Noticias del mercado

-

20:21

American focus: the dollar rose

The US dollar rose against most major currencies after data on consumer sentiment. The final results of the studies submitted by Thomson-Reuters and the Institute of Michigan, showed in June, American consumers are feeling more optimistic about the economy than last month. According to published data, in June consumer sentiment index rose to 96.1 points compared to the final reading for May at around 90.7 points and a preliminary value of 94.6 points in June. According to experts the average index was up 94.6 points.

The final index of current conditions in the month reached 108.9 against a final figure of 100.8 in May. The expectations index was 87.8 against 84.2. Despite the recovery in prices for gasoline and eggs, consumers still hold relatively moderate inflation. According to University of Michigan final index of inflation expectations for the year ahead in June fell to 2.7% against 2.8% in May. The final index of inflation expectations for the next five years reached 2.6% against 2.8%.

The euro accelerated losses against the dollar on the news on Greece. According to media reports, the Greek Government has rejected a proposal to extend the term of the financial assistance program for 5 months. The proposal included the extension of the program until the end of November, and voiced the amount of 15.5 bn. Euros (8.7 billion. Euros from the European Fund, 3.3 billion. Euros within the SMP and 3.5 billion. Euros from the IMF). However, according to reports, the situation is quite unfortunate. Greek Prime Tsipras previously accused of blackmail creditors Greece. The Greek government wants to conclude a long-term agreement, and not get a reprieve until November. According to sources in Greece, recent proposals have been called inappropriate. The main thing is that the agreement does not allow Greece to escape from the vicious circle of "austerity measures". The next meeting of the Eurogroup is scheduled for Saturday 12:00 GMT.

Little impact on the single currency also had data on the euro zone. A report published by the ECB showed that the growth rate of monetary aggregate M3 slowed to 5.0% in May against 5.3% in April. Experts expect that this figure will increase by 5.4%. In the period from March to May, the average annual growth rate of M3 was 5.0% compared with + 4.7% in the previous three months (February to April). Meanwhile, the ECB reported that the growth rate of credit to the government accelerated to 4.0% from 3.8% in April, while the rate of lending to the private sector increased to 0.2% versus 0.0% in the previous month. Lending to the private sector accelerated to 0.5% in May against 0.0% in the previous month. The annual growth rate of lending to households was 0.9% compared to 0.0% in April. The growth rate of lending for house purchase has accelerated to 1.4% in May from 0.1% in the previous month.

The yen fell against the dollar after rising earlier in the day. Earlier, the yen has supported the positive macroeconomic statistics in Japan. According to the data released today, core consumer price index in Japan rose in May by 0.1% compared with the same period of the previous year after, in April remained unchanged. Economists expected the index to remain unchanged. However, the national consumer price index excluding prices for food and energy prices in annual terms fell from the previous value of 2.2% to 0.4% key indicator of inflation in Japan rose in May for the first time in two months. It is likely to reinforce expectations for what the Bank of Japan will refrain from further action. We also learned that household spending in May rose by 4.8% adjusted for price changes. This is the first increase in the index for 14 months. Previous value of the index was -1.3%, the analysts forecast an increase of 3.4%. The unemployment rate in May remained unchanged at 3.3%, and the ratio of jobs to applicants peaked in March, 1992 - 1.19. This means that for every 100 applicants were free to 119 jobs.

-

17:15

European Commission President Jean-Claude Juncker is optimistic a deal with Greece could be reached

European Commission President Jean-Claude Juncker said on Friday that he was optimistic a deal with Greece could be reached.

"Tomorrow is a crucial day not only for Greece but also for the euro area as a whole. I am quite optimistic but not over optimistic," he said.

-

17:04

Greek government rejects a five-month extension to its bailout programme

The Guardian reported on Friday that the Greek government rejected a five-month extension to its bailout deal.

According to a European official, Greece's lenders offers a financial aid of €15.5 billion in four instalments by the end of November if Greece implements economic reforms. Greece would receive the first instalment of €1.8 billion by Tuesday.

-

16:31

Thomson Reuters/University of Michigan final consumer sentiment index increases to 96.7 in June

The Thomson Reuters/University of Michigan final consumer sentiment index increased to 96.7 in June from 90.7 in May, beating the preliminary estimate of 94.6.

"Consumers voiced in the first half of 2015 the largest and most sustained increase in economic optimism since 2004. Consumer spending will remain the driving force of economic growth in 2015," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

He adds that consumer spending could rise 3.0% in 2015.

The current economic conditions index soared to 108.9 in June from 100.8 in May.

The index of consumer expectations rose to 87.8 from 84.2.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, June 96.1 (forecast 94.6)

-

15:31

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E1.37bn), $1.1115(E369mn), $1.1150(E380mn), $1.1200(E333mn), $1.1215(E367mn)

USD/JPY: Y123.00($1.37bn), Y123.50($1.3bn), Y124.30($355mn), Y125.00($265mn)

USD/CHF: Chf0.9285($220mn)

AUD/USD: $0.7700(A$388mn)

NZD/USD: $0.6800 (NZ$1.17bn), $0.7200(NZ$1.66bn)

-

15:28

Greece’s lenders offers a financial aid of €15.5 billion

According to a European official, Greece's lenders offers a financial aid of €15.5 billion in four instalments by the end of November if Greece implements economic reforms. Greece would receive the first instalment of €1.8 billion by Tuesday.

The financial help would contain €8.7 billion from the European Financial Stability Facility, €3.5 billion from the International Monetary Fund and €3.3 billion euros in central-bank profits on bond purchases.

-

15:03

New Zealand's trade surplus climbs to NZ$350 million in May

Statistics New Zealand released its trade data on late Thursday. New Zealand's trade surplus climbed to NZ$350 million in May from NZ$183 million in April. April's figure was revised up from a surplus of NZ$123 million.

Analysts had expected a deficit of NZ$100 million.

Exports fell 4.7% in May, driven by a 28% decline in milk powder, butter and cheese, while imports dropped 7.0%, driven a fall in crude oil and capital goods.

-

14:41

Japan's national consumer price index (CPI) falls to an annual rate of 0.5% in May

Japan's Ministry of Internal Affairs and Communications released its inflation data late Thursday. Japan's national consumer price index (CPI) fell to an annual rate of 0.5% in May from 0.6% in April. Japan's national CPI excluding fresh food declined to an annual rate of 0.1% in May from 0.3% in April, beating expectations for a flat reading.

Household spending in Japan jumped at annual rate of 4.8% in May, exceeding forecasts of a 3.4% increase, after a 1.3% fall in April.

Japan's unemployment rate remained unchanged at 3.3% in May, in line with expectations.

-

14:27

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar on the uncertainty over the debt talks between Greece and its creditors

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:45 France Consumer confidence June 94 Revised From 93 93 94

08:00 Eurozone Private Loans, Y/Y May 0.0% 0.5%

08:00 Eurozone M3 money supply, adjusted y/y May 5.3% 5.4% 5.0%

09:00 Eurozone EU Economic Summit

The U.S. dollar traded mixed against the most major currencies ahead of the final Reuters/Michigan Consumer Sentiment Index. The index is expected to rise to 94.6 in June from 90.7 in May.

The euro traded mixed against the U.S. dollar on the uncertainty over the debt talks between Greece and its creditors. Athens yesterday failed to reach agreement with its creditors, and it is a step closer to a possible default now. Next round of debt talks is scheduled to be tomorrow.

If a deal is not reached at Saturday's meeting, officials are expected to start preparing a "Plan B" to protect the Eurozone from damaging other countries in the Eurozone.

German Chancellor Angela Merkel said on Friday that the Eurogroup's meeting on Saturday would be decisive for finding a deal for Greece.

Athens have to repay €1.6 billion IMF loans by June 30.

Meanwhile, the economic data from the Eurozone was mixed. M3 money supply rose 5.0% in May from last year, missing expectations for a 5.4% gain, after a 5.3 % increase in April.

Loans to the private sector in the Eurozone climbed 0.5% in May from the last year, after a flat reading in April.

German import prices declined by 0.8% in May from last year, after a 0.6% fall in April. Import prices decline since January 2013.

German export prices climbed 1.4% year-on-year in May, after a 1.6% increase in April.

French consumer confidence index remained unchanged at 94 in June, beating expectation for a decline to 93.

The Italian consumer confidence index climbed to 109.5 in June from 106.0 in May. The increase was driven by rises in economic and personal financial expectations subindices.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K. The Bank of England Governor Mark Carney is expected to speak at 14:15 GMT.

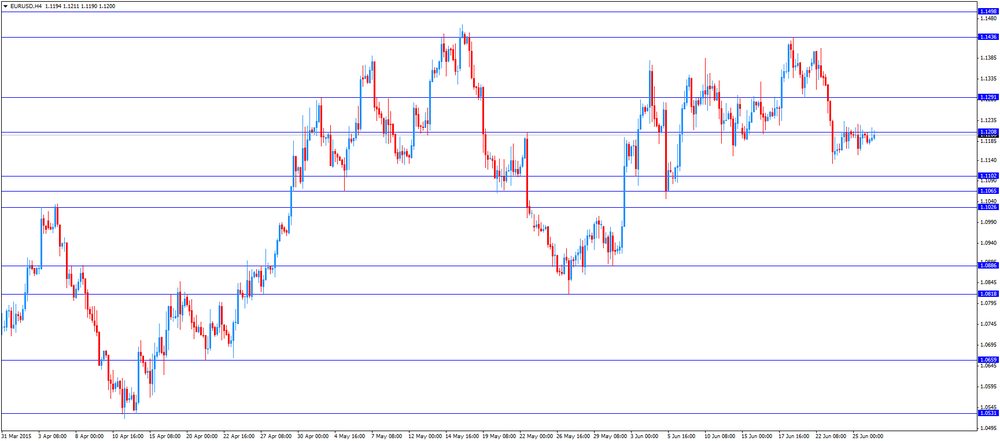

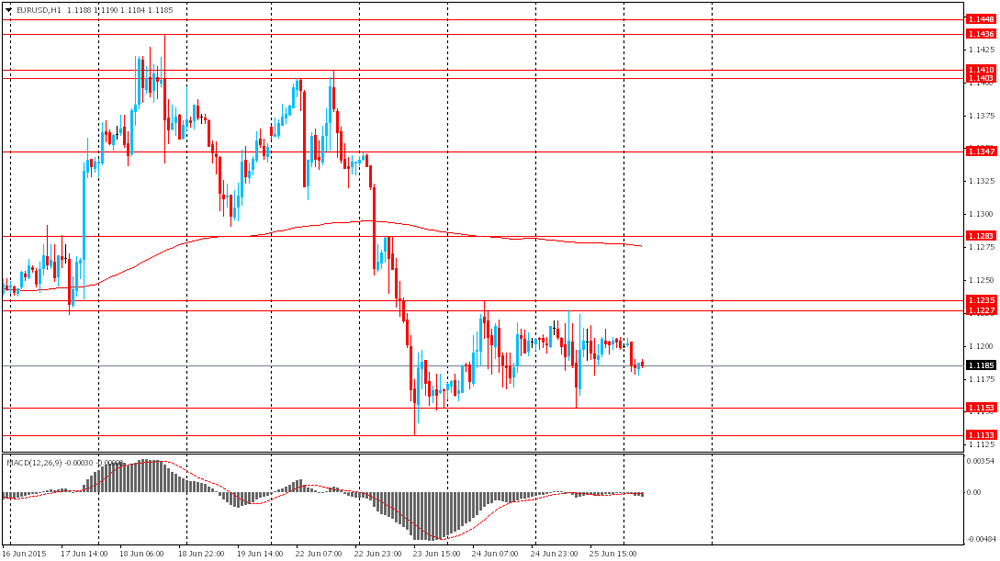

EUR/USD: the currency pair traded mixed

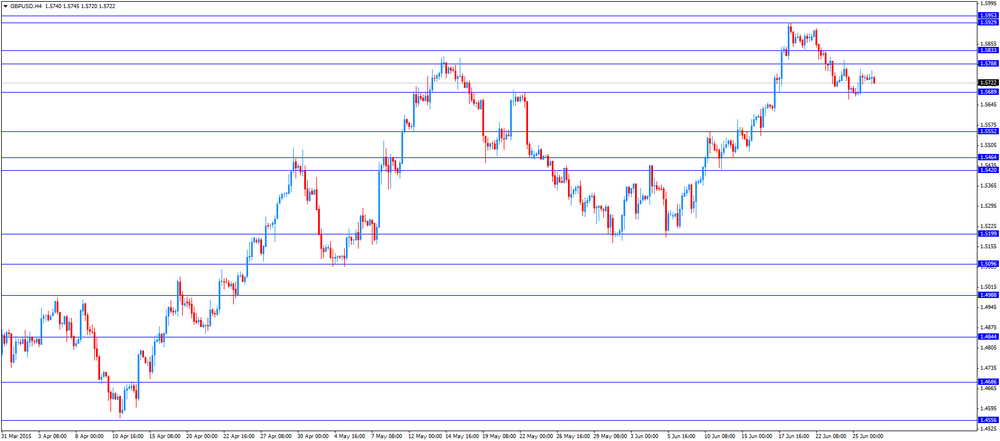

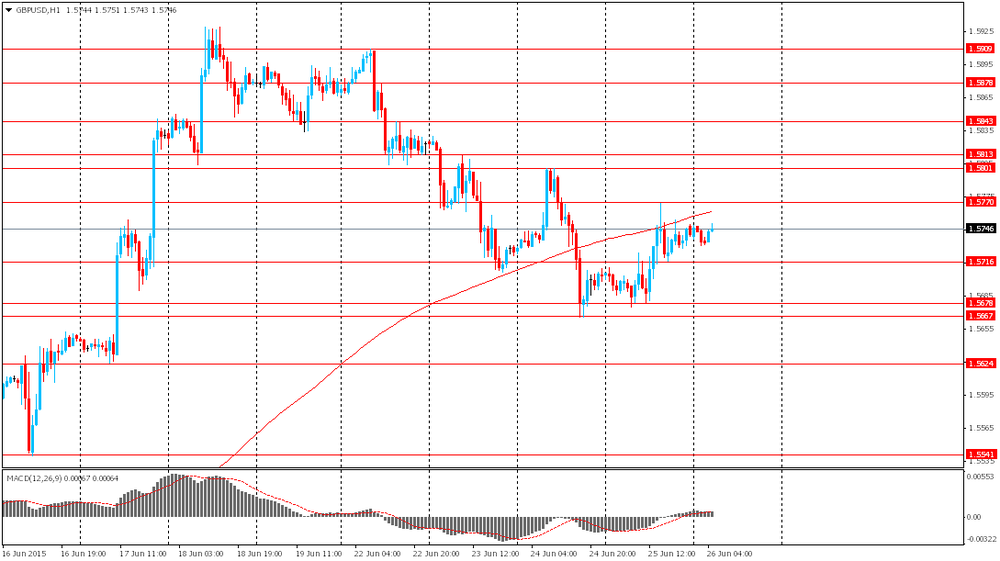

GBP/USD: the currency pair traded mixed

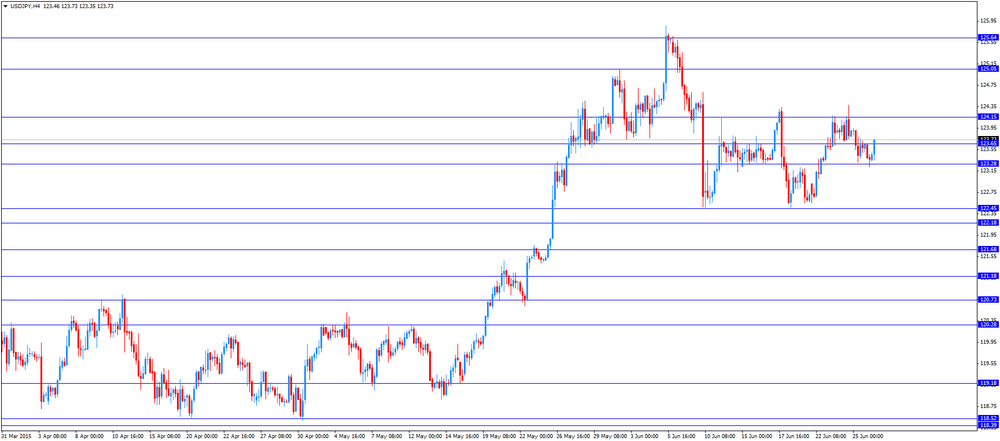

USD/JPY: the currency pair rose to Y123.73

The most important news that are expected (GMT0):

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) June 90.7 94.6

14:15 United Kingdom BOE Gov Mark Carney Speaks

-

14:00

Orders

EUR/USD

Offers 1.1220-25 1.1245 1.1280 1.1300 1.1330 1.1350 1.1365

Bids 1.1170 1.1150 1.1130 1.1100 1.1080 1.1050 1.1030 1.1000

GBP/USD

Offers 1.5780 1.5800 1.5820-25 1.5850 1.5875 1.5900

Bids 1.5720 1.5700 1.5675-80 1.5650 1.5630 1.5600 1.5585 1.5570 1.5550

EUR/GBP

Offers 0.7125-30 0.7150 0.7170 0.7180-85 0.7200 0.7220

Bids 0.7100 0.7080-85 0.7065 0.7050 0.7030 0.7000

EUR/JPY

Offers 138.70 139.00 139.30 139.50 139.80 140.00

Bids 138.00 137.80 137.50 137.00

USD/JPY

Offers 123.75 124.00 124.20-25 124.40 124.50 124.75 125.00 125.25

Bids 123.20 123.00122.75 122.50 122.30

AUD/USD

Offers 0.7730 0.7750-60 0.7785 0.7800 0.7825-30 0.7850

Bids 0.7700 0.7685 0.7650 0.7630 0.7600 0.7585 0.7550

-

11:44

Italian consumer confidence index climbs to 109.5 in June

The Italian statistical office ISTAT released its consumer confidence index for Italy on Friday. The Italian consumer confidence index climbed to 109.5 in June from 106.0 in May. May's figure was revised up from 105.7.

The increase was driven by rises in economic and personal financial expectations subindices.

-

11:37

German import prices decline 0.8% in May

Destatis released its import prices data for Germany on Friday. German import prices declined by 0.8% in May from last year, after a 0.6% fall in April.

Import prices decline since January 2013.

On a monthly base, import prices decreased 0.2% in May, after a 0.6% rise in April.

On a monthly base, import prices excluding crude oil and mineral oil products climbed by 2.4% in May.

Export prices climbed 1.4% year-on-year in May, after a 1.6% increase in April.

On a monthly base, export prices were down 0.2% in May, after a 0.3% rise in April.

-

11:24

French consumer confidence index remains unchanged at 94 in June

French statistical office INSEE released its consumer confidence index for France on Friday. French consumer confidence index remained unchanged at 94 in June, beating expectation for a decline to 93. May's figure was revised from 93.

The index of the outlook on consumers' saving capacity remained unchanged at -7 in June.

The index of households' assessment of their financial situation in the past twelve months remained flat in June.

The index of the outlook on consumers' financial situation rose to -12 in June from -13 in May.

The index of the outlook on unemployment rising in coming months fell to 55 in June from 57 in the previous month.

The index for current inflation expectations climbed to -55 in June.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E360mn), $1.1200(E339mn), $1.1250/55(E550mn), $1.1300(E705mn)

USD/JPY: Y122.25($560mn), Y123.50($215mn), Y124.00($835mn), Y124.50($369mn)

USD/CHF: Chf0.9410($320mn)

USD/CAD: Cad1.2300($331mn)

AUD/USD: $0.7700(A$307mn), $0.7730(A$260mn), $0.7750(A$268mn), $0.7800(A$1.0bn)

NZD/USD: $0.7000(NZ$200mn)

-

11:12

M3 money supply in the Eurozone rises 5.0% in May from last year

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 5.0% in May from last year, missing expectations for a 5.4% gain, after a 5.3 % increase in April.

During three months to May, M3 money supply rose to 5.0% from 4.7% in the February to April period.

The lending for house purchase jumped 1.4% year-on-year in May.

Loans to the private sector in the Eurozone climbed 0.5% in May from the last year, after a flat reading in April.

-

10:51

Bank of Spain upgrades its economic growth forecast for 2015 for Spain

The Bank of Spain Governor Luis Maria Linde said on Wednesday that the Bank of Spain upgraded its economic growth forecast for 2015 for Spain. The Spanish economy is expected to expand at 3.1% in 2015, up from the previous forecast of 2.8%. The economic growth forecast was upgraded as domestic demand gathers momentum.

The Spanish economy is expected to grow 2.7% in 2016.

According to Linde, the economy probably expand at 1% in the second quarter. Inflation in Spain is expected to be above zero by the end of the year.

"The forecasts for what remains of the year and for next point to the maintenance of elevated dynamism, clearly superior to that of the majority of our partners in the euro area," the Bank of Spain governor said.

-

10:38

Average weekly earnings of Canadian non-farm payroll employees increases 2.5% in April

Statistics Canada released its average weekly earnings data of Canadian non-farm payroll employees on Thursday. Average weekly earnings of Canadian non-farm payroll employees increased 2.5% in April year-on-year.

Weekly earnings rose C$955.37 in April from C$931.94 a year earlier.

Employees in Canada worked an average 33.1 hours per week in April, up from 32.9 hours last year.

Total non-farm employment climbed by 16,400 in April.

-

10:27

German Bundesbank President Jens Weidmann criticizes the continued provision of Emergency Liquidity Assistance (ELA) to Greek banks

German Bundesbank President Jens Weidmann criticized in Frankfurt on Thursday the continued provision of Emergency Liquidity Assistance (ELA) to Greek banks.

"When banks without access to the markets buy debt of a sovereign which is likewise locked out of the market, taking recourse to ELA raises serious monetary-financing concerns. The Eurosystem must not provide bridge financing to Greece even in anticipation of later disbursements," he said.

Weidmann noted that Greek banks that receive ELA should be urged to "do their utmost to improve their liquidity situation and be prevented from worsening it further by rolling over illiquid T-bills of their sovereign".

ELA now stands at nearly €89 billion.

-

10:14

Marine Le Pen, a frontrunner in France's 2017 presidential election: a Greek exit from the Eurozone is inevitable

Marine Le Pen, a frontrunner in France's 2017 presidential election, said in an interview on Tuesday that a Greek exit from the Eurozone is inevitable. France will follow Greece, she added.

"We've won a few months' respite but the problem will come back. Today we're talking about Grexit, tomorrow it will be Brexit, and the day after tomorrow it will be Frexit," Le Pen said.

-

10:00

Eurozone: M3 money supply, adjusted y/y, May 5.0% (forecast 5.4%)

-

08:53

Foreign exchange market. Asian session: Japanese yen gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

06:45 France Consumer confidence June 93 93 94

The euro is weighed by Greece's crisis as meetings, designed to reach a deal on the country's debt and financing, fail. Talks will continue on Saturday. Data by Bloomberg showed that the single currency has lost 5.1% over the past six months.

However the worst results were posted by the New Zealand dollar, which fell 8.7% and reached 68.93 U.S. cents on Tuesday (the lowest level since July 2010.

Japanese yen advanced against the dollar amid positive macroeconomic data. Japan core inflation rose by 0.1% in May after a flat reading in the previous month. This might intensify expectations that the Bank of Japan will not undertake new measure in the near future. The adjusted household spending index by the Statistics Bureau of Japan rose by 4.8% in May (the first rise in 14 months).The unemployment rate remained unchanged at 3.3% in May.

EUR/USD: the pair has fallen to $1.1180 this morning

USD/JPY: the pair fell to Y123.20

GBP/USD: the pair traded around $1.5730-50

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Eurozone Private Loans, Y/Y May 0.0%

08:00 Eurozone M3 money supply, adjusted y/y May 5.3% 5.4%

09:00 Eurozone EU Economic Summit

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) June 90.7 94.6

14:15 United Kingdom BOE Gov Mark Carney Speaks

-

08:45

France: Consumer confidence , June 94 (forecast 93)

-

08:19

Options levels on friday, June 26, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1348 (3551)

$1.1292 (3522)

$1.1243 (975)

Price at time of writing this review: $1.1202

Support levels (open interest**, contracts):

$1.1166 (2076)

$1.1122 (4001)

$1.1059 (5257)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 56243 contracts, with the maximum number of contracts with strike price $1,1500 (5250);

- Overall open interest on the PUT options with the expiration date July, 2 is 88325 contracts, with the maximum number of contracts with strike price $1,1000 (13979);

- The ratio of PUT/CALL was 1.57 versus 1.55 from the previous trading day according to data from June, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.6001 (551)

$1.5902 (814)

$1.5804 (1391)

Price at time of writing this review: $1.5737

Support levels (open interest**, contracts):

$1.5694 (834)

$1.5597 (836)

$1.5499 (720)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 22676 contracts, with the maximum number of contracts with strike price $1,5500 (2543);

- Overall open interest on the PUT options with the expiration date July, 2 is 26869 contracts, with the maximum number of contracts with strike price $1,5100 (2113);

- The ratio of PUT/CALL was 1.18 versus 1.19 from the previous trading day according to data from June, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:36

Japan: National CPI Ex-Fresh Food, y/y, May 0.1% (forecast 0.0%)

-

01:33

Japan: Tokyo CPI ex Fresh Food, y/y, June 0.1% (forecast 0.1%)

-

01:33

Japan: National Consumer Price Index, y/y, May 0.5%

-

01:32

Japan: Household spending Y/Y, May 4.8% (forecast 3.4%)

-

01:32

Japan: Tokyo Consumer Price Index, y/y, June 0.3%

-

01:31

Japan: Unemployment Rate, May 3.3% (forecast 3.3%)

-

00:45

New Zealand: Trade Balance, mln, May 350 (forecast -100)

-

00:27

Currencies. Daily history for Jun 25’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1199 -0,04%

GBP/USD $1,5741 +0,24%

USD/CHF Chf0,9361 +0,28%

USD/JPY Y123,65 -0,20%

EUR/JPY Y138,48 -0,23%

GBP/JPY Y194,63 +0,04%

AUD/USD $0,7731 +0,39%

NZD/USD $0,6871 -0,15%

USD/CAD C$1,2327 -0,47%

-

00:01

Schedule for today, Friday, Jun 26’2015:

(time / country / index / period / previous value / forecast)

06:45 France Consumer confidence June 93 93

08:00 Eurozone Private Loans, Y/Y May 0.0%

08:00 Eurozone M3 money supply, adjusted y/y May 5.3% 5.4%

09:00 Eurozone EU Economic Summit

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) June 90.7 94.6

14:15 United Kingdom BOE Gov Mark Carney Speaks

-