Noticias del mercado

-

17:42

Oil prices traded lower on worries over the Greek debt

Oil prices traded lower on worries over the Greek debt crisis. Greek Prime Minister Alexis Tsipras called for a referendum on Saturday morning. The Eurogroup has not agreed to extend the Greek bailout programme.

The referendum is scheduled to be on July 05. Greeks will be asked to vote if they want to accept the aid proposal by the country's creditors.

Greece's parliament approved a referendum on yearly Sunday.

The Greek government Sunday announced its decision to shut the country's banks and to impose capital controls to avert the collapse of its financial system. Banks will be closed until July 06.

Daily cash withdrawals has been limited to 60 euros and payments and transfers abroad has been banned.

Investors expect the results of talks on the Iranian nuclear program. It is likely that talks will continue as there are doubts that all issues can be resolved before June 30. An agreement could put more pressure on oil prices as Iran is likely to boost its crude exports.

WTI crude oil for August delivery decreased to $58.45 a barrel on the New York Mercantile Exchange.

Brent crude oil for August dropped to $61.80 a barrel on ICE Futures Europe.

-

17:23

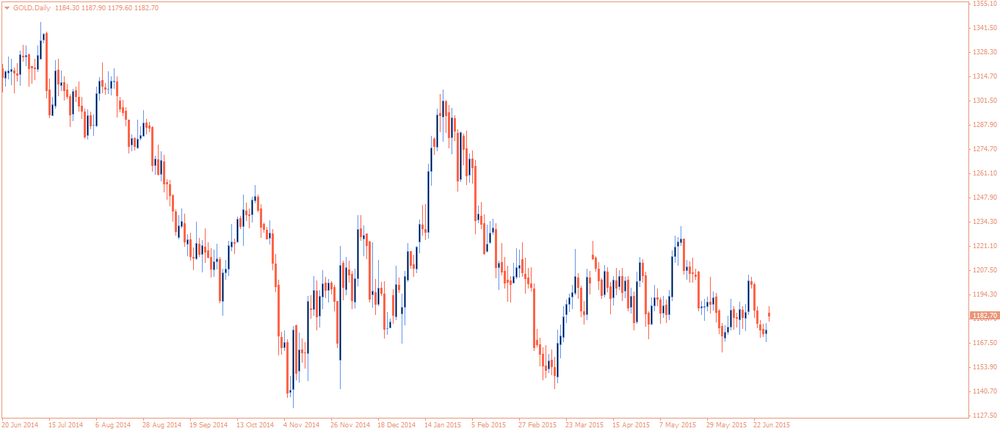

Gold price traded higher on news that debt talks were broken down

Gold price traded higher on news that debt talks were broken down. Greek Prime Minister Alexis Tsipras called for a referendum on Saturday morning. The Eurogroup has not agreed to extend the Greek bailout programme.

The referendum is scheduled to be on July 05. Greeks will be asked to vote if they want to accept the aid proposal by the country's creditors.

Greece's parliament approved a referendum on yearly Sunday.

The Greek government Sunday announced its decision to shut the country's banks and to impose capital controls to avert the collapse of its financial system. Banks will be closed until July 06.

Daily cash withdrawals has been limited to 60 euros and payments and transfers abroad has been banned.

Greek Prime Minister assured Greeks that their bank deposits were safe.

Stock exchange in Greece also remains closed.

The weaker-than-expected U.S. economic data also supported gold price. The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. rose 0.9% in May, exceeding expectations for a 1.2% increase, after a 2.7% gain in April. April's figure was revised down from a 3.4% rise.

August futures for gold on the COMEX today rose to 1177.70 dollars per ounce.

-

14:41

U.S. oil and gas rigs rise by 2 to 857 last week

The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 3 rigs to 628 last week, the lowest weekly level since August 06, 2010. It was the 29th consecutive weekly fall.

Combined oil and gas rigs increased by 2 to 859.

Oil production in the U.S. continues to rise despite the decline in oil rigs.

The U.S. Energy Information Administration forecasts that U.S. crude-oil production would begin to fall from June until February 2016.

-

11:04

People’s Bank of China cuts its one-year lending rate by 25 basis points to 4.85%

The People's Bank of China Sunday cut the one-year lending rate by 25 basis points to 4.85% effective June 28. The one-year deposit rate has been lowered by 25 basis points to 2%, while reserve ratios for some lenders will be cut by 50 basis points.

It was the fourth cut since November.

Shanghai Composite stock index dropped almost 20% in the past two weeks, the biggest decline since 1996.

-

09:17

Oil: prices dropped amid Greece crisis

West Texas Intermediate futures for August delivery dropped to $58.65 (-1.64%). Meanwhile Brent crude for August declined to $62.32 (-1.49%) a barrel. Prices dropped after media reported that Greece failed to reach an agreement with its creditors. Market participants are also waiting for news on sanctions against Iran. A possibility of cancellation of sanctions spurred fears that Iranian oil might add to the global glut, however some experts say that sanctions won't be lifted until compliance is verified. At the same time the verification process can take at least 4-8 months and additional crude oil will only flow from Iran by the first-quarter of 2016 at the earliest, even if the deal is finalized by July the 5th.

Oil prices are expected to be volatile this week. -

09:14

Gold celebrates safe-haven demand

Gold advanced to $1,183.40 (+0.87%) an ounce amid safe-haven demand as Greece got no deal with its creditors. The country's bailout program and its €1.6 billion payment to the International Monetary Fund both expire on June the 30th. This puts Greece's EU membership at a serious risk.

Meanwhile Greek government imposed capital controls and announced a referendum on creditors' austerity proposals. The referendum is supposed to be held on July the 5th. -

00:36

Commodities. Daily history for Jun 26’2015:

(raw materials / closing price /% change)

Oil 59.65 +0.03%

Gold 1,173.70 +0.04%

-