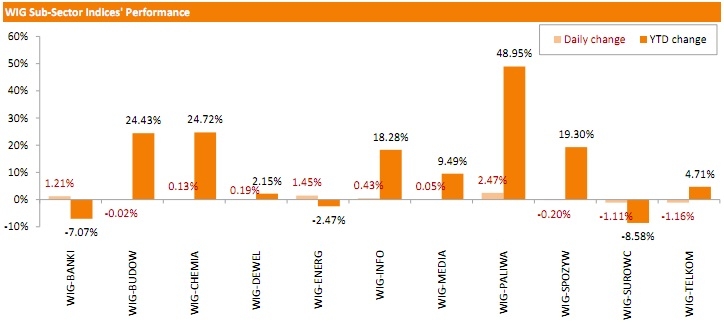

Polish equity market demonstrated an upward tendency on Tuesday. The broad market measure, the WIG Index, added 0.80%. Oil and gas stocks (+2.47%) and utilities names (+1.45%) performed best within the WIG Index, while telecommunications (-1.16%) and materials (-1.11%) sectors were the weakest performers.

The large-cap stocks' measure, the WIG30 Index, outperformed the broad market, returning 1.06%. BZ WBK (WSE: BZW), PGNIG (WSE: PGN), PKN ORLEN (WSE: PKN) and ENERGA (WSE: ENG) were among the best performers in the WIG30 Index, recording gains of 2.43%-2.79%. On the other side of the ledger, BOGDANKA (WSE: LWB) continued to fall (-3.98%), hitting a new historical low of PLN 51.85. It was followed by KERNEL (WSE: KER) and SYNTHOS (WSE: SNS), declining 1.67% and 1.27% respectively.

-

18:04

European stocks close: stocks closed lower despite hopes for a last-minute deal between Athens and its lenders

Stock indices closed lower despite hopes for a last-minute deal between Athens and its lenders. According to a statement from the office of the Prime Minister Alexis Tsipras, the Greek government has requested a 2-year bailout programme from the European Stability Mechanism (ESM) to fully cover its financing needs, including restructuring of debt.

Athens said that it will continue debt talks seeking a "viable agreement" within the Eurozone.

The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that Eurozone finance ministers will have a teleconference today at 17:00 GMT to discuss the latest proposals from Greece to keep the bailout negotiations going.

"Extraordinary Eurogroup teleconference tonight 19:00 Brussels time to discuss official request of Greek government received this afternoon", he twitted.

Meanwhile, the economic data from the Eurozone was mixed. The preliminary consumer price inflation in the Eurozone fell to an annual rate of 0.2% in June from 0.3% in May, in line with expectations.

The decrease was driven by lower energy prices and by a softer increase in food and services prices.

Eurozone's unemployment rate remained unchanged at 11.1% in May, in line with expectations. It was the lowest level since March 2012.

The final U.K. GDP expanded at 0.4% in the first quarter, beating May's estimate of a 0.3% gain, after a 0.8% rise in the fourth quarter.

The upward revision was driven by methodological changes in construction.

On a yearly basis, the revised U.K. GDP rose 2.9% in the first quarter, eating May's estimate of a 2.4% increase, after a 3.4% gain in the fourth quarter.

The U.K. current account deficit narrowed to £26.5 billion in the first quarter from £28.93 billion in the fourth quarter. The fourth quarter's figure was revised down from a deficit of £25.3 billion.

Analysts had expected the current account deficit to decrease to £23.25 billion.

The first quarter's current account deficit amounted to 5.8% of GDP, after 6.4% of GDP in the fourth quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,520.98 -99.50 -1.50 %

DAX 10,944.97 -138.23 -1.25 %

CAC 40 4,790.2 -79.62 -1.63 %

-

18:00

European stocks closed: FTSE 100 6,520.98 -99.50 -1.50% CAC 40 4,790.2 -79.62 -1.63% DAX 10,944.97 -138.23 -1.25%

-

17:39

Wall Street. Major U.S. stock-indexes rose

Major U.S. stocks rose on Tuesday, rebounding sharply from Monday's losses, as investors hoped Greece would strike a last-minute deal to avoid an exit from the euro zone. Greece is hours away from defaulting on a 1.6 billion euro repayment to the International Monetary Fund. The European Commission made its final push to try to persuade Greek Prime Minister Alexis Tsipras to accept a bailout deal he has rejected before.

Most of Dow stocks in positive area (21 of 30). Top looser Pfizer Inc. (PFE, -0.51%). Top gainer - The Walt Disney Company (DIS, +1.11).

Almost all of S&P index sectors in positive area. Top gainer - Financial (+0,6%). Top looser - Utilities (-0.2%).

At the moment:

Dow 17570.00 +50.00 +0.29%

S&P 500 2058.75 +8.25 +0.40%

Nasdaq 100 4397.25 +19.25 +0.44%

10-year yield 2.34% +0.01

Oil 58.69 +0.36 +0.62%

Gold 1168.70 -10.30 -0.87%

-

17:07

U.S. consumer confidence index jumps to 101.4 in June

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index rose to 101.4 in June from 94.6 in May, exceeding expectations for a rise to 97.2. May's figure was revised down from 95.4.

The increase was driven by the better outlook for both current conditions and expectations for the next six months.

The present conditions index climbed to 111.6 in June from 107.1 in May.

The Conference Board's consumer expectations index for the next six months increased to 94.6 in June from 86.2 in May.

"Over the past two months, consumers have grown more confident about the current state of business and employment conditions. Overall, consumers are in considerably better spirits and their renewed optimism could lead to a greater willingness to spend in the near-term," the director of economic indicators at The Conference Board, Lynn Franco, said.

The percentage of consumers expecting more jobs in the coming months was up to 17.8% in June from 14.7% in May.

-

16:52

Head of the Eurogroup Jeroen Dijsselbloem: Eurozone finance ministers will have a teleconference today at 17:00 GMT

The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that Eurozone finance ministers will have a teleconference today at 17:00 GMT to discuss the latest proposals from Greece to keep the bailout negotiations going.

"Extraordinary Eurogroup teleconference tonight 19:00 Brussels time to discuss official request of Greek government received this afternoon", he twitted.

-

16:37

Greek government requests a 2-year bailout programme from the European Stability Mechanism

According to a statement from the office of the Prime Minister Alexis Tsipras, the Greek government has requested a 2-year bailout programme from the European Stability Mechanism (ESM) to fully cover its financing needs, including restructuring of debt.

Athens said that it will continue debt talks seeking a "viable agreement" within the Eurozone.

-

16:17

Chicago purchasing managers' index rises to 49.4 in June

The Institute for Supply Management released its Chicago purchasing managers' index on Tuesday. The index climbed to 49.4 in June from 46.2 in May, missing expectations for an increase to 50.1.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The rise was partly driven by an increase in new orders. The new orders index was up to 51.7 in May from 47.5 in May.

The production index jumped by 8.7% in June, while the employment index declined to its lowest level since November of 2009.

-

16:04

Preliminary consumer prices in Italy increase 0.1% in June

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Tuesday. Preliminary consumer prices in Italy increased 0.1% in June, after a 0.1% gain May.

Services prices related to transport increased 0.2% in June, while services prices to recreation, including repair and personal care, gained 0.4%.

On a yearly basis, consumer prices climbed 0.1% in June, after a 0.1% increase in May.

Services prices related to transport were up at an annual rate of 0.3% in June, tobacco prices rose 4.0%, while non energy industrial goods - durables prices were flat.

-

15:50

German Chancellor Angela Merkel says she has heard nothing about any progress in debt talks with Greece

German Chancellor Angela Merkel said in Berlin on Tuesday that she has heard nothing about any progress in debt talks with Greece. She added that Greece's bailout program expires at midnight.

Merkel pointed out that debt talks can be continued.

"The door is open for talks - that is all I can say at this hour," she said.

-

15:34

S&P/Case-Shiller home price index rises 4.9% in April

The S&P/Case-Shiller home price index increased 4.9% in April, missing expectations for a 5.5% rise, after a 4.9% gain in March.

San Francisco and Denver were the largest contributors to the rise, where prices climbed by 10.0% and 10.3%, respectively.

"Home prices continue to rise across the country, but the pace is not accelerating," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index climbed by a seasonally adjusted 0.3% in April, after a 1.0% rise in March.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:32

U.S. Stocks open: Dow +0.69%, Nasdaq +0.75%, S&P +0.65%

-

15:27

Before the bell: S&P futures +0.74%, NASDAQ futures +0.56%

U.S. stock-index futures advanced, indicating equities will climb, after posting their longest losing streak since March amid Greece worsening debt crisis.

Nikkei 20,235.73 +125.78 +0.63%

Hang Seng 26,250.03 +283.05 +1.09%

Shanghai Composite 4,277.79 +224.76 +5.55%

FTSE 6,588.99 -31.49 -0.48%

CAC 4,876.99 +7.17 +0.15%

DAX 11,102.86 +19.66 +0.18%

Crude oil $58.72 (+0.67%)

Gold $1170.70 (-0.70%)

-

15:18

French producer prices decrease 0.5% in May

French statistical office INSEE released its producer price index (PPI) data on Tuesday. French producer prices decreased 0.5% in May, after a 0.4% decline in April.

The decline was driven a fall in prices for mining and quarrying products, energy and water.

On a yearly basis, French PPI fell 1.7% in May.

Import prices rose 0.4% in May, after a 0.6% gain in April.

-

15:09

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

3M Co

MMM

154.50

+0.36%

0.8K

Procter & Gamble Co

PG

78.64

+0.41%

0.9K

The Coca-Cola Co

KO

39.60

+0.51%

2.7K

International Business Machines Co...

IBM

163.81

+0.52%

1.4K

Wal-Mart Stores Inc

WMT

71.79

+0.52%

1K

HONEYWELL INTERNATIONAL INC.

HON

102.41

+0.55%

0.4K

Deere & Company, NYSE

DE

95.50

+0.57%

4.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.49

+0.57%

1.1K

Exxon Mobil Corp

XOM

83.30

+0.58%

10.5K

Pfizer Inc

PFE

33.79

+0.60%

13.1K

United Technologies Corp

UTX

112.20

+0.60%

1.5K

Verizon Communications Inc

VZ

47.05

+0.60%

8.3K

McDonald's Corp

MCD

96.02

+0.61%

0.1K

Cisco Systems Inc

CSCO

27.71

+0.62%

0.9K

ALCOA INC.

AA

10.42

+0.62%

14.3K

Microsoft Corp

MSFT

44.65

+0.63%

3.7K

AT&T Inc

T

36.00

+0.64%

11.2K

General Electric Co

GE

26.81

+0.64%

35.4K

UnitedHealth Group Inc

UNH

121.98

+0.65%

0.3K

Chevron Corp

CVX

97.33

+0.66%

8.0K

Nike

NKE

108.39

+0.67%

3.8K

ALTRIA GROUP INC.

MO

49.00

+0.68%

5.0K

Intel Corp

INTC

30.60

+0.69%

280.8K

E. I. du Pont de Nemours and Co

DD

64.10

+0.72%

7.1K

Walt Disney Co

DIS

113.86

+0.72%

2.8K

Home Depot Inc

HD

111.35

+0.73%

0.8K

Goldman Sachs

GS

209.18

+0.74%

1.2K

Boeing Co

BA

139.75

+0.74%

0.1K

Johnson & Johnson

JNJ

98.40

+0.74%

15.8K

Facebook, Inc.

FB

86.44

+0.75%

157.1K

Google Inc.

GOOG

525.50

+0.76%

3.0K

Amazon.com Inc., NASDAQ

AMZN

433.15

+0.77%

3.9K

Starbucks Corporation, NASDAQ

SBUX

53.96

+0.77%

2.2K

Ford Motor Co.

F

15.14

+0.80%

190.7K

JPMorgan Chase and Co

JPM

67.75

+0.82%

12.2K

Merck & Co Inc

MRK

57.77

+0.84%

0.3K

Apple Inc.

AAPL

125.58

+0.84%

360.9K

Twitter, Inc., NYSE

TWTR

34.50

+0.85%

42.2K

Citigroup Inc., NYSE

C

55.36

+0.87%

4.1K

General Motors Company, NYSE

GM

33.55

+0.96%

6.1K

Visa

V

67.37

+0.97%

0.6K

Travelers Companies Inc

TRV

97.10

+1.00%

0.2K

Yahoo! Inc., NASDAQ

YHOO

39.30

+1.00%

4.0K

Caterpillar Inc

CAT

86.19

+1.04%

0.6K

Yandex N.V., NASDAQ

YNDX

15.00

+1.08%

5.1K

Tesla Motors, Inc., NASDAQ

TSLA

266.50

+1.71%

31.6K

Hewlett-Packard Co.

HPQ

29.97

0.00%

2.8K

Barrick Gold Corporation, NYSE

ABX

10.76

-0.19%

11.9K

-

15:05

French consumer spending increases 0.1% in May

French statistical office INSEE released its consumer spending data on Tuesday. French consumer spending increased 0.1% in May, after a flat reading in April. April's figure was revised down from a 0.1% gain.

Spending on food was flat in May, spending on automobiles rose 0.2%, spending on household durables was up 0.2%, while spending on energy rose 0.3%.

Spending on manufactured goods increased 0.1% in May.

On a yearly basis, consumer spending climbed 1.8% in May.

-

14:54

KOF leading indicator for Switzerland drops to 89.7 in June, the lowest level since December 2011

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Tuesday. The KOF leading indicator dropped to 89.7 in June from 92.7 in May, missing expectations for a rise to 93.6. May's figure was revised down from 93.1.

It was the lowest level since December 2011.

The decline was driven by a negative sentiment in all industrial sub-categories.

"The perspectives for the Swiss economy, according to the Barometer, have become more negative for the coming months," the KOF said.

-

14:44

Canada's GDP declines 0.1% in April

Statistics Canada released GDP (gross domestic product) growth data on Tuesday. Canada's GDP growth declined 0.1% in April, missing expectations for a 0.1% rise, after a 0.2% drop in March. It was the fourth consecutive decline.

The decline was driven by a drop in in the output of goods-producing industries. Goods production decreased 0.8% in April, driven by a contraction in mining, quarrying, and oil and gas extraction.

The output of service-providing industries climbed 0.3% in April, driven by wholesale trade.

-

12:07

European stock markets mid session: stocks traded lower on Greece’s debt crisis

Stock indices traded lower on Greece's debt crisis. A Greek government official confirmed on Monday that Athens will not repay €1.538 billion IMF loans by June 30.

German Finance Minister Wolfgang Schaeuble said on Monday that the impact of Greece's debt crisis on other countries from the Eurozone is limited.

The rating agency Standard & Poor's on Monday downgraded Greece's sovereign debt rating to CCC- from CCC. The outlook is negative.

Meanwhile, the economic data from the Eurozone was mixed. The preliminary consumer price inflation in the Eurozone fell to an annual rate of 0.2% in June from 0.3% in May, in line with expectations.

The decrease was driven by lower energy prices and by a softer increase in food and services prices.

Eurozone's unemployment rate remained unchanged at 11.1% in May, in line with expectations. It was the lowest level since March 2012.

The final U.K. GDP expanded at 0.4% in the first quarter, beating May's estimate of a 0.3% gain, after a 0.8% rise in the fourth quarter.

The upward revision was driven by methodological changes in construction.

On a yearly basis, the revised U.K. GDP rose 2.9% in the first quarter, eating May's estimate of a 2.4% increase, after a 3.4% gain in the fourth quarter.

The U.K. current account deficit narrowed to £26.5 billion in the first quarter from £28.93 billion in the fourth quarter. The fourth quarter's figure was revised down from a deficit of £25.3 billion.

Analysts had expected the current account deficit to decrease to £23.25 billion.

The first quarter's current account deficit amounted to 5.8% of GDP, after 6.4% of GDP in the fourth quarter.

Current figures:

Name Price Change Change %

FTSE 100 6,578.99 -41.49 -0.63 %

DAX 11,041.33 -41.87 -0.38 %

CAC 40 4,857.49 -12.33 -0.25 %

-

11:53

Preliminary consumer price inflation in the Eurozone declines to 0.2% in June

Eurostat released its consumer price inflation data for the Eurozone on Tuesday. The preliminary consumer price inflation in the Eurozone fell to an annual rate of 0.2% in June from 0.3% in May, in line with expectations.

The decrease was driven by lower energy prices and by a softer increase in food and services prices.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco decreased to an annual rate of 0.8% in June from 0.9% in May.

Food, alcohol and tobacco prices were up 1.2% in June, non-energy industrial goods prices gained 0.4%, and services prices climbed 1.0%, while energy prices dropped 5.1%.

-

11:44

Eurozone's unemployment rate remains unchanged at 11.1% in May

Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate remained unchanged at 11.1% in May, in line with expectations. It was the lowest level since March 2012.

There were 17.726 million unemployed in the Eurozone in May, down 35,000 from April.

The lowest unemployment rate in the Eurozone in April was recorded in Germany (4.7%), and the highest in Greece (25.6% in March 2015) and Spain (22.5%).

The youth unemployment rate was 22.1% in the Eurozone in May, compared to 23.8% in May a year ago.

-

11:37

Final U.K. GDP grows at 0.4% in the first quarter

The Office for National Statistics (ONS) released its final gross domestic product (GDP) data on Tuesday. The final U.K. GDP expanded at 0.4% in the first quarter, beating May's estimate of a 0.3% gain, after a 0.8% rise in the fourth quarter.

The upward revision was driven by methodological changes in construction.

On a yearly basis, the revised U.K. GDP rose 2.9% in the first quarter, eating May's estimate of a 2.4% increase, after a 3.4% gain in the fourth quarter.

The service sector climbed 0.4% in the first quarter, the construction sector dropped 0.2%, while the production sector was up 0.2%.

-

11:27

U.K. current account deficit narrows to £26.5 billion in the first quarter

The U.K.'s National Statistics Office (ONS) released its current account data for the U.K. on Tuesday. The U.K. current account deficit narrowed to £26.5 billion in the first quarter from £28.93 billion in the fourth quarter. The fourth quarter's figure was revised down from a deficit of £25.3 billion.

Analysts had expected the current account deficit to decrease to £23.25 billion.

The first quarter's current account deficit amounted to 5.8% of GDP, after 6.4% of GDP in the fourth quarter.

Declines in the deficit on the secondary income account and the primary income account partially offset a rise in the deficit on the trade account.

-

11:14

German adjusted retail sales are up 0.5% in May

Destatis released its retail sales for Germany on Tuesday. German adjusted retail sales rose 0.5% in May, beating forecasts of a flat reading, after a 1.3% increase in April. April's figure was revised down from a 1.7% gain.

On a yearly basis, German retail sales fell 0.4% in May, missing expectations for a 2.5% gain, after a 1.1% rise in April. April's figure was revised up from a 1.0% increase.

Sales of non-food products increased at an annual rate of 0.2% in May, while sales of food products declined by 1.1%.

-

11:03

Number of unemployed people in Germany declines by 1,000 in June

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany declined by 1,000 in June, missing expectations for a 5,000 decline, after a 5,000 drop in May.

The number of unemployed people was 2.786 million in June, the lowest level since December 1991.

Germany's adjusted unemployment rate remained unchanged at 6.4% in June, in line with expectations.

-

10:55

Standard & Poor’s downgrades Greece’s sovereign debt rating to CCC-

The rating agency Standard & Poor's on Monday downgraded Greece's sovereign debt rating to CCC- from CCC. The outlook is negative.

The rating agency said that the likelihood is 50% that Greece eventually exits the Eurozone. Standard & Poor's forecasts a default within six months.

"In our view, the Greek government's decision to hold a national referendum on official creditors' loan proposals indicates that Prime Minister Alexis Tsipras will prioritize domestic politics over the country's financial and economic stability, commercial debt service, and membership of the Eurozone," the agency said.

-

10:45

Greek government official confirms Athens will not repay €1.538 billion IMF loans by June 30

A Greek government official confirmed on Monday that Athens will not repay €1.538 billion IMF loans by June 30.

IMF Managing Director Christine Lagarde said earlier this month that Greece would be in default as of July 1 if it failed to repay loans.

-

10:34

German Chancellor Angela Merkel: Europe should be able to find a common compromise

German Chancellor Angela Merkel said on Monday that Europe should be able to find a common compromise. She warned that if the "euro fails, Europe fails". But Merkel added that that Europe's principles "need to be fought for".

"Again and again we hear the question: 'can't we, just for once, shelve the principles?' And here we have to say: 'No we cannot' ... and that's because we want Europe to emerge from this crisis stronger than it was when it went into the crisis," she said.

-

10:18

Earnings in Japan climb 0.6% in May

Japan's Ministry of Health, Labor and Welfare released its labour cash earnings data on Tuesday. Total earnings in Japan climbed 0.6% year-over-year in May, after a 0.7% rise in April.

Total real wage fell 0.1% in May, after a 0.1% decline in April.

-

10:10

German vice chancellor Sigmar Gabriel: a Greek referendum could make sense

Germany's vice chancellor Sigmar Gabriel said in an interview on Saturday that a Greek referendum could make sense.

"We'd be advised not to dismiss this suggestion from Mr. Tsipras out of hand and say 'that's just a trick.' But rather if the questions are clearly framed…then it could make sense," he said.

-

08:53

Global Stocks: US indices declined

A sharp stocks selloff was recorded on Monday worldwide, including Wall Street. Investors are preparing themselves for Greek default. At the same time they are concerned that a similar scenario can happen to other financially weak countries around the globe.

The Dow Jones industrial average dropped by 350.33 points, or 1.95%, to 17,596.35 (the biggest one-day decline since June 2013, which erased all of the gains made by the index this year). The Standard & Poor's 500 declined by 43.85 points, or 2.10%, to 2,057.64. The Nasdaq Composite fell by 122.04 points, or 2.40%, to close at 4,958.47.

Experts say that a default would definitely shake markets, but it would not be as painful as the 2008 crisis.

This morning in Asia Hong Kong Hang Seng rose by 1.24%, or 322.65 points, to 26,289.63 despite Greek drama. China Shanghai Composite Index advanced by 1.96%, or 79.64 points, to 4,132.67. Meanwhile the Nikkei gained 0.49%, or 99.43 points, to 20,209.38 with airlines leading the gains amid lower fuel prices.

Chinese stocks volatility is likely to persist in the coming weeks.

Investors are waiting for statements from the European Central Bank. Some believe that it can boost its QE program to help markets overcome Greek drama.

-

04:01

Nikkei 225 20,178.04 +68.09 +0.34 %, Hang Seng 26,021.21 +54.23 +0.21 %, Shanghai Composite 4,022.92 -30.11 -0.74 %

-

00:29

Stocks. Daily history for Jun 29’2015:

(index / closing price / change items /% change)

Nikkei 225 20,109.95 -596.20 -2.88 %

Hang Seng 25,966.98 -696.89 -2.61 %

S&P/ASX 200 5,422.49 -123.40 -2.23 %

Shanghai Composite 4,054.86 -138.02 -3.29 %

FTSE 100 6,620.48 -133.22 -1.97 %

CAC 40 4,869.82 -189.35 -3.74 %

Xetra DAX 11,083.2 -409.23 -3.56 %

S&P 500 2,057.64 -43.85 -2.09 %

NASDAQ Composite 4,958.47 -122.04 -2.40 %

Dow Jones 17,596.35 -350.33 -1.95 %

-