Noticias del mercado

-

17:15

Eurogroup’s meeting ended without a deal today

Eurogroup's meeting ended without a deal today. Next Eurogroup's meeting is scheduled to be on Saturday.

European Commission President Jean-Claude Juncker said on Thursday that officials will "work until the last minute, second, millisecond so that the euro project does not crash".

-

17:07

Greek Prime Minister Alexis Tsipras said he was confident that a compromise that will help the Eurozone and Greece to overcome the crisis will be reached

Greek Prime Minister Alexis Tsipras said on Thursday that he was confident that a compromise that will help the Eurozone and Greece to overcome the crisis will be reached.

He added that he thinks the current proposal is a "good basis" for a deal.

-

16:58

International Monetary Fund expects Greece to repay IMF loans by June 30

The International Monetary Fund (IMF) said that it expects Greece to repay IMF loans by June 30. Athens have to repay €1.6 billion IMF loans.

The IMF spokesman Gerry Rice said that talk of a default is a speculation as the Greek government has said publicly that it will make the payment.

-

16:41

European Council President Donald Tusk: he hopes a deal will be reached with Greece

European Council President Donald Tusk said on Thursday that he hopes a deal will be reached with Greece.

For now, I can only say, that work is underway and for sure it will need still many hours. The last hours have been critical but I have a good hunch that unlike in Sophocles' tragedies this Greek story will have a happy end," he said.

-

16:17

U.S. preliminary services purchasing managers' index declines to 54.8 in June

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Thursday. The U.S. preliminary services purchasing managers' index (PMI) declined to 54.8 in June from 56.2 in May, missing expectations for an increase to 56.7.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a decrease in new business growth and hiring. The preliminary new business index declined to 55.0 in June from 55.7 in May.

"A slowdown in the economy at the end of the second quarter may mean the Fed takes a further pause for thought before hiking interest rates. The latest flash PMI surveys showed the smallest rise in service sector activity since January and the slowest growth of factory output for over a year and a half, linked to the strong dollar," Markit Chief Economist Chris Williamson.

-

15:52

Swiss National Bank President Thomas Jordan: the Swiss franc remains “significantly overvalued”

The Swiss National Bank (SNB) President Thomas Jordan said in Lausanne on Thursday that the Swiss franc remains "significantly overvalued". He added that the strength of the Swiss currency is a reflection of global crisis.

Jordan pointed out that the decision to remove the minimum exchange rate was driven by "the growing divergence between the monetary policy stances of the world's main currency blocks". If waited longer to remove the minimum exchange rate, the central would have lost control of its monetary policy, and it would have removed the minimum exchange rate later "under much less favourable conditions".

The SNB president noted that the Swiss economic outlook depends on global economic developments. The SNB expects the Swiss economy to pick up in the second half of the year.

Jordan said that that a deflationary spiral is not expected despite price declines.

-

15:45

U.S.: Services PMI, June 54.8 (forecast 56.7)

-

15:35

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E1.37bn), $1.1115(E369mn), $1.1150(E380mn), $1.1200(E333mn), $1.1215(E367mn)

USD/JPY: Y123.00($1.37bn), Y123.50($1.3bn), Y124.30($355mn), Y125.00($265mn)

USD/CHF: Chf0.9285($220mn)

AUD/USD: $0.7700(A$388mn)

NZD/USD: $0.6800 (NZ$1.17bn), $0.7200(NZ$1.66bn)

-

15:27

CBI retail sales balance drops to +29% in June

The Confederation of British Industry released its retail sales balance data on Thursday. The CBI retail sales balance dropped to +29% in June from +51% in May.

The decline was driven by a drop in grocery sales as the supermarket price wars continue.

Sales expectations for next month eased.

CBI Distributive Trades Survey Chairman and Asda's Chief Customer Officer, Barry Williams, said that retailers hope to purchase more in the summer months.

"Low inflation - expected to stay below 1% throughout this year - has given customers more discretionary income. The power of the pound in their pocket is going further and shoppers are spending more on treats, like flowers and jewellery, as well as on activities with their families," he added.

-

15:13

U.S. personal spending jumps 0.9% in May, the biggest increase since August 2009

The U.S. Commerce Department released personal spending and income figures on Thursday. Personal spending jumped 0.9% in May, exceeding expectations for 0.7% gain, after a 0.1% increase in April. It was the biggest increase since August 2009.

April's figure was revised up from a flat reading.

Consumer spending makes more than two-thirds of U.S. economic activity.

Personal spending was partly driven by a rise in spending on automobiles, which soared 2.2% in May.

The saving rate declined to 5.1% from 5.4% in April.

Personal income increased 0.5% in May, in line with expectations, after a 0.5% rise in April. April's figure was revised up from a 0.4% gain.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in May, in line with forecasts, after a 0.1% gain in April.

On a yearly basis, the PCE price index excluding food and index increased 1.2% in May, beating expectations for a 0.8% gain, after a 1.3% rise in April. It was the smallest rise since February 2014.

April's figure was revised up from a 1.2% increase.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

14:44

Initial jobless claims climb by 3,000 to 271,000 in the week ending June 20

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending June 20 in the U.S. increased by 3,000 to 271,000 from 268,000 in the previous week. T the previous week's figure was revised down from 267,000.

Analysts had expected the number of initial jobless claims to be 272,000.

Jobless claims remained below 300,000 the 16th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims rose by 22,000 to 2,247,000 in the week ended June 13.

-

14:30

U.S.: PCE price index ex food, energy, m/m, May 0.1% (forecast 0.1%)

-

14:30

U.S.: Personal spending , May 0.9% (forecast 0.7%)

-

14:30

U.S.: PCE price index ex food, energy, Y/Y, May 1.2% (forecast 0.8%)

-

14:30

U.S.: Personal Income, m/m, May 0.5% (forecast 0.5%)

-

14:30

U.S.: Initial Jobless Claims, June 271 (forecast 272)

-

14:30

U.S.: Continuing Jobless Claims, June 2247 (forecast 2215)

-

14:17

Foreign exchange market. European session: the Swiss franc dropped against the U.S. dollar after comments by the Swiss National Bank President Thomas Jordan

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany Gfk Consumer Confidence Survey July 10.2 10.2 10.1

08:00 Switzerland SNB Chairman Jordan Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the final U.S. economic data. The personal consumer expenditures (PCE) price index excluding food and energy is expected to increase 0.1% in May, after a 0.1 rise in April.

Personal income in the U.S. is expected to rise 0.5% in May, after a 0.4% gain in April.

Personal spending in the U.S. is expected to gain 0.7% in May, after a flat reading in April.

The preliminary services purchasing managers' index is expected to climb to 56.7 in June from 56.2 in April.

The number of initial jobless claims in the U.S. is expected to increase by 5,000 to 272,000.

The euro traded mixed against the U.S. dollar on the uncertainty over the debt talks between Greece and its creditors. Yesterday's debt talks between Greece and its creditors ended without any results. Greece rejected on Wednesday a "counter proposal" from its international creditors, according a government source. There are still differences.

"Unfortunately we have not reached an agreement yet, but we are determined to continue work," the head of the Eurogroup Jeroen Dijsselbloem said.

Athens and its lenders failed to reach a deal on tax, pension reform and VAT.

Athens have to repay €1.6 billion IMF loans by June 30.

Meanwhile, the economic data from the Eurozone was soft. German Gfk consumer confidence index fell to 10.1 in July from 10.2 in June. Analysts had expected the index to remain unchanged at 10.2.

The decrease was driven by declines in economic expectations and the willingness to buy. The previously unsuccessful attempts to find a solution to the debt crisis in Greece and a possible Greek default also weighed on the index.

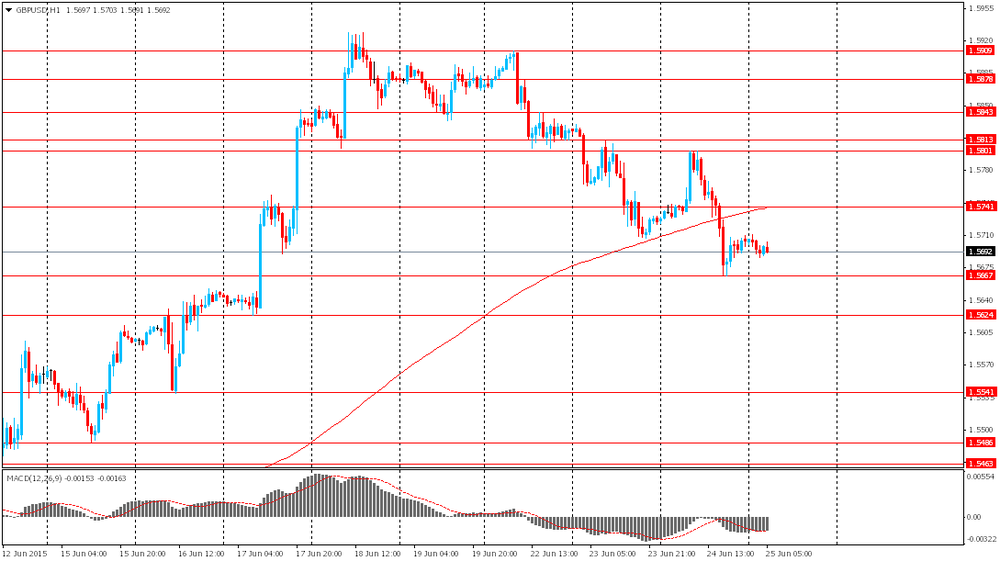

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc dropped against the U.S. dollar after comments by the Swiss National Bank President Thomas Jordan. He said that the Swiss franc is overvalued.

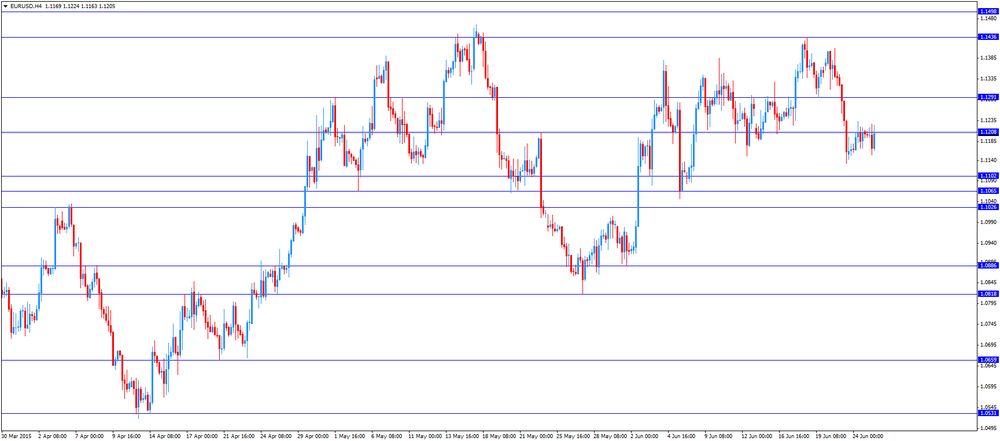

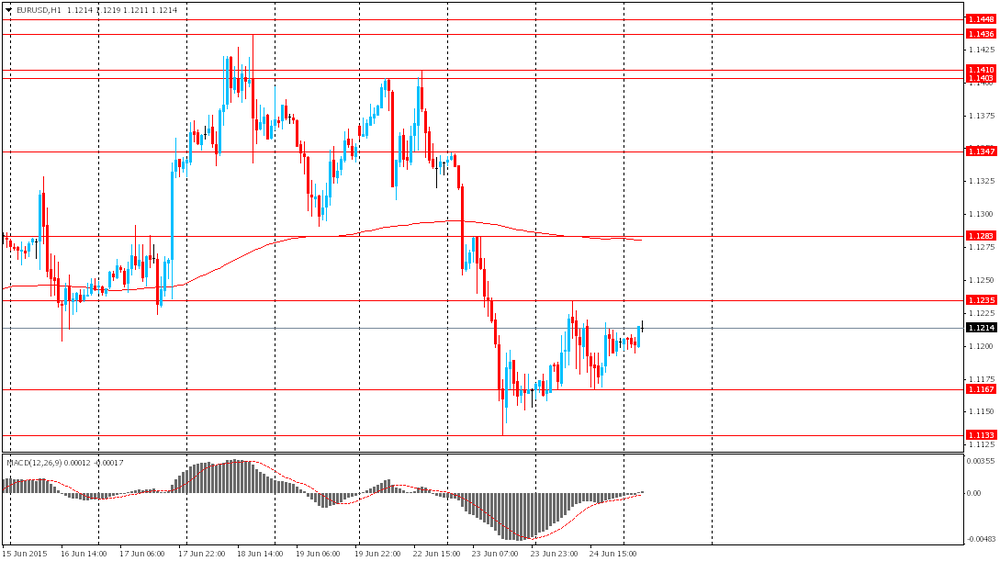

EUR/USD: the currency pair traded mixed

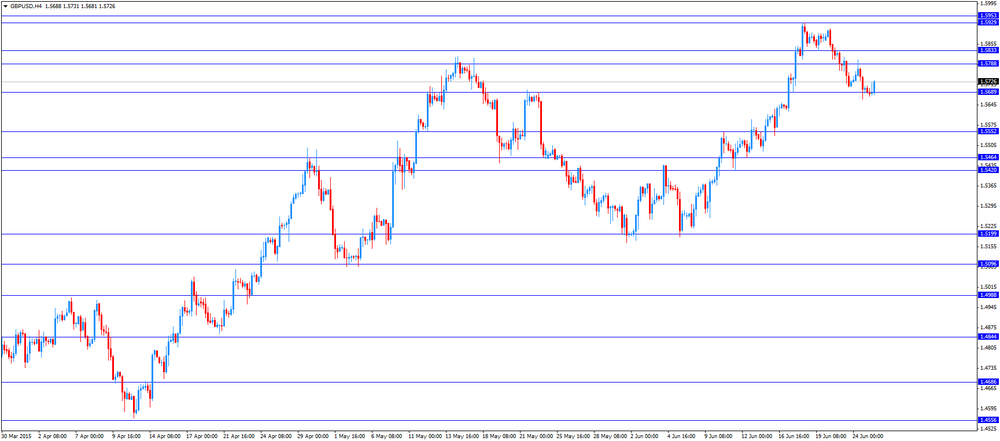

GBP/USD: the currency pair increased to $1.5731

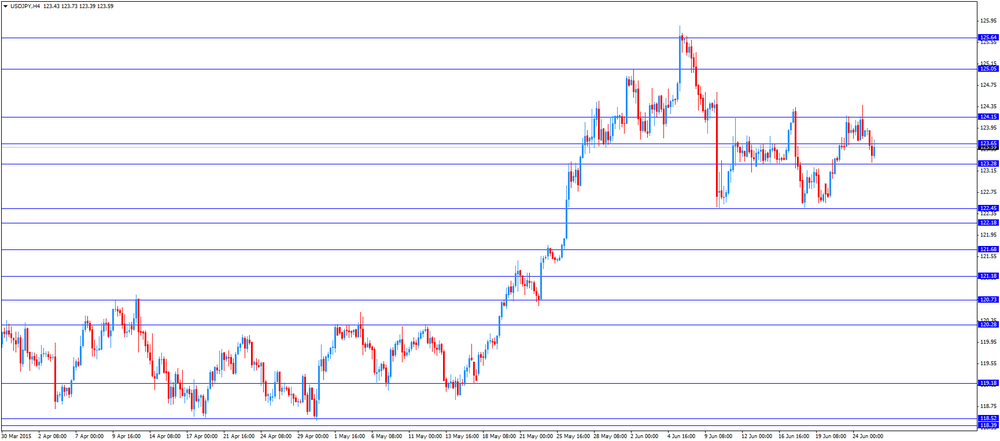

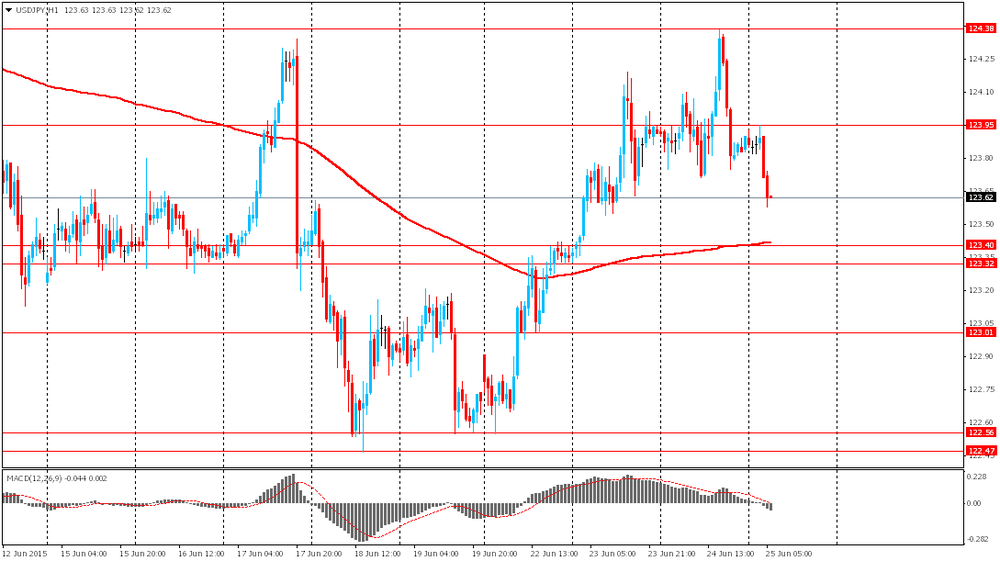

USD/JPY: the currency pair fell to Y123.31

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims June 267 272

12:30 U.S. Personal Income, m/m May 0.4% 0.5%

12:30 U.S. Personal spending May 0.0% 0.7%

12:30 U.S. PCE price index ex food, energy, m/m May 0.1% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y May 1.2% 0.8%

13:45 U.S. Services PMI (Preliminary) June 56.2 56.7

13:45 U.S. FOMC Member Jerome Powell Speaks

16:10 Canada BOC Deputy Governor Lawrence Schembri Speaks

22:45 New Zealand Trade Balance, mln May 123 -100

23:30 Japan Unemployment Rate May 3.3% 3.3%

23:30 Japan Household spending Y/Y May -1.3% 3.4%

23:30 Japan Tokyo Consumer Price Index, y/y June 0.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y June 0.2% 0.1%

23:30 Japan National Consumer Price Index, y/y May 0.6%

23:30 Japan National CPI Ex-Fresh Food, y/y May 0.3% 0.0%

-

14:00

Orders

EUR/USD

Offers 1.1220-25 1.1245 1.1280 1.1300 1.1330 1.1350 1.1365

Bids 1.1170 1.1150 1.1130 1.1100 1.1080 1.1050 1.1030 1.1000

GBP/USD

Offers 1.5750 1.5780 1.5800 1.5820-25 1.5850 1.5875 1.5900

Bids 1.5675-80 1.5650 1.5630 1.5600 1.5585 1.5570 1.5550

EUR/GBP

Offers 0.7150 0.7170 0.7180-85 0.7200 0.7220

Bids 0.7100 0.7080-85 0.7065 0.7050 0.7030 0.7000

EUR/JPY

Offers 139.00 139.30 139.50 139.80 140.00

Bids 138.35 138.00 137.80 137.50 137.00

USD/JPY

Offers 124.00 124.20-25 124.40 124.50 124.75 125.00 125.25

Bids 123.50 123.20 123.00122.75 122.50 122.30

AUD/USD

Offers 0.7750-60 0.7785 0.7800 0.7825-30 0.7850

Bids 0.7700 0.7680 0.7650 0.7630 0.7600

-

11:44

Spanish producer prices increase 0.3% in May

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Thursday. The Spanish producer prices rose 0.3% in May, after a 0.5% increase in April.

On a yearly basis, producer price inflation in Spain fell 1.4% in May, after a 0.9% decline in April. Producer prices have been declining since July 2014.

Producer prices excluding energy climbed 0.7% year-on-year in May, after a 0.6% rise in April.

Energy prices dropped 7.5% in May.

-

11:24

German Gfk consumer confidence index declines to 10.1 in July

Market research group GfK released its consumer confidence index for Germany on Thursday. German Gfk consumer confidence index fell to 10.1 in July from 10.2 in June.

Analysts had expected the index to remain unchanged at 10.2.

The decrease was driven by declines in economic expectations and the willingness to buy. The previously unsuccessful attempts to find a solution to the debt crisis in Greece and a possible Greek default also weighed on the index.

The economic expectations index plunged to 13.4 points in July to 24.9 in June, while the willingness to buy index fell 5.6 points to 57.0.

The income expectations index climbed by 5.2 points in June and is now at 57.2.

"Despite the dampened climate, private spending remains a pillar of economic growth for Germany. However, the latest development also shows that the consumer climate is exposed to risks from international crises. The struggle for a solution to Greece's debt crisis, which has recently escalated, making a default more and more likely, could cause the motor for consumption, which has been running at top speed, to stutter," Gfk noted.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E1.37bn), $1.1115(E369mn), $1.1150(E380mn), $1.1200(E333mn), $1.1215(E367mn)

USD/JPY: Y123.00($1.37bn), Y123.50($1.3bn), Y124.30($355mn), Y125.00($265mn)

USD/CHF: Chf0.9285($220mn)

AUD/USD: $0.7700(A$388mn)

NZD/USD: $0.6800 (NZ$1.17bn), $0.7200(NZ$1.66bn)

-

11:07

Number of unemployed people in France increases 0.5% in May

The French Labour Ministry released its labour market data on Wednesday. The number of unemployed people in France - registered job seekers who are fully unemployed - increased 0.5% in May from April to 3,552,200.

The unemployment in France has continued to increase since French President Francois Hollande took office in 2012.

The French government is struggling to bring down unemployment despite a rise in economic growth.

-

10:47

Debt talks between Greece and its creditors end without any results yesterday

Debt talks between Greece and its creditors ended without any results yesterday.

"Unfortunately we have not reached an agreement yet, but we are determined to continue work," the head of the Eurogroup Jeroen Dijsselbloem said.

Greek Prime Minister Alexis Tsipras met with European Commission President Jean-Claude Juncker, European Central Bank President Mario Draghi, International Monetary Fund Managing Director Christine Lagarde and Dijsselbloem on Wednesday, ahead of the Eurogroup's meeting.

Athens and its lenders failed to reach a deal on tax, pension reform and VAT.

Greece plans to increase corporate tax rates to 29%, while the creditors want to set the upper limit to no more than 28%.

Athens have to repay €1.6 billion IMF loans by June 30.

-

10:33

Federal Reserve Vice Chair Stanley Fischer: the Fed plans to adapt the stress-testing framework for three international systemically important insurance companies

Federal Reserve Vice Chair Stanley Fischer said in Stockholm on Wednesday that the Fed plans to adapt the stress-testing framework for three international systemically important insurance companies that it regulates.

"While distress at these firms poses risks to financial stability, particularly during a stressful period, certain sources of risk to these firms are distinct from the risks banking organizations face," he said.

Fischer said nothing about the Fed's monetary policy.

-

10:17

German thin tank DIW downgrades its economic growth forecast for 2015 for Germany

The German thin tank DIW downgraded its economic growth forecast for Germany on Wednesday. The economy is expected to expand at 1.5% in 2015, down from the previous forecast of 2.2%. The downward revision was driven by the weak industrial production at the beginning of the year.

The German economic growth in 2016 is expected to 1.9%.

"The German economy looks stronger at the moment than it actually is," DIW President Marcel Fratzscher said.

He also said that a Greek exit from the Eurozone is an "enormous" risk to corporate investment in Germany.

-

08:40

Foreign exchange market. Asian session: euro little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

06:00 Germany Gfk Consumer Confidence Survey July 10.2 10.2 10.1

The euro traded without significant changes amid uncertainty over Greece's negotiations. The latest discussion ended at night with no agreement. Negotiations are expected to be resumed today. Media reported that Greece and its lenders still disagree on pension reform, labor legislation, taxation, wages in the Greek public sector and investment.

The U.S. dollar declined against the yen after yesterday's data showed that the U.S. economy contracted in the first quarter. According to report by the Department of Commerce, U.S. GDP fell by 0.2% y/y in the first quarter in line with analysts' expectations. An earlier report suggested a 0.7% drop, but revisions had shown that personal consumption added more than it was presumed in the initial report.

EUR/USD: the pair has traded around $1.1200 this morning

USD/JPY: the pair declined to Y123.60

GBP/USD: the pair traded around $1.5700

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Switzerland SNB Chairman Jordan Speaks

12:30 U.S. Continuing Jobless Claims June 2222 2215

12:30 U.S. Initial Jobless Claims June 267 272

12:30 U.S. Personal Income, m/m May 0.4% 0.5%

12:30 U.S. Personal spending May 0.0% 0.7%

12:30 U.S. PCE price index ex food, energy, m/m May 0.1% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y May 1.2% 0.8%

13:45 U.S. Services PMI (Preliminary) June 56.2 56.7

13:45 U.S. FOMC Member Jerome Powell Speaks

16:10 Canada BOC Deputy Governor Lawrence Schembri Speaks

22:45 New Zealand Trade Balance, mln May 123 -100

23:30 Japan Unemployment Rate May 3.3% 3.3%

23:30 Japan Household spending Y/Y May -1.3% 3.4%

23:30 Japan Tokyo Consumer Price Index, y/y June 0.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y June 0.2% 0.1%

23:30 Japan National Consumer Price Index, y/y May 0.6%

23:30 Japan National CPI Ex-Fresh Food, y/y

-

08:23

Options levels on thursday, June 25, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1352 (3566)

$1.1297 (3314)

$1.1261 (1728)

Price at time of writing this review: $1.1213

Support levels (open interest**, contracts):

$1.1146 (1864)

$1.1091 (2371)

$1.1057 (5135)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 56131 contracts, with the maximum number of contracts with strike price $1,1500 (5290);

- Overall open interest on the PUT options with the expiration date July, 2 is 87289 contracts, with the maximum number of contracts with strike price $1,1000 (13974);

- The ratio of PUT/CALL was 1.55 versus 1.55 from the previous trading day according to data from June, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.6001 (575)

$1.5901 (798)

$1.5803 (1250)

Price at time of writing this review: $1.5693

Support levels (open interest**, contracts):

$1.5596 (773)

$1.5498 (639)

$1.5399 (1743)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 22524 contracts, with the maximum number of contracts with strike price $1,5500 (2543);

- Overall open interest on the PUT options with the expiration date July, 2 is 26691 contracts, with the maximum number of contracts with strike price $1,5100 (2113);

- The ratio of PUT/CALL was 1.19 versus 1.15 from the previous trading day according to data from June, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:02

Germany: Gfk Consumer Confidence Survey, July 10.1 (forecast 10.2)

-

00:29

Currencies. Daily history for Jun 24’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1203 +0,33%

GBP/USD $1,5703 -0,14%

USD/CHF Chf0,9335 -0,06%

USD/JPY Y123,90 -0,01%

EUR/JPY Y138,80 +0,31%

GBP/JPY Y194,55 -0,15%

AUD/USD $0,7701 -0,42%

NZD/USD $0,6881 +0,44%

USD/CAD C$1,2385 +0,44%

-