Noticias del mercado

-

20:20

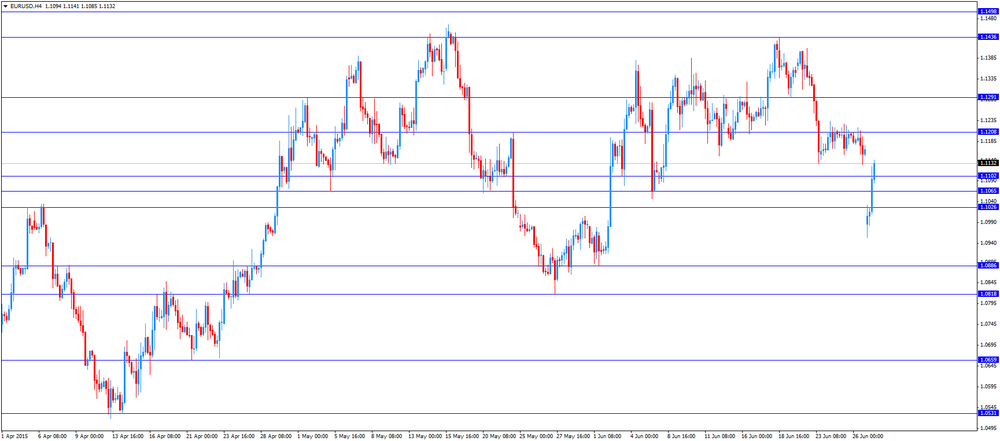

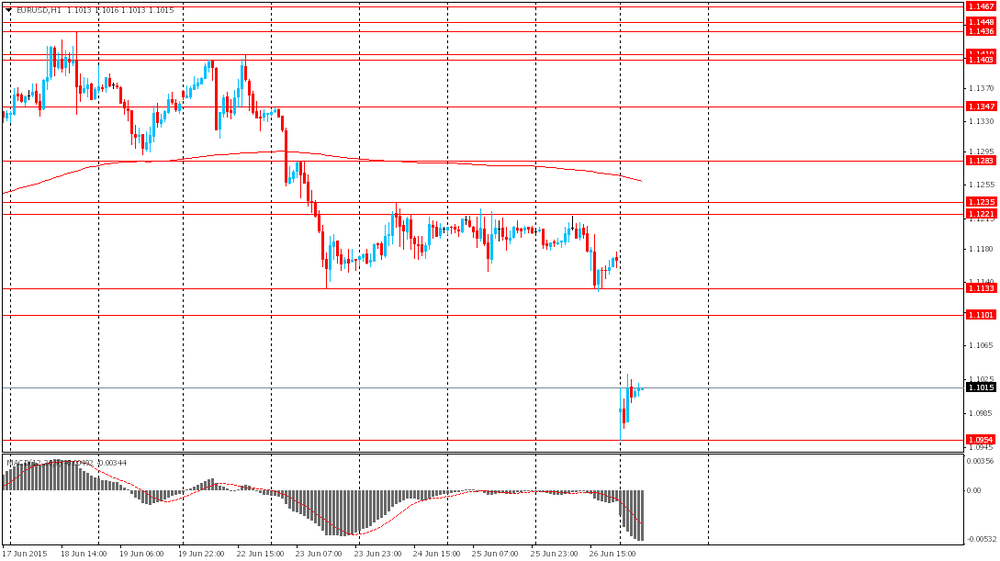

American focus: the dollar fell markedly against the euro

The euro rose substantially against the US dollar, closing today's gap and updating a maximum of 24 of June. First, the markets reacted sharply to the events of the weekend referendum in Greece capital controls and the closing of the banks. But then the market quickly stabilized and started to recover. In the referendum, the Greeks will have to make a decision: whether to agree to the terms on which lenders offer financial assistance. Survey results suggest that people can say "yes", and such an outcome could topple the government. At the same time, "no" does not necessarily entail the exit of Greece from the eurozone. The Greek government actually says that it is ready to give up running the country, if not the other alternatives will be offered claims of creditors. Meanwhile, tomorrow, Greece had to pay part of the debt to the IMF, but recently a representative of the Greek government announced that the country does not pay the installment on Tuesday. Experts point out, even if the rating agencies do not take some action, European lenders may well respond to such a move. According to traders, sharp turn euros caused by such factors: 1) the hope that an agreement is still possible, or the country will be extended for the period of payment of the debt before the referendum. 2) the purchase of euros from the SNB 3) closing of transactions carry trade in the euro.

The Swiss franc rose against the dollar significantly by upgrading the maximum on June 24 despite the fact that the SNB confirmed that makes intervention. As previously reported, the Central Bank of Switzerland on Monday night to intervene in the currency market to stabilize the franc against the backdrop of growing concerns about the possibility of a Greek exit from the eurozone. Chairman of the Governing Board of the Swiss National Bank Thomas Jordan said the bank intervened in the development of the situation on the market in order to restore the stability of the franc. "We have been active in the foreign exchange market to stabilize the situation", - he said, speaking in Bern. "We are in a very difficult situation and are closely watching the development of events," - he said, referring to the financial problems of Greece and the pressure they exert on the Swiss currency. Jordan is not outlined the scale of the intervention carried out by the Swiss National Bank and did not answer the question of whether this intervention is the first after 15 January, when the central bank reversed the lower limit for the euro / franc.

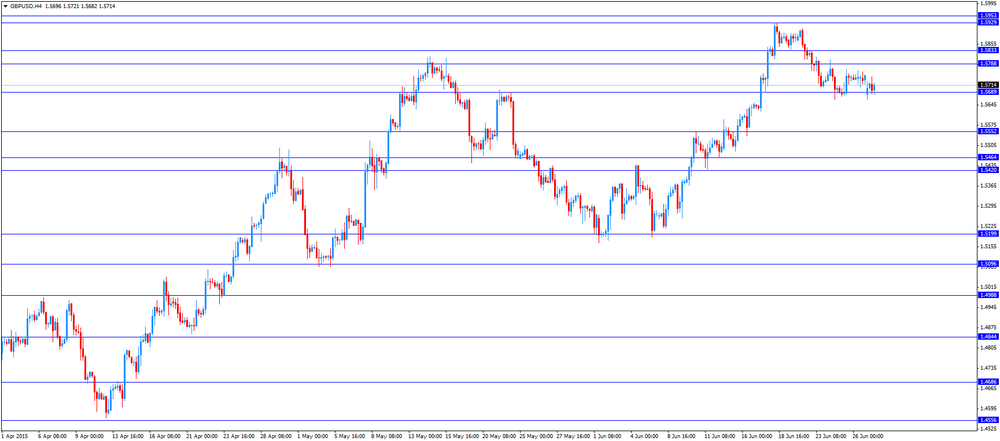

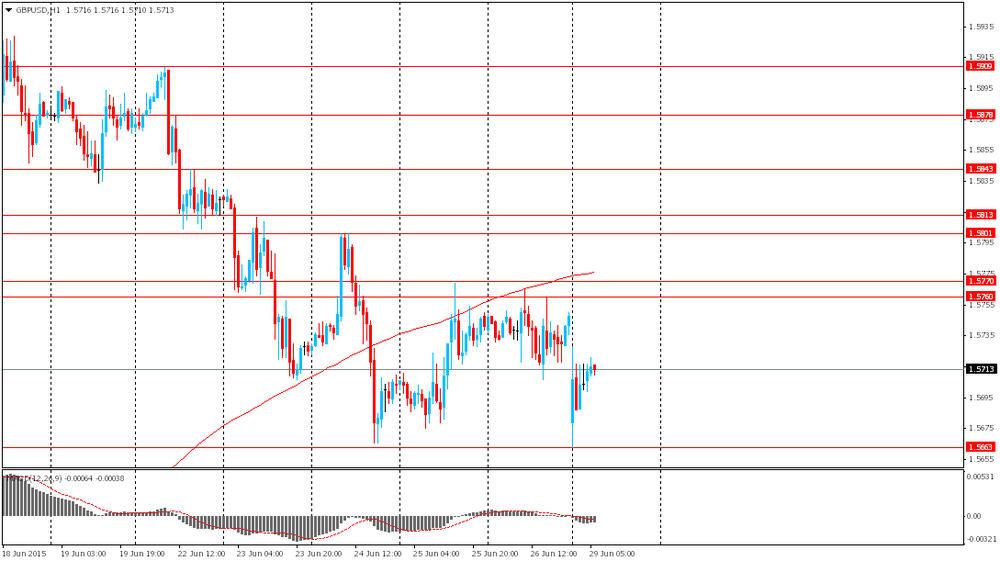

The British pound rose against the dollar mildly, updating a maximum of 25 of June, but then lost some positions. A little influenced by data on lending in the UK. Mortgage approval unexpectedly fell in May, data showed on Monday, the Bank of England, in contrast with other recent signs that activity in the housing market has intensified in recent months. Bank of England data also showed that consumer credit growth slowed slightly in May, but it is still strong. On a three-month annual basis, consumer loans grew at the fastest pace in nearly 10 years that emphasizes the dependence of the UK economic recovery from household expenditure. Mortgage permission to purchase homes totaled 64,434 in May, compared with 67,580 in April. Analysts predicted that 68,700 mortgage approvals were made in May. Net mortgage lending, which follows approvals increased by 2.098 billion. Pounds in May, noting the largest increase since November, said the Bank of England. This is slightly more than the forecast 2.05 billion pounds. The Bank of England said that consumer loans rose by 1.0 billion pounds in May, compared with 1.176 billion pounds in April. Economists had forecast an increase of 1.1 billion pounds. Despite the slowdown in May, consumer loans for three months on an annualized basis increased by 8.5 per cent, the highest rate since August 2005.

-

17:48

German consumer price inflation falls 0.1% in June

Destatis released its consumer price data for Germany on Monday. German preliminary consumer price index fell 0.1% in June, missing expectations for a 0.1% gain, after a 0.1% rise in May.

The decline was driven by lower energy, food and services costs.

On a yearly basis, German preliminary consumer price index declined to 0.3% in June from 0.7% in May, missing expectations for a decrease to 0.5%.

-

17:02

European Central Bank decides not to raise the amount of emergency funding (ELA) on Sunday

The European Central Bank (ECB) decided not to raise the amount of emergency funding (ELA) on Sunday. The amount the Greek central bank can lend its banks totals around €89 billion.

The ECB Governing Council Member Ewald Nowotny said on Monday that the central bank will decide on Wednesday whether to raise emergency funding or not.

-

16:51

Bank of England Chief Economist Andy Haldane: hiking interest rate too early could lead to another recession in the U.K.

The Bank of England (BoE) Chief Economist Andy Haldane plans to tell students at the Open University on Tuesday that hiking interest rate too early could lead to another recession in the U.K.

"A policy of early lift-off could be self-defeating," he said.

Haldane thinks that the central bank should keep its interest rate unchanged for the short to medium term.

-

16:40

Federal Reserve Bank of New York President William C. Dudley: the Fed is likely to raise its interest rate in September if the U.S. economy continues to strengthen

Federal Reserve Bank of New York President William C. Dudley said in an interview with the Financial Times that the Fed is likely to raise its interest rate in September if the U.S. economy continues to strengthen.

"If the data continue to evolve in the way they have, I think September is very much in play," he said.

"If we hit 2.5 percent growth in the second quarter and it looks like the third quarter is shaping up for something similar, then I think you are on a firm enough track that you would imagine you would have made sufficient progress in our two tests, certainly by the end of the year," Dudley added.

-

16:29

U.S. pending home sales climbs 0.9% in May

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. rose 0.9% in May, exceeding expectations for a 1.2% increase, after a 2.7% gain in April. April's figure was revised down from a 3.4% rise.

Pending home sales increased in two of four regions of the country.

"The steady pace of solid job creation seen now for over a year has given the housing market a boost this spring. It's very encouraging to now see a broad based recovery with all four major regions showing solid gains from a year ago and new home sales also coming alive. " the NAR's chief economist Lawrence Yun said.

He warned that home prices could increase "to an unhealthy and unsustainable pace" if new and existing house supply will not rise.

-

16:05

European Union Economic Affairs Commissioner Pierre Moscovici: a deal between Athens and its lenders is still possible

European Union (EU) Economic Affairs Commissioner Pierre Moscovici said in an interview to the French radio RTL on Monday that a deal between Athens and its lenders is still possible.

"We are just centimetres away from an agreement," Moscovici said. "We must find a compromise," he added.

-

16:00

U.S.: Pending Home Sales (MoM) , May 0.9% (forecast 1.2%)

-

15:53

International Monetary Fund Managing Director Christine Lagarde is disappointed with the outcome of debt talks with Greece, but is still willing to continue debt talks

International Monetary Fund Managing Director Christine Lagarde said on Sunday that she is disappointed with the outcome of debt talks with Greece. She added that she is still willing to continue debt talks with Athens.

"I continue to believe that a balanced approach is required to help restore economic stability and growth in Greece," Lagarde said.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0945/50(E420mn), $1.1100(E666mn)

GBP/USD: $1.5800(stg183mn)

USD/JPY: Y122.00($2.0bn), Y122.45/50($370mn), Y123.25($255mn), Y123.50($280mn)

EUR/JPY: Y137.00(E225mn)

USD/CAD: Cad1.2430($240mn)

AUD/USD: $0.7670(A$240mn)

NZD/USD: $0.6840(NZ$366mn), $0.6875(NZ363mn), $0.6890(NZ$180mn)

-

15:39

Consumer price inflation in Spain increases 0.3% in June

The Spanish statistical office INE released its consumer price inflation data on Monday. Consumer price inflation in Spain was up 0.3% in June, after a 0.5% gain in May.

On a yearly basis, consumer prices climbed by 0.1% in June from a year ago, after a 0.2% decline in May. It was the first rise since last June.

-

15:22

Retail sales in Spain rise at a seasonally adjusted rate of 0.1% in May

The Spanish statistical office INE released its retail sales data on Monday. Retail sales in Spain rose at a seasonally adjusted rate of 0.1% in May, after a 1.3% gain in April.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 3.4% in May, after a 3.9% rise in April. Retail sales have been increasing since August 2015.

Sales of non-food products climbed 5.3% in May from a year ago, while food sales fell 0.4%.

-

15:14

Swiss National Bank President Thomas Jordan: the central bank intervened to stabilize the market

The Swiss National Bank (SNB) President Thomas Jordan said in Bern on Monday that the central bank intervened to stabilize the market.

"We have always said that we are active in the foreign exchange market if necessary. A situation like we experienced over the weekend is a situation which warranted this need and we went in to stabilize the market," he said.

Jordan declined to comment on the details of the intervention.

The SNB president pointed that the central bank is prepared for a Greek default. He added that the Greek debt crisis should not destabilise other countries from the Eurozone such as Spain and Portugal.

-

14:52

Canadian industrial product and raw materials price indexes climb in May

Statistics Canada released its industrial product and raw materials price indexes on Monday. The Industrial Product Price Index (IPPI) climbed 0.5% in May, after a 0.9% drop in April.

The increase was driven by higher prices for energy and petroleum products. Energy and petroleum products rose 5.0% in May.

15 of the 21 commodity groups declined, 3 increased and 3 were unchanged.

The Raw Materials Price Index (RMPI) climbed 4.4% in May, after a 4.0% rise in April. April's figure was revised up from a 3.8% increase.

The increase was driven by higher prices for crude energy products. Crude energy products soared 8.8% in May.

3 of the 6 commodity groups rose and 3 decreased.

-

14:30

Canada: Industrial Product Price Index, y/y, May -1.3%

-

14:30

Canada: Industrial Product Price Index, m/m, May 0.5%

-

14:30

Canada: Raw Material Price Index, May 4.4%

-

14:19

Foreign exchange market. European session: the Swiss franc traded lower against the U.S. dollar on comments that the Swiss National Bank (SNB) intervened in foreign exchange markets

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:30 United Kingdom Consumer credit, mln May 1176 Revised From 1173 1100 1001

08:30 United Kingdom Net Lending to Individuals, bln May 2.9 3.1

08:30 United Kingdom Mortgage Approvals May 67.58 Revised From 68.08 68.7 64.43

09:00 Eurozone Economic sentiment index June 103.8 103.8 103.5

09:00 Eurozone Consumer Confidence (Finally) June -5.6 -5.6 -5.6

09:00 Eurozone Business climate indicator June 0.28 0.27 0.1

09:00 Eurozone Industrial confidence June -3.0 -3.0 -3.4

12:00 Germany CPI, m/m (Preliminary) June 0.1% 0.1% -0.1%

12:00

Germany CPI, y/y (Preliminary) June 0.7% 0.5% 0.3%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. pending home sales data. Pending home sales in the U.S. are expected to climb 1.2% in May, after a 3.4% increase in April.

The euro traded higher against the U.S. dollar on comments that the Swiss National Bank (SNB) intervened in foreign exchange markets. The SNB President Thomas Jordan said in Bern on Monday that the central bank intervened to stabilize the market.

The euro dropped against the greenback after the weekend. Greek Prime Minister Alexis Tsipras called for a referendum on Saturday morning. The Eurogroup has not agreed to extend the Greek bailout programme.

The referendum is scheduled to be on July 05. Greeks will be asked to vote if they want to accept the aid proposal by the country's creditors.

Greece's parliament approved a referendum on yearly Sunday.

The Greek government Sunday announced its decision to shut the country's banks and to impose capital controls to avert the collapse of its financial system. Banks will be closed until July 06.

Daily cash withdrawals has been limited to 60 euros and payments and transfers abroad has been banned.

Greek Prime Minister assured Greeks that their bank deposits were safe.

Stock exchange in Greece also remains closed.

Meanwhile, the economic data from the Eurozone was weaker than expected. German preliminary consumer price index fell 0.1% in June, missing expectations for a 0.1% gain, after a 0.1% rise in May.

On a yearly basis, German preliminary consumer price index declined to 0.3% in June from 0.7% in May, missing expectations for a decrease to 0.5%.

The European Commission's economic sentiment index for the Eurozone declined to 103.5 in June from 130.8 in May. Analysts had expected the index to remain unchanged at 103.8.

The decline was driven by a fall in confidence in industry and in retail trade. The industrial confidence index decreased to -3.4 in June, while the index for retail trade declined to -1.1 in from 1.5.

The British pound traded mixed against the U.S. dollar after the release of the economic data from the U.K. The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. fell to 64,434 in May from 67,580 in April, missing expectations for an increase to 68,700.

The BoE introduced tighter rules on mortgage lending last year. Lenders have to make more checks on whether borrowers can afford their loans.

Consumer credit in the U.K. climbed by £1.001 billion in May, after a rise by £1.176 billion in April.

Net lending to individuals in the U.K. increased by £3.1 billion in May, after a £2.9 billion gain in April.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian economic data.

The Swiss franc traded lower against the U.S. dollar on comments that the Swiss National Bank (SNB) intervened in foreign exchange markets. The SNB President Thomas Jordan said in Bern on Monday that the central bank intervened to stabilize the market.

EUR/USD: the currency pair increased to $1.1141

GBP/USD: the currency pair traded mixed

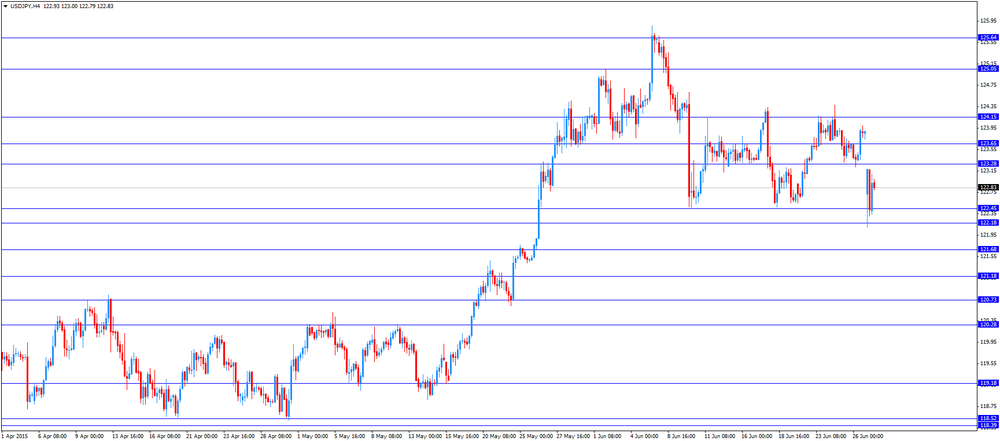

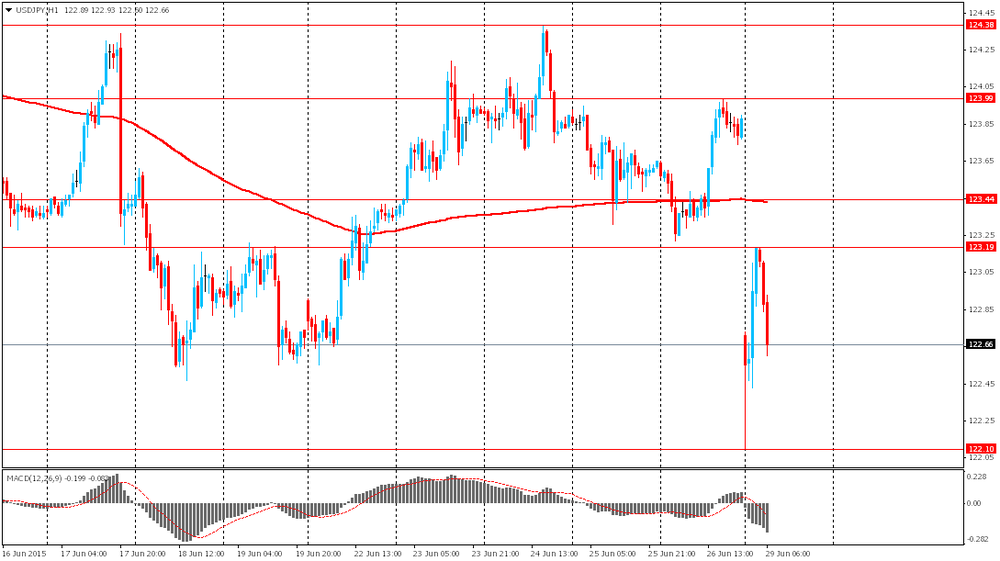

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Industrial Product Price Index, y/y May -2.4%

12:30 Canada Industrial Product Price Index, m/m May -0.9%

12:30 Canada Raw Material Price Index May 3.8%

14:00 U.S. Pending Home Sales (MoM) May 3.4% 1.2%

22:45 New Zealand Building Permits, m/m May -1.7%

23:05 United Kingdom Gfk Consumer Confidence June 1 2

-

14:00

Germany: CPI, y/y , June 0.3% (forecast 0.5%)

-

14:00

Germany: CPI, m/m, June -0.1% (forecast 0.1%)

-

11:40

Eurozone’s economic sentiment index declines to 103.5 in June

The European Commission released its economic sentiment index for the Eurozone on Monday. The index declined to 103.5 in June from 130.8 in May. Analysts had expected the index to remain unchanged at 103.8.

The decline was driven by a fall in confidence in industry and in retail trade. The industrial confidence index decreased to -3.4 in June, while the index for retail trade declined to -1.1 in from 1.5.

The final consumer confidence index was at -5.6 in June, in line with expectations.

The services sentiment index remained unchanged at 7.8 in May June.

The business climate index was down to 0.14 in June from 0.28 in May, missing forecasts of a decline to 0.27.

-

11:24

Number of mortgages approvals in the U.K. decline to 64,434 in May

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. fell to 64,434 in May from 67,580 in April, missing expectations for an increase to 68,700.

The BoE introduced tighter rules on mortgage lending last year. Lenders have to make more checks on whether borrowers can afford their loans.

Consumer credit in the U.K. climbed by £1.001 billion in May, after a rise by £1.176 billion in April.

Net lending to individuals in the U.K. increased by £3.1 billion in May, after a £2.9 billion gain in April.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0945/50(E420mn), $1.1100(E666mn)

GBP/USD: $1.5800(stg183mn)

USD/JPY: Y122.00($2.0bn), Y122.45/50($370mn), Y123.25($255mn), Y123.50($280mn)

EUR/JPY: Y137.00(E225mn)

USD/CAD: Cad1.2430($240mn)

AUD/USD: $0.7670(A$240mn)

NZD/USD: $0.6840(NZ$366mn), $0.6875(NZ363mn), $0.6890(NZ$180mn)

-

11:04

People’s Bank of China cuts its one-year lending rate by 25 basis points to 4.85%

The People's Bank of China Sunday cut the one-year lending rate by 25 basis points to 4.85% effective June 28. The one-year deposit rate has been lowered by 25 basis points to 2%, while reserve ratios for some lenders will be cut by 50 basis points.

It was the fourth cut since November.

Shanghai Composite stock index dropped almost 20% in the past two weeks, the biggest decline since 1996.

-

11:00

Eurozone: Business climate indicator , June 0.1 (forecast 0.27)

-

11:00

Eurozone: Industrial confidence, June -3.0 (forecast -3.0)

-

11:00

Eurozone: Consumer Confidence, June -6.0 (forecast -5.6)

-

11:00

Eurozone: Economic sentiment index , June 103.5 (forecast 103.8)

-

10:55

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Sunday: the central bank is alert to downside risks to reach its 2% inflation target by around September 2016

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Sunday (remarks were released Monday) that the central bank is alert to downside risks to reach its 2% inflation target by around September 2016.

"While our projection is that inflation will be in the neighbourhood of 2 percent most likely around the April-September period of 2016, the risks to that scenario cannot be ignored, particularly when the global economy is full of uncertainty, including over geopolitical factors," Kuroda said.

He added that Japan's consumer inflation declined to around zero due partly to "the temporary influence of low oil prices".

-

10:41

German Finance Minister Wolfgang Schaeuble: Britain’s exit from the European Union would be a disaster for both Europe and the United Kingdom

German Finance Minister Wolfgang Schaeuble said on Friday that it would be a disaster for both Europe and the United Kingdom if the UK were to leave the European Union.

"It would not only be a disaster for the UK it would be a disaster for Europe. Therefore we will avoid this," he said.

Schaeuble added that it is Britain's decision.

-

10:30

United Kingdom: Mortgage Approvals, May 64.43 (forecast 68.7)

-

10:30

United Kingdom: Consumer credit, bln, May 1001 (forecast 1100)

-

10:30

United Kingdom: Net Lending to Individuals, bln, May 3.1

-

10:25

European Council President Donald Tusk: Greece must remain a member of the Eurozone

European Council President Donald Tusk said on Sunday that Greece must remain a member of the Eurozone.

"Greece is and should remain euro area member," he said.

Tusk added that he is in touch with Eurozone leaders "to ensure integrity of euro area of 19 countries".

-

10:14

Greek government shuts the country’s banks and imposes capital controls to avert the collapse of its financial system

The Greek government Sunday announced its decision to shut the country's banks and to impose capital controls to avert the collapse of its financial system. Banks will be closed until July 06.

Daily cash withdrawals has been limited to 60 euros and payments and transfers abroad has been banned.

Greek Prime Minister assured Greeks that their bank deposits were safe.

Stock exchange also remains closed.

-

09:04

Foreign exchange market. Asian session: concerns about Greece rule

Euro dropped after Greece failed to come up to an agreement with its lenders. The Eurogroup refused to extend the country's financial aid program without a clear reform program. This might lead Greece to a default on its €1.6 billion payment to the IMF due June the 30th. This might result in the country's exit from the euro zone. This weekend Greece's government announced a referendum on the agreement with creditors. The referendum will be held on July the 5th. Meanwhile daily withdrawals were limited to 60 euros. It is prohibited to transfer money abroad.

The yen received safe-haven support amid Greece crisis. However the currency was slightly weighed by weak industrial production data. The country's Ministry of Economy, Trade and Industry reported that industrial production fell by -2.2% m/m and -4.0% y/y in May.

Also today Bank of Japan Governor Kuroda said that the central bank remained committed to achieving the 2% inflation target. At the same time he noted that global economic uncertainty creates risks for the timing of this target.

EUR/USD: the pair has fallen to $1.0955 this morning

USD/JPY: the pair fell to Y122.10

GBP/USD: the pair fell to $1.5665

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Consumer credit, bln May 1173 1100

08:30 United Kingdom Net Lending to Individuals, bln May 2.9

08:30 United Kingdom Mortgage Approvals May 68.08 68.7

09:00 Eurozone Economic sentiment index June 103.8 103.8

09:00 Eurozone Consumer Confidence (Finally) June -5.6 -5.6

09:00 Eurozone Business climate indicator June 0.28 0.27

09:00 Eurozone Industrial confidence June -3.0 -3.0

12:00 Germany CPI, m/m (Preliminary) June 0.1% 0.1%

12:00 Germany CPI, y/y (Preliminary) June 0.7% 0.5%

12:30 Canada Industrial Product Price Index, y/y May -2.4%

12:30 Canada Industrial Product Price Index, m/m May -0.9%

12:30 Canada Raw Material Price Index May 3.8%

14:00 U.S. Pending Home Sales (MoM) May 3.4% 1.2%

22:45 New Zealand Building Permits, m/m May -1.7%

23:05 United Kingdom Gfk Consumer Confidence June 1 -

08:28

Options levels on monday, June 29, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1232 (1697)

$1.1204 (1936)

$1.1175 (205)

Price at time of writing this review: $1.1035

Support levels (open interest**, contracts):

$1.0968 (14162)

$1.0928 (2940)

$1.0884 (5472)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 61056 contracts, with the maximum number of contracts with strike price $1,1500 (5322);

- Overall open interest on the PUT options with the expiration date July, 2 is 89018 contracts, with the maximum number of contracts with strike price $1,1000 (14162);

- The ratio of PUT/CALL was 1.46 versus 1.57 from the previous trading day according to data from June, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.6000 (548)

$1.5901 (806)

$1.5804 (1401)

Price at time of writing this review: $1.5723

Support levels (open interest**, contracts):

$1.5694 (852)

$1.5597 (826)

$1.5499 (719)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 22738 contracts, with the maximum number of contracts with strike price $1,5500 (2541);

- Overall open interest on the PUT options with the expiration date July, 2 is 26948 contracts, with the maximum number of contracts with strike price $1,5100 (2113);

- The ratio of PUT/CALL was 1.19 versus 1.18 from the previous trading day according to data from June, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:55

Japan: Industrial Production (YoY), May -4.0%

-

01:53

Japan: Industrial Production (MoM) , May -2.2% (forecast -0.8%)

-

01:52

Japan: Retail sales, y/y, May 3.0% (forecast 2.3%)

-

00:29

Currencies. Daily history for Jun 26'2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1166 -0,30%

GBP/USD $1,5748 +0,04%

USD/CHF Chf0,9329 -0,34%

USD/JPY Y123,88 +0,19%

EUR/JPY Y138,28 -0,14%

GBP/JPY Y195,01 +0,19%

AUD/USD $0,7657 -0,97%

NZD/USD $0,6841 -0,44%

USD/CAD C$1,2321 -0,05%

-

00:00

Schedule for today, Monday, Jun 29’2015:

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Consumer credit, bln May 1173 1100

08:30 United Kingdom Net Lending to Individuals, bln May 2.9

08:30 United Kingdom Mortgage Approvals May 68.08 68.7

09:00 Eurozone Economic sentiment index June 103.8 103.8

09:00 Eurozone Consumer Confidence (Finally) June -5.6 -5.6

09:00 Eurozone Business climate indicator June 0.28 0.27

09:00 Eurozone Industrial confidence June -3.0 -3.0

12:00 Germany CPI, m/m (Preliminary) June 0.1% 0.1%

12:00 Germany CPI, y/y (Preliminary) June 0.7% 0.5%

12:30 Canada Industrial Product Price Index, y/y May -2.4%

12:30 Canada Industrial Product Price Index, m/m May -0.9%

12:30 Canada Raw Material Price Index May 3.8%

14:00 U.S. Pending Home Sales (MoM) May 3.4% 1.2%

22:45 New Zealand Building Permits, m/m May -1.7%

23:05 United Kingdom Gfk Consumer Confidence June 1 2

-