Noticias del mercado

-

21:00

Dow -1.59% 17,661.75 -284.93 Nasdaq -2.00% 4,978.96 -101.55 S&P -1.70% 2,065.76 -35.73

-

18:38

WSE: Session Results

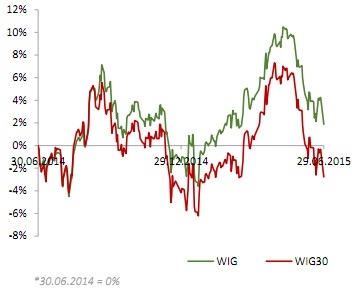

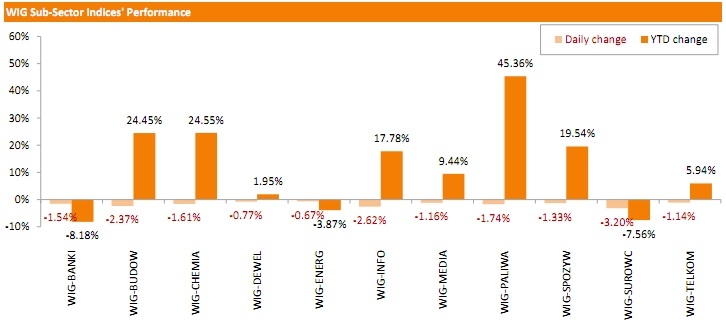

Polish equity market posted losses on Monday on the Greek threat. The broad market measure, the WIG Index, declined 1.73 %. All sectors in the WIG Index fell, with materials (-3.20%), technologies (-2.62%) and constructions (-2.32%) stocks dragging the market down.

In the large-cap stock universe, most of the names posted losses, pushing the group measure, the WIG30 Index, down 1.74%. BOGDANKA (WSE: LWB) recorded the biggest slump, dropping 5.20%. Additional pressure on the company's quotations came from news that the Office of Competition and Consumer Protection (UOKiK) stated that the state-owned coal miner Kompania Weglowa does not curb competition, rejecting charges posed by BOGDANKA. It was followed by LPP (WSE: LPP) and KGHM (WSE: KGH), losing 3.85% and 3.07% respectively. At the same time, TAURON PE (WSE: TPE), GTC (WSE: GTC) and KERNEL (WSE: KER) were the only names that stepped up, returning gains of 0.23%-0.69%.

-

18:01

European stocks closed: FTSE 100 6,620.48 -133.22 -1.97% CAC 40 4,869.82 -189.35 -3.74% DAX 11,083.2 -409.23 -3.56%

-

18:00

European stocks close: stocks closed lower as debt talks between Athens and its creditors were broken down

Stock indices closed lower as debt talks between Athens and its creditors were broken down. Greek Prime Minister Alexis Tsipras called for a referendum on Saturday morning. The Eurogroup has not agreed to extend the Greek bailout programme.

The referendum is scheduled to be on July 05. Greeks will be asked to vote if they want to accept the aid proposal by the country's creditors.

Greece's parliament approved a referendum on yearly Sunday.

The Greek government Sunday announced its decision to shut the country's banks and to impose capital controls to avert the collapse of its financial system. Banks will be closed until July 06.

Daily cash withdrawals has been limited to 60 euros and payments and transfers abroad has been banned.

Greek Prime Minister assured Greeks that their bank deposits were safe.

Stock exchange in Greece also remains closed.

Meanwhile, the economic data from the Eurozone was weaker than expected. German preliminary consumer price index fell 0.1% in June, missing expectations for a 0.1% gain, after a 0.1% rise in May.

On a yearly basis, German preliminary consumer price index declined to 0.3% in June from 0.7% in May, missing expectations for a decrease to 0.5%.

The European Commission's economic sentiment index for the Eurozone declined to 103.5 in June from 130.8 in May. Analysts had expected the index to remain unchanged at 103.8.

The decline was driven by a fall in confidence in industry and in retail trade. The industrial confidence index decreased to -3.4 in June, while the index for retail trade declined to -1.1 in from 1.5.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. fell to 64,434 in May from 67,580 in April, missing expectations for an increase to 68,700.

The BoE introduced tighter rules on mortgage lending last year. Lenders have to make more checks on whether borrowers can afford their loans.

Consumer credit in the U.K. climbed by £1.001 billion in May, after a rise by £1.176 billion in April.

Net lending to individuals in the U.K. increased by £3.1 billion in May, after a £2.9 billion gain in April.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,620.48 -133.22 -1.97 %

DAX 11,083.2 -409.23 -3.56 %

CAC 40 4,869.82 -189.35 -3.74 %

-

17:48

German consumer price inflation falls 0.1% in June

Destatis released its consumer price data for Germany on Monday. German preliminary consumer price index fell 0.1% in June, missing expectations for a 0.1% gain, after a 0.1% rise in May.

The decline was driven by lower energy, food and services costs.

On a yearly basis, German preliminary consumer price index declined to 0.3% in June from 0.7% in May, missing expectations for a decrease to 0.5%.

-

17:02

European Central Bank decides not to raise the amount of emergency funding (ELA) on Sunday

The European Central Bank (ECB) decided not to raise the amount of emergency funding (ELA) on Sunday. The amount the Greek central bank can lend its banks totals around €89 billion.

The ECB Governing Council Member Ewald Nowotny said on Monday that the central bank will decide on Wednesday whether to raise emergency funding or not.

-

16:51

Bank of England Chief Economist Andy Haldane: hiking interest rate too early could lead to another recession in the U.K.

The Bank of England (BoE) Chief Economist Andy Haldane plans to tell students at the Open University on Tuesday that hiking interest rate too early could lead to another recession in the U.K.

"A policy of early lift-off could be self-defeating," he said.

Haldane thinks that the central bank should keep its interest rate unchanged for the short to medium term.

-

16:45

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Monday after Greek bailout talks collapsed, intensifying fears that the country could be the first to exit the euro zone.

Almost all of Dow stocks in negative area (29 of 30). Top looser -JPMorgan Chase & Co. (JPM, -2.03%). Top gainer - Pfizer Inc. (PFE, +0.24).

Almost all of S&P index sectors in negative area. Top gainer - Utilities (+0,3%). Top looser - Financial (-1.5%).

At the moment:

Dow 17698.00 -175.00 -0.98%

S&P 500 2074.75 -21.00 -1.00%

Nasdaq 100 4432.00 -48.50 -1.08%

10-year yield 2.38% -0.09

Oil 58.59 -1.04 -1.74%

Gold 1176.20 +3.00 +0.26%

-

16:40

Federal Reserve Bank of New York President William C. Dudley: the Fed is likely to raise its interest rate in September if the U.S. economy continues to strengthen

Federal Reserve Bank of New York President William C. Dudley said in an interview with the Financial Times that the Fed is likely to raise its interest rate in September if the U.S. economy continues to strengthen.

"If the data continue to evolve in the way they have, I think September is very much in play," he said.

"If we hit 2.5 percent growth in the second quarter and it looks like the third quarter is shaping up for something similar, then I think you are on a firm enough track that you would imagine you would have made sufficient progress in our two tests, certainly by the end of the year," Dudley added.

-

16:29

U.S. pending home sales climbs 0.9% in May

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. rose 0.9% in May, exceeding expectations for a 1.2% increase, after a 2.7% gain in April. April's figure was revised down from a 3.4% rise.

Pending home sales increased in two of four regions of the country.

"The steady pace of solid job creation seen now for over a year has given the housing market a boost this spring. It's very encouraging to now see a broad based recovery with all four major regions showing solid gains from a year ago and new home sales also coming alive. " the NAR's chief economist Lawrence Yun said.

He warned that home prices could increase "to an unhealthy and unsustainable pace" if new and existing house supply will not rise.

-

16:05

European Union Economic Affairs Commissioner Pierre Moscovici: a deal between Athens and its lenders is still possible

European Union (EU) Economic Affairs Commissioner Pierre Moscovici said in an interview to the French radio RTL on Monday that a deal between Athens and its lenders is still possible.

"We are just centimetres away from an agreement," Moscovici said. "We must find a compromise," he added.

-

15:53

International Monetary Fund Managing Director Christine Lagarde is disappointed with the outcome of debt talks with Greece, but is still willing to continue debt talks

International Monetary Fund Managing Director Christine Lagarde said on Sunday that she is disappointed with the outcome of debt talks with Greece. She added that she is still willing to continue debt talks with Athens.

"I continue to believe that a balanced approach is required to help restore economic stability and growth in Greece," Lagarde said.

-

15:39

U.S. Stocks open: Dow -0.79%, Nasdaq -0.95%, S&P -0.78%

-

15:39

Consumer price inflation in Spain increases 0.3% in June

The Spanish statistical office INE released its consumer price inflation data on Monday. Consumer price inflation in Spain was up 0.3% in June, after a 0.5% gain in May.

On a yearly basis, consumer prices climbed by 0.1% in June from a year ago, after a 0.2% decline in May. It was the first rise since last June.

-

15:27

Before the bell: S&P futures +1.05%, NASDAQ futures +1.18%

U.S. stock-index futures retreated amid mounting concern Greece will exit the euro area, with the nation imposing capital controls and shutting banks before the government puts creditors' demands to a vote.

Global markets:

Nikkei 20,109.95 -596.20 -2.88%

Hang Seng 25,966.98 -696.89 -2.61%

Shanghai Composite 4,054.86 -138.02 -3.29%

FTSE 6,658.98 -94.72 -1.40%

CAC 4,907.25 -151.92 -3.00%

DAX 11,190.53 -301.90 -2.63%

Crude oil $58.89 (-1.24%)

Gold $1182.40 (+0.78%)

-

15:22

Retail sales in Spain rise at a seasonally adjusted rate of 0.1% in May

The Spanish statistical office INE released its retail sales data on Monday. Retail sales in Spain rose at a seasonally adjusted rate of 0.1% in May, after a 1.3% gain in April.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 3.4% in May, after a 3.9% rise in April. Retail sales have been increasing since August 2015.

Sales of non-food products climbed 5.3% in May from a year ago, while food sales fell 0.4%.

-

15:14

Swiss National Bank President Thomas Jordan: the central bank intervened to stabilize the market

The Swiss National Bank (SNB) President Thomas Jordan said in Bern on Monday that the central bank intervened to stabilize the market.

"We have always said that we are active in the foreign exchange market if necessary. A situation like we experienced over the weekend is a situation which warranted this need and we went in to stabilize the market," he said.

Jordan declined to comment on the details of the intervention.

The SNB president pointed that the central bank is prepared for a Greek default. He added that the Greek debt crisis should not destabilise other countries from the Eurozone such as Spain and Portugal.

-

15:05

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

11.04

+1.28%

10.6K

Wal-Mart Stores Inc

WMT

71.72

-0.55%

3.2K

AT&T Inc

T

35.90

-0.61%

39.1K

Procter & Gamble Co

PG

78.80

-0.68%

6.2K

The Coca-Cola Co

KO

39.70

-0.75%

0.3K

Nike

NKE

108.88

-0.76%

11.7K

United Technologies Corp

UTX

112.66

-0.76%

2.2K

General Motors Company, NYSE

GM

34.12

-0.76%

42.9K

Verizon Communications Inc

VZ

47.25

-0.78%

11.7K

McDonald's Corp

MCD

96.50

-0.81%

3.5K

International Business Machines Co...

IBM

164.08

-0.83%

7.8K

Johnson & Johnson

JNJ

98.80

-0.84%

11.0K

Pfizer Inc

PFE

33.63

-0.85%

5.2K

Walt Disney Co

DIS

114.00

-0.86%

3.9K

ALTRIA GROUP INC.

MO

49.05

-0.86%

4.9K

Merck & Co Inc

MRK

57.98

-0.87%

1.3K

American Express Co

AXP

79.17

-0.89%

0.4K

Caterpillar Inc

CAT

85.99

-0.96%

1.2K

Home Depot Inc

HD

111.50

-0.98%

1.5K

Cisco Systems Inc

CSCO

28.00

-0.99%

11.1K

Google Inc.

GOOG

526.25

-1.02%

3.7K

UnitedHealth Group Inc

UNH

121.98

-1.03%

0.4K

Deere & Company, NYSE

DE

95.40

-1.08%

1.2K

Exxon Mobil Corp

XOM

82.95

-1.09%

27.8K

FedEx Corporation, NYSE

FDX

171.77

-1.09%

0.3K

Apple Inc.

AAPL

125.34

-1.11%

487.7K

Chevron Corp

CVX

97.50

-1.12%

12.9K

Microsoft Corp

MSFT

44.75

-1.12%

44.1K

AMERICAN INTERNATIONAL GROUP

AIG

62.00

-1.16%

0.2K

Amazon.com Inc., NASDAQ

AMZN

433.03

-1.16%

5.4K

General Electric Co

GE

26.76

-1.22%

40.6K

Ford Motor Co.

F

15.21

-1.23%

5.3K

3M Co

MMM

155.10

-1.27%

0.2K

Intel Corp

INTC

30.62

-1.29%

40.2K

Boeing Co

BA

140.60

-1.32%

0.6K

Goldman Sachs

GS

210.20

-1.39%

10.7K

Yahoo! Inc., NASDAQ

YHOO

39.50

-1.40%

15.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.65

-1.45%

9.1K

Facebook, Inc.

FB

86.70

-1.49%

229.4K

E. I. du Pont de Nemours and Co

DD

64.60

-1.52%

5.4K

Starbucks Corporation, NASDAQ

SBUX

53.79

-1.52%

2.3K

International Paper Company

IP

47.50

-1.55%

0.3K

Hewlett-Packard Co.

HPQ

30.05

-1.56%

4.2K

Visa

V

67.64

-1.61%

3.2K

ALCOA INC.

AA

11.49

-1.71%

19.4K

JPMorgan Chase and Co

JPM

67.69

-1.83%

29.0K

Yandex N.V., NASDAQ

YNDX

15.50

-1.96%

3.4K

Tesla Motors, Inc., NASDAQ

TSLA

261.75

-2.00%

50.8K

Citigroup Inc., NYSE

C

55.20

-2.02%

216.7K

Twitter, Inc., NYSE

TWTR

34.54

-2.04%

120.0K

-

14:52

Canadian industrial product and raw materials price indexes climb in May

Statistics Canada released its industrial product and raw materials price indexes on Monday. The Industrial Product Price Index (IPPI) climbed 0.5% in May, after a 0.9% drop in April.

The increase was driven by higher prices for energy and petroleum products. Energy and petroleum products rose 5.0% in May.

15 of the 21 commodity groups declined, 3 increased and 3 were unchanged.

The Raw Materials Price Index (RMPI) climbed 4.4% in May, after a 4.0% rise in April. April's figure was revised up from a 3.8% increase.

The increase was driven by higher prices for crude energy products. Crude energy products soared 8.8% in May.

3 of the 6 commodity groups rose and 3 decreased.

-

14:52

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Tesla Motors (TSLA) reiterated at Outperform at Credit Suisse, target raised from $290 to $325

-

12:02

European stock markets mid session: stocks traded lower on worries Greece may leave the Eurozone

Stock indices traded lower on worries Greece may leave the Eurozone. Greek Prime Minister Alexis Tsipras announced his decision for a referendum on Saturday morning. The Eurogroup has not agreed to extend the Greek bailout programme.

The referendum is scheduled to be on July 05. Greeks will be asked to vote if they want to accept the aid proposal by the country's creditors.

Greece's parliament approved a referendum on yearly Sunday.

The Greek government Sunday announced its decision to shut the country's banks and to impose capital controls to avert the collapse of its financial system. Banks will be closed until July 06.

Daily cash withdrawals has been limited to 60 euros and payments and transfers abroad has been banned.

Greek Prime Minister assured Greeks that their bank deposits were safe.

Stock exchange in Greece also remains closed.

Meanwhile, the economic data from the Eurozone was weaker than expected. The European Commission's economic sentiment index for the Eurozone declined to 103.5 in June from 130.8 in May. Analysts had expected the index to remain unchanged at 103.8.

The decline was driven by a fall in confidence in industry and in retail trade. The industrial confidence index decreased to -3.4 in June, while the index for retail trade declined to -1.1 in from 1.5.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. fell to 64,434 in May from 67,580 in April, missing expectations for an increase to 68,700.

The BoE introduced tighter rules on mortgage lending last year. Lenders have to make more checks on whether borrowers can afford their loans.

Consumer credit in the U.K. climbed by £1.001 billion in May, after a rise by £1.176 billion in April.

Net lending to individuals in the U.K. increased by £3.1 billion in May, after a £2.9 billion gain in April.

Current figures:

Name Price Change Change %

FTSE 100 6,649.39 -104.31 -1.54 %

DAX 11,140.61 -351.82 -3.06 %

CAC 40 4,900.53 -158.64 -3.14 %

-

11:40

Eurozone’s economic sentiment index declines to 103.5 in June

The European Commission released its economic sentiment index for the Eurozone on Monday. The index declined to 103.5 in June from 130.8 in May. Analysts had expected the index to remain unchanged at 103.8.

The decline was driven by a fall in confidence in industry and in retail trade. The industrial confidence index decreased to -3.4 in June, while the index for retail trade declined to -1.1 in from 1.5.

The final consumer confidence index was at -5.6 in June, in line with expectations.

The services sentiment index remained unchanged at 7.8 in May June.

The business climate index was down to 0.14 in June from 0.28 in May, missing forecasts of a decline to 0.27.

-

11:24

Number of mortgages approvals in the U.K. decline to 64,434 in May

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. fell to 64,434 in May from 67,580 in April, missing expectations for an increase to 68,700.

The BoE introduced tighter rules on mortgage lending last year. Lenders have to make more checks on whether borrowers can afford their loans.

Consumer credit in the U.K. climbed by £1.001 billion in May, after a rise by £1.176 billion in April.

Net lending to individuals in the U.K. increased by £3.1 billion in May, after a £2.9 billion gain in April.

-

11:04

People’s Bank of China cuts its one-year lending rate by 25 basis points to 4.85%

The People's Bank of China Sunday cut the one-year lending rate by 25 basis points to 4.85% effective June 28. The one-year deposit rate has been lowered by 25 basis points to 2%, while reserve ratios for some lenders will be cut by 50 basis points.

It was the fourth cut since November.

Shanghai Composite stock index dropped almost 20% in the past two weeks, the biggest decline since 1996.

-

10:55

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Sunday: the central bank is alert to downside risks to reach its 2% inflation target by around September 2016

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Sunday (remarks were released Monday) that the central bank is alert to downside risks to reach its 2% inflation target by around September 2016.

"While our projection is that inflation will be in the neighbourhood of 2 percent most likely around the April-September period of 2016, the risks to that scenario cannot be ignored, particularly when the global economy is full of uncertainty, including over geopolitical factors," Kuroda said.

He added that Japan's consumer inflation declined to around zero due partly to "the temporary influence of low oil prices".

-

10:41

German Finance Minister Wolfgang Schaeuble: Britain’s exit from the European Union would be a disaster for both Europe and the United Kingdom

German Finance Minister Wolfgang Schaeuble said on Friday that it would be a disaster for both Europe and the United Kingdom if the UK were to leave the European Union.

"It would not only be a disaster for the UK it would be a disaster for Europe. Therefore we will avoid this," he said.

Schaeuble added that it is Britain's decision.

-

10:25

European Council President Donald Tusk: Greece must remain a member of the Eurozone

European Council President Donald Tusk said on Sunday that Greece must remain a member of the Eurozone.

"Greece is and should remain euro area member," he said.

Tusk added that he is in touch with Eurozone leaders "to ensure integrity of euro area of 19 countries".

-

10:14

Greek government shuts the country’s banks and imposes capital controls to avert the collapse of its financial system

The Greek government Sunday announced its decision to shut the country's banks and to impose capital controls to avert the collapse of its financial system. Banks will be closed until July 06.

Daily cash withdrawals has been limited to 60 euros and payments and transfers abroad has been banned.

Greek Prime Minister assured Greeks that their bank deposits were safe.

Stock exchange also remains closed.

-

09:11

Global Stocks: Asian equities decline amid Greece default fears

U.S. stock indices posted mixed results on Friday. Dow Jones gain was caused by an over 4% increase by Nike due to strong quarterly results. Market participants were cautious about the future of Greece as European leaders were supposed to hold another meeting on Saturday. Later on media reported that the Eurogroup refused to extend Greece's financial aid program without a clear reforms plan. Thus Greece might default on its €1.6 billion payment to the IMF, which is due June the 30th.

Media also reported that Greece's PM Alexis Tsipras announced a referendum. The country's citizens will be asked to express their opinion on relations between Greece and its lenders when the referendum is held on July the 5th. Tsipras recommended objecting lenders' austerity proposals.

The International Monetary Fund has also refused to provide additional funds.

The Dow Jones industrial average rose by 56.32 points, or 0.31%, to 17,946.68. The Standard & Poor's 500 declined by 0.82 points, or 0.04%, to 2,102.31. The Nasdaq Composite fell by 31.68 points, or 0.62%, to close at 5,080.51.

On Monday morning Hong Kong Hang Seng fell by 3.22%, or 859.61 points, to 25,804.26. China Shanghai Composite Index dropped 5.82%, or 243.99 points, to 3,948.88. Meanwhile the Nikkei declined by 2.45%, or 506.56 points, to 20,199.59.

Asian stocks fell amid absence of Greece's deal. Especially this concerns to companies dealing with Europe.

On Saturday China's central bank cut both its one-year benchmark lending rate and its one-year benchmark deposit rate by 25bp to 4.85% and 2.0%, respectively. This decision was made after a sharp selloff in China stocks market. -

04:01

Nikkei 225 20,289.48 -416.67 -2.01 %, Hang Seng 26,231.65 -432.22 -1.62 %, Shanghai Composite 4,289.77 +96.90 +2.31 %

-

00:35

Stocks. Daily history for Jun 26’2015:

(index / closing price / change items /% change)

Nikkei 225 20,706.15 -65.25 -0.31 %

Hang Seng 26,663.87 -481.88 -1.78 %

S&P/ASX 200 5,545.89 -86.83 -1.54 %

Shanghai Composite 4,193.64 -334.14 -7.38 %

FTSE 100 6,753.7 -54.12 -0.79 %

CAC 40 5,059.17 +17.46 +0.35 %

Xetra DAX 11,492.43 +19.30 +0.17 %

S&P 500 2,101.49 -0.82 -0.04 %

NASDAQ Composite 5,080.5 -31.69 -0.62 %

Dow Jones 17,946.68 +56.32 +0.31 %

-